Semi-Annual Report and Accounts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Accounts

Fidelity Active STrategy Société d’investissement à capital variable Established in Luxembourg RCS Luxembourg B 102 944 Annual Report and Accounts For the year ended 30 September 2019 Audited This audited Annual Report of the Company does not constitute an offer of Shares. Shares are offered on the basis of the info rmation contained in the current Prospectus (and the documents referred to within it) supplemented by the last available audited Annual Report of the Company and any subsequently published unaudited Semi-Annual Report. Copies of the current Prospectus, latest audited Annual and unaudited Semi- Annual Reports and Portfolio Changes for the Company are available free of charge from the registered office of the Company o r from any of the companies registered as distributors of Fidelity Active STrategy. Fidelity Active STrategy Contents Directors' Report 2 Directors and Conducting Officers 5 Investment Manager’s Report 6 Footnotes 7 Fund Reviews 8 . Schedule of Investments Equity Funds Asia Fund 14 Emerging Markets Fund 16 Europe Fund 19 Global Fund 20 UK Fund 21 US Fund 22 . Statement of Net Assets 24 Statement of Net Asset Value per Share 26 Statement of Operations and Changes in Net Assets 28 Statement of Share Statistics 30 Notes to the Financial Statements 31 Audit Report 36 Unaudited Supplementary Information 39 Directory 42 1 Fidelity Active STrategy Directors' Report . I Introduction Fidelity Active STrategy (the "Company") is an open-ended investment company established in Luxembourg as a société d'investissement à capital variable (SICAV). Its assets are held in different sub-funds. Each sub-fund holds a separate portfolio of securities and other assets managed in accordance with specific investment objectives. -

Informações Cadastrais 2021

INFORMAÇÕES CADASTRAIS 2021 CADASTRO 2021 Posição 31/12/2020 EMPRESAS NO BRASIL ................................................................................................................................ 5 1.1 WEG S.A. (WSA)....................................................................................................................................... 6 1.2 WEG EQUIPAMENTOS ELÉTRICOS S.A. (WEL) ................................................................................... 8 1.3 WEG LINHARES EQUIPAMENTOS ELÉTRICOS S.A. (WLI) ............................................................... 14 1.4 WEG-CESTARI INDÚSTRIA DE REDUTORES E MOTORREDUTORES S/A (WCES) ........................ 16 1.5 WEG DRIVES & CONTROLS – AUTOMAÇÃO LTDA (WDC) ............................................................... 18 1.6 PAUMAR S/A – INDÚSTRIA E COMÉRCIO (PMAR) ............................................................................ 20 1.7 WEG LOGÍSTICA LTDA (WLO) ............................................................................................................. 22 1.8 HIDRÁULICA INDUSTRIAL - IND. E COM. LTDA. (HISA) .................................................................... 23 1.9 WEG AMAZÔNIA S.A. (WAM) ................................................................................................................ 25 1.10 RF REFLORESTADORA LTDA (RF) ................................................................................................... 27 1.11 WEG ADMINISTRADORA DE BENS LTDA (WAD) ............................................................................ -

Morgan Stanley's Top-Performing Fund Buys Undervalued Stocks

January 19, 2020 | bloomberg.com Photographer: Michael Nagle/Bloomberg Markets Morgan Stanley’s Top-Performing Fund Buys Undervalued Stocks by Ishika Mookerjee January 19, 2020 ▶ Consumer stocks are a focus; more than half of assets in China ▶ Meituan, Moutai among drivers of fund’s 44% gain in past year A top-performing Morgan Stanley fund remain a key focus this year despite its invested capital and 15% revenue growth is betting on cash-rich consumption- slower growth in 2019. over the past three years, he added. The focused stocks in Asia, especially China, to Asian consumer stocks provide “high MSCI Asia ex Japan Index has gained 3.4% manage risks in market cycles this year. returns on capital, low leverage and so far this year. The Wall Street firm’s Asia Opportunity quality growth prospects,” Hong Kong- With more than 800 million people Portfolio, which focuses on equities in based Heugh said. The region offers “the emerging from poverty since market the region excluding Japan, returned 44% highest ratio” of high-quality companies reforms began in 1978, China is an in the past year, beating 99% of its peers, that have generated both 15% return on especially attractive hunting ground for according to data compiled by Bloomberg. The portfolio focuses on undervalued companies with low debt or net cash on their balance sheets, many of which are found in consumer sectors, said Kristian Heugh, who has been co-managing the fund since its inception in 2016. “We seek to protect investors’ capital by focusing on high quality companies with sustainable competitive advantages and purchasing them at a discount to our estimate of intrinsic value,” Heugh said. -

Semi-Annual Report and Accounts

Fidelity Active STrategy Société d’investissement à capital variable Established in Luxembourg RCS Luxembourg B 102 944 Semi-Annual Report and Accounts For the period ended 31 March 2019 Unaudited This Semi-Annual Report of the Company does not constitute an offer of Shares. Shares are offered on the basis of the information conta ined in the current Prospectus (and the documents referred to within it) supplemented by the last available Annual Report of the Comp any and any subsequently published Semi-Annual Report. Copies of the current Prospectus, latest Annual and Semi-Annual Reports and Portfolio Changes for the Company are available free of charge from the registered office of the Company or from any of the companies registered as distributors of Fidelity Active Strategy or, for Investors in Switzerland, from the representative of the Company in this country. Fidelity Active STrategy Contents Introduction 2 Directors and Conducting Officers 3 Investment Manager’s Report 4 . Schedule of Investments Equity Funds Asia Fund 5 Emerging Markets Fund 7 Europe Fund 9 Global Fund 10 UK Fund 12 US Fund 13 . Statement of Net Assets 16 Statement of Net Asset Value per Share 18 Notes to the Financial Statements 19 Supplementary Information 23 Directory 24 1 Fidelity Active STrategy Introduction Fidelity Active STrategy (the "Company") is an open-ended investment company established in Luxembourg as a société d'investissement à capital variable (SICAV). Its assets are held in different sub-funds. Each sub-fund holds a separate portfolio of securities and other assets managed in accordance with specific investment objectives. Separate classes of Shares are or may be issued in relation to the sub-funds. -

Cadastro 2018 Grupo WEG CADASTRO 2018 Posição 31/12/2017

Cadastro 2018 Grupo WEG CADASTRO 2018 Posição 31/12/2017 EMPRESAS NO BRASIL ...........................................................................................................5 1.1 WEG S.A. (WSA) ..................................................................................................................6 1.2 WEG EQUIPAMENTOS ELÉTRICOS S.A. (WEL) ..............................................................8 1.3 WEG LINHARES EQUIPAMENTOS ELÉTRICOS S.A. (WLI) ..........................................14 1.4 WEG-CESTARI INDÚSTRIA DE REDUTORES E MOTORREDUTORES S/A (WCES) ...17 1.5 WEG DRIVES & CONTROLS – AUTOMAÇÃO LTDA (WDC) ..........................................19 1.6 WEG TINTAS LTDA (WTI) .................................................................................................21 1.7 PAUMAR S/A – INDÚSTRIA E COMÉRCIO (PMAR) ........................................................23 1.8 WEG LOGÍSTICA LTDA (WLO) .........................................................................................25 1.9 HIDRÁULICA INDUSTRIAL IND. E COM. LTDA. (HISA) .................................................26 1.10 WEG AMAZÔNIA S.A. (WAM) .........................................................................................28 1.11 RF REFLORESTADORA LTDA (RF) ...............................................................................30 1.12 WEG ADMINISTRADORA DE BENS LTDA (WAD) ........................................................32 1.13 TRANSFORMADORES DO NORDESTE LTDA (WTN) ..................................................33 -

Voluntary Disclosure, Enterprise Risk Management, Culture and Stock Price Synchronicity

CAPITAL UNIVERSITY OF SCIENCE AND TECHNOLOGY, ISLAMABAD Voluntary Disclosure, Enterprise Risk Management, Culture and Stock Price Synchronicity by Zeeshan Ghafoor A thesis submitted in partial fulfillment for the degree of Doctor of Philosophy in the Faculty of Management & Social Sciences Department of Management Sciences 2019 i Voluntary Disclosure, Enterprise Risk Management, Culture and Stock Price Synchronicity By Zeeshan Ghafoor (PM131007) Prof. Dr. Erwan Le Saou Universit Paris 1 Panthon-Sorbonne, France Foreign Evaluator 1 Dr. Ali Coskun Bogazici University, Istanbul, Turkey Foreign Evaluator 2 Dr. Arshad Hassan (Thesis Supervisor) Dr. Sajid Bashir (Head, Department of Management Sciences) Dr. Arshad Hassan (Dean, Faculty of Management & Social Sciences) DEPARTMENT OF MANAGEMENT SCIENCES CAPITAL UNIVERSITY OF SCIENCE AND TECHNOLOGY ISLAMABAD 2019 ii Copyright c 2018 by Zeeshan Ghafoor All rights reserved. No part of this thesis may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, by any information storage and retrieval system without the prior written permission of the author. iii This work is dedicated to my Parents, Late Grandparents, My Wife, My Son, My Brother and My Sister without whom I would have not been able to achieve this accomplishment. vii List of Publications It is certified that following publication(s) have been made out of the research work that has been carried out for this thesis:- 1. Ghafoor, Z., & Hassan, A. (2018). Voluntary Disclosure, Enterprise Risk Management and Stock Price Synchronicity: Evidence from Shariah Com- pliant and Non-Shariah Compliant Companies . Journal of Islamic Business and Management, Vol. -

The Rule of Law: a Challenge for the Emerging Markets in Mexico and Brazil Nubia Nieto

The rule of law: a challenge for the emerging markets in Mexico and Brazil Estado de direito: o desafio das economias emergentes no México e no Brasil Nubia Nieto Abstract The new global order has been reshaped in recent times. New actors are emerging from different part of Asia, Latin America and Eastern Europe, even if the president of the United States, Donald Trump, tries to contain this trend. The emerging economies continue their expansion and some analysts predict that they will overtake G7 economies by 2027. However, the main question raised in this text is not whether the BRIC’s countries and emerging countries will surpass developed countries; rather, the emerging countries will be able to create strong institutions and ensure the rule of law, reduce social inequalities and guarantee a sustainable development for a long period, taking advantage of the economic growth that they are living. This text will be focused on analyzing the need to create, maintain, and promote the rule of law in emerging countries, emphasizing the case of Brazil and Mexico, as these countries are in a decisive moment to determine their future. Keywords Emerging Markets; BRICs; Rule of Law; Latin America; Global Order. Resumo A nova ordem global foi remodelada nos últimos tempos. Novos atores estão surgindo de diferentes partes da Ásia, América Latina e Europa Oriental, mesmo que o presidente dos Estados Unidos, Donald Trump, tente conter essa tendência. As economias emergentes continuam a expandir-se e alguns analistas preveem que ultrapassarão as economias do G7 até 2027. No entanto, a principal questão levantada neste texto não é se os países do BRIC e os países emergentes ultrapassarão os países desenvolvidos mas se estes países poderão criar instituições fortes para garantir o Estado de Direito, reduzir as desigualdades sociais e garantir um desenvolvimento sustentável por um longo período, aproveitando o crescimento econômico que estão vivendo. -

Greater China 2019

IR Magazine Awards – Greater China 2019 Winners and nominees AWARDS BY RESEARCH Best overall investor relations (large cap) ANTA Sports Products China Resources Beer WINNER China Telecom China Unicom Shenzhou International Group Holdings Best overall investor relations (small to mid-cap) Alibaba Pictures Group Far East Consortium International WINNER Health and Happiness H&H International Holdings Li-Ning NetDragon Websoft Holdings Best investor relations officer (large cap) ANTA Sports Products Suki Wong Cathay Financial Holdings Yajou Chang & Sophia Cheng China Resources Beer Vincent Tse WINNER China Telecom Lisa Lai China Unicom Jacky Yung Best investor relations officer (small to mid-cap) Agile Group Holdings Samson Chan BizLink Holding Tom Huang Far East Consortium International Venus Zhao WINNER Li-Ning Rebecca Zhang Yue Yuen Industrial (Holdings) Olivia Wang Best IR by a senior management team Maggie Wu, CFO & Daniel Zhang, Alibaba Group CEO Tomakin Lai Po-sing, CFO & China Resources Beer Xiaohai Hou, CEO Xiaochu Wang, CEO & Zhu WINNER China Unicom Kebing, CFO Wai Hung Boswell Cheung, CFO & Far East Consortium International David Chiu, Chairman & CEO Ma Jianrong, CEO & Cun Bo Wang, Shenzhou International Group Holdings CFO AWARDS BY REGION Best in region: China Alibaba Pictures Group ANTA Sports Products China Resources Beer WINNER China Telecom China Unicom Shenzhou International Group Holdings Best in region: Hong Kong AIA Group Far East Consortium International WINNER Health and Happiness H&H International Holdings Yue Yuen -

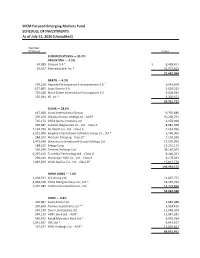

WCM Focused Emerging Markets Fund SCHEDULE of INVESTMENTS As of July 31, 2020 (Unaudited)

WCM Focused Emerging Markets Fund SCHEDULE OF INVESTMENTS As of July 31, 2020 (Unaudited) Number of Shares Value COMMON STOCKS — 91.0% ARGENTINA — 4.5% 49,089 Globant S.A.* $ 8,489,451 20,427 MercadoLibre, Inc.* 22,972,613 31,462,064 BRAZIL — 4.3% 724,230 Hapvida Participacoes e Investimentos S.A.1 9,043,504 637,865 Lojas Renner S.A. 5,029,212 735,180 Notre Dame Intermedica Participacoes S.A. 9,408,545 135,494 XP, Inc.* 6,300,471 29,781,732 CHINA — 28.6% 467,060 Airtac International Group 9,797,686 200,258 Alibaba Group Holding Ltd. - ADR* 50,268,763 735,174 ANTA Sports Products Ltd. 6,978,998 346,687 Autobio Diagnostics Co., Ltd. - Class A 8,082,568 2,134,296 By-health Co., Ltd. - Class A 7,654,996 3,532,000 Kingdee International Software Group Co., Ltd.* 9,768,906 288,105 Meituan Dianping - Class B* 7,129,590 1,473,420 Shenzhou International Group Holdings Ltd. 17,599,596 188,215 Silergy Corp. 11,291,122 556,290 Tencent Holdings Ltd. 38,160,505 4,297,415 TravelSky Technology Ltd. - Class H 8,266,021 294,444 Wuliangye Yibin Co., Ltd. - Class A 9,178,043 1,049,069 WuXi AppTec Co., Ltd. - Class H1 15,817,778 199,994,572 HONG KONG — 7.8% 2,418,531 AIA Group Ltd. 21,807,752 3,869,330 China Mengniu Dairy Co., Ltd.* 18,156,740 1,407,385 Techtronic Industries Co., Ltd. 14,719,896 54,684,388 INDIA — 9.8% 204,687 Asian Paints Ltd. -

Wilmington Funds Holdings Template DRAFT

Wilmington International Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.82% ISHARES MSCI CANADA ETF 2.43% SAMSUNG ELECTRONICS CO LTD 1.97% TENCENT HOLDINGS LTD 1.82% DREYFUS GOVT CASH MGMT-I 1.76% MSCI INDIA FUTURE JUN21 1.68% AIA GROUP LTD 1.05% HDFC BANK LTD 1.05% ASML HOLDING NV 1.03% ISHARES MSCI EUROPE FINANCIALS ETF 1.02% USD/EUR SPOT 20210601 BNYM 1.00% ALIBABA GROUP HOLDING LTD 0.95% DSV PANALPINA A/S 0.90% TECHTRONIC INDUSTRIES CO LTD 0.88% JAMES HARDIE INDUSTRIES PLC 0.83% INFINEON TECHNOLOGIES AG 0.73% BHP GROUP LTD 0.67% SIKA AG 0.64% MEDIATEK INC 0.60% NOVO NORDISK A/S 0.56% OVERSEA-CHINESE BANKING CORP LTD 0.55% CSL LTD 0.55% LVMH MOET HENNESSY LOUIS VUITTON SE 0.54% RIO TINTO LTD 0.53% DREYFUS GOVT CASH MGMT-I 0.53% MIDEA GROUP CO LTD 0.53% TOYOTA MOTOR CORP 0.52% PARTNERS GROUP HOLDING AG 0.52% SAP SE 0.51% ADIDAS AG 0.49% NAVER CORP 0.49% HITACHI LTD 0.49% MERIDA INDUSTRY CO LTD 0.47% ZALANDO SE 0.47% SK MATERIALS CO LTD 0.47% CHINA PACIFIC INSURANCE GROUP CO LTD 0.45% HEXAGON AB 0.45% LVMH MOET HENNESSY LOUIS VUITTON SE 0.44% JD.COM INC 0.44% TOMRA SYSTEMS ASA 0.44% DREYFUS GOVT CASH MGMT-I 0.44% SONY GROUP CORP 0.43% L'OREAL SA 0.43% EDENRED 0.43% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.43% NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC 0.42% HUAZHU GROUP LTD 0.41% CRODA INTERNATIONAL PLC 0.40% ATLAS COPCO AB 0.40% ASSA ABLOY AB 0.40% IMCD NV 0.40% HUTCHMED CHINA LTD 0.40% JARDINE MATHESON HOLDINGS LTD 0.40% HONG KONG EXCHANGES -

Global Corporate Data 2021

GLOBAL CORPORATE DATA 2021 WEG GLOBAL CORPORATE DATA 2021 31/12/2020 BRAZILIAN ENTITIES ....................................................................................................................................... 5 1.1 WEG S.A. (WSA).......................................................................................................................................... 6 1.2 WEG EQUIPAMENTOS ELÉTRICOS S.A. (WEL) ...................................................................................... 8 1.3 WEG LINHARES EQUIPAMENTOS ELÉTRICOS S.A. (WLI) .................................................................. 14 1.4 WEG-CESTARI INDÚSTRIA DE REDUTORES E MOTORREDUTORES S/A (WCES) ........................... 16 1.5 WEG DRIVES & CONTROLS – AUTOMAÇÃO LTDA (WDC) .................................................................. 18 1.6 PAUMAR S/A – INDÚSTRIA E COMÉRCIO (PMAR) ............................................................................... 20 1.7 WEG LOGÍSTICA LTDA (WLO) ................................................................................................................ 22 1.8 HIDRÁULICA INDUSTRIAL - IND. E COM. LTDA. (HISA) ....................................................................... 23 1.9 WEG AMAZÔNIA S.A. (WAM) ................................................................................................................... 25 1.10 RF REFLORESTADORA LTDA (RF) ...................................................................................................... 27 1.11 WEG ADMINISTRADORA -

IFC Deal Query Based on IFC Investment Services Projects

IFC Deal Query Based on IFC Investment Services Projects Date Disclosed Project Name Project Number Product Line 07/23/2021 DCM UBP Social Bond 44900 Loan 07/07/2021 RATCH Loan 43901 Loan 07/01/2021 HDFC II 44139 Loan 06/30/2021 Erste_CRO_MREL 44745 Loan 06/30/2021 OCB green loan 43733 Loan 06/30/2021 Aspen Pharmacare 45174 Loan 06/29/2021 PSL - Ultratech 45146 Loan 06/28/2021 Banco BV SEF Credit Line 43661 Loan 06/24/2021 CTP Bond 44887 Loan 06/23/2021 WCS COVID NMBTZ 44080 Loan 06/22/2021 NSG RSE FACILITY 45366 Loan 06/15/2021 Axian Togo 44666 Loan Page 1 of 1315 09/29/2021 IFC Deal Query Based on IFC Investment Services Projects Company Name Country Sector UNION BANK OF THE Philippines Financial Institutions PHILIPPINES RH INTERNATIONAL Thailand Infrastructure (SINGAPORE) CORPORATION PTE. LTD. HOUSING DEVELOPMENT India Financial Institutions FINANCE CORPORATION LIMITED ERSTE & Croatia Financial Institutions STEIERMARKISCHE BANK D. D. ORIENT COMMERCIAL Vietnam Financial Institutions JOINT STOCK BANK ASPEN FINANCE South Africa other PROPRIETARY LIMITED PRECIOUS SHIPPING Thailand Infrastructure PUBLIC COMPANY LIMITED BANCO VOTORANTIM S.A. Brazil Financial Institutions CTP N.V. Central Europe Region other NMB BANK PLC Tanzania Financial Institutions NSG UK ENTERPRISES Argentina Manufacturing LIMITED LA SOCIETE HOLDING Togo Telecommunications, Media, and Technology Page 2 of 1315 09/29/2021 IFC Deal Query Based on IFC Investment Services Projects Environmental Category Department Status FI-2 Regional Industry - FIG Asia & Pac Active B Regional