Interim Report Q1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Purchase and Sales by Report Date Composite

Purchase and Sales by Report Date Composite July 1, 2013 to July 31, 2013 View Date: August 8, 2013 Funds Included in Composite NJBD COMMON D EMERGING NJBU COMMON D DEVELOPED NJDE COMMON D DEVELOPED PASSIVE NJDO COMMON D DEVELOPED ETFS NJDU COMMON D HEALTHCARE NJDV COMMON D TECHNOLOGY NJDZ COMMON D OAC NJEA COMMON D EMERGING MORGAN STNLY NJEB COMMON D EMERGING LAZARD NJED COMMON D EMERGING PICTET NJEM COMMON D EMERGING WELLINGTON Page 1 Prepared by State Street Purchase Report by Report Date Composite July 1, 2013 to July 31, 2013 View Date: August 8, 2013 Base Currency: USD - US DOLLAR Asset ID Security Name/Description Trd Date Stl Date Fail Days Broker Name Stl Cur/Loc Comm Per Shr Shares/Par/Contracts Exchange Rate Fund Price Interest Commissions Taxes/Fees/Other Net Cost Units/Original Face CASH EQUIVALENTS US DOLLAR 85749P9B9 STATE STR INSTL LIQUID RESVS 0.093% 31 Dec 2099 01 Jul 2013 01 Jul 2013 STATE STREET BANK AND TRUST USD/CSW 744,135.040 1.000000 NJEM Local 100.000000 0.00 0.00 0.00 744,135.04 Base 100.000000 0.00 0.00 0.00 744,135.04 85749P9B9 STATE STR INSTL LIQUID RESVS 0.093% 31 Dec 2099 01 Jul 2013 01 Jul 2013 STATE STREET BANK AND TRUST USD/CSW 592,948.130 1.000000 NJEA Local 100.000000 0.00 0.00 0.00 592,948.13 Base 100.000000 0.00 0.00 0.00 592,948.13 85749P9B9 STATE STR INSTL LIQUID RESVS 0.093% 31 Dec 2099 01 Jul 2013 01 Jul 2013 STATE STREET BANK AND TRUST USD/CSW 478,031.100 1.000000 NJEB Local 100.000000 0.00 0.00 0.00 478,031.10 Base 100.000000 0.00 0.00 0.00 478,031.10 85749P9B9 STATE STR INSTL LIQUID RESVS -

Law Enforcement Disclosure Report

Law Enforcement Disclosure Report Millicom Law Enforcement Disclosure Report 2017 Millicom Law Enforcement Disclosure Report 2017 1. Introduction 02 2. Reporting at Millicom 04 What’s inside 3. Our internal policies, guidelines, and governance 06 4. Our engagement 08 this report... 5. South America: 10 a. Overview b. Legal frameworks c. Requests from law enforcement in 2017 6. Central America: 12 a. Overview b. Legal frameworks c. Requests from law enforcement in 2017 7. Africa: 14 a. Overview b. Legal frameworks c. Requests from law enforcement in 2017 8. Case Study 16 9. Major Events in 2017 17 a. Shutdowns b. Proposals for significant changes in operational procedures or local laws c. Other events 10. Trends and priorities for 2018 21 Millicom Law Enforcement Disclosure Report 2017 1 1. Introduction This is Millicom’s third Law Enforcement Disclosure (LED) report, covering the year 2017. It serves to provide information about the extent and context of our interaction with law enforcement agencies and governments relating to issues that affect the privacy or freedom of expression of our customers in Latin America and Africa. Since the advent of WikiLeaks and the Edward In March 2017 Millicom, together with six other Snowden information leaks, there has been telecommunications companies, announced its ever increasing scrutiny in the public domain on membership of the Global Network Initiative the topics of privacy and freedom of expression (GNI). This organization, which now has over in the digital age. Indeed, ongoing dialogue 50 members, brings together technology with our stakeholders informs us that these companies, ethical investors, academics and topics are among the most material corporate human rights organizations to work jointly on responsibility issues for stakeholders. -

Biography of Jan Stenbeck - Google Search

biography of jan stenbeck - Google Search Sign in All Images News Videos Maps More Settings Tools About 24 700 results (0,52 seconds) Career. Stenbeck was born in Stockholm, Sweden, the youngest son of business lawyer Hugo Stenbeck (1890–1977) and his wife Märtha (née Odelfelt; 1906–1992). ... Control of the group was passed to his daughter Cristina Stenbeck after his death of a heart attack. Jan Stenbeck - Wikipedia https://en.wikipedia.org/wiki/Jan_Stenbeck Biography About Featured Snippets Feedback Jan Hugo Robert Arne Stenbeck was a Swedish business leader, media Jan Stenbeck - Wikipedia pioneer, sailor and financier. He was https://en.wikipedia.org/wiki/Jan_Stenbeck head of Kinnevik Group from 1976 and Career. Stenbeck was born in Stockholm, Sweden, the youngest son of business lawyer Hugo founded among other things the Stenbeck (1890–1977) and his wife Märtha (née Odelfelt; 1906–1992). ... Control of the group companies Comviq, Invik & Co AB, was passed to his daughter Cristina Stenbeck after his death of a heart attack. Tele2, Banque Invik, Millicom, Modern Born: Jan Hugo Robert Arne Stenbeck; 14 Died: 19 August 2002 (aged 59); Paris, Times Group and NetCom Systems. Nov... France Wikipedia Born: November 14, 1942, Stockholm Jan Stenbeck – Wikipedia Died: August 19, 2002, American https://sv.wikipedia.org/wiki/Jan_Stenbeck Translate this page Hospital of Paris, Neuilly-sur-Seine, Jan Stenbeck var yngste son till affärsadvokaten Hugo Stenbeck (1890–1977) och dennes France hustru Märta, född Odelfelt (1906–1992). Efter studentexamen vid ... Spouse: Merrill McLeod (m. Föräldrar: Hugo Stenbeck; Märta Odelfelt Styrelse- ledamot i: Investment AB Kinnevik, In.. -

2009 Corporate Governance Report

2009 Corporate Governance Report Tele2 AB (“the Company”) offers mobile services, fixed broadband and telephony, data network services, cable TV and content services. In 2009, we had net sales of SEK 39,265 million and reported an operating profit (EBITDA) of SEK 9,185 million. Tele2 is a Swedish joint- stock Company with shares listed on the OMX Nordic Exchange and thus applies the Swedish Code of Corporate Governance (“the Code”) as amended on July 1, 2008. This Corporate Governance Report is prepared in accordance with the provisions of the Code, and it contains information regarding the following deviations: Reference from the Code Deviation and Explanation 2.4 A member of the Board shall not chair the Cristina Stenbeck, who is the Chairman of the nomination committee, is considered to be dependent nomination committee in respect of being a member of the Company’s Board. However, the other members of the nomination committee have declared their decision regarding the election as being in the Company’s and the share holders´ best interest and a natural consequence of Cristina Stenbeck representing the Company’s largest shareholders. 9.1 The members of the remuneration committee, Mia Brunell Livfors and Vigo Carlund, members of the remuneration committee, are not considered apart from the Chairman, must be independent of independent in respect of the Company and its executive management. The Board however considers the Company and the corporate executives. that their experience will benefit the Company and make them suitable committee members. The code notwithstanding, the Board believes that they will be as free of conflict as if they were independent. -

Millicom International Cellular S.A

PRESS RELEASE New York and Stockholm – 25 May, 2010 MILLICOM INTERNATIONAL CELLULAR S.A. ANNUAL GENERAL MEETING OF SHAREHOLDERS New York and Stockholm, 25 May 2010 – Millicom International Cellular S.A. (“Millicom”) (Nasdaq Stock Market: MICC and Stockholmsbörsen: MIC) today held its Annual General Meeting ("AGM") of shareholders in Luxembourg. The AGM resolved to allocate USD 52,643 of the USD 620,581,503 profit generated in 2009 to the legal reserves in accordance with the requirements of Luxembourg Law, and to distribute approximately USD 652 million as a dividend, corresponding to a gross dividend amount of US $6 per share. The AGM also resolved to re-elect Ms Maria Brunell Livfors, Ms Donna Cordner, Mr Daniel Johannesson, Mr Michel Massart, Mr Allen Sangines-Krause and Mr Paul Donovan as Non-Executive Directors and to elect Mr Omari Issa and Mr Hans Holger Albrecht as new Non-Executive Directors of the Company. Mr Omari Issa, born 1947, is the CEO of Investment Climate Facility for Africa. He is a Tanzanian citizen who is responsible for managing the ICF's seven year program to improve Africa's investment climate and remove barriers to growth. Mr Issa has extensive business experience in the public and private sectors, having worked in both Africa and abroad. He has first hand experience of the realities of doing business in Africa, having previously worked as Executive Director and Chief Operating Officer of Celtel International, where he played an instrumental role in managing the company's growth and expansion across the continent. Prior to working at Celtel, Mr Issa spent fourteen years with the IFC and six years with the World Bank. -

Empowering Societies Innovation Moments Millicom Annual Report 2014 1 1 Millicom Annual Report 2014 Millicom Annual Report 2014 1 Overview

Millicom International Cellular S.A. Annual Report 2014 Annual Report 2014 Empowering Societies Innovation Moments Millicom Annual Report 2014 1 1 Millicom Annual Report 2014 Millicom Annual Report 2014 1 Overview About us Overview About us MillicomMillicom is is a a leading leading international international telecommunicationstelecommunications and and media media companycompany dedicated dedicated to to emerging emerging marketsmarkets in in Latin Latin America America and and Africa.Africa. We We empower empower a a digital digital lifestylelifestyle by by offering offering communication, communication, information and entertainment Strategy information and entertainment Strategy whichwhich connect connect people people to to their their world. world. Operating under the Tigo brand in 14 countries,Operating Millicom under the offers Tigo innovative brand in 14and customer-centriccountries, Millicom products. offers innovativeMillicom employs and 23,297customer-centric people and products.provides mobile, Millicom cable, employs satellite,23,297 peoplebroadband and providesand mobile mobile, financial cable, servicessatellite, to broadband over 56 million and customersmobile financial in mobileservices and to five over million 56 million revenue-generating customers in mobile and five million revenue-generating Performance units in cable, with 5.6 million HFC Performance homesunits inpassed. cable, with 5.6 million HFC homes passed. Financial highlights Revenue (US$m) EBITDA (US$m) (reported figures) 6,386 5,159 4,814 2,092 2,065 2,093 -

College Retirement Equities Fund

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2010-05-27 | Period of Report: 2010-03-31 SEC Accession No. 0000930413-10-003160 (HTML Version on secdatabase.com) FILER COLLEGE RETIREMENT EQUITIES FUND Mailing Address Business Address 730 THIRD AVE 730 THIRD AVE CIK:777535| IRS No.: 136022042 | State of Incorp.:NY | Fiscal Year End: 1231 NEW YORK NY 10017 NEW YORK NY 10017 Type: N-Q | Act: 40 | File No.: 811-04415 | Film No.: 10861628 2129164905 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number File No. 811-4415 COLLEGE RETIREMENT EQUITIES FUND (Exact name of Registrant as specified in charter) 730 Third Avenue, New York, New York 10017-3206 (Address of principal executive offices) (Zip code) Stewart P. Greene, Esq. c/o TIAA-CREF 730 Third Avenue New York, New York 10017-3206 (Name and address of agent for service) Registrants telephone number, including area code: 212-490-9000 Date of fiscal year end: December 31 Date of reporting period: March 31, 2010 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Item 1. Schedule of Investments. COLLEGE RETIREMENT EQUITIES FUND - Stock Account COLLEGE RETIREMENT EQUITIES FUND STOCK ACCOUNT SCHEDULE OF INVESTMENTS (unaudited) March 31, 2010 MATURITY VALUE PRINCIPAL ISSUER RATE RATING DATE (000) BONDS - 0.0% CORPORATE BONDS - 0.0% HOLDING AND OTHER INVESTMENT OFFICES - 0.0% $ 100,000,000 j Japan Asia Investment Co Ltd 0.000% 09/26/11 NR $ 535 22,970 Kiwi Income Property Trust 8.950 12/20/14 NR 17 TOTAL HOLDING AND OTHER INVESTMENT OFFICES 552 Copyright © 2012 www.secdatabase.com. -

Corporate Governance Report 2011

Corporate Governance Report 2011 TELE2 IN BRIEF Tele2 AB (“the Company”) has 34 million customers in 11 countries and offers mobile services, fixed broadband and telephony, data network services, cable TV and content services. In 2011, the Company had net sales of SEK 40,750 (40,164) million and reported an operating profit (EBITDA) of SEK 10.852 (10,284) million. Tele2 AB (publ.) is a Swedish joint-stock company with shares listed on the Nasdaq OMX Stockholm Large Cap list and thus applies the Swedish Code of Corporate Governance (“the Code”) as amended on February 1, 2010. This Corporate Governance Report is prepared in accordance with the provisions of the Code. Prior years’ corporate governance reports and other corporate governance documents are available on the corporate website, www.tele2.com. The Code is based on the principle of comply or explain, which means that companies can deviate from single rules in the Code, given that they provide an explanation for the deviation. This report contains information regarding the following deviations from the Code: Reference from the Code Deviation and Explanation 2.4 A member of the Board shall not chair Cristina Stenbeck, who is the Chairman of the Nomination Committee, is also a member of the Company´s the Nomination Committee Board. The other members of the Nomination Committee have explained their decision regarding the election of the Chairman of the Nomination Committee as being in the Company’s and shareholders’ best interest – and a natural consequence of Cristina Stenbeck leading the Nomination Committee’s work in recent years as well as her representing the Company’s largest shareholder. -

COMCEL TRUST (A Cayman Islands Trust) 6.875% Senior Notes Due 2024 Guaranteed by Comunicaciones Celulares, S.A

OFFERING MEMORANDUM CONFIDENTIAL US$800,000,000 COMCEL TRUST (a Cayman Islands Trust) 6.875% Senior Notes due 2024 guaranteed by Comunicaciones Celulares, S.A. and the other Note Guarantors named herein The 6.875% senior notes due 2024 offered hereby (the “Notes”) are being issued by Intertrust SPV (Cayman) Limited (the “Cayman Trustee”) acting as trustee of Comcel Trust (the “Trust”) established pursuant to a Declaration of Trust dated January 8, 2014 (the “Declaration of Trust”). The net proceeds obtained from the sale of the Notes will be used by the Cayman Trustee to acquire as an asset of the Trust, pursuant to a Participation Agreement (the “Participation Agreement”) between the Cayman Trustee and Credit Suisse AG, Cayman Islands Branch (the “Lender”), a 100% participation interest (the “Participation”) in a US$800,000,000 senior unsecured loan (the “Loan”) made by the Lender to Comunicaciones Celulares, S.A. (“Comcel” or the “Borrower”), a stock corporation (sociedad anónima) organized under the laws of the Republic of Guatemala, pursuant to a Credit and Guaranty Agreement (the “Credit and Guaranty Agreement”) among the Lender, the Borrower, and Comunicaciones Corporativas, S.A., Distribuidora Central de Comunicaciones, S.A., Distribuidora de Comunicaciones de Occidente, S.A., Distribuidora de Comunicaciones de Oriente, S.A., Distribuidora Internacional de Comunicaciones, S.A., Navega.com, S.A., Servicios Especializados en Telecomunicaciones, S.A. and Servicios Innovadores de Comunicación y Entretenimiento, S.A., affiliates of Comcel, as guarantors (together, the “Loan Guarantors”) (such guarantees, the “Loan Guarantees”). The principal asset of the Trust is the Participation and certain related rights described herein. -

Millicom International Cellular S.A. Tele2 Ab

MILLICOM INTERNATIONAL CELLULAR S.A. TELE2 AB FOR IMMEDIATE RELEASE October 31, 2001 MILLICOM INTERNATIONAL CELLULAR AND TELE2 AB CONFIRM DISCUSSIONS REGARDING THE POSSIBLE SALE OF MILLICOM’S RUSSIAN ASSETS TO TELE2 New York, Stockholm and Luxembourg – October 31, 2001 – Millicom International Cellular S.A (“MIC”) (Nasdaq Stock Market: MICC) and Tele2 AB (“Tele2”) (Nasdaq Stock Market: TLTOA and TLTOB and Stockhomsbörsen: TEL2A and TEL2B) today confirm, in response to questions raised by investors, that discussions between Tele2 AB and MIC are ongoing regarding the possible sale of MIC’s Russian cellular telephony assets to Tele2. MIC sold its cellular telephony business in Estonia to Tele2 in 1998. During these negotiations the two parties discussed the sale of MIC’s Russian assets but, at that time, decided not to proceed as Tele2 wished first to focus on building its Baltic operations. Tele2’s investment in the Baltics has been very successful and now the possible expansion into Russia is a logical step, which would bring a total of 124,000 proportional subscribers. Lars-Johan Jarnheimer, CEO of Tele2 AB said: “It is no secret that our Scandinavian competitors have made clear their intentions to develop mobile businesses in Russia to leverage on the increasing opportunities in this market, Telia combining with Sonera and Telenor through Vimpelcom. We believe that the opportunity to purchase MIC’s Russian assets is a natural step in order to establish our position in this growth market following on from our successes in the Baltics.” MIC and Tele2 have appointed Bank of America and Carnegie respectively as advisors. -

Investment AB Kinnevik

Investment AB Kinnevik Skeppsbron 18 (Publ) Reg no 556047-9742 P.O. Box 2094 Phone +46 8 562 000 00 SE-103 13 Stockholm Sweden Fax +46 8 20 37 74 www.kinnevik.se BOKSLUTSKOMMUNIKÉ 2007 Finansiell utveckling under fjärde kvartalet • Marknadsvärdet på koncernens aktier i Noterade Kärninnehav steg med 6.241 Mkr och uppgick per 31 december till 50.761 Mkr. • Korsnäs intäkter uppgick till 1.821 (1.722) Mkr. • Rörelseresultatet för Korsnäs var 7 (78) Mkr (jämförelsetal exklusive omstruktureringskostnader). • Koncernens totala intäkter uppgick till 1.873 (1.767) Mkr och rörelseresultatet var -5 (-124) Mkr. • Resultat efter skatt, inklusive förändring i verkligt värde av finansiella tillgångar, uppgick till 6.647 (9.192) Mkr. • Resultat per aktie uppgick till 25,18 (34,82) kronor. Händelser under fjärde kvartalet • Koncernen deltog i Black Earth Farmings nyemission. Kinnevik ägde vid årets utgång 20% av bolaget. Finansiell utveckling under 2007 • Marknadsvärdet på koncernens aktier i Noterade Kärninnehav ökade med 14.606 Mkr, motsvarande 40%, till 50.761 Mkr den 31 december. • Korsnäs intäkter ökade med 5% till 7.519 (7.134) Mkr (jämförelsetal proforma inklusive Frövi). • Rörelseresultatet för Korsnäs var 836 (865) Mkr (jämförelsetal proforma inklusive Frövi, exklusive omstruktureringskostnader). • Koncernens totala intäkter uppgick till 7.673 (6.305) Mkr och rörelseresultatet var 885 (478) Mkr. • Resultat efter skatt, inklusive förändring i verkligt värde av finansiella tillgångar, uppgick till 16.179 (11.549) Mkr. • Resultat per aktie uppgick till 61,29 (43,74) kronor. • Styrelsen föreslår att årsstämman beslutar om en kontantutdelning om 2,00 (1,70) kronor per aktie. Därutöver avser styrelsen att rekommendera till Kinneviks årsstämma som hålls den 15 maj att besluta om ett förnyat mandat att återköpa maximalt 10% av bolagets egna aktier. -

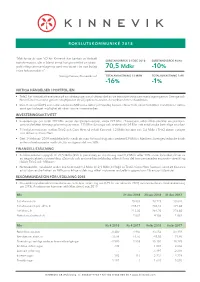

70,5 Mdkr -10% -16%

BOKSLUTSKOMMUNIKÉ 2018 ”Mitt första år som VD för Kinnevik har kantats av fortsatt SUBSTANSVÄRDE 31 DEC 2018 SUBSTANSVÄRDE Kv/Kv transformation, där vi bland annat har genomfört en strate- giskt viktig sammanslagning samt investerat i tio nya bolag 70,5 Mdkr -10% i våra fokusområden” Georgi Ganev, Kinneviks vd TOTALAVKASTNING 12 MÅN TOTALAVKASTNING 5 ÅR -16% -1% VIKTIGA HÄNDELSER I PORTFÖLJEN • Tele2 har fortsatt att exekvera på sin strategi genom slutförandet av de transformativa sammanslagningarna i Sverige och Nederländerna samt genom utnyttjandet av säljoptionen avseende verksamheten i Kazakstan • Den 9 Januari 2019 sekundärnoterades Millicoms aktier på Nasdaq-börsen i New York, vilket förbättrar likviditeten i aktien samt ger bolaget möjlighet att nå en större investerarbas INVESTERINGSAKTIVITET • Investeringar om totalt 392 Mkr under det fjärde kvartalet, varav 227 Mkr i Travelperk, vilka tillhandahåller en plattform som underlättar företags planering av resor, 111 Mkr i Livongo och resterande 54 Mkr i ett antal andra befntliga innehav • Till följd av fusionen mellan Tele2 och Com Hem så erhöll Kinnevik 1,2 Mdkr kontant och 3,6 Mdkr i Tele2 aktier, i utbyte mot aktierna i Com Hem • Den 14 februari 2019 meddelade Kinnevik att man förbundit sig att investera 0,9 Mdkr i MatHem, Sveriges ledande fristå- ende onlinebaserade matbutik, för en ägarandel om 38% FINANSIELL STÄLLNING • Substansvärdet uppgick till 70,5 Mdkr (256 kr per aktie), en minskning med 8,2 Mdkr eller 10% under kvartalet, drivet av en negativ aktiekursutveckling i Zalando och andra e-handelsbolag vilken till viss del kompenserades av positiv utveckling i både Tele2 och Millicom • Nettoskulden minskade under kvartalet med 1,2 Mdkr till 2,9 Mdkr, till följd av Tele2 / Com Hem fusionen samt att Kinnevik erhöll den andra halvan av Millicoms årliga utdelning, vilket motsvarar en belåningsgrad om 4% av portföljvärdet REKOMMENDATION FÖR UTDELNING 2018 • Kinneviks styrelse rekommenderar en ordinarie utdelning om 8,25 kr per aktie för 2018 motsvarande en direktavkastning om 3,9%.