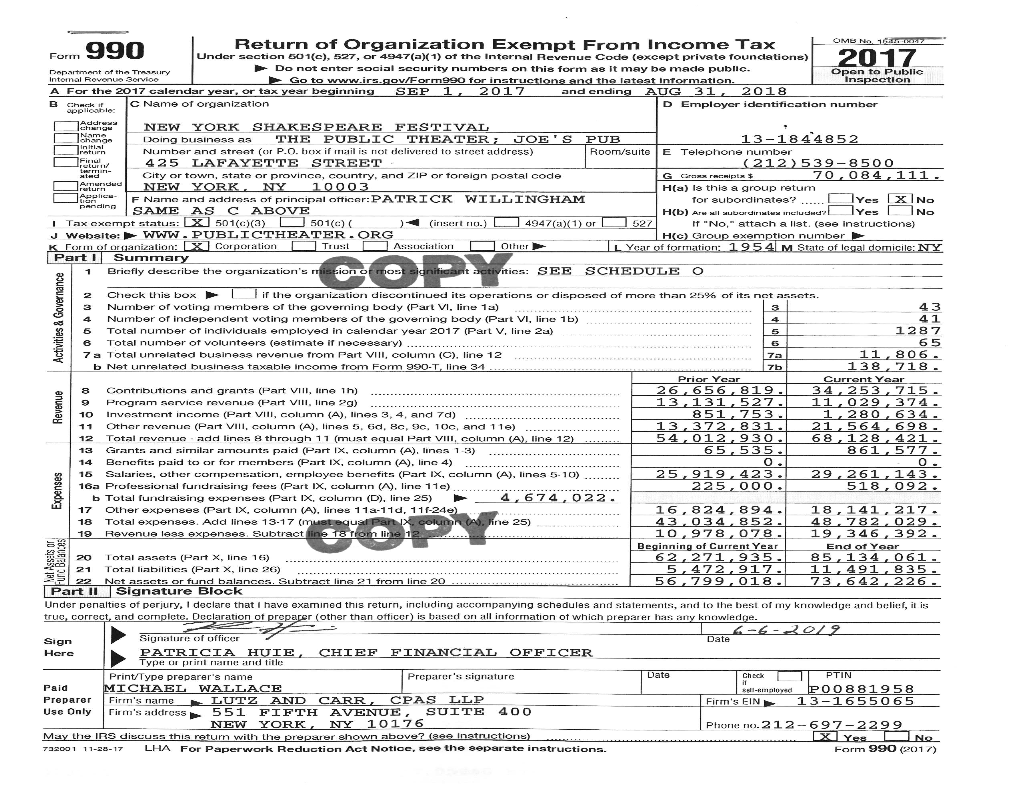

Fy18-Form-990---Final-Public.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OSLO Big Winner at the 2017 Lucille Lortel Awards, Full List! by BWW News Desk May

Click Here for More Articles on 2017 AWARDS SEASON OSLO Big Winner at the 2017 Lucille Lortel Awards, Full List! by BWW News Desk May. 7, 2017 Tweet Share The Lortel Awards were presented May 7, 2017 at NYU Skirball Center beginning at 7:00 PM EST. This year's event was hosted by actor and comedian, Taran Killam, and once again served as a benefit for The Actors Fund. Leading the nominations this year with 7 each are the new musical, Hadestown - a folk opera produced by New York Theatre Workshop - and Sweeney Todd: The Demon Barber of Fleet Street, currently at the Barrow Street Theatre, which has been converted into a pie shop for the intimate staging. In the category of plays, both Paula Vogel's Indecent and J.T. Rogers' Oslo, current Broadway transfers, earned a total of 4 nominations, including for Outstanding Play. Playwrights Horizons' A Life also earned 4 total nominations, including for star David Hyde Pierce and director Anne Kauffman, earning her 4th career Lortel Award nomination; as did MCC Theater's YEN, including one for recent Academy Award nominee Lucas Hedges for Outstanding Lead Actor. Lighting Designer Ben Stanton earned a nomination for the fifth consecutive year - and his seventh career nomination, including a win in 2011 - for his work on YEN. Check below for live updates from the ceremony. Winners will be marked: **Winner** Outstanding Play Indecent Produced by Vineyard Theatre in association with La Jolla Playhouse and Yale Repertory Theatre Written by Paula Vogel, Created by Paula Vogel & Rebecca Taichman Oslo **Winner** Produced by Lincoln Center Theater Written by J.T. -

OCTOBER 2016 Welcome to October Sky! We Can’T Imagine a More Perfect Show to Give Our 2016–2017 Season a Great Launch (If You’Ll Pardon the Pun)

OCTOBER 2016 Welcome to October Sky! We can’t imagine a more perfect show to give our 2016–2017 Season a great launch (if you’ll pardon the pun). New musicals are, of course, one of The Old Globe’s specialties, and the upcoming season is filled with exactly the kind of work the Globe does best. In this very theatre, you’ll have a chance to see a revival of Steve Martin’s hilarious Picasso at the Lapin Agile; the exciting backstage drama Red Velvet; and the imaginative, fable- like musical The Old Man and The Old Moon. And of course, we’re bringing back The Grinch for its 19th year! Across the plaza in the Sheryl and Harvey White Theatre, we hope you’ll join us for work by some of the most exciting voices in the American theatre today: award-winning actor/ songwriter Benjamin Scheuer (The Lion), Globe newcomer Nick Gandiello (The Blameless), the powerful and trenchant Dominique Morisseau (Skeleton Crew), and the ingenious Fiasco Theater, with their own particular spin on Molière’s classic The Imaginary Invalid. It’s a season we’re extremely proud and excited to share with all of you. DOUGLAS GATES Managing Director Michael G. Murphy and Erna Finci Viterbi Artistic Director Barry Edelstein. We’re also proud to welcome the outstanding creative team that has made October Sky a reality. Director/choreographer Rachel Rockwell is an artist whose work we’ve long admired, whose skill in staging is matched by her deft touch with actors. She’s truly a perfect fit for this heartwarming and triumphant show. -

Programming; Providing an Environment for the Growth and Education of Theatre Professionals, Audiences, and the Community at Large

JULY 2017 WELCOME MIKE HAUSBERG Welcome to The Old Globe and this production of King Richard II. Our goal is to serve all of San Diego and beyond through the art of theatre. Below are the mission and values that drive our work. We thank you for being a crucial part of what we do. MISSION STATEMENT The mission of The Old Globe is to preserve, strengthen, and advance American theatre by: creating theatrical experiences of the highest professional standards; producing and presenting works of exceptional merit, designed to reach current and future audiences; ensuring diversity and balance in programming; providing an environment for the growth and education of theatre professionals, audiences, and the community at large. STATEMENT OF VALUES The Old Globe believes that theatre matters. Our commitment is to make it matter to more people. The values that shape this commitment are: TRANSFORMATION Theatre cultivates imagination and empathy, enriching our humanity and connecting us to each other by bringing us entertaining experiences, new ideas, and a wide range of stories told from many perspectives. INCLUSION The communities of San Diego, in their diversity and their commonality, are welcome and reflected at the Globe. Access for all to our stages and programs expands when we engage audiences in many ways and in many places. EXCELLENCE Our dedication to creating exceptional work demands a high standard of achievement in everything we do, on and off the stage. STABILITY Our priority every day is to steward a vital, nurturing, and financially secure institution that will thrive for generations. IMPACT Our prominence nationally and locally brings with it a responsibility to listen, collaborate, and act with integrity in order to serve. -

House of Cards Review

House of Cards: TV Review http://www.hollywoodreporter.com/print/415589 Source URL: http://www.hollywoodreporter.com/review/house-cards-netflix-tv-review-415589 8:00 AM PST 1/26/2013 by Tim Goodman The Bottom Line Kevin Spacey shines in this heavyweight new contender in the drama category that makes Netflix a major player as a content provider. Premieres Feb. 1 (Netflix) Director David Fincher Cast Kevin Spacey, Robin Wright, Kate Mara, Corey Stoll, Michael Kelly, Constance Zimmer, Michael Gill, Sakina Jaffrey, If Netflix wanted to come out of the gates strong as a content provider worthy of any cable channel, it picked a stellar choice in House of Cards, a remake of the Brit series starring a riveting Kevin Spacey and directed by David Fincher (at least the first two episodes, which were shown to critics before Netflix releases all 13 for streaming Feb. 1). The streaming and DVD-by-mail service got its original-content feet wet a year ago with Lillyhammer, starring Steven Van Zandt as a New York gangster who goes into witness protection in Norway, but it is really making its mark with a slate of five new series rolling out in 2013. It’s a concerted, calculated slate that says, “We’ve arrived -- and what are you going to do about it?” 1 of 4 1/28/2013 10:55 AM House of Cards: TV Review http://www.hollywoodreporter.com/print/415589 PHOTOS: 7 Music to Movie Directors: Michael Bay, David Fincher, Spike Jonze [7] As a threat to higher-end niche cable channels that traffic in acclaimed dramas, Netflix’s likeliest competitors are FX, AMC and Starz. -

Donor-Advised Fund

WELCOME. The New York Community Trust brings together individuals, families, foundations, and businesses to support nonprofits that make a difference. Whether we’re celebrating our commitment to LGBTQ New Yorkers—as this cover does—or working to find promising solutions to complex problems, we are a critical part of our community’s philanthropic response. 2018 ANNUAL REPORT 1 A WORD FROM OUR DONORS Why The Trust? In 2018, we asked our donors, why us? Here’s what they said. SIMPLICITY & FAMILY, FRIENDS FLEXIBILITY & COMMUNITY ______________________ ______________________ I value my ability to I chose The Trust use appreciated equities because I wanted to ‘to‘ fund gifts to many ‘support‘ my community— different charities.” New York City. My ______________________ parents set an example of supporting charity My accountant and teaching me to save, suggested The Trust which led me to having ‘because‘ of its excellent appreciated stock, which tools for administering I used to start my donor- donations. Although advised fund.” my interest was ______________________ driven by practical considerations, The need to fulfill the I eventually realized what charitable goals of a dear an important role it plays ‘friend‘ at the end of his life in the City.” sent me to The Trust. It was a great decision.” ______________________ ______________________ The Trust simplified our charitable giving.” Philanthropy is a ‘‘ family tradition and ______________________ ‘priority.‘ My parents communicated to us the A donor-advised fund imperative, reward, and at The Trust was the pleasure in it.” ‘ideal‘ solution for me and my family.” ______________________ I wanted to give back, so I opened a ‘fund‘ in memory of my grandmother and great-grandmother.” 2 NYCOMMUNITYTRUST. -

Café Society

Presents CAFÉ SOCIETY A film by Woody Allen (96 min., USA, 2016) Language: English Distribution Publicity Bonne Smith Star PR 1352 Dundas St. West Tel: 416-488-4436 Toronto, Ontario, Canada, M6J 1Y2 Fax: 416-488-8438 Tel: 416-516-9775 Fax: 416-516-0651 E-mail: [email protected] E-mail: [email protected] www.mongrelmedia.com @MongrelMedia MongrelMedia CAFÉ SOCIETY Starring (in alphabetical order) Rose JEANNIE BERLIN Phil STEVE CARELL Bobby JESSE EISENBERG Veronica BLAKE LIVELY Rad PARKER POSEY Vonnie KRISTEN STEWART Ben COREY STOLL Marty KEN STOTT Co-starring (in alphabetical order) Candy ANNA CAMP Leonard STEPHEN KUNKEN Evelyn SARI LENNICK Steve PAUL SCHNEIDER Filmmakers Writer/Director WOODY ALLEN Producers LETTY ARONSON, p.g.a. STEPHEN TENENBAUM, p.g.a. EDWARD WALSON, p.g.a. Co-Producer HELEN ROBIN Executive Producers ADAM B. STERN MARC I. STERN Executive Producer RONALD L. CHEZ Cinematographer VITTORIO STORARO AIC, ASC Production Designer SANTO LOQUASTO Editor ALISA LEPSELTER ACE Costume Design SUZY BENZINGER Casting JULIET TAYLOR PATRICIA DiCERTO 2 CAFÉ SOCIETY Synopsis Set in the 1930s, Woody Allen’s bittersweet romance CAFÉ SOCIETY follows Bronx-born Bobby Dorfman (Jesse Eisenberg) to Hollywood, where he falls in love, and back to New York, where he is swept up in the vibrant world of high society nightclub life. Centering on events in the lives of Bobby’s colorful Bronx family, the film is a glittering valentine to the movie stars, socialites, playboys, debutantes, politicians, and gangsters who epitomized the excitement and glamour of the age. Bobby’s family features his relentlessly bickering parents Rose (Jeannie Berlin) and Marty (Ken Stott), his casually amoral gangster brother Ben (Corey Stoll); his good-hearted teacher sister Evelyn (Sari Lennick), and her egghead husband Leonard (Stephen Kunken). -

The Public Theater's Free Shakespeare in the Park Troilus and Cressida / Delacorte Theater, Central Park Stephanie Pietros

Early Modern Culture Volume 12 Article 28 6-12-2017 The Public Theater's Free Shakespeare in the Park Troilus and Cressida / Delacorte Theater, Central Park Stephanie Pietros Follow this and additional works at: https://tigerprints.clemson.edu/emc Part of the Literature in English, British Isles Commons, and the Theatre and Performance Studies Commons Recommended Citation Stephanie Pietros (2017) "The ubP lic Theater's Free Shakespeare in the Park Troilus and Cressida / Delacorte Theater, Central Park," Early Modern Culture: Vol. 12 , Article 28. Available at: https://tigerprints.clemson.edu/emc/vol12/iss1/28 This Theater Review is brought to you for free and open access by TigerPrints. It has been accepted for inclusion in Early Modern Culture by an authorized editor of TigerPrints. For more information, please contact [email protected]. The Public Theater’s Free Shakespeare in the Park Troilus and Cressida Directed by Daniel Sullivan Delacorte Theater; Central Park, New York, NY Performance Date: August 9, 2016 Reviewed by STEPHANIE PIETROS he Public Theater’s production of Troilus and Cressida, directed by Daniel Sullivan, brought to the forefront the world-weariness of protracted war T that is at the heart of the play. Nothing, not even the brief romance of the titular characters, felt fresh and new, for even that was engineered by the sleazy Pandarus. The set, casting, parallels between Greeks and Trojans, jaded romances, and, ultimately, final battle between Hector and Achilles, all pointed to the conclusion Wilfred Owen drew three centuries after Shakespeare wrote his play: that Horace’s famous dictum about it being sweet and fitting to die for one’s country is not borne out by the realities of wartime. -

Eureka Du 1200 State Street, Utica 13502 NY Ydux5

Name: Eureka Du Address: 1200 State Street, Utica 13502 NY Email: [email protected] Typography and Information Design PrattMWP College of Art and Design Class #1 Professor: Christina Sharp Content 1.creative brief 4.ideation 2.research 5.development 3.inspiration 6.conclusions Creative Brief In this map project we are selecting a New York State Park, and redesign an engaging and exciting map for the park in Adobe Illustrator for potential visitors through compositions, symbols, icon systems, labels, illustrations, and colors. The redesigned map should be practical and able to be used in the real world. My choice on the New York State Park is the Central Park in Manhatten New York. I Chose Central Park because of my own experience. As a first time visitor in New York last year, I visited Central Park with my cousin who has been living in NewYork for seven years. While I was doing my research, I did not find any map for first-time visitors from the central park official website. If I were on my own while I first visited Central Park, I would not be able to know where to begin my visit. I am sure that the other first-time visitors would have the same problem. These are the reasons that my map is designed for first-time visitors who have a limited amount of time. In my map, I featured several top attractions in and around the park. I also included some top-rated restaurants around and inside the park since Knowing where to consume good food is essential during visiting. -

Masque Sound Celebrates 50 Years of Providing Audio

MASQUE SOUND CELEBRATES 50 YEARS OF PROVIDING AUDIO EQUIPMENT FOR NEW YORK CITY’S DELACORTE THEATER Majestic Venue Commemorates Golden Anniversary of Shakespeare in the Park NEW YORK, JUNE 19, 2012—As the curtain rises on the 2012 season of Shakespeare in the Park at the Delacorte Theater in Central Park, Masque Sound, a leading theatrical sound reinforcement, installation and design company, is celebrating its 50th anniversary of providing audio equipment and services to the theater for one of New York City’s most beloved traditions. Shakespeare in the Park moved to its permanent home at the Delacorte Theater in 1962 and since then, New York natives and visitors alike have enjoyed free Shakespeare performances each summer season. The majestic, open‐air theater has a seating capacity of 1,800, and each season more than 100,000 people attend performances produced by The Public Theater. “Masque Sound has enjoyed a long and successful relationship with The Public and Delacorte theaters and their summer productions of Shakespeare in the Park,” says Dennis Short, Masque Sound. “Being able to celebrate 50 years as the theater’s audio equipment provider is quite an accomplishment and demonstrates our commitment to supporting the theatrical community. The Delacorte is in such a magnificent setting, and being able to provide theatergoers with an audio experience to match their visual experience is something we take great pride in doing.” Celebrating its 50th Anniversary, the Delacorte Theater officially opened in Central Park on June 18, 1962 with The Merchant of Venice. The Merchant of Venice was followed that summer by a production of The Tempest, featuring Paul Stevens as Prospero and James Earl Jones as Caliban. -

False Authenticity in the Films of Woody Allen

False Authenticity in the Films of Woody Allen by Nicholas Vick November, 2012 Director of Thesis: Amanda Klein Major Department: English Woody Allen is an auteur who is deeply concerned with the visual presentation of his cityscapes. However, each city that Allen films is presented in such a glamorous light that the depiction of the cities is falsely authentic. That is, Allen's cityscapes are actually unrealistic recreations based on his nostalgia or stilted view of the city's culture. Allen's treatment of each city is similar to each other in that he strives to create a cinematic postcard for the viewer. However, differing themes and characteristics emerge to define Allen's optimistic visual approach. Allen's hometown of Manhattan is a place where artists, intellectuals, and writers can thrive. Paris denotes a sense of nostalgia and questions the power behind it. Allen's London is primarily concerned with class and the social imperative. Finally, Barcelona is a haven for physicality, bravado, and sex but also uncertainty for American travelers. Despite being in these picturesque and dynamic locations, happiness is rarely achieved for Allen's characters. So, regardless of Allen's dreamy and romanticized visual treatment of cityscapes and culture, Allen is a director who operates in a continuous state of contradiction because of the emotional unrest his characters suffer. False Authenticity in the Films of Woody Allen A Thesis Presented To the Faculty of the Department of English East Carolina University In Partial Fulfillment of the Requirements for the Degree MA English by Nicholas Vick November, 2012 © Nicholas Vick, 2012 False Authenticity in the Films of Woody Allen by Nicholas Vick APPROVED BY: DIRECTOR OF DISSERTATION/THESIS: _______________________________________________________ Dr. -

Download This Issue

The Harlem Community Newspapers, Inc. Connecting Harlem, Queens, Brooklyn and The Bronx BRONX NEWSCOMMUNITY “Good News You Can Use” Vol. 26 No. 32 August 12, 2021 – August 18, 2021 FREE “Lucky to Be Here HARLEM WEEK Kicks Off With “at the Longwood Gallery see page 5 A BLAST at "A GREAT DAY" see pages 14-15 Black Playwrights Will Abound On Broadway! Hoorah! see page 9 HARLEM WEEK Senior Citizens Day see page 16 Follow Harlem Community Newspapers on Social Media! VISIT OUR WEBSITE: www.harlemcommunitynews.com Facebook: @HarlemCommunityNewspapers Twitter: @HCNewspapers Instagram: Harlem_community_newspapers YouTube: harlemnewsinc HARLEM COMMUNITY NEWSPAPERS CONTENTS HARLEM COMMUNITY NEWS “Good news you can use” BROOKLYN COMMUNITY NEWS BRONX COMMUNITY NEWS NITY COMMU Connecting Harlem, Queens, Brooklyn and The South Bronx QUEENS COMMUNITY NEWS The Harlem News Group, Inc. FREE Free copies distributed in your community weekly Harlem“Good News You CanNews Use” July 24–July 30, 2014 Vol. 14 No. 29 EEK M Wpage 16 The Harlem News Group, Inc. LE Connecting Harlem, Queens, Brooklyn and The South Bronx IN THIS ISSUE: INSIDE AR UE: H Calendar of Events THIS ISS Bronx News Community 3 Focus 12 COMMUNITY Vol. 14 No. 28 “Good News You Can Use” Education 4 Travel 13 INSIDE THIS ISSUE July 17 - July 23, 2014 PAT STEVENSON Soul Food and eet : Op Ed Editorial 6 Urbanology 14 African Cuisine M at Jacob Restaurant page 12 FREE Real Estate 7 Wellness 15 GOOD NEWS Calendar 8 Games 16 Denny Moe’s YOU CAN USE! “Cutting For A Cure” page 14 Events 9 Literary Corner 17 Romeo & Juliet – Free at Riverbank Park It was certainly “A Great Day” page 10 Photos from HARLEM WEEK 2013 page 8 Classified 18 OF EVENTS in Harlem this past Sunday as we ALENDAR Y C /harlemnewsinc celebrated the HARLEM WEEK NIT Capital One COMMU Student Banker @harlemnewsinc Program event at Grants Tomb. -

Memories of New York Is Your One-Stop-Shop for Holiday Decorations

Issue No. 2 Fall/Winter MEMORIES 2010 TM TM Of New York NEWSLETTER ~ 25th Anniversary Specials ~ Welcome ~~ Bienvenidos ~~ Bienvenue ~ Willkommen ~~ Benvenuto ~~ Bem-vindo Memories of New York is your one-stop-shop for holiday decorations. We have thousands of keepsake ornaments for sale all year ‘round, each one beautiful and Happy Holidays unique. From classic Santa Claus to officially licensed Elvis Presley, Betty Boop, I & Happy New Love Lucy, Wizard of Oz, Sex & the City, and more, we are sure to have something that will make your holiday a special one. Year From Beautiful NYC 16-Month Calendar – only $2.85 each (reg. $11.99) New York City! Novelty Giant Pen – only $0.95 each (reg. $4.99) We at Memories of Picture Frames – only $2.85 each (reg. $9.99) NYC Firefighter Picture Frame – only $0.95 each (reg. $3.99) New York would like Quality Metal Keychains – only $0.95 each (reg. $4.99) to wish everyone a Handcrafted Ashtrays & Cardholders – only $0.85 each (reg. $7.99) happy and healthy Shot Glasses – only $0.95 each (reg. $3.99) Mugs – only $1.95 each (reg. $4.99) holiday season! NYC Playing Cards – only $0.95 each (reg. $4.99) Thank you all for the overwhelmingly positive response to the first issue of 20 Postcards – $1 (only pre-packaged) the Memories of New York Newsletter! Your feedback means a lot to us. We hope that this new Fall/Winter issue will be just as enjoyable and informative, All while supplies last! Remember to ask for your free gift with purchase! Certain restrictions apply, ask for details.