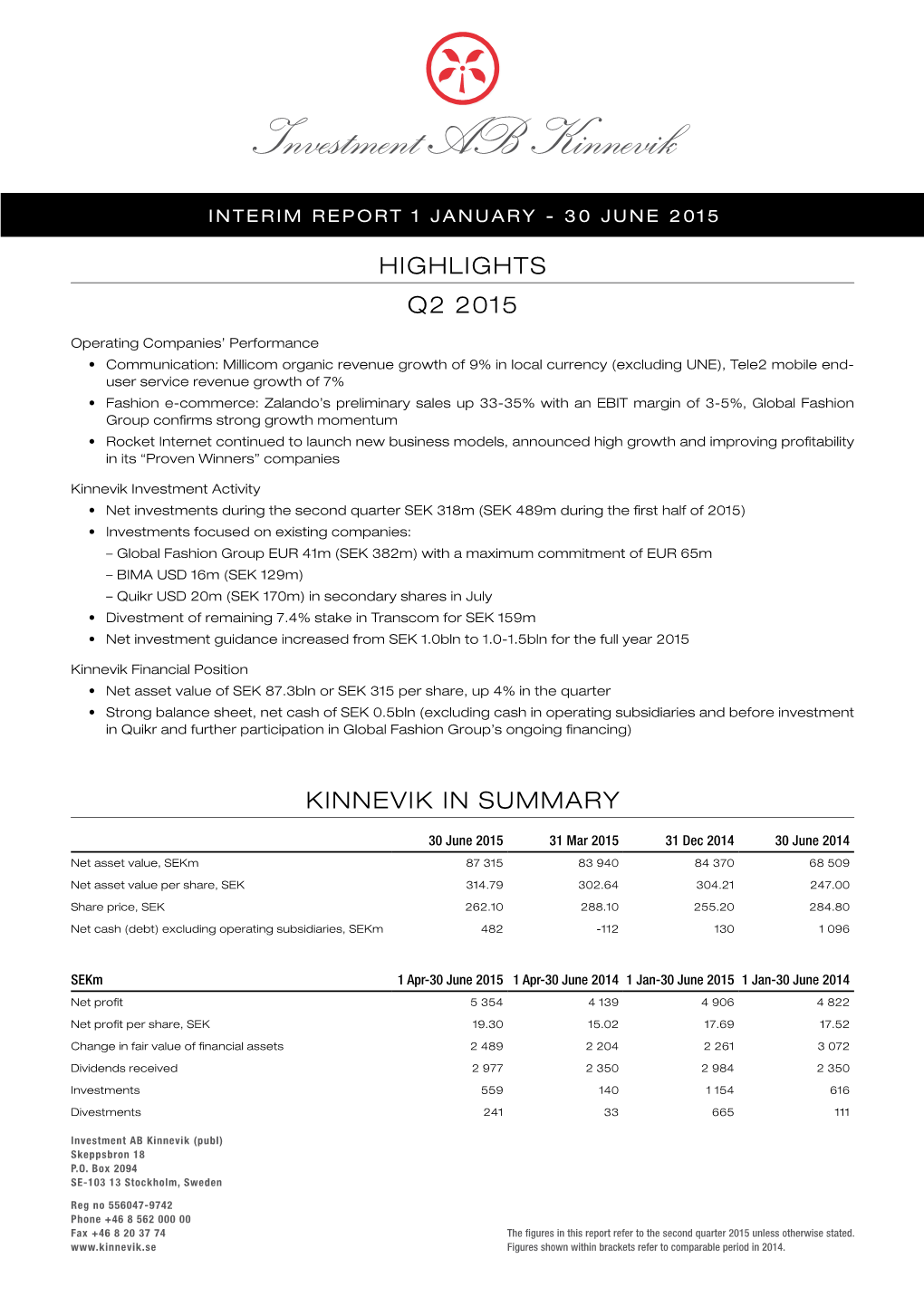

Interim Report Q2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Purchase and Sales by Report Date Composite

Purchase and Sales by Report Date Composite July 1, 2013 to July 31, 2013 View Date: August 8, 2013 Funds Included in Composite NJBD COMMON D EMERGING NJBU COMMON D DEVELOPED NJDE COMMON D DEVELOPED PASSIVE NJDO COMMON D DEVELOPED ETFS NJDU COMMON D HEALTHCARE NJDV COMMON D TECHNOLOGY NJDZ COMMON D OAC NJEA COMMON D EMERGING MORGAN STNLY NJEB COMMON D EMERGING LAZARD NJED COMMON D EMERGING PICTET NJEM COMMON D EMERGING WELLINGTON Page 1 Prepared by State Street Purchase Report by Report Date Composite July 1, 2013 to July 31, 2013 View Date: August 8, 2013 Base Currency: USD - US DOLLAR Asset ID Security Name/Description Trd Date Stl Date Fail Days Broker Name Stl Cur/Loc Comm Per Shr Shares/Par/Contracts Exchange Rate Fund Price Interest Commissions Taxes/Fees/Other Net Cost Units/Original Face CASH EQUIVALENTS US DOLLAR 85749P9B9 STATE STR INSTL LIQUID RESVS 0.093% 31 Dec 2099 01 Jul 2013 01 Jul 2013 STATE STREET BANK AND TRUST USD/CSW 744,135.040 1.000000 NJEM Local 100.000000 0.00 0.00 0.00 744,135.04 Base 100.000000 0.00 0.00 0.00 744,135.04 85749P9B9 STATE STR INSTL LIQUID RESVS 0.093% 31 Dec 2099 01 Jul 2013 01 Jul 2013 STATE STREET BANK AND TRUST USD/CSW 592,948.130 1.000000 NJEA Local 100.000000 0.00 0.00 0.00 592,948.13 Base 100.000000 0.00 0.00 0.00 592,948.13 85749P9B9 STATE STR INSTL LIQUID RESVS 0.093% 31 Dec 2099 01 Jul 2013 01 Jul 2013 STATE STREET BANK AND TRUST USD/CSW 478,031.100 1.000000 NJEB Local 100.000000 0.00 0.00 0.00 478,031.10 Base 100.000000 0.00 0.00 0.00 478,031.10 85749P9B9 STATE STR INSTL LIQUID RESVS -

MONDAY 18 MAY 2015 CONTENTS 1. Qliro Group

QLIRO GROUP AB (PUBL) DOCUMENTS FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS – MONDAY 18 MAY 2015 CONTENTS 1. Qliro Group AB Nomination Committee's explanatory statement regarding the proposal for election of the Board at the 2015 Annual General Meeting. 2. Press release on 5 May 2015 – The Nomination Committee amends its proposal regarding election of Board of Directors. 3. Information on the proposed members of the Board – updated on 5 May 2015 due to the Nomination Committee's amended proposal regarding election of Board of Directors. 4. The Board's statement pursuant to Ch 19 Sec 22 of the Swedish Companies Act. 5. Auditors' report in accordance with Ch 8, Sec 54 of the Swedish Companies Act whether the guidelines for remuneration to Executive Management as approved by the Annual General Meeting have been complied with. 6. Evaluation of Qliro Group's remuneration to the CEO and other Members of the Management Group (Report according to the Swedish Corporate Governance Code, 9.1 and 10.3). 1. Qliro Group AB Nomination Committee's explanatory statement regarding the proposal for election of the Board at the 2015 Annual General Meeting Qliro Group's Nomination Committee In accordance with the procedure for the Nomination Committee adopted at the 2014 Annual General Meeting, Cristina Stenbeck, being a representative of the Company’s largest shareholder Investment AB Kinnevik, convened a Nomination Committee to prepare the proposals for the Company’s 2015 Annual General Meeting. The Nomination Committee consists of Cristina Stenbeck appointed by Investment AB Kinnevik; Annika Andersson appointed by Swedbank Robur Funds; and Rezo Kanovich appointed by Oppenheimer Funds. -

Biography of Jan Stenbeck - Google Search

biography of jan stenbeck - Google Search Sign in All Images News Videos Maps More Settings Tools About 24 700 results (0,52 seconds) Career. Stenbeck was born in Stockholm, Sweden, the youngest son of business lawyer Hugo Stenbeck (1890–1977) and his wife Märtha (née Odelfelt; 1906–1992). ... Control of the group was passed to his daughter Cristina Stenbeck after his death of a heart attack. Jan Stenbeck - Wikipedia https://en.wikipedia.org/wiki/Jan_Stenbeck Biography About Featured Snippets Feedback Jan Hugo Robert Arne Stenbeck was a Swedish business leader, media Jan Stenbeck - Wikipedia pioneer, sailor and financier. He was https://en.wikipedia.org/wiki/Jan_Stenbeck head of Kinnevik Group from 1976 and Career. Stenbeck was born in Stockholm, Sweden, the youngest son of business lawyer Hugo founded among other things the Stenbeck (1890–1977) and his wife Märtha (née Odelfelt; 1906–1992). ... Control of the group companies Comviq, Invik & Co AB, was passed to his daughter Cristina Stenbeck after his death of a heart attack. Tele2, Banque Invik, Millicom, Modern Born: Jan Hugo Robert Arne Stenbeck; 14 Died: 19 August 2002 (aged 59); Paris, Times Group and NetCom Systems. Nov... France Wikipedia Born: November 14, 1942, Stockholm Jan Stenbeck – Wikipedia Died: August 19, 2002, American https://sv.wikipedia.org/wiki/Jan_Stenbeck Translate this page Hospital of Paris, Neuilly-sur-Seine, Jan Stenbeck var yngste son till affärsadvokaten Hugo Stenbeck (1890–1977) och dennes France hustru Märta, född Odelfelt (1906–1992). Efter studentexamen vid ... Spouse: Merrill McLeod (m. Föräldrar: Hugo Stenbeck; Märta Odelfelt Styrelse- ledamot i: Investment AB Kinnevik, In.. -

College Retirement Equities Fund

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2010-05-27 | Period of Report: 2010-03-31 SEC Accession No. 0000930413-10-003160 (HTML Version on secdatabase.com) FILER COLLEGE RETIREMENT EQUITIES FUND Mailing Address Business Address 730 THIRD AVE 730 THIRD AVE CIK:777535| IRS No.: 136022042 | State of Incorp.:NY | Fiscal Year End: 1231 NEW YORK NY 10017 NEW YORK NY 10017 Type: N-Q | Act: 40 | File No.: 811-04415 | Film No.: 10861628 2129164905 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number File No. 811-4415 COLLEGE RETIREMENT EQUITIES FUND (Exact name of Registrant as specified in charter) 730 Third Avenue, New York, New York 10017-3206 (Address of principal executive offices) (Zip code) Stewart P. Greene, Esq. c/o TIAA-CREF 730 Third Avenue New York, New York 10017-3206 (Name and address of agent for service) Registrants telephone number, including area code: 212-490-9000 Date of fiscal year end: December 31 Date of reporting period: March 31, 2010 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Item 1. Schedule of Investments. COLLEGE RETIREMENT EQUITIES FUND - Stock Account COLLEGE RETIREMENT EQUITIES FUND STOCK ACCOUNT SCHEDULE OF INVESTMENTS (unaudited) March 31, 2010 MATURITY VALUE PRINCIPAL ISSUER RATE RATING DATE (000) BONDS - 0.0% CORPORATE BONDS - 0.0% HOLDING AND OTHER INVESTMENT OFFICES - 0.0% $ 100,000,000 j Japan Asia Investment Co Ltd 0.000% 09/26/11 NR $ 535 22,970 Kiwi Income Property Trust 8.950 12/20/14 NR 17 TOTAL HOLDING AND OTHER INVESTMENT OFFICES 552 Copyright © 2012 www.secdatabase.com. -

Corporate Governance Report 2011

Corporate Governance Report 2011 TELE2 IN BRIEF Tele2 AB (“the Company”) has 34 million customers in 11 countries and offers mobile services, fixed broadband and telephony, data network services, cable TV and content services. In 2011, the Company had net sales of SEK 40,750 (40,164) million and reported an operating profit (EBITDA) of SEK 10.852 (10,284) million. Tele2 AB (publ.) is a Swedish joint-stock company with shares listed on the Nasdaq OMX Stockholm Large Cap list and thus applies the Swedish Code of Corporate Governance (“the Code”) as amended on February 1, 2010. This Corporate Governance Report is prepared in accordance with the provisions of the Code. Prior years’ corporate governance reports and other corporate governance documents are available on the corporate website, www.tele2.com. The Code is based on the principle of comply or explain, which means that companies can deviate from single rules in the Code, given that they provide an explanation for the deviation. This report contains information regarding the following deviations from the Code: Reference from the Code Deviation and Explanation 2.4 A member of the Board shall not chair Cristina Stenbeck, who is the Chairman of the Nomination Committee, is also a member of the Company´s the Nomination Committee Board. The other members of the Nomination Committee have explained their decision regarding the election of the Chairman of the Nomination Committee as being in the Company’s and shareholders’ best interest – and a natural consequence of Cristina Stenbeck leading the Nomination Committee’s work in recent years as well as her representing the Company’s largest shareholder. -

Information to Shareholders in Investment AB Kinnevik (Publ) Prior to the Extraordinary General Meeting to Be Held on 11 May 2009

Information to shareholders in Investment AB Kinnevik (publ) prior to the Extraordinary General Meeting to be held on 11 May 2009 Acquisition of Emesco AB Table of Contents Background and Reasons for the Transaction............................................................................... 3 Emesco................................................................................................................................................ 4 The Transaction ................................................................................................................................. 5 Effects of the Transaction on Kinnevik ........................................................................................... 7 Summary of the Transaction Agreement......................................................................................... 9 Fairness Opinions............................................................................................................................ 13 Extraordinary General Meeting, 11 May 2009 The Board of Directors of Investment AB Kinnevik (publ) (“Kinnevik”) proposes that the shareholders in Kinnevik at the Extraordinary General Meeting (“EGM”) to be held on Monday 11 May 2009 at 11.00 am CET after the Annual General Meeting (“AGM”), approves the acquisition of all shares in Emesco AB (“Emesco”). For information regarding participation at the EGM, see the notice to the EGM available at www.kinnevik.se. This information brochure has been prepared to provide information for the shareholders in Kinnevik -

Investment AB Kinnevik

Investment AB Kinnevik Skeppsbron 18 (Publ) Reg no 556047-9742 P.O. Box 2094 Phone +46 8 562 000 00 SE-103 13 Stockholm Sweden Fax +46 8 20 37 74 www.kinnevik.se BOKSLUTSKOMMUNIKÉ 2007 Finansiell utveckling under fjärde kvartalet • Marknadsvärdet på koncernens aktier i Noterade Kärninnehav steg med 6.241 Mkr och uppgick per 31 december till 50.761 Mkr. • Korsnäs intäkter uppgick till 1.821 (1.722) Mkr. • Rörelseresultatet för Korsnäs var 7 (78) Mkr (jämförelsetal exklusive omstruktureringskostnader). • Koncernens totala intäkter uppgick till 1.873 (1.767) Mkr och rörelseresultatet var -5 (-124) Mkr. • Resultat efter skatt, inklusive förändring i verkligt värde av finansiella tillgångar, uppgick till 6.647 (9.192) Mkr. • Resultat per aktie uppgick till 25,18 (34,82) kronor. Händelser under fjärde kvartalet • Koncernen deltog i Black Earth Farmings nyemission. Kinnevik ägde vid årets utgång 20% av bolaget. Finansiell utveckling under 2007 • Marknadsvärdet på koncernens aktier i Noterade Kärninnehav ökade med 14.606 Mkr, motsvarande 40%, till 50.761 Mkr den 31 december. • Korsnäs intäkter ökade med 5% till 7.519 (7.134) Mkr (jämförelsetal proforma inklusive Frövi). • Rörelseresultatet för Korsnäs var 836 (865) Mkr (jämförelsetal proforma inklusive Frövi, exklusive omstruktureringskostnader). • Koncernens totala intäkter uppgick till 7.673 (6.305) Mkr och rörelseresultatet var 885 (478) Mkr. • Resultat efter skatt, inklusive förändring i verkligt värde av finansiella tillgångar, uppgick till 16.179 (11.549) Mkr. • Resultat per aktie uppgick till 61,29 (43,74) kronor. • Styrelsen föreslår att årsstämman beslutar om en kontantutdelning om 2,00 (1,70) kronor per aktie. Därutöver avser styrelsen att rekommendera till Kinneviks årsstämma som hålls den 15 maj att besluta om ett förnyat mandat att återköpa maximalt 10% av bolagets egna aktier. -

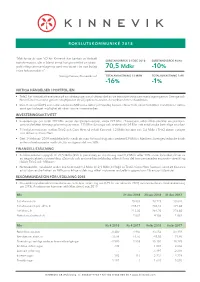

70,5 Mdkr -10% -16%

BOKSLUTSKOMMUNIKÉ 2018 ”Mitt första år som VD för Kinnevik har kantats av fortsatt SUBSTANSVÄRDE 31 DEC 2018 SUBSTANSVÄRDE Kv/Kv transformation, där vi bland annat har genomfört en strate- giskt viktig sammanslagning samt investerat i tio nya bolag 70,5 Mdkr -10% i våra fokusområden” Georgi Ganev, Kinneviks vd TOTALAVKASTNING 12 MÅN TOTALAVKASTNING 5 ÅR -16% -1% VIKTIGA HÄNDELSER I PORTFÖLJEN • Tele2 har fortsatt att exekvera på sin strategi genom slutförandet av de transformativa sammanslagningarna i Sverige och Nederländerna samt genom utnyttjandet av säljoptionen avseende verksamheten i Kazakstan • Den 9 Januari 2019 sekundärnoterades Millicoms aktier på Nasdaq-börsen i New York, vilket förbättrar likviditeten i aktien samt ger bolaget möjlighet att nå en större investerarbas INVESTERINGSAKTIVITET • Investeringar om totalt 392 Mkr under det fjärde kvartalet, varav 227 Mkr i Travelperk, vilka tillhandahåller en plattform som underlättar företags planering av resor, 111 Mkr i Livongo och resterande 54 Mkr i ett antal andra befntliga innehav • Till följd av fusionen mellan Tele2 och Com Hem så erhöll Kinnevik 1,2 Mdkr kontant och 3,6 Mdkr i Tele2 aktier, i utbyte mot aktierna i Com Hem • Den 14 februari 2019 meddelade Kinnevik att man förbundit sig att investera 0,9 Mdkr i MatHem, Sveriges ledande fristå- ende onlinebaserade matbutik, för en ägarandel om 38% FINANSIELL STÄLLNING • Substansvärdet uppgick till 70,5 Mdkr (256 kr per aktie), en minskning med 8,2 Mdkr eller 10% under kvartalet, drivet av en negativ aktiekursutveckling i Zalando och andra e-handelsbolag vilken till viss del kompenserades av positiv utveckling i både Tele2 och Millicom • Nettoskulden minskade under kvartalet med 1,2 Mdkr till 2,9 Mdkr, till följd av Tele2 / Com Hem fusionen samt att Kinnevik erhöll den andra halvan av Millicoms årliga utdelning, vilket motsvarar en belåningsgrad om 4% av portföljvärdet REKOMMENDATION FÖR UTDELNING 2018 • Kinneviks styrelse rekommenderar en ordinarie utdelning om 8,25 kr per aktie för 2018 motsvarande en direktavkastning om 3,9%. -

Annual General Meeting of Shareholders

FOR IMMEDIATE RELEASE Thursday, May 15, 2003 ANNUAL GENERAL MEETING OF SHAREHOLDERS New York and Stockholm – Tele2 AB, (“Tele2”), (Nasdaq Stock Market: TLTOA and TLTOB and Stockholmsbörsen: TEL2A and TEL2B), the leading alternative pan-European telecommunications company, today announced that the company’s Annual General Meeting (AGM) of shareholders held today in Stockholm re-elected Marc Beuls, Vigo Carlund, Bruce Grant, Sven Hagströmer and Håkan Ledin as Board members. John Shakeshaft and Cristina Stenbeck were elected as new members of the Board of Directors. Mikael Winkvist was elected as deputy auditor. The AGM approved the proposal from the Board of Directors not to distribute a dividend to shareholders for 2002. The AGM resolved to approve the existing procedure for the nomination of Board Directors. A Chairman of the group of major shareholders responsible for nominating Board members will be announced before the year end. At a statutory Board meeting following the AGM, Sven Hagströmer was elected as Chairman of the Board of Directors. Sven Hagströmer has served as a Non-Executive Director of Tele2 since 1997 and is Chairman of Investment AB Öresund, AB Custos and Acando, as well as a member of the Boards of LGP Telecom Holding AB, Avanza AB and HQ Fonder. John Shakeshaft is an advisor to the board of Quintain Estates and Development plc and an external member of the University of Cambridge audit committee. Cristina Stenbeck is Vice Chairman of the Board of Directors of Metro International and a member of the Board of Directors of Modern Times Group. Authorisation was given for the Board of Directors to, on one or several occasions during the period until the next Annual General Meeting, issue subordinated debentures with no more than 217,300 detachable warrants, in order to enable stock options to be granted under the incentive programme adopted at the Annual General Meeting held on 16 May 2002. -

Årsredovisning 2011 CDON Group AB NASDAQ OMX Stockholm: CDON

Narva CDON GR CDON O UP AB ÅRSRE DO VIS N I NG 2011 Årsredovisning 2011 CDON Group AB NASDAQ OMX Stockholm: CDON CDON Group AB Bergsgatan 20 Box 385 CDON GROUP AB 54 % NETTOOMSÄTTNING 3 404 Mkr RÖRELSERESULTAT 201 23 Malmö www.cdongroup.com FÖRVÄRV AV RUM21 AB LANSERING AV MEMBERS.COM FÖRVÄRV AV TRETTI AB LANSERING AV NELLY.COM PÅ 20 NYA MARKNADER LANSERING AV CDON Group AB Årsredovisning 20112011 CDON Group AB Årsredovisning 2011 Innehållsförteckning Innehållsförteckning VD har ordet 1 VD har ordet 1 Ansvarstagande 3 Ansvarstagande 3 Finansiell översikt 6 Finansiell översikt 6 Förvaltningsberättelse 7 Förvaltningsberättelse 7 Bolagsstyrning 28 Bolagsstyrning 28 Styrelse 37 Styrelse 37 Verkställande ledning 41 Verkställande ledning 41 Koncernens räkenskaper 44 Koncernens räkenskaper 44 Moderbolagets räkenskaper 49 Moderbolagets räkenskaper 49 Noter 54 Noter 54 Underskrifter 92 Underskrifter 92 Revisionsberättelse 93 Revisionsberättelse 93 Definitioner 95 Definitioner 95 Produktion: Narva Tryck: Elanders CDON Group AB 1 Årsredovisning 2011 CDON Group AB ÅrsredovisningÖkad tillväxttakt 2011 och stärkt resultat ÖkadVD har ordet tillväxttakt och stärkt resultat VD har ordet CDON Group har haft en fantastisk utveckling och 2011 var inget undantag. Vårt första fullständiga år som en fristående e-handelskoncern på Nasdaq OMX CDONStockholm Group prägla har haftdes aven sortimentsu fantastisk utvecklingtveckling, ochgeografisk 2011 var expansion inget undantag. samt Vårt förstaförvärv fullständiga och lansering år somav ny ena verksamhetfristående eer-handelskoncern. Årets resultat ärpå samtidigt Nasdaq OMX vårt Stockholmstarkaste någonsin präglades med av sortimentsubåde accelereradtveckling, tillväxt geografisk och stärkt expansion lönsamhet samt. Det är förvärvett kvitto och på lansering att vår strategi av nya fungerar.verksamhet er. -

Annual Report 2011 ”Seventyfive Years of Entrepreneurial Tradition Under the Same Group of Principal Owners” Contents

Annual Report 2011 ”Seventyfive years of entrepreneurial tradition under the same group of principal owners” Contents Five-year Summary 3 Chief Executive’s review 4 The Kinnevik share 6 Book and fair value of assets 8 Proportional part of revenue and result 9 Historical background 10 Corporate Responsibility 12 Kinnevik’s strategic focus 16 Paper & Packaging - Korsnäs 18 Telecom & Services 22 Media 24 Online 26 Microfinancing 28 Agriculture 29 Renewable energy 29 Annual and Consolidated Accounts for 2011 Board of Directors’ Report 30 Financial Statements and Notes for the Group 39 Financial Statements and Notes for the Parent Company 65 Audit Report 73 Board of Directors 74 Senior Executives and other key employees 75 Definitions of financial key ratios 76 Annual general meeting 77 Five-year Summary (SEK m) 2011 2010 2009 2008 2007 Key Ratios Operating margin, % 9.4 10.3 10.0 5.2 11.5 Capital employed 66 898 62 111 50 462 33 067 59 778 Return on capital employed, % 10.8 24.8 40.1 -54.5 32.0 Return on shareholders' equity, % 11.5 28.3 50.2 -69.8 38.2 Equity/assets ratio, % 85 84 78 66 80 Net debt 6 539 7 123 8 233 8 906 9 205 Debt/equity ratio, multiple 0.12 0.14 0.21 0.41 0.19 Net debt against Korsnäs 5 212 5 575 6 419 5 845 6 534 Net debt against listed holdings 1 605 1 706 2 001 3 066 2 753 Available liquidity 5 465 4 923 3 942 2 031 2 481 Risk capital ratio, % 86.8 85.7 80.4 69.0 82.2 Fair value Paper & Packaging 4 992 4 755 3 813 2 181 5 125 Fair value Telecom & Services 44 406 43 557 35 735 22 251 45 130 Fair value Media 5 000 6 936 5 -

Annual Report 2009 ”More Than Seventy Years of Entrepreneurial Tradition Under the Same Group of Principal Owners” Contents

Annual Report 2009 ”More than seventy years of entrepreneurial tradition under the same group of principal owners” Contents Five-year Summary 3 Chief Executive’s review 4 Board of Directors 6 Senior Executives 8 Historical background 9 The Kinnevik share 10 Corporate Responsibility 12 Book and fair value of assets 15 Our Group 16 Proportional part of revenue and result 18 Major Unlisted Holdings Korsnäs 19 Major Listed Holdings Millicom 23 Tele2 24 Modern Times Group MTG 25 Metro 26 Transcom 26 New Ventures 27 Corporate Governance Report 30 Annual and Consolidated Accounts for 2009 Board of Directors’ Report 33 Financial Statements and Notes for the Group 37 Financial Statements and Notes for the Parent Company 63 Audit Report 70 Definitions of financial key ratios 71 Five-year Summary (SEK million) 2009 2008 2007 2006 2005 Key Ratios Operating margin, % 10,0 5.2 11.5 7.6 7.6 Capital employed 50 462 33 067 59 778 44 629 31 022 Return on captial employed, % 40.1 -54.5 32.0 31.6 15.9 Return on shareholders' equity, % 50.2 -69.8 38.2 40.0 18.9 Equity/assets ratio, % 78 66 80 72 70 Net debt 8 233 8 906 9 205 9 856 7 249 Debt/equity ratio, multiple 0.2 0.4 0.2 0.3 0.3 Risk capital ratio, % 80.4 69.0 82.2 75.3 72.3 Total assets 53 240 35 871 62 818 47 733 32 122 Net asset value 44 829 24 325 54 941 39 168 25 717 Net asset value per share, SEK 162 93 208 148 97 Closing price, class B share, SEK 107 63 147 115 74 Market capitalization 29 656 16 410 38 739 30 358 19 535 Market value, Major Unlisted Holdings 10 232 8 026 11 659 11 559 6 131 Market