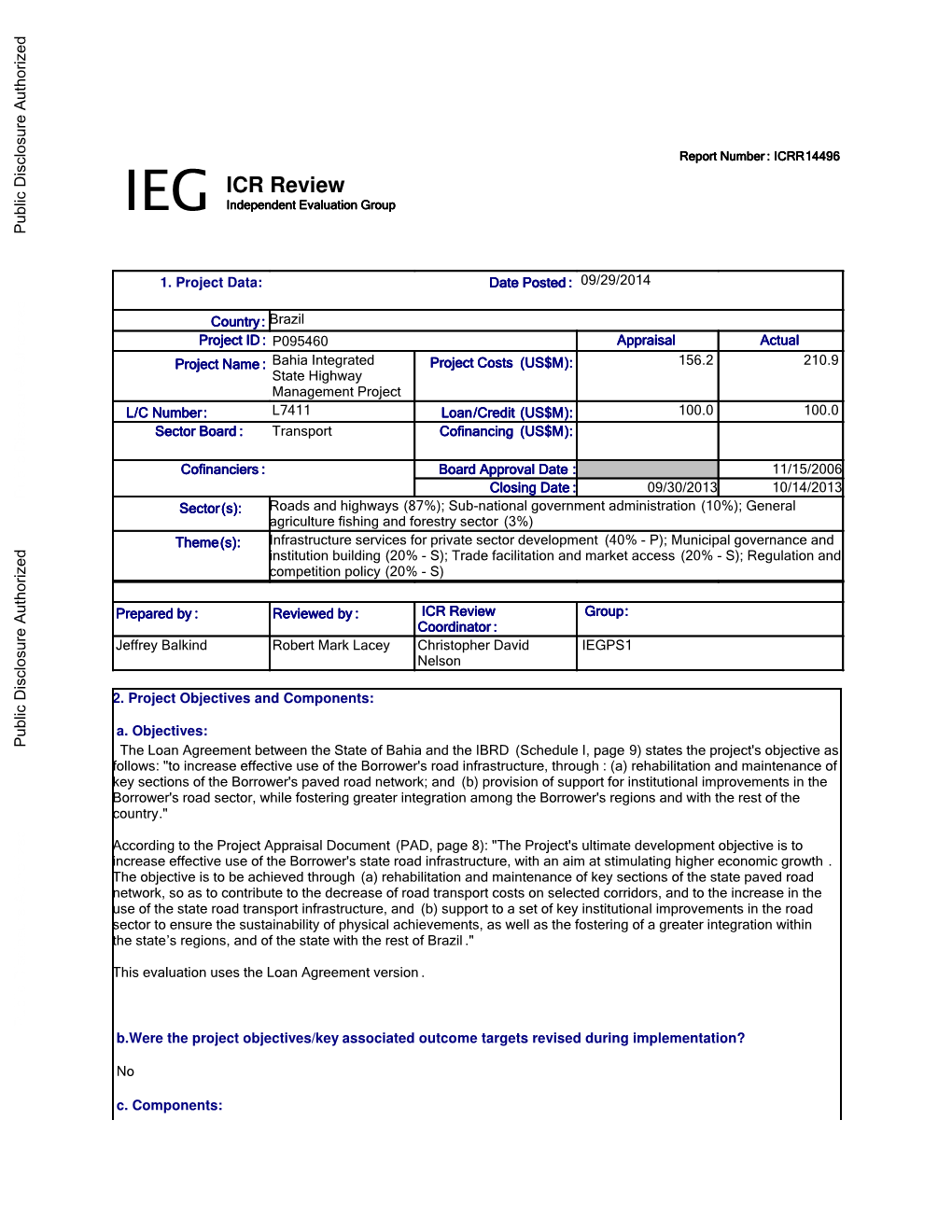

IEG ICR Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Potential Impacts of the Port of Salvador Improvements on the Brazilian Cotton Industry

International Journal of Food and Agricultural Economics ISSN 2147-8988 Vol. 3 No. 1, (2015), pp. 45-61 THE POTENTIAL IMPACTS OF THE PORT OF SALVADOR IMPROVEMENTS ON THE BRAZILIAN COTTON INDUSTRY Rafael Costa Texas A&M University, Department of Agricultural Economics, College Station, Texas, USA, Email: [email protected] Parr Rosson Texas A&M University, Department of Agricultural Economics, College Station, Texas, USA. Ecio de Farias Costa Universidade Federal de Pernambuco, Departamento de Economia, Recife, Pernambuco, Brasil. Abstract A spatial price equilibrium model of the international cotton sector was used to analyze the impacts of the Port of Salvador improvements on the Brazilian cotton industry and world cotton trade. The port of Salvador is undergoing relevant improvements in its facilities and physical structure. As a result of these improvements, the port of Salvador is expected to become more competitive and attract ocean shipping companies which are willing to export products directly to Asian importing markets. Scenarios with different reduction in export cost for the port of Salvador were examined. For all scenarios, the new direct ocean shipping lines were found to be important for the cotton exporters in Brazil, especially for the producers in the state of Bahia. In addition, results suggested that the state of Bahia would have the potential of becoming the largest cotton exporting state in Brazil. Keywords: Cotton, international trade, Brazil, spatial equilibrium model, transportation 1. Introduction and Background In the 18th century, cotton was introduced in Brazil in the Northeastern region of the country. As the Southeastern region of the country started to industrialize in late 1800’s, the textile industry followed and eventually cotton cultivation was solidified in the states of São Paulo and Paraná. -

Madre De Deus - Ingles 7/5/06 3:55 PM Page 1

10 - Madre de Deus - ingles 7/5/06 3:55 PM Page 1 PORT INFORMATION Terminal MADRE DE DEUS 1ª edition 10 - Madre de Deus - ingles 7/5/06 3:55 PM Page 2 10 - Madre de Deus - ingles 7/5/06 3:55 PM Page 3 1 INTRODUCTION, p. 5 2 DEFINITIONS, p. 7 UMMARY 3 CHARTS AND REFERENCE DOCUMENTS, p. 9 3.1 Nautical Charts, p. 9 S 3.2 Other Publications – Brazil (DHN), p. 10 4 DOCUMENTS AND INFORMATION EXCHANGE, p. 11 5 DESCRIPTION OF THE PORT AND ANCHORAGE AREA, p. 13 5.1 General description of the Terminal, p. 13 5.2 Location, p. 14 5.3 Approaching the Todos os Santos Bay and the Terminal, p. 14 5.4 Environmental Factors, p. 23 5.5 Navigation Restrictions in the Access Channel, p. 25 5.6 Area for Ship Maneuvers, p. 27 6 DESCRIPTION OF THE TERMINAL, p. 31 6.1 General description, p. 31 6.2 Physical details of the Berths, p. 32 6.3 Berthing and Mooring Arrangements, p. 32 6.4 Berth features for Loading, Discharging and Bunker, p. 37 6.5 Berthing and LaytimeManagement and Control, p. 40 6.6 Major Risks to Berthing and Laytime, p. 40 10 - Madre de Deus - ingles 7/5/06 3:55 PM Page 4 7 PROCEDURES, p. 41 7.1 Before Arrival, p. 41 7.2 Arrival, p. 41 7.3 Berthing, p. 43 7.4 Before Cargo Transfer, p. 44 7.5 Cargo Transfer, p. 46 7.6 Cargo Measurement and Documentation, p. 47 7.7 Unberthing and Leaving Port, p. -

Ice in the Tropics: the Export of ‘Crystal Blocks of Yankee Coldness’ to India and Brazil

Ice in the Tropics: the Export of ‘Crystal Blocks of Yankee Coldness’ to India and Brazil Marc W. Herold * Abstract. The Boston natural ice trade thrived during 1830-70 based upon Frederic Tudor’s idea of combining two useless products – natural winter ice in New England ponds and sawdust from Maine’s lumber mills. Tudor ice was exported extensively to the tropics from the West Indies to Brazil and the East Indies as well as to southern ports of the United States. In tropical ice ports, imported natural ice was a luxury product, e.g., serving to chill claret wines (Calcutta), champagne (Havana and Manaus), and mint juleps (New Orleans and Savannah) and used in luxury hotels or at banquets. In the temperate United States, natural ice was employed to preserve foods (cold storage) and to cool water (Americans’ peculiar love of ice water). In both temperate and tropical regions natural ice found some use for medicinal purposes (to calm fevers). With the invention of a new technology to manufacture artificial ice as part of the Industrial Revolution, the natural ice export trade dwindled as import substituting industrialization proceeded in the tropics. By the turn of the twentieth century, ice factories had been established in half a dozen Brazilian port cities. All that remained of the once extensive global trade in natural ice was a sailing ship which docked in Rio Janeiro at Christmas time laden with ice and apples from New England. Key words : natural ice export, nineteenth century globalization, artificial ice industry, luxury consumption, commodity chain. * MARC W. -

Wilson Sons Limited Relevant Fact Notice

WILSON SONS LIMITED CNPJ 05.721.735/0001-28 BM&FBOVESPA: WSON11 RELEVANT FACT NOTICE Wilson Sons Limited (BM&FBovespa: WSON11, the “Company”) announces to all its shareholders the signing of the amendment to the TECON Salvador lease contract with the Companhia das Docas do Estado da Bahia (CODEBA), effective as of September 2nd, 2010. The amendment to the TECON Salvador lease contract referenced in the Material Fact released on August 9th, 2010, contemplates the extension into the area called “Ponta Norte” of Salvador’s Port, adjacent to TECON Salvador. The “Ponta Norte” area includes an additional quay of 167m and retro-area of 44,000m². The amendment to the TECON Salvador lease contract includes a down-payment to CODEBA of R$25 million (twenty five million Reais) with monthly rental price based on the new area and a price per-container or cargo movement consistent with the original TECON Salvador lease contract. Wilson, Sons history of contribution to the development of Brazilian maritime trade in the city of Salvador dates back more than 173 years with the formation of the company. The expansion represents an important investment in the development of the future of trade capacity for Salvador, Bahia and the Northeast of Brazil. This expansion together with public dredging of the access channel from 12 to 15 meters, will allow the efficient access of Post-panamax ships that can measure in excess of 300 metres in length and are capable of transporting up to 9,000 TEUs at a time. The public dredging is expected to be completed by the end of the year. -

A Decade of Action in Transport an Evaluation of World Bank Assistance to the Transport Sector, 1995–2005 the WORLD BANK GROUP

THE WORLD BANK A Decade of Action in Transport An Evaluation of World Bank Assistance to the Transport Sector, 1995–2005 THE WORLD BANK GROUP WORKING FOR A WORLD FREE OF POVERTY The World Bank Group consists of five institutions—the International Bank for Reconstruction and Development (IBRD), the International Finance Corporation (IFC), the International Development Association (IDA), the Multilateral Investment Guarantee Agency (MIGA), and the International Centre for the Settlement of Investment Disputes (ICSID). Its mission is to fight poverty for lasting results and to help people help themselves and their envi- ronment by providing resources, sharing knowledge, building capacity, and forging partnerships in the public and private sectors. THE INDEPENDENT EVALUATION GROUP ENHANCING DEVELOPMENT EFFECTIVENESS THROUGH EXCELLENCE AND INDEPENDENCE IN EVALUATION The Independent Evaluation Group (IEG) is an independent, three-part unit within the World Bank Group. IEG-World Bank is charged with evaluating the activities of the IBRD (The World Bank) and IDA, IEG-IFC focuses on assessment of IFC’s work toward private sector development, and IEG-MIGA evaluates the contributions of MIGA guarantee projects and services. IEG reports directly to the Bank’s Board of Directors through the Director-General, Evaluation. The goals of evaluation are to learn from experience, to provide an objective basis for assessing the results of the Bank Group’s work, and to provide accountability in the achievement of its objectives. It also improves Bank Group work by identifying and disseminating the lessons learned from experience and by framing recommendations drawn from evaluation findings. WORLD BANK INDEPENDENT EVALUATION GROUP A Decade of Action in Transport An Evaluation of World Bank Assistance to the Transport Sector, 1995–2005 2007 The World Bank http://www.worldbank.org/ieg Washington, D.C. -

WEEKLY NEWS 19.05.2021 | 20 Ed

WILLIAMS BRAZIL 1 WEEKLY NEWS 19.05.2021 | 20 Ed. Due to this situation with Coronavirus, most businesses are operating PRODUCTION OF CORN ETHANOL CONTINUES TO GROW from home-office. In case of need, please contact us through our Key Sugarcane crushing, and the quality of raw materials for sugar Personnel mobile phones on our website (williams.com.br) production declined in April. As a result, the production of sugar fell by SOY AND MEAT DRIVE AGRIBUSINESS EXPORTS 28.51% (2.15 million tons), and the ethanol productivity dropped by Driven by soybeans and by-products, meat, forest products, sugar, and 20.13% (2.07 billion liters). Of the total, hydrous ethanol production was coffee, Brazilian agribusiness exports reached US$ 13.6 billion in April, 1.57 billion liters (-20.54%), while anhydrous ethanol reached 448 39% higher than in the same month last year, pursuant to data compiled thousand liters (-27.26%). On the other hand, the production of corn by SECEX (the Ministry of Agriculture’s foreign trade secretariat) ethanol maintains an upward trend. In the second half of April, Brazil According to the file, it was the first time in history that agribusiness produced about 117 million liters of corn ethanol, up 4.41% when shipments generated more than US$ 10 billion in April. Even with the compared the same period in the 2020/2021 cycle. Total production in jump, the sector’s share in the country’s total exports fell to 51.2%, April reached 228.43 million liters, up 15.16% in the same comparison. -

TRANSPORTATION and LOGISTICS in BRAZILIAN AGRICULTURE Prof

Agricultural Outlook Forum 2003 Presented: Thursday, February 20, 2003 TRANSPORTATION AND LOGISTICS IN BRAZILIAN AGRICULTURE1 Prof. Dr. José Vicente Caixeta-Filho Departamento de Economia, Administração e Sociologia Escola Superior de Agricultura “Luiz de Queiroz” (ESALQ) Universidade de São Paulo (USP), Brazil [email protected] Transportation infrastructure can determine the competitive success of an agricultural enterprises or entire agricultural sector. The Brazilian Government has proposed investment in large projects to improve the transportation infrastructure of the country’s Center-West and North regions. These projects intend explicitly to develop the commodity delivery system in those regions, which should stimulate the expansion of soybean cultivation into northern areas. The highway freight market is not under government control, meaning that freight prices are formed through free negotiation determined by supply and demand for the transport service. Carriers have to stay current on changes in every shipping cost variable to negotiate efficiently with shippers. These demanders, except under certain very specific circumstances, have the negotiation power to exert strong pressure on carriers to obtain freight transport discounts. The new deregulated railway system shows good potential, especially for the shipment of grains. Transportation using waterway systems, considered to be the most economical one for bulk volumes, has generated a lot of expectations due to projects such as the Madeira waterway system. It is hoped that this waterway system will efficiently reduce the transportation costs for grains produced in Brazil’s Center-West region. The ports of Santos and Paranaguá are still the preferred embarkation points, but the ports of Itaqui, Vitoria, Ilhéus, São Francisco do Sul and Rio Grande can be considered very good alternatives. -

The Role of the Brazilian Ports in the Improvement of the National Ballast

The Role of the Brazilian Ports in the Improvement of the National Ballast Water Management Program According the Provisions of the International Ballast Water Convention Uirá Cavalcante Oliveira The United Nations-Nippon Foundation Fellowship Programme 2007 - 2008 DIVISION FOR OCEAN AFFAIRS AND THE LAW OF THE SEA OFFICE OF LEGAL AFFAIRS, THE UNITED NATIONS NEW YORK, 2008 DISCLAIMER The views expressed herein are those of the author and do not necessarily reflect the views of the Government of Brazil, the United Nations, the Nippon Foundation of Japan, Tulane University, or those of the Brazilian National Agency for Waterway Transportation. © 2008 Uirá Cavalcante Oliveira. All rights reserved. - i - Abstract Ballast water is the water used by ships for obtaining draft, trim, or stability; and usually it is taken and discharged into port areas during operations of unloading and loading cargoes. Ballast water has been identified as the main vector for the introduction of alien and harmful organisms into coastal zone waters, from which can originate ecological, social and economic impacts. In response to this problem, the International Maritime Organization has adopted the “International Convention for the Control and Management of Ships’ Ballast Water and Sediments” (2004), which was partially internalized in Brazil through a federal norm named NORMAM-20 that provides the general IMO guidelines for ships exchanging their ballast water in oceanic waters beyond 200 nm. However, this measure presents limitations and a considerable number of vessels probably do not comply, or do so only partially. Therefore, the ballast water oceanic exchange cannot totally assure the prevention of new introductions. -

Feasibility of an Intermodal Transport Solution Towards Northern Europe Using Portuguese Ports November 2017

Feasibility of an intermodal transport solution towards Northern Europe using Portuguese ports Jean-Pierre Fernandes Thesis to obtain a master degree in Naval Architecture and Ocean Engineering Supervisors: Professor Tiago Santos Jury: Professor Carlos Guedes Soares Professor Manuel Ventura Professor Tiago Santos November 2017 Feasibility of an intermodal transport solution towards Northern Europe Using Portuguese ports Comparative study of Maritime versus rail network transport systems for containerized cargo The European Jean Pierre Fernandes Acknowledgements I hereby express my gratitude to professors Doctor Manuel Ventura and Doctor Tiago Alexendre Rosado Santos for allowing me to undertake this thesis project. I would like to thank Professor Doctor Guedes Carlos Soares for accepting my proposal for the topic of this thesis. I wish to thank the Instituto Superior Tecnico for their initial acceptance of myself to do this degree and all associated professors that have developed my knowledge to be able to analyze this maritime topic and its effects. I would like to thank my advisor Professor Tiago Santos, for guidance, input, and assistance towards the development of the thesis. I would like to thank Mr. Paulo Niza of Medway logistics for the help and explanations related to Rail and intermodal container transportation, cost, and operational analysis. I would like to thank Mrs Sandra Ponce Mrs. Barbara d´ Azevedo, for their tireless unending efforts of assistance towards the organization of affairs relating to the presentation and submission of the thesis. i Abstract Global maritime freight transportation systems are dynamic, expansive, and integrated. The same is true regarding local and regional systems. Therefore, analyzing the sections requires an understanding of all the components that supply chain has and understanding how to apply the relative cost associated with each dynamic activity. -

Grain Ports of Brazil

PORTS PRESENTATION BRAZIL 2 PAGE OF CONTENTS Ports & Terminals 03 Salvador 46 NORTH Aratu 50 Itacoatiara 04 Ilhéus 53 Santarém 07 SOUTHEAST Santana 10 Tubarão 56 Belém 13 Vitória 59 Vila do Conde 17 Rio de Janeiro 63 NORTHEAST São Sebastião 66 Itaqui 20 Santos 69 Fortaleza (Mucuripe) 24 SOUTH Natal 27 Paranaguá 77 Cabedelo 30 São Francisco do Sul 81 Recife 34 Imbituba 84 Suape 37 Porto Alegre 87 Maceió 40 Rio Grande 90 Barra dos Coqueiros 43 3 BRAZIL PORTS AND TERMINALS 4 NORTH ITACOATIARA OVERVIEW Itacoatiara CITY AND RIVER PORT IS located at THE NORTHeastern Amazonas state IN THE NORTHWESTERN REGION OF BRAZIL. PORT RESTRICTIONS MAX MAX MAX AIR MAX W. PORT TERMINAL WHARF WATER TIDE NAABSA DRAFT LOA BEAM DRAFT DWT DENSITY 0-10 m if Itacoatiara Hermasa 1 11.50 m 225 m 32 m 15.50 m 75,000 mt FW 997 No dry/full 0-10 m if Itacoatiara Hermasa 2 11.50 m 255 m 39 m 17 m N/R FW 997 No dry/full NAUTICAL INFORMATION BRAZILIAN CHARTS: North Bar up to Fazendinha Pilot Station 200, 201, 202, 203, 204, 205,, 206, 210 and 220 River current of 4 to 6 knots in average, but subject to weather condition. Berthing side preference by starboard side. The vessel must shift for changing holds on loading operations. Masters are required to make their loading sequence considering the minimum possible number of runs in order to reduce the number of shifting as well as to speed up loading. INLAND ACCESS Terminal access usually made by boat, taking approximately 30 minutes by boat or 4 hours by car from Manaus. -

WEEKLY NEWS 26.08.2020 | 297 Ed

WILLIAMS BRAZIL 1 WEEKLY NEWS 26.08.2020 | 297 Ed. Due to this situation with Coronavirus, most of business are operating JULY WAS BEST MONTH THIS YEAR FOR BRAZIL´S EXPORTS from home-office. In case of need, please contact us through our Key TO ARAB COUNTRIES Personnel mobile phones in our website (williams.com.br) Data compiled by the Arab-Brazil Chamber of Commerce indicates that in July, exports from Brazil to Arab countries reached their highest BRAZILIAN SUGAR PRODUCTION MAY SURGE 32% IN 2020/2021 value since the beginning of the year. Sales revenue stood at US$1.1 HARVEST, SAYS CONAB billion, 30.8% more than in June 2019. The good performance is Brazil’s total sugar production in the 2020-21 season is expected to related to the process of normalizing maritime transport logistics for grow 32% and reach 39.33 million tons, said Conab (Brazil’s food the region, the replenishment of inventories after Ramadan, and the supply agency) on Thursday. Conab projected total sugarcane crush gradual resumption of activities in the Arab countries. The secretary- of 642 million tons, 0.1% smaller than last year, but higher than the general and CEO of the Arab Brazilian Chamber reports that normally estimated 630.7 million tons in May. The agency said that the large July would be the period of low demand in the Arab market, as it is Brazilian output has so far found destination, with exports rising 70% vacation time and very hot. “People would not be in the Arab countries, in the first four months of the crop (April-July) compared to the same they would be on vacation, but as it is an atypical year, people did not period in 2019. -

The Potential Impacts of the Port of Salvador Improvements on the Brazilian Cotton Exporting Industry

THE POTENTIAL IMPACTS OF THE PORT OF SALVADOR IMPROVEMENTS ON THE BRAZILIAN COTTON EXPORTING INDUSTRY Rafael de Farias Costa (AgriLogic Consulting) Ecio de Farias Costa (UFPE) Resumo: Abstract: A spatial price equilibrium model of the international cotton sector was used to analyze the impacts of the Port of Salvador improvements on the Brazilian cotton industry and world cotton trade. By the end of 2012, the port of Salvador is expected to have undergone relevant improvements in its facilities and physical structure. As a result of these improvements, the port of Salvador is expected to become more competitive and attract ocean shipping companies which are willing to export products directly to Asian importing markets. Scenarios with different reduction in export cost for the port of Salvador were examined. For all scenarios, the new direct ocean shipping lines were found to be important for the cotton exporters in Brazil, especially for the producers in the state of Bahia. As the ocean shipping carriers introduce their new shipping lines, the analysis indicated a shift in Brazil cotton export flows from the port of Santos to the port of Salvador as well as an increase in exports and producer revenues. In addition, results suggested that the state of Bahia would have the potential of becoming the largest cotton exporting state in Brazil. Resumo: Um modelo de equilíbrio preço espacial do mercado internacional do algodão foi utilizado para analisar os impactos dos investimentos na infraestrutura do porto de Salvador na indústria algodoeira brasileira e no comércio mundial do algodão. Até o final de 2012, o porto de Salvador deverá ter concluído melhorias relevantes em suas instalações e estrutura física.