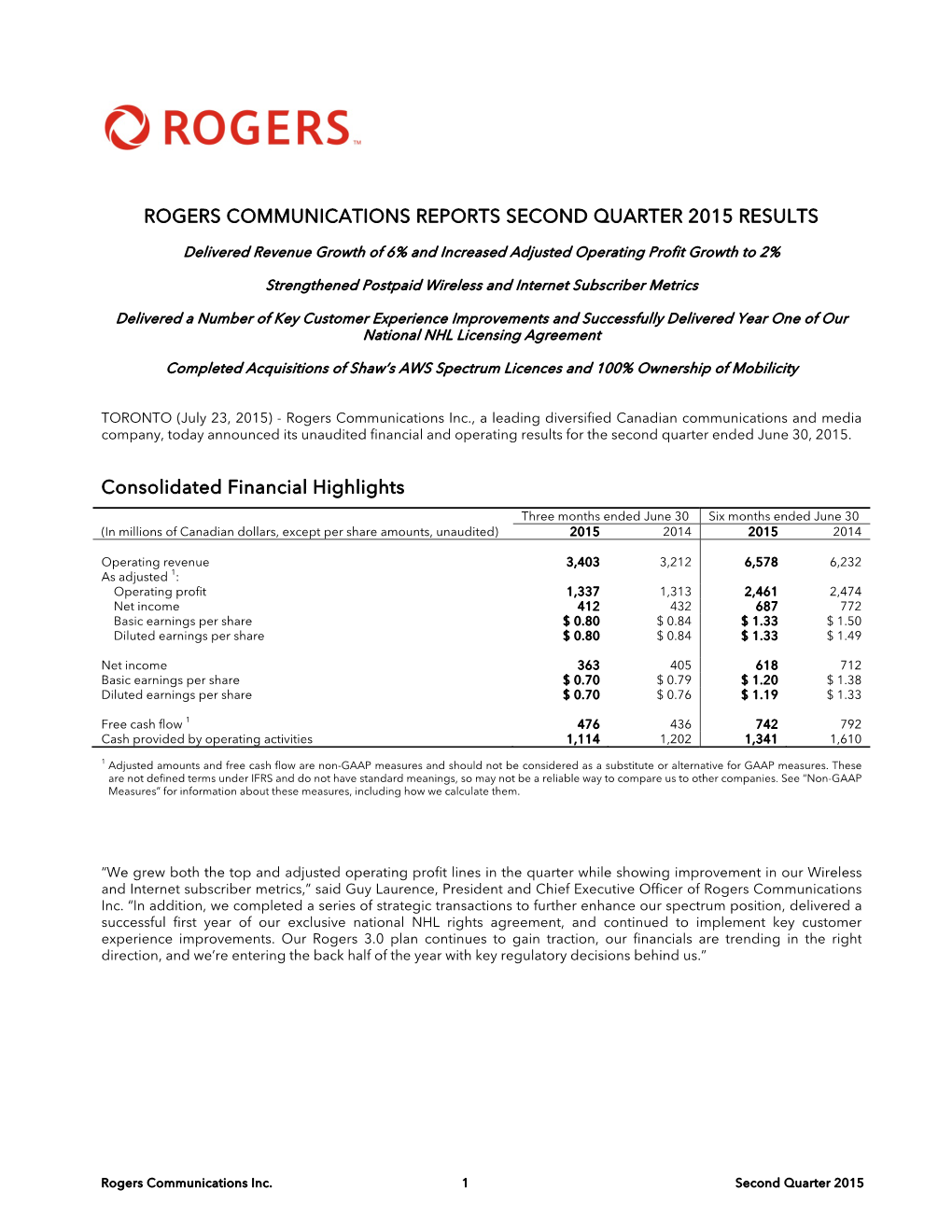

Rogers Communications Reports Second Quarter 2015 Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2011 BCE Annual Information Form

Annual Information Form BCE Inc. For the year ended December 31, 2011 March 8, 2012 In this Annual Information Form, Bell Canada is, unless otherwise indicated, referred to as Bell, and comprises our Bell Wireline, Bell Wireless and Bell Media segments. Bell Aliant means, collectively, Bell Aliant Inc. and its subsidiaries. All dollar figures are in Canadian dollars, unless stated otherwise. The information in this Annual Information Form is as of March 8, 2012, unless stated otherwise, and except for information in documents incorporated by reference that have a different date. TABLE OF CONTENTS PARTS OF MANAGEMENT’S DISCUSSION & ANALYSIS AND FINANCIAL STATEMENTS ANNUAL INCORPORATED BY REFERENCE INFORMATION (REFERENCE TO PAGES OF THE BCE INC. FORM 2011 ANNUAL REPORT) Caution Regarding Forward-Looking Statements 2 32-34; 54-69 Corporate Structure 4 Incorporation and Registered Offices 4 Subsidiaries 4 Description of Our Business 5 General Summary 5 23-28; 32-36; 41-47 Strategic Imperatives 6 29-31 Our Competitive Strengths 6 Marketing and Distribution Channels 8 Our Networks 9 32-34; 54-69 Our Employees 12 Corporate Responsibility 13 Competitive Environment 15 54-57 Regulatory Environment 15 58-61 Intangible Properties 15 General Development of Our Business 17 Three-Year History (1) 17 Our Capital Structure 20 BCE Inc. Securities 20 112-114 Bell Canada Debt Securities 21 Ratings for BCE Inc. and Bell Canada Securities 21 Ratings for Bell Canada Debt Securities 22 Ratings for BCE Inc. Preferred Shares 22 Outlook 22 General Explanation 22 Explanation of Rating Categories Received for our Securities 24 Market for our Securities 24 Trading of our Securities 25 Our Dividend Policy 27 Our Directors and Executive Officers 28 Directors 28 Executive Officers 30 Directors’ and Executive Officers’ Share Ownership 30 Legal Proceedings 31 Lawsuits Instituted by BCE Inc. -

The State of Competition in Canada's Telecommunications

RESEARCH PAPERS MAY 2016 THE STATE OF COMPETITION IN CANADA’S TELECOMMUNICATIONS INDUSTRY – 2016 By Martin Masse and Paul Beaudry The Montreal Economic Institute is an independent, non-partisan, not-for-profi t research and educational organization. Through its publications, media appearances and conferences, the MEI stimu- lates debate on public policies in Quebec and across Canada by pro- posing wealth-creating reforms based on market mechanisms. It does 910 Peel Street, Suite 600 not accept any government funding. Montreal (Quebec) H3C 2H8 Canada The opinions expressed in this study do not necessarily represent those of the Montreal Economic Institute or of the members of its Phone: 514-273-0969 board of directors. The publication of this study in no way implies Fax: 514-273-2581 that the Montreal Economic Institute or the members of its board of Website: www.iedm.org directors are in favour of or oppose the passage of any bill. The MEI’s members and donors support its overall research program. Among its members and donors are companies active in the tele- communications sector, whose fi nancial contribution corresponds to around 4.5% of the MEI’s total budget. These companies had no input into the process of preparing the fi nal text of this Research Paper, nor any control over its public dissemination. Reproduction is authorized for non-commercial educational purposes provided the source is mentioned. ©2016 Montreal Economic Institute ISBN 978-2-922687-65-1 Legal deposit: 2nd quarter 2016 Bibliothèque et Archives nationales du Québec -

Claimant's Memorial on Merits and Damages

Public Version INTERNATIONAL CENTRE FOR ICSID Case No. ARB/16/16 SETTLEMENT OF INVESTMENT DISPUTES BETWEEN GLOBAL TELECOM HOLDING S.A.E. Claimant and GOVERNMENT OF CANADA Respondent CLAIMANT’S MEMORIAL ON THE MERITS AND DAMAGES 29 September 2017 GIBSON, DUNN & CRUTCHER LLP Telephone House 2-4 Temple Avenue London EC4Y 0HB United Kingdom GIBSON, DUNN & CRUTCHER LLP 200 Park Avenue New York, NY 10166 United States of America Public Version TABLE OF CONTENTS I. Introduction ............................................................................................................................ 1 II. Executive Summary ............................................................................................................... 3 III. Canada’s Wireless Telecommunications Market And Framework For The 2008 AWS Auction................................................................................................................................. 17 A. Overview Of Canada’s Wireless Telecommunications Market Leading Up To The 2008 AWS Auction.............................................................................................. 17 1. Introduction to Wireless Telecommunications .................................................. 17 2. Canada’s Wireless Telecommunications Market At The Time Of The 2008 AWS Auction ............................................................................................ 20 B. The 2008 AWS Auction Framework And Its Key Conditions ................................... 23 1. The Terms Of The AWS Auction Consultation -

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

Wireless Competition in Canada: an Assessment

Volume 6•Issue 27•September 2013 WIRELESS COMPETITION IN CANADA: AN ASSESSMENT Jeffrey Church † Professor, Department of Economics and Director, Digital Economy Program, The School of Public Policy, University of Calgary Andrew Wilkins † Research Associate, Digital Economy Program, The School of Public Policy, University of Calgary SUMMARY If there’s one thing Canadians agree on, it’s that Canada’s wireless industry can and should be more competitive. The federal government is on side with the policy objective of having four carriers in every region and has responded with policies that provide commercial advantages to entrants. But, the rub is that there has not been a study that actually assesses the state of competition in wireless services in Canada, until now. Those in favour of policies that will promote and sustain entry point to Canada’s high average revenue per user and low wireless penetration rate (mobile connections per capita) as evidence that there is insufficient competition. The difficulty is that the facts are not consistent with this simplistic analysis. Measurements of wireless penetration are skewed toward countries that maintain the Calling Party Pays Protocol and favour pay-as-you-go plans, both of which encourage inflated user counts. Canada’s participation per capita on monthly plans and minutes of voice per capita are not outliers. Moreover, in terms of smartphone adoption and smartphone data usage, Canada is a global leader, contributing to high average revenue per user. Consistent with being world leaders in the rollout of high speed wireless networks, Canada lead its peer group in capital expenditures per subscriber in 2012: the competition of importance to Canadians is not just over price, but also over the quality of wireless networks. -

Opening Canada's Doors to Foreign Investment in Telecommunications

Response To: Opening Canada’s Doors to Foreign Investment in Telecommunications: Options for Reform Industry Canada Consultation Paper June 2010 Section 1. EXECUTIVE SUMMARY Mobilicity is pleased to be given an opportunity to respond to the recently published Industry Canada Consultation Paper on foreign investment in Telecommunications. We have reviewed the various foreign investment options suggested in the publication, and would like to specifically support Option 2 – The Telecommunications Policy Review Plan / Competition Policy Review Panel approach – specifically allowing smaller telecom players to be exempt from current restrictions related to foreign investment in telecommunications. In summary, we believe Option 2 will help facilitate fair competition among telecom companies and deliver the most consumer benefits of all the options under consideration. As will be discussed, telecommunications companies, in particular wireless operators, are capital intensive due to the large network and employee base required to offer service. Moreover, for new entrants and smaller operators, there is significant risk in their business plans because much of the capital outlay is required in advance of attracting subscribers, their large fixed cost base means that it is often many years before they can generate positive cash flow, and in the interim the incumbent competition can take predatory actions to impact smaller companies‟ viability. The result, therefore, is that while all telecommunications carriers need regular access to capital, new entrants in particular need access to “risk capital”, which is funding for earlier stage companies, many of which are not developed enough to be traded publicly. In Canada, there is ample domestic capital available for mature, relatively safe businesses such as telecommunication incumbents, but the amount of risk capital available is small relative to the requirements of new entrants and smaller operators. -

Igniting Growth at a Glance Highlights for 2015

Rogers Communications Inc. 2015 Annual Report Igniting growth At a glance highlights for 2015 Rogers Communications Inc. Wireless Rogers Communications (TSX: RCI; NYSE: RCI) Wireless is Canada’s largest provider of voice and data is a diversified Canadian communications and communications services. We provide these services to media company. We report our results of approximately 9.9 million customers under the Rogers, Fido, chatr and Mobilicity brands. We provide customers operations in the four segments of Wireless, with the best and latest wireless devices, applications and Cable, Business Solutions and Media. leading network speeds. Our far-reaching LTE network covers approximately 93% of all Canadians. Our strategic spectrum investments position us well to provide the network connectivity, speed and reliability our customers Operating revenue Adjusted operating profit have come to enjoy and expect. Wireless also provides (In billions of dollars) (In billions of dollars) seamless wireless roaming across the U.S. and more than 200 other countries and is the Canadian leader in the 2015 13.4 2015 5.0 deployment of machine-to-machine communications and Internet of Things applications. 2014 12.9 2014 5.0 2013 12.7 2013 5.0 Free cash flow Annualized dividend Operating revenue Adjusted operating profit (In billions of dollars) rate at year end ($) (In billions of dollars) (In billions of dollars) 2015 1.7 2015 $1.92 2015 7.7 2015 3.2 2014 1.4 2014 $1.83 2014 7.3 2014 3.2 2013 1.5 2013 $1.74 2013 7.3 2013 3.2 2015 Operating revenue 2015 Operating revenue $13.4 Billion $7.7 Billion Wireless 56% $13.4 Cable 26% $7.7 Network 90% Billion Billion Media 15% Business Solutions 3% Equipment 10% Cable and Business Solutions Media Cable is a leading Canadian cable services provider whose Media is Canada’s premier destination for category-leading service territory covers approximately 4.2 million homes sports entertainment, digital media, television and radio in Ontario, New Brunswick and Newfoundland representing broadcasting and publishing properties. -

Rogers Communications Reports Fourth Quarter

ROGERS COMMUNICATIONS REPORTS FOURTH QUARTER 2015 RESULTS • Rogers 3.0 plan delivers solid financial and operating metrics for the fourth quarter • Continued revenue growth of 3% driven by growth of 4% in Wireless, our largest segment representing approximately 60% of total revenue and adjusted operating profit • Wireless adjusted operating profit growth of 4%; Wireless postpaid net additions of 31,000, an improvement of 89,000 year on year, on an 11 basis point improvement in churn • Postpaid ARPA up 4% with strong growth in Share Everything customers, up 63% • Internet net additions of 16,000, an improvement of 20,000 year on year; Internet revenue up 10% • Strong operating fundamentals delivered operating cash flow and free cash flow of $950 million and $274 million, respectively • Customer complaints as reported by the Commissioner for Complaints for Telecommunications Services (CCTS) declined faster than key competitors’, down 26% in 2015 and down 50% over the past two years • Met 2015 guidance and announced our 2016 outlook, with continued growth in operating revenue and adjusted operating profit as well as a declining capital expenditure profile expected to drive higher free cash flow TORONTO (January 27, 2016) - Rogers Communications Inc., a leading diversified Canadian communications and media company, today announced its unaudited financial and operating results for the fourth quarter ended December 31, 2015. Consolidated Financial Highlights Three months ended December 31 Twelve months ended December 31 (In millions of Canadian -

Rogers Wireless Inc

333 Bloor Street East Toronto, Ontario M4W 1G9 Tel. (416) 935-7211 Fax (416) 935-7719 [email protected] Dawn Hunt Vice-President Government & Intercarrier Relations March 14, 2003 Jan Skora Director General Radiocommunications and Broadcasting Regulatory Branch EMAILED TO: [email protected] Industry Canada 300 Slater Street Ottawa, Ontario K1A 0C8 Dear Mr. Skora, Re: Comments - Canada Gazette Notices: DGRB-004-02 and DGRB-001-03 Consultation on a New Fee and Licensing Regime for Cellular and Incumbent Personal Communications Services (PCS) Licensees Pursuant to the Canada Gazette, Part I, dated December 21, 2002, and February 21, 2003 respectively, RWI is pleased to file the attached comments regarding the above noted proceeding. The comments are submitted in Adobe Acrobat (PDF) version 5.0 software produced on a computer using a Windows 2000 Professional operating system. If there are any questions regarding these comments, please do not hesitate to contact the undersigned. Sincerely, Original Signed by: Joel Thorp On Behalf of: Dawn Hunt, DH:jt Attach. Department of Industry CONSULTATION ON A NEW FEE AND LICENSING REGIME FOR CELLULAR AND INCUMBENT PERSONAL COMMUNICATIONS SERVICES (PCS) LICENSEES DGRB-004-02 COMMENTS OF ROGERS WIRELESS INC. March 14, 2003 COMMENTS OF ROGERS WIRELESS INC. DGRB-004-02 Table of Contents 1EXECUTIVE SUMMARY ................................................................................................3 DETAILED COMMENTS...................................................................................................4 -

Public Accounts of the Province of Ontario for the Year Ended March

PUBLIC ACCOUNTS, 1994-95 MINISTRY OF AGRICULTURE, FOOD AND RURAL AFFAIRS Hon. Elmer Buchanan, Minister DETAILS OF EXPENDITURE Voted Salaries and Wages ($87,902,805) Temporary Help Services ($1,329,292): Management Board Secretariat, 1,220,010; Accounts under $50,000—109,282. Less: Recoveries from Other Ministries ($196,635): Environment and Energy, 196,635. Employee Benefits ($13,866,524) Payments for Canada Pension Plan, 1 ,594,486; Dental Plan, 95 1 ,332; Employer Health Tax, 1 ,702,083; Group Life Insurance, 170,970; Long Term Income Protection, 1,028,176; Supplementary Health and Hospital Plan, 1,016,690; Unemployment Insurance, 3,017,224; Unfunded Liability— Public Service Pension Fund, 1,024,574. Other Benefits: Attendance Gratuities, 401,716; Death Benefits, 18,660; Early Retirement Incentive, 467,244; Maternity/Parental/Adoption Leave Allowances, 530,045; Severance Pay, 1,494,057; Miscellaneous Benefits, 51,035. Workers' Compensation Board, 315,097. Payments to Other Ministries ($152,141): Accounts under $50,000—152,141. Less: Recoveries from Other Ministries ($69,006): Accounts under $50,000—69,006. Travelling Expenses ($3,859,979) Hon. Elmer Buchanan, 7,002; P. Klopp, 3,765; R. Burak, 9,912; W.R. Allen, 13,155; D.K. Alles, 16,276; P.M. Angus, 23,969; D. Beattie, 12,681; A. Bierworth, 14,510; J.L. Cushing, 12,125; L.L. Davies, 11,521; P. Dick, 16,999; E.J. Dickson, 11,231; R.C. Donais, 10,703; J.R. Drynan, 10,277; R. Dunlop, 10,662; JJ. Gardner, 43,319; C.L. Goubau, 12,096; N. Harris, 12,593; F.R Hayward, 26,910; M. -

What Matters to You Matters to Us 2013 ANNUAL REPORT

what matters to you matters to us 2013 ANNUAL REPORT Our products and services Wireless TELUS provides Clear & Simple® prepaid and postpaid voice and data solutions to 7.8 million customers on world-class nationwide wireless networks. Leading networks and devices: Total coverage of 99% of Canadians over a coast-to-coast 4G network, including 4G LTE and HSPA+, as well as CDMA network technology. We offer leading-edge smartphones, tablets, mobile Internet keys, mobile Wi-Fi devices and machine- to-machine (M2M) devices Data and voice: Fast web browsing, social networking, messaging (text, picture and video), the latest mobile applications including OptikTM on the go, M2M connectivity, clear and reliable voice services, push-to-talk solutions including TELUS LinkTM service, and international roaming to more than 200 countries Wireline In British Columbia, Alberta and Eastern Quebec, TELUS is the established full-service local exchange carrier, offering a wide range of telecommunications products to consumers, including residential phone, Internet access, and television and entertainment services. Nationally, we provide telecommunications and IT solutions for small to large businesses, including IP, voice, video, data and managed solutions, as well as contact centre outsourcing solutions for domestic and international businesses. Voice: Reliable home phone service with long distance and Hosting, managed IT, security and cloud-based services: advanced calling features Comprehensive cybersecurity solutions and ongoing assured 1/2 INCH TRIMMED -

Moneygram | Canada Post

Pay for utilities, phone services, cable bills and more at your local post office with MoneyGram! Please consult the list below for all available billers. Payez vos factures de services publics, de services téléphoniques, de câblodistribution et autres factures à votre bureau de poste local avec MoneyGram! Consultez la liste ci-dessous pour tous les émetteurs de factures participants. A B C D E F G H I J K L M N O P Q R S T U V W X Y Z BILLER NAME/ PROVINCE AVAILABLE SERVICE/ NOM DE L’ÉMETTEUR DE FACTURE SERVICE DISPONIBLE 310-LOAN BC NEXT DAY/JOUR SUIVANT 407 ETR ON NEXT DAY/JOUR SUIVANT A.R.C. ACCOUNTS RECOVERY CORPORATION BC NEXT DAY/JOUR SUIVANT AAA DEBT MANAGERS BC NEXT DAY/JOUR SUIVANT ABERDEEN UTILITY SK NEXT DAY/JOUR SUIVANT ABERNETHY UTILITY SK NEXT DAY/JOUR SUIVANT ACCORD BUSINESS CREDIT ON NEXT DAY/JOUR SUIVANT ACTION COLLECTIONS & RECEIVABLES MANAGEMENT ON NEXT DAY/JOUR SUIVANT AFFINITY CREDIT SOLUTIONS AB NEXT DAY/JOUR SUIVANT AJAX, TOWN OF - TAXES ON NEXT DAY/JOUR SUIVANT ALBERTA BLUE CROSS AB NEXT DAY/JOUR SUIVANT ALBERTA MAINTENANCE ENFORCEMENT PROGRAM AB NEXT DAY/JOUR SUIVANT ALBERTA MOTOR ASSOCIATION - INSURANCE COMPANY AB NEXT DAY/JOUR SUIVANT ALGOMA POWER ON NEXT DAY/JOUR SUIVANT ALIANT ACTIMEDIA NL NEXT DAY/JOUR SUIVANT ALIANT MOBILITY - NS/NB NS NEXT DAY/JOUR SUIVANT ALIANT MOBILITY / NL NS NEXT DAY/JOUR SUIVANT ALIANT MOBILITY/PEI PE NEXT DAY/JOUR SUIVANT ALLIANCEONE ON NEXT DAY/JOUR SUIVANT ALLSTATE INSURANCE ON NEXT DAY/JOUR SUIVANT ALLY CREDIT CANADA ON NEXT DAY/JOUR SUIVANT ALLY CREDIT CANADA LIMITED (AUTO)