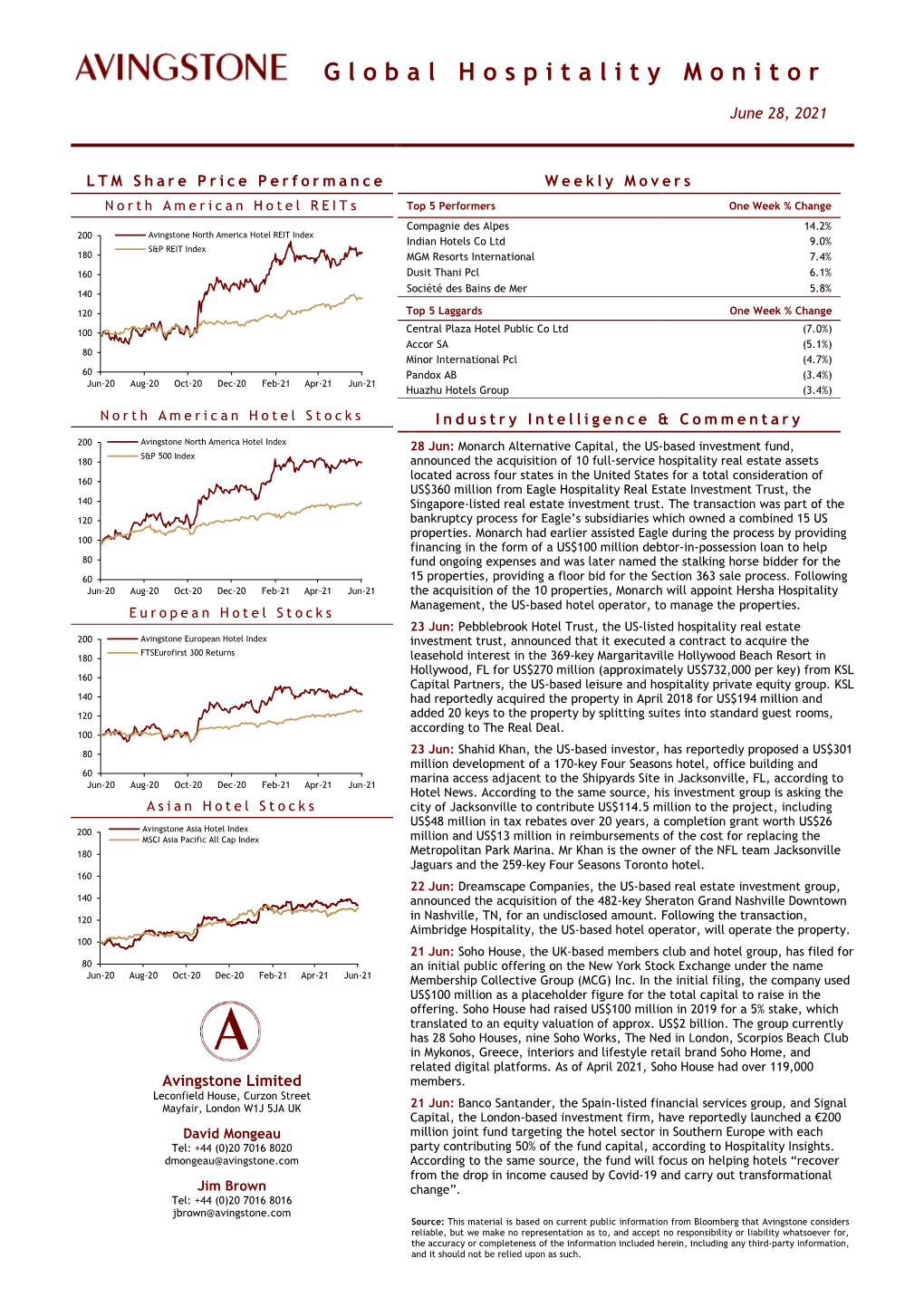

LTM Share Price Performance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The World's Biggest Hotel Companies. Old Trends and New Tendencies

MISCELLANEA GEOGRAPHICA – REGIONAL STUDIES ON DEVELOPMENT Vol. 19 • No. 4 • 2015 • pp. 26-33 • ISSN: 2084-6118 • DOI: 10.1515/mgrsd-2015-0020 The world’s biggest hotel companies. Old trends and new tendencies Abstract Many hotels are owned by a few dozen so-called hotel chains or hotel Andrzej Kowalczyk systems. The rapid growth of big hotel companies can be regarded as proof of the entrance of hotel systems into the globalisation phase. Since 2006, companies from the People’s Republic of China (PRC) have been among the world’s top hotel systems. This year can be considered Department of Geography of Tourism & Recreation as the symbolic beginning of a new stage in the history of the largest Institute of Socio-Economic Geography & Spatial Management hotel systems. This paper shows two main trends. On the one hand, the Faculty of Geography & Regional Studies processes that could be observed in the market of the major global hotel University of Warsaw Poland systems from the 1990s are still discernible (for example, the position of e-mail: [email protected] the so-called hotel megasystems). On the other hand, new trends have come to the fore in recent years, notably the emergence of systems from the People’s Republic of China among the world’s largest hotel systems. Keywords Hospitality • hotel megasystems • Chinese hotel chains Received: 30 September 2014 © University of Warsaw – Faculty of Geography and Regional Studies Accepted: 18 August 2015 Introduction A large proportion of hotels worldwide are owned by a few systems, non-cash settlements, launching new services for clients dozen so-called chains or systems, many of which operate and new technological solutions in catering, and so on. -

China Hotel Market (5Th Consecutive Survey on the Influence of the Coronavirus Outbreak) 2021 Q2

Singapore: Hotel Market Market Report - March 2019 SENTIMENT SURVEY China Hotel Market (5th Consecutive Survey on the Influence of the Coronavirus Outbreak) 2021 Q2 APRIL 2021 China Hotel Market Sentiment Survey – April 2021 With Large-scale Vaccination, the Market is Expected to Pick up Significantly 2021 Q2 Sentiment Score -14 31 32 27 Under the influence 18 23 9 3 of Covid-19 -9 -9 outbreak -14 -32 -40 1 -47 -12 -88 -116 14 First 14 15 First 15 16 First 16 17 First 17 18 First 18 19 First 19 Feb Jun Sep Jan Mar Half Second Half Second Half Second Half Second Half Second Half Second 2020 2020 2020 2021 2021 Half Half Half Half Half Half Question: Compared with the second quarter 2021 Q1 Hotel Market Performance Outlook of 2019, what’s your prediction on the overall 100% hotel market performance of the second quarter of 2021? 80% Occupancy With the normalization of domestic epidemic prevention and the large- 60% scale vaccination, the market confidence has been greatly improved. The sentiment score of Q2 2021 reached a peak since the Covid-19 outbreak, 40% even exceeding the score in the second half of 2019. 34% of the respondents predict that the overall occupancy rate of Q2 2021 will 20% recover to the same level of Q2 2019. 29% of the respondents even believe that the occupancy rate will be higher. Benefiting from the return 0% of high-value tourists, the sentiment score of Hainan increased 24 points OCC ADR Total Rev compared with that of last survey to 29, showing positive market Mu ch Worse Wo rse expectations. -

Global Hospitality Monitor

Global Hospitality Monitor July 26, 2021 LTM Share Price Performance Weekly Movers North American Hotel REITs Top 5 Performers One Week % Change NH Hotel Group SA 5.8% 200 Avingstone North America Hotel REIT Index Hilton Worldwide Holdings Inc. 4.6% S&P REIT Index 180 Whitbread Plc 3.7% Marriott International Inc. 3.1% 160 Playa Hotels & Resorts NV 2.7% 140 Top 5 Laggards One Week % Change 120 Central Plaza Hotel Public Co Ltd (9.9%) 100 Banyan Tree Holdings Ltd (9.0%) Ashford Hospitality Trust Inc. (6.7%) 80 Hong Kong & Shanghai Hotels/The (5.6%) Jul-20 Sep-20 Nov-20 Jan-21 Mar-21 May-21 Jul-21 Huazhu Hotels Group (5.2%) North American Hotel Stocks Ind ustry Intelligence & Commentary 200 Avingstone North America Hotel Index 23 Jul: Star Entertainment, the Australia-listed hotel and casino group, S&P 500 Index 180 announced that it withdrew a A$9 billion (US$6.6 billion) buyout proposal for Crown Resorts, the Australia-listed hotel and casino group, over concerns that 160 Crown could lose its license to run its Melbourne casino property. Star said it might consider a tie-up with Crown but was concerned about the impact on its 140 value “including whether it retains the license to operate its Melbourne casino 120 or the conditions under which its license is retained”. 100 22 Jul: Pebblebrook Hotel Trust, the US-listed hospitality real estate investment trust, announced the acquisition of the 200-key Jekyll Island Club 80 Resort in Georgia for US$94 million (approx. -

2015 Registration Document and Annual Financial Report Content

2015 Registration Document and Annual Financial Report Content 1 Corporate 4 Review PRESENTATION 3 OF 2015 161 1.1 Corporate profile 4 4.1 Financial review 162 1.2 Core businesses 4 4.2 Report on the parent company 1.3 Financial highlights 11 financial statements for the year ended December 31, 2015 170 1.4 Milestones 12 4.3 Material contracts 172 1.5 Strategic Vision and Outlook 15 4.4 Subsequent events 173 2 Corporate 5 Financial RESPONSIBILITY 21 STATEMENTS 175 2.1 Vision and commitments 22 5.1 Statutory Auditor’s report Steering the CSR APPROACH 29 2.2 on the consolidated financial statements 176 commitments to employees AFR 35 2.3 5.2 Consolidated financial statements 2.4 Social responsibility and notes 177 commitments AFR 52 5.3 Statutory Auditors’ report 2.5 Environmental commitments AFR 65 on the financial statements 250 2.6 Measuring and assessing performance 80 5.4 Parent company financial statements 2.7 Independent verifier’s report and notes 251 on consolidated social, environmental and societal information presented in the management report 94 6 Capital AND OWNERSHIP 3 Corporate STRUCTURE 285 GOVERNANCE 97 6.1 Information about the Company 286 3.1 Administrative and management bodies 98 6.2 Share capital AFR 288 3.2 Report of the Chairman 6.3 Ownership structure AFR 292 of the Board of Directors AFR 113 6.4 The market for Accor securities 295 3.3 Statutory Auditors' report, on the report prepared by the Chairman of the Board of Directors of ACCOR AFR 129 7 Other 3.4 Risk Management AFR 130 INFORMATION 297 3.5 Interests and -

Family Tree: Global Hotel Companies and Their Brands

Family Tree: Global hotel companies and their brands This family tree is organized by parent company and lists hotel brands that had properties open as of 31 December 2014. PARENT COMPANY BRAND PARENT COMPANY BRAND 25Hours Hotels 25Hours Hotels Arcadia Hotels Af Arcadia Hotels Af 7 Days Inn 7 Days Inn Archipelago International Aston International A Victory Hotels A Victory Hotels Archipelago International Fave Hotels Abad Group Abad Hotels & Resorts Archipelago International Kamuela Villas Abba Abba Archipelago International Neo Hotels Abotel Abotel Archipelago International Quest Hotels Abou Nawas Abou Nawas Arcona Hotels Arcona Hotels Absolute Hotel Services Group Eastin Arcotel Hotels Arcotel Hotels Absolute Hotel Services Group Eastin Easy Aristos Hotels Aristos Hotels Absolute Hotel Services Group U Hotels & Resorts Arora Arora Accor Adagio City Aparthotel Aryaduta Hotel Group Aryaduta Hotel Accor All Seasonshotels As Hotels As Hotels Accor Caesar Park Hotels Ascott Group Ascott Accor Coralia Ascott Group Citadines Accor Etap Hotel Ascott Group Somerset Hotels Accor Grand Mercure Ashok Ashok Accor Hotel F1 Atahotels Atahotels Accor Hotel Formule 1 Atlantic Hotels Atlantic Hotels Accor Hotel Ibis Atton Hotels S.a. Atton Hotel S.a. Accor Ibis Budget Austria Trend Hotels & Resorts Austria Trend Hotels & Resorts Accor Ibis Styles Avari Hotels Avari Hotels Accor Libertel Axel Hotels Axel Hotels Accor Mercure Hotels Ayre Hoteles Ayre Accor Mgallery Hotel Collection Ayres Hotels Ayres Accor Novotel Hotels Azalai Hotels Azalai Hotels Accor -

In Re: Marriott International, Inc., Customer Data Security Breach

Case 8:19-cv-00368-PWG Document 80 Filed 07/24/20 Page 1 of 327 UNITED STATES DISTRICT COURT DISTRICT OF MARYLAND SOUTHERN DIVISION IN RE: MARRIOTT INTERNATIONAL, INC., CUSTOMER DATA SECURITY MDL No. 8:19-md-2879-PWG BREACH LITIGATION Judge Paul W. Grimm This Document Relates To: This document relates to Case No. 8:19-cv-00368-PWG DENNIS MCGRATH, Individually and on behalf of all others similarly situated, Plaintiff, JURY TRIAL DEMANDED vs. MARRIOTT INTERNATIONAL, INC., ARNE M. SORENSON, KATHLEEN KELLY OBERG, BAO GIANG VAL BAUDUIN, BRUCE HOFFMEISTER, MARY K. BUSH, FREDERICK A. HENDERSON, LAWRENCE W. KELLNER, AYLWIN B. LEWIS, and GEORGE MUÑOZ, Defendants. THIRD AMENDED CONSOLIDATED CLASS ACTION COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS Case 8:19-cv-00368-PWG Document 80 Filed 07/24/20 Page 2 of 327 TABLE OF CONTENTS Page I. NATURE OF THE CLAIM ................................................................................................ 2 A. Marriott Seeks to Merge with Starwood, Attracted by Its Clientele and Data ......................................................................................................................... 3 B. Marriott Was Obligated to Protect Starwood’s Data and to Perform Due Diligence on Starwood’s Systems .......................................................................... 5 C. Marriott Assured the Market that It Conducted Extensive Due Diligence and That Starwood’s Customer Data Was Secure .................................................. 6 D. Starwood’s Systems Were Outdated and Unprotected -

Global Hospitality Monitor

Global Hospitality Monitor August 2, 2021 LTM Share Price Performance Weekly Movers North American Hotel REITs Top 5 Performers One Week % Change Hilton Worldwide Holdings Inc. 4.9% 200 Avingstone North America Hotel REIT Index Marriott International Inc. 4.9% S&P REIT Index 180 TUI AG 4.7% Chatham Lodging Trust 4.5% 160 Wyndham Hotels & Resorts Inc. 3.2% 140 Top 5 Laggards One Week % Change 120 Hong Kong & Shanghai Hotels/The (7.6%) 100 Ashford Hospitality Trust Inc. (4.6%) Huazhu Hotels Group (4.5%) 80 Miramar Hotel & Investment Co Ltd (3.8%) Jul-20 Sep-20 Nov-20 Jan-21 Mar-21 May-21 Jul-21 NH Hotel Group SA (3.7%) North American Hotel Stocks Ind ustry Intelligence & Commentary 200 Avingstone North America Hotel Index 02 Aug: Hilton Grand Vacations (“HGV”), the US-listed timeshare vacation S&P 500 Index 180 group, announced the closing of its all-stock acquisition of Diamond Resorts International, the US-based timeshare vacation group, from a consortium 160 between Apollo Global Management, the US-listed asset management group, Reverance Capital Partners, the US-based investment group, and other 140 unnamed Diamond shareholders. The transaction creates the largest luxury 120 timeshare operator with an equity value of approximately US$1.4 billion. According to HGV, the combined company is expected to generate over US$125 100 million in run-rate cost synergies within 24 months from closing. 80 30 Jul: The Blackstone Group, the US-listed asset management group, has Jul-20 Sep-20 Nov-20 Jan-21 Mar-21 May-21 Jul-21 reportedly acquired the 204-key Courtyard by Marriott Washington Capitol European Hotel Stocks Hill/Navy Yard Hotel for US$52.6 million (approx. -

Međunarodne Hotelske Marke U Rh

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Croatian Digital Thesis Repository VELEUČILIŠTE U KARLOVCU POSLOVNI ODJEL PREDDIPLOMSKI STRUČNI STUDIJ UGOSTITELJSTVA Martina Brckan MEĐUNARODNE HOTELSKE MARKE U RH ZAVRŠNI RAD Karlovac, 2018. Martina Brckan MEĐUNARODNE HOTELSKE MARKE U RH ZAVRŠNI RAD Veleučilište u Karlovcu Poslovni odjel Preddiplomski stručni studij Ugostiteljstva Kolegij: Poslovanje ugostiteljskog poduzeća Mentor: dr. sc. Silvija Vitner Marković prof. v. š. Matični broj studenta: 0618611018 Karlovac, prosinac 2018. SAŽETAK Rad je strukturiran u sedam poglavlja. U radu se analizira povijest hotelijerstva, razvoj hotelske industrije, razvoj hotelskih lanaca, te nastanku hotelskog branda. Također se govori o načinima povezivanja hotela u hotelske lance, a pobliže su objašnjeni ugovor o franšizingu, menadžmentu, najmu, hotelski rezervacijski sustav – konzorcij i potpuno vlasništvo. Prezentirani su najveći hotelski lanci u svijetu prema podacima iz 2015. godine, te je prikazan nastanak i razvoj, kao i način poslovanja svakog pojedinog hotela. Detaljno su objašnjeni i opisani odabrani hotelski brandovi koji posluju u RH. Ključne riječi: hotel, hotelski lanac, hotelska marka, ugovor o franšizi, ugovor o menadžmentu ABSTRACT The paper has been founded in seven chapters. The paper analyzes the history of hotel industry, the development of the hotel industry, the development of hotel chains and the emergence of hotel brand are mentioned. It is also about ways of connecting hotels to hotel chains, and it explains the franchise agreement, management, lease, hotel reservation system - consortium and full ownership. The largest hotel chains in the world have been presented according to 2015 data, showing the emergence and development as well as the way in wich each hotel operates. -

LTM Share Price Performance

G l o b a l Hospitality M o n i t o r July 19, 2021 L T M S h a r e P r i c e Performance W e e k l y M o v e r s North American Hotel REITs Top 5 Performers One Week % Change Indian Hotels Co Ltd 3.3% 200 Avington North America Hotel REIT Index Minor International Pcl 2.6% S&P REIT Index The Shilla (000's) 2.5% 180 Banyan Tree Holdings Ltd 1.5% 160 Dusit Thani Pcl 1.0% 140 Top 5 Laggards One Week % Change 120 Ashford Hospitality Trust Inc. (21.6%) Marcus Corp (12.2%) 100 TUI AG (9.8%) 80 MGM Resorts International (8.8%) Jul-20 Sep-20 Nov-20 Jan-21 Mar-21 May-21 Jul-21 Playa Hotels & Resorts NV (7.8%) North American Hotel Stocks Industry Intelligence & Commentary 15 Jul: Fort Partners, the US-based real estate development group, has 200 Avington North America Hotel Index reportedly acquired the 221-key Four Seasons Brickell in Miami, FL for S&P 500 Index 180 approximately US$130 million (approx. US$588,000 per key), according to The Real Deal. Following the transaction, Fort plans to renovate the property’s 160 rooms, pool deck, lobby and food and beverage areas. 140 13 Jul: Entities controlled by the Nakash family, the owners of the 231-key Setai Resort & Residences in Miami Beach, FL, have reportedly filed a lawsuit 120 challenging zoning amendments and the vacation of a right-of-way made by 100 the City of Miami Beach to enable the redevelopment of the 172-key Seagull Hotel, according to Hotels Mag. -

Consolidated Financial Statements and Notes December 31, 2017

AccorHotels – Consolidated financial statements and notes December 31, 2017 CONSOLIDATED FINANCIAL STATEMENTS AND NOTES Consolidated income statement p. 2 Consolidated statement of comprehensive income p. 3 Consolidated statement of financial position p. 4 Consolidated cash flow statements p. 6 Changes in consolidated shareholders’ equity p. 7 Notes to the consolidated financial statements p. 8 Unless stated otherwise, the amounts presented are in millions of euros, rounded to the nearest million. Generally speaking, the amounts presented in the consolidated financial statements and the notes to the financial statements are rounded to the nearest unit. This may result in a non-material difference between the sum of the rounded amounts and the reported total. All ratios and variances are calculated using the underlying amounts rather than the rounded amounts. AccorHotels – Consolidated financial statements and notes December 31, 2017 Consolidated income statement Notes 2016(*) 2017 (in millions of euros) Revenue 4 1,646 1,937 Operating expense 4 (1,139) (1,311) EBITDA 5 506 626 Depreciation, amortization and provision expense (109) (134) EBIT 5 397 492 Share of net profit of associates and joint-ventures 7 6 28 EBIT including profit of associates and joint-ventures 403 520 Other income and expenses 8 (96) (107) Operating profit 307 413 11 Net financial expense (117) (54) Income tax 12 2 51 Profit from continuing operations 193 411 Profit from discontinued operations 3 106 71 Net profit of the year 299 481 • Group share 265 441 from -

Operating Regulations

American Express OptBlue® Program Operating Regulations Merchant Exclusion List October 2017 This document is effective on October 13, 2017. Copyright © 2013-2017 American Express Travel Related Services Company, Inc. All rights reserved. This document and its appendices contain sensitive, confidential, and trade secret information and no part of it shall be disclosed to third parties or reproduced in any form or by any electronic or mechanical means, including without limitation information storage and retrieval systems, without the express prior written consent of American Express Travel Related Services Company, Inc. The provisions of this document and its appendices are subject to change from time to time by American Express Travel Related Services Company, Inc. American Express Operating Regulations Merchant Exclusion List Merchants – Do Not Sign The following merchants are not eligible to participate in from the OptBlue® Program. The names may be represented by the legal name or the DBA name. In the event Participant solicits a prospective merchant for Card acceptance that appears on this list, then Participant must refer such merchant to American Express' 'Want-to-Honor' Program at 1.855.TAKE.AXP or 1.855.825.3297. Participant may be subject to Non-Compliance fees if a merchant listed below is acquired under the Program; as well, such merchant may be converted or moved from the Program to a direct Card acceptance relationship with American Express. United States (excluding Puerto Rico and the U.S. Virgin Islands) 0-10 7-Eleven* A Aamco Transmission Alamo Car Rental Amtrak/National Railroad Passenger Abbey Carpet Alaska Railroad Corp. Corporation AC Hotels Alcatraz Cruises LLC Andaz Hotels Academy Bus LLC All Tune & Lube Another Broken Egg AccorHotels Allegra Network Apex Car Rental Adagio Access Aloft Hotels Arby's Adagio City Aparthotel Aloha Petroleum* Ascend Hotels Adagio Premium Alphagraphics Au Bon Pain Agway American Fastsigns Auntie Anne's Airport Connection, Inc. -

LTM Share Price Performance

Global Hospitality Monitor July 12, 2021 LTM Share Price Performance Weekly Movers North American Hotel REITs Top 5 Performers One Week % Change American Hotel Income Properties 7.3% 220 Avingstone North America Hotel REIT Index EIH (Oberoi Hotels & Resorts) 5.2% S&P REIT Index 200 Pandox AB 3.6% 180 Scandic Hotels Group AB 3.5% Indian Hotels Co Ltd 3.5% 160 140 Top 5 Laggards One Week % Change 120 Ashford Hospitality Trust Inc. (41.4%) Huazhu Hotels Group (8.8%) 100 Marcus Corp (8.5%) 80 Dusit Thani Pcl (5.4%) Jul-20 Sep-20 Nov-20 Jan-21 Mar-21 May-21 Jul-21 Braemar Hotels and Resorts (4.7%) North American Hotel Stocks Ind ustry Intelligence & Commentary 220 Avingstone North America Hotel Index 9 Jul: KSL Capital Partners, the US-based hospitality and leisure private equity S&P 500 Index 200 group, has acquired a 379-key, four-hotel portfolio in Florida. The portfolio 180 comprises the beachfront properties of Amara Cay Resort, La Siesta Resort & Marina, Pelican Cove Resort & Marina and Postcard Inn Beach Resort & Marina. 160 Following the transaction, KSL has plans for extensive renovations and 140 impactful enhancements to the guest experience and has extended its partnership with Davidson Hospitality Group, the US-based hotel operator, to 120 manage the portfolio with its lifestyle operating vertical, Pivot. 100 8 Jul: Único Hotels, the Spain-based hotel owner and operator controlled by 80 the Guardens family, has reportedly sold the 146-key Grand Hotel Central in Jul-20 Sep-20 Nov-20 Jan-21 Mar-21 May-21 Jul-21 Barcelona, Spain, to Schroders, the UK-listed asset management group, for €93 European Hotel Stocks million (approx.