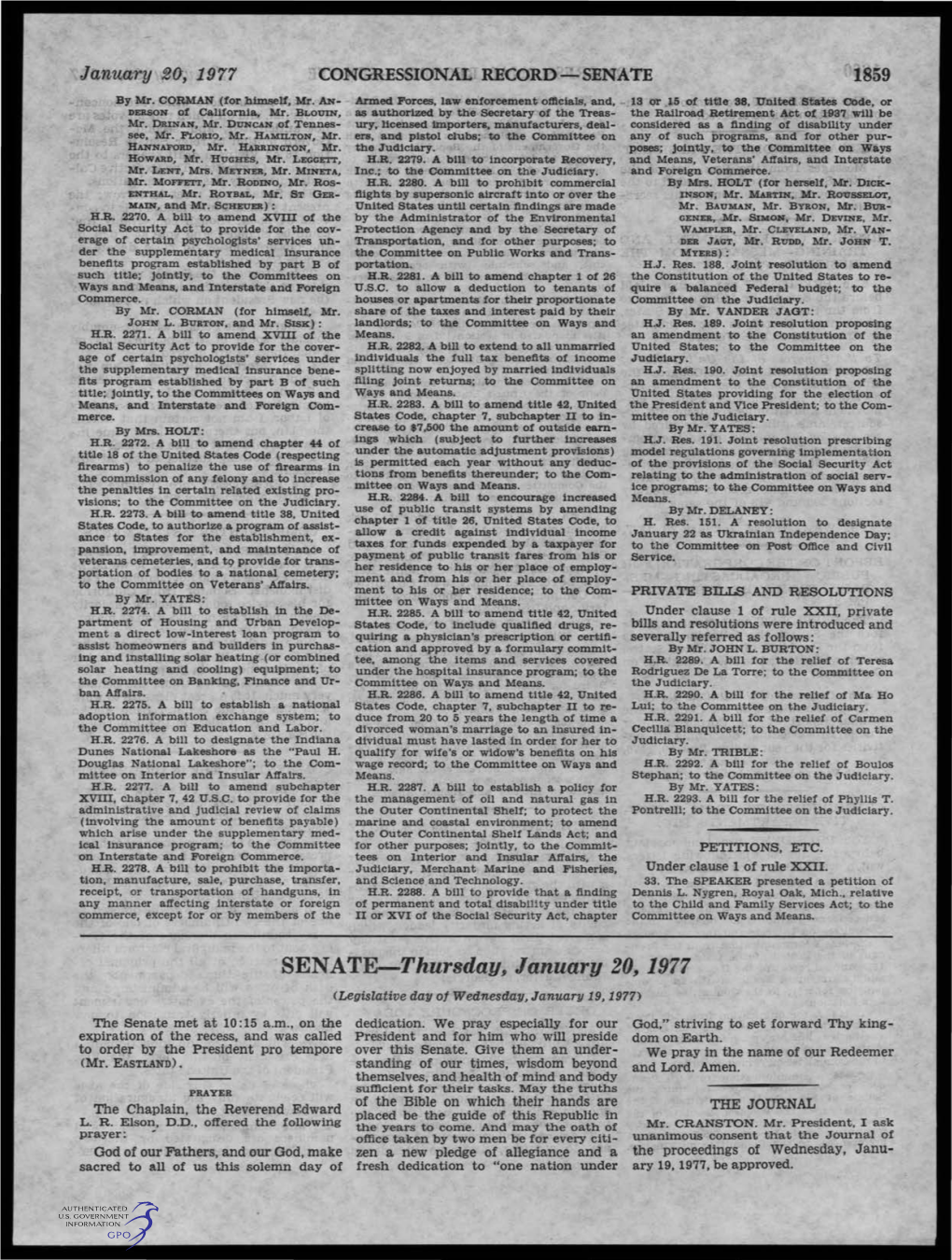

SENATE-Thursday, January 20, 1977

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Emergency! Electric Fireplace 114736 - Media Console Electric F Ireplace 888400/13 HEATS up to 1,000 SQ

T1 January 7 - 13, 2018 Connie Britton, Angela Bassett and Peter Krause star in “9-1-1” FIREPLACES STARTING AT $688 HOLLYWOOD II URBAN LOFT Mirrored electric fireplace 119522 Media console electric fireplace 112726 ENTERPRISE BLACK ASTORIA Emergency! Electric fireplace 114736 - Media console electric f ireplace 888400/13 HEATS UP TO 1,000 SQ. FT. T2 Page 2 — Sunday, January 7, 2018 — The Robesonian Under pressure First responders struggle to save the day and themselves in Fox’s ‘9-1-1’ By Kyla Brewer first responders contend that (“AHS: Roanoke”). Aside from her TV Media they’re also the most rewarding, top-notch television work, Bassett and this new series sheds light on is best known for her appearances hen the heat is on, it helps to the highs and lows these brave men in feature films. She secured her Wkeep a cool head. In an emer- and women experience every day. spot as a Hollywood icon with her gency situation, first responders “In those moments when you portrayal of Tina Turner in the must keep it together and rely on actually save someone, there’s no biopic “What’s Love Got to Do their training to help those in need. better feeling in the world,” Nash With It,” for which she won a Gold- However, that doesn’t mean first says in “9-1-1.” en Globe and earned an Oscar responders don’t need help them- Bringing those moments to the nomination. She’s also famous for selves. small screen may be a big chal- her starring turn in the romantic Creators Ryan Murphy and Brad lenge, but if there’s currently a comedy “How Stella Got Her Falchuk explore the pressures team in network television that Grove Back” (1998). -

The 46Th Annual

the 46th Annual 2018 TO BENEFIT NANTUCKET COMMUNITY SAILING PROUD TO SPONSOR MURRAY’S TOGGERY SHOP 62 MAIN STREET | 800-368-3134 2 STRAIGHT WHARF | 508-325-9600 1-800-892-4982 2018 elcome to the 15th Nantucket Race Week and the 46th Opera House Cup Regatta brought to you by Nantucket WCommunity Sailing, the Nantucket Yacht Club and the Great Harbor Yacht Club. We are happy to have you with us for an unparalleled week of competitive sailing for all ages and abilities, complemented by a full schedule of awards ceremonies and social events. We look forward to sharing the beauty of Nantucket and her waters with you. Thank you for coming! This program celebrates the winners and participants from last year’s Nantucket Race Week and the Opera House Cup Regatta and gives you everything you need to know about this year’s racing and social events. We are excited to welcome all sailors in the Nantucket community to join us for our inaugural Harbor Rendezvous on Sunday, August 12th. We are also pleased to welcome all our competitors, including young Opti and 420 racers; lasers, Hobies and kite boarders; the local one design fleets; the IOD Celebrity Invitational guest tacticians and amateur teams; and the big boat regatta competitors ranging from Alerions and Wianno Seniors to schooners and majestic classic yachts. Don’t forget that you can go aboard and admire some of these beautiful classics up close, when they will be on display to the public for the 5th Classic Yacht Exhibition on Saturday, August 18th. -

Appendix File Anes 1988‐1992 Merged Senate File

Version 03 Codebook ‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐ CODEBOOK APPENDIX FILE ANES 1988‐1992 MERGED SENATE FILE USER NOTE: Much of his file has been converted to electronic format via OCR scanning. As a result, the user is advised that some errors in character recognition may have resulted within the text. MASTER CODES: The following master codes follow in this order: PARTY‐CANDIDATE MASTER CODE CAMPAIGN ISSUES MASTER CODES CONGRESSIONAL LEADERSHIP CODE ELECTIVE OFFICE CODE RELIGIOUS PREFERENCE MASTER CODE SENATOR NAMES CODES CAMPAIGN MANAGERS AND POLLSTERS CAMPAIGN CONTENT CODES HOUSE CANDIDATES CANDIDATE CODES >> VII. MASTER CODES ‐ Survey Variables >> VII.A. Party/Candidate ('Likes/Dislikes') ? PARTY‐CANDIDATE MASTER CODE PARTY ONLY ‐‐ PEOPLE WITHIN PARTY 0001 Johnson 0002 Kennedy, John; JFK 0003 Kennedy, Robert; RFK 0004 Kennedy, Edward; "Ted" 0005 Kennedy, NA which 0006 Truman 0007 Roosevelt; "FDR" 0008 McGovern 0009 Carter 0010 Mondale 0011 McCarthy, Eugene 0012 Humphrey 0013 Muskie 0014 Dukakis, Michael 0015 Wallace 0016 Jackson, Jesse 0017 Clinton, Bill 0031 Eisenhower; Ike 0032 Nixon 0034 Rockefeller 0035 Reagan 0036 Ford 0037 Bush 0038 Connally 0039 Kissinger 0040 McCarthy, Joseph 0041 Buchanan, Pat 0051 Other national party figures (Senators, Congressman, etc.) 0052 Local party figures (city, state, etc.) 0053 Good/Young/Experienced leaders; like whole ticket 0054 Bad/Old/Inexperienced leaders; dislike whole ticket 0055 Reference to vice‐presidential candidate ? Make 0097 Other people within party reasons Card PARTY ONLY ‐‐ PARTY CHARACTERISTICS 0101 Traditional Democratic voter: always been a Democrat; just a Democrat; never been a Republican; just couldn't vote Republican 0102 Traditional Republican voter: always been a Republican; just a Republican; never been a Democrat; just couldn't vote Democratic 0111 Positive, personal, affective terms applied to party‐‐good/nice people; patriotic; etc. -

Sydney Program Guide

Firefox http://prtten04.networkten.com.au:7778/pls/DWHPROD/Program_Repor... SYDNEY PROGRAM GUIDE Sunday 18th April 2021 06:00 am Home Shopping (Rpt) Home Shopping 06:30 am Home Shopping (Rpt) Home Shopping 07:00 am Home Shopping (Rpt) Home Shopping 07:30 am Key Of David PG The Key of David, a religious program, covers important issues of today with a unique perspective. 08:00 am Bondi Rescue (Rpt) CC PG Coarse Language, Santa comes to Bondi and he's brought the South Pole with him. It is the Mature Themes wettest Christmas day in seventy two years. Meanwhile, a seizure on the sand turns pear-shaped. 08:30 am Star Trek: Voyager (Rpt) PG The Muse A poet discovers an unconscious B'Elanna Torres in the Delta Flyer, after it crash landed on his planet. In need of inspiration, this poet intends on using the stories of Voyager in his plays. Starring: Kate Mulgrew, Roxann Dawson, Garrett Wang, Robert Duncan McNeill, Tim Russ, Ethan Phillips, Robert Picardo, Robert Beltran, Jeri Ryan Guest Starring: Tony Amendola, John Schuck, Joseph Will, Kellie Waymire 09:30 am Star Trek: Voyager (Rpt) PG Fury An older Kes returns to Voyager to take revenge on Janeway for taking her from her homeworld too young. Using her telekinetic powers to travel through time, Kes intends to rescue her younger self. Starring: Kate Mulgrew, Tim Russ, Ethan Phillips, Robert Beltran, Robert Picardo, Roxann Dawson, Robert Duncan McNeill, Garrett Wang, Jeri Ryan Guest Starring: Jennifer Lien, Vaughn Armstrong 10:30 am Escape Fishing With ET (Rpt) CC Escape with former Rugby League Legend "ET" Andrew Ettingshausen as he travels Australia and the Pacific, hunting out all types of species of fish, while sharing his knowledge on how to catch them. -

Speech, National Conference of Christians and Jews, Cleveland, OH” of the Gerald R

The original documents are located in Box 134, folder “June 9, 1974 - Speech, National Conference of Christians and Jews, Cleveland, OH” of the Gerald R. Ford Vice Presidential Papers at the Gerald R. Ford Presidential Library. Copyright Notice The copyright law of the United States (Title 17, United States Code) governs the making of photocopies or other reproductions of copyrighted material. Gerald Ford donated to the United States of America his copyrights in all of his unpublished writings in National Archives collections. Works prepared by U.S. Government employees as part of their official duties are in the public domain. The copyrights to materials written by other individuals or organizations are presumed to remain with them. If you think any of the information displayed in the PDF is subject to a valid copyright claim, please contact the Gerald R. Ford Presidential Library. Digitized from Box 134 of the Gerald R. Ford Vice Presidential Papers at the Gerald R. Ford Presidential Library 7 t' . NATIONAL CONFERENCE OF CHRISTIANS AND JEWS ( SHERATON CLEVELAND HOTEL, SUNDAY, JUNE 9, 1974 MAYOR PERK, CHAIRMAN E. MANDELL DE WINDT OF THE OVER-ALL CIVIC COMMITTEE SPONSORING THIS OCCASION, DINNER CHAIRMAN FRANC~S A. COY, PRESIDING CHAIRMAN LOUIS B. SELTZER OF THE NORTHERN OHIO ____.) REGION OF THE NATIONAL CONFERENCE OF CHRISTIANS AND JEWS, LADIES AND GENTLEMEN: 'I - 2 - I AM HONORED TO ADDRESS THE ORGANIZATION THAT MADE BROTHERHOOD MORE THAN A PHRASE. THE NATIONAL CONFERENCE OF CHRISTIANS AND JEWS HAS TRANSLATED PREACHMENT INTO PRACTICE. YOU HAVE BUILT A COALITION OF AMERICANS COMMITTED TO THIS NATION'S IDEALS OF ~ , /LIBERTY, AND JUSTICE FOR ALL. -

Senator Dole FR: Kerry RE: Rob Portman Event

This document is from the collections at the Dole Archives, University of Kansas http://dolearchives.ku.edu TO: Senator Dole FR: Kerry RE: Rob Portman Event *Event is a $1,000 a ticket luncheon. They are expecting an audience of about 15-20 paying guests, and 10 others--campaign staff, local VIP's, etc. *They have asked for you to speak for a few minutes on current issues like the budget, the deficit, and health care, and to take questions for a few minutes. Page 1 of 79 03 / 30 / 93 22:04 '5'561This document 2566 is from the collections at the Dole Archives, University of Kansas 141002 http://dolearchives.ku.edu Rob Portman Rob Portman, 37, was born and raised in Cincinnati, in Ohio's Second Congressional District, where he lives with his wife, Jane. and their two sons, Jed, 3, and Will~ 1. He practices business law and is a partner with the Cincinnati law firm of Graydon, Head & Ritchey. Rob's second district mots run deep. His parents are Rob Portman Cincinnati area natives, and still reside and operate / ..·' I! J IT ~ • I : j their family business in the Second District. The family business his father started 32 years ago with four others is Portman Equipment Company headquartered in Blue Ash. Rob worked there growing up and continues to be very involved with the company. His mother was born and raised in Wa1Ten County, which 1s now part of the Second District. Portman first became interested in public service when he worked as a college student on the 1976 campaign of Cincinnati Congressman Bill Gradison, and later served as an intern on Crradison's staff. -

Presidents Worksheet 43 Secretaries of State (#1-24)

PRESIDENTS WORKSHEET 43 NAME SOLUTION KEY SECRETARIES OF STATE (#1-24) Write the number of each president who matches each Secretary of State on the left. Some entries in each column will match more than one in the other column. Each president will be matched at least once. 9,10,13 Daniel Webster 1 George Washington 2 John Adams 14 William Marcy 3 Thomas Jefferson 18 Hamilton Fish 4 James Madison 5 James Monroe 5 John Quincy Adams 6 John Quincy Adams 12,13 John Clayton 7 Andrew Jackson 8 Martin Van Buren 7 Martin Van Buren 9 William Henry Harrison 21 Frederick Frelinghuysen 10 John Tyler 11 James Polk 6 Henry Clay (pictured) 12 Zachary Taylor 15 Lewis Cass 13 Millard Fillmore 14 Franklin Pierce 1 John Jay 15 James Buchanan 19 William Evarts 16 Abraham Lincoln 17 Andrew Johnson 7, 8 John Forsyth 18 Ulysses S. Grant 11 James Buchanan 19 Rutherford B. Hayes 20 James Garfield 3 James Madison 21 Chester Arthur 22/24 Grover Cleveland 20,21,23James Blaine 23 Benjamin Harrison 10 John Calhoun 18 Elihu Washburne 1 Thomas Jefferson 22/24 Thomas Bayard 4 James Monroe 23 John Foster 2 John Marshall 16,17 William Seward PRESIDENTS WORKSHEET 44 NAME SOLUTION KEY SECRETARIES OF STATE (#25-43) Write the number of each president who matches each Secretary of State on the left. Some entries in each column will match more than one in the other column. Each president will be matched at least once. 32 Cordell Hull 25 William McKinley 28 William Jennings Bryan 26 Theodore Roosevelt 40 Alexander Haig 27 William Howard Taft 30 Frank Kellogg 28 Woodrow Wilson 29 Warren Harding 34 John Foster Dulles 30 Calvin Coolidge 42 Madeleine Albright 31 Herbert Hoover 25 John Sherman 32 Franklin D. -

2010 Year Book

2010 YEAR BOOK www.massbaysailing.org $5.00 HILL & LOWDEN, INC. YACHT SALES & BROKERAGE J boat dealer for Massachusetts and southern new hampshire Hill & Lowden, Inc. offers the full range of new J Boat performance sailing yachts. We also have numerous pre-owned brokerage listings, including quality cruising sailboats, racing sailboats, and a variety of powerboats ranging from runabouts to luxury cabin cruisers. Whether you are a sailor or power boater, we will help you find the boat of your dreams and/or expedite the sale of your current vessel. We look forward to working with you. HILL & LOWDEN, INC. IS CONTINUOUSLY SEEKING PRE-OWNED YACHT LISTINGS. GIVE US A CALL SO WE CAN DISCUSS THE SALE OF YOUR BOAT www.Hilllowden.com 6 Cliff Street, Marblehead, MA 01945 Phone: 781-631-3313 Fax: 781-631-3533 Table of Contents ______________________________________________________________________ INFORMATION Letter to Skippers ……………………………………………………. 1 2009 Offshore Racing Schedule ……………………………………………………. 2 2009 Officers and Executive Committee …………… ……………............... 3 2009 Mass Bay Sailing Delegates …………………………………………………. 4 Event Sponsoring Organizations ………………………………………................... 5 2009 Season Championship ………………………………………………………. 6 2009 Pursuit race Championship ……………………………………………………. 7 Salem Bay PHRF Grand Slam Series …………………………………………….. 8 PHRF Marblehead Qualifiers ……………………………………………………….. 9 2009 J105 Mass Bay Championship Series ………………………………………… 10 PHRF EVENTS Constitution YC Wednesday Evening Races ……………………………………….. 11 BYC Wednesday Evening -

PDF (V. 78:15, January 28, 1977)

• NOTICE: re-re-re-re-re-re-re T E CA I ORNIA TEC -re-re-re-Election on volume LXXVIII Number 15 ASClr Re-re-re-re- Febmary 29, 1977 Pasadena, California Friday, January 28, 1977 Eight Pages Teller Warns of Misuse Spot in Carter Of Power by Scientists Administration by Gregg Brown Dr. Edward Teller, one of the founders of the Lawrence Likely For Livermore Laboratory and sometimes referred to as the father of the H-Bomb, was on campus yesterday to talk to students about his Chern Head involvement in the history of nuclear warfare and the science A Student Poll by Brett van Steenwyk that he is involved in now. Perhaps the most accurate Teller spoke during a lunch The Honor Code: thing that can be said about Dr. time reception at the Caltech Y John Baldeschwieler's future is who brought Teller to campus, that he is on many people's lists. and the center of conversation Does It Work? The Carter administration, with revolved around Teller's opinions by Kevin Drum perhaps some recommendation about the responsibility of the and Henry Fuhrmann from Harold Brown, may appoint individual scientist to control his him as the President's Science Photo-Kevin Drum own creations. No member of the Caltech Advisor, Director of the National Bert Wells and Ed Bielecki give their views to the Tech for Monday's community shall take unfair re-re-election. According to the opinions he Science Foundation, or even expressed during the the noon advantage of another member of Director of Defense Research and time get-together, Teller be the Caltech community. -

Amicus Brief: Bar Associations, Human Rights Organizations, And

No. 04-10566; No. 05-51 IN THE Supreme Court of the United States MOISES SANCHEZ-LLAMAS, Petitioner, v. STATE OF OREGON, Respondent. MARIO BUSTILLO, Petitioner, v. GENE M. JOHNSON, DIRECTOR OF THE VIRGINIA DEPARTMENT OF CORRECTIONS, Respondent. ON WRIT OF CERTIORARI TO THE SUPREME COURT OF VIRGINIA AND THE SUPREME COURT OF OREGON Brief of Amici Curiae Bar Associations, Human Rights Organizations, and Other Legal Groups In Support of Petitioners i TABLE OF CONTENTS INTEREST OF AMICI CURIAE ........................................1 SUMMARY OF ARGUMENT...........................................7 ARGUMENT ......................................................................9 I. RESPECT FOR THE RULE OF LAW IS AN IMPORTANT COMPONENT OF U.S. FOREIGN POLICY.........................................................................9 II. THE CONSULAR ASSISTANCE PROVISIONS OF THE VIENNA CONVENTION ARE ESSENTIAL FOR PROTECTING THE RIGHTS OF FOREIGN NATIONALS ..............................................................13 III. FAILURE TO COMPLY WITH THE VIENNA CONVENTION WILL UNDERMINE CONSULAR ASSISTANCE IN THE UNITED STATES AND VIOLATIONS WILL BE REPLICATED ABROAD 18 CONCLUSION .................................................................23 ii TABLE OF AUTHORITIES INTERNATIONAL CASES Case Concerning Avena and Other Mexican Nationals (Mex. v. U.S.), 2004 I.C.J 12 (March 31). ............16, 17, 18 LaGrand Case (F.R.G. v. U.S.), 2001 I.C.J. 104 (June 27) ......................................................................16, 17 Memorial of United States of America, United States Diplomatic and Consular Staff in Tehran (United States v. Iran), 1982 I.C.J. Pleadings 228 (Dec. 29, 1979) ................9 Or. Arg. of United States, United States Diplomatic and Consular Staff in Tehran (United States v. Iran) 1982 I.C.J. Pleadings 225 ......................................................................9 FEDERAL CASES Brief of the United States, Boos v. Barry, 485 U.S. 312 (1988) ...........................................................................21-22 Bustillo v. -

Dauntless Women in Childhood Education, 1856-1931. INSTITUTION Association for Childhood Education International, Washington,/ D.C

DOCUMENT RESUME ED 094 892 PS 007 449 AUTHOR Snyder, Agnes TITLE Dauntless Women in Childhood Education, 1856-1931. INSTITUTION Association for Childhood Education International, Washington,/ D.C. PUB DATE [72] NOTE 421p. AVAILABLE FROM Association for Childhood Education International, 3615 Wisconsin Avenue, N.W., Washington, D.C. 20016 ($9.50, paper) EDRS PRICE NF -$0.75 HC Not Available from EDRS. PLUS POSTAGE DESCRIPTORS *Biographical Inventories; *Early Childhood Education; *Educational Change; Educational Development; *Educational History; *Educational Philosophy; *Females; Leadership; Preschool Curriculum; Women Teachers IDENTIFIERS Association for Childhood Education International; *Froebel (Friendrich) ABSTRACT The lives and contributions of nine women educators, all early founders or leaders of the International Kindergarten Union (IKU) or the National Council of Primary Education (NCPE), are profiled in this book. Their biographical sketches are presented in two sections. The Froebelian influences are discussed in Part 1 which includes the chapters on Margarethe Schurz, Elizabeth Palmer Peabody, Susan E. Blow, Kate Douglas Wiggins and Elizabeth Harrison. Alice Temple, Patty Smith Hill, Ella Victoria Dobbs, and Lucy Gage are- found in the second part which emphasizes "Changes and Challenges." A concise background of education history describing the movements and influences preceding and involving these leaders is presented in a single chapter before each section. A final chapter summarizes the main contribution of each of the women and also elaborates more fully on such topics as IKU cooperation with other organizations, international aspects of IKU, the writings of its leaders, the standardization of curriculuis through testing, training teachers for a progressive program, and the merger of IKU and NCPE into the Association for Childhood Education.(SDH) r\J CS` 4-CO CI. -

OHC Competitors Overall Results

45th Opera House Cup Regatta Panerai Classic Yacht Challenge August 20, 2017 Overall Results by Competitors Start: Start 1 - Class 6, Finishes: Finish time, Time: 10:55:00, Distance: 20.3, Course: Course B, Ave wind: 10-15 knots Start: Start 2 - Class 1, Finishes: Finish time, Time: 11:05:00, Distance: 20.3, Course: Course B, Ave wind: 10-15 knots Start: Start 3 - Class 2, Finishes: Finish time, Time: 11:20:00, Distance: 20.3, Course: Course B, Ave wind: 10-15 knots Start: Start 4 - Class 3, Finishes: Finish time, Time: 11:30:00, Distance: 20.3, Course: Course B, Ave wind: 10-15 knots Start: Start 5 - Class 4, Finishes: Finish time, Time: 11:40:00, Distance: 20.3, Course: Course B, Ave wind: 10-15 knots Start: Start 6 - Class 5, Finishes: Finish time, Time: 11:50:00, Distance: 20.3, Course: Course B, Ave wind: 10-15 knots Rank Start Class Name of Yacht Sail Number CRF MkII Rating Skipper's Name Panerai Division OHC Division One Design Class Start Finish Elapsed Corrected BCE Points 1 5 Nirvana 150 30.7 David Ray Vintage Grand Classic Cruising Division 11:50:00 14:44:04 2:54:04 2:25:39 0:00:00 1 2 2 Siren NY20 24 Peter Cassidy Vintage Corinthian Yacht Cruising Division 11:20:00 14:32:19 3:12:19 2:26:39 0:01:00 2 3 4 Valiant US 24 40 Gary Gregory Grand Prix Yacht Day Racing Division Twelve Metre 11:40:00 14:19:01 2:39:01 2:26:50 0:01:11 3 4 2 Gentian NY18 23.9 Ben Sperry Vintage Corinthian Yacht Cruising Division 11:20:00 14:34:46 3:14:46 2:28:45 0:03:06 4 5 4 Weatherly (US 17) US 17 38.5 Deborah Hoadley Grand Prix Yacht Day Racing Division