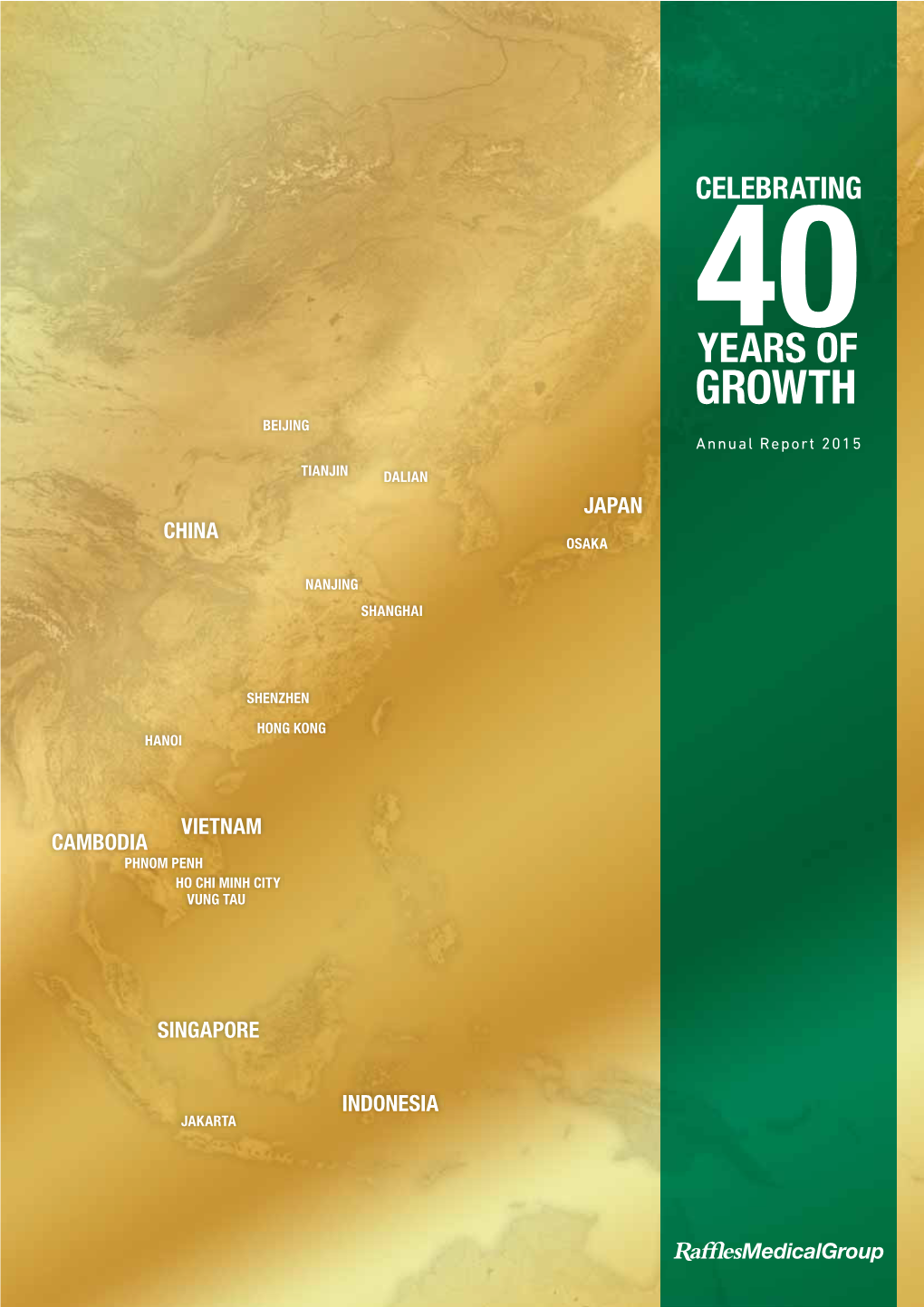

GROWTH BEIJING Annual Report 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Caring for Our People: 50 Years of Healthcare in Singapore

Caring for our People Prime Minister’s Message Good health is important for individuals, for families, and for our society. It is the foundation for our people’s vitality and optimism, and a reflection of our nation’s prosperity and success. A healthy community is also a happy one. Singapore has developed our own system for providing quality healthcare to all. Learning from other countries and taking advantage of a young population, we invested in preventive health, new healthcare facilities and developing our healthcare workforce. We designed a unique financing system, where individuals receive state subsidies for public healthcare but at the same time can draw upon the 3Ms – Medisave, MediShield and Medifund – to pay for their healthcare needs. As responsible members of society, each of us has to save for our own healthcare needs, pay our share of the cost, and make good and sensible decisions about using healthcare services. Our healthcare outcomes are among the best in the world. Average life expectancy is now 83 years, compared with 65 years in 1965. The infant mortality rate is 2 per 1,000 live births, down from 26 per 1,000 live births 50 years ago. This book is dedicated to all those in the Government policies have adapted to the times. We started by focusing on sanitation and public health and went on healthcare sector who laid the foundations to develop primary, secondary and tertiary health services. In recent years, we have enhanced government subsidies of a healthy nation in the years gone by, substantially to ensure that healthcare remains affordable. -

Fotona User Meeting Invitation2

AUG 9, Friday | 14:30 - 21:00 Hilton Kuala Lumpur Organised by PROGRAMME AGENDA SESSION ONE Chairperson: Assoc Prof Dr Morthy 02.30 REGISTRATION ASSOC PROF DR MORTHY 03.30 DR LUCAS LC CHIA Treatment Of Pigmentation & Recalcitrant 03.35 Melasma With Combination Of Fotona’s Multiple Wavelengths DR TRISTAN TAN Combined Approach In Skin Toning & 03.55 Tightening With Fotona Nd & Erbium YAG DR KENNETH THEAN Non Invasive Eyebag Treatment Using 04.15 The Synergistic Combination Of Four lasers Q&A 04.35 TEA BREAK 04.50 SESSION TWO Chairperson: Dr Hew Yin Keat DR HEW YIN KEAT 05.05 DR RATCHATHORN 05.10 PANCHAPRATEEP Pan Facial 4D Tightening DR ADRIAN YONG Acne And Acne Scarring 05.30 Treatments With Starwalker DR CH’NG CHIN CHWEN Er:YAG Hair Stimulation 05.50 An Asian Experience DR NURUL AIN Yummy Mummy : Head To Toe 06.10 With Fotona SP Dynamis Q&A 06.30 Gynaecology DATO’ DR. MOHAMED RAFI Aesthetic Gynaecology 06.45 The Unspoken Revolution DR VIDYA PANCHOLIA The Use Of Non-ablative 07.05 Er:YAG For Pelvic Floor Disorders Q&A 07.25 DINNER 07.40 CHAIRPERSONS • Associate Professor Dr Ramamurthy (Dr. Morthy), a graduate of Manipal University (1995) is an internationally renowned Aesthetic Physician, Academician and Business Consultant. • He pursued his education in Dermatology (Cardiff) and obtained his Fellowship in Laser Surgery (Utah). He was appointed as a senior lecturer and later as the Head of Department and Assoc Professor of Aesthetic Medicine for a medical university in Malaysia. He is currently the chairman for Aesthetic Academy Asia. -

A Study of Collocations and Move Analysis of Online International Hospital Profile 'About Us': a Comparison Between Thai and Singaporean Hospitals

A STUDY OF COLLOCATIONS AND MOVE ANALYSIS OF ONLINE INTERNATIONAL HOSPITAL PROFILE 'ABOUT US': A COMPARISON BETWEEN THAI AND SINGAPOREAN HOSPITALS BY MISS PATTRA SRISUWATANASAGUL AN INDEPENDENT STUDY PAPER SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF ARTS IN CAREER ENGLISH FOR INTERNATIONAL COMMUNICATION LANGUAGE INSTITUTE, THAMMASAT UNIVERSITY ACADEMIC YEAR 2016 COPYRIGHT OF THAMMASAT UNIVERSITY Ref. code: 25595821040291AJY A STUDY OF COLLOCATIONS AND MOVE ANALYSIS OF ONLINE INTERNATIONAL HOSPITAL PROFILE 'ABOUT US': A COMPARISON BETWEEN THAI AND SINGAPOREAN HOSPITALS BY MISS PATTRA SRISUWATANASAGUL AN INDEPENDENT STUDY PAPER SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF ARTS IN CAREER ENGLISH FOR INTERNATIONAL COMMUNICATION LANGUAGE INSTITUTE, THAMMASAT UNIVERSITY ACADEMIC YEAR 2016 COPYRIGHT OF THAMMASAT UNIVERSITY Ref. code: 25595821040291AJY (1) Independent Study Paper Title A STUDY OF COLLOCATIONS AND MOVE ANALYSIS OF ONLINE INTERNATIONAL HOSPITAL PROFILE 'ABOUT US': A COMPARISON BETWEEN THAI AND SINGAPOREAN HOSPITALS Author MISS PATTRA SRISUWATANASAGUL Degree Master of Arts Major Field/Faculty/University Career English for International Communication Language Institute Thammasat University Independent Study Paper Advisor Chanika Gampper, Ph.D. Academic Years 2016 ABSTRACT This study aimed to investigate the section headings, move patterns and the adjectives used to describe ‘hospital’ in online international hospital profiles (OIHP) ‘about us’ between Thai and Singaporean hospitals. The corpora consisted of eight texts from hospital profile ‘about us’ from Thailand and Singapore. This study adapted the framework of Lam (2009) and Graham (2013) to analyze the section headings and move analysis in genre OIHP ‘about us’ overview and used AntConc, freeware corpus analysis toolkit (Anthony,2014) to seek the collocations between ‘adjectives + hospital’ at left span of 2:0. -

Collaborative Effort in Dental Care

WWW.SINGHEALTH.COM.SG • WWW.SGH.COM.SG SEP/OCT 2020 MCI (P) 056/10/2019 THE FLAGSHIP IN FOCUS PUBLICATION OF THE SINGHEALTH DUKE-NUS ACADEMIC MEDICAL CENTRE Collaborative Page 05 Start walking hours effort in after hip surgery dental care IN FOCUS National Dental Centre Singapore partners dentists in the community to bring affordable and convenient dental care to patients READ MORE ON PAGE 3 Page 07 Designing healthcare spaces for holistic experiences PEOPLE Page 13 Pharmacists are more than just medication dispensers 01 SingHealth Issue 60 Cover Final.indd 7 17/8/20 4:44 PM SGH200 PAGE 02 The history of Singapore General Hospital (SGH) is the history Counting of medicine in Singapore. The first general hospital for British troops was established in Singapore in 1819, but it was only in PUBLISHERS down to 1821 that it began serving the general populace — marking the true beginnings of SGH. As the countdown to SGH’s bicentennial begins, Singapore Health will present snapshots showing changes in 2021 medicine and its various disciplines in the past 200 years. CO-PUBLISHERS A late bloomer blossoms The Department of Physiotherapy is the largest in Singapore, providing services across the wide spectrum of clinical specialties. Photo: Vernon Wong Photo: by Jennifer Liaw, Head, Physiotherapy ® Department, Singapore General Hospital hysiotherapy at Singapore CONTENT ADVISOR General Hospital (SGH) is Group Chief Communications a late bloomer. For over Officer, SingHealth 5,000 years, the Chinese Audrey Lau had considered stretching and P EDITORIAL TEAM breathing exercises as vital to health. Meanwhile, Hippocrates (around Lim Mui Khi, Domenica Tan, 460-377 BC), widely accepted as the Jenny Ang, Lydia Ng founder of Western medicine, strongly promoted regular physical activity. -

Exploring Healthcare and Culture in China's Southwest Dean’S Message

A publication of the Yong Loo Lin School of Medicine • Issue 31 / August 2019 EXPLORING HEALTHCARE AND CULTURE IN CHINA'S SOUTHWEST DEAN’S MESSAGE Dear Reader As we look ahead, I am confident that Nursing will play an even bigger role in the planning and delivery of care, Fourteen years ago, the National University of Singapore especially when the focus of care shifts beyond hospitals. introduced an undergraduate nursing degree. Taught by This is where our graduate nurses will come to the fore. They experienced faculty with extensive nursing experience are the best professionals to deliver care in the community, gained here and abroad, the pioneer batch of graduate as the population gets older and more chronic care is nurses has gone on to make their mark in various required. healthcare roles throughout Singapore. The next time you encounter our nurses, please take a They have been joined over the years by over a thousand moment to congratulate them. They do us all proud. other NUS Nursing graduates. Working alongside other healthcare colleagues, NUS Nursing graduates have On an equally happy note, I am pleased to introduce our contributed immensely to the health and well-being of School orchid, the Vanda NUS Medicine. The orchid is Singaporeans from all walks of life. This year, the Alice Lee distinguished by its base yellow colour and tessellations Centre for Nursing Studies celebrates the 10th anniversary that range from orange to crimson red – colours that of the graduation of that inaugural Nursing Class of 2009. correspond to those on the hoods of academic gowns worn That first class numbered about 50 graduates. -

Appointment of Independent Non-Executive Director

Company Announcement Boustead Singapore Limited (Co. Reg. No. 197501036K) 82 Ubi Avenue 4 #08-01 Edward Boustead Centre Singapore 408832 APPOINTMENT OF INDEPENDENT NON-EXECUTIVE DIRECTOR Singapore, 1 April 2020 The Board is pleased to announce the appointment today of Mr Liak Teng Lit as an Independent Non-Executive Director of the Company, as well as member of the Audit & Risk Committee. The Board considers Mr Liak Teng Lit to be an independent Director for the purposes of Rule 704(8) of the Listing Manual of Singapore Exchange Securities Trading Limited. The Board is of the view that the appointment of Mr Liak will further broaden and enhance the collective skills and experience of the Board. In particular, Mr Liak’s experience in public healthcare in Singapore will be beneficial to the Company’s Healthcare Technology business. Mr Liak currently serves on the boards of Pathlight School, At-Sunrice GlobalChef Academy and Advisory Board of Centre for Liveable Cities. He was previously Group Chief Operating Officer of Perennial Real Estate Holdings Limited and Chief Executive Officer of Perennial Healthcare Pte Ltd. Mr Liak served 38 years in the public healthcare sector. He was previously Group Chief Executive Officer of Alexandra Health System which managed Khoo Teck Puat Hospital and Yishun Community Hospital in the north of Singapore. He was also previously Chief Executive Officer of Khoo Teck Puat Hospital, Alexandra Hospital, Changi General Hospital and Toa Payoh Hospital. He was involved in the restructuring of major public hospitals in Singapore including National University Hospital, Kandang Kerbau Hospital and Singapore General Hospital. -

Perspectives from KK Hospital, Singapore - the Former World's Largest Maternity Hospital K Tan, S Chern

The Internet Journal of Gynecology and Obstetrics ISPUB.COM Volume 2 Number 2 Progress in Obstetrics from 19th to 21st Centuries: Perspectives from KK Hospital, Singapore - the Former World's Largest Maternity Hospital K Tan, S Chern Citation K Tan, S Chern. Progress in Obstetrics from 19th to 21st Centuries: Perspectives from KK Hospital, Singapore - the Former World's Largest Maternity Hospital. The Internet Journal of Gynecology and Obstetrics. 2002 Volume 2 Number 2. Abstract KK Maternity Hospital, Singapore was the former world's largest maternity hospital from 1950s to 1970s. This article presents the history of KK Maternity Hospital in Singapore, the changes in KK Hospital over the years from 19th century up to the 21st century and the last decades where the changes became more rapid. INTRODUCTION known as “KK” or “Tek Kah” served as the national Our generation at the edge of this new millennium has maternity hospital of Singapore from 1924 to 1997. witnessed the rapid advance of new technologies. With this The old KK Hospital has a long tradition of service to the we saw rapid development and advancement in all aspects of people of Singapore. It was first built in 1858 to function as our lives at home, at work & at leisure, and at a breathtaking a general hospital. In 1905, it expanded to accept female pace, not experienced by or even dreamt of by our pauper patients from Tan Tock Seng Hospital and later forefathers. The rapid advancement in technology is also felt housed female lepers and poor children. It eventually in the medical industry and the obstetric speciality is not became the Pauper Hospital for Women and Children. -

Doctor, Doctor! and Then on to the Community Centre”

BIBLIOASIA JUL - SEP 2019 VOL. 15 ISSUE 02 FEATURE “travelling dispensaries” twice a month. college days at the University of Malaya in cloth round and round my foot. They hadn’t These dispensaries were ships kitted out Singapore: “My medical cohort had 100 cleaned it first. But the wound healed; no with a pharmacy and medical equipment. students. I took the bus to college every tetanus or anything like that.” With it, she visited Singapore’s outlying islets, day… I was doing open heart surgery, Housewife Yau Chung Chii including Semakau, Sebarok, Sudong and practising on dogs.” remembered well the kitchen-table Seraya. The ship would berth itself some When Singapore attained self- wisdom passed down to her generation. distance away from the shore, so she had government in 1959, its leaders had to Speaking in Cantonese, Yau said, for to “go right up to the island in a motorboat, overcome the most fundamental problems example, that pregnant women would Doctor, Doctor! and then on to the community centre”. to give the nation a fighting chance to avoid lamb, lest it gave their babies Well into the 1960s, healthcare in thrive. Founding Prime Minister Lee epilepsy. Upon giving birth, women would Singapore was largely rudimentary, and Kuan Yew listed his Cabinet’s priorities be fed pig’s trotters stewed with ginger Singapore’s Medical Services not just on the nation’s outlying islands. as the setting up of defence forces; the and black vinegar, a dish thought to be Renowned gynaecologist Dr Tow Siang provision of affordable public housing effective in ridding their bodies of gas. -

Toa Payoh Heritage Trail

» DISCOVER OUR SHARED HERITAGE TOA PAYOH HERITAGE TRAIL » CONTENTS Toa Payoh in the 19th Century p. 2 Big Swamps and Smaller Relations: Naming Toa Payoh Early History & Mapping Life on the Plantations Smallholder Plantations Burial Grounds in Toa Payoh Temples and Villages: The Kampong Era p. 8 Cottage Industries in Toa Payoh Kampong Life Gangs of Toa Payoh The Gotong-Royong Spirit Twilight of the Kampongs p. 17 Resistance and Resolution How to Build a Singapore Town p. 22 Industry in Toa Payoh Neighbourhoods & Memories p. 28 Tree Shrine at Block 177 1973 SEAP Games Village Entertainment in Toa Payoh Toa Payoh Town Park Heritage Trees of Toa Payoh Toa Payoh Sports Complex Storied Neighbourhoods Religious, Community and Healthcare Institutions p. 44 Masjid Muhajirin United Temple Lian Shan Shuang Lin Monastery Sri Vairavimada Kaliamman Temple Church of the Risen Christ Toa Payoh Methodist Church Chung Hwa Medical Institution Mount Alvernia Hospital Former Toa Payoh Hospital SIA-NKF Dialysis Centre Lee Ah Mooi Old Age Home Grave Hill p. 59 Dragon Playground p. 60 Bibliography and Credits p. 62 Guide to Marked Sites p. 64 1 INTRODUCTION n the surface of things, Toa Payoh seems mosque to be constructed under the Mosque an entirely typical Singapore town. Building Fund (MBF), among other rsts. OWhat differentiates it from nearby Ang Mo Kio, or Tampines to the east? Beneath the veneers of recent history and the lists of institutional milestones however, Indeed, as the rst town designed and the stories of life in Toa Payoh run deep. developed entirely by the Housing & From the earliest settlers, plantation owners Development Board (HDB), Toa Payoh is the and workers in the 19th century struggling archetypical granddaddy of all public housing to clear vast swathes of swampland, to the towns in Singapore. -

THE NATIONAL HEALTH PLAN (Paper Presented at the SMA Silver Jubilee National Medical Convention 1985)

SINGAPORE MEDICAL JOURNAL PLANNING FOR THE FUTURE - THE NATIONAL HEALTH PLAN (Paper presented at the SMA Silver Jubilee National Medical Convention 1985) Chew Chin Hin In 1983 the National Health Plan was tabled before Parliament following discussions and consultation not only with officials within the Ministry of Health but with numerous representatives from the profession and professional bodies (1). The Plan outlined the health development strategies for our country up to the end of the century. It is relevant at this juncture to reiterate that the guiding objective of the Ministry has always been to strive for medical excellence and in so doing provide better health services to the nation. We also believe that as this objective is achieved, Singapore will be established as a regional medical centre. Ministry of Health Singapore has had a remarkable health record especially over 55 Cuppage Road, 110R00 Cuppage Centre the last 25 years. This is reflected by Singapore's low morbidity Singapore 0922 and mortality rates which compare most favourably with the best in the world. This, of course, cannot be attributed to improve- Chew Chin Hin, PPA, FRCP, FRACP, FACP ments in health services alone, but also to the country's growing Deputy Director of Medical Services economic prosperity and improvements in socioeconomic (Hospitals) status. 210 VOLUME 28, NO 3, JUNE 1987 Disease patterns have also been changing to a ROLE OF COMMUNITY HOSPITALS measure as a result of our country's social and economic development. These changing disease In the planning of hospitals, consideration has also patterns will necessitate different and higher stan- been given to the fact that patients' needs for hospital dards of medical care. -

Paediatrics in Singapore: the Early Days—SH Quak

126C Paediatrics in Singapore: The Early Days—SH Quak Paediatrics in Singapore: The Early Days 1 SH Quak, MBBS, M Med (Paeds), MD Abstract Paediatric services in Singapore started at the end of the 19th century. Because of inadequate housing, poor sanitation and inadequate health services, malnutrition and infections were the main problems. Infant mortality was in excess of 300/1000. There were many prominent doctors who worked in extremely demanding environments in order to better the health of children at that time. Over the years, there has been a steady improvement of healthcare in Singapore and this has been mainly due to the foresight and hard work of the pioneers. With excellent primary healthcare and specialised paediatric centres, paediatric services in Singapore are among the best in the world. Ann Acad Med Singapore 2005;34:126C-129C Key words: Child health, Infant mortality, Malnutrition, Worm infestation Introduction malnutrition and infectious diseases. The immigrants to Singapore used to be a colony of the British Empire. The Singapore were mainly from the villages who had little main reason for having a colonial government trade was the knowledge of sanitation and who disliked milk for exploitation of raw materials and cheap labour. The medical themselves or for their children. The health staff were services provided by the colonial government were mainly mainly occupied with the prevention of smallpox, plague for the British in the colony while those provided for the and cholera and with the treatment of diphtheria. According indigenous people were rudimentary. There were no to Dr Keys Smith,1 one of the founder members of the comprehensive health services as we have today. -

Singapore's Health Care System

9648_9789814696043_tp.indd 1 20/10/15 11:26 am World Scientific Series on Singapore’s 50 Years of Nation-Building Published 50 Years of Social Issues in Singapore edited by David Chan Our Lives to Live: Putting a Woman’s Face to Change in Singapore edited by Kanwaljit Soin and Margaret Thomas 50 Years of Singapore–Europe Relations: Celebrating Singapore’s Connections with Europe edited by Yeo Lay Hwee and Barnard Turner Perspectives on the Security of Singapore: The First 50 Years edited by Barry Desker and Cheng Guan Ang 50 Years of Singapore and the United Nations edited by Tommy Koh, Li Lin Chang and Joanna Koh 50 Years of Environment: Singapore’s Journey Towards Environmental Sustainability edited by Tan Yong Soon Food, Foodways and Foodscapes: Culture, Community and Consumption in Post-Colonial Singapore edited by Lily Kong and Vineeta Sinha Singapore’s Health Care System: What 50 Years Have Achieved edited by Chien Earn Lee and K. Satku Forthcoming 50 Years of the Chinese Community in Singapore edited by Pang Cheng Lian Singapore–China Relations: 50 Years edited by Zheng Yongnian and Lye Liang Fook Singapore’s Economic Development: Retrospection and Reflections edited by Linda Y. C. Lim 50 Years of Technical Education in Singapore: How to Build a World Class Education System from Scratch by N Varaprasad and Others* *The complete list of titles in the series can be found at http://www.worldscientific.com/series/wss50ynb 9648_9789814696043_tp.indd 2 20/10/15 11:26 am Published by World Scientific Publishing Co. Pte. Ltd. 5 Toh Tuck Link, Singapore 596224 USA office: 27 Warren Street, Suite 401-402, Hackensack, NJ 07601 UK office: 57 Shelton Street, Covent Garden, London WC2H 9HE Library of Congress Cataloging-in-Publication Data Singapore’s health care system : what 50 years have achieved / editors, Lee Chien Earn, K.