China Coal Weekly

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

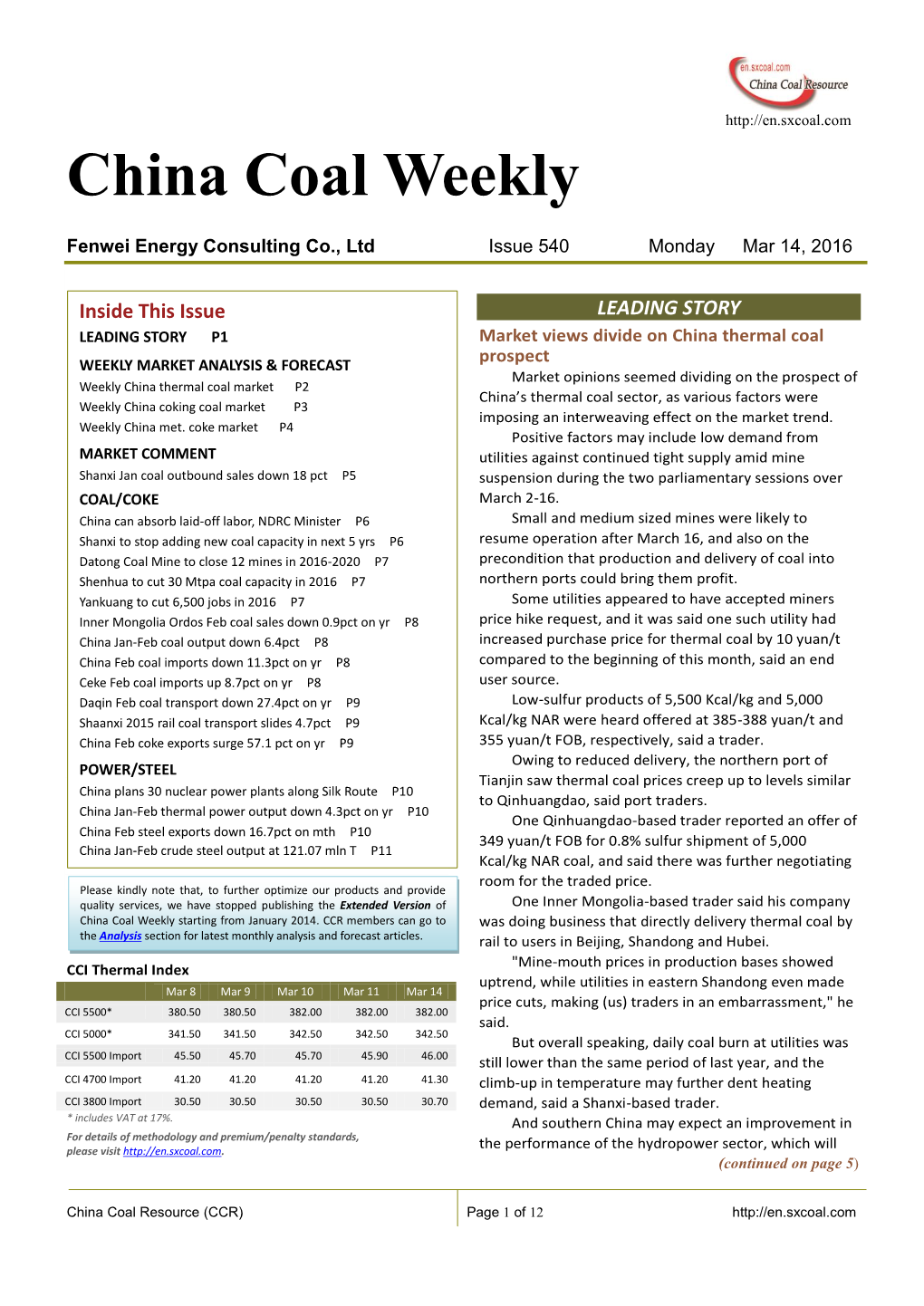

-

The Mineral Industry of China in 2016

2016 Minerals Yearbook CHINA [ADVANCE RELEASE] U.S. Department of the Interior December 2018 U.S. Geological Survey The Mineral Industry of China By Sean Xun In China, unprecedented economic growth since the late of the country’s total nonagricultural employment. In 2016, 20th century had resulted in large increases in the country’s the total investment in fixed assets (excluding that by rural production of and demand for mineral commodities. These households; see reference at the end of the paragraph for a changes were dominating factors in the development of the detailed definition) was $8.78 trillion, of which $2.72 trillion global mineral industry during the past two decades. In more was invested in the manufacturing sector and $149 billion was recent years, owing to the country’s economic slowdown invested in the mining sector (National Bureau of Statistics of and to stricter environmental regulations in place by the China, 2017b, sec. 3–1, 3–3, 3–6, 4–5, 10–6). Government since late 2012, the mineral industry in China had In 2016, the foreign direct investment (FDI) actually used faced some challenges, such as underutilization of production in China was $126 billion, which was the same as in 2015. capacity, slow demand growth, and low profitability. To In 2016, about 0.08% of the FDI was directed to the mining address these challenges, the Government had implemented sector compared with 0.2% in 2015, and 27% was directed to policies of capacity control (to restrict the addition of new the manufacturing sector compared with 31% in 2015. -

Chinacoalchem

ChinaCoalChem Monthly Report Issue May. 2019 Copyright 2019 All Rights Reserved. ChinaCoalChem Issue May. 2019 Table of Contents Insight China ................................................................................................................... 4 To analyze the competitive advantages of various material routes for fuel ethanol from six dimensions .............................................................................................................. 4 Could fuel ethanol meet the demand of 10MT in 2020? 6MTA total capacity is closely promoted ....................................................................................................................... 6 Development of China's polybutene industry ............................................................... 7 Policies & Markets ......................................................................................................... 9 Comprehensive Analysis of the Latest Policy Trends in Fuel Ethanol and Ethanol Gasoline ........................................................................................................................ 9 Companies & Projects ................................................................................................... 9 Baofeng Energy Succeeded in SEC A-Stock Listing ................................................... 9 BG Ordos Started Field Construction of 4bnm3/a SNG Project ................................ 10 Datang Duolun Project Created New Monthly Methanol Output Record in Apr ........ 10 Danhua to Acquire & -

秦 皇 島 港 股 份 有 限 公 司 Qinhuangdao Port Co., Ltd.*

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. 秦皇島港股份有限公司 QINHUANGDAO PORT CO., LTD.* (a joint stock limited liability company incorporated in the People’s Republic of China) (Stock Code: 3369) CONNECTED TRANSACTION ESTABLISHMENT OF A JOINT VENTURE The Board is pleased to announce that, on 5 July 2019, the Company entered into the Capital Contributors’ Agreement with QOS and Other Capital Contributors for establishment of the Joint Venture. Pursuant to the Capital Contributors’ Agreement, the total registered capital of the Joint Venture will be RMB600 million, among which, the Company and QOS have agreed to contribute RMB24.00 million and RMB18.00 million, representing 4% and 3% of the total registered capital of the Joint Venture, respectively, and the remaining 33 Capital Contributors shall subscribe the corresponding equity interests in the Joint Venture in proportion to their respective capital contributions. Upon the Establishment, the Joint Venture will not become a subsidiary of the Company. As at the date of this announcement, QOS is a connected person of the Company as HPG is the holding company of QOS and HPG is the controlling shareholder of the Company. Accordingly, the Establishment constitutes a connected transaction of the Company under Chapter 14A of the Listing Rules. As one or more applicable percentage ratio(s) in respect of the Establishment, as calculated by the total amount of contribution by the Company under the Capital Contributors’ Agreement are more than 0.1% but less than 5%, the Establishment is only subject to the reporting and announcement requirements under Chapter 14A of the Listing Rules, but is exempted from independent shareholders’ approval requirements. -

Coal Mine Methane Country Profiles, Chapter 20, Updated March 2020

20 CHINA In 2019, China was the world’s largest coal producer and consumer, and was also responsible for over 50 percent of world coal mine methane (CMM) emissions. With its signing and ratification of the Paris Agreement on Climate Change and the internal policies set out in the country’s 13th 5-year plan (National Development and Reform Commission P.R.C., 2016), China has expressed its intention to reduce its greenhouse gas (GHG) emissions. Chinese government subsidies and a number of regulatory changes and policy incentives have made CMM projects more economically attractive. China’s 13th 5-year plan (National Development and Reform Commission P.R.C., 2016) has made natural gas development a key part of the country’s energy policy. China is making a concerted effort to increase the capacity of its natural gas pipeline infrastructure, explore new reserves (the majority of which are CMM and shale gas reserves), and developing innovative methane capture technologies. The country seeks to augment its energy production through CMM projects and just over 1,000 mines have implemented CMM projects. 20.1 Summary of Coal Industry 20.1.1 ROLE OF COAL IN CHINA • Coal accounts for 60.4 percent of total national energy consumption in China. • Coal production increased 31.6 percent between 2007 and 2013 before decreasing to 10.8 percent between 2013 and 2017. • Natural gas consumption increased 340 percent between 2007 and 2017. • Chinese electricity generation in 2017 was comprised of coal (60.4 percent), oil (19.4 percent), hydroelectric (8.3 percent), natural gas (6.6 percent), renewables (3.4 percent), and nuclear (1.8 percent) (BP, 2018). -

Medium-Term Coal Market Report 2012

COAL Medium-Term Market Report 2012 Market Trends and Projections to 2017 Please note that this PDF is subject to specific restrictions that limit its use and 2012 distribution. The terms and conditions are available online at http://www.iea.org/ termsandconditionsuseandcopyright/ OECD/IEA, © COAL Medium-Term Market Report 2012 The Medium-Term Coal Market Report 2012 provides IEA forecasts on coal markets for the coming five years as well as an in-depth analysis of recent developments in global coal demand, supply and trade. The annual report shows that while coal continues to be a growing source of primary energy worldwide, its future is increasingly linked to non-OECD countries, particularly China and India, and to the rise of natural gas. The international coal market is experiencing dynamic changes. In 2011, China alone accounted for more than three-quarters of incremental coal production, while domestic consumption was more than three times that of global trade. Low gas prices associated with the shale gas revolution caused a marked decrease in coal use in the United States, the world’s second-largest consumer. This led US thermal coal producers to seek other markets, which resulted in an oversupply of coal in Europe and a significant gas-to-coal switch. Meanwhile, China surpassed Japan as the largest importer of coal, and Indonesia overtook Australia as the world’s largest exporter on a tonnage basis. The report examines the pronounced role the Chinese and Indian economies will exert on the international coal trade through 2017. In the report’s Base Case Scenario, China accounts for over half of global consumption from 2014, and India surpasses the United States as the world’s second-largest consumer of coal in 2017. -

Annual Report 2 018

Annual Report 2 018 (A joint stock limited company incorporated in the People’s Republic of China with limited liability) Stock Code : 01898 Contents Chairman’s Statement 2 Management Discussion and Analysis of Financial Conditions and Operating Results 6 Business Performance 28 Capital Expenditure 41 Technological Innovations 46 Investor Relations 49 Safety, Health, Environmental Protection and Social Responsibility 51 Directors, Supervisors, Senior Management and Employees 54 Directors’ Report 66 Supervisory Committee’s Report 85 Corporate Governance Report 88 Independent Auditor’s Report 104 Financial Summary for Recent Five Years 262 Company Profile 263 Definitions 265 Organisation Chart of the Company 268 Note: In this report, unless otherwise indicated, all financial indicators are presented in RMB. ANNUAL REPORT 2018 1 Chairman’s Statement Dear Shareholders, On behalf of the Board, I would like to express my sincere appreciation to our Shareholders and people from all walks of life for their care and support to the Company over the past year, and to present the 2018 annual report to all Shareholders. The year 2018 marks the 40th anniversary of China’s reform and opening-up. It is the reform and opening-up that has given life and prosperity to China Coal Group and has made the Group develop from a trading company primarily engaged in coal import and export to the second largest coal production enterprise in China. The development history of China Coal Group is a vivid microcosm of the coal industry’s reform and opening-up as China Coal Group has taken the first step to open up China’s coal industry to the outside world by developing and constructing the Antaibao Open Pit Mine, the first ever sino-foreign cooperative project, making significant contribution to promote the upgrade of the coal industry. -

Aegon-Responsible-Investment-Policy-January-2021.Pdf

Aegon N.V. Responsible Investment Policy Contents 1. Purpose .................................................................................................................................................................................. 2 2. Scope ...................................................................................................................................................................................... 3 2.1. External asset managers ............................................................................................................................................... 3 3. Governance ............................................................................................................................................................................ 4 3.1. Execution and implementation ..................................................................................................................................... 4 3.2. Stakeholder engagement .............................................................................................................................................. 4 3.3. Local policies ................................................................................................................................................................. 4 3.4. Update procedure ......................................................................................................................................................... 4 4. RI Framework ........................................................................................................................................................................ -

Appendix 7 Coal Industry Administration in Shanxi Province

47131 Public Disclosure Authorized Economically, socially and environmentally sustainable coal mining sector in China Public Disclosure Authorized Public Disclosure Authorized The World Bank China Coal Information Institute Energy Sector Management Assistance Program Public Disclosure Authorized December, 2008 i Contents CHAPTER 1 INTRODUCTION...........................................................................................................1 CHAPTER 2 OPTIMIZING EXTRACTION .....................................................................................8 2.1 QUANTIFYING COAL RESOURCES AND RECOVERABLE RESERVES ....................................................8 2.2 RESOURCE EXPLOITATION POLICY ................................................................................................11 2.3 COAL RESOURCE POLICY REFORM NEEDS......................................................................................17 2.4 RECOMMENDED POLICIES TO IMPROVE EFFICIENCY OF RESOURCE EXPLOITATION........................17 CHAPTER 3 COAL SUPPLY INFRASTRUCTURE.......................................................................20 3.1 CURRENT STATUS .........................................................................................................................21 3.2 POLICY REFORM NEEDS TO ENHANCE PERFORMANCE OF THE COAL SUPPLY CHAIN.......................32 3.3 RECOMMENDED POLICIES .............................................................................................................33 CHAPTER 4 RESTRUCTURING AND REFORM -

ANNUAL REPORT 2013 3 Overview of Business Data

CHINA COAL ENERGY COMPANY LIMITED CHINA COAL ENERGY COMPANY (A joint stock limited company incorporated in the People's Republic of China with limited liability) Stock Code : 01898 2013 Annual Report 2013 Annual Report ADD : 1, HUANGSI DAJIE, CHAOYANG DISTRICT, BEIJING, CHINA POST CODE : 100120 TEL : (010) 82236028 FAX : (010) 82256484 www.chinacoalenergy.com Contents 2 Overview of Key Financial Data 4 Overview of Business Data 6 Organisation Chart of the Company 8 Chairman’s Statement 12 Management Discussion and Analysis of Financial Conditions and Operating Results 32 Business Performance 44 Capital Expenditure 52 Technological Innovation 55 Investor Relations 57 Safety, Health, Environmental Protection and Social Responsibility 60 Directors, Supervisors and Senior Management 69 Directors’ Report 89 Supervisory Committee’s Report 92 Corporate Governance Report 107 Human Resources Report 111 Independent Auditor’s Report 242 Financial Summary for Recent Five Years 243 Company Profile 246 Definitions Note: In this report, unless otherwise indicated, all financial indicators are presented in RMB. Overview of Key Financial Data Summary of Consolidated Balance Sheet Unit: RMB100 million As at As at Notes to 31 December 31 December Percentage financial Items 2013 2012 change statements (Restated) (%) Assets 2,165.20 1,856.99 16.6 Of which: Property, plant and equipment 1,100.15 855.10 28.7 Note 7 Mining and exploration rights 325.67 324.79 0.3 Note 9 Investment in associates 95.60 84.84 12.7 Note 11 Inventories 68.06 66.97 1.6 Note 18 Trade -

Business Editors for Immediate Release King Stone Energy Group

Press Release To: Business Editors For Immediate Release King Stone Energy Group Limited Enter a new era with a strong team (Hong Kong, 1 March 2010) King Stone Energy Group Limited (the “Company” or “King Stone Energy”, Stock Code: 663.HK) announced today the establishment of strategic partnership with CCB International Asset Management Limited (“CCBIAM”). The partnership demonstrates CCBIAM’s support to the Company’s business transformation as well as its future development plan, subsequent to its prior announcement in relation to its expansion into the mining industry and change of its company name. The Company introduced its new management, representatives from CCBI, the Company’s corporate governance structure as well as future business direction at its press conference today. King Stone Energy expanded its business to coal mining and sales through acquisition of Eerduosi Hengtai Coal Company Limited (“Hengtai Company”). Hengtai Company is in possession of two coal mines located in Eerduosi, Inner Mongolia, among which No. 1 coal mine commenced its operation in December 2009 and No. 2 coal mine will commence its production before the end of 2011. Dr. Wang Dayong, Chairman and CEO of King Stone Energy said, “Shareholders’ interests have always been the top priority of the Company. In view of the ever-increasing demand for coal in Mainland China, the management is proactively committed to the development of coal business. The Company will be principally engaged in coal mining business for future development with an aim to maximize shareholder values. Today King Stone Energy announced CCBlAM as our strategic partner, which expressed their confidence in our management and industry prospects apart from further reinforcement in the shareholding structure. -

Aegon AM Multi-Management Funds

Aegon AM Multi-Management Funds - Exclusion list 2021 Extended version Entity Name Involvement A Brown Co Inc Biodiversity AAK AB Biodiversity Aemetis Inc Biodiversity Agalawatte Plantations PLC Biodiversity Ahmad Zaki Resources Bhd. Biodiversity Anglo-Eastern Plantations Plc Biodiversity Astral Asia Bhd. Biodiversity Ayer Holdings Bhd. Biodiversity Batu Kawan Bhd Biodiversity Benso Oil Palm Plantation Ltd Biodiversity BLD Plantation Bhd Biodiversity Boustead Holdings Bhd Biodiversity Boustead Plantations Bhd Biodiversity Bukit Darah PLC Biodiversity Bumitama Agri Ltd Biodiversity Cam Resources Bhd Biodiversity Carson Cumberbatch PLC Biodiversity Cepatwawasan Group Bhd Biodiversity Chin Teck Plantations Bhd Biodiversity Chumporn Palm Oil Industry Public Co. Ltd. Biodiversity CI Resources Ltd. Biodiversity Dekel Agri-Vision Plc Biodiversity Delloyd Ventures Sdn. Bhd. Biodiversity Domtar Corp. Biodiversity Elpitiya Plantations PLC Biodiversity Energy Absolute Public Co. Ltd. Biodiversity Far East Holdings Bhd Biodiversity Feronia Inc. Biodiversity FGV Holdings Bhd. Biodiversity Fima Corp. Bhd Biodiversity First Pacific Company Limited Biodiversity First Resources Ltd. (Singapore) Biodiversity Fitters Diversified Bhd. Biodiversity FPC Finance Ltd. Biodiversity FPC Treasury Ltd. Biodiversity FPT Finance Ltd. Biodiversity Fuji Oil Holdings Inc. Biodiversity Genting Bhd. Biodiversity Genting Plantations Bhd Biodiversity Global Palm Resources Holdings Ltd. Biodiversity Godrej Agrovet Ltd. Biodiversity GOHL Capital Ltd. Biodiversity Golden Agri-Resources Ltd Biodiversity Golden Land Bhd. Biodiversity Goodman Fielder Pty Ltd. Biodiversity Gopeng Bhd Biodiversity Green Ocean Corp Bhd Biodiversity HAGL JSC Biodiversity Hap Seng Consolidated Bhd. Biodiversity Hap Seng Plantations Holdings Bhd. Biodiversity Harn Len Corp Bhd Biodiversity IJM Corp Bhd Biodiversity IJM Plantations Bhd Biodiversity Indofood Agri Resources Ltd Biodiversity Innoprise Plantations Bhd Biodiversity Interfor Corp. Biodiversity International Paper Co. -

![33China Coal[1]](https://docslib.b-cdn.net/cover/1895/33china-coal-1-8151895.webp)

33China Coal[1]

TOWARD A SUSTAINABLE COAL SECTOR IN CHINA JUNE 2004 Joint UNDP/World Bank Energy Sector Management Assistance Programme (ESMAP) Contents Acknowledgments ......................................................................................................xi Abbreviations and Acronyms ..................................................................................xiii Foreword.................................................................................................................. xvii Executive Summary..................................................................................................xix Institutional framework.................................................................................... xix Key Issues........................................................................................................ xx Safety and Health ................................................................................ xx Environmental Protection..................................................................... xx Restructuring and Rationalization........................................................ xx Supply Shortages ................................................................................ xxi Investment in Coal Mining .............................................................................. xxi International Comparison................................................................................xxii Australia ..............................................................................................xxii