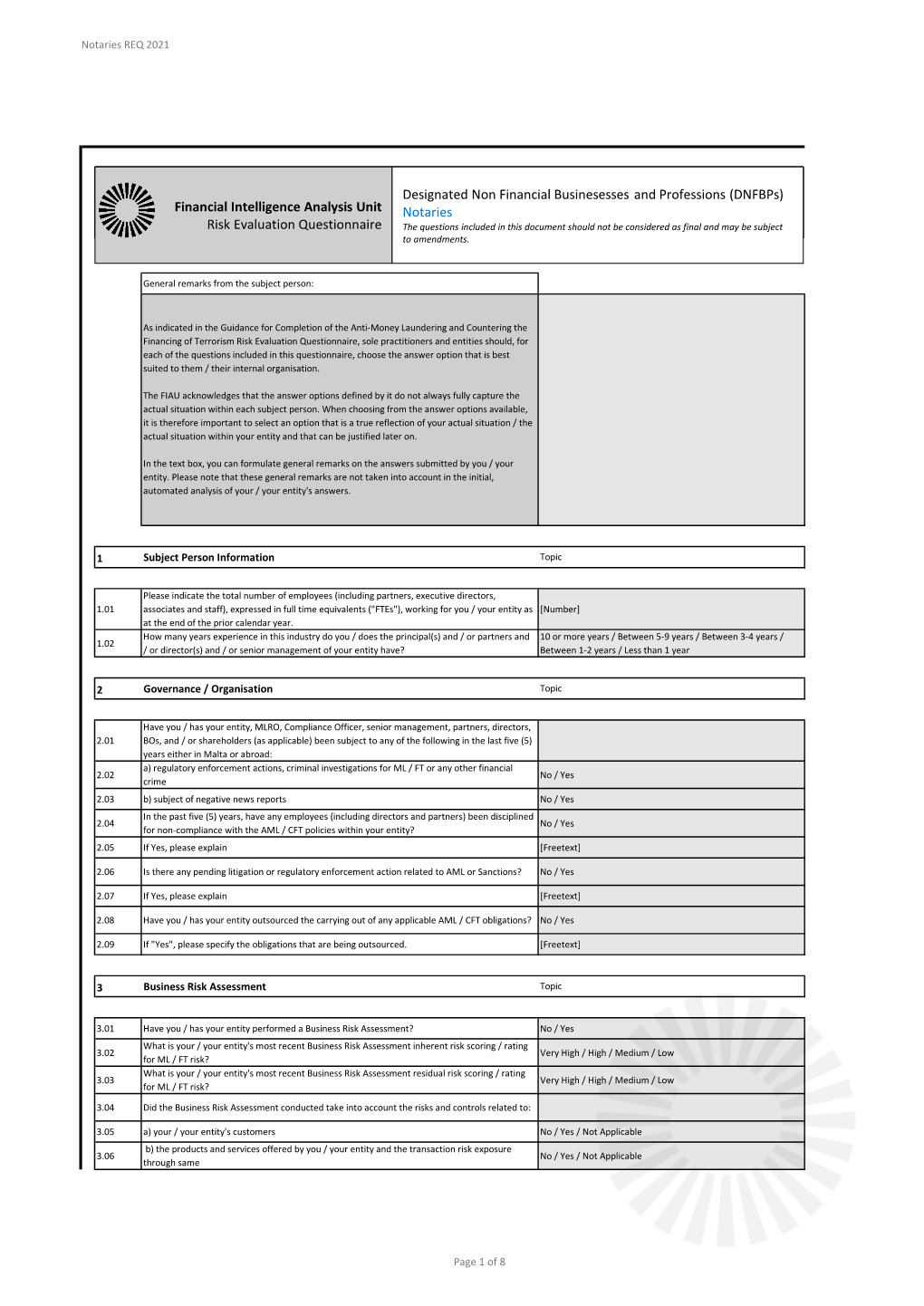

Notaries REQ 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Opportunities and Challenges in the Dominican Dairy Sector

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Voluntary - Public Date: 5/6/2019 GAIN Report Number: DR1901 Dominican Republic Post: Santo Domingo Opportunities and Challenges in the Dominican Dairy Sector Report Categories: Dairy and Products Approved By: Lisa Ahramjian, Agricultural Attaché Prepared By: Luis C. González B, Agricultural Specialist Report Highlights: While the Dominican Republic’s (DR) dairy sector is a very important source of local employment, it is not able to supply the full range of dairy products consumed domestically, especially in the growing hotel, restaurant, and industrial (HRI) sector. In 2017, U.S. dairy exports to the DR totaled $78 million (a 27 percent market share), including cheeses and non-fat dry milk (NFDM). In 2018, U.S. dairy exports increased 11 percent ($87 million) from 2017. While the United States continues to be the dominant supplier of NFDM to the DR, it is facing increasing competition from the European Union (EU) under its Economic Partnership Agreement with CARIFORUM. The DR remains a promising sector for U.S. dairy products, including cheese, yogurt and fluid milk, given its rapidly growing economy and HRI sector. However, importers regularly face a high level of uncertainty due to stringent regulations, which are reportedly causing retailers to stop importing certain lines of dairy products. Commodities Dairy, Fluid Milk Dairy, Cheese Dairy, Skimmed Milk/NFDM Dairy, Whole Milk Powder Dairy, Malt Extract Dairy, Whey Executive Summary While the Dominican Republic’s (DR) dairy sector is a very important source of local employment, it is not able to supply the full range of dairy products consumed domestically, especially in the growing hotel, restaurant, and industrial (HRI) sector. -

Automatic Exchange of Information: Status of Commitments

As of 27 September 2021 AUTOMATIC EXCHANGE OF INFORMATION (AEOI): STATUS OF COMMITMENTS1 JURISDICTIONS UNDERTAKING FIRST EXCHANGES IN 2017 (49) Anguilla, Argentina, Belgium, Bermuda, British Virgin Islands, Bulgaria, Cayman Islands, Colombia, Croatia, Cyprus2, Czech Republic, Denmark, Estonia, Faroe Islands, Finland, France, Germany, Gibraltar, Greece, Guernsey, Hungary, Iceland, India, Ireland, Isle of Man, Italy, Jersey, Korea, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Mexico, Montserrat, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Seychelles, Slovak Republic, Slovenia, South Africa, Spain, Sweden, Turks and Caicos Islands, United Kingdom JURISDICTIONS UNDERTAKING FIRST EXCHANGES BY 2018 (51) Andorra, Antigua and Barbuda, Aruba, Australia, Austria, Azerbaijan3, The Bahamas, Bahrain, Barbados, Belize, Brazil, Brunei Darussalam, Canada, Chile, China, Cook Islands, Costa Rica, Curacao, Dominica4, Greenland, Grenada, Hong Kong (China), Indonesia, Israel, Japan, Lebanon, Macau (China), Malaysia, Marshall Islands, Mauritius, Monaco, Nauru, New Zealand, Niue4, Pakistan3, Panama, Qatar, Russia, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Samoa, Saudi Arabia, Singapore, Sint Maarten4, Switzerland, Trinidad and Tobago4, Turkey, United Arab Emirates, Uruguay, Vanuatu JURISDICTIONS UNDERTAKING FIRST EXCHANGES BY 2019 (2) Ghana3, Kuwait5 JURISDICTIONS UNDERTAKING FIRST EXCHANGES BY 2020 (3) Nigeria3, Oman5, Peru3 JURISDICTIONS UNDERTAKING FIRST EXCHANGES BY 2021 (3) Albania3, 7, Ecuador3, Kazakhstan6 -

Economic Impact 2015 Guadeloupe for More Information, Please Contact: Rochelle Turner Head of Research [email protected]

The Authority on World Travel & Tourism Travel & Tourism ECONOMIC IMPACT 2015 GUADELOUPE For more information, please contact: Rochelle Turner Head of Research [email protected] ©2015 World Travel & Tourism Council Foreword The World Travel & Tourism Council (WTTC) is the global authority on the economic and social contribution of Travel & Tourism. WTTC promotes sustainable growth for the sector, working with governments and international institutions to create jobs, to drive exports and to generate prosperity. Travel & Tourism’s impact on the economic and social development of a country can be enormous; opening it up for business, trade and capital investment, creating jobs and entrepreneurialism for the workforce and protecting heritage and cultural values. To fully understand its impact, however, governments, policy makers and businesses around the world require accurate and reliable data on the impact of the sector. Data is needed to help assess policies that govern future industry development and to provide knowledge to help guide successful and sustainable Travel & Tourism investment decisions. For 25 years, WTTC has been quantifying the economic impact of Travel & Tourism. This year, the 2015 Annual Economic Reports cover 184 countries and 25 regions of the world, including, for the first time, the Pacific Alliance. Travel & Tourism generated US$7.6 trillion (10% of global GDP) and 277 million jobs (1 in 11 jobs) for the global economy in 2014. Recent years have seen Travel & Tourism growing at a faster rate than both the wider economy and other significant sectors such as automotive, financial services and health care. Last year was no exception. International tourist arrivals also surged, reaching nearly 1.14billion and visitor spending more than matched that growth. -

State of Ambiguity: Civic Life and Culture in Cuba's First Republic

STATE OF AMBIGUITY STATE OF AMBIGUITY CiviC Life and CuLture in Cuba’s first repubLiC STEVEN PALMER, JOSÉ ANTONIO PIQUERAS, and AMPARO SÁNCHEZ COBOS, editors Duke university press 2014 © 2014 Duke University Press All rights reserved Printed in the United States of America on acid-f ree paper ♾ Designed by Heather Hensley Typeset in Minion Pro by Tseng Information Systems, Inc. Library of Congress Cataloging-in-Publication Data State of ambiguity : civic life and culture in Cuba’s first republic / Steven Palmer, José Antonio Piqueras, and Amparo Sánchez Cobos, editors. pages cm Includes bibliographical references and index. isbn 978-0-8223-5630-1 (cloth : alk. paper) isbn 978-0-8223-5638-7 (pbk. : alk. paper) 1. Cuba—History—19th century. 2. Cuba—History—20th century. 3. Cuba—Politics and government—19th century. 4. Cuba—Politics and government—20th century. 5. Cuba— Civilization—19th century. 6. Cuba—Civilization—20th century. i. Palmer, Steven Paul. ii. Piqueras Arenas, José A. (José Antonio). iii. Sánchez Cobos, Amparo. f1784.s73 2014 972.91′05—dc23 2013048700 CONTENTS Introduction: Revisiting Cuba’s First Republic | 1 Steven Palmer, José Antonio Piqueras, and Amparo Sánchez Cobos 1. A Sunken Ship, a Bronze Eagle, and the Politics of Memory: The “Social Life” of the USS Maine in Cuba (1898–1961) | 22 Marial Iglesias Utset 2. Shifting Sands of Cuban Science, 1875–1933 | 54 Steven Palmer 3. Race, Labor, and Citizenship in Cuba: A View from the Sugar District of Cienfuegos, 1886–1909 | 82 Rebecca J. Scott 4. Slaughterhouses and Milk Consumption in the “Sick Republic”: Socio- Environmental Change and Sanitary Technology in Havana, 1890–1925 | 121 Reinaldo Funes Monzote 5. -

Haiti Market Analysis: Sud and Grand'anse Departments

R E S E A R C H T E C H N I C A L A S S I S T A N C E C E N T E R February 2021 Haiti Market Analysis: Sud and Grand’Anse Departments The Research Technical Assistance Center (RTAC) is made possible by the generous support of the American people through the United States Agency for International Development (USAID) under the terms of contract no. 7200AA18C00057. This report was produced by NORC at the University of Chicago. The contents are the sole responsibility of RTAC and NORC at the University of Chicago, and do not necessarily reflect the views of USAID or the United States Government. Month Year Acknowledgments This report was prepared by Isaac Marcelin, Ruth Aggiss, Gabriela Alcaraz, and Jack Devine. We thank Professor Jeliel Darius and Professor Jean-Baptiste Antenord at the State University of Haiti [Université d'État d'Haïti (UEH)], Mr. Alain Thermil, Mr. Robitsher Simon, Mr. Kodjo Aflagah, Ms. Martine Mathieu, Ms. Elsie Despeigne, Mr. Shanto Sadhu, and Ms. Samantha Wasala for their inputs and contributions to this activity. We thank USAID staff at the Bureau for Humanitarian Assistance (BHA) and the USAID Mission in Haiti for their engagement throughout this process. Finally, we thank the stakeholders in Port au Prince and Grand’Anse whose insights helped inform this analysis. Research Technical Assistance Center The Research Technical Assistance Center is a network of academic researchers generating timely research for the United States Agency for International Development (USAID) to promote evidence- based policies and programs. -

Climate Change and Small Island States with Reference to Malta

Climate Change and Small Island States with reference to Malta Lino Briguglio University of Malta London: 25 May 2016 SIDS AND GLOBAL WARMING About one fifth of all politically independent countries are Small Island States (SIS). These are to be found in all regions of the world, but most of them are located in the South Pacific Ocean, the Indian Ocean and the Caribbean Sea. One of the greatest challenges to the sustainable development faced by these states relates to climate change. A matter of great concern for these states is that although they contribute very little to global warming, they are the ones that will be harmed most by the effects of climate change. 2 Location of most SIDS Most small island developing states are located in (a) the Caribbean Sea, (b) the South Pacific Ocean and (c) the Indian Ocean/East Atlantic Ocean Most SIDS are located in the Pacific Ocean, Indian Ocean and the Caribbean Sea. They have an important voice in the international arena through the Alliance of Small Caribbean Region Island States (AOSIS). AOSIS had a Antigua/Barbuda Pacific Region leading role in the Barbados Bahamas West Africa/ Cook Islands conference on the sustainable Barbados Atlantic Ocean Fiji Belize Cape Verde Kiribati development of SIDS (1994) and in Cuba Guinea-Bissau Marshall Islands the Mauritius conference on the ten- Dominica Sao Tome/Principe Micronesia, FS year review of the BPoA. The Dominican Republic Nauru Alliance is also very visible in climate Grenada Niue Guyana Indian Palau change negotiations, including the Haiti Ocean/Asia Papua New Conference of the Parties where Jamaica Comoros Guinea signatories of the United Nations St. -

USPS List of Overseas Countries Served Abu Dhabi (United Arab Emirates) Admiralty Islands (Papua New Guinea) Afghanistan Aitutak

USPS List of Overseas Countries Served Abu Dhabi (United Arab Emirates) Admiralty Islands (Papua New Guinea) Afghanistan Aitutaki (Cook Islands) (New Zealand) Ajman (United Arab Emirates) Aland Island (Finland) Albania Alderney, Channel Islands (Great Britain) Algeria Alhucemas (Spain) Alofi Island (New Caledonia) Andaman Islands (India) Andorra Angola Anguilla Anjouan (Comoros) Annobon Island (Equatorial Guinea) Antigua and Barbuda Argentina Armenia Aruba Ascension Astypalaia (Greece) Atafu (Western Samoa) Atiu (Cook Islands) (New Zealand) Australia Austria Avarua (New Zealand) Azerbaijan Azores (Portugal) Bahamas Bahrain Balearic Islands (Spain) Baluchistan (Pakistan) Bangladesh Banks Island (Vanuatu) Barbados Barbuda (Antigua and Barbuda) Barthelemy (Guadeloupe) Belarus Belgium Belize Benin Bermuda Bhutan Bismark Archipelago (Papua New Guinea) Bolivia Bonaire (Netherlands Antilles) Borabora (French Polynesia) Borneo (Kalimantan) (Indonesia) Borneo (North) (Malaysia) Bosnia–Herzegovina Botswana Bougainville (Papua New Guinea) Bourbon (Reunion) Brazil British Guiana (Guyana) British Honduras (Belize) British Virgin Islands Brunei Darussalam Buka (Papua New Guinea) Bulgaria Burkina Faso Burma (Myanmar) Burundi Caicos Islands (Turks and Caicos Islands) Cambodia Cameroon Canary Islands (Spain) Canton Island (Kiribati) Cape Verde Cayman Islands Central African Rep. Ceuta (Spain) Ceylon (Sri Lanka) Chad Chaferinas Islands (Spain) Chalki (Greece) Channel Islands (Jersey, Guernsey, Alderney and Sark) (Great Britain) Chile China Christmas Island -

Fax Cover Sheet

PUBLIC DOCUMENT OF THE INTER-AMERICAN DEVELOPMENT BANK MULTILATERAL INVESTMENT FUND HAITI SCALING UP THE SMALLHOLDER ALLIANCE FOR SORGHUM IN HAITI (SMASH) (HA-M1050) DONORS MEMORANDUM This document was prepared by the project team comprised of: Yolanda Strachan, team leader (MIF/AMC), Ralph Denizé (MIF/CHA), Alejandro Escobar (MIF/AMC), Frednel Isma (MIF/CHA), Winsome Leslie (MIF/ATF), Steve Wilson (MIF/ABS), Carlos Sanchez Román (MIF/ABS), Dora Moscoso (MIF/DEU), Laura Torá (MIF/KSC), Bruno Jacquet (RND/CHA), Gerard Alleng (INE/CCS), Sara Valero Freitag (INE/CCS), and Luciane Medeiros (LEG/NSG). Under the Access to Information Policy, this document is subject to Public Disclosure. TABLE OF CONTENTS PROJECT SUMMARY 1. BACKGROUND AND JUSTIFICATION ........................................................................................ 2 2. PROJECT DESCRIPTION ....................................................................................................... 8 3. MONITORING AND EVALUATION STRATEGY .......................................................................... 16 4. COST AND FINANCING ...................................................................................................... 17 5. EXECUTING AGENCY ........................................................................................................ 18 6. PROJECT RISKS ................................................................................................................ 18 7. ENVIRONMENTAL AND SOCIAL EFFECTS .............................................................................. -

Automatic Exchange of Information (Aeoi): Status of Commitments1

As of 22 September 2021 AUTOMATIC EXCHANGE OF INFORMATION (AEOI): STATUS OF COMMITMENTS1 JURISDICTIONS UNDERTAKING FIRST EXCHANGES IN 2017 (49) Anguilla, Argentina, Belgium, Bermuda, British Virgin Islands, Bulgaria, Cayman Islands, Colombia, Croatia, Cyprus2, Czech Republic, Denmark, Estonia, Faroe Islands, Finland, France, Germany, Gibraltar, Greece, Guernsey, Hungary, Iceland, India, Ireland, Isle of Man, Italy, Jersey, Korea, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Mexico, Montserrat, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Seychelles, Slovak Republic, Slovenia, South Africa, Spain, Sweden, Turks and Caicos Islands, United Kingdom JURISDICTIONS UNDERTAKING FIRST EXCHANGES BY 2018 (51) Andorra, Antigua and Barbuda, Aruba, Australia, Austria, Azerbaijan3, The Bahamas, Bahrain, Barbados, Belize, Brazil, Brunei Darussalam, Canada, Chile, China, Cook Islands, Costa Rica, Curacao, Dominica4, Greenland, Grenada, Hong Kong (China), Indonesia, Israel, Japan, Lebanon, Macau (China), Malaysia, Marshall Islands, Mauritius, Monaco, Nauru, New Zealand, Niue4, Pakistan3, Panama, Qatar, Russia, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Samoa, Saudi Arabia, Singapore, Sint Maarten4, Switzerland, Trinidad and Tobago4, Turkey, United Arab Emirates, Uruguay, Vanuatu JURISDICTIONS UNDERTAKING FIRST EXCHANGES BY 2019 (2) Ghana3, Kuwait5 JURISDICTIONS UNDERTAKING FIRST EXCHANGES BY 2020 (3) Nigeria3, Oman5, Peru3 JURISDICTIONS UNDERTAKING FIRST EXCHANGES BY 2021 (3) Albania3, 7, Ecuador3, Kazakhstan6 -

PUBLIC PROSECUTOR´S OFFICE of CHILE 1.- Briefing on the Legal

PUBLIC PROSECUTOR´S OFFICE OF CHILE 1.- Briefing on the legal bases used for mutual legal assistance, including, where feasible, on the use of the United Nations Convention against Transnational Organized Crime, and the status of bilateral and other multilateral treaties or agreements At the national level, Chile does not have a domestic law in international cooperation. However, few rules regulate the mutual legal assistance and are applied for the execution of the outcoming and incoming MLA. The article 20 bis of the Criminal Procedural Code, establishes that the Public Prosecutor´s Office executes the incoming Mutual Legal Assistance, and when necessary the judicial authorization will be requested to the Judge of Guarantees. In the same sense, Law N°19.913, on Assets Laundering, article 33, and article 47 of the Law N°20.000, on Illegal Drug Trafficking regulate the proceeding for the MLA. In general, double incrimination is not required for the execution of an incoming MLA. However, when coactive or precautionary measures are requested, such as confiscation, seizure, and searches, including house searches, the double incrimination may be required. The international conventions in criminal matters have an essential role, as legal bases, in the Mutual Legal Assistance requests. Chile is part of bilateral and multilateral agreements, but also reciprocity is recognized as a legal ground for the MLA. There are several bilateral agreements mainly with Latin American countries and the United States of America. In 2014 Chile and Spain signed a bilateral agreement for Fighting Against Crime and Security. On the other hand, Chile is part of several multilateral conventions for international cooperation in criminal matters, such as: - The Inter American Convention of Mutual Assistance in Criminal Matters, Nassau Convention. -

Company Service Providers (Legal Persons) REQ 2021

Company Service Providers (Legal Persons) REQ 2021 Annex Financial Intelligence Analysis Unit Designated Non Financial Businesses and Professions (DNFBPs) Designated Non Financial Businesses and Professions Sector RiskFinancial Evaluation Intelligence Questionnaire Analysis Unit Company Service Providers (Legal Persons) Risk Evaluation Questionnaire TheAuditorsquestions and included Accountants in this document (Legal should Persons)not be considered as final and may be subject to amendments. General remarks from the subject person: As indicated in the Guidance for Completion of the Anti-Money Laundering and Countering the Financing of Terrorism Risk Evaluation Questionnaire, sole practitioners and entities should, for each of the questions included in this questionnaire, choose the answer option that is best suited to them / their internal organization. The FIAU acknowledges that the answer options defined by it do not always fully capture the actual situation within each subject person. When choosing from the answer options available, it is therefore important to select an option that is a true reflection of your actual situation / the actual situation within your entity and that can be justified later on. In the text box, you can formulate general remarks on the answers submitted by you / your entity. Please note that these general remarks are not taken into account in the initial, automated analysis of your / your entity's answers. 1 Subject Person Information Topic Please indicate the total number of employees (including partners, -

Soviet Transcript of the Malta Summit December 2-3, 1989

Soviet Transcript of the Malta Summit December 2-3, 1989 First Plenary session, December 2. Gorbachev: Welcome, Mr. President, and members of the American delegation, aboard the Soviet cruise ship Maxim Gorky. It was you who took the initiative for organizing this meeting between us. I would first like to say that we regard the president’s initiative highly. Bush: Thank you very much. Gorbachev: I have been thinking: what has happened in world developments that has prompted the USSR and the U.S. to meet like this? Not only what has happened, but that so much is happening. That is the important thing. For that reason we need to find a new, deep dialogue, one that will be integrally linked with those changes and new events that need to be faced in the international arena. We must conduct our affairs in some other way; we must address the changes. Therefore, we can no longer limit the active work being conducted to the level of foreign ministers. Life demands that we organize more frequent working meetings and increase contacts between our nations' leaders. This meeting is undoubtedly a prelude to an official meeting with you. In any case, it will have a meaning of its own. I am generally impressed by unofficial meetings which are not accompanied by particular formalities. You and I carry on a substantial correspondence. But it is important to sit down at the table and talk. This has a symbolic significance not only for the USSR and the U.S., but for the whole world. In the Soviet Union and the United States, and throughout the world, people are hoping that the negotiations in Malta will not simply be a nice symbol of our relations, but that they will bring results.