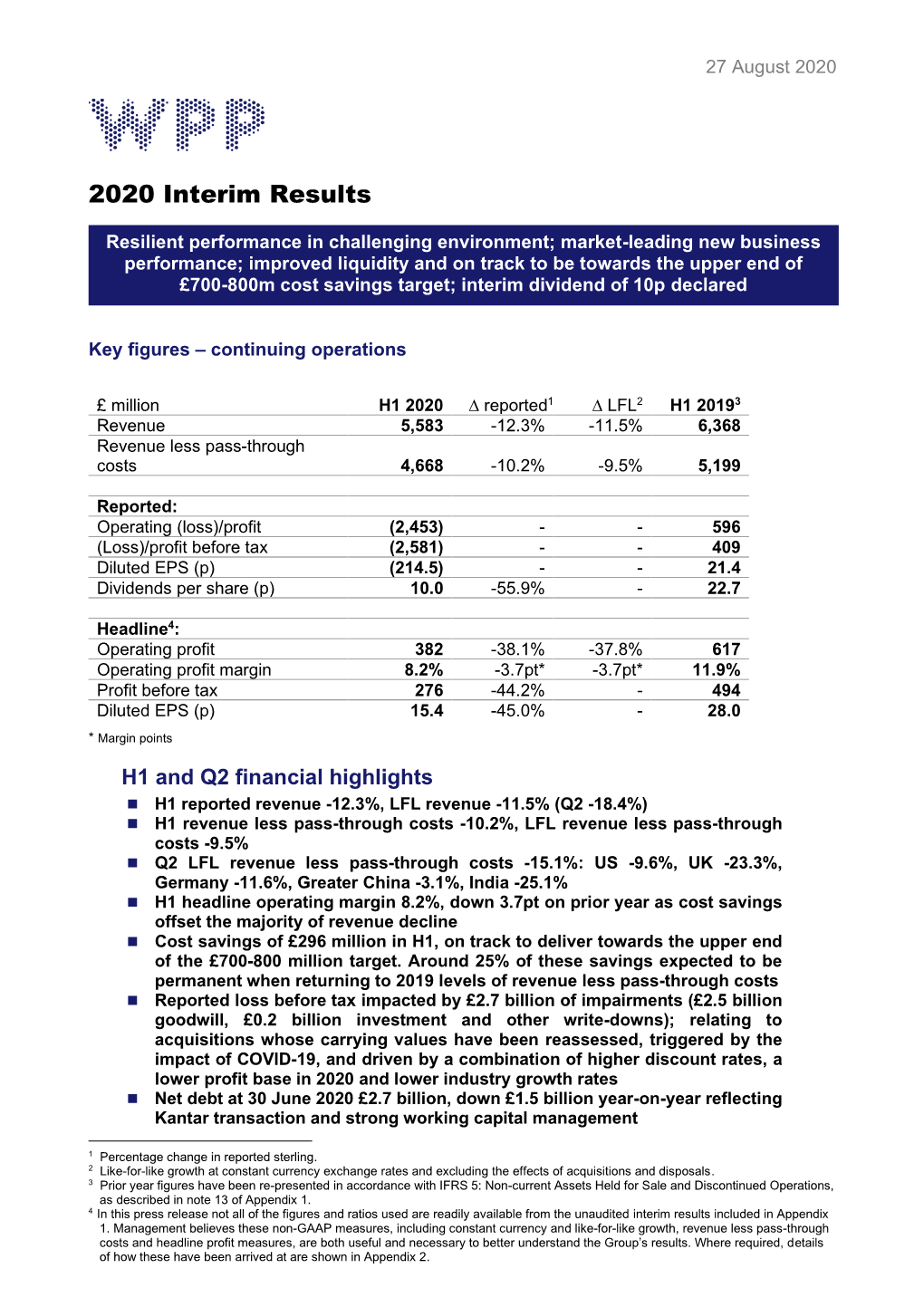

2020 Interim Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report & Accounts 2019

ANNUAL REPORT & ACCOUNTS 2019 WHO WE ARE WPP IS A CREATIVE TRANSFORMATION COMPANY. WE USE THE POWER OF CREATIVITY TO BUILD BETTER FUTURES FOR OUR PEOPLE, CLIENTS AND COMMUNITIES. STRATEGIC REPORT Covid-19 2 Chief Executive’s statement 3 At a glance 8 Our business model 9 Investment case 10 Where we are 12 The market 14 Our strategy 16 Delivering on our strategy 18 Jeremy Bullmore’s essay 48 Remembering two industry greats 50 Financial review 52 Sustainability 58 Assessing and managing our risks 80 CORPORATE GOVERNANCE Chairman’s letter 94 Our Board 96 Our Executive Committee 98 Corporate governance report 100 Sustainability Committee report 107 Nomination and Governance Committee report 108 Audit Committee report 109 Compliance with the Code 112 Compensation Committee report 114 FINANCIAL STATEMENTS Accounting policies 140 Consolidated financial statements 147 Notes to the consolidated financial statements 152 Company financial statements 182 Notes to the Company financial statements 185 Independent auditor’s report 187 ADDITIONAL INFORMATION Taskforce on Climate-related Financial Disclosures 196 Other statutory information 198 Five-year summary 201 Information for shareholders 202 To learn more see Financial glossary 204 wpp.com Where to find us 206 WPP ANNUAL REPORT 2019 1 STRATEGIC REPORT COVID-19 The coronavirus pandemic has touched all our lives. At WPP our first priority is the wellbeing of our people and doing what we can to limit the impact of the virus on society. Our second is continuity of service for our clients. We have thrown ourselves into achieving both objectives. To ensure the safety of employees and We have also modelled a range of revenue When we come through the current to help reduce transmission, we moved declines resulting from the pandemic and, situation, the world will have been changed to a global policy of managed remote in the most extreme scenarios tested, in ways that we cannot fully anticipate yet. -

Printmgr File

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F (Mark One) ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended 31 December 2020 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report For the transition period from to Commission file number 001-38303 WPP plc (Exact Name of Registrant as specified in its charter) Jersey (Jurisdiction of incorporation or organization) Sea Containers, 18 Upper Ground London, United Kingdom, SE1 9GL (Address of principal executive offices) Andrea Harris Group Chief Counsel Sea Containers, 18 Upper Ground, London, United Kingdom, SE1 9GL Telephone: +44(0) 20 7282 4600 E-mail: [email protected] (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Trading Symbol (s) Name of each exchange on which registered Ordinary Shares of 10p each WPP London Stock Exchange American Depositary Shares, each WPP New York Stock Exchange representing five Ordinary Shares (ADSs) Securities registered or to be registered pursuant to Section 12(g) of the Act. Not applicable (Title of Class) Not applicable (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. -

Simpler Structure Clients

STRATEGIC REPORT OUR STRATEGY SIMPLER STRUCTURE CLIENTS The new WPP is built around the needs of clients. How we are delivering on our strategy ACCESS TO THE BEST OF WPP Progress in 2019 “CLIENT-CENTRICITY Client-centricity runs through every aspect – Appointed 17 Global Client KEEPS US FOCUSED of our strategy. It means simplifying our Leaders to head up our most structure, building solutions tailored to important client relationships AND FRESH.” clients, and making available our best talent – Won 18 new major global Lindsay Pattison and cutting-edge capabilities – all in service accounts Chief Client Officer of client growth and satisfaction. – Expanded almost half of our existing top-50 client Many of our clients have Global Client relationships Leaders assigned to ensure easy and expert access to the breadth and depth of WPP. Focus for 2020 They play a critical role in setting our clients – Support clients and help up for success in the modern marketing them chart a course through world, delivering our expanded offer of the Covid-19 pandemic communications, experience, commerce – Establish a best-in-class and technology (see page 19). customer feedback satisfaction system – Continue to strengthen central resources for high-impact engagements, including more resource in the United States 36 WPP ANNUAL REPORT 2019 OUR STRATEGY STRATEGIC REPORT COMPANIES Our streamlined company structure delivers what our clients need. How we are delivering on our strategy A SIMPLIFIED PORTFOLIO Progress in 2019 “WPP TODAY IS The mergers to create VMLY&R and – Sale of 60% share in Kantar SIMPLER, EASIER TO Wunderman Thompson combined brilliant – 22 disposals of non-core MANAGE AND EASIER creativity, expertise in data and sophisticated businesses technology skills. -

First Name Last Name Job Title Company Type Company Name Hank Beaver VP, Group Account Director Ad Tech

First Name Last Name Job Title Company_Type Company Name Hank Beaver VP, Group Account Director Ad Tech - Platform 360i Kristen Baker VP Ad Tech - Platform 360i Heather Chancey Account Director Ad Tech - Platform 360i Blake Ivie Director, Integrated Media Ad Tech - Platform 360i Michaela Haswell Associate Media Manager Ad Tech - Platform 360i Marla Kaplowitz CEO Trade Body 4A's R Lee Barstow VP Revenue Operations Publisher A+E Networks Joe Catanzaro VP, Revenue Operations & Yield Ad Tech - Platform a4 media pty Dan Riccio VP, Advertising Insights & Ad Operations Publisher Al Jazeera Cooper Greene Agency Partnerships Ad Tech - Platform Ampersand Megan Kasler Associate Director of Marketing & Communications Media Agency Amplifi USA/ dentsu Timothy Chung Technical Account Manager Media Agency Annalect Anny Buakaew Director Media Agency Annalect Nicole Lewis Associate Director Media Agency Annalect Kristopher Schmelzer Senior Account Manager Media Agency Annalect Ashley Lai Senior Account Manager Media Agency Annalect Genie Gilder Assistant Vice President Marketing Advertiser Aon Corporation Delia O'Donnell Buyer Ad Tech - Platform APEX EXCHANGE, LLC Jason Wulfsohn COO & Co-Founder Ad Tech - Platform AUDIENCEX Steve Bligh-WIlliams Director, Paid Media Media Agency Aurum Producciones SA Tara Craze VP, Digital Media Agency Aurum Producciones SA Nora Okonski Senior Director, Revenue Operations Publisher Axios Kathleen Pratt Director, Ad Operations Publisher Axios Media Terri Schriver SVP Enterprise Customer Engagement & Investment Advertiser Bank of America paul D'Urso Head of Digital Taxonomy and Projects Publisher Bauer Media Paul Gelb Head of Social and Programmatic Advertiser Bayer Courtney Greenspan Head of AdOps, North America Publisher BBC Melissa Chapman Collaborator Consultancy Beeler Tech LLC Rob Beeler Founder & CEO Consultancy Beeler.Tech Ariel Anderson Media Director Media Agency Best Buy Co., Inc. -

The Leading Global Resource for Benchmarking Creativity and Effectiveness a MESSAGE from CANNES LIONS

Global Creativity Report By Cannes Lions with Key Trends & Commentary by WARC The leading global resource for benchmarking creativity and effectiveness A MESSAGE FROM CANNES LIONS Creativity is Community Creativity is Potential Creativity is Curiosity Creativity is a unifying force that brings communities together. We Over 2000 brands participate in our wider initiatives throughout I recently came across the agency strapline ‘Never Finished’. For see this clearly at Cannes Lions. In 2019 a diverse collective of the year and over 100 brands brought speakers to the Festival this particular agency ‘Never Finished’ is about curiosity, limitless dedicated experts converged in Cannes to immerse themselves in stages. That’s a 15% increase from 2018 and nearly a 50% possibility and always asking ‘what can we do better?’. It’s the a rich spread of increasingly diverse creative ideas, and business increase from 2017 – so the case for creativity is alive and well. same for those who say that winning a Lion isn’t the end...it’s just solutions, from around the globe. Our jurors awarded the very Brands come to Cannes Lions because they recognise that greater the beginning. They view the Lion as a symbol of recognition, but best work and set the creative and effective benchmark for the commercial success is gained when you’re able to unlock creative also as a green light - permission to push something further and global industry, from Craft to eCommerce, Sport to Strategy. I’d potential and produce Lion-winning work. raise the bar. like to take this opportunity to thank our juries on behalf of every single person who entered. -

The Best of European Design & Advertising Art Directors Club Of

The Best of European Design Art Directors Club & Advertising of Europe Category Sub-category Award Title Company Name Client Country Grand Prix 2017 Check it before it's removed: Naked breasts on Grand Prix DDB Group Germany Pink Ribbon Deutschland Germany Facebook against Breast Cancer Gold Winners Film & Radio TV/Cinema Commercials Gold Lachende Pferde Grabarz & Partner Volkswagen Germany United Film & Radio TV/Cinema Commercials Gold 4Creative Channel 4 Paralympics - We're The Superhumans Kingdom Film & Radio Radio Commercials Gold Countdown. Grabarz & Partner Volkswagen Germany Print & Outdoor Poster Advertising Gold Queen (You're not you:British Edition) BBDO Ukraine Mars Inc. Ukraine Verlag Der Tagesspiegel Print & Outdoor Newspaper Advertising Gold Scholz & Friends Germany Newspaper Stack - Trump GmbH Print & Outdoor Magazine & Trade Advertising Gold Switch it off Ogilvy Germany Amnesty International Germany The Tear-Open-Mailing for “Mein Kampf Print & Outdoor Mailings Gold Ogilvy Germany Gesicht Zeigen! Germany – against racism" Interactive & Mobile Online Advertising Gold Water Recipe Tiempo BBDO Oxfam Intermón Spain United Interactive & Mobile Mobile Applications Gold Saatchi & Saatchi Deutsche Telekom Sea Hero Quest Kingdom Check it before it's removed: Naked breasts on Interactive & Mobile Social Media Campaigns Gold DDB Group Germany Pink Ribbon Deutschland Germany Facebook against Breast Cancer Ogilvy & Mather madrid / Interactive & Mobile Any Other Gold Ford Spain Spain Max Motor Dreams GTB Spain Interactive & Mobile Any Other Gold Chat Yourself Y&R Italia Italia Longeva Italy Design & Craft Graphic Design Gold SBERBANK. NEIGHBORHOODS GOOD Moscow SBERBANK OF RUSSIA Russia STRICHPUNKT | KMS Design & Craft Corporate Brand Identity Gold AUDI AG Germany Audi Brand Appearance TEAM | BLACKSPACE Zeitverlag Gerd Bucerius Design & Craft Editorial Gold ZEITmagazin Germany Photography column: Cattelan & Ferrari GmbH & Co. -

2021 Interim Results

5 August 2021 2021 Interim Results Strong first half across the business: returned to 2019 levels a year ahead of plan; full-year guidance raised; good progress on transformation; £350 million buyback planned for H2 Key figures – continuing operations +/(-) % +/(-) % £ million H1 2021 reported1 LFL2 H1 20203 Revenue 6,133 9.8 16.1 5,583 Revenue less pass-through costs 4,899 5.0 11.0 4,668 Reported: Operating profit/(loss) 484 n/m4 - (2,751) Profit/(loss) before tax 394 n/m - (3,177) Diluted EPS (p) 20.6 n/m - (262.0) Dividends per share (p) 12.5 25.0 - 10.0 Headline5: Operating profit 590 54.4 - 382 Operating profit margin 12.1% 3.9pt* - 8.2% Profit before tax 502 81.9 - 276 Diluted EPS (p) 28.7 86.4 - 15.4 * Margin points H1 and Q2 financial highlights H1 reported revenue 9.8%, LFL revenue 16.1% (Q2 26.4%) H1 revenue less pass-through costs 5.0%, LFL revenue less pass-through costs 11.0% (up 0.5% on H1 2019) Q2 LFL revenue less pass-through costs 19.3%: US 12.6%, UK 31.8%, Germany 20.3%, Greater China 1.4%, Australia 8.4%, India 30.0% Q2 LFL revenue less pass-through costs on 2019 1.3%: US 1.8%, UK 1.1%, Germany 6.3%, Greater China -1.7%, Australia -13.6%, India -2.6% Strong new business performance: $2.9 billion net new billings in H1 H1 headline operating margin 12.1%, up 3.9 pt on prior year with strong top- line growth supporting significant reinvestment in incentives H1 headline operating margin pre incentives up 7.8 pt to 17.0% Net debt at 30 June 2021 £1.5 billion, down £1.2 billion year-on-year reflecting good working capital management 1 Percentage change in reported sterling. -

ADC 99TH ANNUAL AWARDS – FINALISTS Includes Gold, Silver, Bronze Cubes and Merit Winners

ADC 99TH ANNUAL AWARDS – FINALISTS Includes Gold, Silver, Bronze Cubes and Merit winners. Award details will be announced during Creative Month, May 18-22 ADVERTISING BY ENTRANT 360I + HBO / NEW YORK Direct - Mail HBO His Dark Materials “Personal Daemons” Promotional Materials - Dimensional - Single HBO Create #ForTheThrone 360I / NEW YORK + MONDELEZ / EAST HANOVER + HBO / NEW YORK Craft in Video - Animation - Single Mondelez (Oreo) Oreo x Game of Thrones 360I / NEW YORK + NEW ORLEANS TOURISM / NEW ORLEANS Innovation - Branded Content / Entertainment New Orleans Tourism The Offline Playlist 72ANDSUNNY + TINDER + M SS NG P ECES / LOS ANGELES Innovation - Branded Content / Entertainment Tinder Swipe Night 72ANDSUNNY / NEW YORK Art Direction - Digital / Motion - Digital Smirnoff Web of Infamy 72ANDSUNNY / NEW YORK + ANONYMOUS CONTENT / LOS ANGELES Craft in Writing - TV / Film / Video - Campaign Halo Top Ice Cream For Adults Television / Film / Online Video - Halo Top Ice Cream For Adults Television - Campaign 1 ADC 99TH ANNUAL AWARDS – FINALISTS Includes Gold, Silver, Bronze Cubes and Merit winners. Award details will be announced during Creative Month, May 18-22 ADVERTISING BY ENTRANT AKESTAM HOLST / STOCKHOLM Direct - Wildcard - Single Maurten Maurten Unofficial ALMAPBBDO + ALPARGATAS / SAO PAULO Art Direction - Press / Poster - Alpargatas Let’s Summer Poster Advertising - Campaign Art Direction - Press / Poster - Alpargatas Let’s Summer Press / Print Advertising - Campaign Out of Home - Poster - Campaign Alpargatas Let’s Summer Out of -

2021 Nielsen Audio “Who to Call” List for Local and Regional Agency and Advertiser Clients

2021 NIELSEN AUDIO “WHO TO CALL” LIST FOR LOCAL AND REGIONAL AGENCY AND ADVERTISER CLIENTS. SORTED BY AUDIO METRO MARKET. Agency Account Nielsen DMA Nielsen Audio Metro Email Address Phone # Manager Abilene-Sweetwater, TX ABILENE, TX Stephanie Coggins [email protected] 972-619-2373 Cleveland-Akron (Canton) AKRON, OH Beth DuPre [email protected] 970-364-3750 Albany-Schenectady-Troy ALBANY-SCHENECTADY-TROY Beth DuPre [email protected] 970-364-3750 Albany, GA ALBANY, GA Beth DuPre [email protected] 970-364-3750 Albuquerque-Santa Fe ALBUQUERQUE Josh Hopson [email protected] 323-217-3895 Wilkes Barre-Scranton-Hztn ALLENTOWN-BETHLEHEM, PA Beth DuPre [email protected] 970-364-3750 Amarillo AMARILLO, TX Stephanie Coggins [email protected] 972-619-2373 Anchorage, AK ANCHORAGE Stephanie Coggins [email protected] 972-619-2373 Detroit ANN ARBOR, MI Beth DuPre [email protected] 970-364-3750 Green Bay-Appleton, WI APPLETON-OSHKOSH, WI Kristen Millsap [email protected] 312-961-8675 Greenvll-Spart-Ashevll-And ASHVILLE, NC Beth DuPre [email protected] 970-364-3750 Atlanta ATLANTA Tisha Jett [email protected] 205-482-3065 Philadelphia ATLANTIC CITY-CAPE MAY, NJ Beth DuPre [email protected] 970-364-3750 Portland-Auburn, ME AUGUSTA-WATERVILLE, ME Beth DuPre [email protected] 970-364-3750 Augusta-Aiken AUGUSTA, GA Beth DuPre [email protected] 970-364-3750 Austin AUSTIN Monica Narvaez [email protected] 832-953-8404 Bakersfield BAKERSFIELD Stephanie -

Industry Update a Summary of Newsworthy Client/Agency Relationship Developments and Relevant Marketing Or Agency Management Trends from the Past Month

Industry Update A summary of newsworthy client/agency relationship developments and relevant marketing or agency management trends from the past month. Volume 33 Executive Summary—Monthly Recap TALENT: securing the right talent and resources The decision by Ford Motor Company, the nation’s seventh-largest advertiser, to walk away from WPP In-house agencies are still on the rise, with more than as its sole agency partner after 75 years was big two-thirds of advertisers now having some in-house news. Nearly half of the account is estimated to be agency capability. The top services that have moved from leaving WPP and will be handled by BBDO. The external agencies to in-house departments have been brand has been reported to be seeking $150 million content marketing, social media, and influencer marketing. in annual efficiencies. This is a big win for Omnicom Top reported benefits of in-house agencies include cost efficiencies, better knowledge of brands, institutional and a major blow for WPP, which for years claimed knowledge, dedicated staff, speed, and nimbleness. Even Ford as one its largest clients under a dedicated Ford Motor Company, as part of a global marketing operations unit called Global Team Blue (or GTB), headquar- restructuring, created in-house marketing positions previously tered near Ford’s offices in Michigan, and with 3,000 handled by WPP’s team, Global Team Blue (GTB). Managing people in offices around the world. It was originally partnerships—in-house or external—has never been more critical: check out the newly introduced Agency Management set up as a multiagency dedicated entity called Team eTraining offered by the ANA. -

Annual Report & Accounts 2020

WPP ANNUA WPP ANNUAL REPORT & ACCOUNTS 2020 L REPORT & A & REPORT CC OU NTS 2020 NTS 240101803_WPP_AR2020_Cover&Spine_Design_190321_SD.indd All Pages 26/03/2021 15:45 OUR PEOPLE ARE OUR COMPANY This year the design of the Annual Report is inspired by our people who, despite the many challenges of Covid-19, have been totally committed to supporting our clients, looking after each other and serving the communities in which we live and work. Thank you to everyone across the Company who kindly volunteered their images for inclusion on this year’s front cover and throughout the Annual Report. STRATEGIC REPORT WHO WE ARE What you will find in this report STRATEGIC REPORT About us 2 WPP IS A CREATIVE Highlights 3 What we do 4 TRANSFORMATION Where we are 5 COMPANY. Chief Executive’s statement 6 Key events of the year 10 Our business model 12 WE USE THE POWER OF Investment case 16 The market 18 CREATIVITY TO BUILD Our strategy 22 Key performance indicators 54 BETTER FUTURES FOR OUR Chief Financial Officer’s statement 58 PEOPLE, PLANET, CLIENTS Financial review 61 Sustainability 66 AND COMMUNITIES. Assessing and managing our risks 90 Jeremy Bullmore’s essay 102 CORPORATE GOVERNANCE Chairman’s letter 108 Our Board 112 Our Executive Committee 115 How our Board engages 117 Division of responsibilities 120 Board activities 122 Composition, succession and evaluation 123 Nomination and Governance Committee report 126 Audit Committee report 128 Sustainability Committee report 133 Compensation Committee report 134 FINANCIAL STATEMENTS Accounting policies 158 Consolidated financial statements 165 Notes to the consolidated financial statements 170 Company financial statements 199 Notes to the Company financial statements 202 Independent auditor’s report 204 Reconciliation to non-GAAP measures of performance 212 This report provides an update ADDITIONAL INFORMATION on strategic progress, financial Task Force on Climate-related performance and sustainability Financial Disclosures statement 216 activities for the year ended 31 December 2020. -

Annual Report & Accounts 2019

ANNUAL REPORT & ACCOUNTS 2019 WHO WE ARE WPP IS A CREATIVE TRANSFORMATION COMPANY. WE USE THE POWER OF CREATIVITY TO BUILD BETTER FUTURES FOR OUR PEOPLE, CLIENTS AND COMMUNITIES. STRATEGIC REPORT Covid-19 2 Chief Executive’s statement 3 At a glance 8 Our business model 9 Investment case 10 Where we are 12 The market 14 Our strategy 16 Delivering on our strategy 18 Jeremy Bullmore’s essay 48 Remembering two industry greats 50 Financial review 52 Sustainability 58 Assessing and managing our risks 80 CORPORATE GOVERNANCE Chairman’s letter 94 Our Board 96 Our Executive Committee 98 Corporate governance report 100 Sustainability Committee report 107 Nomination and Governance Committee report 108 Audit Committee report 109 Compliance with the Code 112 Compensation Committee report 114 FINANCIAL STATEMENTS Accounting policies 140 Consolidated financial statements 147 Notes to the consolidated financial statements 152 Company financial statements 182 Notes to the Company financial statements 185 Independent auditor’s report 187 ADDITIONAL INFORMATION Taskforce on Climate-related Financial Disclosures 196 Other statutory information 198 Five-year summary 201 Information for shareholders 202 To learn more see Financial glossary 204 wpp.com Where to find us 206 WPP ANNUAL REPORT 2019 1 STRATEGIC REPORT COVID-19 The coronavirus pandemic has touched all our lives. At WPP our first priority is the wellbeing of our people and doing what we can to limit the impact of the virus on society. Our second is continuity of service for our clients. We have thrown ourselves into achieving both objectives. To ensure the safety of employees and We have also modelled a range of revenue When we come through the current to help reduce transmission, we moved declines resulting from the pandemic and, situation, the world will have been changed to a global policy of managed remote in the most extreme scenarios tested, in ways that we cannot fully anticipate yet.