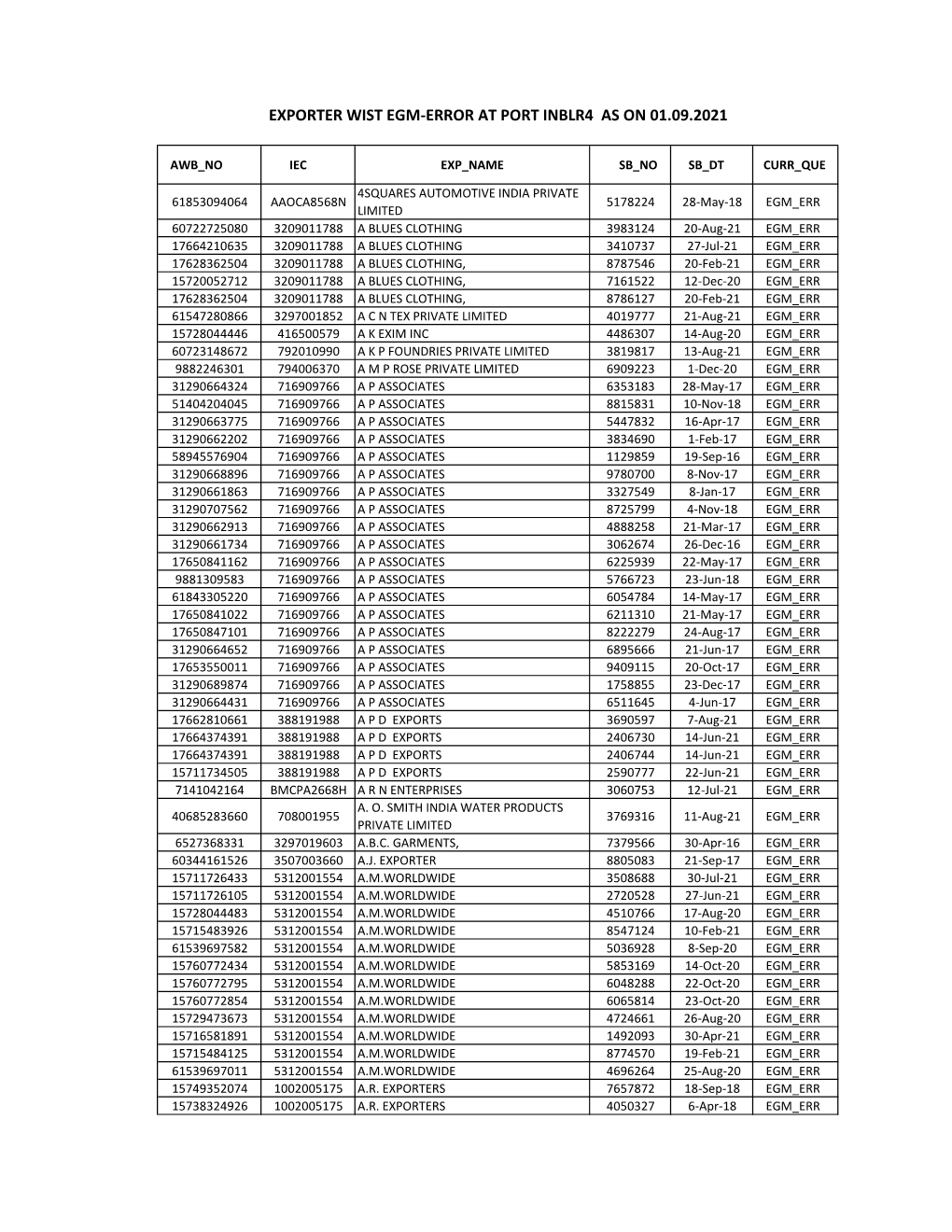

Sbs in EGM Error Queue At

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mahindra & Mahindra

Mahindra & Mahindra (MAHMAH) CMP: | 866 Target: | 1,000 (16%) Target Period: 12 months BUY February 7, 2021 Further strength up ahead… Mahindra & Mahindra (M&M) reported a healthy operational performance in Q3FY21. Standalone net sales were at | 14,216 crore (up 15.2% YoY) – with Particulars automotive and tractor ASPs at | 6.92 lakh/unit (down 1.6% QoQ) and | 5.19 Particular Amount lakh/unit (flat QoQ), respectively. Standalone EBITDA margins at 16% dipped 12 bps QoQ, as operating leverage benefits cancelled out 150 bps Market Capitalization (₹ crore) 1,07,661.1 ₹ contraction in gross margins. Automotive EBIT margins rose ~210 bps QoQ Total Debt (FY20, crore) 3,068.0 Cash and Inv (FY20, ₹ crore) 6,426.1 to 6.3% while tractor margins were down ~100 bps QoQ to 23.4%. EV (FY20, ₹ crore) 1,04,303.1 Standalone PAT for the quarter came in at | 31 crore, impacted by a large 52 week H/L (₹) 893 / 246 Result Update Result impairment hit of | 1,692 crore in relation to long term investments. Equity capital (₹ crore) (FY20) 596.5 Strong volume headroom up ahead once supply concerns ease Face value (₹) ₹ 5 Price Performance M&M’s automotive and tractor performance continues to be on divergent 1000 20,000 paths – total automotive volumes are down 35% YoY in 9MFY21, thus far 750 15,000 (comprises~25% UV decline & ~26% drop in <3.5T LCVs i.e. pickups) while 500 10,000 tractors are up ~11% YoY. Auto performance has been hampered by slow 250 5,000 ramp up due to manufacturing presence in Maharashtra (among the worst hit by the pandemic) and fresh semiconductor shortage. -

OTC TCS 2005.Pdf

1 Annual Report 2004-05 Contents Board of Directors ............................................................................................................................................................................................................................... 3 Management Team ............................................................................................................................................................................................................................. 4 Message from the CEO...................................................................................................................................................................................................................... 6 Notice........................................................................................................................................................................................................................................................ 8 Directors' Report ............................................................................................................................................................................................................................... 15 Management Discussion and Analysis ................................................................................................................................................................................... 30 Corporate Governance Report................................................................................................................................................................................................... -

Franklin India Fund LU0231204701 31 August 2021

Franklin Templeton Investment Funds India Equity Franklin India Fund LU0231204701 31 August 2021 Fund Fact Sheet For Professional Client Use Only. Not for distribution to Retail Clients. Fund Overview Performance Base Currency for Fund USD Performance over 5 Years in Share Class Currency (%) Total Net Assets (USD) 1.44 billion Franklin India Fund I (acc) USD MSCI India Index-NR Fund Inception Date 25.10.2005 200 Number of Issuers 45 180 Benchmark MSCI India Index-NR 160 Investment Style Blend Morningstar Category™ India Equity 140 Summary of Investment Objective 120 The Fund aims to achieve long-term capital appreciation by 100 principally investing in equity securities of companies of any size located or performing business predominately in India. 80 Fund Management 60 08/16 02/17 08/17 02/18 08/18 02/19 08/19 02/20 08/20 02/21 08/21 Sukumar Rajah: Singapore Discrete Annual Performance in Share Class Currency (%) Ratings - I (acc) USD 08/20 08/19 08/18 08/17 08/16 08/21 08/20 08/19 08/18 08/17 Overall Morningstar Rating™: I (acc) USD 53.68 3.31 -9.75 -0.35 12.92 Asset Allocation Benchmark in USD 53.15 3.00 -7.64 7.12 17.46 Performance in Share Class Currency (%) Cumulative Since 1 Mth 3 Mths 6 Mths YTD 1 Yr 3 Yrs 5 Yrs Incept I (acc) USD 8.00 10.33 21.17 24.53 53.68 43.28 61.24 518.48 % Benchmark in USD 10.94 11.12 22.35 25.75 53.15 45.68 83.30 371.80 Equity 103.05 Category Average 7.59 10.63 20.10 25.82 52.53 37.90 66.00 355.61 Cash & Cash Equivalents -3.05 Calendar Year Performance in Share Class Currency (%) 2020 2019 2018 2017 2016 I (acc) USD 13.92 8.35 -14.74 39.23 2.82 Benchmark in USD 15.55 7.58 -7.31 38.76 -1.43 Past performance is not an indicator or a guarantee of future performance. -

Franklin India Fund LU1212701376 31 August 2021

Franklin Templeton Investment Funds India Equity Franklin India Fund LU1212701376 31 August 2021 Fund Fact Sheet For Professional Client Use Only. Not for distribution to Retail Clients. Fund Overview Performance Base Currency for Fund USD Performance over 5 Years in Share Class Currency (%) Total Net Assets (USD) 1,44 billion Franklin India Fund A (acc) EUR-H1 MSCI India Index-NR in USD Fund Inception Date 25.10.2005 190 Number of Issuers 45 170 Benchmark MSCI India Index-NR 150 Morningstar Category™ Other Equity 130 Summary of Investment Objective The Fund aims to achieve long-term capital appreciation by 110 principally investing in equity securities of companies of any size located or performing business predominately in India. 90 Fund Management 70 Sukumar Rajah: Singapore 50 08/16 02/17 08/17 02/18 08/18 02/19 08/19 02/20 08/20 02/21 08/21 Asset Allocation Discrete Annual Performance in Share Class Currency (%) 08/20 08/19 08/18 08/17 08/16 08/21 08/20 08/19 08/18 08/17 A (acc) EUR-H1 50,51 -1,01 -13,58 -3,55 9,44 Benchmark in USD 53,15 3,00 -7,64 7,12 17,46 % Performance in Share Class Currency (%) Equity 103,05 Cumulative Annualised Cash & Cash Equivalents -3,05 Since Since 1 Mth 3 Mths 6 Mths 1 Yr 3 Yrs 5 Yrs Incept 3 Yrs 5 Yrs Incept A (acc) EUR-H1 7,78 9,87 19,92 50,51 28,75 35,90 46,91 8,79 6,33 6,24 Benchmark in USD 10,94 11,12 22,35 53,15 45,68 83,30 84,41 13,36 12,89 10,11 Calendar Year Performance in Share Class Currency (%) 2020 2019 2018 2017 2016 A (acc) EUR-H1 9,54 4,01 -17,74 34,53 0,74 Benchmark in USD 15,55 7,58 -7,31 38,76 -1,43 Past performance is not an indicator or a guarantee of future performance. -

ICICI Securities – Retail Equity Research Result Update Marico

Marico (MARLIM) CMP: | 546 Target: | 630 (15%) Target Period: 12 months BUY August 1, 2021 Saffola growth momentum continues… About the stock: Marico is one of the major FMCG companies present in hair oil, edible oil, foods & personal care segment. Major brands include Parachute, Saffola, Nihar, Hair & Care, Set Wet, Livon and Beardo. Particulars The company has an overall distribution network of more than 5 million Particulars (| crore) Amount outlets and direct reach of ~1 million outlets. Through its stockist network, Market Capitalization 70,503.0 it reaches 58000 villages Total Debt (FY21) 340.0 Cash and Investments (FY21) 1,572.0 Update Result With the high gross margins of ~47%, Marico is able to spend 10% of its EV 69,271.0 sales for advertisements to support new categories & products 52 week H/L (|) 552 / 333 Equity capital 129.0 Face value (|) 1.0 Q1FY22 Results: Marico reported robust revenue growth in Q1FY22 results. Shareholding pattern Sales were up 31.2% YoY with strong volume recovery and price hikes (in %) Sep-20 Dec-20 Mar-21 Jun-21 EBITDA was at | 481 crore, up 3.1% YoY, with margins at 19% Promoter 59.6 59.6 59.6 59.6 FII 23.7 24.2 24.0 25.0 Consequent PAT was at | 365 crore (down 5.3% YoY) DII 10.4 10.2 10.2 9.7 Others 6.3 6.0 6.2 5.7 What should investors do? Marico’s share price has given 84% return in the last five years (from | 297 in July 2016 to | 547 in July 2021). -

Invesco India Equity Fund a (HKD)-Acc Shares 31 August 2021

Invesco India Equity Fund A (HKD)-Acc Shares 31 August 2021 This marketing communication is for investors in Switzerland only. Investors should read the legal documents prior to investing. Fund Strategy Summary of fund objective The fund aims to achieve long-term capital growth by investing principally in equity or similar The Fund is actively managed. instruments of Indian companies. We believe India is a high growth market with wealth of The objective of the Fund is to achieve investment opportunities, and that by focusing on stock fundamentals, we can identify long-term capital growth by investing “Quality Growth” companies with strong business models, industry leadership, competitive principally in equity or similar instruments advantages, strong management and what the believe to be reasonable valuations. We of Indian companies. For the full objectives adhere to a purely bottom-up investment process with a conviction-based approach and and investment policy please consult the preference for private enterprises. While the fund does not have any binding investment current prospectus. restrictions based on ESG, we believe ESG characteristics can positively impact financial performance and conduct in-depth proprietary research to assign ESG risk ratings. Key facts Indexed performance* Fund Benchmark 200 180 160 Shekhar 140 Sambhshivan 120 Hong Kong 100 Managed fund since May 2006 80 60 Share class launch 40 07 July 2011 08/16 08/17 08/18 08/19 08/20 08/21 Original fund launch 1 02 December 1994 The performance period shown here starts on the last day of the first indicated month and ends on the last day of the last indicated month. -

Ambuja Cements ( AMBCEM)

Ambuja Cements ( AMBCEM) CMP: | 407 Target: | 490 (20%) Target Period: 12 months BUY July 26, 2021 Beats estimates with strong margins… About the stock: Ambuja Cement (a Holcim group company) is a large cement player with capacity of over 29.7 MT spread across North-Central (40%), West (~35%) and East (~25%) India. It has a large marketing set-up, pan-India presence and strong operational linkages with ACC. Particulars The upcoming new capacity at Rajasthan will enhance its cement capacity by Particular Amount 1.8 MT to 31.5 MT and clinker capacity by 3.0 MT Market cap | 80816 crore Debt (CY20) | 72 crore Result Update Result In the long run, the company plans to reach over ~50 MT capacity through Cash & Invest (CY20) | 686 crore significant de-bottlenecking and setting up of satellite grinding units EV | 80202 crore 52 week H/L | 410 / 196 Equity capital | 397.1 crore Q1FY22 Results: Ambuja Cement reported 149 bps QoQ expansion in margins Face value | 2 leading to better profitability despite cost pressure. Shareholding pattern Clocked revenue of | 3,371 crore, down 6.9% QoQ led by sales volumes de- (in %) Sep-20 Dec-20 Mar-21 Jun-21 growth of 11.3% to 6.4 MT. On a YoY basis, revenues were up 53.2% Promoter 63.3 63.3 63.3 63.3 EBITDA/t was up 10.8% QoQ to | 1,495/t (vs. last quarter EBITDA/t of FII 16.8 18.1 17.8 17.7 | 1,349/t). EBITDA margin was at 28.5%, up 149 bps QoQ, 112 bps YoY DII 13.3 11.5 12.4 12.5 Others 6.6 7.1 6.6 6.5 Reported PAT was at | 723.1 crore, up 59.5% YoY, 8.8% QoQ vs. -

DEBT CAPITAL MARKETS Advantage Debt Capital Markets @ YES BANK

DEBT CAPITAL MARKETS Advantage Debt Capital Markets @ YES BANK § Integrated approach of end to end Origination to Distribution resulting in efficient execution of mandates § Deep knowledge of the underlying market dynamics and strong structuring capabilities § Leveraging a strong in-house INR rates research team; supplemented by comprehensive coverage of Corporates through pro- active relationship teams § Ability to originate transactions for a wide range of issuers, across various sectors including Automobiles, Cement, Fertilizers, Infrastructure, Pharmaceuticals, Power and Retail etc § Superior Distribution Capabilities with strong relationships across various investor categories including Banks, Financial Institutions, Mutual Funds, Insurance Companies, Non Banking Finance Companies, Provident & Pension Funds, Foreign Portfolio Investors and Private Wealth Managers 40.0% YES BANK’s outperformance vis-à-vis market 35.0% Banks / Mutual 30.0% Funds 25.0% Insurance Indian Pvt. & PSU Companies INVESTORS 20.0% Corporates 15.0% YES BANK PensionProvident/ Funds 10.0% ISSUERS Non Banking Product Suite Finance Cos. Securitisation 5.0% Preference Shares Foreign Portfolio INR Bond Underwriting/ Syndication Investors 0.0% Financial Investment Advisory & Value Added Offerings Total issuance volume Pvt sector issuance volume Institutions Market YBL Domestic PSUs Emerging Business Houses Entrepreneurs CAGR over the last five years of the total market issuance volume and YES BANK’s origination volume RELATIONSHIPS Corporate Bond issuance volumes in -

About Natural Capital Awards

an initiative endorsed by September 4, 2013, New Delhi A Compendium About Natural Capital Awards We're always planning for the future. As the species that's able to 'think', we're securing our homes and our children's future. In the process, sometimes we forget that the resources we need to truly protect are the ones that we seem to ignore: water, air, flora, fauna, and soil. To truly acknowledge the link between natural resource consumption and economic development, conserving and protecting these resources is imperative. However, we only seem to appreciate and nurture an asset once we have assigned a monetary value to it. 'Natural Capital', simply put, is the economic value of nature. Therefore, calculations must take into consideration the intangibles, such as boundless beauty, as well as the tangibles, such as the cost per unit of a natural resource. The YES BANK-Saevus Natural Capital Awards programme will endeavour to find, reward and showcase the finest natural capitalists of India, comprising individuals, groups and corporations that are dedicated towards spearheading biodiversity growth and environmental stewardship. The eminent jury panel for the awards comprises legendary Indian naturalists, photographers and environmentalists who have contributed in building natural capital. The Logo Inspiration The design of the logo is inspired by the symbol of infinity. It is representative of the continuous cycle of nature and natural capital. The continuum symbolizes the importance of the sustainable use of our resources in order to preserve and balance the reserve of natural resources for future generations. The upper section of the logo contains coloured strands that represent the 4 elements of nature – Earth, Wind, Fire, Water, which form the building blocks of our ecosystem and maintain its balance. -

Acquiring Majority Stake in ACC Investor Meetings

Strength. Performance. Passion. Acquiring Majority Stake in ACC Investor Meetings Short title, Department, Date yymmdd, Classification © 2012 Legal entity 1 Disclaimer /Safe Harbor Cautionary statement regarding forward-looking statements This presentation may contain certain forward-looking statements relating to Ambuja Cements Ltd. (“ ACL ”, or “Company ”) and its future business, development and economic performance. These statements include descriptions regarding the intent, belief or current expectations of the Company, its subsidiaries and associates and their respective directors and officers with respect to the results of operations and financial condition of the Company, subsidiary or associate, as the case may be. Such forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and assumptions that are difficult to predict. These risks and uncertainties include, but are not limited to (1) competitive pressures; (2) legislative and regulatory developments; (3) global, macroeconomic and political trends; (4) fluctuations in currency exchange rates and general financial market conditions; (5) delay or inability in obtaining approvals from authorities ; (6) technical developments ; (7) litigation ; (8) adverse publicity and news coverage, which could cause actual development and results to differ materially from the statements made in this presentation. Company assumes no obligation to update or alter forward-looking statements whether as a result of new information, -

Mahindra & Mahindra

Mahindra & Mahindra (MAHMAH) CMP: | 758 Target: | 1000 (32%) Target Period: 12 months BUY August 9, 2021 Healthy performance, firing on all cylinders… About the stock: Mahindra & Mahindra (M&M) is a conglomerate with a presence Particulars in auto, IT, financial services, logistics, hospitality, real estate among others. At the Particular Amount standalone level, it is India’s largest tractor manufacturer (38.2% FY21 market share) Market Capitalization (₹ crore) 94,483 & second largest CV, fourth largest PV maker (27.5%, 5.8% FY21 market share). Total Debt (FY21, ₹ crore) 7,667 FY21 standalone revenue mix – ~56% automotive, ~41% tractors Cash and Inv (FY21, ₹ crore) 10,744 EV (FY21, ₹ crore) 91,406 Best-of-class 20%+ tractor EBIT margins 52 week H/L (₹) 952 / 566 Result Update Result Equity capital (₹ crore) (FY21) 597.4 Face value (₹) ₹ 5 Q1FY22 Results: The company posted healthy Q1FY22 results. Shareholding pattern Sep-20 Dec-20 Mar-21 Jun-21 Standalone net sales declined 12.9% QoQ to | 11,763 crore Promoter 19.6 19.4 19.5 19.5 EBITDA margins at 13.9% were higher by 63 bps sequentially FII 34.7 37.9 38.9 40.1 Consequent standalone PAT for the quarter came in at | 856 crore DII 30.7 28.2 27.4 26.1 Other 15.0 14.4 14.3 14.4 Price Chart What should investors do? The stock price performance has been largely flattish 1200 20,000 over the past five years, in step with the wider Nifty Auto index. 900 15,000 We retain BUY rating on pivot towards capital efficiency, EV proactiveness 600 10,000 300 5,000 Target Price and Valuation: We retain SOTP-based target of | 1,000 for M&M (10x 0 0 EV/EBITDA to standalone business; 35% holding company discount to investments). -

Notice of 16Th Annual General Meeting (AGM) of the Bank

YBL/CS/2020-21/62 August 17, 2020 National Stock Exchange of India Limited BSE Limited Exchange Plaza, Corporate Relations Department Plot no. C/1, G Block, P.J. Towers, Dalal Street Bandra - Kurla Complex Mumbai – 400 001 Bandra (E), Mumbai - 400 051 Tel.: 2272 8013/15/58/8307 NSE Symbol: YESBANK BSE Scrip Code: 532648 Dear Sirs, Sub: Notice of 16th Annual General Meeting (AGM) of the Bank This is to inform that the 16th Annual General Meeting (AGM) of the Bank is scheduled to be held on Thursday, September 10, 2020 at 11:00 AM through video-conferencing / other audio- visual means as per the details mentioned in the enclosed Notice of the AGM. The Notice of 16th AGM, Annual Report for FY 2019-20 have also been made available on the website of the Bank at the link https://www.yesbank.in/about-us/investors-relation/financial- information/annual-reports The Bank shall commence dispatch (by electronic means) of the Notice of 16th AGM and the Annual Report for FY 2019-20 to the shareholders from today i.e. August 17, 2020. Shareholders, who do have their email ID registered with their Depository Participant may register their email ID for AGM and e-voting purpose by sending an email at [email protected] or to the Registrar & Share Transfer Agent of the Bank specifying therein identification details per the instructions mentioned in the Notice of AGM. Kindly take the above on your record and disseminate to all concerned. Thanking you, Yours faithfully, For YES BANK LIMITED Shivanand R.