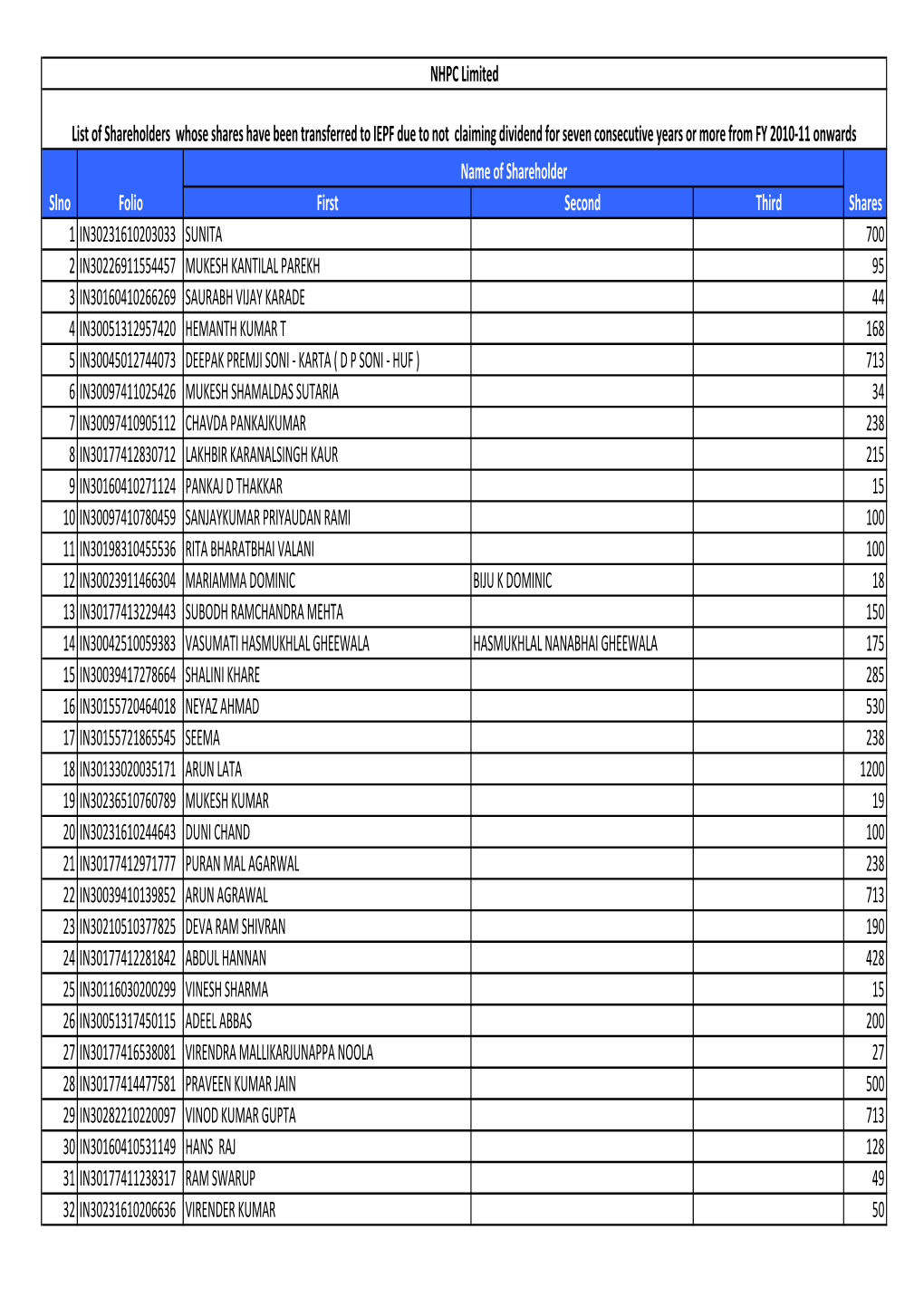

Copy of NHPUNP17-Final List After Trasnfer.Xlsx

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PUBLIC ADDRESS SYSTEM for PFBR BHAVINI, Kalpakkam

BHARATIYA NABHIKIYA VIDYUT NIGAM LIMITED (A Government of India Enterprise) Kalpakkam – 603 102, Kancheepuram District, Tamil Nadu. Tender No - BHAVINI/IT/08/111/10 Name of Work PUBLIC ADDRESS SYSTEM FOR PFBR BHAVINI, Kalpakkam. BHARATIYA NABHIKIYA VIDYUT NIGAM LIMITED (A Government of India Enterprise) Kalpakkam - 603 102, Kancheepuram Dist. (TN) Tender No: BHAVINI /IT/08/111/10 Submission of Tender upto Opening of Tender Date Tim e Date Time 03.12.2008 14:00 hrs 03.12.2008 15:00 hrs Important Notes: • Tender forms shall be signed at the appropriate places by the intending tenderers. • The tenderer shall submit their offer in original Tender documents without changing the Tender format which satisfies each and every condition laid down in the tender documents, failing which the tender is liable to be rejected. • Contractor shall furnish the unconditional bid undertaking failing which their tender shall be considered incomplete and liable for rejection summarily. • This tender document should be returned with all papers intact without detaching any part of it. Tender Issued to M/s. …………………………………………………. By …………………………………………………… BHARATIYA NABHIKIYA VIDYUT NIGAM LIMITED (A Government of India Enterprise) Kalpakkam Name of the work: Design, material, construction features, engineering, manufacture, packing, transportation, delivery, unloading, safe storage, installation, testing, commissioning, training, documentation & guarantee of Public Address system for 500MWe Prototype Fast Breeder Reactor(PFBR) BHAVINI, Kalpakkam, Kancheepuram District, -

India Capital Markets Experience

Dorsey’s Indian Capital Markets Capabilities March 2020 OVERVIEW Dorsey’s capital markets team has the practical wisdom and depth of experience necessary to help you succeed, even in the most challenging markets. Founded in 1912, Dorsey is an international firm with over 600 lawyers in 19 offices worldwide. Our involvement in Asia began in 1995. We now cover Asia from our offices in Hong Kong, Shanghai and Beijing. We collaborate across practice areas and across our international and U.S. offices to assemble the best team for our clients. Dorsey offers a full service capital markets practice in key domestic and international financial centers. Companies turn to Dorsey for all types of equity offerings, including IPOs, secondary offerings (including QIPs and OFSs) and debt offerings, including investment grade, high-yield and MTN programs. Our capital markets clients globally range from emerging companies, Fortune 500 seasoned issuers, and venture capital and private equity sponsors to the underwriting and advisory teams of investment banks. India has emerged as one of Dorsey’s most important international practice areas and we view India as a significant market for our clients, both in and outside of India. Dorsey has become a key player in the Indian market, working with major global and local investment banks and Indian companies on a range of international securities offerings. Dorsey is recognized for having a market-leading India capital markets practice, as well as ample international M&A and capital markets experience in the United States, Asia and Europe. Dorsey’s experience in Indian capital markets is deep and spans more than 15 years. -

NHPC Limited: Ratings Reaffirmed

July 09, 2021 NHPC Limited: Ratings reaffirmed Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) Long term bonds programme 6,710.41 6,710.41 [ICRA]AAA(Stable) reaffirmed [ICRA]AAA(Stable) reaffirmed and Long term bonds programme 2,039.59 - withdrawn Total 8,750.0 6,710.41 *Instrument details are provided in Annexure-1 Rationale ICRA’s rating reflects NHPC Limited’s (NHPC) established position in India’s hydropower generation sector, its significant scale of operations and strategic importance to the Government of India (GoI) as reflected in GoI’s shareholding of 70.95% as on March 31, 2021. ICRA also favourably notes the competitive tariff level for the company’s power plants and strong operating efficiencies as reflected in its plant availability factor (PAF) over the years. The rating continues to reflect the low business risk for the company’s operational portfolio arising out of cost-plus tariff mechanism applicable for its hydel power generating stations and superior operational efficiency levels, ensuring regulated returns. Further, the rating continues to factor in the healthy track record of power generation from operational hydel power projects aided by a favourable hydrology. The company’s credit profile is also supported by a favourable capital structure as reflected in a debt-to-equity ratio of 0.71 times on a consolidated basis (0.80 times on standalone basis) and strong liquidity as reflected in cash and bank balances of Rs. 2,257 crore on a consolidated basis (Rs. 914 crore on a standalone basis), as on March 31, 2021. -

February-2021 Executive Summary on Power Sector

भारत सरकार Government of India वि饍युत मंत्रालय Ministry of Power के न्द्रीय वि饍युत प्राधिकरण Central Electricity Authority Executive Summary on Power Sector February-2021 Executive Summary for the Month of February-2021 Contents SN Section A - Highlights of Power Sector Page 1 Electricity Generation for Feb-2021 (BU) 1A & 1B 2 Generating Capacity Addition for Feb-2021 (MW) 2 3 List of Projects Commissioned in Feb-2021 3 4 All India Installed Capacity (MW) Region-wise as on 28-02-2021 3 5 All India Installed Capacity (MW) Sector-wise as on 28-02-2021 4 6 Transmission Lines Added during Feb-2021 (Ckms) 5 7 Transformation Capacity Addition during Feb-2021 (MVA) 6 8 Power Supply Position (Energy & Peak) in Feb-2021 7 9 Peak Shortage of Power Supply (MW) in Different Regions 8-9 10 All India PLF Sector-wise for Feb-2021 10 11 T & D and AT & C Losses (%) 12 All India Village Electrification 11 13 Average cost of Power & Average Realisation 14 All India Coal consumption for Power Generation (MT) Section B - Capacity Addition 1 Capacity Addition Targets and Achievements in 12th Plan, 2017-18 , 2018-19 and 2019-20 12 2 Capacity Addition Targets & Achievements during Feb-2021 13 3 Installed Capacity in various Regions including their shares. 14-19 Section C - Transmission Lines 1 Programme and Achievements of Transmission Lines in Feb-2021 20 2 List of Transmission Lines Commissioned during Feb-2021 Section D - Sub Stations Programme and Achievements of Sub-Stations in Feb-2021 1 21 2 List of Sub Stations commissioned during Feb-2021 Section E -

List of Abbreviations

LIST OF ABBREVIATIONS S. No. 1. A&N Andaman & Nicobar 2. ACO Assistant Committee Officer 3. AEES Atomic Energy Education Society 4. AeBAS Aadhaar enabled Biometric Attendance System 5. AIIMS All India Institute of Medical Sciences 6. AIU Association of Indian Universities 7. AMC Annual Maintenance Contract 8. ARO Assistant Research Officer 9. ASEAN Association of South-East Asian Nations 10. ASGP Association of Secretaries-General of Parliaments 11. ASI Archaeological Survey of India 12. ASSOCHAM Associated Chambers of Commerce and Industry of India 13. ATNs Action Taken Notes 14. ATRs Action Taken Reports 15. AWS Automatic Weather Station 16. AYCL Andrew Yule & Company Ltd. 17. AYUSH Ayurvedic, Yoga and Naturopathy, Unani, Siddha and Homeopathy 18. BCD Basic Customs Duty 19. BEML Bharat Earth Movers Limited 20. BHAVINI Bhartiya Nabhikiya Vidyut Nigam Ltd. 21. BHEL Bharat Heavy Electricals Ltd. 22. BHMRC Bhopal Memorial Hospital & Research Centre 23. BIOS Bills Information Online System 24. BIS Bureau of Indian Standards 25. BMRCL Bangalore Metro Rail Corporation Ltd. 26. BOAT Board of Apprentice Ship Training 27. BOB Bank of Baroda 28. BPCL Bharat Petroleum Corporation Limited 29. BPST Bureau of Parliamentary Studies and Training 30. BRO Border Roads Organisation 31. BSF Border Security Force 32. BSNL Bharat Sanchar Nigam Limited 33. C&AG Comptroller & Auditor General 34. CARA Central Adoption Resource Authority 35. CAT Central Administrative Tribunal 36. CBI Central Bureau of Investigation 37. CBRN Chemical Biological Radiological Nuclear 38. CBDT Central Board of Direct Taxes 39. CCL Child Care Leave 40. CCRYN Central Council for Research in Yoga and Naturopathy 41. CCS Central Civil Services 42. -

NTPC Limited and BPDP on Build, Own and Operate Basis

Name of the Issue: NTPC 1Type of issue (IPO/ FPO) FPO 2 Issue size (Rs cr) 8,480.10 3 Grade of issue alongwith name of the rating agency Not applicable* * Grading applicable only for initial public offerings, as per ICDR and other applicable regulations 4 Subscription Level (Number of times) 1.24* Source: Final Post Issue Monitoring Report. * The above figure is net of cheque returns, but before technical rejections; Amount of subscription includes all bids received at Employee price of Rs 191 for eligible Employees, at floor price of Rs 201 for Retail Category and Non Institutional Category and above Floor Price of Rs 201 per equity share, at clearing price of Rs. 202 per equity share received from QIBs 5 QIB Holding (as a % of outstanding capital) Particulars % (i) allotment in the issue - Feb 18, 2010 (1) 4.53% (ii) at the end of the 1st Quarter immediately after the listing of the issue (March 31, 2010) (2) 11.59% (iii) at the end of 1st FY (March 31, 2010) (2) 11.59% (iv) at the end of 2nd FY (March 31, 2011) (2) 11.84% (v) at the end of 3rd FY (March 31, 2012) (2) 11.68% Source: (1) Basis of Allotment. Excludes pre-issue holding by QIBs. (2) Clause 35 Reporting with the Stock Exchanges. Represents holding of "Institutions" category. 6 Financials of the issuer (Rs. Crore) Parameters 1st FY (March 31, 2010) 2nd FY (March 31, 2011) 3rd FY (March 31, 2012) Income from operations* 50,163. 3 59,505.4 65,893.7 Net Profit for the period 8,837. -

Diversification on the Cards for Indian State-Owned Enterprises

1 Vibhuti Garg, Energy Economist December 2019 Diversification on the Cards for State-Owned Enterprises State-Owned Enterprises Going Green for Growth and to Stay Relevant The Indian Central Government is leading the country in the adoption of clean renewable energy, driving the uptake and the building of new capacity by state- owned enterprise (SOEs), through learning by doing. The ambition is clear. The country had already installed 83 gigawatts (GW) of renewable energy capacity as of October 2019,1 an 80% increase in less than three years. India has also put forward a target of 175GW of variable renewable energy by 2022 to 450GW by 2030, in a bid to clean up the air in its cities and lessen the economy’s rapidly growing dependence on imported fossil fuels. Currently, thermal power plant developers in India are under huge pressure. Existing plants are being underutilised, with the plant load factor (PLF) sitting below 60% over the past two years. Further stress is being caused by Thermal power plant excessive financial leverage, fuel supply developers in India are disruptions, issues in securing competitively under huge pressure. priced power purchase agreements (PPAs), and payment delays, which all together ensures debt servicing is extremely difficult. In contrast, falling renewable energy prices have led to a recent increase in privately funded renewable projects. The favourable addition of priority grid access, exemption from transmission charges, and increased renewable targets, have further boosted this optimistic sector. Transitioning of Energy Investment in India Energy investment by SOEs in India – also called public sector undertaking (PSU) or public sector enterprise (PSE) – has so far largely focused on fossil fuel production. -

Expenditure Budget Vol. I, 2015-2016

Expenditure Budget Vol. I, 2015-2016 49 STATEMENT 14 PLAN INVESTMENT IN PUBLIC ENTERPRISES (In crores of Rupees) Actuals 2013-2014 Budget 2014-2015 Revised 2014-2015 Budget 2015-2016 S.No. Name of Enterprise/Undertaking Total Plan Budget Support Total Plan Budget Support Total Plan Budget Support Total Plan Budget Support Outlay Outlay Outlay Outlay Equity Loans Equity Loans Equity Loans Equity Loans Ministry of Agriculture 24.66 ... 24.66 ... ... ... 10.00 ... 10.00 12.00 ... 12.00 Department of Agriculture and Cooperation 24.66 ... 24.66 ... ... ... 10.00 ... 10.00 12.00 ... 12.00 1. Land Development Banks 24.66 ... 24.66 ... ... ... 10.00 ... 10.00 12.00 ... 12.00 Department of Atomic Energy 5068.14 329.60 ... 8320.62 371.00 422.00 6860.73 158.50 319.00 10045.92 418.00 422.00 2. Bharatiya Nabhikiya Vidyut Nigam Limited 289.60 289.60 ... 440.00 40.00 400.00 354.63 ... 300.00 440.00 40.00 400.00 (BHAVINI) 3. Electonics Corporation of India Limited 39.28 ... ... 27.50 ... ... 27.50 ... ... 25.00 ... ... 4. Indian Rare Earths Limited 22.09 ... ... 65.70 ... ... 67.80 ... ... 65.14 ... ... 5. Nuclear Power Corporation of India Limited 4675.73 ... ... 7446.42 181.00 22.00 6227.50 72.50 19.00 9095.00 178.00 22.00 (NPCIL) 6. Uranium Corporation of India Limited 41.44 40.00 ... 341.00 150.00 ... 183.30 86.00 ... 420.78 200.00 ... Ministry of Ayurveda, Yoga and Naturopathy, ... ... ... 8.60 8.60 ... ... ... ... ... ... ... Unani, Siddha and Homoeopathy (AYUSH) 7. Homeopathic Medicines Pharmaceutical Co. -

NHPC LTD. (A Govt. of India Enterprise) TENDER DOCUMENT for Purchase of Spares of Two No of 3000 LPH, CEE DEE Make Transformer O

NHPC LTD. (A Govt. of India Enterprise) TENDER DOCUMENT FOR Purchase of Spares of Two no of 3000 LPH, CEE DEE make Transformer oil Filtration plant Tender Specification No._NH/DG/PCS/1507/120 dated 22/06/18 SECTION – 0 NOTICE INVITING TENDER (NIT) एन एच पी सी लिलिटेड NHPC LIMITED (A Govt. of India Enterprise) Procurement Contract Services Dhauliganga Power Station, Tapovan, Dharchula-PIN 262545 CIN: L40101HR1975GOI032564 SECTION–0: NOTICE INVITING E-TENDER (NIT) (Domestic Open Competitive Bidding) Online electronic bids (e-tenders) under two cover system are invited on behalf of NHPC Limited (A Public Sector Enterprise of the Government of India) from domestic bidders registered in India. Purchase of Spares of Two no of 3000 LPH, CEE DEE make Transformer oil Filtration plant Tender Specification No.:( NH/DG/PCS/1507/2018/120 ) Tender document can be viewed and downloaded from NHPC Limited website www.nhpcindia.com and Central Public Procurement Portal (CPPP) at https://eprocure.gov.in/eprocure/app. The bid is to be submitted online only on https://eprocure.gov.in/eprocure/app up to last date and time of submission of bids. Sale of hard copy of tender document is not applicable. 1.0 Brief Details & Critical Dates of Tender: 1.1 Brief Details of Tender: S. Item Description No. Purchase of Spares of Two no of 3000 LPH, CEE (i) Name of work DEE make Transformer oil Filtration plant (ii) Tender Specification No. NH/DG/PCS/1507/2018/120 (iii) Mode of tendering e-procurement system (Open Tender) (iv) Tender ID 2018_NHPC_351819 (v) Cost of bidding document Rs 590/- in the form of Crossed Demand Draft in favour of “NHPC Limited” payable at SBI DHARCHULA. -

Annual Report 2018-19

43rd ANNUAL REPORT 2018-19 CORPORATE VISION To be a global leading organization CORPORATE MISSION for sustainable development of clean power through competent, To achieve excellence in development of responsible and clean power at international standards. innovative values. To execute & operate projects through efficient and competent contract management and innovative R&D in environment friendly and socio-economically responsive manner. To develop, nurture and empower the human capital to leverage its full potential. To practice the best corporate governance and competent value based management for a strong corporate identity and showing concern for employees, customer, environment and society. To adopt & innovate state-of-the-art technologies and optimize use of natural resources through effective management. Shri Balraj Joshi, CMD (centre), Shri Ratish Kumar, Director (Projects) (2nd from left), Shri N. K. Jain, Director (Personnel) (2nd from right), Shri M. K. Mittal, Director (Finance) (extreme left) and Shri Janardan Choudhary, Director (Technical) (extreme right) during the Analyst Meet at Mumbai on 30th May, 2019 Annual Report 2018-19 NHPC Digest of Important Financial Data (Five Years) ..................................................................... 2 Reference Information ......................................................................................................... 3 Letter to Shareholders ......................................................................................................... 5 NHPC’s Performance -

Taking Over of Equity Share of PTC in CVPPPL by NHPC Limited ~: NHPC L I M I Ted~ CVPPPL # PTC Cfi'l' ~ ~M Cl;" ~Cl;"~

tPrtriftft~ Fcrt rn~s (~ '<N <t> I'< <ITT ~) NHPC Limited (A Government of India Enterprise) ~/Phone :________________ _ ~ ~./Ref. No. ________________ _ ~I Date :________________ _ NH/CS/199 11.02.2021 Manager General Manager The Listing Department, The Listing Department M/s BSE Limited, M/s National Stock Exchange of India Limited, Phiroze Jeejeebhoy Towers, Da lal Street, Exchange Plaza, Sandra Kurla Complex, Sandra Mumbai-400001 (E), Mumbai- 400051 ~ . Qf+C:a1 ~ . ~ . f(>)f+C:a 1 ~ . ~Q~?: s ~lal(>!" Rfcn Q CFH =cl "1 ~ ~ Q ~ ?:s fer . ~ . crcrn- . ~ $ , QCf'fi:c)0j ~ . 6fTw ~ q;)'J=Cc'lCf'fi , 6fTw (~) , ~ ~-400 001 ~ - 4 00051 ~ Seri Code: 533098 Seri Code: NHPC ISIN No. INE848E01016 Sub: Taking over of equity share of PTC in CVPPPL by NHPC Limited ~: NHPC L i m i ted~ CVPPPL # PTC cfi'l' ~ ~M cl;" ~cl;"~# S ir s~ . In compliance to Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Reg ulations, 2015, it is to inform that Board of Directors in its meeting held today i.e. Thursday, February 11, 2021 has approved the proposal for taking over of 2% equity share of PTC India Limited (PTC) in Chenab Valley Power Projects Private Limited (a Joint Venture Company between NHPC Limited (49%), Jammu and Kashmir State Power Development Corporation Limited (49%) and PTC (2%)) by NHPC Limited subject to approval of Ministry of Power, Govt. of India. The details required to be disclosed as per SEBI circular dated 09.09.2015 is enclosed at Annexure-1. This is for your record and information. ~ ~ ~ 3ITT- "1 1o=t<h lfl ~ ~ 61 ~I ~ 4l1iii&1ii : ~ ~ qt ~ 3fffiITT:r ¢1iqJ\cr<1, ~-33 , 45tl~ 1 t1 1 ~ - 121 003, t:Rii1011 Regd . -

Expenditure Budget Vol. I, 2013-2014 53 STATEMENT 15 RESOURCES of PUBLIC ENTERPRISES (In Crores of Rupees) Revised 2012-2013 Budget 2013-2014 S.No

Expenditure Budget Vol. I, 2013-2014 53 STATEMENT 15 RESOURCES OF PUBLIC ENTERPRISES (In crores of Rupees) Revised 2012-2013 Budget 2013-2014 S.No. Name of Enterprise/Undertaking Internal Bonds/ E.C.B/ Others Total Internal Bonds/ E.C.B/ Others Total Resources Debentures Suppliers Resources Debentures Suppliers Credit Credit Department of Atomic Energy 2707.55 2927.00 ... 110.00 5744.55 3534.30 4257.68 ... 207.08 7999.06 1. Bharatiya Nabhikiya Vidyut Nigam Limited (BHAVINI) ... ... ... 60.00 60.00 ... 7.68 ... 107.08 114.76 2. Electonics Corporation of India Limited 44.00 ... ... ... 44.00 36.50 ... ... ... 36.50 3. Indian Rare Earths Limited 122.05 ... ... ... 122.05 100.30 ... ... ... 100.30 4. Nuclear Power Corporation of India Limited (NPCIL) 2523.00 2927.00 ... 50.00 5500.00 3130.50 4250.00 ... 100.00 7480.50 5. Uranium Corporation of India Limited 18.50 ... ... ... 18.50 267.00 ... ... ... 267.00 Ministry of Chemicals and Fertilisers 2971.75 ... ... ... 2971.75 2770.71 ... ... ... 2770.71 Department of Fertilisers 2971.75 ... ... ... 2971.75 2770.71 ... ... ... 2770.71 6. Fertilizer Corporation of India (FAGMIL) 11.11 ... ... ... 11.11 44.05 ... ... ... 44.05 7. Krishak Bharti Cooperative Ltd. 522.00 ... ... ... 522.00 927.00 ... ... ... 927.00 8. National Fertilizers Ltd. 2087.94 ... ... ... 2087.94 803.20 ... ... ... 803.20 9. Projects and Development (India) Ltd. 5.57 ... ... ... 5.57 18.17 ... ... ... 18.17 10. Rashtriya Chemicals and Fertilizers Ltd. 345.13 ... ... ... 345.13 978.29 ... ... ... 978.29 Ministry of Civil Aviation -161.93 ... 508.59 2741.56 3088.22 1230.49 ... 539.27 1895.64 3665.40 11.