Quarterly Holdings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Morgan Stanley's Top-Performing Fund Buys Undervalued Stocks

January 19, 2020 | bloomberg.com Photographer: Michael Nagle/Bloomberg Markets Morgan Stanley’s Top-Performing Fund Buys Undervalued Stocks by Ishika Mookerjee January 19, 2020 ▶ Consumer stocks are a focus; more than half of assets in China ▶ Meituan, Moutai among drivers of fund’s 44% gain in past year A top-performing Morgan Stanley fund remain a key focus this year despite its invested capital and 15% revenue growth is betting on cash-rich consumption- slower growth in 2019. over the past three years, he added. The focused stocks in Asia, especially China, to Asian consumer stocks provide “high MSCI Asia ex Japan Index has gained 3.4% manage risks in market cycles this year. returns on capital, low leverage and so far this year. The Wall Street firm’s Asia Opportunity quality growth prospects,” Hong Kong- With more than 800 million people Portfolio, which focuses on equities in based Heugh said. The region offers “the emerging from poverty since market the region excluding Japan, returned 44% highest ratio” of high-quality companies reforms began in 1978, China is an in the past year, beating 99% of its peers, that have generated both 15% return on especially attractive hunting ground for according to data compiled by Bloomberg. The portfolio focuses on undervalued companies with low debt or net cash on their balance sheets, many of which are found in consumer sectors, said Kristian Heugh, who has been co-managing the fund since its inception in 2016. “We seek to protect investors’ capital by focusing on high quality companies with sustainable competitive advantages and purchasing them at a discount to our estimate of intrinsic value,” Heugh said. -

Greater China 2019

IR Magazine Awards – Greater China 2019 Winners and nominees AWARDS BY RESEARCH Best overall investor relations (large cap) ANTA Sports Products China Resources Beer WINNER China Telecom China Unicom Shenzhou International Group Holdings Best overall investor relations (small to mid-cap) Alibaba Pictures Group Far East Consortium International WINNER Health and Happiness H&H International Holdings Li-Ning NetDragon Websoft Holdings Best investor relations officer (large cap) ANTA Sports Products Suki Wong Cathay Financial Holdings Yajou Chang & Sophia Cheng China Resources Beer Vincent Tse WINNER China Telecom Lisa Lai China Unicom Jacky Yung Best investor relations officer (small to mid-cap) Agile Group Holdings Samson Chan BizLink Holding Tom Huang Far East Consortium International Venus Zhao WINNER Li-Ning Rebecca Zhang Yue Yuen Industrial (Holdings) Olivia Wang Best IR by a senior management team Maggie Wu, CFO & Daniel Zhang, Alibaba Group CEO Tomakin Lai Po-sing, CFO & China Resources Beer Xiaohai Hou, CEO Xiaochu Wang, CEO & Zhu WINNER China Unicom Kebing, CFO Wai Hung Boswell Cheung, CFO & Far East Consortium International David Chiu, Chairman & CEO Ma Jianrong, CEO & Cun Bo Wang, Shenzhou International Group Holdings CFO AWARDS BY REGION Best in region: China Alibaba Pictures Group ANTA Sports Products China Resources Beer WINNER China Telecom China Unicom Shenzhou International Group Holdings Best in region: Hong Kong AIA Group Far East Consortium International WINNER Health and Happiness H&H International Holdings Yue Yuen -

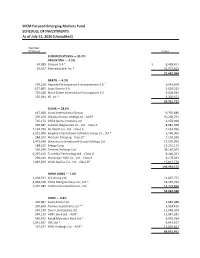

WCM Focused Emerging Markets Fund SCHEDULE of INVESTMENTS As of July 31, 2020 (Unaudited)

WCM Focused Emerging Markets Fund SCHEDULE OF INVESTMENTS As of July 31, 2020 (Unaudited) Number of Shares Value COMMON STOCKS — 91.0% ARGENTINA — 4.5% 49,089 Globant S.A.* $ 8,489,451 20,427 MercadoLibre, Inc.* 22,972,613 31,462,064 BRAZIL — 4.3% 724,230 Hapvida Participacoes e Investimentos S.A.1 9,043,504 637,865 Lojas Renner S.A. 5,029,212 735,180 Notre Dame Intermedica Participacoes S.A. 9,408,545 135,494 XP, Inc.* 6,300,471 29,781,732 CHINA — 28.6% 467,060 Airtac International Group 9,797,686 200,258 Alibaba Group Holding Ltd. - ADR* 50,268,763 735,174 ANTA Sports Products Ltd. 6,978,998 346,687 Autobio Diagnostics Co., Ltd. - Class A 8,082,568 2,134,296 By-health Co., Ltd. - Class A 7,654,996 3,532,000 Kingdee International Software Group Co., Ltd.* 9,768,906 288,105 Meituan Dianping - Class B* 7,129,590 1,473,420 Shenzhou International Group Holdings Ltd. 17,599,596 188,215 Silergy Corp. 11,291,122 556,290 Tencent Holdings Ltd. 38,160,505 4,297,415 TravelSky Technology Ltd. - Class H 8,266,021 294,444 Wuliangye Yibin Co., Ltd. - Class A 9,178,043 1,049,069 WuXi AppTec Co., Ltd. - Class H1 15,817,778 199,994,572 HONG KONG — 7.8% 2,418,531 AIA Group Ltd. 21,807,752 3,869,330 China Mengniu Dairy Co., Ltd.* 18,156,740 1,407,385 Techtronic Industries Co., Ltd. 14,719,896 54,684,388 INDIA — 9.8% 204,687 Asian Paints Ltd. -

Wilmington Funds Holdings Template DRAFT

Wilmington International Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.82% ISHARES MSCI CANADA ETF 2.43% SAMSUNG ELECTRONICS CO LTD 1.97% TENCENT HOLDINGS LTD 1.82% DREYFUS GOVT CASH MGMT-I 1.76% MSCI INDIA FUTURE JUN21 1.68% AIA GROUP LTD 1.05% HDFC BANK LTD 1.05% ASML HOLDING NV 1.03% ISHARES MSCI EUROPE FINANCIALS ETF 1.02% USD/EUR SPOT 20210601 BNYM 1.00% ALIBABA GROUP HOLDING LTD 0.95% DSV PANALPINA A/S 0.90% TECHTRONIC INDUSTRIES CO LTD 0.88% JAMES HARDIE INDUSTRIES PLC 0.83% INFINEON TECHNOLOGIES AG 0.73% BHP GROUP LTD 0.67% SIKA AG 0.64% MEDIATEK INC 0.60% NOVO NORDISK A/S 0.56% OVERSEA-CHINESE BANKING CORP LTD 0.55% CSL LTD 0.55% LVMH MOET HENNESSY LOUIS VUITTON SE 0.54% RIO TINTO LTD 0.53% DREYFUS GOVT CASH MGMT-I 0.53% MIDEA GROUP CO LTD 0.53% TOYOTA MOTOR CORP 0.52% PARTNERS GROUP HOLDING AG 0.52% SAP SE 0.51% ADIDAS AG 0.49% NAVER CORP 0.49% HITACHI LTD 0.49% MERIDA INDUSTRY CO LTD 0.47% ZALANDO SE 0.47% SK MATERIALS CO LTD 0.47% CHINA PACIFIC INSURANCE GROUP CO LTD 0.45% HEXAGON AB 0.45% LVMH MOET HENNESSY LOUIS VUITTON SE 0.44% JD.COM INC 0.44% TOMRA SYSTEMS ASA 0.44% DREYFUS GOVT CASH MGMT-I 0.44% SONY GROUP CORP 0.43% L'OREAL SA 0.43% EDENRED 0.43% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.43% NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC 0.42% HUAZHU GROUP LTD 0.41% CRODA INTERNATIONAL PLC 0.40% ATLAS COPCO AB 0.40% ASSA ABLOY AB 0.40% IMCD NV 0.40% HUTCHMED CHINA LTD 0.40% JARDINE MATHESON HOLDINGS LTD 0.40% HONG KONG EXCHANGES -

Platinum Asia Fund 6% 18% 29% 27% 34% Msci Ac Asia Ex Japan 10% 24% 28% 22% 24%

PLATINUM PERFORMANCE ASIA PERFORMANCE (compound pa, to 31 December 2006) FUND QUARTER 1 YR 2 YRS 3 YRS SINCE INCEPTION PLATINUM ASIA FUND 6% 18% 29% 27% 34% MSCI AC ASIA EX JAPAN 10% 24% 28% 22% 24% Source: Platinum and Factset. Refer to Note 1, page 46. It was an extraordinary quarter for Chinese stocks with the Shanghai "A" market up over 50% and the Hong Kong "H" market up 45%1. While the Chinese “A” shares have been steadily making ground over the last 18 months, having previously been one of the world's worst performing markets, this quarter's performance would suggest that the Andrew Clifford Portfolio Manager country's massive trade and capital account surplus have finally created liquidity conditions conducive to a good bull market. Efforts to hold back property prices, the major alternative asset class for domestic investors, have possibly helped funnel funds back towards stocks as well. Foreign investors have bought up the “H” share market in sympathy, particularly as it represents one of the few ways of playing the ongoing appreciation in the Chinese yuan. Other strong performers for the quarter were Indonesia, the Philippines, and Singapore, all up in excess of 16%. The major laggard was Thailand which was down 1% for the quarter after the Bank of Thailand imposed capital controls. 1 The “A” share market in China is primarily a domestic market only, although foreign investors now have some limited access, while the “H” share market in Hong Kong is open to foreign investors but not mainland investors. DISPOSITION OF ASSETS REGION DEC 2006 SEP 2006 CHINA (LISTED EX PRC) 5% 5% HONG KONG 8% 7% CHINA (LISTED PRC) 19% 22% VALUE OF $10,000 INVESTED SINCE INCEPTION TAIWAN 6% 4% 3 MARCH 2003 TO 31 DECEMBER 2006 GREATER CHINA TOTAL 38% 38% $35,000 KOREA 15% 18% Platinum Asia Fund $30,000 INDIA 15% 15% $25,000 MALAYSIA 7% 6% THAILAND 5% 5% $20,000 SINGAPORE 2% 2% $15,000 INDONESIA 3% 3% $10,000 MSCI All Country Asia ex Japan Index CASH 15% 13% $5,000 SHORTS 15% 9% 2003 2004 2005 2006 Source: Platinum and Factset. -

China Cement Sector

China / Hong Kong Industry Focus U740 China Cement Sector Refer to important disclosures at the end of this report DBS Group Research . Equity 2 Apr 2020 Sales to pick up from an exceptionally low season HSI: 23,086 • Recovering cement sales activities nationwide; shipment rate is up while inventory level is down U740 • Seasonal price correction signals stabilisation ANALYST Duncan CHAN +852 36684178 [email protected] • Resilient demand to drive cement consumption rebound in next few quarters • Top picks are China Resources Cement (1313 HK) and Recommendation & valuation Anhui Conch (914 HK) T arget Mk t PE Cement giants delivered good results. Three major cement Price Price Cap 21F companies’ net earnings uptrend continued in 2019. China Resources Cement (CR Cement) benefitted from resilient cement Local$ Local$ Recom US$m x China Resources Cement selling prices in Southern China market. Conch leveraged on its 9 11.00 BUY 8,107 7.36 (1313 HK) U740 low-cost advantage and higher margin aggregates business Anhui Conch Cmt. 'A' expansion. CNBM’s average capacity utilisation also improved 54.8 60.00 BUY 36,947 8.44 (600585 CH) post merger with SINOMA. Average unit cement gross margin U740 Anhui Conch Cement 'H' was RMB116 (CNBM) – RMB158 per tonne (Conch). Improved 54.05 58.00 BUY 36,947 7.62 U740 (914 HK) cash inflow on operation brought down net gearing to 104% for China National Building Mat CNBM and net cash for Conch and CR Cement. Conch 8.28 8.30 HOLD 8,890 5.69 'H' (3323 HK) outperformed in terms of asset turnover at 1.0x while CNBM ranked the last at 0.6x. -

Foreign Bonds

Quarterly Portfolio Disclosure |March 31, 2020 CI ICBCCS S&P China 500 Index ETF (CHNA.B) Summary of Investment Portfolio Sector Breakdown† as at 3/31/20 Top 25 Holdings* as at 3/31/20 Sector________________________________ ___________________________% of Net Asset Value Description________________________________ ___________________________% of Net Asset Value Financials 21.4 % Alibaba Group Holding Ltd. 9.7 % Consumer Discretionary 19.3 % Tencent Holdings Ltd. 9.1 % Communication Services 12.3 % Ping An Insurance Group Co. of China Ltd. 4.6 % Industrials 9.0 % China Construction Bank Corp. 2.8 % Information Technology 8.2 % China Merchants Bank Co., Ltd. 2.6 % Consumer Staples 7.7 % Kweichow Moutai Co., Ltd. 2.6 % Materials 5.8 % Industrial & Commercial Bank of China Ltd. 2.3 % Health Care 5.8 % China Mobile Ltd. 1.4 % Real Estate 5.1 % Meituan Dianping 1.4 % Utilities 2.5 % Bank of China Ltd. 1.3 % Energy 2.4 % JD.com, Inc. 1.2 % Other Assets less Liabilities‡ 0.5 % Jiangsu Hengrui Medicine Co., Ltd. 1.1 % Total 100.0 % Industrial Bank Co., Ltd. 1.1 % † The ETF’s sector breakdown is expressed as a percentage of net Midea Group Co., Ltd. 1.0 % asset value and may change over time. In addition, a sector may be Gree Electric Appliances, Inc. of Zhuhai 1.0 % comprised of several industries. It does not include derivatives (if CITIC Securities Co., Ltd. 1.0 % any). China Minsheng Banking Corp., Ltd. 1.0 % ‡ Other assets include investment of cash collateral for securities on Wuliangye Yibin Co., Ltd. 1.0 % loan (if any). Anhui Conch Cement Co., Ltd. -

Anhui Conch Cement Company Limited 2020

Anhui Conch Cement Company Limited Anhui Conch Cement Company Limited (H Share: 00914, A Share: 600585) 2020 ANNUAL REPORT Annual Report 2020 Important 1. The Board, Supervisory Committee and Directors, Supervisors and the senior management of the Company warrant that the information in this report, for which they jointly and severally accept legal liability, is truthful, accurate and complete, and does not contain any misrepresentation, misleading statement or material omission. 2. All Directors of the Company attended the sixth meeting of the eighth session of the Board. 3. KPMG and KPMG Huazhen LLP issued a standard unqualified audit report for the Company. 4. Mr. Gao Dengbang, Chairman, Mr. Wu Bin, officer-in-charge of the accounting function and Ms. Liu Yan, officer-in-charge of the accounting department, have declared that they warrant the financial statements contained herein are true, accurate and complete. 5. As considered by the sixth meeting of the eighth session of the Board of the Company, the annual profit distribution proposal for 2020 is a cash dividend of RMB2.12 per share (tax inclusive). No capitalization of common reserve fund was made. 6. Declaration of risks with respect to the forward-looking statements: the Company’s plans for 2021 concerning its capital expenditure, new production capacity and net sales objectives as disclosed Important herein do not constitute any substantive commitment to investors. Investors and the public are advised to be cautious of any investment risks. 7. There was no appropriation of the Company’s funds for non-operating purpose by the controlling shareholder of the Company and its related parties. -

Eligible Assets and Credit-To-Asset Ratio for Secured Credit

Eligible Assets and Credit-to-asset Ratio for Secured Credit Effective from 30 Sep 2021 List of Eligible Assets (Excluding Stocks) Asset Types Credit-to-asset Ratio HKD Time Deposits 100% Foreign Currency Time or Saving Deposits 85% Deposit Plus 70% Structured Investment Deposits (Including Capital Protected Investment Deposits) 70% Unit Trusts*/Bonds*#/Certificates of Deposit/Equity Link Notes/Equity Link Investment with Product Risk Level 1 70% Product Risk Level 2 70% Product Risk Level 3 50% Product Risk Level 4 30% Product Risk Level 5 – *exclude the Non-eligible Products listed below. #For new bonds issued on or after 17 Mar 2020, the timeline for assignment of Credit -to-asset Ratio for Secured Credit Facility will be revised follow: for new bonds issued between 1 Jan to 30 Jun each year, Credit-to-asset Ratio will be assigned in Sep of the same year (where applicable); for new bonds issued between 1 Jul to 31 Dec, Credit-to-asset Ratio will be assigned in Mar of next year (where applicable); Please refer to the relevant bond term sheet or the bond details in our website for the issue date of the relevant bond. Gold 0% (Credit-to-asset Ratio for Gold (Wayfoong Statement Gold) is removed from 20 Dec 2019) List of Non-eligible Products (Capital in Nature Instruments and Other TLAC-eligible Instruments, Hedge Funds, Liquid Alternative Funds are not eligible) Product Type Bond / Fund Code Bond / Fund Name Bonds US404280AN99 HSBC HOLDINGS PLC 4% USD BOND 3/30/2022 Bonds US404280AL34 HSBC HOLDINGS PLC 4.875% USD BOND 1/14/2022 Bonds -

Consolidated Statement of Investments (Unaudited), September 30, 2020

TEMPLETON DRAGON FUND, INC. Consolidated Statement of Investments (unaudited), September 30, 2020 a Country Shares a Value a Common Stocks 98.6% Air Freight & Logistics 1.3% aSF Holding Co. Ltd., A .................................. China 884,700 $10,644,988 Auto Components 0.7% Minth Group Ltd. ...................................... China 1,422,000 6,209,547 Banks 3.5% aChina Construction Bank Corp., A ......................... China 3,875,500 3,516,871 aChina Merchants Bank Co. Ltd., A ......................... China 1,935,246 10,301,832 China Merchants Bank Co. Ltd., H ......................... China 3,270,500 15,519,982 29,338,685 Beverages 2.6% China Resources Beer Holdings Co. Ltd. .................... China 1,082,000 6,645,564 aKweichow Moutai Co. Ltd., A ............................. China 46,445 11,456,278 aLuzhou Laojiao Co. Ltd., A ............................... China 202,956 4,310,078 22,411,920 Biotechnology 4.6% bBeiGene Ltd. ......................................... China 502,100 11,073,976 aHualan Biological Engineering, Inc., A ...................... China 538,188 4,530,141 bI-Mab, ADR .......................................... China 18,922 889,902 b,c,dInnoCare Pharma Ltd., 144A, Reg S ....................... China 2,028,400 2,657,048 b,dInnovent Biologics, Inc., 144A, Reg S ...................... China 2,133,900 15,913,012 aJinyu Bio-Technology Co. Ltd., A .......................... China 988,700 3,946,610 39,010,689 Capital Markets 0.5% aEast Money Information Co. Ltd., A ........................ China 1,268,800 4,515,968 Chemicals 1.6% aJiangsu Yangnong Chemical Co. Ltd., A .................... China 277,900 3,598,703 aShenzhen Capchem Technology Co. Ltd., A.................. China 1,218,410 10,309,913 13,908,616 Commercial Services & Supplies 2.4% dA-Living Services Co. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

1/12/2021 Print Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANIES Investment Company Act file number 811-08071 Lazard Retirement Series, Inc. (Exact name of Registrant as specified in charter) 30 Rockefeller Plaza New York, New York 10112 (Address of principal executive offices) (Zip code) Mark R. Anderson, Esq. Lazard Asset Management LLC 30 Rockefeller Plaza New York, New York 10112 (Name and address of agent for service) Registrant’s telephone number, including area code: (212) 632-6000 Date of fiscal year end: 12/31 Date of reporting period: 9/30/2020 https://prospectus-express.broadridge.com/print.asp?doctype=phq3&clientid=lazardll&fundid=521071803 1/22 1/12/2021 Print Document Item 1. Schedule of Investments. https://prospectus-express.broadridge.com/print.asp?doctype=phq3&clientid=lazardll&fundid=521071803 2/22 1/12/2021 Print Document Fair Fair Description Shares Value Description Shares Value Lazard Retirement Emerging Markets Equity Portfolio Indonesia | 4.0% Common Stocks | 96.5% PT Astra International Tbk 11,421,504 $ 3,436,239 Brazil | 4.1% PT Bank Mandiri (Persero) Tbk 21,526,030 7,223,354 Banco do Brasil SA 1,411,602 $ 7,445,227 PT Telekomunikasi Indonesia (Persero) BB Seguridade Participacoes SA 1,178,100 5,091,346 Tbk Sponsored ADR 322,481 5,601,495 CCR SA 1,926,050 4,345,350 16,261,088 16,881,923 Luxembourg | 0.8% China | 21.4% Ternium SA Sponsored ADR (*) 181,880 3,424,800 AAC Technologies Holdings, Inc. -

Stake in WCC Likely to Cement Leadership in Northwest China

June 19, 2015 COMPANY UPDATE Anhui Conch Cement (H) (0914.HK) Buy Equity Research Stake in WCC likely to cement leadership in Northwest China What's changed Investment Profile Anhui Conch Cement announced that its wholly-owned subsidiary Conch Low High International will acquire 16.7% of the enlarged equity of West China Growth Growth Returns * Returns * Cement (2233 HK, Not Covered) for a consideration of HK$1,527mn. The Multiple Multiple implied EV/t is Rmb355/t, compared with Conch’s 2015E EV/t of Rmb492/t. Volatility Volatility Percentile 20th 40th 60th 80th 100th Implications Anhui Conch Cement (H) (0914.HK) We see strategic merit for both West China Cement and Anhui Conch. Asia Pacific Metals & Mining Peer Group Average * Returns = Return on Capital For a complete description of the investment West China Cement is Shaanxi’s biggest cement producer, with dominant profile measures please refer to the market position in South Shaanxi (75% market share), while Conch is its disclosure section of this document. major competitor in Central Shaanxi. After the acquisition, Conch and Key data Current West China Cement could control 46% of Central and South Shaanxi Price (HK$) 29.10 12 month price target (HK$) 35.80 capacity, and we note that better market cooperation should enhance 600585.SS Price (Rmb) 24.88 600585.SS 12 month price target (Rmb) 28.00 profitability in the region. Market cap (HK$ mn / US$ mn) 154,209.7 / 19,891.4 Foreign ownership (%) -- Ytd Shaanxi cement price is down 5% due to weak demand. We think any 12/14 12/15E 12/16E 12/17E EPS (Rmb) 2.07 2.11 2.44 2.54 potential improvement in the market structure post the proposed deal could EPS growth (%) 17.0 1.9 15.8 4.0 EPS (diluted) (Rmb) 2.07 2.11 2.44 2.54 help stabilize pricing in the region, and note that WCC and Conch’s Shaanxi EPS (basic pre-ex) (Rmb) 2.07 2.11 2.44 2.54 plants are well positioned to benefit from any demand uptick.