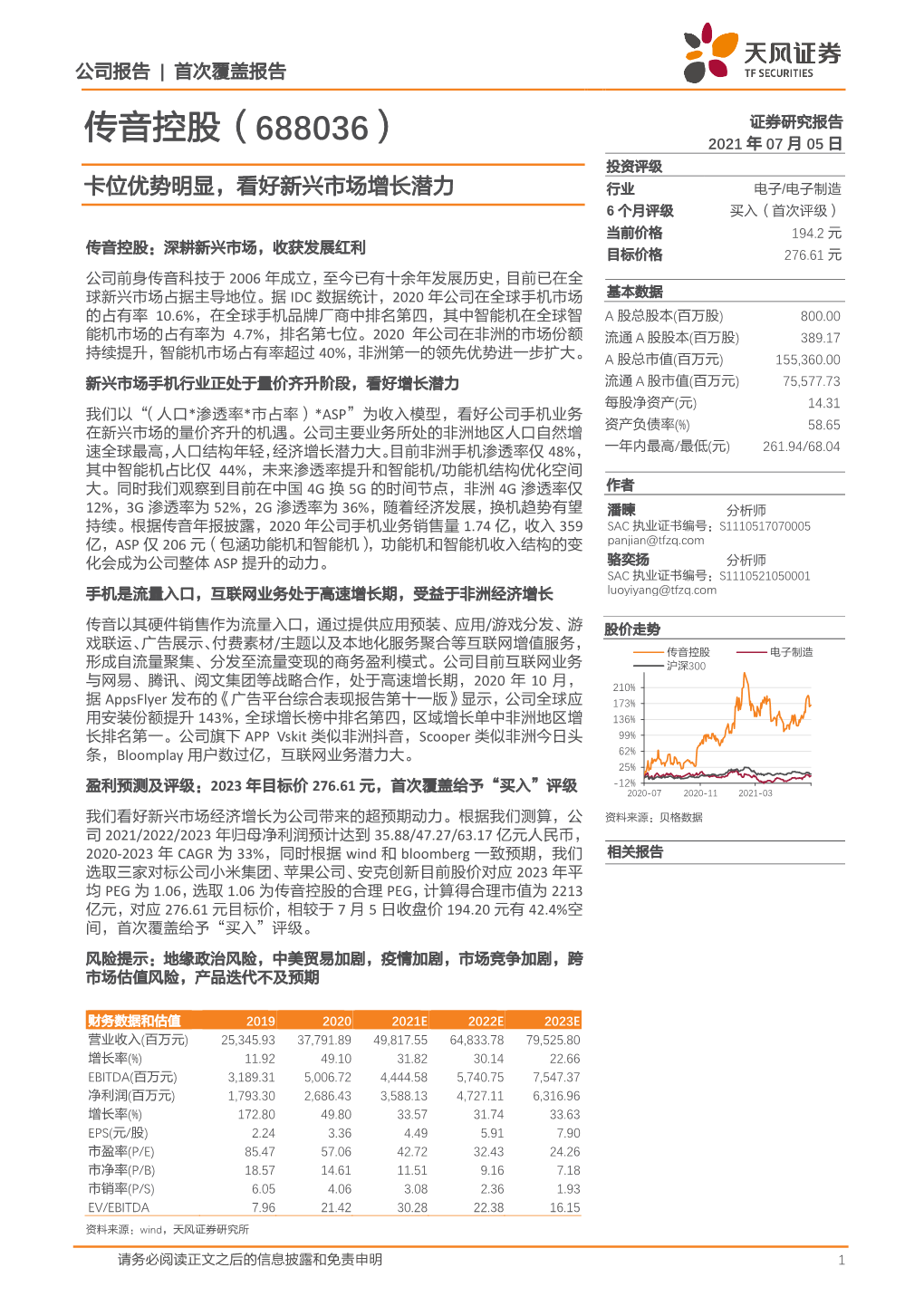

传音控股(688036) 2021 年 07 月 05 日 投资评级 卡位优势明显,看好新兴市场增长潜力 行业 电子/电子制造 6 个月评级 买入(首次评级)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

State of Mobile Data 2019 Report by Nendo

A Nendo Publication THE STATE OF MOBILE DATA 2019 Context, Consumption, Control Contents ACKNOWLEDGEMENTS 03 CONSUMPTION CONTROL BACKGROUND 03 THE 5 S'S OF KENYAN INTERNET USE 24 SOFTWARE 39 THE ATTENTION ECONOMY 04 MINIMISING USAGE 39 SEARCH 25 THE 3 C'S OF THE INTERNET 04 MONITORING 42 SOCIAL 26 ZERO-RATING 42 SPORT 27 CONTEXT WI-FI AND ALTERNATIVE MEANS OF 44 SEX 28 CONNECTIVITY THE MOBILE PHONE AND THE 10 STORIES 28 INFORMATION SUPERHIGHWAY LITE-APPS OVER FULL APPS 46 IN THE BEGINNING WAS THE CYBER CAFÉ 10 INTERNET & MOBILE DATA BUNDLE 30 SWITCHING TO ANDROID GO-EDITION 46 THE MODERN CYBER CAFÉ - TYPE, 12 PRICING - AFFORDABILITY AND 30 TRANSSION & BOOMPLAY 47 REGISTER, PRINT OPTIONS IS THE WEB OPTIMISED FOR 48 BILLING & BYTES: THE CYBER CAFÉ VS 13 THE COST OF ACCESS 31 PREMIUM EXPERIENCES RATHER THE SMARTPHONE ADVERTISING TECHNOLOGY’S 35 THAN MEGABYTECONSTRAINTS? SMARTPHONES, FEATURE PHONES & 13 CONSUMING EFFECT ON MEGABYTES IN BASIC PHONES KENYA RECOMMENDATIONS HOW SMARTPHONES WORK 18 CAVEAT 50 HOW MANY KENYANS ARE ON THE 09 DISCLOSURES 53 INTERNET? END NOTES 54 State of Mobile Data 2019: Introduction 02 About Author Acknowledgements Mark Kaigwa is the Founder of Nendo - a digital My appreciation goes to Wanjiru Kaigwa for her growth consultancy delivering Advisory, Academy support in bringing this report to life and being a and Agency services. As a speaker, he has travelled sounding board throughout the writing process. My to over 37 countries around the world in a quest to thanks to Makena Onjerika for her editorial deliver projects, workshops and insights about assistance. -

Leading Chinese Cross-Border Brands – the Top 50

Leading Chinese cross-border brands The Top 50 kpmg.com/cn © 2018 KPMG, a Hong Kong partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Contents Foreword: KPMG & Facebook 2 Executive summary 4 Methodology 6 Top 50 Chinese global brands 8 Survey commentary 10 Chinese brands going global – business opportunities for SMEs 32 • Thought leader: Yan Zhu, Head, Institute of Internet Industry, Tsinghua University 34 Going global and ensuring market diversification 36 Customer centricity 44 Thought leaders 58 • Kaitian Zeng, Co-founder, 37 Interactive Entertainment 58 • Yue Leng, General Manager, Tmall Global, Alibaba Group 59 • Scott Thiel, Partner, DLA Piper 60 • Gu He, Vice President, Shenzhen Globalegrow E-Commerce Co., Ltd. 62 • Chibo Tang, Managing Director, Gobi Partners 63 • Ethan Wang, Vice President, NetEase 64 • Scott Kronick, Chief Executive, Public Relations & Influence, Asia, Ogilvy 65 • Alen Wu, Vice President, OPPO Mobile; Head of Business, Overseas Markets 66 • Beehong Hong, General Manager, Brand Management Centre, TRANSSION Holdings 67 Acknowledgements 68 About us 69 Contact us 70 Leading Chinese cross-border brands: The Top 50 1 © 2018 KPMG, a Hong Kong partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. © 2018 KPMG, a Hong Kong partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Foreword Global trade has long been a hallmark of Chinese business culture. -

Handset ODM Industry White Paper

Publication date: April 2020 Authors: Robin Li Lingling Peng Handset ODM Industry White Paper Smartphone ODM market continues to grow, duopoly Wingtech and Huaqin accelerate diversified layout Brought to you by Informa Tech Handset ODM Industry White Paper 01 Contents Handset ODM market review and outlook 2 Global smartphone market continued to decline in 2019 4 In the initial stage of 5G, China will continue to decline 6 Outsourcing strategies of the top 10 OEMs 9 ODM market structure and business model analysis 12 The top five mobile phone ODMs 16 Analysis of the top five ODMs 18 Appendix 29 © 2020 Omdia. All rights reserved. Unauthorized reproduction prohibited. Handset ODM Industry White Paper 02 Handset ODM market review and outlook In 2019, the global smartphone market shipped 1.38 billion units, down 2.2% year-over- year (YoY). The mature markets such as North America, South America, Western Europe, and China all declined. China’s market though is going through a transition period from 4G to 5G, and the shipments of mid- to high-end 4G smartphone models fell sharply in 2H19. China’s market shipped 361 million smartphones in 2019, a YoY decline of 7.6%. In the early stage of 5G switching, the operator's network coverage was insufficient. Consequently, 5G chipset restrictions led to excessive costs, and expectations of 5G led to short-term consumption suppression. The proportion of 5G smartphone shipments was relatively small while shipments of mid- to high-end 4G models declined sharply. The overall shipment of smartphones from Chinese mobile phone manufacturers reached 733 million units, an increase of 4.2% YoY. -

Section 3: China's Strategic Aims in Africa

SECTION 3: CHINA’S STRATEGIC AIMS IN AFRICA Key Findings • Beijing has long viewed African countries as occupying a cen- tral position in its efforts to increase China’s global influence and revise the international order. Over the last two decades, and especially under General Secretary of the Chinese Com- munist Party (CCP) Xi Jinping’s leadership since 2012, Beijing has launched new initiatives to transform Africa into a testing ground for the export of its governance system of state-led eco- nomic growth under one-party, authoritarian rule. • Beijing uses its influence in Africa to gain preferential access to Africa’s natural resources, open up markets for Chinese exports, and enlist African support for Chinese diplomatic priorities on and beyond the continent. The CCP flexibly tailors its approach to different African countries with the goal of instilling admira- tion and at times emulation of China’s alternative political and governance regime. • China is dependent on Africa for imports of fossil fuels and commodities constituting critical inputs in emerging technology products. Beijing has increased its control of African commodi- ties through strategic direct investment in oil fields, mines, and production facilities, as well as through resource-backed loans that call for in-kind payments of commodities. This control threatens the ability of U.S. companies to access key supplies. • As the top bilateral financier of infrastructure projects across Africa, China plays an important role in addressing the short- age of infrastructure on the continent. China’s financing is opaque and often comes with onerous terms, however, leading to rising concerns of economic exploitation, dependency, and po- litical coercion. -

Annual Report DBX ETF Trust

May 31, 2021 Annual Report DBX ETF Trust Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF (ASHS) Xtrackers MSCI All China Equity ETF (CN) Xtrackers MSCI China A Inclusion Equity ETF (ASHX) DBX ETF Trust Table of Contents Page Shareholder Letter ....................................................................... 1 Management’s Discussion of Fund Performance ............................................. 3 Performance Summary Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 6 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 8 Xtrackers MSCI All China Equity ETF .................................................... 10 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 12 Fees and Expenses ....................................................................... 14 Schedule of Investments Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 15 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 20 Xtrackers MSCI All China Equity ETF .................................................... 28 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 33 Statements of Assets and Liabilities ........................................................ 42 Statements of Operations ................................................................. 43 Statements of Changes in Net -

China and the World: Inside the Dynamics of a Changing Relationship

China and the world: Inside the dynamics of a changing relationship changing a of dynamics the Inside world: the and China China and the world Inside the dynamics of a changing relationship July 2019 McKinsey Global Institute Since its founding in 1990, the McKinsey Global Institute (MGI) has sought to develop a deeper understanding of the evolving global economy. As the business and economics research arm of McKinsey & Company, MGI aims to provide leaders in the commercial, public, and social sectors with the facts and insights on which to base management and policy decisions. MGI research combines the disciplines of economics and management, employing the analytical tools of economics with the insights of business leaders. Our “micro-to-macro” methodology examines microeconomic industry trends to better understand the broad macroeconomic forces affecting business strategy and public policy. MGI’s in-depth reports have covered more than 20 countries and 30 industries. Current research focuses on six themes: productivity and growth, natural resources, labor markets, the evolution of global financial markets, the economic impact of technology and innovation, and urbanization. Recent reports have assessed the digital economy, the impact of AI and automation on employment, income inequality, the productivity puzzle, the economic benefits of tackling gender inequality, a new era of global competition, Chinese innovation, and digital and financial globalization. MGI is led by three McKinsey & Company senior partners: Jacques Bughin, Jonathan Woetzel, and James Manyika, who also serves as the chairman of MGI. Michael Chui, Susan Lund, Anu Madgavkar, Jan Mischke, Sree Ramaswamy, and Jaana Remes are MGI partners, and Mekala Krishnan and Jeongmin Seong are MGI senior fellows. -

Unwanted App Distribution on Android Devices

How Did That Get In My Phone? Unwanted App Distribution on Android Devices Platon Kotzias∗, Juan Caballeroy, Leyla Bilge∗ ∗NortonLifelock Research Group, y IMDEA Software Institute Abstract—Android is the most popular operating system with services such as the Play market are restricted [53], [77]. Since billions of active devices. Unfortunately, its popularity and app markets are popular and open to any user, prior work openness makes it attractive for unwanted apps, i.e., malware has focused on analyzing them [15], [53], [72], [77], [83]. and potentially unwanted programs (PUP). In Android, app installations typically happen via the official and alternative mar- However, the security community lacks a global understanding kets, but also via other smaller and less understood alternative about how Android unwanted apps are distributed. While distribution vectors such as Web downloads, pay-per-install (PPI) apps are largely distributed through markets, other smaller services, backup restoration, bloatware, and IM tools. This work alternative distribution vectors such as Web downloads, pay- performs a thorough investigation on unwanted app distribution per-install (PPI) services, bloatware, backup restoration, and by quantifying and comparing distribution through different vectors. At the core of our measurements are reputation logs of a even instant messaging (IM) should not be ignored. We close large security vendor, which include 7.9M apps observed in 12M this gap in the existing research by investigating how un- devices between June and September 2019. As a first step, we wanted apps get distributed into user devices through different measure that between 10% and 24% of users devices encounter at distribution vectors. -

DHL Supports Transsion Holdings Rapid Expansion Into

______________________________________________________________ DHL supports Transsion Holdings rapid expansion into emerging markets • Fast-growing mobile phone manufacturer taps on DHL Global Forwarding’s vast network to grow distribution footprint Hong Kong, July, 13th 2016: DHL Global Forwarding, the leading international provider of air, sea and road freight services, today announced it has been awarded the airfreight solutions provider for Transsion Holdings, one of the world’s fastest-growing and major mobile phone manufacturers. With the contract, DHL provides airfreight services from Transsion’s manufacturing base in South China to 28 countries around the world across Asia, the Middle East and Africa. In addition, DHL Global Forwarding provides sea freight for Transsion products into India, where it also provides warehousing services to support the company’s new foray into the India market. Transsion Holdings, a privately held company founded in Hong Kong, sold 59 million cell phone units in 2015 through its brands Tecno, itel and Infinix which target different market segments. The high tech company, which has carved a strong market presence in Africa, specializes in R&D, production, sale and services for mobile communication products. The company is actively expanding its international footprint across emerging markets. Transsion Holdings is a strategic customer under DHL's Fast Growing Enterprises initiative which offers a comprehensive suite of tailored logistics solutions across the divisions of the group. As part of the strategic engagement between the two companies, DHL’s airfreight service complements and supports Transsion’s existing sales, supply chain, and manufacturing network. Offering an end-to-end solution, DHL’s airfreight services transport Transsion mobile devices and spare parts from Hong Kong into both India and Africa, with additional value added services such as customs clearance and truck delivery to Transsion warehouses, saving Transsion time and resources compared to its previous operations. -

LIGHT COMMERCIAL LIGHT R410a

2018 Gene LIGHT COMMERCIAL r al Catalogue R410a LIGHT COMMERCIAL R410a C Appliances (India) Pvt. Ltd. Commercial Air Conditioning omme ADDRESS ADDRESS Building No-1, Okhla Industrial Estate, No.1 Haier Road, Hi-tech Zone, Qingdao 266101 P.R.China r cia Phase III, New Delhi-110020 CONTACTS l CONTACTS Tel: +86-532-8893-6938 A Tel: +91-11-39496000, 30674000 B2B Website: www.haierac.com C B2B Website: www.haierindiacac.com B2C Website: www.haier.com B2C Website: www.haier.com/in The specifications, designs and information in this brochure are subject to the actual products. Haier reserves the right to make change without any notice. 2018 2018 Gene LIGHT COMMERCIAL r al Catalogue R410a LIGHT COMMERCIAL R410a C Appliances (India) Pvt. Ltd. Commercial Air Conditioning omme ADDRESS ADDRESS Building No-1, Okhla Industrial Estate, No.1 Haier Road, Hi-tech Zone, Qingdao 266101 P.R.China r cia Phase III, New Delhi-110020 CONTACTS l CONTACTS Tel: +86-532-8893-6938 A Tel: +91-11-39496000, 30674000 B2B Website: www.haierac.com C B2B Website: www.haierindiacac.com B2C Website: www.haier.com B2C Website: www.haier.com/in The specifications, designs and information in this brochure are subject to the actual products. Haier reserves the right to make change without any notice. 2018 Global Network From introduction to absorption, from manufacture to creation, Haier has been accomplishing Chinese peopleʼs goal of creating a world-renowned brand step over the past 30 years.Haier boasts 66 trading companies, 10 design R&D Centers,108 manufacturing bases and 24 innovative industrial parks across the world with a global selling network comprised of 143,300 sales outlets spanning more than 100 countries. -

Market Entry Strategies Adopted by Multinational Smartphone Companies in Kenya: a Case Study of Tecno Mobile

MARKET ENTRY STRATEGIES ADOPTED BY MULTINATIONAL SMARTPHONE COMPANIES IN KENYA: A CASE STUDY OF TECNO MOBILE WYCLIFFE AMOLLO ONYALO A RESEARCH PROJECT SUBMITTED IN PARTIAL FULFILMENT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION, SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI NOVEMBER, 2016 DECLARATION This research project is my original work and has not been submitted for examination to any other University. Signature................................................ Date...................................... WYCLIFFE AMOLLO ONYALO D61/72534/2014 This research project has been submitted for examination with my approval as the University Supervisor Signature................................................ Date...................................... DR. JOHN YABS SENIOUR LECTURER SCHOOL OF BUSINESS UNIVERSITY OF NAIROBI ii ACKNOWLEDGEMENT First and foremost, I give all Glory and Honour to the Almighty God for granting me good health during my postgraduate studies. Secondly, I sincerely thank my family for their love, encouragement and support during this period. Finally, I give many thanks to my supervisors, Dr. John Yabs & Dr. Victor Ndambuki, and my Moderator, Prof. Martin Ogutu, for their wise guidance and assistance during the research period. iii DEDICATION I dedicate this project to my little boy Alvah Griffin, my wife Cynthia and all those who wholeheartedly supported me in the completion of this project. iv TABLE OF CONTENTS DECLARATION ............................................................................................................................. -

The Mobile Economy China 2019

The Mobile Economy China 2019 Copyright © 2019 GSM Association The GSMA represents the interests of mobile operators GSMA Intelligence is the definitive source of global mobile worldwide, uniting more than 750 operators with over operator data, analysis and forecasts, and publisher of 350 companies in the broader mobile ecosystem, authoritative industry reports and research. Our data including handset and device makers, software companies, covers every operator group, network and MVNO in every equipment providers and internet companies, as well as country worldwide – from Afghanistan to Zimbabwe. It is organisations in adjacent industry sectors. The GSMA also the most accurate and complete set of industry metrics produces the industry-leading MWC events held annually in available, comprising tens of millions of individual data Barcelona, Los Angeles and Shanghai, as well as the Mobile points, updated daily. GSMA Intelligence is relied on by 360 Series of regional conferences. leading operators, vendors, regulators, financial institutions and third-party industry players, to support strategic For more information, please visit the GSMA corporate decision-making and long-term investment planning. The website at www.gsma.com data is used as an industry reference point and is frequently cited by the media and by the industry itself. Our team Follow the GSMA on Twitter: @GSMA of analysts and experts produce regular thought-leading research reports across a range of industry topics. www.gsmaintelligence.com [email protected] Contents -

01 TCL Cover E 0..0

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in doubt as to any aspect about this circular, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitors, professional accountant or other professional advisor. If you have sold or transferred all your Shares in TCL ELECTRONICS HOLDINGS LIMITED, you should at once hand this circular and proxy form enclosed herein to the purchaser or transferee, or to the bank or stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. TCL ELECTRONICS HOLDINGS LIMITED TCL 電子控股有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 01070) (1) MAJOR AND CONNECTED TRANSACTION IN RELATION TO THE ACQUISITION (2) MAJOR AND CONNECTED TRANSACTION IN RELATION TO THE DISPOSAL (3) THE NON-COMPETITION ARRANGEMENT AND (4) NOTICE OF EGM Independent Financial Adviser to the Independent Board Committee and the Shareholders SOMERLEY CAPITAL LIMITED A letter from the Board is set out on pages 6 to 43 of this circular. A letter from the Independent Board Committee containing its recommendation to the Shareholders is set out on page 44 of this circular. A letter from Somerley Capital Limited, the Independent Financial Adviser, containing its advice to the Independent Board Committee and the Shareholders is set out on pages 45 to 75 of this circular.