Pre-Blackout Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tuen Mun District Council 2016-2017 Environment, Hygiene and District Development Committee

EHDDC Paper 1 7 /2017 For Information on 24 March 2017 Tuen Mun District Council 2016-2017 Environment, Hygiene and District Development Committee Progress Report as at 28.2.2017 No. Items Responsible Departments Progress A. (i) Drainage Improvement Works in Tuen Mun District (ii) Progress of Channel Desilting at Tuen Mun Drainage Services River Channel (as at Department Annex I 28.2.2017)and Maintenance Programme for the Coming Year (iii) Dredging Works at Fish Wholesales Market and Tuen Mun Typhoon Shelter (iv) Tuen Mun Village Sewerage B. Report on Environmental Civil Engineering and Annex II Monitoring of Mud Pit V Development Department Report on Water Seepage C. Problems at Buildings in Tuen Building Department and Annex III * Mun District Food and Environmental Hygiene Department, Joint Office Progress Report of Water D. Main Laying Works in Water Supplies Annex IV Tuen Mun District Department 檔號: HAD TMGR 1-90/8/176 HAD TMD/17-230/4/06 Pt.III HAD TMD/17-122/10/13 HAD TMGR 17-20/1/85 Annex 1 Drainage Services Department’s Progress Report I. Drainage Improvement Works in Tuen Mun District Drainage Improvement Works by Drainage Services Department: - (i) Construction of Intercepting Drains at Shun Tat Street, Tuen Mun Location Length (m) Drain type Shun Tat Street near Sun Fung Wai and 600 Underground drainage near the junction of Castle Peak Road pipe (Hung Shui Kiu Section) Castle Peak Road (Hung Shui Kiu 100 Underground drainage Section) near Sun Fung Wai San Tsuen pipe The construction commenced in May 2010. The works were substantially completed in August 2013. -

The Hyperlinks of Merchant Websites Will Bring to You to Another Website on the Internet, Which Is Published and Operated by a Third Party

The hyperlinks of merchant websites will bring to you to another website on the Internet, which is published and operated by a third party. Such links are only provided on our website for the convenience of the Client and Standard Chartered Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites is also subject to the terms of use and other terms and guidelines, if any, contained within each such website. In the event that any of the terms contained herein conflict with the terms of use or other terms and guidelines contained within any such websites, then the terms of use and other terms and guidelines for such website shall prevail. Offers are applicable for Standard Chartered Visa Credit Card Offers are applicable for Standard Chartered Mastercard Offers are applicable for Standard Chartered UnionPay Dual Currency Platinum Credit Card Offers are applicable for Standard Chartered WorldMiles Card Merchants Offers Details and Merchant's Additional Terms and Conditions Contact Details (852) 2833 0128 BEE CHENG HIANG SHOP NO.1 GROUND FLOOR, YING KONG MANSION, NO. 2-6 10% off on regular-priced meat products upon spending of HK$300 or above YEE WO STREET, CAUSEWAY BAY Promotion period is from 1 Jan to 31 Dec 2017. (852) 2730 8390 SHOP C, G/F, DAILY HOUSE, Merchant website: http://www.bch.hk NO.35-37 HAIPHONG ROAD, TSIM SHA TSUI (852) 2411 0808 SHOP NO.2 GROUND FLOOR,NO. 60 SAI YEUNG CHOI STREET SOUTH, MONGKOK (852) 3514 4018 SHOP NO.B02-36, LANGHAM PLACE,NO.8 ARGYLE STREET, MONGKOK (852) 2362 0823 SHOP NO.E5,HUNG HOM STATION,HUNG HOM (852) 2357 077 SHOP NO.KWT 20 ,KWUN TONG STATION, KWUN TONG (852) 2365 2228 Shop B12, Basement 1, Site 5,(Aeon Dept Store)Whampoa Garden, Hung Hom, Kowloon (852) 2698 8310 SHOP NO. -

Railway Network

Railway Network Railways play a vital role in serving the transport needs of COVID-19 pandemic. By end 2020, the AEL carries about Hong Kong. They account for about 39 per cent of domestic 8 400 passenger trips per day. public transport by end 2020. Light Rail: Light Rail is a local transportation network Existing Network: The existing railway network in Hong which started operation in 1988 to meet the transport needs of Kong has a total route length of about 263 kilometres. The the residents in the northwest New Territories. It now has a Legislative Council passed in June 2007 the Rail Merger route length of about 36 km with 68 stops. By end 2020, it Ordinance which provides the legal framework for the carries an average of about 305 600 passenger trips every post-merger corporation to operate both the Mass Transit day. It has four interchange stations in Yuen Long, Tin Shui Railway (MTR) system and Kowloon-Canton Railway (KCR) Wai, Siu Hong and Tuen Mun to facilitate passenger system. The post-merger Corporation, i.e. the MTR interchange between the Light Rail and West Rail Line Corporation Limited (MTRCL) has been granted a 50-year networks. franchise to operate the MTR and KCR systems with effect from December 2, 2007. Other fixed track systems include the Hong Kong Section of Guangzhou-Shenzhen-Hong Tramway and the Peak Tram. Kong Express Rail Link (XRL): The Hong Kong section of the XRL, commissioned in September 2018, is a 26-km long MTR: MTR is a heavily patronized railway network underground rail corridor connecting Hong Kong with the consisting of 10 heavy rail lines, Airport Express and the Hong national high-speed rail network. -

332 Controlling Officer's Reply

Examination of Estimates of Expenditure 2019-20 Reply Serial No. FHB(FE)332 CONTROLLING OFFICER’S REPLY (Question Serial No. 5578) Head: (49) Food and Environmental Hygiene Department Subhead (No. & title): (-) Not specified Programme: (2) Environmental Hygiene and Related Services Controlling Officer: Director of Food and Environmental Hygiene (Miss Vivian LAU) Director of Bureau: Secretary for Food and Health Question: How many unisex toilets are there in the territory? Please provide their addresses with a breakdown by the 18 districts. Does the Food and Environmental Hygiene Department have any plan to continuously increase the number of unisex toilets? If yes, please provide the details. Asked by: Hon CHAN Chi-chuen (LegCo internal reference no.: 409) Reply: The Food and Environmental Hygiene Department (the Department) has 379 public toilets with accessible unisex toilets (AUTs) provision. A list of these toilets is provided at Annex. If circumstances permit, the Department will, based on “The Design Manual on Barrier Free Access 2008”, provide AUTs at new public toilets or during reprovisioning or refurbishment of existing ones. Access to AUTs does not necessitate traversing an area reserved for one sex only. - End - Session 13 FHB(FE) - Page 901 Annex (Page 1 of 20) List of Public Toilets with Accessible Unisex Toilets Serial District Name of Public Toilet Address No. 1 Central/Western Belcher's Street Public Behind No.2-12 Belcher's Street, Sai Toilet Wan 2 Central/Western Centre Street Public Toilet Near Centre Street Market, -

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Islands Hong Kong Skycity Marriott Hotel 5482 Islands Hong Kong Skycity Marriott Hotel 5483 Yau Tsim Mong Block 2, The Long Beach 5484 Kwun Tong Dorsett Kwun Tong, Hong Kong 5486 Wan Chai Victoria Heights, 43A Stubbs Road 5487 Islands Tower 3, The Visionary 5488 Sha Tin Yue Chak House, Yue Tin Court 5492 Islands Hong Kong Skycity Marriott Hotel 5496 Tuen Mun King On House, Shan King Estate 5497 Tuen Mun King On House, Shan King Estate 5498 Kowloon City Sik Man House, Ho Man Tin Estate 5499 Wan Chai 168 Tung Lo Wan Road 5500 Sha Tin Block F, Garden Rivera 5501 Sai Kung Clear Water Bay Apartments 5502 Southern Red Hill Park 5503 Sai Kung Po Lam Estate, Po Tai House 5504 Sha Tin Block F, Garden Rivera 5505 Islands Ying Yat House, Yat Tung Estate 5506 Kwun Tong Block 17, Laguna City 5507 Crowne Plaza Hong Kong Kowloon East Sai Kung 5509 Hotel Eastern Tower 2, Pacific Palisades 5510 Kowloon City Billion Court 5511 Yau Tsim Mong Lee Man Building 5512 Central & Western Tai Fat Building 5513 Wan Chai Malibu Garden 5514 Sai Kung Alto Residences 5515 Wan Chai Chee On Building 5516 Sai Kung Block 2, Hillview Court 5517 Tsuen Wan Hoi Pa San Tsuen 5518 Central & Western Flourish Court 5520 1 Related Confirmed / District Building Name Probable Case(s) Wong Tai Sin Fu Tung House, Tung Tau Estate 5521 Yau Tsim Mong Tai Chuen Building, Cosmopolitan Estates 5523 Yau Tsim Mong Yan Hong Building 5524 Sha Tin Block 5, Royal Ascot 5525 Sha Tin Yiu Ping House, Yiu On Estate 5526 Sha Tin Block 5, Royal Ascot 5529 Wan Chai Block E, Beverly Hill 5530 Yau Tsim Mong Tower 1, The Harbourside 5531 Yuen Long Wah Choi House, Tin Wah Estate 5532 Yau Tsim Mong Lee Man Building 5533 Yau Tsim Mong Paradise Square 5534 Kowloon City Tower 3, K. -

LCQ9: Public Transport Services Between Tuen Mun and the Airport *********************************************************

LCQ9: Public transport services between Tuen Mun and the Airport ********************************************************* Following is a question by the Hon Cheung Hok-ming and a written reply by the Secretary for Transport and Housing, Ms Eva Cheng, in the Legislative Council today (November 2): Question: Some Tuen Mun residents have reflected that quite a number of residents in the district work at the Hong Kong International Airport (the Airport) due to insufficient employment opportunities in Tuen Mun; yet, at present only a few trips are made in the morning and afternoon daily by the buses of route E33P running between Siu Hong Railway Station in Tuen Mun and the Airport, and the service can hardly meet the demand during peak commuting hours. They have also indicated that as the first bus of this route from the Airport departs after 5pm, people who get off work earlier than that in the afternoon have to take buses of other routes which charge higher fares. In this connection, will the Government inform this Council: (a) whether it knows the percentage of the working population in Tuen Mun in the past three years who have to work across districts; (b) in response to the situation that the workers engaged in many types of jobs at the Airport need to work shifts, whether the authorities will request the operator of the aforesaid bus route to arrange for the first bus to depart from the Airport earlier in the afternoon as warranted by the actual situation; and (c) of the measures to improve the present public transport services between Tuen Mun (i.e. -

RNTPC Paper No. A/TM/552 for Consideration by the Rural and New Town Planning Committee on 23.10.2020

RNTPC Paper No. A/TM/552 For Consideration by the Rural and New Town Planning Committee on 23.10.2020 APPLICATION FOR PERMISSION UNDER SECTION 16 OF THE TOWN PLANNING ORDINANCE APPLICATION NO. A/TM/552 Applicant Fortune Ferry Company Limited Premises Shops 01-02, Level 1 (Main Deck), Tuen Mun Ferry Pier, Tuen Mun Total Floor Area of Premises About 33m2 Lease Government Property under Tenancy Agreement No. GPA N588 Plan Approved Tuen Mun Outline Zoning Plan (OZP) No. S/TM/35 Zonings “Other Specified Uses” annotated “Pier” (“OU(Pier)”) (about 76.65%) and “Open Space” (“O”) (about 23.35%) [Kiosks not greater than 10m2 each in area and not more than 10 in number for uses as shop and services are considered as ancillary to ‘pier’ use] Application Proposed Shop and Services (Retail Shop) 1. The Proposal 1.1 The applicant seeks planning permission to use Shops 01 and 02 (the Premises) located at Level 1 (Main Deck) of Tuen Mun Ferry Pier (the Pier) for shop and services (retail shop) (Plans A-1 and A-2). Shop 01 falls partly within an area zoned “Other Specified Uses” annotated “Pier” (“OU(Pier)”) and partly within an area zoned “Open Space” (“O”), while Shop 02 falls solely within the “OU(Pier)” zone on the approved Tuen Mun OZP No. S/TM/35. According to the Notes of the OZP, ‘Shop and Services (Bank, Fast Food Shop, Retail Shop, Service Trades, Showroom only)’ and ‘Shop and Services’ are Column 2 uses within “OU(Pier)” and “O” zones respectively and require planning permission from the Town Planning Board (the Board). -

Hong Kong in Brief

Brand Hong Kong’s visual identity — a powerful and energetic dragon — was designed to communicate the city’s historic link with a mythical icon. The image incorporates the Chinese characters for 'Hong Kong' (香港) and the letters 'H' and 'K'. This dual expression symbolises the blend of East and West that characterises Hong Kong. The dragon's fluid shape imparts a sense of movement and speed, communicating that Hong Kong is forever changing. The brandline — ‘Asia's world city’ — highlights Hong Kong's multiple roles as an international business hub, a gateway to economic opportunities in the mainland of China and Asia, and a center for arts and culture. Contents ABOUT HONG KONG 4 Location Population Language Climate International Trading Centre Global Services Centre International Corporate Base Free Trade and Free Market Small Government Monetary System The Rule of Law Airport Hong Kong Port ECONOMIC COMPETITIVENESS 9 Economic Development Economic Policy International Financial Centre Economic Links with the Mainland LIVING IN HONG KONG 16 Government Structure Legal System Employment Education Health Housing Transport Pollution and Environmental Control Law and Order Tax System Mandatory Provident Fund The Media Telecommunications COMING TO HONG KONG 32 Tourism Immigration Leisure and Culture Traditional Festivals THE FUTURE OF HONG KONG 38 Asia’s Cyber City for the Cyber Century Infrastructure Projects for the 21st Century HONG KONG : THE FACTS 43 USEFUL CONTACTS 46 3 ABOUT HONG KONG About Hong Kong Hong Kong, described as a ‘barren rock’ some 150 years ago, is today a world-class financial, trading and business centre and, indeed, a great world city. -

Transport Infrastructure and Traffic Review

Transport Infrastructure and Traffic Review Planning Department October 2016 Hong Kong 2030+ 1 TABLE OF CONTENTS 1 PREFACE ........................................................... 1 5 POSSIBLE TRAFFIC AND TRANSPORT 2 CHALLENGES ................................................... 2 ARRANGEMENTS FOR THE STRATEGIC Changing Demographic Profile .............................................2 GROWTH AREAS ............................................. 27 Unbalanced Spatial Distribution of Population and Synopsis of Strategic Growth Areas ................................. 27 Employment ........................................................................3 Strategic Traffic and Transport Directions ........................ 30 Increasing Growth in Private Vehicles .................................6 Possible Traffic and Transport Arrangements ................. 32 Increasing Cross-boundary Travel with Pearl River Delta Region .......................................................................7 3 FUTURE TRANSPORT NETWORK ................... 9 Railways as Backbone ...........................................................9 Future Highway Network at a Glance ................................11 Connecting with Neighbouring Areas in the Region ........12 Transport System Performance ..........................................15 4 STRATEGIC DEVELOPMENT DIRECTIONS FROM TRAFFIC AND TRANSPORT PERSPECTIVE ................................................. 19 Transport and Land Use Optimisation ...............................19 Railways Continue to be -

Rail Merger (1) Connected Transactions (2) Very Substantial Acquisition

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION This Circular does not constitute, or form part of, an offer or invitation, or solicitation or inducement of an offer, to subscribe for or purchase any of the MTRC Shares or other securities of the Company. If you are in any doubt as to any aspect of this Circular, or as to the action to be taken, you should consult a licensed securities LR 14.63(2)(b) dealer, bank manager, solicitor, professional accountant or other professional adviser. LR 14A.58(3)(b) If you have sold or transferred all your MTRC Shares, you should at once hand this Circular to the purchaser or transferee or to the bank, licensed securities dealer or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this Circular, makes no representation as to its LR 14.58(1) accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the LR 14A.59(1) whole or any part of the contents of this Circular. App. 1B, 1 LR 13.51A RAIL MERGER (1) CONNECTED TRANSACTIONS (2) VERY SUBSTANTIAL ACQUISITION Joint Financial Advisers to the Company Goldman Sachs (Asia) L.L.C. UBS Investment Bank Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders Merrill Lynch (Asia Pacific) Limited It is important to note that the purpose of distributing this Circular is to provide the Independent Shareholders of the Company with information, amongst other things, on the proposed Rail Merger, so that they may make an informed decision on voting in respect of the EGM Resolution. -

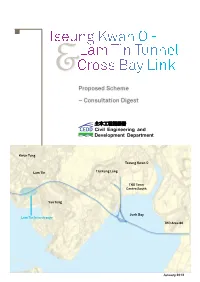

Tseung Kwan O - 及 Lam Tin Tunnel Cross Bay Link

Tseung Kwan O - 及 Lam Tin Tunnel Cross Bay Link Proposed Scheme – Consultation Digest Kwun Tong Tseung Kwan O Lam Tin Tiu Keng Leng TKO Town Centre South Yau Tong Junk Bay Lam Tin Interchange TKO Area 86 January 2012 Project Information Legends: Benefits Proposed Interchange • Upon completion of Route 6, the new road • The existing Tseung Kwan O Tunnel is operating Kai Tak Tseung Kwan O - Lam Tin Tunnel network will relieve the existing heavily near its maximum capacity at peak hours. The trafficked road network in the central and TKO-LT Tunnel and CBL will relieve the existing Kowloon Bay Cross Bay Link eastern Kowloon areas, and hence reduce travel traffic congestion and cater for the anticipated Kwun Tong Trunk Road T2 time for vehicles across these areas and related traffic generated from the planned development Yau Ma Tei Central Kowloon Route environmental impacts. of Tseung Kwan O. To Kwa Wan Lam Tin Tseung Kwan O Table 1: Traffic Improvement - Kwun Tong District Yau Tong From Yau Tong to Journey Time West Kowloon Area (Peak Hour) Current (2012) 22 min. Schematic Alignment of Route 6 and Cross Bay Link Via Route 6 8 min. Traffic Congestion at TKO Tunnel The Tseung Kwan O - Lam Tin Tunnel (TKO-LT Tunnel) At present, the existing Tseung Kwan O Tunnel is towards Kowloon in the morning is a dual-two lane highway of approximately 4.2km the main connection between Tseung Kwan O and Table 2: Traffic Improvement - Tseung Kwan O long, connecting Tseung Kwan O (TKO) and East urban areas of Kowloon. -

MTR Corporation

Prospectus MTR Corporation Limited ࠰ಥ᚛༩Ϟࠢʮ̡ (a company incorporated on 26th April 2000 under the Companies Ordinance of Hong Kong with company number 714016) and MTR Corporation (C.I.) Limited (a company organised under the laws of the Cayman Islands on 30th October 2000) (Unconditionally and Irrevocably Guaranteed by MTR Corporation Limited) US$3,000,000,000 Debt Issuance Programme For the issue of Notes with maturities of between one month and 30 years On 22nd December 1993, Mass Transit Railway Corporation (“MTRC”) entered into a US$1,000,000,000 Debt Issuance Programme (the “Programme”). The maximum aggregate nominal amount of Notes (as defined below) which may be outstanding under the Programme was increased to US$2,000,000,000 with effect from 1st June 1999 and to US$3,000,000,000 with effect from 31st October 2006. On 30th June 2000 MTR Corporation Limited (“MTRCL” or “the Company”) replaced MTRC as the issuer of Notes under the Programme. All the assets and liabilities of MTRC vested in MTRCL and MTRCL has adopted all of the accounts of MTRC. MTR Corporation (C.I.) Limited (“MTR Cayman”) became an additional issuer of Notes under the Programme with effect from 9th April 2001 pursuant to an Amending and Restating Programme Agreement dated 9th April 2001 made between MTRCL, MTR Cayman and the Dealers named therein (MTRCL and MTR Cayman together being the “Issuers” and each an “Issuer”). This Prospectus supersedes any previous prospectus, listing particulars or offering circular describing the Programme. Any Notes issued under the Programme on or after the date of this Prospectus are issued subject to the provisions described herein.