Snam's Profile

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ethics Agreement in Order to Avoid Any Financial Conflict

Date: 7 .-e-•15 Iett..% 1--4 17 MEMORANDUM FOR THE RECORD SUBJECT: Ethics Agreement In order to avoid any financial conflict of interest in violation of 18 U.S.C. § 208(a) or the appearance of a financial conflict of interest as defined in the Standards of Ethical Conduct for Employees of the Executive Branch, 5 C.F.R. § 2635.502, and to adhere to the Ethics Pledge instituted by Executive Order 13770 issued on January 28, 2017, and entitled "Ethics Commitments by Executive Branch Appointees" (the Ethics Pledge), I am issuing the following statement. I understand that as an appointee I must sign the Ethics Pledge and that I will be bound by the requirements and restrictions therein even if not specifically mentioned in this or any other ethics agreement. Before beginning my covered Federal position, I resigned from my non-Federal positions with the Association of State and Territorial Health Officials (ASTHO) and the State of Georgia on July 6, 2017. Pursuant to the Ethics Pledge, I will not, for a period of two years from the date of my appointment to my covered Federal position, participate in an official capacity in any particular matter involving specific parties that is directly and substantially related to ASTHO, unless an exception applies or I am granted a waiver. I understand that this provision in the Ethics Pledge does not apply to state government entities, including the State of Georgia. Even when the two-year restriction of the Ethics Pledge does not apply, under 5 C.F.R. § 2635.502, I will not, for a period of one year from the date of my resignation from ASTHO and the State of Georgia, participate in any particular matter involving specific parties in which ASTHO or the State of Georgia is a party or represents a party, unless I am first authorized to participate, pursuant to 5 C.F.R. -

THE SNAM SHAREHOLDER the GUIDE to GETTING INVOLVED in YOUR INVESTMENT 2 Snam | L'azionista Di Snam | Testatina

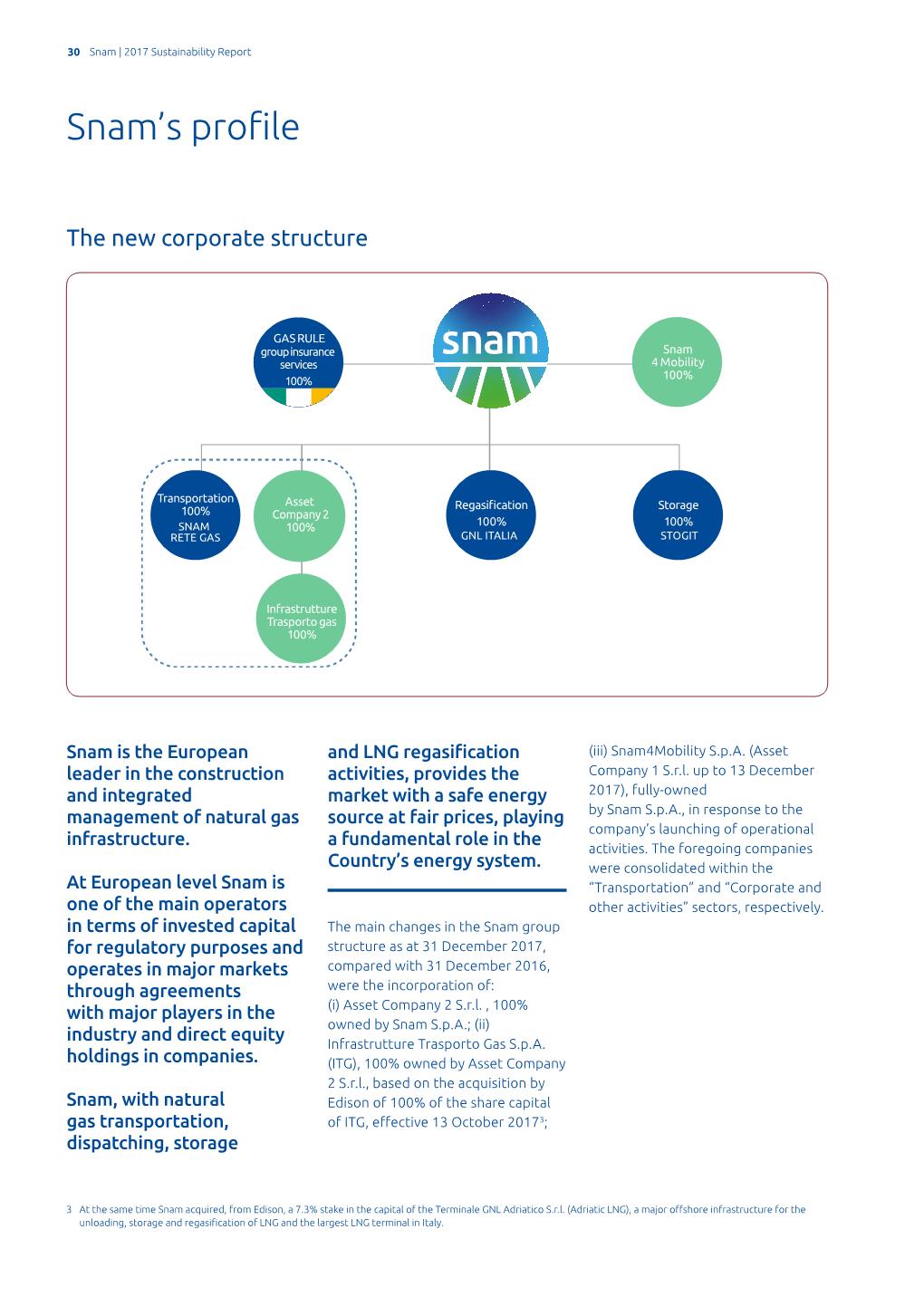

Snam | L'azionista di Snam | Testatina 1 April 2018 THE SNAM SHAREHOLDER THE GUIDE TO GETTING INVOLVED IN YOUR INVESTMENT 2 Snam | L'azionista di Snam | Testatina Dear shareholders, the purpose of this Guide is to provide annually both current and potential owners of Snam shares with a summary of relevant information. Starting from 2010, it is part of a series of tools to enhance our communication with retail investors. We believe that the trust you have showed us Snam must be cultivated through an increasingly Company profile 3 effective dialogue. The first part Snam overview 4 of the Guide outlines the Group’s Snam: an integrated player in the gas system 5 structure, its business and strategic Management team 6 guidelines. The Guide also presents Governance in action 7 some key features about Snam Regulation in Italy 8 shares and practical information Regulation in Europe 9 so that you can really get involved Inclusion in SRI indices 10 in your role as a shareholder. Snam strategy 11 We hope that these pages will be Snam in Europe 13 easy and interesting to read, Corporate structure 14 as well as helpful. By nature, this Guide is not an exhaustive Snam on the Stock Exchange Remuneration through dividends 16 product. In order to obtain Stock Market performance 17 more complete information Shareholders 19 we invite you to visit our corporate The bond market 20 website at www.snam.it or, Income Statement figures 21 for specific requests, to contact Balance Sheet figures 22 the Investor Relations department. Cash flow 23 Get involved in your Snam investment The steps to investing 25 Attend the Shareholders’ Meeting 26 Keep yourself informed and participate in corporate events 27 Snam | The Snam Shareholder | Company profile 3 Company profile Snam is Europe’s leading gas utility. -

Green Hydrogen the Next Transformational Driver of the Utilities Industry

EQUITY RESEARCH | September 22, 2020 | 9:41PM BST The following is a redacted version of the original report. See inside for details. Green Hydrogen The next transformational driver of the Utilities industry In our Carbonomics report we analysed the major role of clean hydrogen in the transition towards Net Zero. Here we focus on Green hydrogen (“e-Hydrogen”), which is produced when renewable energy powers the electrolysis of water. Green hydrogen looks poised to become a once-in-a-generation opportunity: we estimate it could give rise to a €10 trn addressable market globally by 2050 for the Utilities industry alone. e-Hydrogen could become pivotal to the Utilities (and Energy) industry, with the potential by 2050 to: (i) turn into the largest electricity customer, and double power demand in Europe; (ii) double our already top-of-the-street 2050 renewables capex EU Green Deal Bull Case estimates (tripling annual wind/solar additions); (iii) imply a profound reconfiguration of the gas grid; (iv) solve the issue of seasonal power storage; and (v) provide a second life to conventional thermal power producers thanks to the conversion of gas plants into hydrogen turbines. Alberto Gandolfi Ajay Patel Michele Della Vigna, CFA Mafalda Pombeiro Mathieu Pidoux +44 20 7552-2539 +44 20 7552-1168 +44 20 7552-9383 +44 20 7552-9425 +44 20 7051-4752 alberto.gandolfi@gs.com [email protected] [email protected] [email protected] [email protected] Goldman Sachs International Goldman Sachs International Goldman Sachs International Goldman Sachs International Goldman Sachs International Goldman Sachs does and seeks to do business with companies covered in its research reports. -

Forest Oil Corporation Oil and Gas Valuation Report

Forest Oil Corporation Oil and Gas Valuation Report Reference Code: GDGE0484V Publication Date: OCT 2008 Forest Oil Corporation, Oil and Gas Valuation Report GDGE0484V / Published 10 / 2008 © GlobalData. Refer to important disclosures at the end of this report. Page 1 Table of Contents 1 Table of Contents 1 Table of Contents ....................................................................................................................... 2 1.1 List of Tables ........................................................................................................................................................................... 5 1.2 List of Figures.......................................................................................................................................................................... 6 2 Investment Summary ............................................................................................................... 11 2.1 Strong Commodity Prices and Resource Potential Providing Attractive Valuation Upside............................. 12 2.2 Haynesville Shale Acreage Presents Potential Upside............................................................................................... 13 2.3 Large and Attractive Asset Base with Substantial Upside ........................................................................................ 16 2.4 Strategic Acquisitions Adds Value to the company.................................................................................................... 17 2.5 Utica -

Negativliste. Fossil Energi

Negativliste. Fossil energi Maj 2021 Udstedende selskab 1 ABJA Investment Co Pte Ltd 2 ABM Investama Tbk PT 3 Aboitiz Equity Ventures Inc 4 Aboitiz Power Corp 5 Abraxas Petroleum Corp 6 Abu Dhabi National Energy Co PJSC 7 AC Energy Finance International Ltd 8 Adams Resources & Energy Inc 9 Adani Electricity Mumbai Ltd 10 Adani Power Ltd 11 Adani Transmission Ltd 12 Adaro Energy Tbk PT 13 Adaro Indonesia PT 14 ADES International Holding PLC 15 Advantage Oil & Gas Ltd 16 Aegis Logistics Ltd 17 Aenza SAA 18 AEP Transmission Co LLC 19 AES Alicura SA 20 AES El Salvador Trust II 21 AES Gener SA 22 AEV International Pte Ltd 23 African Rainbow Minerals Ltd 24 AGL Energy Ltd 25 Agritrade Resources Ltd 26 AI Candelaria Spain SLU 27 Air Water Inc 28 Akastor ASA 29 Aker BP ASA 30 Aker Solutions ASA 31 Aksa Akrilik Kimya Sanayii AS 32 Aksa Enerji Uretim AS 33 Alabama Power Co 34 Alarko Holding AS 35 Albioma SA 36 Alexandria Mineral Oils Co 37 Alfa Energi Investama Tbk PT 38 ALLETE Inc 1 39 Alliance Holdings GP LP 40 Alliance Resource Operating Partners LP / Alliance Resource Finance Corp 41 Alliance Resource Partners LP 42 Alliant Energy Corp 43 Alpha Metallurgical Resources Inc 44 Alpha Natural Resources Inc 45 Alta Mesa Resources Inc 46 AltaGas Ltd 47 Altera Infrastructure LP 48 Altius Minerals Corp 49 Altus Midstream Co 50 Aluminum Corp of China Ltd 51 Ameren Corp 52 American Electric Power Co Inc 53 American Shipping Co ASA 54 American Tanker Inc 55 AmeriGas Partners LP / AmeriGas Finance Corp 56 Amplify Energy Corp 57 Amplify Energy Corp/TX 58 -

Codice Di Stoccaggio STOGIT

Storage Code TABLE OF CONTENTS STORAGE CODE pursuant to Article 12, paragraph 7, of Legislative Decree 23 May 2000, n. 164/00 as approved by the Authority for Electricity Gas and Water with resolution n. 220/06 and subsequent amendments and additions Storage Code STOGIT Rev. 2018 - I Approved by the Authority for Electricity Gas and Water with resolution 15/03/2018, 156/2018/R/gas This document is not binding and is provided by Stogit exclusively for information purposes. The Italian documents being the sole and unique legally valid reference and in any case prevailing over the translated version. Stogit will provide updates of the translation at any time as deemed necessary, also to improve and/or adjust the quality and/or content of the translation submitted. Storage Code TABLE OF CONTENTS TABLE OF CONTENTS GLOSSARY .................................................................................................................................. XII INTRODUCTION ...................................................................................................................... XVIII INFORMATION .......................................................................................................................... XIX 1 THE LEGISLATIVE CONTEXT ......................................................................................... 1 1.1 European Union Legislation ........................................................................................................... 1 1.2 Domestic Legislation ...................................................................................................................... -

Maintenance Modification and Operations

MAINTENANCE MODIFICATIONS AND OPERATIONS INDEX SAIPEM TODAY 04 SAIPEM ENGINEERING & CONSTRUCTION 06 MAINTENANCE, MODIFICATIONS AND OPERATIONS 08 DECENTRALIZED SERVICES AND GLOBAL PRESENCE 10 A CONTINUOUS COMMITMENT TO LOCAL CONTENT 14 SERVICE FOCUS: MAINTENANCE AND INSPECTION ENGINEERING 16 PROJECT REFERENCES 20 SERVICE FOCUS: OPERATIONS AND MAINTENANCE CONTRACTS 26 PROJECT REFERENCES 28 SERVICE FOCUS: MODIFICATIONS AND TURNAROUNDS 34 PROJECT REFERENCES 36 3 SAIPEM TODAY SAIPEM TODAY IS A WORLD LEADER IN THE GLOBAL SUPPLY OF ENGINEERING, PROCUREMENT, PROJECT MANAGEMENT, CONSTRUCTION AND DRILLING SERVICES WITH DISTINCTIVE CAPABILITIES IN THE DESIGN AND EXECUTION OF LARGE-SCALE OFFSHORE AND ONSHORE PROJECTS. Saipem has a strong bias towards oil and gas frontiers, namely activities in harsh and remote areas, in deep waters as well as in extremely cold and hot environments, applying significant technological competences in many diverse fields such as gas monetization and heavy oil exploitation. Saipem is organized in two Business Units:Engineering & Construction and Drilling. 4 5 SAIPEM ENGINEERING & CONSTRUCTION FOLLOWING AN AGGRESSIVE GROWTH STRATEGY, WHICH INCLUDED IN THE LAST DECADE THE ACQUISITION OF MANY CONSTRUCTION, TECHNOLOGY AND ENGINEERING COMPANIES, MOST PROMINENTLY OF SNAMPROGETTI, BOUYGUES OFFSHORE, SOFRESID AND MOSS MARITIME, SAIPEM HAS BECOME ONE OF THE WORLD LARGEST AND MOST COMPLETE ENGINEERING AND CONSTRUCTION COMPANIES IN THE GLOBAL OIL AND GAS MARKETS, ONSHORE AND OFFSHORE. 6 Ever since its initial steps in the fifties and numerous project execution installation; also revamps, upgradings, as the construction division of Snam, centres around the globe, and with maintenance, decommissionings, the pipeline company of the Eni Group yearly revenues exceeding 10 billion €/y; reclamations and decontaminations. in Italy, Saipem has pursued all held together by outstanding project a systematic growth strategy, based management skills. -

Press Release

Press Release Eurogas joins global initiative to combat methane emissions London, 16 January 2020. Today Eurogas joins the Methane Guiding Principles initiative – a voluntary partnership of industry and civil society organisations aimed at reducing methane emissions across the natural gas supply chain, from production to end consumer. This development stresses the gas industry’s commitment to reducing methane emissions in relation to natural gas. The European Commission is expected to bring forward an EU methane strategy in the first quarter of 2020. Eurogas Secretary General, James Watson, explained the move to join the initiative: “Members of Eurogas have always been committed to limiting methane emissions in their networks and will continue to work on and implement best practices. Joining the Methane Guiding Principles partnership is another step in this direction. It includes cooperation on advancing strong performance across value chains, improving transparency and data accuracy, and positively engaging in dialogue on methane regulation with policymakers.” “Gas will play a crucial role in supporting countries across Europe to address their carbon emissions. Using gas for power generation, industry, transport and heating will help meet future energy demand while achieving decarbonisation. Therefore, working together with serious partners from across the spectrum of energy sector interests to reduce methane emissions is the right and responsible action to take.” The Methane Guiding principles focus on five priority areas for action along the natural gas supply chain: 1. Continually reduce methane emissions 2. Advance strong performance across the gas supply chain 3. Improve accuracy of methane emissions data 4. Advocate sound policy and regulations on methane emissions 5. -

Global Gas Security Review 2018 Foreword

Global Gas Security Review Meeting Challenges in a Fast Changing Market 2018 Global Gas Security Review Meeting Challenges in a Fast Changing Market 2018 INTERNATIONAL ENERGY AGENCY The IEA examines the full spectrum of energy issues including oil, gas and coal supply and demand, renewable energy technologies, electricity markets, energy efficiency, access to energy, demand side management and much more. Through its work, the IEA advocates policies that will enhance the reliability, affordability and sustainability of energy in its 30 member countries, 7 association countries and beyond. The four main areas of IEA focus are: n Energy Security: Promoting diversity, efficiency, flexibility and reliability for all fuels and energy sources; n Economic Development: Supporting free markets to foster economic growth and eliminate energy poverty; n Environmental Awareness: Analysing policy options to offset the impact of energy production and use on the environment, especially for tackling climate change and air pollution; and n Engagement Worldwide: Working closely with association and partner countries, especially major emerging economies, to find solutions to shared energy and environmental IEA member countries: concerns. Australia Austria Belgium Canada Czech Republic Denmark Estonia Finland France Germany Greece Secure Hungary Sustainable Ireland Together Italy Japan Korea Luxembourg Mexico Netherlands New Zealand Norway Poland Portugal Slovak Republic © OECD/IEA, 2018 Spain International Energy Agency Sweden Website: www.iea.org Switzerland Turkey United Kingdom United States Please note that this publication is subject to specific restrictions The European Commission that limit its use and distribution. The terms and conditions are also participates in available online at www.iea.org/t&c/ the work of the IEA. -

Il Metanino 2018Il Statistical Metanino Data Dati Statistici 2017

1 Il Metanino 2018Il Statistical Metanino Data Dati statistici 2017 1941 2016 SNAM: the mission Snam is Europe’s leading gas utility. Founded in 1941 as “Società Nazionale Metanodotti”, it has been building and managing sustainable and technologically advanced infrastructure guaranteeing energy security for over 75 years. Snam operates in Italy and, through subsidiaries, Austria (TAG and GCA), France (Teréga) and the United Kingdom (Interconnector UK). It is one of the main shareholders of TAP (Trans Adriatic Pipeline) and is the company most involved in projects for the creation of the Energy Union. First in Europe by transport network size (over 32,500 km in Italy, about 40,000 with international subsidiaries) and natural gas storage capacity (16.7 billion cubic meters in Italy, about 20 billion with international subsidiaries), Snam manages the first liquefied natural gas (LNG) plant built in Italy and is a shareholder of the country’s main terminal. Snam’s business model is based on sustainable growth, transparency, nurturing talent, and development of local areas by dialoguing with communities. It fosters sustainable mobility, expands into energy efficiency, and invests in biomethane and innovative technologies to increase the use of renewable gas, a key resource of the green economy. *Teréga has been the new denomination of TIGF since 30 March 2018. 2 Index 5 The Energy Environment 6 Natural gas reserves in the world (2017) 8 Natural gas production in the world (2017) 9 Natural gas consumption in the world (2017) 10 Natural gas: -

Update on Iran Divestment

UPDATE ON IRAN DIVESTMENT The State Pension Board (SPB) retained Risk Metrics Group which found that the state’s portfolio of direct investments included 38 companies (listed on back) doing more than $20 million of business annually with Iran’s energy sector. On August 5, 2008 the board sent a letter directly to those companies indicating that they could either clarify their Iran operations (possibly to argue that they weren’t engaged in the proscribed business practices), cease such business within 90 days, or face divestment. Similarly, the SPB also sent letters to five external investment managers informing them of the new law, directing them to sell, redeem, divest, or withdraw all publicly traded securities of the 38 companies no later than July 11, 2009. Though divestment of indirect holdings is not required by the law, the SPB nonetheless did request that its five managers of private market funds either: (a) consider removing the 38 companies from their funds, or; (b) create a similar fund devoid of those companies. Of the five managers, only The Rock Creek Group has acted to address the SPB’s indirect holdings. It has redeemed all or some of its investments in CamCap Energy Onshore Fund LP, Cantillon World LP and Lansdowne UK Equity Fund LP. Rock Creek has agreed to continue to monitor the exposure of underlying managers. So far a total of $3.3 million has been “direct divested” from 7 companies. (See chart.) Since the law stipulates that all scrutinized companies must be divested from by July 11, 2009 we are anticipating many more millions will be divested over the next few months. -

INTERIM FINANCIAL REPORT AS of JUNE 30, 2020 001-078Saipemsem20ing.Qxd 3-08-2020 16:55 Pagina II

001-078SaipemSem20Ing.qxd 3-08-2020 16:55 Pagina I INTERIM FINANCIAL REPORT AS OF JUNE 30, 2020 001-078SaipemSem20Ing.qxd 3-08-2020 16:55 Pagina II Mission Our mission is to implement challenging, safe and innovative projects, leveraging on the competence of our people and on the solidity, multiculturalism and integrity of our organisational model. With the ability to face and overcome the challenges posed by the evolution of the global scenarios, we must seize the opportunities to create economic and social value for all our stakeholders. OUR VALUES Innovation; health, safety and environment; multiculturalism; passion; integrity. Disclaimer By their nature, forward-looking statements are subject to risk and uncertainty since they are dependent upon circumstances which should or are considered likely to occur in the future and are outside of the Group’s control. These include, but are not limited to: exchange and interest rate fluctuations, commodity price volatility, credit and liquidity risks, HSE risks, the levels of capital expenditure in the oil and gas industry and other sectors, political instability in areas where the Group operates, actions by competitors, success of commercial transactions, risks associated with the execution of projects (including ongoing investment projects), the recent Coronavirus outbreak (including its impact across our business, worldwide operations and supply chain); in addition to changes in stakeholders’ expectations and other changes affecting business conditions. Actual results could therefore differ materially from the forward-looking statements. The financial reports contain in-depth analyses of some of the aforementioned risks. Forward-looking statements are to be considered in the context of the date of their release.