1 for IMMEDIATE RELEASE 8 August 2001 METRO

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

For Immediate Release Chad Vader Episode V

FOR IMMEDIATE RELEASE CHAD VADER EPISODE V “HOLIDAY EPISODE” TO BE RELEASED TOMORROW Madison, WI – December 18, 2006 - Matt Sloan and Aaron Yonda of Blame Society Productions have just announced the completion of "Chad Vader - Episode 5," the fifth installment of the hit internet series "Chad Vader," which has garnered over 7 million downloads to date. Chad Vader has been featured on Good Morning America and the BBC and has been written up in the New York Times Magazine, the Wall Street Journal, the LA Times, Metro International, and the Boston Globe. Episode 5 is a holiday-themed episode that was filmed on location in Madison, Wisconsin at Cafe Montmartre and Tenney Park. It features the acting talents of Mike McCafferty (Idiocracy, ER, The West Wing) and Steve Agee (Jimmy Kimmel Live, Sarah Silverman – Jesus is Magic) along with the rest of the extremely talented local cast. Episode 5 will debut on MySpace on Tuesday, December 19th, and will be released to other internet sites the following day. Episodes 1 through 4 can be viewed at www.blamesociety.net . A DVD featuring the first four episodes and some bonus features is available along with other merchandise at www.blamesociety.net . Sloan and Yonda will also be appearing on VH1's "50 Greatest Internet Superstars" which will air on February 10, 2007. It will feature Aaron and Matt and 49 other internet notables. It will also feature clips from Chad Vader. Thank you for your time! Please contact me with any questions at [email protected] Matt Sloan www.blamesociety.net . -

A Fresh Look at Free Daily Newspapers in New York City

new york • philadelphia • boston media clubmetro • metroX • ziptrials a fresh look at free daily newspapers in new york city Q2 2016 Thanks to the Alliance for Audited Media (AAM), circulation data is now available on a quarterly basis in AAM’s Media Intelligence Center. The state of art integrated database includes both free and paid newspapers and allows us to delve deep into the newspaper market in New York City. Here are some insights. free daily newspapers dominate new york city new york city* new york city* Q2 2016 Q2 2016 000's daily print copies 000's daily print copies 200 196 194 POST 82 150 14% METRO 196 DAILY NEWS 116 33% 100 116 20% 82 50 AMNY 194 33% 0 METRO AMNY DAILY NEWS POST Together, metro and AMNY hold two thirds of newspaper circulation market in New York City. Metro itself commands one third of the market – as much as the Daily News and the Post combined. Metro and AMNY print circulation level in New York City are broadly similar. distribution* distribution throughout new york city, points: 1,100+ north new jersey, & westchester AMNY BRONX/ WESTCHESTER 3,033 NEW JERSEY 6,475 the importance of stapling MANHATTAN Unlike its competitors, metro 134,800 newspaper is stapled. Stapling helps to keep the integrity of the QUEENS 40,410 product and extends its “shelf life.” metro International’s 20 year-experience around the world BROOKLYN strongly suggest stapling 17,782 contributes to higher number of readers per copy. reaching readers from all five boroughs † metro circulation breakdown* metro readership breakdown NYC, Q2 2016 NYC, Q2 2016 000's daily print copies 000's daily print readers BROOKLYN 18 9% MANHATTAN BROOKLYN QUEENS 140 137 40 28% 28% 21% SI MANHATTAN BRONX 8 135 3 2% BRONX QUEENS 69% 1% 77 133 15% 27% In NYC, metro circulation is concentrated in Manhattan with 135K daily copies – twice more than the Daily News and the Post combined. -

Ceasefire Does Not Hold As Karabakh, Armenia Come Under Attack

OCTOBER 17, 2020 MMirror-SpeirTHEror-SpeARMENIAN ctator Volume LXXXXI, NO. 14, Issue 4656 $ 2.00 NEWS The First English Language Armenian Weekly in the United States Since 1932 IN BRIEF 370 New Cases of Ceasefire Does Not Hold as Karabakh, COVID-19 Confirmed in Armenia Come Under Attack Armenia YEREVAN (news.am) — As of Monday, October 12, 370 new cases of the coronavirus were con- STEPANAKERT (Combined Sources) — firmed in Armenia, and the total number of these A ceasefire agreed upon over the weekend cases has reached 56,821 in the country, according at a meeting of the foreign ministers of to the National Center for Disease Control and Armenia and Azerbaijan in Moscow with Prevention. their Russian counterpart collapsed almost Also, six more deaths from COVID-19 were regis- immediately. Azerbaijan started shelling tered, making the respective total 1,026 cases. the contact line immediately, killing civil- Three more cases of coronavirus patients dying ians as well as soldiers. from some other illnesses were recorded in Armenia A team of French, Russian and U.S. in the past one day, and the corresponding overall mediators urged Armenia and Azerbaijan death toll in the country is 306 now. on October 13 to immediately stop hostili- ties in and around Nagorno-Karabakh in line with a ceasefire agreement brokered UNESCO Asks for End to by Russia. The diplomats co-heading the Killing Civilians, Organization for Security and Cooperation Damaging in Europe (OSCE) Minsk Group warned that continued fighting in the Karabakh Infrastructures conflict zone would be fraught with “cata- strophic consequences for the region.” PARIS (Armenpress) — The United Nations Educational, Scientific and Cultural Organization “The Co-Chairs note with alarm the con- Destruction of Stepanakert tinuing violence in the Nagorno-Karabakh (UNESCO) on October 12 issued a statement conflict,” they said in a joint statement. -

The Armenian Weekly APRIL 26, 2008

Cover 4/11/08 8:52 PM Page 1 The Armenian Weekly APRIL 26, 2008 IMAGES PERSPECTIVES RESEARCH WWW.ARMENIANWEEKLY.COM Contributors 4/13/08 5:48 PM Page 3 The Armenian Weekly RESEARCH PERSPECTIVES 6 Nothing but Ambiguous: The Killing of Hrant Dink in 34 Linked Histories: The Armenian Genocide and the Turkish Discourse—By Seyhan Bayrakdar Holocaust—By Eric Weitz 11 A Society Crippled by Forgetting—By Ayse Hur 38 Searching for Alternative Approaches to Reconciliation: A 14 A Glimpse into the Armenian Patriarchate Censuses of Plea for Armenian-Kurdish Dialogue—By Bilgin Ayata 1906/7 and 1913/4—By George Aghjayan 43 Thoughts on Armenian-Turkish Relations 17 A Deportation that Did Not Occur—By Hilmar Kaiser By Dennis Papazian 19 Scandinavia and the Armenian Genocide— 45 Turkish-Armenian Relations: The Civil Society Dimension By Matthias Bjornlund By Asbed Kotchikian 23 Organizing Oblivion in the Aftermath of Mass Violence 47 Thoughts from Xancepek (and Beyond)—By Ayse Gunaysu By Ugur Ungor 49 From Past Genocide to Present Perpetrator Victim Group 28 Armenia and Genocide: The Growing Engagement of Relations: A Philosophical Critique—By Henry C. Theriault Azerbaijan—By Ara Sanjian IMAGES ON THE COVER: Sion Abajian, born 1908, Marash 54 Photography from Julie Dermansky Photo by Ara Oshagan & Levon Parian, www.genocideproject.net 56 Photography from Alex Rivest Editor’s Desk Over the past few tographers who embark on a journey to shed rials worldwide, and by Rivest, of post- years, the Armenian light on the scourge of genocide, the scars of genocide Rwanda. We thank photographers Weekly, with both its denial, and the spirit of memory. -

Designated Ports-Of-Departure (Pod) Alphabetical List

DESIGNATED PORTS-OF-DEPARTURE (POD) ALPHABETICAL LIST A I Alcan, Port of Entry Derby Line Port of Entry International Falls Port of Entry Tok, AK Derby Line, VT International Falls, MN Amistad Dam Detroit Canada Int. Bridge, J Del Rio, TX Port of Entry, Detroit, MI Anchorage Int. Airport Detroit Canada Tunnel, Port JFK International Airport, New Anchorage, AK of Entry, Detroit, MI York City - Jamaica, NY Atlanta-Hartsfield Int. Airport Detroit Metro Int. Airport, K Atlanta, GA Detroit, MI B Douglas Port of Entry Ketchikan Seaport-Port of Douglas, AZ Entry, Ketchikan, AK Baltimore Int. Airport E Kona Air and Sea Ports Baltimore, MD Kailua Kona, HI Bell Harbor Pier 66 Cruise Ship Eagle Pass Bridge L Terminal Seattle, WA Eagle Pass, TX Bridge of the Americas Eastport Port of Entry Laredo Gateway to the El Paso, TX Eastport, ID Americas - Laredo, TX Brownsville/Matamoras Int. Bridge F Las Vegas (McCarran) Int. Brownsville, TX Airport, Las Vegas, NV Buffalo Peace Bridge Fort Covington Port of Entry Lewiston Bridge, Niagara Falls, Buffalo, NY Fort Covington, NY New York Lewiston, NY C Fort Duncan Int. Bridge Logan International Airport Eagle Pass, TX East Boston, MA Calais Port of Entry G Long Beach Seaport Calais, ME Long Beach, CA Calexico Port of Entry Galveston Seaport Los Angeles Int. Airport Calexico, CA Galveston, TX Los Angeles, CA Cape Canaveral Seaport Grand Potage - Port of Entry M Port Canaveral, FL Grand Potage, MN Cape Vincent - Hornes Ferry Dock Guam Int. Airport Madawaska Port of Entry, Cape Vincent, NY Tamuning, Guam Madawaska, ME Champlain Port Of Entry H Massena (Seaway International Champlain, NY Bridge) - Massena, NY Charlotte/Douglas Int. -

Metro International S.A

FOR IMMEDIATE RELEASE 5 May 2004 METRO LAUNCHES IN NEW YORK CITY Metro International S.A. (“Metro”), the international newspaper group, today launched Metro New York. 300,000 copies of the free newspaper are being distributed this morning on the streets of New York, making Metro the fifth largest newspaper in the biggest city in the United States. New York is the world’s largest individual advertising buying community. Metro International has also today launched its ‘Metro US’ sales package, enabling clients to buy packaged advertising space and solutions from Metro’s three Eastern seaboard editions - New York City, Boston and Philadelphia. The three editions will have a combined daily circulation of 620,000 copies, making Metro the seventh largest general interest newspaper in the United States. The three cities generate combined gross annual newspaper advertising spend of US$ 7 billion. The New York City edition is being distributed Monday through Friday by hand and from racks in high-traffic central locations in Manhattan, as well as along key suburban commuter routes into the city. Based on Metro’s global average of 2.8 readers per copy, Metro New York will attract 850,000 daily readers. Metro is designed and packaged for a young, urban, active, well-educated audience and provides readers with the news that they need at the time that they read. The newspaper will include Metro’s distinctive mix of clear, concise, unbiased news and information. Local, national and international news reports are combined with the latest entertainment listings and reviews, together with specialist feature sections on everything from health and fitness to education, and from travel to real estate. -

Member News – October / November 2014

Member News – October / November 2014 RCBM Group (Carrollton, TX, USA) Oscar Mary is pleased to announce that the firm has launched a new website for the USA office in Texas – www.rcbmgroup.com Rodriguez, Ciancio (Caracas, Venezuela) Due to the ongoing troubles in the country, the majority of the firm’s clients have gone out of business which has caused the firm to discontinue its membership in Integra. Global CPA (HK) Ltd. (Hong Kong) Simon Cheung has been in the news lately: (1) Joining a media interview on Chinese outbound investment, Simon and representative of The Ministry of Commerce (MOFCOM) of the Government of the People's Republic of China were interviewed by Press Medium China Daily, Hong Kong Economic Times, Singtao newspaper, News, Hong Kong standard newspaper, etc. Simon was shared his views on the trend, opportunities, risks and supporting services of Chinese outbound investment. (2) Simon was interviewed by Media, Metro newspaper about the business opportunities of professional Certified Public Accountant in Hong Kong since 1990. Metro is the world's largest international newspaper and is recognized by the Guinness World Records. Metro International S.A. publishes free newspapers in over 100 major cities in 20 countries around the world, including Asia, Europe, North and South America. HMWC CPA’s (Los Angeles, CA, USA) Gerry Herter reports that the firm held its 36 annual “death March with 25 participants ranging in age from 10 months to 71 years old enjoying the California mountain wilderness of Sequoia High Sierra Camp. Now the time has come to plan the 37th Annual Death March in summer 2015, where anyone who is interested is welcome to join. -

130412 Johan Hansson Eng

PRESS RELEASE April 12, 2013 Roxen appoints industry profile to head its growth in US and Latin America Johan Hansson is Roxen’s new President for the US and Latin America. He will be responsible for growing Roxen's customer base on the company’s largest market outside Scandinavia. Johan Hansson has been a partner at Gansevoort Media, a New York based media and internet product development consultancy with customers including The Wall Street Journal, The New York Times, The New York Observer, St Petersburg Times, and The Dallas Morning News as well as smaller internet and software development companies. Prior to Gansevoort Media, Hansson worked for 6 years at Metro International, the world’s largest publisher of free newspapers where he was part of Metro’s Executive Management team as head of Metro’s North American operations and responsible for the launch of Metro New York - the company’s largest ever. He also held positions as Managing Director and Publisher of Metro Hong Kong, Metro Warsaw and Metro Holland. Hansson most recently worked as a Management Consultant at BTS in New York, a global leader in Strategy Implementation serving Fortune 500 companies. He is a graduate of Lund University in Sweden and has added studies in Digital Publishing from New York University. “As complexity and speed increases in the media industry, we have experienced an increasing interest in Roxen’s lean, multi-channel editorial solutions from mainly regional publications and new media. With more than 10 year’s of experience in developing publishing businesses and the digital presence of some of the industry’s most innovative newspapers, Johan has a solid understanding of what drives our customers’ businesses. -

Editorial I Published in the Boston Metro in 2004

ARTS WEEKEND ARTS WEEKEND Take Steamy your ‘Nights’ pick ªª SECOND DANCE, SAME THERON ªª AS THE FIRST AND OTHERS p/13 UP FOR OSCARS: METRO’S BALLOT p/15 Weekend, February 27-29, 2004 • volume 3 • issue 211 • WWW.METROPOINT.COM Morocco security clashes with protesters over aid MOROCCO. Moroccan security forces Rebels clashed Thursday with protesters who had attacked a governor’s office during an angry demonstration over the gov- ernment’s response to Tuesday’s earth- quake. p/07 aim for Feds probe bribes claims in Medicare bill passage BOTTOM: WILLIAM PLOWMAN/METRO GETTYTOP: IMAGES Federal agents capital WASHINGTON, D.C. have begun examining whether bribes HAITI. Rebels battling to oust President were offered to win passage of a White Jean-Bertrand Aristide warned Thurs- House-backed Medicare prescription day an attack on the capital was immi- drug bill, a Capitol Hill newspaper nent as heavily armed U.S. security reported Thursday. p/02 forces helped foreigners fleeing the country. “The attack is imminent and I ask the population to stay home when we REUTERS attack Port-au-Prince,” rebel leader Guy Philippe told local radio. “I advise President Aristide to leave the national palace immediately, we will attack shortly at the national palace and capture him,” he said. He A young boy runs (top) past a added he will be in the capital by Sun- burning barricade in Port-au- day to celebrate his 36th birthday. Prince, Haiti, Thursday. A convoy of buses with diplomatic families, charity workers and an Two-year old Zoe Chantry orphan on the way to a new family in (right) tries to touch her father Spain sped out of a U.N. -

Secret Armies and Revolutionary Federations: the Rise and Fall of Armenian Political Violence, 1973-1993 Christopher Gunn

Florida State University Libraries Electronic Theses, Treatises and Dissertations The Graduate School 2014 Secret Armies and Revolutionary Federations: The Rise and Fall of Armenian Political Violence, 1973-1993 Christopher Gunn Follow this and additional works at the FSU Digital Library. For more information, please contact [email protected] FLORIDA STATE UNIVERSITY COLLEGE OF ARTS AND SCIENCES SECRET ARMIES AND REVOLUTIONARY FEDERATIONS: THE RISE AND FALL OF ARMENIAN POLITICAL VIOLENCE, 1973-1993 By CHRISTOPHER GUNN A Dissertation submitted to the Department of History in partial fulfillment of the requirements for the degree of Doctor of Philosophy Degree Awarded: Summer Semester, 2014 Christopher Gunn defended this dissertation on July 8, 2014. The members of the supervisory committee were: Jonathan Grant Professor Directing Dissertation Mark Souva University Representative Michael Creswell Committee Member Will Hanley Committee Member Edward Wynot Committee Member The Graduate School has verified and approved the above-named committee members, and certifies that the dissertation has been approved in accordance with university requirements. ii To Felix and Maxim iii ACKNOWLEDGEMENTS Over the last eight years, I have become indebted to a number of individuals and organizations that helped, assisted, and encouraged me as I pursued my doctorate in history and this research project in particular. Without them, I would never have completed this journey. I owe a special thanks to the late Daniel Walbolt, and his spouse, Sylvia, who have generously supported the Department of History at Florida State University, and who provided the means for my fellowship at the University. I am extremely grateful for the patience and guidance of my advisor, Dr. -

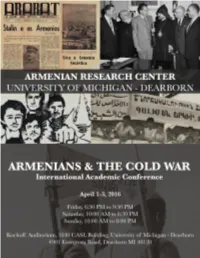

Program Armenians and Thec

FROM THE DIRECTOR The Armenian Research Center at the University of Michigan-Dearborn is honored to welcome you at the “Armenians and the Cold War” conference. It is arguably the first time that an academic conference is being organized anywhere in the world to study this specific period in modern Armenian history, focusing on events both in the homeland (then, a union republic of the Soviet Union) and the post-genocide Diasporan communities in the Americas, Europe and the Middle East. The Cold War was global in nature and, therefore, it could not have left the Armenians untouched. If the Cold War is interpreted as a competition or struggle between the free market/capitalistic and the government-controlled/socialist systems, then Armenians were obliged to take stands in this regard as early as the 1920s. The eastern sector of their ancestral homeland had been incorporated into the Soviet Union, while the survivors of the World War I genocide had been prevented from returning to their homes and had thus been obliged to set new roots in a number of host countries in the Americas, Europe and the Middle East. Under these conditions, the existence of pro- and anti-Soviet political blocs was well evident in the nascent Armenian Diaspora in the inter-war period. The Soviet territorial claims on Turkey at the end of World War II were welcomed by Armenians of all political persuasions. However, the West’s stiff opposition to these demands dashed Armenian expectations and turned this particular post-war episode into one of the first salvos of the ensuing Cold War. -

The Armenian

OCTOBER 5, 2013 MirTHErARoMENr IAN -Spe ctator Volume LXXXIV, NO. 12, Issue 430 6 $ 2.00 NEWS IN BRIEF The First English Language Armenian Weekly in the United States Since 1932 Abaka Weekly Holds Foreign Minister Addresses UN Benefit On October 19 MONTREAL — The Friends of Abaka weekly of Montreal, a publication of the Tekeyan Cultural NEW YORK (ArmeniaNow) — Armenia obstructing peace. Association and a sister paper of the Armenian welcomes the resolution of the Security “Azerbaijan is pretend - Mirror-Spectator, has organized a benefit dinner- Council, which could lead to “the elimina - ing that the international concert on Saturday, tion of chemical weapons and exclusion of community shares its October 19, to cele - their use in Syria and pave the way to a approaches and it shares brate the 38th political solution of the Syrian crisis, the approaches of the anniversary of the putting an end to the sufferings of the international community. first trilingual Armenian weekly of Canada. Syrian people”, said Armenian Foreign In reality, Azerbaijan is Quator Rhapsody, a string quartet composed of Minister Eduard Nalbandian, addressing continuously rejecting all four Quebec musicians led by Nayiri Piloyan, will be the 68th United Nations General Assembly proposals of the interna - the performers. Over the last seven years the quar - in New York on Saturday. tionally mandated OSCE tet has gained recognition and popularity. Their “Armenia remains alarmed by the wors - Minsk Group Co-Chair repertoire consists mainly of semi-classic and cham - ening of the humanitarian situation in countries. Baku rejected ber music as well as popular, operatic music and Syria.