“Growing with You for a Better Life” 2020 ANNUAL RESULTS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Shifting Tides China’S Boat People Plot an Uncertain Course

AT FOUR SEA WIN A 2- N SON IGHT STAY S R E SORT CHIANG MAI Shifting Tides China’s Boat People Plot an Uncertain Course 城市漫步上海 英文版 7 月份 国内统一刊号: CN 11-5233/GO China Intercontinental Press JULY 2018 that’s Shanghai 《城市漫步》上海版 英文月刊 主管单位 : 中华人民共和国国务院新闻办公室 Supervised by the State Council Information Office of the People's Republic of China 主办单位 : 五洲传播出版社 地址 : 中国北京 北京西城月坛北街 26 号恒华国际商务中心南楼 11 层文化交流中心 邮编 100045 Published by China Intercontinental Press Address: 11th Floor South Building, HengHua linternational Business Center, 26 Yuetan North Street, Xicheng District, Beijing 100045, PRC http://www.cicc.org.cn 社长 President of China Intercontinental Press: 陈陆军 Chen Lujun 期刊部负责人 Supervisor of Magazine Department: 付平 Fu Ping 主编 Executive Editor: 袁保安 Yuan Baoan 编辑 Editor: 朱莉莉 Zhu Lili 发行 Circulation: 李若琳 Li Ruolin Chief Editor Dominic Ngai Section Editors Erica Martin, Cristina Ng Production Manager Ivy Zhang Designer Joan Dai, Nuo Shen Contributors Mia Li, Logan Brouse, Noelle Mateer, Matthew Bossons, Dominique Wong, Iris Wang, Valerie Osipov, Tess Humphrys, Yuzhou Hu, Aimee Burlamacchi, Yannick Faillard, Chloe Dumont, Samantha Kennedy, Molly Jett, Daniel Plafker, Tristin Zhang Copy Editor Amy Fabris-Shi HK FOCUS MEDIA Shanghai (Head office) 上海和舟广告有限公司 上海市蒙自路 169 号智造局 2 号楼 305-306 室 邮政编码 : 200023 Room 305-306, Building 2, No.169 Mengzi Lu, Shanghai 200023 电话 : 021-8023 2199 传真 : 021-8023 2190 Guangzhou 上海和舟广告有限公司广州分公司 广州市越秀区麓苑路 42 号大院 2 号楼 610 室 邮政编码 : 510095 Room 610, No. 2 Building, Area 42, Luyuan Lu, Yuexiu District, Guangzhou 510095 电话 : 020-8358 -

2013 Year Book.Pdf

2013 Contents Preface / P_05> Overview / P_07> SICA Profile / P_13> Cultural Performances and Exhibitions, 2013 / P_17> Foreign Exchange, 2013 / P_37> Academic Conferences, 2013 / P_55> Foreign Visits & Receptions, 2013 / P_65> Summary of Cultural Exchanges and Foreign Visits, 2013 / P_73> List of Council Members / P_81> Preface With the improvement of China’s comprehensive national strength and international status, much importance is unprecedentedly attached to overseas-oriented cultural publicity. This renders favorable conditions, as well as precious opportunities, for cultural communications between China and foreign countries. The year 2013 is one with plenty of challenges and benefits, as we made remarkable achievements on the ground of advantageous overseas- oriented publicity based on Great Culture. On behalf of the entire staff of SICA, I hereby extend our sincere gratitude for the concern and support offered by multifarious levels of government departments, various partner institutions and cultural institutions, people from all circles of life, and friends from both home and abroad. In this booklet we present an annual report on the events held and programs initiated in 2013 in forms of journals and pictures, with a hope that our friends from different fields will know better about SICA, continue to provide support for us, and move forward alongside with us to make more achievements in cultural communications between China and foreign countries. Deng Xiaoxian Vice President and Secretary-General Shanghai International Culture Association December, 2013 「Beautiful Mourtain Flower in Full Bloom」(detail) Tang Yilan From Hong Kong-Shanghai Contemporary Ink Painting Exhibition 2013 2013年报 Overview (detail) Norbert Page From United Exhibition of Modern Chinese and French Paintings 2013 Annual Report PART1 1 Overview Overview style. -

Revista N9.Indd

SOCIEDADE BRASILEIRA DE SOCIOLOGIA – SBS Vol 05, No. 09 | Jan./Abr./2017 SOCIEDADE BRASILEIRA DE SOCIOLOGIA - DIRETORIA (GESTÃO 2015-2017) Presidente 2º Secretário Carlos Benedito Martins, UnB Iracema Brandão Guimarães, UFBA 1º Vice Presidente Maria Ligia Barbosa, UFRJ Diretores Adriano Premebida, FADB 2º Vice Presidente Eliane Veras Soares, UFPE Jacob Lima, UFSCarlos Claudio Santiago Dias Junior, UFMG Secretário Geral Mariana Miggiolaro Chaguri, Unicamp Emil Albert Sobottka, PUC-RS Alex Niche Teixeira, UFRGS Tesoureiro Conselho Fiscal Jordão Horta Nunes, UFGO Danyelle Nilin Gonçalves,UFC 1º Secretário Carlos Eduardo Sell, UFSC Márcia Lima, USP Simone Meucci, UFPR PUBLICAÇÃO QUADRIMESTRAL DA SOCIEDADE BRASILEIRA DE SOCIOLOGIA – SBS Coordenação Editorial Carlos Fortuna, Universidade de Coimbra Carlos Benedito Martins, UnB Cesar Barreira, Universidade Federal do Ceará Charles C. Lemert, Yale University Editores Gabriel Cohn, Universidade de São Paulo Rogerio Proença Leite, UFS Jacob Lima, Universidade Federal de São Carlos Sergio B. F. Tavolaro, UnB Jorge Ventura, Universidade Federal de Pernambuco José Machado Pais, Instituto de Ciências Sociais da Comissão Editorial Universidade de Lisboa Irlys Barreira, UFC José Vicente Tavares, Universidade Federal do Rio Grande do Sul Celi Scalon, UFRJ Emil Sobottka, PUC-RS José Ricardo Ramalho, Universidade Federal do Rio de Janeiro Renato Sérgio de Lima, FBSP Lúcio Oliver Costilla, Universidad Nacional Autónoma de México Tom Dwyer, UNICAMP Marcos César Alvarez, Universidade de São Paulo Margaret Archer, -

Boredom, Shanzhai, and Digitisation in the Time of Creative China

ASIAN VISUAL CULTURES De Kloet,De (eds) & Scheen Chow in the Time of Creative China Creative of Time the in Boredom, Edited by Jeroen de Kloet, Chow Yiu Fai, and Lena Scheen Shanzhai Boredom, Shanzhai, and Digitisation in the Time of Creative China , and Digitisation Boredom, Shanzhai, and Digitisation in the Time of Creative China Asian Visual Cultures This series focuses on visual cultures that are produced, distributed and consumed in Asia and by Asian communities worldwide. Visual cultures have been implicated in creative policies of the state and in global cultural networks (such as the art world, film festivals and the Internet), particularly since the emergence of digital technologies. Asia is home to some of the major film, television and video industries in the world, while Asian contemporary artists are selling their works for record prices at the international art markets. Visual communication and innovation is also thriving in transnational networks and communities at the grass-roots level. Asian Visual Cultures seeks to explore how the texts and contexts of Asian visual cultures shape, express and negotiate new forms of creativity, subjectivity and cultural politics. It specifically aims to probe into the political, commercial and digital contexts in which visual cultures emerge and circulate, and to trace the potential of these cultures for political or social critique. It welcomes scholarly monographs and edited volumes in English by both established and early-career researchers. Series Editors Jeroen de Kloet, University -

(Diux) China’S Technology Transfer Strategy: How Chinese Investments in Emerging Technology Enable a Strategic Competitor to Access the Crown Jewels of U.S

Defense Innovation Unit Experimental (DIUx) China’s Technology Transfer Strategy: How Chinese Investments in Emerging Technology Enable A Strategic Competitor to Access the Crown Jewels of U.S. Innovation Updated with 2016 and 2017 Data Michael Brown and Pavneet Singh January 2018 UNCLASSIFIED Silicon Valley | Boston | Austin | Washington D.C. China’s Technology Transfer Strategy 2018 Executive Summary This report explores China’s participation in venture deals1 financing early-stage technology companies to assess: how large the overall investment is, whether it is growing, and what technologies are the focus of investment. Chinese participation in venture-backed startups is at a record level of 10-16% of all venture deals (2015-2017) and has grown quite rapidly in the past seven years. The technologies where China is investing are the same ones where U.S. firms are investing and that will be foundational to future innovation: artificial intelligence, autonomous vehicles, augmented/virtual reality, robotics and blockchain technology. Moreover, these are some of the same technologies of interest to the U.S. Defense Department to build on the technological superiority of the U.S. military today. The rapidity at which dual-use technologies are developed in the commercial sector has significant impact on the nature of warfare; mastering them ahead of competitors will “ensure that we will be able win the wars of the future”.2 Because the U.S. economy is open, foreign investors, including those from China, are able to invest in the newest and most relevant technologies gaining experience with those technologies at the same rate as the U.S. -

November 2018

November 2018 November Vol. 845 Innovation in CIIE International Trade 国内零售价: 10元 USA $5.10 UK ₤3.20 12-14 58-61 72-77 Australia $9.10 Europe €5.20 Canada $7.80 Turkey TL.10.00 A New Day in Bittersweet Typhoon Landscapes of Rural China Mangkhut the Mind 2-903 CN11-1429/Z 邮发代号 可绕地球赤道栽种树木按已达塞罕坝机械林场的森林覆盖率寒来暑往,沙地变林海,荒原成绿洲。半个多世纪,三代人耕耘。牢记使命 80% , 1 米株距排开, 艰苦创业 12 圈。 绿色发展 Saihanba is a cold alpine area in northern Hebei Province bordering the Inner Mongolia Autonomous Region. It was once a barren land but is now home to 75,000 hectares of forest, thanks to the labor of generations of forestry workers in the past 55 years. Every year the forest purifies 137 million cubic meters of water and absorbs 747,000 tons of carbon dioxide. The forest produces 12 billion yuan (around US$1.8 bil- lion) of ecological value annually, according to the Chinese Academy of Forestry. Nov 2O18 Administrative Agency: China International Publishing Group 主管:中国外文出版发行事业局 (中国国际出版集团) Publisher: China Pictorial Publications 主办: 社 Address: 33 Chegongzhuang Xilu 社址: Haidian, Beijing 100048 北京市海淀区车公庄西路33号 邮编: 100048 Email: [email protected] : [email protected] 邮箱 President: Yu Tao 社长: 于 涛 Editorial Board: Yu Tao, Li Xia, He Peng 编委会: Bao Linfu, Yu Jia, Yan Ying 于 涛、李 霞、贺 鹏 鲍林富、于 佳、闫 颖 Editor-in-Chief: Li Xia 总编辑: 李 霞 Editorial Directors: Wen Zhihong, Qiao Zhenqi 编辑部主任: 温志宏、乔振祺 English Editor: Liu Haile 英文定稿: 刘海乐 Editorial Consultants: Scott Huntsman, Mithila Phadke 语言顾问: 苏 格、弥萨罗 Editors and Translators: Gong Haiying, Yin Xing 编辑、翻译: Zhao Yue, -

J.Ctvqr1bnw.4

UvA-DARE (Digital Academic Repository) Introduction We Must Create? de Kloet, J.; Chow, Y.F.; Scheen, L. DOI 10.2307/j.ctvqr1bnw.4 10.1515/9789048535538-002 Publication date 2019 Document Version Final published version Published in Boredom, <i>Shanzhai</i>, and Digitisation in the Time of Creative China License CC BY-NC-ND Link to publication Citation for published version (APA): de Kloet, J., Chow, Y. F., & Scheen, L. (2019). Introduction: We Must Create? In J. de Kloet, Y. F. Chow, & L. Scheen (Eds.), Boredom, Shanzhai, and Digitisation in the Time of Creative China (pp. 13-38). (Asian Visual Cultures). Amsterdam University Press. https://doi.org/10.2307/j.ctvqr1bnw.4, https://doi.org/10.1515/9789048535538-002 General rights It is not permitted to download or to forward/distribute the text or part of it without the consent of the author(s) and/or copyright holder(s), other than for strictly personal, individual use, unless the work is under an open content license (like Creative Commons). Disclaimer/Complaints regulations If you believe that digital publication of certain material infringes any of your rights or (privacy) interests, please let the Library know, stating your reasons. In case of a legitimate complaint, the Library will make the material inaccessible and/or remove it from the website. Please Ask the Library: https://uba.uva.nl/en/contact, or a letter to: Library of the University of Amsterdam, Secretariat, Singel 425, 1012 WP Amsterdam, The Netherlands. You will be contacted as soon as possible. UvA-DARE is a service provided by the library of the University of Amsterdam (https://dare.uva.nl) Download date:28 Sep 2021 I Introduction We Must Create? Jeroen de Kloet, Chow Yiu Fai, and Lena Scheen Abstract Premised on the imperative of creativity, this introduction explicates discourses saturated with notions of individual talent marked by inspi- ration, newness, and innovation. -

CHAPTER I INTRODUCTION 1.1 BACKGROUND Literally Art Has

CHAPTER I INTRODUCTION 1.1 BACKGROUND Literally art has many kinds and varieties. Literally art is divided into a novel, short story, poetry, etc. Literally art is an individual emotion based on experience and expressed into literally writing. One of literally art is Poetry. Poetry is a common language and almost as ancient (Perrine & Arp, 1974). Poetry itself has a lot of meaning. Poetry is defined by sounds and combined with imaginative words. According to Perrine & Arp (1974), poetry might be defined as a kind of language that says more intensely than does ordinary language (p. 553). Poetry and song lyrics are related. The song arrangements are a combination of poetry and musical elements. The songs will be strings of a poem if musical elements are removed. The writer wants to combine poetry and Japanese culture related to Japanese music. Nowadays, Japanese culture is popular in the world. Chinese fu-sui has influenced different areas of Japanese culture from the layout of cities in the Heian period (794-1185) to court music (Slaymaker & Martinez, 2006). One of the biggest Japanese cultures is J-Pop. According to Shun (2008) “J-Pop has grown exponentially, affecting nearly every aspect of popular culture in not only Japan but countries like Taiwan, Hong Kong, Singapore, and the Phillipines among many others. Anime, television shows, and video games regularly use JPop theme songs and voice actors while movies are repeatedly made featuring top stars from the genreu” J-pop itself includes Japanese Idol. Idols are mostly girls portrayed for their "cuteness" and "innocence"; they are mostly intended to 8 be role models everyone adores (Kelly, 2004). -

AKB48 and a New Trend in Japan's Music Industry

Idols You Can Meet: AKB48 and a New Trend in Japan’s Music Industry YUYA KIUCHI Introduction KB48, A JAPANESE IDOL GROUP WITH OVER 130 YOUNG FEMALE singers, presents a new trend in the entertainment industry. A It is a trend that is seemingly more democratic, but that cre- ates and takes advantage of passionate and sometimes obsessive fans in a unique way. More significantly, it is the trend in which musical talents matter less than the group’s manipulative image of purity that discounts the individuality of singers, quiets them, and even exposes them to psychological and physical danger for the success of the group. The group reflects problematic gender dynamics in which women’s sexuality is both idolized and exploited. Members of AKB48 are constantly evaluated by fans through pop- ularity voting. The winner of the process, also known as the general election, earns the middle front-row spot to appear on TV and in con- certs. The group sells merchandise that also serves as a medium for popularity voting, creating a massive marketing machine. In other instances, CDs come with a ticket for a special invitation-only event. Such an event where fans may be able to shake hands with or talk to a singer not only gives fans a sense of privilege but also reminds AKB48 members that their career is directly connected to these core fans. Furthermore, despite the mass popularity of certain singers, new singers join and old ones quit frequently. Group members are also split into subgroups so that AKB48 can be at multiple locations at The Journal of Popular Culture, Vol. -

Alih Kode Dan Campur Kode Padalirik Lagu Dalam Album 一心向前 (Yixin Xiang Qian)

ALIH KODE DAN CAMPUR KODE PADALIRIK LAGU DALAM ALBUM 一心向前 (YIXIN XIANG QIAN) ALIH KODE DAN CAMPUR KODE PADALIRIK LAGU DALAM ALBUM 一心向前 (YIXIN XIANG QIAN) Ilham Suaryadi Jurusan Bahasa dan Sastra Mandarin, Fakultas Bahasa dan Seni, Universitas Negeri Surabaya [email protected] Pembimbing: Dr. Maria Mintowati, M.Pd Abstrak Penggunaan alih kode dan campur kode sudah menjadi hal yang sering terjadi di kehidupan sehari-hari. Hal ini dikarenakan adanya bilingualisme, multilingualisme, kemajuan budaya dan teknologi dalam kehidupan. Bahkan lagu- lagu yang diciptakan pada era sekarang ini juga tak luput dari penggunaan alih kode dan campur kode. Seperti halnya lagu dalam Album 一心向前 (yīxīn xiàng qián), lagu-lagu dalam album tersebut banyak ditemukan alih kode dan campur kode. Kata Kunci: Alih Kode, Campur Kode, Lagu Abstract The use of code switching and code mixing is becoming a habbit in everyday life. It happens because of the improvement in bilingualism, multilingualism, culture and technology. Even songs in this era also have code switching and code mixing on it. Just like the songs from 一心向前 (yīxīn xiàng qián) album, songs in that album have been found some code switching and code mixing. Keywords : Code Switching, Code Mixing, Song seseorang, karena saat ini bahasa memegang peranan PENDAHULUAN penting dalam pergaulan internasional dan segala aspek Bahasa adalah sistem simbol bunyi yang kehidupan. Orang dengan multibahasa cenderung lebih keluarkan oleh alat ucap manusia yang bersifat arbitrer mudah bergaul dan memiliki pergaulan yang lebih luas dan konvensional dan digunakan sebagai alat komunikasi. dengan lingkungan sekitar atau dunia internasional karena bahasa merupakan salah satu alat komunikasi yang paling mereka tidak terhalang dengan bahasa. -

Japan's Diplomacy Open to the Public

Chapter 4 Japan’s Diplomacy Open to the Public section 1 Japanese Society and People Deepening Their Ties with the World・・・・・・・ 300 section 2 Supporting Japanese Nationals Overseas・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・ 317 section 3 Diplomacy with the Support of the Public・ ・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・ 332 Chapter 4 Japan's Diplomacy Open to the Public Section 1 Japanese Society and People Deepening Their Ties with the World Overview in 2015),” a policy is set forth whereby the government promotes further participation of (Tapping the Power of Foreign Nationals foreign human resources. To reach such target, for the Growth of Japan) MOFA works with relevant ministries and Increasing the number of people traveling agencies to ensure the system and measures between Japan and other countries for accepting foreign human resources to stimulates the economy and promotes mutual be effective and in line with the principle of understanding among different cultures. human rights. Moreover, MOFA encourages Based on this view, the Ministry of Foreign national debate on the challenges arising Affairs (MOFA) takes steps to facilitate the from the acceptance of foreign nationals and entry of foreign nationals into Japan and also their integration into Japanese society, as their stay in the country. well as appropriate measures to be taken. The Government of Japan attaches (International Organizations and Japanese importance to promoting Japan as a tourism- Nationals) oriented country and to regional revitalization At international organizations, staff from all inside Japan, and MOFA has engaged in over the world capitalizes on their respective efforts to relax visa requirements. With the skills and traits to carry out activities for continuous trend of yen depreciation and addressing global issues. -

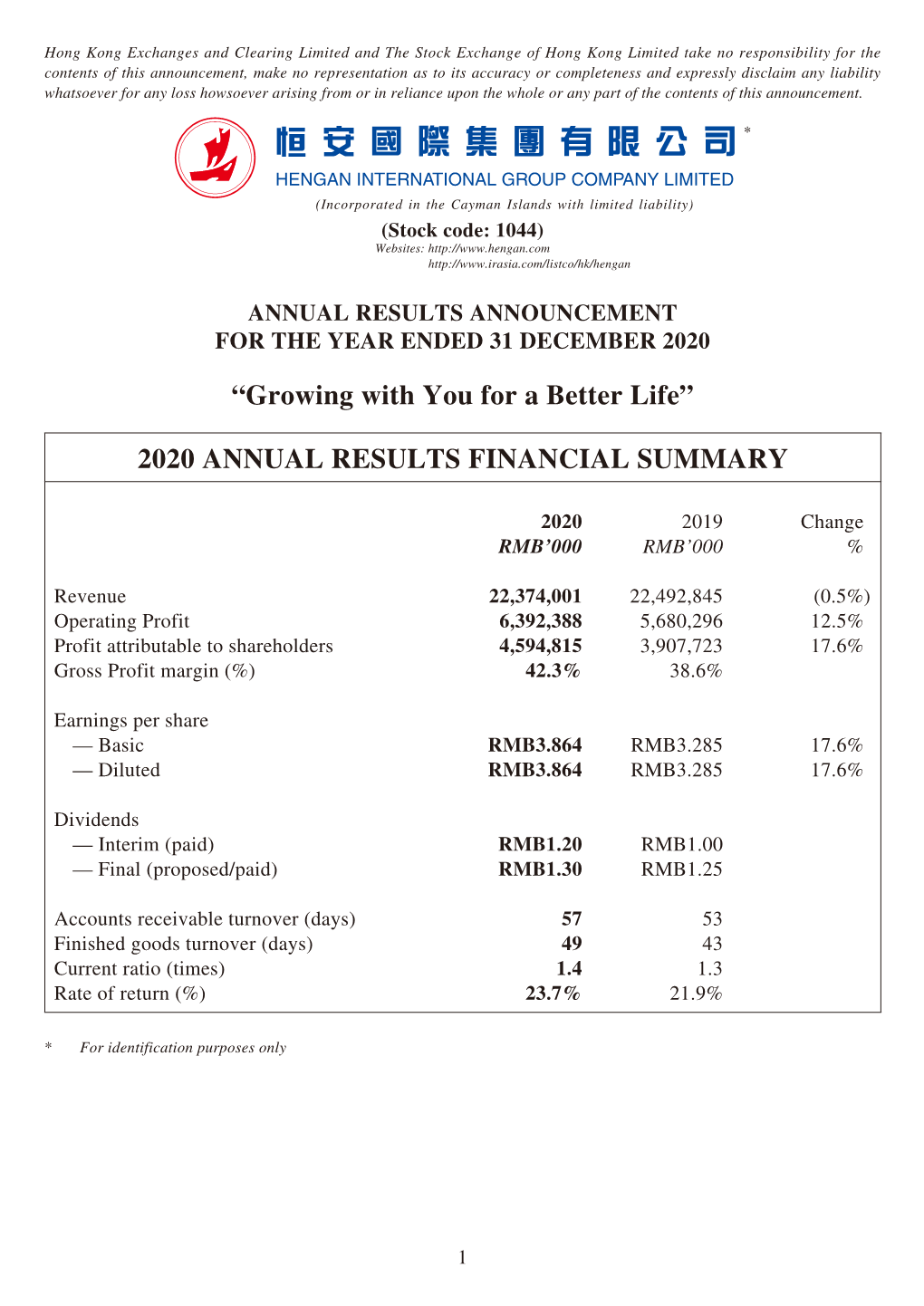

Hengan International Announces 2020 Annual Results Profit Attributable to Shareholders up 17.6% to RMB4.59 Billion Final Dividend at RMB1.30 Per Share Page 2 of 9

【For Immediate Release】 Hengan International Announces 2020 Annual Results Profit Attributable to Shareholders Up 17.6% to RMB4.59 Billion Final Dividend at RMB1.30 Per Share *** *** Notable Positive Effects of Product Premiumisation and Optimisation and Sales Channel Reform Continuously Strengthened Business Resilience Financial Highlights For the year ended 31 December 2020 2019 Change RMB’000 RMB’000 Revenue 22,374,001 22,492,845 -0.5% Gross profit margin 42.3% 38.6% +3.7 p.p. Operating profit 6,392,388 5,680,296 +12.5% Profit attributable to shareholders 4,594,815 3,907,723 +17.6% Basic earnings per share (RMB) 3.864 3.285 +17.6% Final dividend per share (RMB) 1.30 1.25 +4.0% (19 March 2021— Hong Kong) ─ Hengan International Group Company Limited (“Hengan International” or the “Company”, SEHK stock code: 1044, together with its subsidiaries, the “Group”) announces today its annual results for the year ended 31 December 2020. National health awareness heightened significantly and demand for personal and household hygiene products was strong. The Group’s sales in the first quarter were dampened due to the inevitable impacts on logistics and resumption of work, and amidst the market recovery in the second half of the year, the Group stepped up its efforts in developing e-commerce and new retail channels, resulting in a substantial increase in the expenses of marketing and promotion, all of which put pressure on sales during the year. However, thanks to Hengan’s well-known brand quality assurance, agile “small sales team” and the Group’s effort to maintain production and supply levels to the greatest possible extent, the negative impacts were effectively mitigated.