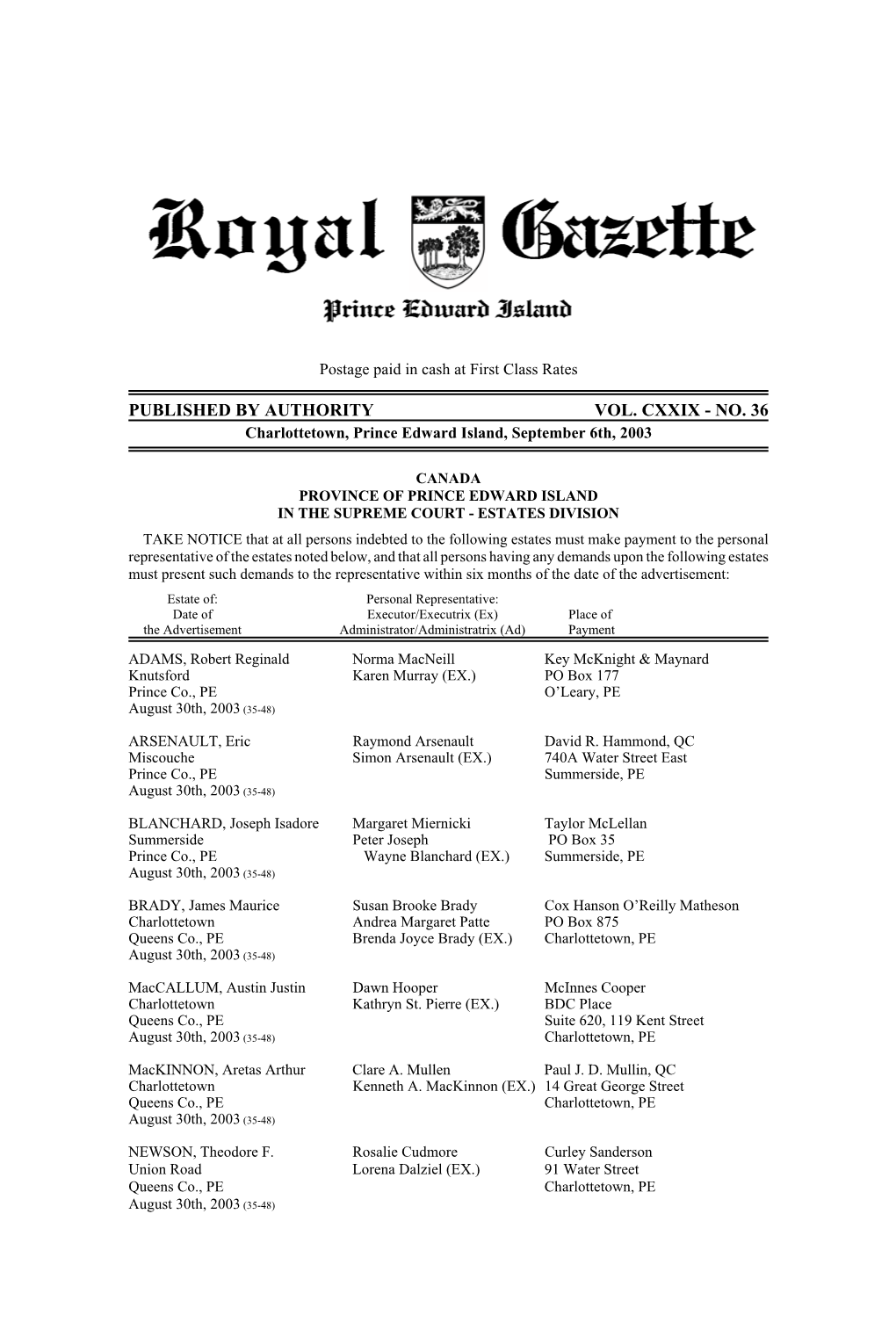

Royal Gazette of Prince Edward Island

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Four Courts of Sir Lyman Duff

THE FOUR COURTS OF SIR LYMAN DUFF RICHARD GOSSE* Vancouver I. Introduction. Sir Lyman Poore Duff is the dominating figure in the Supreme Court of Canada's first hundred years. He sat on the court for more than one-third of those years, in the middle period, from 1906 to 1944, participating in nearly 2,000 judgments-and throughout that tenure he was commonly regarded as the court's most able judge. Appointed at forty-one, Duff has been the youngest person ever to have been elevated to the court. Twice his appointment was extended by special Acts of Parliament beyond the mandatory retirement age of seventy-five, a recogni- tion never accorded to any other Canadian judge. From 1933, he sat as Chief Justice, having twice previously-in 1918 and 1924 - almost succeeded to that post, although on those occasions he was not the senior judge. During World War 1, when Borden considered resigning over the conscription issue and recommending to the Governor General that an impartial national figure be called upon to form a government, the person foremost in his mind was Duff, although Sir Lyman had never been elected to public office. After Borden had found that he had the support to continue himself, Duff was invited to join the Cabinet but declined. Mackenzie King con- sidered recommending Duff for appointment as the first Canadian Governor General. Duff undertook several inquiries of national interest for the federal government, of particular significance being the 1931-32 Royal Commission on Transportation, of which he was chairman, and the 1942 investigation into the sending of Canadian troops to Hong Kong, in which he was the sole commissioner . -

Environmental Histories of the Confederation Era Workshop, Charlottetown, PEI, 31 July – 1Aug

The Dominion of Nature: Environmental Histories of the Confederation Era workshop, Charlottetown, PEI, 31 July – 1Aug Draft essays. Do not cite or quote without permission. Wendy Cameron (Independent researcher), “Nature Ignored: Promoting Agricultural Settlement in the Ottawa Huron Tract of Canada West / Ontario” William Knight (Canada Science & Tech Museum), “Administering Fish” Andrew Smith (Liverpool), “A Bloomington School Perspective on the Dominion Fisheries Act of 1868” Brian J Payne (Bridgewater State), “The Best Fishing Station: Prince Edward Island and the Gulf of St. Lawrence Mackerel Fishery in the Era of Reciprocal Trade and Confederation Politics, 1854-1873” Dawn Hoogeveen (UBC), “Gold, Nature, and Confederation: Mining Laws in British Columbia in the wake of 1858” Darcy Ingram (Ottawa), “No Country for Animals? National Aspirations and Governance Networks in Canada’s Animal Welfare Movement” Randy Boswell (Carleton), “The ‘Sawdust Question’ and the River Doctor: Battling pollution and cholera in Canada’s new capital on the cusp of Confederation” Joshua MacFadyen (Western), “A Cold Confederation: Urban Energy Linkages in Canada” Elizabeth Anne Cavaliere (Concordia), “Viewing Canada: The cultural implications of topographic photographs in Confederation era Canada” Gabrielle Zezulka (Independent researcher), “Confederating Alberta’s Resources: Survey, Catalogue, Control” JI Little (Simon Fraser), “Picturing a National Landscape: Images of Nature in Picturesque Canada” 1 NATURE IGNORED: PROMOTING AGRICULTURAL SETTLEMENT IN -

Historical Portraits Book

HH Beechwood is proud to be The National Cemetery of Canada and a National Historic Site Life Celebrations ♦ Memorial Services ♦ Funerals ♦ Catered Receptions ♦ Cremations ♦ Urn & Casket Burials ♦ Monuments Beechwood operates on a not-for-profit basis and is not publicly funded. It is unique within the Ottawa community. In choosing Beechwood, many people take comfort in knowing that all funds are used for the maintenance, en- hancement and preservation of this National Historic Site. www.beechwoodottawa.ca 2017- v6 Published by Beechwood, Funeral, Cemetery & Cremation Services Ottawa, ON For all information requests please contact Beechwood, Funeral, Cemetery and Cremation Services 280 Beechwood Avenue, Ottawa ON K1L8A6 24 HOUR ASSISTANCE 613-741-9530 • Toll Free 866-990-9530 • FAX 613-741-8584 [email protected] The contents of this book may be used with the written permission of Beechwood, Funeral, Cemetery & Cremation Services www.beechwoodottawa.ca Owned by The Beechwood Cemetery Foundation and operated by The Beechwood Cemetery Company eechwood, established in 1873, is recognized as one of the most beautiful and historic cemeteries in Canada. It is the final resting place for over 75,000 Canadians from all walks of life, including im- portant politicians such as Governor General Ramon Hnatyshyn and Prime Minister Sir Robert Bor- den, Canadian Forces Veterans, War Dead, RCMP members and everyday Canadian heroes: our families and our loved ones. In late 1980s, Beechwood began producing a small booklet containing brief profiles for several dozen of the more significant and well-known individuals buried here. Since then, the cemetery has grown in national significance and importance, first by becoming the home of the National Military Cemetery of the Canadian Forces in 2001, being recognized as a National Historic Site in 2002 and finally by becoming the home of the RCMP National Memorial Cemetery in 2004. -

DOMINION MINISTRIES, 1867-1909. Offic Name. Date of Appointment

530 DOMINION MINISTRIES, 1867-1909. Date of Offic Name. appointment. Seventh Ministry—con. President of Council Hon. A. R. Angers May 1, 1896 Minister of Public Works Hon. A. Desjardins May 1, 18S6 Minister of Interior Hon. Hugh John Macdona May 1, 189li Postmaster General Hon. L. O. Taillon May 1, 1896 Minister of Militia and Defence. Hon. David Tisdale May 2, 1896 Controller of Customs Hon. John F. Wood Jan. 15, 1896 Controller of Inland Revenue.. Hon. E. G. Prior Dec. 17, 1805 Without portfolio Hon. Sir Frank Smith July 29, 1»2 Hon. D. Ferguson. .. Dec. 21, 1891 Hon. J.J. Ross May 1, 1896 Not in the Cabinet. Solicitor General Hon. Sir Charles Hibbert Tupper May 1, 1896 Eighth Ministry. Premier andPresident of Council Right Hon. Sir Wilfrid Laurier July 11, 1896 Minis ter of Tradeand Commerce Right Hon. Sir Richard J. Cartwright July 13, 1896 Secretary of State Hon. R. W. Scott July 13, 1896 Hon. Charles Murphy Oct. 10, 1908 Minister of Justice Hon. Sir Oliver Mowat July 13, 1896 Hon. David Mills Nov. 18, 1-97 Hon. Charles Fitzpatrick.. Feb. 11, 1902 Hon. Allen B. Aylesworth. June 4, 1906 Minister of Marine and Fisheries Hon. Sir Louis Henry Davies July 13, 1896 Hon. James Sutherland Jan. 15, 1H02 Hon. J. Raymond F. Prefontair.e.. Nov. 11, 1902 Hon. Louis P. Brodeur Feb. 6, 1906 Minister of Militia and Defence. Hon. Sir Frederick W. Borden, July 13, 1896 Postmaster General Hon. Sir William Mulock... July 13, 1896 Hon. Allen B. Aylesworth.. Oct. 16, 1905 Hon. -

A Historical and Legal Study of Sovereignty in the Canadian North : Terrestrial Sovereignty, 1870–1939

University of Calgary PRISM: University of Calgary's Digital Repository University of Calgary Press University of Calgary Press Open Access Books 2014 A historical and legal study of sovereignty in the Canadian north : terrestrial sovereignty, 1870–1939 Smith, Gordon W. University of Calgary Press "A historical and legal study of sovereignty in the Canadian north : terrestrial sovereignty, 1870–1939", Gordon W. Smith; edited by P. Whitney Lackenbauer. University of Calgary Press, Calgary, Alberta, 2014 http://hdl.handle.net/1880/50251 book http://creativecommons.org/licenses/by-nc-nd/4.0/ Attribution Non-Commercial No Derivatives 4.0 International Downloaded from PRISM: https://prism.ucalgary.ca A HISTORICAL AND LEGAL STUDY OF SOVEREIGNTY IN THE CANADIAN NORTH: TERRESTRIAL SOVEREIGNTY, 1870–1939 By Gordon W. Smith, Edited by P. Whitney Lackenbauer ISBN 978-1-55238-774-0 THIS BOOK IS AN OPEN ACCESS E-BOOK. It is an electronic version of a book that can be purchased in physical form through any bookseller or on-line retailer, or from our distributors. Please support this open access publication by requesting that your university purchase a print copy of this book, or by purchasing a copy yourself. If you have any questions, please contact us at ucpress@ ucalgary.ca Cover Art: The artwork on the cover of this book is not open access and falls under traditional copyright provisions; it cannot be reproduced in any way without written permission of the artists and their agents. The cover can be displayed as a complete cover image for the purposes of publicizing this work, but the artwork cannot be extracted from the context of the cover of this specificwork without breaching the artist’s copyright. -

The Last Voyage of the Frederick Gerring, Jr

University of Calgary PRISM: University of Calgary's Digital Repository University of Calgary Press University of Calgary Press Open Access Books 2020-05 Canada’s Legal Pasts: Looking Forward, Looking Back University of Calgary Press Campbell, L., McCoy, T., & Méthot, M. (2020). Canada’s Legal Pasts: Looking Forward, Looking Back. University of Calgary Press, University of Calgary, Calgary, AB. http://hdl.handle.net/1880/112105 book https://creativecommons.org/licenses/by-nc-nd/4.0 Downloaded from PRISM: https://prism.ucalgary.ca CANADA’S LEGAL PASTS: Looking Forward, Looking Back Edited by Lyndsay Campbell, Ted McCoy, and Mélanie Méthot ISBN 978-1-77385-117-4 THIS BOOK IS AN OPEN ACCESS E-BOOK. It is an electronic version of a book that can be purchased in physical form through any bookseller or on-line retailer, or from our distributors. Please support this open access publication by requesting that your university purchase a print copy of this book, or by purchasing a copy yourself. If you have any questions, please contact us at [email protected] Cover Art: The artwork on the cover of this book is not open access and falls under traditional copyright provisions; it cannot be reproduced in any way without written permission of the artists and their agents. The cover can be displayed as a complete cover image for the purposes of publicizing this work, but the artwork cannot be extracted from the context of the cover of this specific work without breaching the artist’s copyright. COPYRIGHT NOTICE: This open-access work is published under a Creative Commons licence. -

Prince Edward Island

If you have issues viewing or accessing this file contact us at NCJRS.gov. , :: (; '. ' ;:,' . '; ~ " '1" iiiil i.L~ jiill i,4 iilll i.6 , , MICROCOPY RESOLUTION TEST CHARY NATIONAL BUREAU OF STANDARDS-J963-A . ~\ ,:~ ,. 0) } , .... , ~ ... ~ .... ,J ), ,t. ",'j- '." Microfilming procedures used to create this fiche comply with ., . ~".? .~.~~~- the standards set forth in 41CFR 101-11.5014. G < " ., j! Points of view or opinions stated in this document are I, '; those of the author(s) and do not represent the official position or policies of the U. S. Department of Justice. ';' .-~<- .. _._,. - ! o o t ,;'i t ,Date Filmed 1 r'" < Natioll~lt'!~t!!~t~~~rJustice 1,,~ ;'2/23/81\ . ,~ United States Department of Justice 1. -' ,,' .' ."~" Washington, 'D. C. 20531 ... 8 ' o f '.,··i.. r; .• . OF FOR PRINCE EDWARD ISLAND II'·il 1979 I:~ iii ,~ ~ 4, 1 ~ " f\ ~ '.' j f' .~ ~L~ " Iutrod}.H~tii};;l 7 L"md Registration. 7 \Jniform Law Conferen(:e 8 Departrl1entfll A p}K.i~nt,men.ts 8 Retil'em(~nts < , •••• , , • " •• Q ,.. ' I...&:ig:al ~~1}r,ri(~e.s ])ivi:~i~)r~ .. ~ t,l (, Iwport f,f t;he .Iudidt~l Divisinn _ .. , .. _..... ". " . Iv Report of th,e Crown Cou,r.iI3~~5 ..... 1 j? "~ f ' '- 'ff • ~ • n'" I h,eport 0:. T,ne !",~.'1gls.atnm ,,-,(:unSBR . I.:! Rep{~rt of Cor:t'ectio:l':n:.. Division 13 Bu:l.lclings 13 TO: S€rv;J:~::s 14- Staff 16 1':"rj,Bo:tH3rAetivH:,ies j6 G<~neral 17 Statistjes 1 ~l D(.l<~""_I·... 6- ,r..i; P-~lJ\\UY";~)'lf~ Or ~f.).tlr't;]l)· {""f..<'t,.j1;1~.J. -

Co Supreme Court of Canada

supreme court of canada of court supreme cour suprême du canada Philippe Landreville unless otherwise indicated otherwise unless Landreville Philippe by Photographs Ottawa, Ontario K1A 0J1 K1A Ontario Ottawa, 301 Wellington Street Wellington 301 Supreme Court of Canada of Court Supreme ISBN 978-1-100-21591-4 ISBN JU5-23/2013E-PDF No. Cat. ISBN 978-1-100-54456-4 ISBN Cat. No. JU5-23/2013 No. Cat. © Supreme Court of Canada (2013) Canada of Court Supreme © © Cour suprême du Canada (2013) No de cat. JU5-23/2013 ISBN 978-1-100-54456-4 No de cat. JU5-23/2013F-PDF ISBN 978-0-662-72037-9 Cour suprême du Canada 301, rue Wellington Ottawa (Ontario) K1A 0J1 Sauf indication contraire, les photographies sont de Philippe Landreville. SUPREME COURT OF CANADA rom the quill pen to the computer mouse, from unpublished unilingual decisions to Internet accessible bilingual judgments, from bulky paper files to virtual electronic documents, the Supreme Court of Canada has seen tremendous changes from the time of its inception and is now well anchored in the 21st century. Since its establishment in 1875, the Court has evolved from being a court of appeal whose decisions were subject to review by a higher authority in the United Kingdom to being the final court of appeal in Canada. The Supreme Court of Canada deals with cases that have a significant impact on Canadian society, and its judgments are read and respected by Canadians and by courts worldwide. This edition of Supreme Court of Canada marks the retirement of Madam Justice Marie Deschamps, followed by Fthe recent appointment of Mr. -

ROYAL GAZETTE January 4, 2020

Prince Edward Island PUBLISHED BY AUTHORITY VOL. CXLVI – NO. 1 Charlottetown, Prince Edward Island, January 4, 2020 CANADA PROVINCE OF PRINCE EDWARD ISLAND IN THE SUPREME COURT - ESTATES DIVISION TAKE NOTICE that all persons indebted to the following estates must make payment to the personal representative of the estates noted below, and that all persons having any demands upon the following estates must present such demands to the representative within six months of the date of the advertisement: Estate of: Personal Representative: Date of Executor/Executrix (Ex) Place of the Advertisement Administrator/Administratrix (Ad) Payment BUTTE, Keith Stuart Judith Estelle Butte (EX.) Cox & Palmer Charlottetown 4A Riverside Drive Queens Co., PE Montague, PE December 28, 2019 (52 – 13) CASWELL, Joseph Willard Carol Elizabeth Caswell (EX.) Cox & Palmer Cornwall 97 Queen Street Queens Co., PE Charlottetown, PE December 28, 2019 (52 – 13) FENNESSEY, Joanne Mary Debbie Fennessey (EX.) Cox & Palmer Alberton 347 Church Street Prince Co., PE Alberton, PE December 28, 2019 (52 – 13) GOULD, Kenneth Winslow Stanley C. Gould (EX.) Carr Stevenson & MacKay Springfield 65 Queen Street Vermont, USA Charlottetown, PE December 28, 2019 (52 – 13) GREENOUGH, Brenda Marie Graham Greenough (EX.) Cox & Palmer Montague 4A Riverside Drive Kings Co., PE Montague, PE December 28, 2019 (52 – 13) LEJA, John John Michael Leja (EX.) McLellan, Brennan Linkletter Central St. Prince Co., PE Summerside, PE December 28, 2019 (52 – 13) *Indicates date of first publication in the -

Canadian Government Policy Towards Titular Honours Fkom Macdondd to Bennett

Questions of Honoar: Canadian Government Policy Towards Titular Honours fkom Macdondd to Bennett by Christopher Pad McCreery A Thesis submitted to the Department of History in conformity with requirements for the degree of Master of Arts Queen's University Kingston, Ontario, Caaada September, 1999 Q Christopher Paul McCreery National birary Biblioth&quenationale du Canada Acquisitions and Acquisitions et Bibliographic Services services bibliagraphiques 395 Wellington Street 395, rue Wellington OttawaON KIAON4 OIEawaON K1AON4 Canada Cariada The author has granted a non- L'auteur a accorde melicence non exclusive licence allowing the exclusive pennettant a la National Library of Canada to Bibliotheqe nationale du Canada de reproduce, loan, distriiute or sell reproduire, preter, distn'buer ou copies of this thesis in microform, vendre des copies de cette these sous paper or electronic formats. la forme de microfiche/fih, de reproduction sur papier ou sur format ekctronique. The author retains ownership of the L'auteur conserve la propriete du copyright in this thesis. Neither the droit d'auteur qui protege cette these. thesis nor substantial extracts fkom it Ni Ia these ai des extraits substantiels may be printed or otherwise de celle-ci ne doivent &re imprimes reproduced without the author's ou autrement reproduits sans son permission. autorisation- Abstract This thesis examines the Canadian government's policy towards British tituiar honours and their bestowal upon residents of Canada, c. 1867-1935. In the following thesis, I will employ primary documents to undertake an original study of the early development of government policy towards titular honours. The evolution and development of the Canadian government's policy will be examined in the context of increasing Canadian autonomy within the British Empire/Commonwealth- The incidents that prompted the development of a Canadian made formal policy will also be discussed. -

To Download the PDF File

"A statesmanlike measure with a partisan tail": The Development of the Nineteenth-Century Dominion Electoral Franchise by Colin J. Grittner, BHum A thesis submitted to the Faculty of Graduate Studies and Research in partial fulfillment of the requirements for the degree of Master of Arts Department of History Carleton University Ottawa, Ontario 29 June, 2009 © copyright 2009, Colin J. Grittner Library and Archives Biblioth&que et 1*1 Canada Archives Canada Published Heritage Direction du Branch Patrimoine de l'6dition 395 Wellington Street 395, rue Wellington Ottawa ON K1A 0N4 Ottawa ON K1A0N4 Canada Canada Your file Votra r6f6rence ISBN: 978-0-494-60310-9 Our file Notre r6f6rence ISBN: 978-0-494-60310-9 NOTICE: AVIS: The author has granted a non- L'auteur a accorde une licence non exclusive exclusive license allowing Library and permettant a la Bibliothgque et Archives Archives Canada to reproduce, Canada de reproduire, publier, archiver, publish, archive, preserve, conserve, sauvegarder, conserver, transmettre au public communicate to the public by par telecommunication ou par I'lnternet, preter, telecommunication or on the Internet, distribuer et vendre des theses partout dans le loan, distribute and sell theses monde, a des fins commercials ou autres, sur worldwide, for commercial or non- support microforme, papier, electronique et/ou commercial purposes, in microform, autres formats. paper, electronic and/or any other formats. The author retains copyright L'auteur conserve la propriety du droit d'auteur ownership and moral rights in this et des droits moraux qui protege cette these. Ni thesis. Neither the thesis nor la these ni des extraits substantiels de celle-ci substantial extracts from it may be ne doivent etre imprimes ou autrement printed or otherwise reproduced reproduits sans son autorisation. -

Canada's Admiralty Court in the Twentieth Century

Canada's Admiralty Court in the Twentieth Century Arthur J. Stone* The author outlines the debate surrounding the L'auteur traite du dabat ayant entour6 ]a creation creation of Canada's admiralty court. This debate was d'une Cour d'amiraut6 an Canada. Ce dtbat 6tait ali- fuelled by the desire for autonomy from England and ment6 par ]a volont6 d'une plus grande autonomie vis- the disagreement amongst Canadian politicians re- A-vis l'Angleterre, de meme que par le d~saccord entre garding which court was best suited to exercise admi- les politiciens canadiens quant A la cour la plus appro- ralty jurisdiction. In 1891, more than thirty years after pride pour avoir juridiction en mati~re de droit mari- this debate began, the Exchequer Court of Canada, a time. En 1891, apris plus de trente ans de dtbats, fut national admiralty court, was declared, replacing the crede la Cour de l'&chiquier du Canada, une cour unpopular British vice-admiralty courts. The jurisdic- d'amirantd nationale qui remplaga les impopulaires tion of this court was generally consistent with the ex- cours britanniques de vice-amiraut6. La juridiction de isting English admiralty jurisdiction; it was not until cette cour 6tait gdndralement en accord avec la juridic- 1931 that Canada was able to decide the jurisdiction of tion des cours d'amirautd britanniques; il faflut attendre its own court. Since then, this jurisdiction has been en- 1931 pour que le Canada soit capable de d6cider de ]a larged by federal legislative measures, most notably the juridiction de ses propres tribunaux.