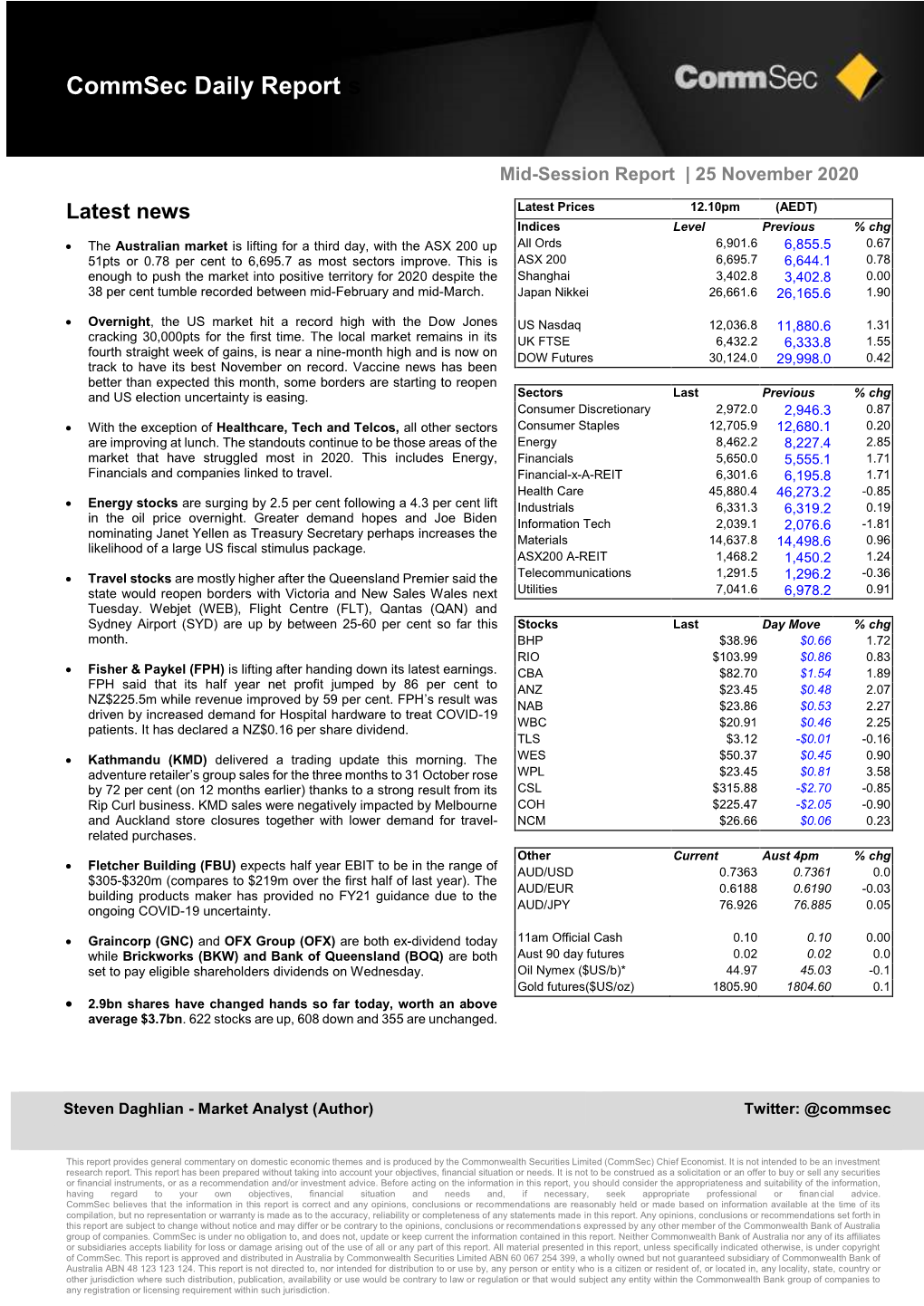

Commsec Daily Report S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

July 2020 Report

AU/NZ REPORT PREPARED FOR COLORADO TOURISM OFFICE JULY 2020 cases are at 7,519 and there have been EXECUTIVE SUMMARY 247 deaths in total. The vast majority of active cases reside in the state of Victoria, where in the past 24 hours there have July marked the first month of FY21 – a been over 700 new cases reported as the year in which we expect a rollercoaster locked-down state continues to battle a journey to a return of international second wave. travel. While border opening dates remain unknown, predictions continue to span The New Zealand (NZ) Department of from September/October for trans-Tasman Health reported total and probable cases travel and late 2020 through to Q2 2021 are 1,569 with 479,000 tests conducted. for long-haul travel including the USA. As The current active cases are 24 and total Australia regained confidence in booking deaths are 22. travel domestically in June and early July, the soaring COVID-19 cases in the state of In July, the focus for both AU and NZ Victoria caused somewhat of a realization has largely been the return to economic that we are far from clear of the virus stability, albeit with Victoria now as state borders tightened once again, an exception. In NZ, all coronavirus creating a new wave of cancellations. restrictions have been lifted except for international travel as daily life returns to Despite the uncertain environment, we a degree of normality. With the exception have kicked off the new year attending of Victoria, intrastate travel continued to several insightful webinars across the increase as confidence in regional travel trade and media landscapes, networked returned. -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

Spheria Opportunities Fund ARSN 144 032 431 APIR WHT0025AU

Spheria Opportunities Fund ARSN 144 032 431 APIR WHT0025AU Performance as at 30th November 2020 Top 5 Holdings Inception Company Name % Portfolio 1m 6m 1yr 3yr p.a. p.a.# Als Ltd 4.7 Orora Limited 4.4 Fund ^ 13.3% 23.5% 2.7% 8.1% 10.3% Crown Resorts Ltd 4.0 Benchmark* 8.3% 19.6% 8.9% 8.2% 10.4% Incitec Pivot 3.8 Fletcher Building 3.8 Value added 5.1% 3.9% -6.2% -0.1% -0.1% Top 5 20.8 ^ Spheria Opportunities Fund. Returns of the Fund are net of applicable fees, costs and taxes. Source: Spheria Asset Management * Benchmark is the S&P/ASX Mid-Small Accumulation Index. # Inception date of the current investment strategy is 11th July 2016. The Fund was established in June 2010. Past performance is not a reliable indicator of future performance. Market Cap Bands Commentary Spheria Opportunities Fund returned 13.3% (after fees) in November, $0-$500m 17.5% outperforming it’s benchmark by 5.1%. Markets $500-$1000m 8.4% Early during the month Pfizer made the pivotal announcement that its Covid 19 vaccine had successfully passed trials and was swiftly followed up by $1000-5000m 45.3% further successful vaccine trials from other pharma companies. This provided markets with a well needed shot in the arm – so to speak. The $5000m- 21.6% backdrop of a genuine prospect for the world to emerge out the Covid 19 shadow, extremely loose monetary regimes and abundant liquidity were like gasoline being poured on steadily burning bonfire. -

Single Sector Funds Portfolio Holdings

! Mercer Funds Single Sector Funds Portfolio Holdings December 2020 welcome to brighter Mercer Australian Shares Fund Asset Name 4D MEDICAL LTD ECLIPX GROUP LIMITED OOH MEDIA LIMITED A2 MILK COMPANY ELDERS LTD OPTHEA LIMITED ABACUS PROPERTY GROUP ELECTRO OPTIC SYSTEMS HOLDINGS LTD ORICA LTD ACCENT GROUP LTD ELMO SOFTWARE LIMITED ORIGIN ENERGY LTD ADBRI LTD EMECO HOLDINGS LTD OROCOBRE LTD ADORE BEAUTY GROUP LTD EML PAYMENTS LTD ORORA LTD AFTERPAY LTD ESTIA HEALTH LIMITED OZ MINERALS LTD AGL ENERGY LTD EVENT HOSPITALITY AND ENTERTAINMENT PACT GROUP HOLDINGS LTD ALKANE RESOURCES LTD EVOLUTION MINING LTD PARADIGM BIOPHARMACEUTICALS LTD ALS LIMITED FISHER & PAYKEL HEALTHCARE CORP LTD PENDAL GROUP LTD ALTIUM LTD FLETCHER BUILDING LTD PERENTI GLOBAL LTD ALUMINA LTD FLIGHT CENTRE TRAVEL GROUP LTD PERPETUAL LTD AMA GROUP LTD FORTESCUE METALS GROUP LTD PERSEUS MINING LTD AMCOR PLC FREEDOM FOODS GROUP LIMITED PHOSLOCK ENVIRONMENTAL TECHNOLOGIES AMP LTD G8 EDUCATION LTD PILBARA MINERALS LTD AMPOL LTD GALAXY RESOURCES LTD PINNACLE INVESTMENT MANAGEMENT GRP LTD ANSELL LTD GDI PROPERTY GROUP PLATINUM INVESTMENT MANAGEMENT LTD APA GROUP GENWORTH MORTGAGE INSRNC AUSTRALIA LTD POINTSBET HOLDINGS LTD APPEN LIMITED GOLD ROAD RESOURCES LTD POLYNOVO LIMITED ARB CORPORATION GOODMAN GROUP PTY LTD PREMIER INVESTMENTS LTD ARDENT LEISURE GROUP GPT GROUP PRO MEDICUS LTD ARENA REIT GRAINCORP LTD QANTAS AIRWAYS LTD ARISTOCRAT LEISURE LTD GROWTHPOINT PROPERTIES AUSTRALIA LTD QBE INSURANCE GROUP LTD ASALEO CARE LIMITED GUD HOLDINGS LTD QUBE HOLDINGS LIMITED ASX LTD -

Aon Non Executive Director Survey Participating Organisations (Pdf, 181.66Kb)

Proprietary and Confidential Constituent Organisations . Abacus Property Group . Bendigo and Adelaide Bank Limited . Accent Group Limited . BHP Group Limited . Adelaide Brighton Ltd. Bingo Industries Ltd. Afterpay Touch Group Limited . Blackmores Limited . AGL Energy Limited . Blue Sky Alternative Investments Ltd. Alacer Gold Corp. Bluescope Steel Limited . ALS Ltd. Boral Limited . Altium Limited . Brambles Limited . Altura Mining Ltd. Bravura Solutions Limited . Alumina Ltd. Breville Group Limited . AMA Group Ltd. Brickworks Ltd. amaysim Australia Ltd. Bubs Australia Ltd. Amcor Plc . BWX Ltd. AMP Ltd. Caltex Australia Ltd. Ansell Limited . Cardno Limited . APA Group . Carnarvon Petroleum Limited . APN Industria REIT . Carsales.Com Limited . Appen Ltd. Cedar Woods Properties Limited . ARB Corp. Ltd. Centuria Capital Group . Ardent Leisure Group Ltd. Challenger Limited . Arena REIT . Champion Iron Ltd. Aristocrat Leisure Limited . Charter Hall Group . Arq Group Ltd. Charter Hall Long WALE REIT . Asaleo Care Ltd. Charter Hall Retail REIT . ASX Limited . Chorus Ltd. Atlas Arteria . CIMIC Group Ltd. AUB Group Limited . Class Ltd. (Australia) . Auckland International Airport Ltd. Clean Teq Holdings Limited . Audinate Group Ltd. Cleanaway Waste Management Ltd. Aurelia Metals Limited . Clinuvel Pharmaceuticals Limited . Aurizon Holdings Ltd. Coca-Cola Amatil Ltd. AusNet Services Ltd. Cochlear Limited . Austal Limited . Codan Limited . Australia & New Zealand Banking Group . Coles Group Ltd. Ltd. Collins Foods Limited . Australian Agricultural Co. Ltd. Commonwealth Bank of Australia . Australian Pharmaceutical Industries Ltd. Computershare Limited . Australian Scholarships Group . Cooper Energy Limited . Automotive Holdings Group Ltd. Coopers Brewery Ltd . Avanti Finance Limited . Corporate Travel Management Limited . Aventus Group . Costa Group Holdings Ltd. Aveo Group . Credit Corp. Group Ltd. Avita Medical Ltd. Cromwell Property Group . Baby Bunting Group Ltd. -

Congratulations to the Finalists!

The 2017 EFFIE AWARDS IN ASSOCIATION WITH TVNZ Congratulations to the finalists! ADVERTISER AGENCY ENTRY TITLE Charity/Not for Profit Lotto DDB Love from Lotto Testicular Cancer New Zealand FCB New Zealand Go Balls Out Social Marketing/Public Service Auckland Council DDB Show your love for Auckland Fire and Emergency New Zealand FCB New Zealand Escape My House Fire and Emergency New Zealand FCB New Zealand Made From Remains Water Safety New Zealand FCB New Zealand Swim Reaper Retail/Etail - Sponsored by The Radio Bureau McDonalds DDB Maccas - The home of Angus Flight Centre New Zealand Ltd FCB Media Gifts That Go Places Air New Zealand FCB New Zealand Great Mates Air New Zealand True Limited Grabaseat: The evolution from a cheeky upstart to having a finger on the pulse of culture Trade Me DDB Life Lives Here Business to Business (B2B) Fonterra Co-Operative Group Ltd Colenso BBDO #4.31AM: Proving a turnaround was possible Fast Moving Consumer Goods (FMCG) - Sponsored by Soar Print Mars NZ Colenso BBDO Child Replacement Programme DB Breweries Colenso BBDO Beer Bottle Sand Lion DDB The other side of Steinlager Nestle Purina Petcare MediaCom See the Difference Lion Breweries Shine Limited Mac's Here's to Interesting Jed's Coffee Company Special Group Jed's Coffee - Find Your Number Lion Special Group Pure Potential Consumer Durables European Motor Distributors FCB New Zealand Tiguan Amplifon Bay Audiology Saatchi & Saatchi The Emotional Hearing Test Consumer Services Contact Energy Bob's Your Uncle Ltd It's a No Brainer Heart of the City Colenso BBDO Lovebites Bank of New Zealand Colenso BBDO Home Turf IAG Colenso BBDO Renters with Renters Insurance Spark New Zealand Colenso BBDO The Great Connection AAI DDB Keep it together, Keep it simple. -

2010 Shareholder Review

SKYCITY ENTERTAINMENT GROUP LIMITED SHAREHOLDER REVIEW YEAR ENDED 30 JUNE 2010 45210_SKY192_SHR_R3.indd 1 17/09/10 4:11 PM SKYCITY ENTERTAINMENT SHAREHOLDER REVIEW GROUP LIMITED 2010 CONTENTS FINANCIAL HIGHLIGHTS SKYCITY ENTERTAINMENT GROUPFinancial Highlights LIMITEDIFC $ Chairman’s Report 04 141.7m 23% CEO’s Report 06 The NPAT before Deferred Tax Adjustment The increase in International Financial Summary 12 business turnover Board of Directors 16 Executive Team 18 $ Our People 22 129.1m $ SKYCITY in the Community 23 The underlying NPAT 20m Directory IBC The saving in interest payments achieved over the last year cps 17.25 $ The dividend for the year 254m The amount of debt repaid during the year 24.6cps The reported earnings per share $ (before Deferred Tax Adjustment) 10.3m The gain over carrying value achieved in the Cinemas sale AT A GLANCE NPAT (before Deferred Tax Adjustment) Net debt: EBITDA now just 2.0 times and Normalised NPAT both record results Exciting plans to develop Federal Street International business continues to grow, with additional bars and restaurants and with strong interest from across Asia a pedestrian friendly focus Local VIP market in Auckland subdued Cinemas successfully divested to because of economic conditions Amalgamated Holdings Limited Marble Hall opens in Adelaide, including Australian Productivity Commission Chandelier Bar releases its report. We support the recommendation of a nationally SKYCITY Adelaide rebranded as consistent pre-commitment model “Adelaide Casino” for gaming machines. Little Mindil -

Ellerston Listed Equity Holdings

Ellerston Listed Equity Holdings Portfolio Holdings, 31 December 2020 The following is a combined listing of all listed equities held by funds managed by Ellerston Capital, including those of Morphic Asset Management (a subsidiary company), as at 31 December 2020. It includes long positions in publicly listed company shares (or equity), other than investments whose disclosure would be against the interests of our investors, for example, small or illiquid companies where disclosure may affect our capacity to manage our investment. Company Name Country of Domicile Aberdeen Standard Physical Platinum USA Adairs Ltd Australia Advantest Corp Japan Afterpay Touch Group Ltd Australia AGL Energy Ltd Australia AIA Group Ltd Hong Kong AJ Lucas Group Ltd Australia Alibaba Group Holding Ltd China ALS Ltd Australia Alstom SA France Alumina Ltd Australia Ampol Ltd Australia Angel Seafood Holdings Ltd Australia Anritsu Corp Japan Ansarada Newco Pty Ltd Australia Ansell Ltd Australia Aphria Inc Canada Aquabounty Technologies Inc USA Ardent Leisure Group Ltd Australia Aristocrat Leisure Ltd Australia Asian Paints Ltd India Assurant Inc USA Astral Poly Technik Ltd India Atlas Arteria Ltd Australia Atomo Diagnostics Ltd Australia Atomos Ltd Australia AUB Group Ltd Australia Aurizon Holding Ltd Australia Auscann Group Holdings Ltd Australia Austal Ltd Australia Australia And New Zealand Banking Australia Australian Careers Network Ltd Australia Australian Finance Group Ltd Australia Auteco Minerals Ltd Australia Autosports Group Ltd Australia Axis Bank Ltd -

The 2019 BEACON AWARDS Proudly Associated With

The 2019 BEACON AWARDS Proudly associated with RESULTS Best in Show sponsored by SKY Agency Advertiser Entry Title Metal FCB Media Flight Centre The Little Christmas Nudge Gold Media Agency of the Year sponsored by NZME PHD Media Rising Star Katia Ducker Sandy Smith Inspiring Individual Award thanks to MediaWorks Anne Lipsham Media Business of the Year Ooh! Media Sales Team of the Year TVNZ Advertiser of the Year sponsored by Google Health Promotion Agency Agency Advertiser Entry Title Metal Social Marketing / Public Service FCB Media Ministry of Social Development - Office for Seniors The Undercover Crossword Gold VMLY&R NZ Electoral Commission Mau tonu e kowhori - Now is Your Time to Choose Silver FCB Media Ministry of Education Oat the Goat Silver Ogilvy NZ Police NZ Police Recruitment Questions Campaign Finalist Contagion Media Tourism New Zealand A Crappy Challenge Finalist OMD NZTA Belt up, Live on Finalist Ogilvy Auckland Transport Auckland Transport Speed Reduction Finalist Retail/Etail sponsored by The Radio Bureau FCB Media Flight Centre The Little Christmas Nudge Gold FCB Media Foodstuffs NZ How to Glaze a Ham Silver PHD Media Michael Hill If You Liked it Then You Should Have Put A Ring On It (Oh Wait You Did) Finalist Carat Air New Zealand Your Perfect Island Finalist PHD Media Instant Kiwi Rolling Out the Red Carpet for Instant Kiwi Finalist OMD McDonald's An Icon Turns 50 Finalist Fast Moving Consumer Goods (FMCG) sponsored by Nielsen MediaCom Fonterra Brands New Zealand Santa's Milk Moustache Gold Ikon Communications Coca-Cola Oceania Character Required Silver Carat Dominion Breweries Zero to Hero Finalist Rocket Swisse How Kiwi Guys Lifted Swisse Finalist Carat Dominion Breweries Save the Entire World Finalist MediaCom Fonterra Brands New Zealand Saving Mammoth From Extinction Finalist PHD Media Estee Lauder How We Got More Women to Sleep With Us Finalist MBM Goodman Fielder A Conscious Coupling Finalist OMD Independent Liquor (19 Crimes) Who says Crime Doesn't Pay? Finalist Consumer Durables No Finalists. -

Choice Travel Destination Guide: New Zealand Contents

Destination Guide: New Zealand What to know before you go Essential preparation and planning tips Accommodation and transport CHOICE TRAVEL DESTINATION GUIDE: NEW ZEALAND CONTENTS New Zealand 2 What you need to know 8 Money 2 Travel-size tips 9 Travel insurance 2 Best time to go 10 Handy links and apps 3 Culture 4 Health and safety 11 Accommodation and transport 4 Laws and watchouts 11 Flights 5 Making a complaint 11 At the airport (and getting to your hotel) 5 Emergency contacts 13 Key destinations and their airports 14 Getting around 6 What you need to do 16 Driving in New Zealand 6 Visas and passports 17 Accommodation and tours 6 Vaccinations 6 Phone and internet 8 Power plugs Who is CHOICE? Set up by consumers for consumers, CHOICE is the consumer advocate that provides Australians with information and advice, free from commercial bias. 1 CHOICE TRAVEL DESTINATION GUIDE: NEW ZEALAND WHAT YOU NEED TO KNOW OVERVIEW Best time to go, culture, language, health, safety, laws, watchouts, emergency contacts and more. Travel-size tips › The weather varies throughout the country. The North Island has a sub-tropical climate with similar › Australians can fly to New Zealand in as little as temperatures to southern areas of Australia, while three hours. the South Island can be much colder. › Most Australians don’t need a visa to visit New › Summer is the peak tourist season when Zealand, just a valid passport. temperatures are warm enough for beach days but not as uncomfortably hot as in many parts of You can drive in New Zealand on your Australian › Australia. -

Australia & New Zealand Report 2018

DISCLOSURE INSIGHT ACTION Australia & New Zealand Report 2018 On behalf of over 650 investors with US$87 trillion in assets. CDP Report 2018 | Published February 2019 Contents 3 CEO foreword 14 Appendix I List of disclosing companies in Australia & 4 Disclosure in 2018 New Zealand 5 Climate Change: Australia & New 18 Appendix II Zealand insights Responding companies in Australia & New Zealand – supply chain program 9 Water Security: Driving water stewardship 19 Appendix III Non-responding companies in Australia & 10 Forests: Building sustainable New Zealand supply chains 12 CDP Australia & New Zealand Awards 2018 13 Investor Signatories & Members in Australia & New Zealand Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2018 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

The First Quarterly Report of Selector Funds Management Limited

SELECTOR FUND Quarterly Report - 30 June 2007 [Issue No.16] FUND PERFORMANCE Hutton went on to note that Australians in general embrace China’s growth, harbour no ill-will and Since inception in November 2004 the Fund has perceive little or no threat from this emerging super delivered a compound annual return of 29.95% to power. If our financial market’s eagerness to 30 June 2007 (inclusive of $0.0709 cents in embrace China is any gauge, Hutton’s view is distributions), outperforming the All Ordinaries surely close to the mark! Accumulation Index, which has compounded at 25.99% over the same period. The one-year return Yet the mood in America starkly contrasts this. to 30 June 2007 was 21.57%. Statistics page 13. SFM Middleclass Americans see China as a direct threat to job security and future living standards. BIG PICTURE According to Hutton at least one US Senator believes a war with China (Iraq –style) is required “From the heart” to diminish the threat to the American way of life. Books are great, that’s why this quarter we are sending you one - our clients (not other readers). With that short introduction we hope you enjoy the read. Needless to say Hutton’s view on China does An autographed copy of Will Hutton’s The Writing not encompass US popular thought. on the Wall - CHINA and the West in the 21st Century, is in the mail today. “make as few decisions as possible. This is not only a sensible way to “Books are great, that’s why this invest but one that sits comfortably quarter we are sending you one” with us” As an invited guest of Macquarie Bank during the recent Sydney Writers Festival, we were fortunate On the subject of books, an all time favourite of enough to hear Hutton espouse his thoughts on the ours, and one we have mentioned in the past, is prevailing juggernaut that is China.