RESIDENTIAL 1Q 2017 11 May 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

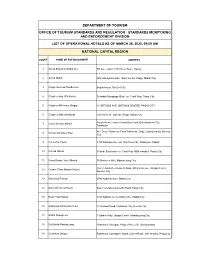

Standards Monitoring and Enforcement Division List Of

DEPARTMENT OF TOURISM OFFICE OF TOURISM STANDARDS AND REGULATION - STANDARDS MONITORING AND ENFORCEMENT DIVISION LIST OF OPERATIONAL HOTELS AS OF MARCH 26, 2020, 09:00 AM NATIONAL CAPITAL REGION COUNT NAME OF ESTABLISHMENT ADDRESS 1 Ascott Bonifacio Global City 5th ave. Corner 28th Street, BGC, Taguig 2 Ascott Makati Glorietta Ayala Center, San Lorenzo Village, Makati City 3 Cirque Serviced Residences Bagumbayan, Quezon City 4 Citadines Bay City Manila Diosdado Macapagal Blvd. cor. Coral Way, Pasay City 5 Citadines Millenium Ortigas 11 ORTIGAS AVE. ORTIGAS CENTER, PASIG CITY 6 Citadines Salcedo Makati 148 Valero St. Salcedo Village, Makati city Asean Avenue corner Roxas Boulevard, Entertainment City, 7 City of Dreams Manila Paranaque #61 Scout Tobias cor Scout Rallos sts., Brgy. Laging Handa, Quezon 8 Cocoon Boutique Hotel City 9 Connector Hostel 8459 Kalayaan Ave. cor. Don Pedro St., POblacion, Makati 10 Conrad Manila Seaside Boulevard cor. Coral Way MOA complex, Pasay City 11 Cross Roads Hostel Manila 76 Mariveles Hills, Mandaluyong City Corner Asian Development Bank, Ortigas Avenue, Ortigas Center, 12 Crowne Plaza Manila Galleria Quezon City 13 Discovery Primea 6749 Ayala Avenue, Makati City 14 Domestic Guest House Salem Complex Domestic Road, Pasay City 15 Dusit Thani Manila 1223 Epifanio de los Santos Ave, Makati City 16 Eastwood Richmonde Hotel 17 Orchard Road, Eastwood City, Quezon City 17 EDSA Shangri-La 1 Garden Way, Ortigas Center, Mandaluyong City 18 Go Hotels Mandaluyong Robinsons Cybergate Plaza, Pioneer St., Mandaluyong 19 Go Hotels Ortigas Robinsons Cyberspace Alpha, Garnet Road., San Antonio, Pasig City 20 Gran Prix Manila Hotel 1325 A Mabini St., Ermita, Manila 21 Herald Suites 2168 Chino Roces Ave. -

An All-Time Record 97 Buildings of 200 Meters Or Higher Completed In

CTBUH Year in Review: Tall Trends All building data, images and drawings can be found at end of 2014, and Forecasts for 2015 Click on building names to be taken to the Skyscraper Center An All-Time Record 97 Buildings of 200 Meters or Higher Completed in 2014 Report by Daniel Safarik and Antony Wood, CTBUH Research by Marty Carver and Marshall Gerometta, CTBUH 2014 showed further shifts towards Asia, and also surprising developments in building 60 58 14,000 13,549 2014 Completions: 200m+ Buildings by Country functions and structural materials. Note: One tall building 200m+ in height was also completed during 13,000 2014 in these countries: Chile, Kuwait, Malaysia, Singapore, South Korea, 50 Taiwan, United Kingdom, Vietnam 60 58 2014 Completions: 200m+ Buildings by Countr5,00y 0 14,000 60 13,54958 14,000 13,549 2014 Completions: 200m+ Buildings by Country Executive Summary 40 Note: One tall building 200m+ in height was also completed during ) Note: One tall building 200m+ in height was also completed during 13,000 60 58 13,0014,000 2014 in these countries: Chile, Kuwait, Malaysia, Singapore, South Korea, (m 13,549 2014 in these Completions: countries: Chile, Kuwait, 200m+ Malaysia, BuildingsSingapore, South byKorea, C ountry 50 Total Number (Total = 97) 4,000 s 50 Taiwan,Taiwan, United United Kingdom, Kingdom, Vietnam Vietnam Note: One tall building 200m+ in height was also completed during ht er 13,000 Sum of He2014 igin theseht scountries: (Tot alChile, = Kuwait, 23,333 Malaysia, m) Singapore, South Korea, 5,000 mb 30 50 5,000 The Council -

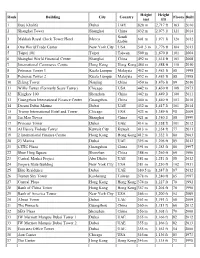

List of World's Tallest Buildings in the World

Height Height Rank Building City Country Floors Built (m) (ft) 1 Burj Khalifa Dubai UAE 828 m 2,717 ft 163 2010 2 Shanghai Tower Shanghai China 632 m 2,073 ft 121 2014 Saudi 3 Makkah Royal Clock Tower Hotel Mecca 601 m 1,971 ft 120 2012 Arabia 4 One World Trade Center New York City USA 541.3 m 1,776 ft 104 2013 5 Taipei 101 Taipei Taiwan 509 m 1,670 ft 101 2004 6 Shanghai World Financial Center Shanghai China 492 m 1,614 ft 101 2008 7 International Commerce Centre Hong Kong Hong Kong 484 m 1,588 ft 118 2010 8 Petronas Tower 1 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 8 Petronas Tower 2 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 10 Zifeng Tower Nanjing China 450 m 1,476 ft 89 2010 11 Willis Tower (Formerly Sears Tower) Chicago USA 442 m 1,450 ft 108 1973 12 Kingkey 100 Shenzhen China 442 m 1,449 ft 100 2011 13 Guangzhou International Finance Center Guangzhou China 440 m 1,440 ft 103 2010 14 Dream Dubai Marina Dubai UAE 432 m 1,417 ft 101 2014 15 Trump International Hotel and Tower Chicago USA 423 m 1,389 ft 98 2009 16 Jin Mao Tower Shanghai China 421 m 1,380 ft 88 1999 17 Princess Tower Dubai UAE 414 m 1,358 ft 101 2012 18 Al Hamra Firdous Tower Kuwait City Kuwait 413 m 1,354 ft 77 2011 19 2 International Finance Centre Hong Kong Hong Kong 412 m 1,352 ft 88 2003 20 23 Marina Dubai UAE 395 m 1,296 ft 89 2012 21 CITIC Plaza Guangzhou China 391 m 1,283 ft 80 1997 22 Shun Hing Square Shenzhen China 384 m 1,260 ft 69 1996 23 Central Market Project Abu Dhabi UAE 381 m 1,251 ft 88 2012 24 Empire State Building New York City USA 381 m 1,250 -

Notice of Filing of Application/S for Alien Employment Permit/S (Aep/S)

PM-NCR-03.01-F.05 NOTICE OF FILING OF APPLICATION/S FOR ALIEN EMPLOYMENT PERMIT/S (AEP/S) Notice is hereby given that the following companies/Employers have filed with this Regional Office application/s for Alien Employment Permit/s: Name and Address of Company/Employ Name of Foreign Position National/Citizenship 1 24/7 BUSINESS PROCESSING INC. Yang, Mengjiao Customer Service 5th - 7th Floor, 81 Newport BL, Newport City, Brgy. Representative (Chinese 183, Pasay City, Metro Manila Chinese Accounts) 2 24/7 BUSINESS PROCESSING INC. Cheng, Xianying Customer Service 5th - 7th Floor, 81 Newport BL, Newport City, Brgy. Representative (Chinese 183, Pasay City, Metro Manila Chinese Accounts) 3 24/7 BUSINESS PROCESSING INC. Zhang, Qian Customer Service 5th - 7th Floor, 81 Newport BL, Newport City, Brgy. Representative (Chinese 183, Pasay City, Metro Manila Chinese Accounts) 4 3D ANALYZER INFORMATION Wu, Zhinan Chinese Speaking Customer TECHNOLOGIES INC. Service Representative 7-8/F Double Dragon Plaza, 255 EDSA Cor. Chinese Macapagal Blvd., Brgy. 076, Pasay City, Metro Manila 5 3D ANALYZER INFORMATION Li, Wenyong Chinese Speaking Customer TECHNOLOGIES INC. Service Representative 7-8/F Double Dragon Plaza, 255 EDSA Cor. Chinese Macapagal Blvd., Brgy. 076, Pasay City, Metro Manila If you have any information/objection to the above mentioned application/s, please communicate with the Regional Director thru Employment Promotion and Workers Welfare (EPWW) Division with Telephone No. 400-6011. ATTY. SARAH BUENA S. MIRASOL ATTY. SARAH BUENA S. MIRASOL REGIONAL DIRECTOR Page 1 of 264 PM-NCR-03.01-F.05 NOTICE OF FILING OF APPLICATION/S FOR ALIEN EMPLOYMENT PERMIT/S (AEP/S) Notice is hereby given that the following companies/Employers have filed with this Regional Office application/s for Alien Employment Permit/s: Name and Address of Company/Employ Name of Foreign Position National/Citizenship 6 3D ANALYZER INFORMATION Pan, Da Chinese Speaking Customer TECHNOLOGIES INC. -

Preliminary Prospectus to the Primary Offer of Series 2 Preferred Shares Dated 04 November 2020

The prospectus is being displayed in the website to make the prospectus accessible to more investors. The Philippine Stock Exchange (PSE) assumes no responsibility for the correctness of any of the statements made or opinions or reports expressed in the prospectus. Furthermore, the PSE makes no representation as to the completeness of the prospectus and disclaims any liability whatsoever for any loss arising from or in reliance in whole or in part on the contents of the prospectus. MEGAWIDE CONSTRUCTION CORPORATION 20 N. Domingo Street, Brgy. Valencia, Quezon City, Metro Manila Telephone No. +63 2 8655 1111 Preliminary Prospectus relating to the Primary Offer in the Philippines of 30,000,000 Non-Voting Perpetual Series 2 Preferred Shares with an Oversubscription Option for up to 20,000,000 Non-Voting Perpetual Series 2 Preferred Shares consisting of Series 2A Preferred Shares “MWP2A” Series 2B Preferred Shares “MWP2B” at an Offer Price of 100.00 per Preferred Share to be listed and traded on the Main Board of The Philippine Stock Exchange, Inc. Sole Issue Manager Joint Lead Underwriters and Bookrunners Selling Agents Trading Participants of the Philippine Stock Exchange, Inc. THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED THESE SECURITIES OR DETERMINED IF THIS PRELIMINARY PROSPECTUS IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE AND SHOULD BE REPORTED IMMEDIATELY TO THE SECURITIES AND EXCHANGE COMMISSION. This Preliminary Prospectus is dated November 4, 2020. 1 1 MEGAWIDE CONSTRUCTION CORPORATION -

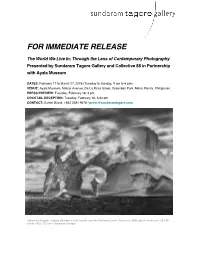

For Immediate Release

FOR IMMEDIATE RELEASE The World We Live In: Through the Lens of Contemporary Photography Presented by Sundaram Tagore Gallery and Collective 88 in Partnership with Ayala Museum DATES: February 17 to March 27, 2016 (Tuesday to Sunday, 9 am to 6 pm) VENUE: Ayala Museum, Makati Avenue, De La Rosa Street, Greenbelt Park, Metro Manila, Philippines PRESS PREVIEW: Tuesday, February 16, 3 pm COCKTAIL RECEPTION: Tuesday, February 16, 6:30 pm CONTACT: Esther Bland, +852 2581 9678 / [email protected] Sebastião Salgado, Iceberg Between Paulet Islands and the Shetland Islands, Antarctica, 2005, gelatin silver print, 36 x 50 inches / 92 x 127 cm © Amazonas Images New York, January 4, 2016—Sundaram Tagore Gallery and Collective 88, in partnership with Ayala Museum, present The World We Live In: Through the Lens of Contemporary Photography, a specially curated exhibition that portrays how contemporary photographers document and interpret the world around us, creating images that are both aesthetically thrilling and deeply thought-provoking. The exhibition includes five iconic photographers represented by Sundaram Tagore Gallery in Asia: Sebastião Salgado, Steve McCurry, Robert Polidori, Edward Burtynsky and Annie Leibovitz. These highly acclaimed individuals share a truly global perspective in their artistic endeavors, while individually crafting unique and often breathtaking visual narratives of key issues of contemporary culture. Sebastião Salgado and Steve McCurry share a photojournalistic approach, recording human struggle and the impacts of conflict and globalization. Robert Polidori’s atmospheric photographs of buildings around the world altered by the passage of time and the people who have lived in them are investigations into the cultural values embedded in the human habitat. -

(CAO) As of 05 February 2021

ACCOMMODATION ESTABLISHMENTS WITH CERTIFICATE OF AUTHORITY TO OPERATE (CAO) as of 05 February 2021 NAME OF ACCREDITATION CERTIFICATE OPERATIONAL QUARANTINE OPEN FOR ADDRESS CONTACT DETAILS CLASSIFICATION ESTABLISHMENT STATUS ISSUED STATUS FACILITY LEISURE CORDILLERA ADMINISTRATIVE REGION (CAR) BAGUIO CITY (074) 422-2075-76-80/ John Hay Special theforestlodge@campjohnhayhotel THE FOREST LODGE AT Economic Zone, Loakan s.ph/ Accredited 4 STAR HTL CAO OPEN No Yes CAMP JOHN HAY Road, Baguio City [email protected] h The Manor at Camp John THE MANOR AT CAMP (074) 424-0931 to 50/ Hay, Loakan Road, Accredited 4 STAR RES CAO OPEN No Yes JOHN HAY [email protected] Baguio City #1 J Felipe Street, (074) 619-0367/ HOTEL ELIZABETH Gibraltar Road, Baguio salesaccount2.baguio@hotelelizab Accredited 3 STAR HTL CAO OPEN No Yes BAGUIO City eth.com.ph #40 Bokawkan Rd., 09173981120/ (074) 442-3350/ Mabuhay PINE BREEZE COTTAGES Accredited CAO OPEN No Yes Baguio City [email protected] Accommodation #01 Apostol St., Corner (074) 442-1559/ 09176786874/ MINES VIEW PARK HOTEL Outlook Drive, Mines 09190660902/ Accredited Hotel CAO OPEN No Yes View, Baguio City [email protected] (074) 619-2050 (074) 442-7674/ Country Club Road, BAGUIO COUNTRY CLUB [email protected] Accredited 5 STAR Resort CAO OPEN No Yes Baguio City [email protected] [email protected] #37 Sepic St. Campo (074) 424-6092 (074) 620-3117/ NYC MANHATTAN HOTEL Accredited Hotel CAO OPEN No Yes Filipino, Baguio City [email protected] -

Contestable Customers As of March 2016 1 PHILIPPINE ECONOMIC ZONE AUTHORITY 2 14-678 PROPERTY HOLDINGS, INC

Contestable Customers as of March 2016 1 PHILIPPINE ECONOMIC ZONE AUTHORITY 2 14-678 PROPERTY HOLDINGS, INC. 3 18-2 PROPERTY HOLDINGS, INC 4 19-1 PROPERTY HOLDINGS, INC. 5 20-12 PROPERTY HOLDINGS, INC. 6 20-34 PROPERTY HOLDINGS. INC. 7 21ST CENTURY STEEL MILLS, INC 8 3-J PLASTICWORLD & MANUFACTURING CORP. 9 557 DRESSING PLANT/557 FEATHER MEAL CORP. 10 6-24 PROPERTY HOLDINGS, INC. 11 6-3 PROPERTY HOLDINGS, INC. 12 6776 AYALA AVENUE CONDOMINIUM CORPORATION 13 A. D. GOTHONG MANUFACTURING. CORP. 14 ABC DEVELOPMENT CORPORATION 15 ABS-CBN CORPORATION 16 ABS-CBN CORPORATION 17 ABSOLUT CHEMICALS 18 ACBEL POLYTECH(PHILIPPINES)INC 19 ACCUPRINT INCORPORATED 20 ACES AMC I.P.P.C/ MAGNOLIA 21 ACESITE (PHILS.) HOTEL CORPORATION 22 ACP TEST COMPANY, INC. 23 ADEBE REALTY COMPANY, INC. 24 ADEBE REALTY COMPANY, INC. 25 ADRIATICO CONSORTIUM, INC. 26 AEGIS PEOPLE SUPPORT REALTY CORPORATION 27 AFC FERTILIZER AND CHEMICALS, INC. 28 AFP GEH HQTRS SERV GRP 29 AFP HNDF PHIL ARMY 30 AGC FLAT GLASS PHILIPPINES, INC. 31 AICHI FORGING CO. OF ASIA, INC. 32 AIKAWA PHILIPPINES INC. 33 AIR EDUCATION AND TRAINING COMMAND-FAB 34 AIR LIQUIDE PHILIPPINES, INC. 35 AIR LIQUIDE PIPELINE UTILITIES 36 AIR LIQUIDE PIPELINE UTILITIES SERVICES, INC. 37 AIR LIQUIDE PIPELINE UTILITIES SERVICES, INC. 38 AIR TRANSPORTATION OFFICE (ILOILO INTERNATIONAL AIRPORT) 39 AJINOMOTO PHILIPPINES FLAVOR FOOD INC. 40 ALABANG COMMERCIAL CORPORATION 41 ALABANG COMMERCIAL CORPORATION 42 ALASCO VINYL CORPORATION 43 ALASKA MILK CORPORATION 44 ALBAY AGRO-INDUSTRIAL DEVELOPMENT CORPORATION 45 ALI MAKATI HOTEL PROPERTY, INC. 46 ALI/TONGCO, MA. CLAVEL G. 47 ALI-CII DEVELOPMENT CORPORATION 48 ALLEGRO MICROSYSTEMS PHILIPPINES,INC. -

PHASE I QUALIFIED CONTESTABLE CUSTOMERS (July 2021 Data)

QUALIFIED CONTESTABLE CUSTOMERS (July 2021 Data) PHASE I NAME LOCATION 1 20-12 PROPERTY HOLDINGS, INC. TAGUIG CITY 2 20-34 PROPERTY HOLDINGS, INC. TAGUIG CITY 3 21ST CENTURY STEEL MILL INC. TAYTAY, RIZAL 4 557 FEATHER MEAL CORPORATION CONCEPCION, TARLAC 5 6776 AYALA AVENUE CONDOMINIUM CORPORATION MAKATI CITY 6 7TH INFANTRY DIV. PHIL ARMY PALAYAN CITY, NUEVA ECIJA 7 A.D. GOTHONG MANUFACTURING CORPORATION MANDAUE CITY, CEBU 8 AAC PLANTSITE NEGROS OCCIDENTAL 9 ABENSON INC. PASAY CITY 10 ABS-CBN CORPORATION (200397770101) QUEZON CITY 11 ABS-CBN CORPORATION (200397910101) QUEZON CITY 12 ABSOLUT CHEMICALS LIAN, BATANGAS 13 ACCUPRINT INCORPORATED QUEZON CITY 14 ACESITE (PHILS.) HOTEL CORPORATION MANILA CITY 15 ACI, INC. (200160740101) QUEZON CITY 16 ADEBE REALTY COMPANY, INC. (100146610101) MAKATI CITY 17 ADEBE REALTY COMPANY, INC. (100146620101) MAKATI CITY 18 ADRIATICO CONSORTIUM, INC. MANILA CITY 19 AEGIS PEOPLE SUPPORT REALTY CORPORATION CEBU CITY 20 AFC FERTILIZER AND CHEMICALS, INC. CEBU CITY 21 AFP HNDF PHIL ARMY QUEZON CITY 22 AGRIPACIFIC CORPORATION TANZA, CAVITE 23 AICHI FORGE PHILIPPINES, INC. STA. ROSA, LAGUNA 24 AIKAWA PHILIPPINES INC. STO. TOMAS, BATANGAS 25 AIR LIQUIDE PHILIPPINES, INC. PASIG CITY 26 AIR LIQUIDE PIPELINE UTILITIES SERVICES, INC. (200150140101) CALAMBA, LAGUNA 27 AIR LIQUIDE PIPELINE UTILITIES SERVICES, INC. (9169094711) BALAMBAN CEBU AIR TRANSPORTATION OFFICE (ILOILO INTERNATIONAL 28 CABATUAN, ILOILO AIRPORT) 29 ALABANG COMMERCIAL CORPORATION (100000240101) MUNTINLUPA CITY 30 ALABANG COMMERCIAL CORPORATION (100072280101) MUNTINLUPA CITY 31 ALASKA MILK CORPORATION SAN PEDRO, LAGUNA 32 ALBAY-AGRO INDUSTRIAL DEVELOPMENT CORPORATION MALINAO 33 ALI MAKATI HOTEL PROPERTY, INC. MAKATI CITY 34 ALI-CII DEVELOPMENT CORPORATION PASAY CITY 35 ALLEGRO MICROSYSTEMS PHILIPPINES,INC. -

Resume 201512

COMPLETED CONSULTING PROJECTS Type of Project Project Name Client Airports Caticlan Airport San Miguel Corporation NAIA IPT 3 Review TCGI Engineers Embassies British Embassy British Embassy Qatar Embassy Astec US Embassy Manila Ayala Land Inc./MDC Excavation Protection 6786 Nova Century Properties 81 Newport IPM Alveo Highpark Ayala Land Inc./MDC Annapolis Building We Enterprises Ascott BGC Winsome Development Corp. Avida 34th Street Mega Philippines Avida Capital House Ayala Land Inc./MDC Bridgetowne (Exxa and Zeta) We Enterprises Bristle Ridge DMCI Homes Cebu Marco Polo Residences Federal Land, Inc. Century BGC Century Properties Century Spire We Enterprises Citynet Central We Enterprises Corinthian Hills Mansion Parade Megaworld Corp. Ecoprime Ecoprime Estancia Mall Hong Drill Estancia Mall We Enteprises Every Nation BGC Hong Drill Finance Centre Daiichi Properties Fortune Hills IPM Garden Towers Ayala Land Inc./MDC Globe Telecoms Building Ayala Land Inc./MDC Grand Hyatt Federal Land, Inc. Hamilton Tower 2 IPM Horizon 101 Taft Property HSS Tower 2 Mega Philippines Imperium Project We Enterprises Jabba Ayala Land Inc./MDC Lopez Tower We Enterprises Magnolia Residences IPM Makati North Gateway 1 Ayala Land Inc./MDC Marriott We Enterprises Marriott Tunnel We Enterprises Mayflower BPO IPM MDC HQ Ayala Land Inc./MDC Net Park We Enterprises Newport PP3 IPM Northwest Superblock Hong Drill One Meridien Ayala Land Inc./MDC One World Place Daiichi Properties Oxford Parksuites Anchor Land Holdings Inc. Park Triangle Ayala Land Inc./MDC Paseo de Roxas - Villar Underpass Ayala Land Inc./MDC Philamlife Cebu We Enterprises Project Jade We Enterprises Robinsons Galleria Cebu Monolith Construction Royalton We Enterprises Type of Project Project Name Client Senta Building Ayala Land Inc./MDC SM Keppel IPM Somerset Alabang We Enterprises Sotogrande We Enterprises Sun Residences SM Development Corp. -

Notice of Filing of Application/S for Alien Employment Permit/S (Aep/S)

PM-NCR-03.01-F.05 NOTICE OF FILING OF APPLICATION/S FOR ALIEN EMPLOYMENT PERMIT/S (AEP/S) Notice is hereby given that the following companies/Employers have filed with this Regional Office application/s for Alien Employment Permit/s: Name and Address of Company/Employ Name of Foreign Position National/Citizenship 1 24/7 BUSINESS PROCESSING INC. Ting Yang Ying, Customer Service 5th - 7th Floor, 81 Newport BL, Newport City, Brgy. Representative (Chinese 183, Pasay City, Metro Manila Malaysian Accounts) 2 24/7 BUSINESS PROCESSING INC. Wang, Dian Customer Service 5th - 7th Floor, 81 Newport BL, Newport City, Brgy. Representative (Chinese 183, Pasay City, Metro Manila Chinese Accounts) 3 24/7 BUSINESS PROCESSING INC. Nie, Fadian Customer Service 5th - 7th Floor, 81 Newport BL, Newport City, Brgy. Representative (Chinese 183, Pasay City, Metro Manila Chinese Accounts) 4 24/7 BUSINESS PROCESSING INC. Chen, Zikai Customer Service 5th - 7th Floor, 81 Newport BL, Newport City, Brgy. Representative (Chinese 183, Pasay City, Metro Manila Chinese Accounts) 5 24/7 BUSINESS PROCESSING INC. Chen, Xiaozhu Customer Service 5th - 7th Floor, 81 Newport BL, Newport City, Brgy. Representative (Chinese 183, Pasay City, Metro Manila Chinese Accounts) If you have any information/objection to the above mentioned application/s, please communicate with the Regional Director thru Employment Promotion and Workers Welfare (EPWW) Division with Telephone No. 400-6011. ATTY. SARAH BUENA S. MIRASOL ATTY. SARAH BUENA S. MIRASOL REGIONAL DIRECTOR Page 1 of 282 PM-NCR-03.01-F.05 NOTICE OF FILING OF APPLICATION/S FOR ALIEN EMPLOYMENT PERMIT/S (AEP/S) Notice is hereby given that the following companies/Employers have filed with this Regional Office application/s for Alien Employment Permit/s: Name and Address of Company/Employ Name of Foreign Position National/Citizenship 6 24/7 BUSINESS PROCESSING INC. -

SEC Form 17-A Annual Report

COVER SHEET SEC Registration Number 6 2 8 9 3 Company Name R O C K W E L L L A N D C O R P O R A T I O N A N D S U B S I D I A R I E S Principal Office (No./Street/Barangay/City/Town/Province) 2 F , 8 R O C K W E L L , H I D A L G O D R I V E R O C K W E L L C E N T E R , M A K A T I C I T Y Form Type Department requiring the report Secondary License Type, If Applicable 1 7 - A N / A COMPANY INFORMATION Company’s Email Address Company’s Telephone Number/s Mobile Number [email protected] 7-793-0088 N/A Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 46,263 (as of 31 MAY 2020) August 28, 2020 December 31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Number/s Mobile Number Ms. Ellen V. Almodiel [email protected] 7-793-0088 N/A Contact Person’s Address Ground Floor, East Podium, Joya Lofts & Towers, 28 Plaza Drive, Rockwell Center, Makati City 1200 Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated.