HP Nearing a Deal with EDS Hewlett-Packard Said to Be Close

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

Case 4:13-md-02420-YGR Document 2321 Filed 05/16/18 Page 1 of 74 1 2 3 4 5 6 7 8 UNITED STATES DISTRICT COURT 9 NORTHERN DISTRICT OF CALIFORNIA 10 OAKLAND DIVISION 11 IN RE: LITHIUM ION BATTERIES Case No. 13-md-02420-YGR ANTITRUST LITIGATION 12 MDL No. 2420 13 FINAL JUDGMENT OF DISMISSAL This Document Relates To: WITH PREJUDICE AS TO LG CHEM 14 DEFENDANTS ALL DIRECT PURCHASER ACTIONS 15 AS MODIFIED BY THE COURT 16 17 18 19 20 21 22 23 24 25 26 27 28 FINAL JUDGMENT OF DISMISSAL WITH PREJUDICE AS TO LG CHEM DEFENDANTS— Case No. 13-md-02420-YGR Case 4:13-md-02420-YGR Document 2321 Filed 05/16/18 Page 2 of 74 1 This matter has come before the Court to determine whether there is any cause why this 2 Court should not approve the settlement between Direct Purchaser Plaintiffs (“Plaintiffs”) and 3 Defendants LG Chem, Ltd. and LG Chem America, Inc. (together “LG Chem”), set forth in the 4 parties’ settlement agreement dated October 2, 2017, in the above-captioned litigation. The Court, 5 after carefully considering all papers filed and proceedings held herein and otherwise being fully 6 informed, has determined (1) that the settlement agreement should be approved, and (2) that there 7 is no just reason for delay of the entry of this Judgment approving the settlement agreement. 8 Accordingly, the Court directs entry of Judgment which shall constitute a final adjudication of this 9 case on the merits as to the parties to the settlement agreement. -

Electronic Data Systems) - Corporate Profile

EDS EDS (Electronic Data Systems) - Corporate Profile [LAST UPDATED OCTOBER 2002] Click ahead to the Economic Profile section Click ahead to the Political Profile section Click ahead to the Social Profile section Click Ahead to the Stakeholder Profile section Click Ahead to the Quotations section (For background information on how these sections are organized, click here) 1. Organizational Profile According to their website: “EDS, the leading global services company, provides strategy, implementation and hosting for clients managing the business and technology complexities of the digital economy. EDS brings together the world’s best technologies to address critical client business imperatives.” They provide information technology services to various businesses and governments. Regarding governments, this includes such areas as welfare provision, Medicaid provision, U.S. Armed Forces Infrastructure, security systems management,… This is originally the company that made Ross Perot rich, as he is the founder. EDS made its money as the ‘original’ private contractor for government and Perot invested heavily in his political connections to do so. This included direct contacts in the Nixon administration and things such as Perot being a consultant for EDS’s first Medicare client Texas Blue Cross. Perot has since broken away from EDS, though EDS continues to be a major provider of outsourced government services, including, as mentioned above, being a major player in welfare and Medicaid provision, which is the focus of this profile. On September 18th 2002, EDS announced that its earnings per share for the quarter ending September 30th were likely to be much lower than previously stated. This caused EDS' share price to fall dramatically, losing more than half its value the following day and fell to as far down ad $10.09 on September 24th. -

Electronic Data Systems Inc

UNITED STATES OF AMERICA Before the SECURITIES AND EXCHANGE COMMISSION SECURITIES EXCHANGE ACT OF 1934 Release No. 56519 / September 25, 2007 ACCOUNTING AND AUDITING ENFORCEMENT Release No. 2725 / September 25, 2007 ADMINISTRATIVE PROCEEDING File No. 3-12825 In the Matter of ORDER INSTITUTING CEASE-AND- DESIST PROCEEDINGS, MAKING ELECTRONIC DATA FINDINGS AND IMPOSING A CEASE- SYSTEMS CORPORATION, AND-DESIST ORDER PURSUANT TO SECTION 21C OF THE SECURITIES Respondent. EXCHANGE ACT OF 1934 I. The Securities and Exchange Commission (“Commission”) deems it appropriate that cease- and-desist proceedings be, and hereby are, instituted pursuant to Section 21C of the Securities Exchange Act of 1934 (“Exchange Act”) against Electronic Data Systems Inc. (“Respondent” or “EDS”). II. In anticipation of the institution of these proceedings, EDS has submitted an Offer of Settlement (the “Offer”) which the Commission has determined to accept. Solely for the purposes of these proceedings and any other proceedings brought by or on behalf of the Commission, or to which the Commission is a party, and without admitting or denying the findings herein, except as to the Commission’s jurisdiction over it and the subject matter of these proceedings, which are admitted, Respondent consents to the entry of this Order Instituting Cease-and-Desist Proceedings, Making Findings and Imposing a Cease-and-Desist Order Pursuant to Section 21C of the Exchange Act (“Order”), as set forth below. III. On the basis of this Order and Respondent’s Offer, the Commission finds that:1 A. RESPONDENT EDS is a Delaware corporation headquartered in Plano, Texas. EDS is in the business of providing information technology services. -

Annual Report 2008 CEO Letter

Annual Report 2008 CEO letter Dear Fellow Stockholders, Fiscal 2008 was a strong year with some notable HP gained share in key segments, while continuing accomplishments. We have prepared HP to perform to show discipline in our pricing and promotions. well and are building a company that can deliver Software, services, notebooks, blades and storage meaningful value to our customers and stockholders each posted doubledigit revenue growth, for the long term. Looking ahead, it is important to highlighting both our marketleading technology and separate 2008 from 2009, and acknowledge the improved execution. Technology Services showed difficult economic landscape. While we have made particular strength with doubledigit growth in much progress, there is still much work to do. revenue for the year and improved profitability. 2008—Solid Progress and Performance in a Tough The EDS Acquisition—Disciplined Execution of a Environment Multiyear Strategy With the acquisition of Electronic Data Systems In August, HP completed its acquisition of EDS, a Corporation (EDS), we continued implementing a global technology services, outsourcing and multiyear strategy to create the world’s leading consulting leader, for a purchase price of $13 technology company. Additionally, we made solid billion. The EDS integration is at or ahead of the progress on a number of core initiatives, including operational plans we announced in September, and the substantial completion of phase one of HP’s customer response to the acquisition remains very information technology transformation. positive. Fiscal 2008 was also a difficult year, during which The addition of EDS further expands HP’s economic conditions deteriorated. -

Board of Directors

Board of Directors Dr. Friedrich Froeschl Chairman Mr. Francesco Serafini Vice Chairman Mr. Balu Ganesh Ayyar Chief Executive Officer Mr. Nawshir Mirza Mr. Davinder Singh Brar Mr. Prakash Jothee Mr. Balu Doraisamy Mr. Juergen Reiners Mr. Gerard Brossard COMPANY SECRETARY, GENERAL COUNSEL AND HEAD - GLOBAL ETHICS AND COMPLIANCE Mr. A. Sivaram Nair AUDITORS REGISTERED OFFICE REGISTRAR & SHARE TRANSFER AGENT S.R. Batliboi & Co. Bagmane Technology Park Integrated Enterprises (India) Limited UB City, ‘Canberra Block’ Byrasandra, C V Raman Nagar 30, Ramana Residency, 4th Cross, 12th and 13th Floor Bangalore - 560 001, India Sampige Road, Malleswaram 24, Vittal Mallya Road Ph: +91 80 4004 0404 Bangalore - 560 003, India Bangalore – 560 001, India www.mphasis.com Ph: +91 80 23460815 - 818 17 Management Discussion of Risks and Concerns Your Company has instituted a Continuous Global Risk Management framework to proactively identify, mitigate, monitor and report risks across various functions in the organization and to facilitate tracking and review continuously. Broadly risks are categorised into i) Strategy (as it has potential to impact entity’s mission which arise out of strategic decisions and has potential to impact long term operations on marketing /resource allocation / delivery models etc and are generally non-routine in nature); ii) Operational (as it has potential to impact objectives to achieve efficiency and effectiveness in operations); iii) Financial & Reporting (as it has potential to impact financial elements and objectives to facilitate timely and accurate information to stakeholders); and iv) Compliance (as it has potential to impact objectives to adhere to laws and regulations) The Risk Governance Committee comprising of the Chief Risk Officer, the Chief Financial Officer and the Company Secretary & General Counsel periodically evaluates various risks and mitigation efforts. -

HP and the Occupation

HP and the Occupation In December 2009, the Israeli Knesset passed a law allowing for the creation of a biometric database of the inhabitants of Israel. As of January 2013, the program is in its initial testing stage. On December 1, 2008, the American corporation Hewlett- Packard won the contract for the development and dispersal of 5 million biometric identification cards as well as the creation and maintenance of the biometric database, a year before the law was passed. The contract was worth 270 million New Israeli Shekels (NIS), or $72 million. In that same month, an HP subsidiary, Electronic Data Systems (EDS), won a yearly 8 million NIS contract for the systemization of biometric data and the installation of the biometric data system in government offices that would issue the ID cards. The political and philosophical implications of the creation of such a thorough biometric database for a nation’s citizenry are complex and worthy of exhaustive discussion, but the implications of the creation of the same system for a population that has been militarily occupied for over 40 years and has no say in its occupier’s government deserves international outcry. There already is a biometric database for the Palestinians, the use of which is oppressive and a serious concern for whatever hope of peace that remains. Biometrics and Restrictions on Palestinian Movement: The Basel System Israeli officials contend that the separation wall, which snakes through the occupied West Bank dissecting agricultural lands from their owners, and the arduous, congested checkpoints that serve as the only permeable entry points for Palestinians laboring in Israel, are necessary and simply intended for security. -

Hewlett Packard, Hewlett Packard-Enterprise Business

Federal Register / Vol. 75, No. 199 / Friday, October 15, 2010 / Notices 63509 for workers of the subject firm. The 19 U.S.C. 2273, the Department of Labor through January 25, 2012, and all workers in workers were engaged in employment issued a Certification of Eligibility to the group threatened with total or partial related to the supply of pharmaceutical Apply for Worker Adjustment separation from employment on date of research and development services. Assistance on January 25, 2010, certification through January 25, 2012, are eligible to apply for adjustment assistance The company reports that workers applicable to workers of Hewlett under Chapter 2 of Title II of the Trade Act leased from Adecco Engineering and Packard, Hewlett Packard—Enterprise of 1974, as amended. Technical were employed on-site at the Business Services, formerly known as Norwich, New York location of Warner Electronic Data Systems, including on- Signed in Washington, DC, this 8th day of October 2010. Chilcott Pharmaceuticals, Inc. The site leased workers from the above listed Department has determined that these firms, Pontiac, Michigan. The Elliott S. Kushner, workers were sufficiently under the Department’s Notice of determination Certifying Officer, Division of Trade control of the subject firm to be was published in the Federal Register Adjustment Assistance. considered leased workers. on March 5, 2010 (75 FR 10322). The [FR Doc. 2010–26016 Filed 10–14–10; 8:45 am] Based on these findings, the notice was amended on July 13, 2010 to BILLING CODE 4510–FN–P Department is amending this correct the impact date. The notice was certification to include workers leased published in the Federal Register on from Adecco Engineering and Technical July 26, 2010 (75 43555). -

Computer Salary Survey and Career Planning Guide

1987 . Computer Salary Survey and Career Planning Guide I ! I I l. ' Contents A Word About Us and Our Data ....... ..................... ... .. ........... ........... ... ...... Page 2 The Career Planning Cycle: Developing a Sensible Strategy . .. ... ........ ...................... .. ... ............. ... Page 4 A Look at New Trends: Technology and Computer Careers .. ...... .. ......... .. ... ......... .. ... .... .... ...... ... Page 6 Professional Compensation : 1987 Data . ....... .. ....... .. ...... .. .. .. .................. .. ...... ..... .... ....... Page 12 Career Development: Six Steps to Top Computing Management .. ......... ... ................... .... .......... ...... Page 16 Career Plannin g Case Stud ies: Pitfalls and Progress ................ .. ............. ...... ..... ..... ............ ...... ...... Page 18 Source Edp: Your Partner in Career Planning .... .. .. ...... ... ... .......... ........... ...... ... .... ... ... Page 20 We Speak From Experience: Our Executive and Management Staff ... ... .. .. ... ... ... ..... ... .. ... ... ........ ..... .... .. .. .. Page 21 Copyright 1987 by Source Edp All rights reserved. A Word About Us and Our Data .- 2 J ource Edp, the organization that We are a non ·franchised firm ; enabling us to Note that as you read this report, although the researched and published this mate· serve you with the same high level of integrity information is comprehensive , we address all rial , is a professional recruiting firm and effectiveness no matter where you are pertinent topics -

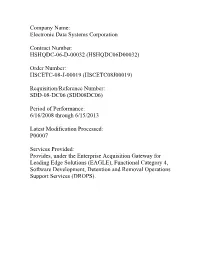

Contract Number: HSHQDC-06-D-00032 (HSHQDC06D00032)

Company Name: Electronic Data Systems Corporation Contract Number: HSHQDC-06-D-00032 (HSHQDC06D00032) Order Number: HSCETC-08-J-00019 (HSCETC08J00019) Requisition/Reference Number: SDD-08-DC06 (SDD08DC06) Period of Performance: 6/16/2008 through 6/15/2013 Latest Modification Processed: P00007 Services Provided: Provides, under the Enterprise Acquisition Gateway for Leading Edge Solutions (EAGLE), Functional Category 4, Software Development, Detention and Removal Operations Support Services (DROPS). AWARD/CONTRACT Department of Homeland Security of Homeland Security Office of Procurement Operations Procurement Ops. (ITAC) Information Tech. Acquisition Div. Dr"ive 245 Hurray Lane, SW Building 410 DC 20528 Washington DC 20528 [J FOB ORIGIN ~ OTHER (See below) ELECTRONIC DATA SYSTEMS CORPORATION l3600 EDS DRIVE MAILSTOP A6N-D48 Net 30 HERNDON VA 20l7l3225 b2High ICE Chief Information Officer of Homeland Security Immigration and Customs Enforcement F;inance Center 801 I Street! NW Box 1620 Suite 700 HQ/OFH Invoice Washington DC 20536 VT 05495-1279 (c)( U.S.C. 253 (c) ( See 15!t SUPPLIEs/SERV!CES 15C. 15D, t5E UNIT PRICE i5F, A!IIIOUNT QUANTITY 1{;, TABLE OF CONTENTS (X) SEC. DESCRIPTiON PAGE(S) (X) SEC. DESCRIPTION PAG&:(S) PART 1- THE SCHEDULE A SOUCJTATIONlCONTRACT fORM B SUPPl1ES OR SERVICES AND PRICES/COSTS OF DOCUMENTS, EXHIBITS AND.oTHER ATTACH. C DESCRIPT10NJSPECS.MIORK STATEMENT F ATTACHMENTS D PACKAGING AND MARKING PART IV w REPRESENTATIONS AND INSTRUCTIONS E INSPECTION AND ACCEPTANCE K REPRESENTATIONS, CERT!FICATIONS AND F DELIVERfES OR PERFORMANCE OTHER STATEMENTS OF OFFERORS G CONTRACT ADMINISTRATION DATA l iNSTRS., CONDK, AND NOTICES TO OFFERORS " SPECIAl CONTAACT REQUIREMENTS ATiON FACTORS FOR AWARD CONTRACTING OFFICER WILL COMPLETE ITEM 17 OR is AS APPLICABLE i7. -

VAOHP0141 Vietnamese American Oral History Project, UC Irvine

VAOHP0141 Vietnamese American Oral History Project, UC Irvine Narrator: Thuy Vo Dang Interviewer: Tom Phan Date: May 22, 2013 Location: Irvine, California Sub-collection: Thuy Vo Dang Oral Histories Length of Interview: 01:32:08 Audio [Track 1] TVD: This is Thuy Vo Dang with the Vietnamese American Oral History Project at UC Irvine [University of California Irvine]. Today is May 22, 2013. I will be interviewing Mr. Tom Phan in Irvine, California. And so can you please introduce yourself, your name, your date of birth, and where you were born. TP: Wow, this is honor to be included in the VAOHP [Vietnamese American Oral History Project] project, I think it’s very meaningful and present great value to future generations. The American name is Tom or Thomas, Tom Phan but the original Vietnamese name is Thuận Phan or Tom Phan but now I go with my American name is Tom Phan. Was born exactly today, is my birthday so it’s very special to have a chance to tell your life story on your birthday, May 22, 1955. So I’m officially 58 years old today. TVD: And where were you born? VAOHP0141 TP: I was born in a central, in the town, in central Vietnam. Nha Trang in the providence of Khánh Hòa. Nha Trang is the city. And the province is Khánh Hòa. It’s very close to Cam Ranh Bay and a lot of Vietnamese-American people know Cam Ranh Bay, which is one of the largest naval base built in the world and still is right now. -

Dell's $3.9 Billion Perot Gamble

Sept. 25, 2009 InformationWeekanalytics.com Analytics Alerts Dell’s $3.9 Billion Perot Gamble Contents Dell faces numerous obstacles, including integration 2 Dell’s Perot Bid A $3.9 Billion challenges and wary customers, as it looks Gamble to become a player in the tech services market. 5 Dell’s Acquisition Of Perot Helps Healthcare Push But it’s on the right track. 6 Dell Buys Perot: Told You So! 7 Dell-Perot Cash-Outs And The Media’s ‘Windfall’ Idiocy Dell’s Perot Gamble InformationWeekanalytics.com Analytics Alerts Sept. 22, 2009 Dell’s Perot Bid A $3.9 Billion Gamble By Paul McDougall DELL’S $3.9 BILLION DEAL TO ACQUIRE PEROT SYSTEMS could be a boon to its own sagging fortunes and to business customers looking to implement new architectures like virtu- alization and cloud computing. But the PC and server maker will have to manage thorny inte- gration issues as it absorbs a company known for its rigid, by-the-book culture and reliance on a market-healthcare-where Dell has little experience. On top of these issues, Dell is a relative neophyte when it comes to IT services and M&As. Not that there isn’t a plan. Dell wants to marry its hardware and automation software with Perot’s integration and out- sourcing services so it can offer end-to-end “solutions,” mirror- ing earlier moves by rivals Hewlett-Packard and IBM. The parts are all there-in theory at least. Dell has the iron and applica- tions needed for advanced data centers. It bundles VMware’s View virtual desktop offering Does Perot give Dell with its Latitude and Optiplex [a winning hand? PCs and PowerEdge servers to create an off-the-shelf virtualization package. -

2014 Registration Document PDF Version

registration document 2014 2014 2015 2016 Ambition 2016 Your business technologists. Powering progress CONTENTS A E Group overview 3 Financials 141 A.1 Business profile [G4-3] and [G4-4] 5E.1 Operational review 142 A.2 Revenue profile [G4-8] and [G4-EC1] 7E.2 Objectives 2015 158 A.3 Interview with Thierry Breton [G4-1] 8E.3 Financial review 159 A.4 Persons responsible 10 E.4 Consolidated financial statements 166 A.5 Atos in 2014 [G4-9] 11 E.5 Parent company summary financial statements 224 A.6 Group presentation 16 F B Risks analysis [G4-14] AFR 247 Atos positioning and strategy 23 F.1 External risk factors [G4-13] 248 B.1 Market trends 24 F.2 Business risks [G4-13] 249 B.2 Market sizing and competitive landscape F.3 Compliance and reputation risk 251 [G4-8] and [G4-13] 29 F.4 Financial markets risks 253 B.3 Strategy and 2016 Ambition 31 F.5 Risk management activities 253 F.6 Claims and litigation 255 C Sales and delivery 37 G C.1 Sales and business development approach 38 Corporate governance C.2 Markets [G4-8] 41 and capital AFR 257 C.3 Managed Services 51 G.1 Management of the Company 258 C.4 Consulting & Systems Integration 54 G.2 Legal Information 258 C.5 Big Data & Cyber-security 57 G.3 Report of Chairman of the Board of Directors C.6 Cloud & Enterprise software 60 on corporate governance and Internal Control 268 C.7 Worldline 62 G.4 Executive compensation and stock ownership 283 G.5 Resolutions 298 G.6 Code and charts [G4-15] and [G4-56] 303 D G.7 Common stock evolution and performance 307 Corporate responsibility AFR 65 D.1 Integrating