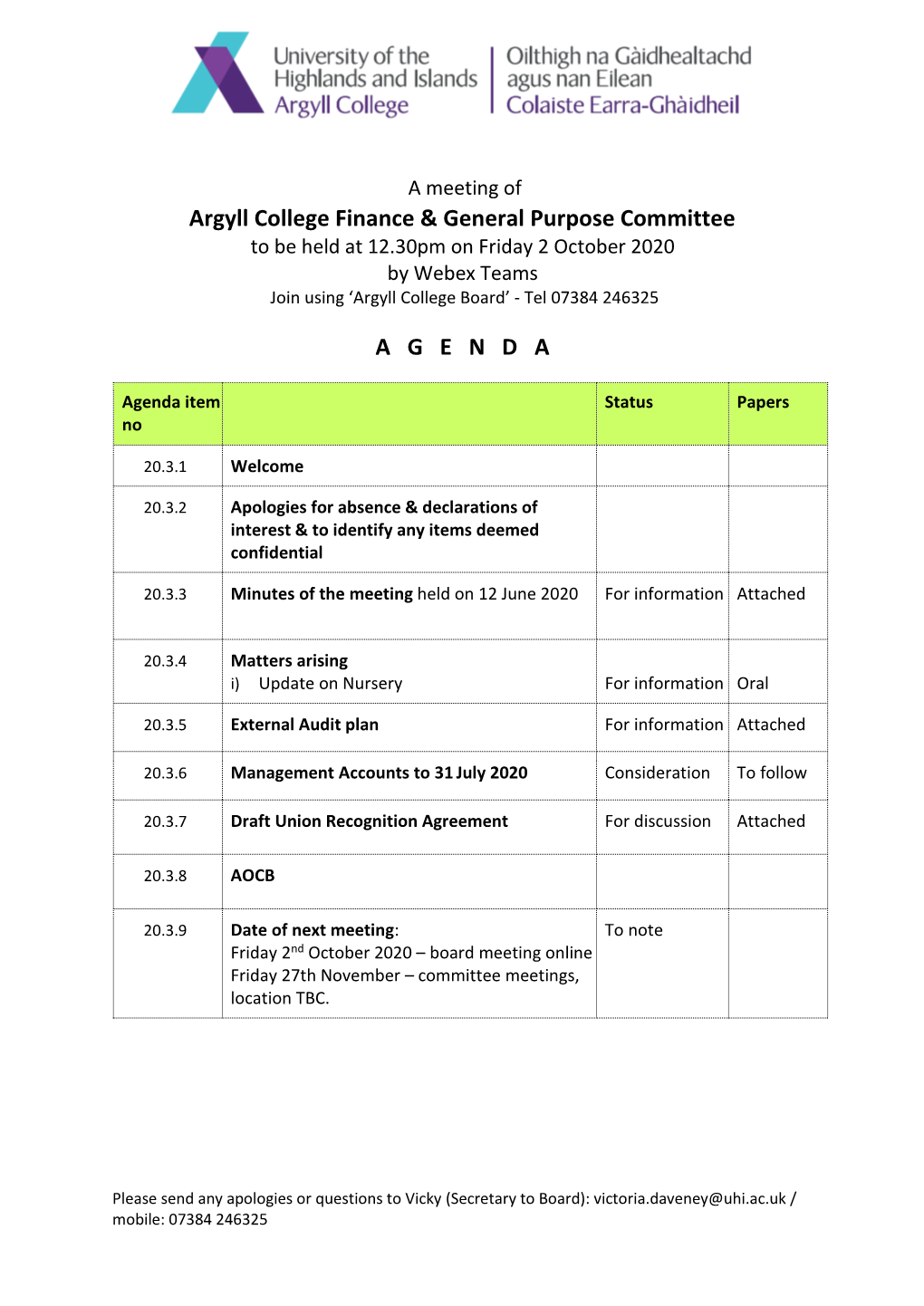

Argyll College Finance & General Purpose Committee a G E N D

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

West Lothian College Board of Governors Tuesday 08 December 2020 at 4.30Pm

West Lothian College Board of Governors Tuesday 08 December 2020 at 4.30pm Agenda Item Paper 1 Welcome and apologies 2 Declarations of Interest 3 Minute of Meeting of 22 September 2020 1 For Approval 4 Matters Arising from Minute of Meeting of 22 September 2 For Approval 2020 Board Business 5 Student Association Report 3 For Information 6 Chief Executive’s Report 4 For Information 7 Regional Chair’s Feedback Verbal 8 Board Development i) Report from Board Secretary – Board Development 5 To Note Committee Business 9 Learning and Teaching Committee i) Update from Chair of the Learning and Teaching 6 For Information Committee from draft minute of 18 November 2020 ii) Curriculum Plan 2020-21 Presentation 10 Finance and General Purposes Committee: i) Update from Chair of the Finance and General Purposes Committee from draft minute of 25 7 For Information November 2020 ii) People Strategy 8 For Approval 11 Audit Committee i) Update from Chair of the Audit Committee from draft 9 For Information minute of 26 November 2020 ii) Annual Report & Financial Statements for 2019-20 10 For Approval iii) Annual Report to the Board of Governors and the 11 To Discuss Auditor General for Scotland 2019-20 iv) Audit Committee’s Report to the Board 12 For Information v) Letter of Representation 13 For Approval vi) Health & Safety Quarterly Report 14 For Information vii) Strategic Risk Register 15 For Information 12 Update from Chair of the Remuneration Committee Verbal 13 Nominations Committee i) Update from Chair of the Nominations Committee 16 For Information from 29 October 2020 ii) Secretary to the Board 17 For Approval 14 Any Other Business 15 Board Development Plan, Review of Meeting, and 18 For Information Supporting Papers 16 Date of Next Meeting: 9 March 2021 at 4.30 p.m. -

College Innovation the Heart of Scotland's Future

FOR SCOTLAND’S COLLEGE SECTOR 2020 THE HEART OF SCOTLAND’S FUTURE An interview with Karen Watt, Chief Executive of the Scottish Funding Council p11 COLLEGE INNOVATION Innovation has never been more important, says City of Glasgow College p12 PROJECT PLASTIC How Dundee and Angus College is tackling the climate emergency head on p30 REACHING NEW HEIGHTS Colleges have a crucial role to play in the new vision for Scotland’s tourism and hospitality sector 11 28 2020 Editor Wendy Grindle [email protected] Assistant Editor Tina Koenig [email protected] Front Cover The cover photo shows Rūta Melvere with her snowboard. She completed the West Highland College UHI Outdoor Leadership NQ and came back to study BA (Hons) Adventure Tourism Management. She has gone on to start her own tourism business. The photo was taken by Simon Erhardt, who CONTENTS studied BA (Hons) Adventure Performance and Coaching at West Highland College UHI and graduated in 2018. 4 ROUND-UP 24 COLLEGE VOICE The latest projects and initiatives The CDN Student of the Year and Colleague of the Year speak to Reach Reach is produced by Connect Publications (Scotland) 9 ADULT LEARNING Limited on behalf of College Development Network Richard Lochhead MSP on a new national strategy 26 DIGITAL COLLEGES A digital learning network has been formed by 11 INTERVIEW Dumfries and Galloway and Borders Colleges Karen Watt, Chief Executive of the Scottish Funding Studio 2001, Mile End Council (SFC), reflects on the role of colleges 12 Seedhill Road 28 INCLUSION Paisley PA1 1JS Fife College -

Reflecting Back – Moving Forward

Reflecting Back – Moving Forward Wednesday 15 and Thursday 16 May 2019 Macdonald Inchyra Hotel & Spa, Grange Road, Polmont, Falkirk FK2 0YB Programme Wednesday 15 May 1300 Registration and Lunch 1400 Welcome and Introductions Arlene Byrne, Chair of CDN School/College Partnership Network and Schools Development Manager, New College Lanarkshire Arlene will open the conference and welcome the keynote speaker. 1410 Looking Back and Moving Forwards in Glasgow Region John Rafferty, DYW Regional Lead, GCRB Glasgow Region currently offers one of the largest School Vocational Programmes in Scotland, catering for almost 3000 senior phase schools pupils from 4 different local authorities and offering almost 200 different courses. Given the rising profile of DYW initiatives and the changing qualifications landscape, an annual data analysis of activity in this area is uncovering a number of surprising trends which suggest a number of insights for future DYW planning. What do learners think of these experiences, and what do delivery staff think? 1430 Workshop Session Delegates should select one of the two workshop sessions available at this time to attend. Further information on workshops can be found below. 1530 Moving Forward These facilitated discussions are about creating the future we want from School/College Partnerships Strand 1 will provide a focus for colleges to share materials and ideas which are in development, with a view to creating meaningful products and services across Scotland. Strand 2 will provide a focus for schools to discuss -

Major Players

PUBLIC BODIES CLIMATE CHANGE DUTIES – MAJOR PLAYER ORGANISATIONS Aberdeen City Council Aberdeen City IJB Aberdeenshire Council Aberdeenshire IJB Abertay University Accountant in Bankruptcy Angus Council Angus IJB Argyll and Bute Council Argyll and Bute IJB Audit Scotland Ayrshire College Borders College City of Edinburgh Council City of Glasgow College Clackmannanshire and Stirling IJB Clackmannanshire Council Comhairlie nan Eilean Siar Creative Scotland Disclosure Scotland Dumfries and Galloway College Dumfries and Galloway Council Dumfries and Galloway IJB Dundee and Angus College Dundee City Council Dundee City IJB East Ayrshire Council East Ayrshire IJB East Dunbartonshire Council East Dunbartonshire IJB East Lothian Council Sustainable Scotland Network Edinburgh Centre for Carbon Innovation, High School Yards, Edinburgh, EH1 1LZ 0131 650 5326 ú [email protected] ú www.sustainablescotlandnetwork.org East Lothian IJB East Renfrewshire Council East Renfrewshire IJB Edinburgh College City of Edinburgh IJB Edinburgh Napier University Education Scotland Falkirk Council Falkirk IJB Fife College Fife Council Fife IJB Food Standards Scotland Forth Valley College Glasgow Caledonian University Glasgow City Council Glasgow City IJB Glasgow Clyde College Glasgow Kelvin College Glasgow School of Art Heriot-Watt University The Highland Council Highlands and Islands Enterprise Highlands and Islands Transport Partnership (HITRANS) Historic Environment Scotland Inverclyde Council Inverclyde IJB Inverness College UHI Lews Castle College -

West Scotland Outcome Agreement 2019-20

REGIONAL OUTCOME AGREEMENT THE WEST REGION Academic years 2017-18 to 2019-20 Update April 2019 1 | Page Index Priority Outcomes and Outputs 3 Quality • New Quality Arrangements 23 West College Scotland • Student Outcomes and Retention 24 • Our Vision and Ambitions 5 • Curriculum Planning 27 • Learning Pathways and Transitions 28 Regional Context • Articulation 29 • Population 7 • Estates 30 • Employment 7 • Digital Ambition and ICT Strategy 31 • School Leaver Destinations 8 • Qualifications and Participation 8 Skills and Employability • Deprivation and Poverty 8 • Developing Scotland’s Young Workforce 34 • Economic Performance 9 • STEM 34 • Business Profile 9 • Work Experience 35 • College Response to our Context 10 • Employability for students with Learning Differences 36 Access • Employer Engagement 36 • Access & Inclusion Strategy 11 • Apprenticeships, Employability and SDS 37 • Deprivation 12 High Performing Institutions • Mainstreaming Equality, Diversity • Sustainability and Carbon Management 39 and Inclusion 14 • Financial Sustainability 40 • Disability 15 • Procurement 41 • Gender 17 • Governance 41 • Ethnicity 19 • Student Association 42 • Age 19 • College Leaver Destination Survey 43 • Corporate Parenting 20 • Student Satisfaction and Engagement 44 • Caring Responsibilities 21 • Staff 45 • School College Partnership 22 Innovation • Supporting Innovation 49 • Entrepreneurial Skills Equality Impact Assessment 50 Purpose of the Outcome Agreement The Board of Management of West College Scotland submit the West Region Outcome Agreement to the Scottish Funding Council. This Outcome Agreement sets out the processes and mechanisms that West College Scotland has established to monitor performance and progress in achieving its goals and objectives. The Outcome Agreement reflects the College’s commitment to responding to the educational and skills needs within our region, aligned to the Scottish Funding Council’s priorities and to demonstrate the College’s contribution to the Scottish Government’s Economic Strategy. -

0845 272 3600 |

Glossary Welcome to of terms 2012/13 NAFC Marine Centre UHI Shetland College UHI our campus Ionad Mara NAFC UHI Colaiste Shealtainn UHI Postgraduate Certificate (PgCert) – To gain the award of PgCert you will complete three 20-credit, or four 15-credit modules, and if you are studying on a full-time basis you will study these modules Fàilte gu Contents over one semester. If you are studying part time, you may take two or more semesters to complete the PgCert. ar n-àrainn Welcome to your campus 2 Postgraduate Diploma (PgDip) – To gain the award of PgDip you Orkney College UHI must complete six or eight modules over two semesters if you are Colaiste Arcaibh UHI studying full time. This will take longer if you are studying part time. Postgraduate study and research 4 International students 8 Masters (MA, MSc, MLitt, MTh, MEd) – To gain the full Masters North Highland College UHI degree you must complete six or eight modules, plus a dissertation Colaiste na Gàidhealtachd a Tuath UHI Gaelic at UHI 9 or other piece of work specific to the course. If you are studying Lews Castle College UHI full time you will normally take one year to complete the Masters Colaisde a’ Chaisteil UHI degree. You can take a maximum of six years to complete your Moray College UHI Colaiste Mhoireibh UHI Masters if you are studying part time. Highland Theological College UHI Our courses Colaiste Dhiadhachd na Continuing professional development (CPD) – You can choose Gàidhealtachd UHI Arts, Humanities and Social Sciences 10 Inverness College UHI to study at postgraduate level on a module-by-module basis to Colaiste Inbhir Nis UHI ABERDEEN Sabhal Mòr contribute to your continuing professional development (CPD). -

Review of Regional Strategic Bodies– University of the Highlands And

Review of Regional Strategic Bodies – University of the Highlands and Islands SFC Publication 1 Issue Date: 20 October 2020 Cover photo credit: University of the Highlands and Islands Contents Review of Regional Strategic Bodies – University of the Highlands and Islands ........... 3 Introduction ................................................................................................................ 3 Methodology .............................................................................................................. 4 General background to RSBs ...................................................................................... 5 Specific background context to the Highlands and Islands ........................................ 6 The University of the Highlands and Islands RSB ................................................... 6 Background ............................................................................................................. 7 Unique challenges .................................................................................................. 7 Regional Strategy .................................................................................................... 8 Summary of main conclusions .................................................................................... 8 Detailed assessment ................................................................................................. 11 Planning provision within the region (right provision in the right place) ............ 11 Funding allocations -

Annual-Review-2018-Final-Web.Pdf

ANNUAL REVIEW 2018 CH AIR’S REMARKS PRINCIpaL’S REMARKS 2018 has been a year of significant change for To be appointed Principal and Chief Executive I intend to prioritise the raising of attainment levels across the West College Scotland. of West College Scotland is a huge honour and a range of study levels. We serve some of Scotland’s most deprived wonderful privilege for me. communities and I also want to explore more deeply how we can Audrey Cumberford, our Principal and Chief Executive since 2013, remove some of the obstacles that still prevent many people from left us in August to take up a similar role at Edinburgh College. In recent years, the College has achieved a national profile through taking the first steps on the path to further education and training. Audrey provided us with five years of outstanding leadership, the efforts of our staff, who have worked through a period of The condition of the buildings in which our staff work and our helping to establish the College as one of Scotland’s most dynamic unprecedented change in the sector. The winners have been our students learn is another priority. In June 2018, the Auditor General and highly regarded educational institutions. She takes with her our students and the many others who use our services and facilities. thanks and good wishes. for Scotland confirmed the needs of our estate are the most acute My challenge to myself is to turn ‘good’ into ‘even better’. in the sector, with an estimated repairs and maintenance backlog of I was delighted to announce the appointment of Liz Connolly to £49 million over the next five years. -

Scotlands Colleges 2017

Scotland’s colleges 2017 EMBARGOED UNTIL 00.01 HOURS THURSDAY 22 JUNE Prepared by Audit Scotland June 2017 Auditor General for Scotland The Auditor General’s role is to: • appoint auditors to Scotland’s central government and NHS bodies • examine how public bodies spend public money • help them to manage their finances to the highest standards • check whether they achieve value for money. The Auditor General is independent and reports to the Scottish Parliament on the performance of: • directorates of the Scottish Government • government agencies, eg the Scottish Prison Service, Historic Environment Scotland • NHS bodies • further education colleges • Scottish Water • NDPBs and others, eg Scottish Police Authority, Scottish Fire and Rescue Service. You can find out more about the work of the Auditor General on our website: www.audit-scotland.gov.uk/about-us/auditor-general Audit Scotland is a statutory body set up in April 2000 under the Public Finance and Accountability (Scotland) Act 2000. We help the Auditor General for Scotland and the Accounts Commission check that organisations spending public money use it properly, efficiently and effectively. Scotland's colleges 2017 | 3 Contents Key facts 4 Summary 5 Part 1. College performance 8 Part 2. College finances 16 Endnotes 29 Appendix 1. Audit methodology 32 Appendix 2. Scotland's college landscape 2017 34 Links PDF download Web link 4 | Key facts Staff in incorporated 10,898 13 3 of which contain colleges in 2015-16 FTE regions more than 1 college Female students in Incorporated incorporated 51 20 colleges colleges in per cent 2015-16 Studying at Scottish Government incorporated 220,680 £557 funding to the college colleges in 2015-16 Students million sector in 2015/16 Summary | 5 Summary Key messages 1 The college sector has continued to exceed the national target for learning but delivered slightly less activity than in 2014-15. -

Board of Management October 2020 Dear Applicant West College

Board of Management October 2020 Dear Applicant West College Scotland Board of Management – Appointment of Non-Executive Board Members Thank you for your interest in the appointment of non-executive Board members for the Board of Management of West College Scotland. Please find enclosed information outlining the role of a non-executive member of the Board. With more than 22,000 students, 1,200 staff and a turnover of £66m, the College is the second largest Regional College in Scotland. Our main campuses are in Clydebank, Paisley and Greenock, although we have a presence across six local authorities and fifteen towns and work from nearly fifty locations. A recent Scottish Funding Council review acknowledged the need for capital investment in our estate, especially at Greenock and Paisley, which is among the most acute in the entire sector. Our plans are not just to rebuild what we have but to create a state-of-the-art, industry-standard hub for local businesses to utilise and for our local communities to access. We also provide training for a range of business partners, from small- and medium-sized local companies to some of the biggest companies in the world. We are proud of the impact we have on our region and beyond, and we are passionate about making a difference. The Board of Management is now seeking enthusiastic individuals who have, or can develop, the skills to deal with complex issues and promote high standards of governance. You do not need to be an expert in education or training to join our Board. -

Glasgow Clyde College

SWAP West SWAPWest Annual Report 2019-20 | Partnership, Accessibility, Student Success and Social Justice Scottish Wider Access Programme (West) SCIO is a registered Scottish Charity, No. SC048288. SWAP is supported by the Scottish Funding Council. Introduction Partnership Accessibility Student Success Social Justice Contact Information Lesson 1 of 6 Introduction SWAP West SWAPWest Annual Report (2019-20) Scottish Wider Access Programme (West) SCIO, known as SWAPWest, is a registered Scottish charity (SC048288). The members of SWAPWest are the colleges and universities in the West of Scotland. The members work in partnership to provide education opportunities for adults who have no or few qualifications. SWAPWest have provided access programmes in the West of Scotland for 32 years. Our college partners provide a broad range of access programmes for adults who want to return to education. On successful completion of the programme students progress to higher education. Progression routes to degree level study are provided by our university partners. Opportunities to progress to HNC are provided by our college partners. Our programme model develops academic and learning skills and relevant social and personal competences. SWAPWest highlights the benefits of adults returning to education to Scottish society and our education partners. Working with SWAPEast and with funding from the Scottish Funding Council, we provide a coherent national provision of access programmes throughout Scotland. We are proud to be partners in two Erasmus plus funded -

Statutory Accounts 2019-2020

West Lothian College ______________________________________________________________________________ WEST LOTHIAN COLLEGE REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 JULY 2020 Scottish Charity No. SC021216 _______________________________________________________________________________ Accounts 2020 Page 1 West Lothian College ______________________________________________________________________________ The financial statements were approved and authorised for issue on 8 December 2020 _______________________________________________________________________________ Accounts 2020 Page 2 West Lothian College ______________________________________________________________________________ CONTENTS PERFORMANCE REPORT FOR THE YEAR ENDED 31 July 2020 .............................. 5 Key Issues and Risks ............................................................................................... 10 Performance Summary ............................................................................................ 11 Financial Review ....................................................................................................... 14 REMUNERATION AND STAFF REPORT .................................................................... 19 BOARD OF GOVERNORS REPORT ........................................................................... 24 Membership of the Board of Governors ................................................................. 24 GOVERNANCE STATEMENT .....................................................................................