Annual Report 2018-19

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

India Capital Markets Experience

Dorsey’s Indian Capital Markets Capabilities March 2020 OVERVIEW Dorsey’s capital markets team has the practical wisdom and depth of experience necessary to help you succeed, even in the most challenging markets. Founded in 1912, Dorsey is an international firm with over 600 lawyers in 19 offices worldwide. Our involvement in Asia began in 1995. We now cover Asia from our offices in Hong Kong, Shanghai and Beijing. We collaborate across practice areas and across our international and U.S. offices to assemble the best team for our clients. Dorsey offers a full service capital markets practice in key domestic and international financial centers. Companies turn to Dorsey for all types of equity offerings, including IPOs, secondary offerings (including QIPs and OFSs) and debt offerings, including investment grade, high-yield and MTN programs. Our capital markets clients globally range from emerging companies, Fortune 500 seasoned issuers, and venture capital and private equity sponsors to the underwriting and advisory teams of investment banks. India has emerged as one of Dorsey’s most important international practice areas and we view India as a significant market for our clients, both in and outside of India. Dorsey has become a key player in the Indian market, working with major global and local investment banks and Indian companies on a range of international securities offerings. Dorsey is recognized for having a market-leading India capital markets practice, as well as ample international M&A and capital markets experience in the United States, Asia and Europe. Dorsey’s experience in Indian capital markets is deep and spans more than 15 years. -

NHPC Limited: Ratings Reaffirmed

July 09, 2021 NHPC Limited: Ratings reaffirmed Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) Long term bonds programme 6,710.41 6,710.41 [ICRA]AAA(Stable) reaffirmed [ICRA]AAA(Stable) reaffirmed and Long term bonds programme 2,039.59 - withdrawn Total 8,750.0 6,710.41 *Instrument details are provided in Annexure-1 Rationale ICRA’s rating reflects NHPC Limited’s (NHPC) established position in India’s hydropower generation sector, its significant scale of operations and strategic importance to the Government of India (GoI) as reflected in GoI’s shareholding of 70.95% as on March 31, 2021. ICRA also favourably notes the competitive tariff level for the company’s power plants and strong operating efficiencies as reflected in its plant availability factor (PAF) over the years. The rating continues to reflect the low business risk for the company’s operational portfolio arising out of cost-plus tariff mechanism applicable for its hydel power generating stations and superior operational efficiency levels, ensuring regulated returns. Further, the rating continues to factor in the healthy track record of power generation from operational hydel power projects aided by a favourable hydrology. The company’s credit profile is also supported by a favourable capital structure as reflected in a debt-to-equity ratio of 0.71 times on a consolidated basis (0.80 times on standalone basis) and strong liquidity as reflected in cash and bank balances of Rs. 2,257 crore on a consolidated basis (Rs. 914 crore on a standalone basis), as on March 31, 2021. -

NTPC Limited and BPDP on Build, Own and Operate Basis

Name of the Issue: NTPC 1Type of issue (IPO/ FPO) FPO 2 Issue size (Rs cr) 8,480.10 3 Grade of issue alongwith name of the rating agency Not applicable* * Grading applicable only for initial public offerings, as per ICDR and other applicable regulations 4 Subscription Level (Number of times) 1.24* Source: Final Post Issue Monitoring Report. * The above figure is net of cheque returns, but before technical rejections; Amount of subscription includes all bids received at Employee price of Rs 191 for eligible Employees, at floor price of Rs 201 for Retail Category and Non Institutional Category and above Floor Price of Rs 201 per equity share, at clearing price of Rs. 202 per equity share received from QIBs 5 QIB Holding (as a % of outstanding capital) Particulars % (i) allotment in the issue - Feb 18, 2010 (1) 4.53% (ii) at the end of the 1st Quarter immediately after the listing of the issue (March 31, 2010) (2) 11.59% (iii) at the end of 1st FY (March 31, 2010) (2) 11.59% (iv) at the end of 2nd FY (March 31, 2011) (2) 11.84% (v) at the end of 3rd FY (March 31, 2012) (2) 11.68% Source: (1) Basis of Allotment. Excludes pre-issue holding by QIBs. (2) Clause 35 Reporting with the Stock Exchanges. Represents holding of "Institutions" category. 6 Financials of the issuer (Rs. Crore) Parameters 1st FY (March 31, 2010) 2nd FY (March 31, 2011) 3rd FY (March 31, 2012) Income from operations* 50,163. 3 59,505.4 65,893.7 Net Profit for the period 8,837. -

Diversification on the Cards for Indian State-Owned Enterprises

1 Vibhuti Garg, Energy Economist December 2019 Diversification on the Cards for State-Owned Enterprises State-Owned Enterprises Going Green for Growth and to Stay Relevant The Indian Central Government is leading the country in the adoption of clean renewable energy, driving the uptake and the building of new capacity by state- owned enterprise (SOEs), through learning by doing. The ambition is clear. The country had already installed 83 gigawatts (GW) of renewable energy capacity as of October 2019,1 an 80% increase in less than three years. India has also put forward a target of 175GW of variable renewable energy by 2022 to 450GW by 2030, in a bid to clean up the air in its cities and lessen the economy’s rapidly growing dependence on imported fossil fuels. Currently, thermal power plant developers in India are under huge pressure. Existing plants are being underutilised, with the plant load factor (PLF) sitting below 60% over the past two years. Further stress is being caused by Thermal power plant excessive financial leverage, fuel supply developers in India are disruptions, issues in securing competitively under huge pressure. priced power purchase agreements (PPAs), and payment delays, which all together ensures debt servicing is extremely difficult. In contrast, falling renewable energy prices have led to a recent increase in privately funded renewable projects. The favourable addition of priority grid access, exemption from transmission charges, and increased renewable targets, have further boosted this optimistic sector. Transitioning of Energy Investment in India Energy investment by SOEs in India – also called public sector undertaking (PSU) or public sector enterprise (PSE) – has so far largely focused on fossil fuel production. -

NHPC LTD. (A Govt. of India Enterprise) TENDER DOCUMENT for Purchase of Spares of Two No of 3000 LPH, CEE DEE Make Transformer O

NHPC LTD. (A Govt. of India Enterprise) TENDER DOCUMENT FOR Purchase of Spares of Two no of 3000 LPH, CEE DEE make Transformer oil Filtration plant Tender Specification No._NH/DG/PCS/1507/120 dated 22/06/18 SECTION – 0 NOTICE INVITING TENDER (NIT) एन एच पी सी लिलिटेड NHPC LIMITED (A Govt. of India Enterprise) Procurement Contract Services Dhauliganga Power Station, Tapovan, Dharchula-PIN 262545 CIN: L40101HR1975GOI032564 SECTION–0: NOTICE INVITING E-TENDER (NIT) (Domestic Open Competitive Bidding) Online electronic bids (e-tenders) under two cover system are invited on behalf of NHPC Limited (A Public Sector Enterprise of the Government of India) from domestic bidders registered in India. Purchase of Spares of Two no of 3000 LPH, CEE DEE make Transformer oil Filtration plant Tender Specification No.:( NH/DG/PCS/1507/2018/120 ) Tender document can be viewed and downloaded from NHPC Limited website www.nhpcindia.com and Central Public Procurement Portal (CPPP) at https://eprocure.gov.in/eprocure/app. The bid is to be submitted online only on https://eprocure.gov.in/eprocure/app up to last date and time of submission of bids. Sale of hard copy of tender document is not applicable. 1.0 Brief Details & Critical Dates of Tender: 1.1 Brief Details of Tender: S. Item Description No. Purchase of Spares of Two no of 3000 LPH, CEE (i) Name of work DEE make Transformer oil Filtration plant (ii) Tender Specification No. NH/DG/PCS/1507/2018/120 (iii) Mode of tendering e-procurement system (Open Tender) (iv) Tender ID 2018_NHPC_351819 (v) Cost of bidding document Rs 590/- in the form of Crossed Demand Draft in favour of “NHPC Limited” payable at SBI DHARCHULA. -

Taking Over of Equity Share of PTC in CVPPPL by NHPC Limited ~: NHPC L I M I Ted~ CVPPPL # PTC Cfi'l' ~ ~M Cl;" ~Cl;"~

tPrtriftft~ Fcrt rn~s (~ '<N <t> I'< <ITT ~) NHPC Limited (A Government of India Enterprise) ~/Phone :________________ _ ~ ~./Ref. No. ________________ _ ~I Date :________________ _ NH/CS/199 11.02.2021 Manager General Manager The Listing Department, The Listing Department M/s BSE Limited, M/s National Stock Exchange of India Limited, Phiroze Jeejeebhoy Towers, Da lal Street, Exchange Plaza, Sandra Kurla Complex, Sandra Mumbai-400001 (E), Mumbai- 400051 ~ . Qf+C:a1 ~ . ~ . f(>)f+C:a 1 ~ . ~Q~?: s ~lal(>!" Rfcn Q CFH =cl "1 ~ ~ Q ~ ?:s fer . ~ . crcrn- . ~ $ , QCf'fi:c)0j ~ . 6fTw ~ q;)'J=Cc'lCf'fi , 6fTw (~) , ~ ~-400 001 ~ - 4 00051 ~ Seri Code: 533098 Seri Code: NHPC ISIN No. INE848E01016 Sub: Taking over of equity share of PTC in CVPPPL by NHPC Limited ~: NHPC L i m i ted~ CVPPPL # PTC cfi'l' ~ ~M cl;" ~cl;"~# S ir s~ . In compliance to Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Reg ulations, 2015, it is to inform that Board of Directors in its meeting held today i.e. Thursday, February 11, 2021 has approved the proposal for taking over of 2% equity share of PTC India Limited (PTC) in Chenab Valley Power Projects Private Limited (a Joint Venture Company between NHPC Limited (49%), Jammu and Kashmir State Power Development Corporation Limited (49%) and PTC (2%)) by NHPC Limited subject to approval of Ministry of Power, Govt. of India. The details required to be disclosed as per SEBI circular dated 09.09.2015 is enclosed at Annexure-1. This is for your record and information. ~ ~ ~ 3ITT- "1 1o=t<h lfl ~ ~ 61 ~I ~ 4l1iii&1ii : ~ ~ qt ~ 3fffiITT:r ¢1iqJ\cr<1, ~-33 , 45tl~ 1 t1 1 ~ - 121 003, t:Rii1011 Regd . -

Financial Committees (2014-2015)

FINANCIAL COMMITTEES (2014-2015) (A REVIEW) PUBLIC ACCOUNTS COMMITTEE ESTIMATES COMMITTEE AND COMMITTEE ON PUBLIC UNDERTAKINGS LOK SABHA SECRETARIAT NEW DELHI September, 2015/Bhadrapada, 1937 (Saka) PAC No. 2056 Price : ` 95.00 © 2015 BY LOK SABHA SECRETARIAT Published under Rule 382 of the Rules of Procedure and Conduct of Business in Lok Sabha (Fifteenth Edition) and printed by the General Manager, Government of India Press, Minto Road, New Delhi-110 002. CONTENTS PAGE PREFACE ......................................................................................... (iii) CHAPTER I Public Accounts Committee ............................................. 1 CHAPTER II Estimates Committee ........................................................ 9 CHAPTER III Committee on Public Undertakings .................................. 17 APPENDICES I. Composition of the Public Accounts Committee (2014-15) 21 II. Subjects selected by the Public Accounts Committee for Examination (2014-15) ........................................................ 22 III. Composition of the Sub-Committees of Public Accounts Committee (2014-15) .......................................................... 31 IV. Statement showing the details of the dates and duration of the sittings of the Public Accounts Committee (2014-15) [Main Committee] .............................................................. 33 V. Statement showing the number of sittings attended by each Member of the Public Accounts Committee (2014-15) [Main Committee] ............................................................. -

Top Public Sector Companies

Top Public Sector Companies Air India Bharat Coking Coal Limited Bharat Dynamics Limited Bharat Earth Movers Limited Bharat Electronics Limited Bharat Heavy Electricals Ltd. Bharat Petroleum Corporation Bharat Refractories Limited Bharat Sanchar Nigam Ltd. Bongaigaon Refinery & Petrochemicals Ltd. Broadcast Engineering Consultants India Ltd Cement Corporation of India Limited Central Warehousing Corporation Chennai Petroleum Corporation Limited Coal India Limited Cochin Shipyard Ltd. Container Corporation Of India Ltd. Cotton Corporation of India Ltd. Dredging Corporation of India Limited Engineers India Limited Ferro Scrap Nigam Limited Food Corporation of India GAIL (India) Limited Garden Reach Shipbuilders & Engineers Limited Goa Shipyard Ltd. Gujarat Narmada Valley Fertilizers Company Limited Haldia Petrochemicals Ltd Handicrafts & Handloom Exports Corporation of India Ltd. Heavy Engineering Corp. Ltd Heavy Water Board Hindustan Aeronautics Limited Hindustan Antibiotics Limited Hindustan Copper Limited Hindustan Insecticides Ltd Hindustan Latex Ltd. Hindustan Petroleum Corporation Ltd. Hindustan Prefab Limited HMT Limited Housing and Urban Development Corporation Ltd. (HUDCO) IBP Co. Limited India Trade Promotion Organisation Indian Airlines Indian Oil Corporation Ltd Indian Rare Earths Limited Indian Renewable Energy Development Agency Ltd. Instrumentation Limited, Kota Ircon Internationl Ltd. ITI Limited Kochi Refineries Ltd. Konkan Railway Corporation Ltd. Krishna Bhagya Jala Nigam Ltd Kudremukh Iron Ore Company Limited Mahanadi -

Press Release NHPC Limited

Press Release NHPC Limited July 06, 2020 Rating Instruments Amount (Rs. crore) Ratings11 Rating Action CARE AAA; Stable Long –Term Bonds (U Series) 900.00 Reaffirmed (Triple A; Outlook Stable) 1,785.00 CARE AAA; Stable Long–Term Bonds (V Series) Reaffirmed (reduced from 1,940.00) (Triple A; Outlook Stable) 1,352.01 CARE AAA; Stable Long–Term Bonds (T Series) Reaffirmed (reduced from 1,474.92) (Triple A; Outlook Stable) 732.50 CARE AAA; Stable Long–Term Bonds (S Series) Reaffirmed (reduced from 824.00) (Triple A; Outlook Stable) CARE AAA; Stable Long–Term Tax Free Bonds 1,000.00 Reaffirmed (Triple A; Outlook Stable) 738.50 CARE AAA; Stable Long–Term Bonds (Q Series) Reaffirmed (reduced from 844.00) (Triple A; Outlook Stable) 1,650.00 CARE AAA; Stable Long–Term Bonds (W Series) Reaffirmed (reduced from 1,950.00) (Triple A; Outlook Stable) 1,500.00 CARE AAA; Stable Long–Term Bonds (X Series) Reaffirmed (reduced from 2,000.00) (Triple A; Outlook Stable) Long term instruments – GoI CARE AAA; Stable 2,017.20 Reaffirmed fully serviced bonds (Triple A; Outlook Stable) CARE AAA; Stable Long–Term Bonds (AA Series) 2,000.00 Reaffirmed (Triple A; Outlook Stable) CARE AAA; Stable Long–Term Bonds (AB Series) 1,000.00 Reaffirmed (Triple A; Outlook Stable) 14,675.21 (Rupees Fourteen Thousand Six Total Hundred Seventy Five crore and Twenty One Lakh only) Details of instruments/facilities in Annexure-1 Detailed Rationale & Key Rating Drivers The rating of NHPC Limited (NHPC) continues to derive strength from its established position as India’s largest hydro power producer with geographical diversity of sales, majority ownership by the Government of India (GoI) with financial and management support. -

Power Finance Corporation Limited

RED HERRING PROSPECTUS Please read Section 60B of the Companies Act, 1956 Book Built Issue Dated April 25, 2011 POWER FINANCE CORPORATION LIMITED Our Company was incorporated in New Delhi on July 16, 1986 under the Companies Act, 1956, as amended (the “Companies Act”), as a public limited company. Registered Office: ‘Urjanidhi’, 1, Barakhamba Lane, Connaught Place, New Delhi 110 001, India Tel: +91 (11) 2345 6000 Fax: +91 (11) 2341 2545 For information on change in the registered office of our Company, see section titled “History and Certain Corporate Matters” on page 133. Company Secretary and Compliance Officer: Mr. J.S. Amitabh Tel: +91 (11) 2345 6740 Fax: +91 (11) 2345 6786 E-mail: [email protected]: www.pfcindia.com. PROMOTER : PRESIDENT OF INDIA, ACTING THROUGH THE MINISTRY OF POWER, GOVERNMENT OF INDIA FURTHER PUBLIC ISSUE OF 229,553,340 EQUITY SHARES OF FACE VALUE OF ` 10 EACH (“EQUITY SHARES”) OF POWER FINANCE CORPORATION LIMITED (“POWER FINANCE”, “OUR COMPANY” OR “THE ISSUER”) FOR CASH AT A PRICE OF ` [•] PER EQUITY SHARE (INCLUDING A SHARE PREMIUM OF ` [•] PER EQUITY SHARE) AGGREGATING ` [•] MILLION* (THE “ISSUE”). THE ISSUE COMPRISES A FRESH ISSUE OF 172,165,005 EQUITY SHARES BY OUR COMPANY (THE “FRESH ISSUE”) AND AN OFFER FOR SALE OF 57,388,335 EQUITY SHARES BY THE PRESIDENT OF INDIA ACTING THROUGH THE MINISTRY OF POWER, GOVERNMENT OF INDIA (THE “SELLING SHAREHOLDER”) (THE “OFFER FOR SALE”). THE ISSUE COMPRISES A NET ISSUE TO THE PUBLIC OF 229,277,876 EQUITY SHARES (THE “NET ISSUE”) AND A RESERVATION OF NOT MORE THAN 275,464 EQUITY SHARES FOR SUBSCRIPTION BY ELIGIBLE EMPLOYEES (AS DEFINED HEREIN) (THE “EMPLOYEE RESERVATION PORTION”). -

Loan Against Securities – Approved Bonds

Loan against securities – Approved Bonds ISIN Bond Name Margin INE134E07190 POWER FINANCE CORPORATION LTD 30 INE261F07040 NABARD 30 INE031A07832 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07857 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07873 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07907 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07931 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07964 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07998 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07949 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 35 INE031A07923 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07956 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07980 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE787H07396 INDIA INFRASTRUCTURE FINANCE COMPANY LIMITED 40 INE031A07865 HOUSING AND URBAN DEVELOPMENT CORPORATION LTD 30 INE031A07972 HOUSING AND URBAN DEVELOPMENT CORPORATION LIMITED 40 INE031A07AA4 HOUSING AND URBAN DEVELOPMENT CORPORATION LIMITED 40 INE053F07538 INDIAN RAILWAY FINANCE CORPORATION LIMITED 30 INE053F07744 INDIAN RAILWAY FINANCE CORPORATION LIMITED 40 INE906B07EP5 NATIONAL HIGHWAYS AUTHORITY OF INDIA 35 INE031A07AB2 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07AH9 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07AF3 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07AC0 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07AM9 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07AS6 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07AL1 HOUSING AND URBAN DEVELOPMENT -

Scheme C - Tier I

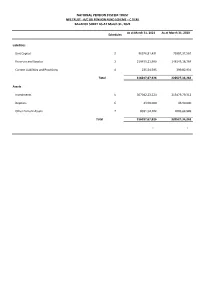

NATIONAL PENSION SYSTEM TRUST NPS TRUST - A/C SBI PENSION FUND SCHEME – C TIER I BALANCE SHEET AS AT March 31, 2021 As at March 31, 2021 As at March 31, 2020 Schedules ` ` Liabilities Unit Capital 2 96326,91,431 73982,32,567 Reserves and Surplus 3 219455,21,900 146145,18,764 Current Liabilities and Provisions 4 235,54,595 399,82,931 Total 316017,67,926 220527,34,262 Assets Investments 5 307042,23,224 213479,79,312 Deposits 6 43,90,000 43,90,000 Other Current Assets 7 8931,54,702 7003,64,949 Total 316017,67,926 220527,34,262 - - NATIONAL PENSION SYSTEM TRUST NPS TRUST - A/C SBI PENSION FUND SCHEME – C TIER I REVENUE ACCOUNT FOR THE HALF YEAR ENDED March 31, 2021 Half Year ended Half Year ended Schedules March 31, 2021 March 31, 2020 ` ` Income Interest 8 9896,36,312 7500,53,107 Profit on sale/redemption of investments 9 (1404,74,989) 225,44,094 Profit on inter-scheme transfer/sale of investments 10 1931,26,131 - Unrealized gain on appreciation in investments 2406,35,845 Other income - - - Miscellaneous Income 11 - - Total 10422,87,454 10132,33,045 Expenses and Losses Unrealized losses in value of investments 481,76,792 747,23,081 Loss on sale/redemption of investments 12 29,60,363 22,485 Loss on inter-scheme transfer/sale of investments 13 - Management fees 16,62,709 11,14,453 NPS Trust fees 7,04,538 4,94,349 Custodian fees 4,73,566 3,49,134 Depository and settlement charges 73,527 1,00,055 Stamp Duty on Bond/Mutual Fund 54,61,012 CRA Fees 159,69,903 128,88,150 Less: Amount recoverable on sale of units on account of CRA Charges (159,69,903)