Case No IV/M.1333 - KINGFISHER / CASTORAMA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Developing Employees As Organisational Assets

Developing Employees as Organisational Assets INTRODUCTION The Kingfisher Recruitment • The Person Specification How KMDS is evolving commercial and afterwards in key functions The Group requires from prospec- Kingfisher plc is one of Europe’s leading retailers based Management Development Scheme Investing in a trainee over ten years tive KMDS trainees: The KMDS was launched in 1995 and • a post-graduate certificate in man- around three main sectors - DIY, electrical and general involves significant cost as well as today has 172 individuals on the scheme agement studies from Templeton • excellent interpersonal skills merchandise. The company employs over 130,000 people in invest- risk. The risk includes choosing the working across the Group. All individu- College, Oxford The KMDS represents a key • enthusiasm and drive to become ment by the organisation in its human wrong type of person and equally als following the KMDS route joined in • a ‘skills tool-box’ consisting of 2,900 stores across 15 countries and has some of the best senior managers within 7-10 years assets. The scheme takes high-poten- importantly losing the person to anoth- their early 20s. Recently Kingfisher has day-release training to develop per- known retail brands in Europe, including B&Q, Castorama, • innovative approach to challenges tial graduates who want to make a er organisation during the training recognised that there are benefits in sonal skills Comet, Darty, BUT, Woolworths and Superdrug among opening up the process to existing high- career in retail, and provides them with process. For this reason, Kingfisher • the ability to analyse and make • a ‘buddy’ who is already on the others. -

Finance Project

MASTER OF SCIENCE IN FINANCE MASTERS FINAL WORK PROJECT EQUITY RESEARCH: HORNBACH BAUMARKT AG JOÃO MARIA GONÇALVES PAIVA DÓRDIO RODRIGUES SUPERVISOR: ANA ISABEL ORTEGA VENÂNCIO OCTOBER 2020 Acknowledgements This paper represents the end of a journey started in 2018 and I would like to express my sincerest gratitude to all persons involved in these 2 years of the Masters. Firstly, to Professor Ana Venâncio for the guidance, time and patience, not only during this project, but also during classes. Secondly, to my family, parents, sister and grandmother, for supporting and believing in me. And last but not least, to my friends, new and old, for the moments shared in these past 2 years. i Abstract The following project is a valuation of the company Hornbach Baumarkt AG, based on publicly available information until the 6th November 2020. It follows the format recommended by the CFA Institute. Hornbach Baumarkt AG was chosen due to the interest in wanting to explore and learn about the DIY sector and by it being the only publicly traded German company. Hornbach Baumarkt AG is a Top 10 player in the DIY Home Improvement sector in Europe. It was created in 1993 after an IPO that saw Hornbach AG being subdivided in Hornbach Holding AG (Parent Company) and Hornbach Baumarkt AG, having the original company being founded in 1877, in Landau, Germany, but only making their first IPO in 1987. Today, Hornbach Baumarkt AG is a Child company of Hornbach Holding AG. The valuation was derived from an intrinsic valuation, based on a Discounted Cash Flow (DFC) method, more specifically, through a Free Cash Flow to the Firm (FCFF) perspective. -

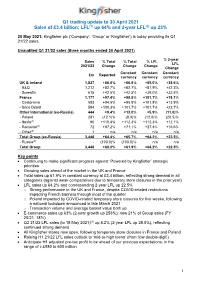

Q1 Trading Update to 30 April 2021 Sales of £3.4 Billion; LFL(1) up 64% and 2-Year LFL(2) up 23%

Q1 trading update to 30 April 2021 Sales of £3.4 billion; LFL(1) up 64% and 2-year LFL(2) up 23% 20 May 2021: Kingfisher plc (‘Company’, ‘Group’ or ‘Kingfisher’) is today providing its Q1 21/22 sales. Unaudited Q1 21/22 sales (three months ended 30 April 2021) % 2-year Sales % Total % Total % LFL LFL 2021/22 Change Change Change Change Constant Constant Constant £m Reported currency currency currency UK & Ireland 1,827 +66.8% +66.8% +65.0% +38.6% - B&Q 1,212 +82.7% +82.7% +81.9% +42.3% - Screwfix 615 +42.5% +42.5% +39.0% +32.5% France 1,177 +97.4% +98.8% +101.7% +18.1% - Castorama 583 +94.5% +95.8% +101.8% +13.9% - Brico Dépôt 594 +100.3% +101.7% +101.7% +22.7% Other International (ex-Russia) 444 +9.4% +13.0% +5.9% (11.0)% - Poland 281 (12.1)% (8.9)% (12.0)% (20.5)% - Iberia(3) 90 +110.8% +112.3% +112.3% +12.1% - Romania(4) 72 +67.2% +71.1% +27.4% +16.6% - Other(5) 1 n/a n/a n/a n/a Total Group (ex-Russia) 3,448 +64.4% +65.7% +64.2% +22.5% - Russia(6) - (100.0)% (100.0)% n/a n/a Total Group 3,448 +60.0% +61.9% +64.2% +22.5% Key points • Continuing to make significant progress against ‘Powered by Kingfisher’ strategic priorities • Growing sales ahead of the market in the UK and France • Total sales up 61.9% in constant currency at £3.4 billion, reflecting strong demand in all categories (against weak comparatives due to temporary store closures in the prior year) • LFL sales up 64.2% and corresponding 2-year LFL up 22.5% o Strong performance in the UK and France, despite COVID-related restrictions impacting French banners through most -

Screwfix Builds Bricks and Mortar Presence with 300Th Store

SCREWFIX BUILDS BRICKS AND MORTAR PRESENCE WITH 300TH STORE Trade and DIY retailer Screwfix is now even more accessible for busy tradesmen on the move across the UK, with the launch of its 300th trade counter in Birstall, West Yorkshire. Screwfix started life as a mail order catalogue-based business, but in response to customers needing to get their tools quickly and conveniently, a rapid store expansion has followed, with 60 stores being opened in 2013 alone. The national store network now gives the nation’s tradesmen, which includes builders, plumbers and electricians, as well as serious DIY-ers, greater access to tools and supplies when on the move in-between jobs. Meeting this 300th store milestone is equally significant given that Screwfix opened its very first store just eight years ago in Yeovil, Somerset. This need for a fast and easy shopping experience has been boosted by an early adoption of a multi-channel model as Screwfix chief executive Andrew Livingston explains: “It really is a case of time is money for our customers because they are busy out and about on the road, from job to job. So we’re doing all we can to help them buy the tools and accessories they need as quickly and easily as possible. As we open the doors to more and more stores across the country, we become even more convenient for our customers. This, topped with our Click & Collect technology, mobile website and smartphone apps means that customers can shop when they want and how they want. “Tradesmen rely on us for the ease and speed of online and over-the-phone ordering, but they also enjoy the store experience thanks to regular – often daily - interaction with staff, many of whom have a background in the trade.” The 300th Screwfix store will open its doors in Birstall, West Yorkshire, joining 8 other stores across West Yorkshire. -

The Revitalized Castorama Store of Ormesson Is Testing Geopositioning with Pricer Search

The revitalized Castorama store of Ormesson is testing geopositioning with Pricer Search Guyancourt, January 25th, 2017. Castorama Ormesson is piloting the Pricer geopositioning solution and is offering its customers a kiosk through which they can easily search the products they are looking for. Locate a product using Infrared trilateration Pricer, the worldwide leader of electronic shelf label (ESL) digital solutions, has developed a unique application based on Infrared (IR) trilateration. The store’s ESLs reply to Pricer’s communication platform, each using a different signal strength enabling their geopositioning and therefore automatically providing the product’s position in the store. Easily find products with the Pricer Search kiosk Relying on the IR infrastructure of the Ormesson store, Pricer has implemented a kiosk allowing customers to easily locate products in the store. The kiosk combines an intuitive « article search » function and a digital map of the store. The automated solution greatly improves the customer’s experience in a DIY world where searching for products can be difficult. Geolocalize with Pricer’s unified platform Trilateration is one the most important components of Pricer’s digital solutions. The Pricer platform associates both hardware (SmartFLASH ESLs) and software solutions composing a unique value added offer which can be easily integrated in any IT environment. Automatic product geolocation provides a better customer experience. Pricer has won the Paris Retail Awards 2016 in the Customer Experience (360) category with its automatic product positioning solution for stores. About Castorama Castorama is part of Kingfisher plc, the European leader of home improvement which operates nearly 1,200 stores in 10 countries in Europe. -

Plan De Vigilance 2020-2021

PLAN DE VIGILANCE 2020-2021 1 Edito du directeur général de Kingfisher France Débutée il y a 30 ans en faveur de la gestion durable des forêts, la démarche d’engagement responsable du Groupe Kingfisher s’est par la suite structurée pour prendre en compte l’ensemble des impacts sociétaux et environnementaux de ses activités. Convaincus que les entreprises ne sont pas des entités hors du monde, nous avons à cœur d’agir de façon responsable vis-à-vis de l’ensemble de nos parties prenantes : nos collaborateurs en premier lieu, en veillant à leur santé, leur sécurité et au respect de leurs libertés ; nos partenaires et tous ceux qui travaillent pour eux, afin qu’ils puissent le faire dans un cadre qui respecte leurs droits fondamentaux ; notre environnement, avec pour objectif de préserver les ressources naturelles, limiter notre empreinte carbone ainsi que celle de nos clients lorsqu’ils utilisent nos produits ; et enfin les communautés locales qui nous entourent. Pour y parvenir, Kingfisher s’est doté d’objectifs ambitieux dans quatre domaines prioritaires : l’inclusion, parce nous voulons donner leur chance à tous les profils ; la lutte contre le changement climatique et la préservation des forêts ; l’accès à des logements plus sains et plus « verts » pour nos clients ; et enfin la lutte contre le mal-logement. Parce que cela relève de notre responsabilité, mais également parce que nous sommes persuadés que ces risques que nous devons éviter sont aussi des opportunités de mieux faire notre métier, en cohérence avec nos valeurs, devenant ainsi un élément essentiel de notre performance. -

Kingfisher Plc 2018-19 Full Year Results Q&A Transcript

Kingfisher plc 2018-19 full year results Q&A transcript - 20 March 2019 __________________________________________________________________________________ 12 months ended 31 January 2019 __________________________________________________________________________________ Speakers: Veronique Laury (VL), CEO Andy Cosslett, (AC), Chairman Karen Witts (KW), CFO Maj Nazir (MN), IR Director __________________________________________________________________________________ GL: Hi there, Geoff Lowery at Redburn. Two questions please. Can you sort of compare and contrast Brico Depot and Castorama for us in terms of the way the new ranges have landed, how you’ve executed that, how you feel about their competitive positions now? It’s just so striking to see such a big delta in top line between your two businesses. And second one, a question for the Chairman. Given your comments about the Board being a hundred percent behind the existing strategy. What flexibility is there for the next CEO if he or she, were to come in and say actually we want to do things differently, we want to trade business differently, the equity market’s not recognising the value of Screwfix therefore we need to change? What scope is there for evolution in strategy? VL: I probably should answer the first one. So, I think that the starting points in Castorama and Brico Depot were very different. The offer was different. You had a starting point, the number of categories that were covering both businesses were not the same, the number of SKU was, as I just said, Brico Depot store is 11,000 SKU today, Castorama is more 50,000 SKU. So, the way the new offer has landed was different. In Brico we have had coverage of customer needs and as well the price positioning of Brico Depot was good at the beginning. -

Strategic Retail Management Text and International Cases 3Rd Edition Strategic Retail Management Joachim Zentes • Dirk Morschett • Hanna Schramm-Klein

Joachim Zentes Dirk Morschett Hanna Schramm-Klein Strategic Retail Management Text and International Cases 3rd Edition Strategic Retail Management Joachim Zentes • Dirk Morschett • Hanna Schramm-Klein Strategic Retail Management Text and International Cases 3rd Edition Joachim Zentes Hanna Schramm-Klein FB Wirtschaftswissenschaften, Universität Siegen Universität des Saarlandes Siegen, Germany Saarbrücken, Germany Dirk Morschett Universität Fribourg Fribourg, Switzerland ISBN 978-3-658-10182-4 ISBN 978-3-658-10183-1 (eBook) DOI 10.1007/978-3-658-10183-1 Springer Gabler Library of Congress Control Number: 2016954795 Springer Gabler © Springer Fachmedien Wiesbaden GmbH 2007, 2011, 2017 This work is subject to copyright. All rights are reserved by the Publisher, whether the whole or part of the material is concerned, specifically the rights of translation, reprinting, reuse of illustrations, recitation, broadcasting, repro- duction on microfilms or in any other physical way, and transmission or information storage and retrieval, elec- tronic adaptation, computer software, or by similar or dissimilar methodology now known or hereafter developed. The use of general descriptive names, registered names, trademarks, service marks, etc. in this publication does not imply, even in the absence of a specific statement, that such names are exempt from the relevant protective laws and regulations and therefore free for general use. The publisher, the authors and the editors are safe to assume that the advice and information in this book are believed to be true and accurate at the date of publication. Neither the publisher nor the authors or the editors give a warranty, express or implied, with respect to the material contained herein or for any errors or omissions that may have been made. -

Full Year Results

‘Powered by Kingfisher’ New strategic direction Thierry Garnier, Chief Executive Officer Our strengths Access to attractive Leading positions Strong Distinctly Home Improvement in our markets commercial assets positioned banners markets Top 2 position in 77,000 skilled and B&Q, Castorama, Long term all key markets engaged colleagues Brico Dépôt Romania, growing markets, Koçtaş: resilient through Collective buying scale & downturns UK, Poland, Turkey: #1 successful own exclusive General home brands (39% of sales) improvement Higher profit margins Responsible business Screwfix, TradePoint: 1,350+ stores than many retail sectors practices Trade-focused Brico Dépôt France Partly insulated against Proven model to operate 90% banner awareness and Iberia: online pure-plays through COVID-19 Discounter 23 Situation in 2019 – key achievements from past 4 years Buying and sourcing Own Exclusive Brands Improved price efficiencies (OEB) product innovation position Benefits from unified ranges Dedicated design and sourcing Clear improvement in price teams. Growth in some categories position vs. peers for B&Q and from differentiated product design Castorama France GNFR efficiencies SAP investments Shared services £100m+ GNFR and operational Common SAP template fully Shared services centre established savings over 4 years deployed in B&Q; rollout in progress for back-office in other banners 24 Situation in 2019 – diagnosis Root causes Consequences ▪ “Become ONE” vs. Do it together ▪ Diluted banner positioning ▪ Imbalanced local-Group operating model ▪ -

11/14 Hindesight UK Dividend Letter

NOV 14 DIVIDEND UK LETTER Mark Mahaffey Ben Davies “October. This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August and February.” Mark Twain OVERVIEW In October 1987, the Dow Jones Industrial Aver- In Views Ben Davies will explore why markets have age plunged more than 20% in one day, an unlikely experienced such sclerotic behaviour, citing what the 20-standard deviation event whose probability of oc- brilliant mathematician Mandelbrot once referred to currence is less than one in ten to the 50th power. Fast as the (mis)behaviour of markets. Ben suggests such forward 27 years and global devel- behaviour should be attributed oped stock markets experienced a to man. fall of 10 to 15% over a course of 3 WE’RE KEEN to to 4 weeks, with a rebound in some The Philae bounce is undoubt- markets as ‘stellar’ in magnitude as HUnt doWN edly another huge leap for the European Space Agency’s (ESA) stoCKS WHICH mankind as it could provide Rosetta mission success to land a confirmation that comets once robotic space probe on the surface BENEFIT not brought water and amino ac- of a comet. ids (protein) to our barren Earth onLY FRom to make life possible. But right On the 12th November 2014 - some here on Earth Ben writes about 10 years after it was launched - maRKET VOL- how we are experiencing anoth- lander module Philae which ac- atILITY, BUT er remarkable experiment which companied the Rosetta space- is highly ingenious in its unor- craft touched down on Comet 67P/ ALso THE GEO- thodoxy and will require careful Churyumov-Gerasimenko (67P). -

XXVIII. Bericht Uč Ber Die Wettbewerbspolitik 1998

EuropaÈ ische Kommission XXVIII. Bericht uÈ ber die Wettbewerbspolitik 1998 (In Zusammenhang mit dem ¹Gesamtbericht uÈ ber die TaÈ tigkeit der EuropaÈ ischen Union 1998ª veroÈ ffentlichter Bericht) BruÈ ssel ð Luxemburg, 1999 Zahlreiche weitere Informationen zur EuropaÈ ischen Union sind verfuÈ gbar uÈ ber Internet, Server Europa (http://europa.eu.int). Bibliographische Daten befinden sich am Ende der VeroÈ ffentlichung. Luxemburg: Amt fuÈ r amtliche VeroÈ ffentlichungen der EuropaÈ ischen Gemeinschaften, 1999 ISBN 92-828-7196-7 EuropaÈ ische Gemeinschaften, 1999 Nachdruck mit Quellenangabe gestattet. Printed in Belgium GEDRUCKT AUF CHLORFREI GEBLEICHTEM PAPIER Inhalt HINWEIS FUÈ R DEN LESER 6 VORWORT VON KAREL VAN MIERT 7 Erstel Teil Ð XXVIII. Bericht uÈ ber die Wettbewerbspolitik (1998) 13 EINLEITUNG 19 I Ð Kartellverbot: Artikel 81 und 82 Staatliche Monopole und Monopolrechte: Artikel 31 und 86 27 A Ð Die Modernisierung des Rechts- und Auslegungsrahmens 27 B Ð Die Konsolidierung des Binnenmarkts 36 C Ð Die Wettbewerbspolitik in einzelnen Wirtschaftszweigen# 43 D Ð Statistischer UÈ berblick 64 II Ð Fusionskontrolle 67 A Ð Einleitung 67 B Ð Neue Entwicklungen 70 C Ð Statistischer UÈ berblick 88 III Ð Staatliche Beihilfen 91 A Ð Allgemeine Politik 91 B Ð Der Begriff der staatlichen Beihilfe 94 C Ð Vereinbarkeit staatlicher Beihilfen mit dem Gemeinsamen Markt 100 D Ð Verfahren 117 E Ð Statistischer UÈ berblick 121 IV Ð Internationale Zusammenarbeit 123 A Ð Erweiterung 123 B Ð Bilaterale Zusammenarbeit 126 C Ð Multilaterale Zusammenarbeit 131 V Ð Vorausschau 1999 135 ANHANG Ð BEHANDELTE FAÈ LLE 139 BER. WETTB. 1998 4 INHALT Zweiter Teil Ð Bericht uÈ ber die Anwendung der Wettbewerbsregelnin der EuropaÈ ischen Union 145 I Ð Kartellverbot: Artikel 81 und 82 EG-Vertrag Ð Artikel 65 und 66 EGKS-Vertrag 151 A Ð Zusammenfassung wichtiger EinzelfaÈ lle 151 B Ð Von der Kommission vorgeschlagene oder angenommene neue Rechtsvorschriften und Mitteilungen bzw. -

ANNUAL REPORT 2010 | 2011 HORNBACH HOLDING AG GROUP Contents

ANNUAL REPORT 2010 | 2011 HORNBACH HOLDING AG GROUP contents Company Profile 4 To Our Shareholders 8 The HORNBACH HOLDING Share 12 Financial Calendar 15 Corporate Governance 16 Group Management Report of HORNBACH HOLDING AG 26 Macroeconomic Framework 26 Sales Performance 30 Earnings Performance 34 Financial Situation 38 Asset Situation 42 Non-Financial Performance Indicators 47 Other Disclosures 55 Risk Report 56 Outlook 63 Retail and Real Estate 76 Directors and Off icers 80 Report of the Supervisory Board 81 Consolidated Financial Statements 86 Income Statement of the HORNBACH HOLDING AG Group 86 Balance Sheet of the HORNBACH HOLDING AG Group 87 Statement of Changes in Equity of the HORNBACH HOLDING AG Group 88 Cash Flow Statement of the HORNBACH HOLDING AG Group 89 Notes to the Consolidated Financial Statements 90 Segment Report 107 Responsibility Statement 155 Auditor’s Report 156 4 COMPANY PROFILE COMPANY PROFILE HORNBACH HOLDING AG is the parent company of the HORNBACH The consistent implementation of the company’s concept, coupled Group. It is not itself an operating company, but has a number of with the high expectations it places in the quality of its locations, major subsidiaries. By far the largest and most important subsidiary its stores, its product range and employees, have facilitated the is HORNBACH-Baumarkt-AG, which operates DIY megastores in dynamic growth witnessed by the company in recent years. Together, Germany and abroad. The retail activities of the Group are supple- these factors form the basis for further expansion in the DIY mega- mented by HORNBACH Baustoff Union GmbH, which is active in the store and garden center segment in Germany and Europe.