Flight Centre Travel Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lloyd's Minimum Standards

LLOYD’S MINIMUM STANDARDS MS1.1 – UNDERWRITING STRATEGY & PLANNING October 2017 1 MS1.1 – UNDERWRITING STRATEGY & PLANNING UNDERWRITING MANAGEMENT PRINCIPLES, MINIMUM STANDARDS AND REQUIREMENTS These are statements of business conduct required by Lloyd’s. The Principles and Minimum Standards are established under relevant Lloyd’s Byelaws relating to business conduct. All managing agents are required to meet the Principles and Minimum Standards. The Requirements represent the minimum level of performance required of any organisation within the Lloyd’s market to meet the Minimum Standards. Within this document the standards and supporting requirements (the “must dos” to meet the standard) are set out in the blue box at the beginning of each section. The remainder of each section consists of guidance which explains the standards and requirements in more detail and gives examples of approaches that managing agents may adopt to meet them. UNDERWRITING MANAGEMENT GUIDANCE This guidance provides a more detailed explanation of the general level of performance expected. They are a starting point against which each managing agent can compare its current practices to assist in understanding relative levels of performance. This guidance is intended to provide reassurance to managing agents as to approaches which would certainly meet the Principles and Minimum Standards and comply with the Requirements. However, it is appreciated that there are other options which could deliver performance at or above the minimum level and it is fully acceptable for managing agents to adopt alternative procedures as long as they can demonstrate the Requirements to meet the Principles and Minimum Standards. DEFINITIONS AFR: actuarial function report Benchmark Premium: The price for each risk at which the managing agent is expected to deliver their required results, in line with the approved Syndicate Business Plan. -

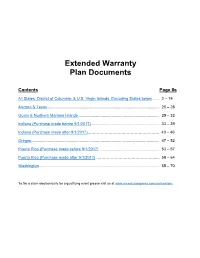

Extended Warranty Coverage

Extended Warranty Plan Documents Contents Page #s All States, District of Columbia, & U.S. Virgin Islands, Excluding States below ...... 2 – 19 Arizona & Texas ..................................................................................................... 20 – 28 Guam & Northern Mariana Islands ......................................................................... 29 – 32 Indiana (Purchase made before 9/1/2017) ............................................................. 33 – 39 Indiana (Purchase made after 9/1/2017)………………………………………………. 40 – 46 Oregon.................................................................................................................... 47 – 52 Puerto Rico (Purchase made before 9/1/2017) ...................................................... 53 – 57 Puerto Rico (Purchase made after 9/1/2017) ……………………………………….... 58 – 64 Washington ............................................................................................................. 65 – 70 To file a claim electronically for a qualifying event please visit us at www.americanexpress.com/onlineclaim. All States, District of Columbia, & U.S. Virgin Islands, Except States below Back to top EXTENDED WARRANTY DESCRIPTION OF COVERAGE Underwritten by AMEX Assurance Company Administrative Office, 20022 N. 31st Ave. MC: 08-01-20 Phoenix AZ 85027 For purchases charged to Your Account, Extended Warranty will extend the terms of the original manufacturer's warranty on warranties of five (5) years or less that are eligible in the United States of America, -

Convenience Is Here with CO-OP Shared Branching!

Convenience is here with CO-OP Shared Branching! Personalized service is a major benefit of banking at Capstone Federal Credit Union, and you don’t have to sacrifice convenience to get it. Take advantage of Capstone FCU’s shared branching services through CO-OP Shared Branch. Access your account at any of the 5,100 credit union branches nationwide. The national CO-OP Shared Branch network links participating credit unions electronically, allowing credit union members to do “branch banking,” even when the branch near you doesn’t belong to Capstone FCU. This is a huge benefit to Capstone FCU members who travel, whose workplaces don’t coincide with our branch locations, or who simply enjoy Look for the CO- the convenience of expanded access. Wherever you are across the OP Shared Branch logo to find shared country, chances are good there’s a shared branch near you. branches near you. Shared branching is yet another example of credit union membership offering the best of both worlds—individualized attention and nationwide availability. The cooperative spirit of credit unions allows them to work with each other in ways that competing banks typically do not. Visit www.co-opsharedbranch.org or download the Shared Branch Locator app for iPhone or Android to find branches nearest you. You can also look for the “CO-OP Shared Branch” logo on the door of any credit union branch. At a CO-OP Shared Branch location, you can: . Make deposits and withdrawals . Make loan payments . Make credit card payments . Access VISA® or MasterCard® funds Many shared branches also offer transfers, statement histories, money orders, traveler’s checks and notary services. -

Financial Strength Connecting to a Stronger Future for Credit Unions

2012 Financial Strength Connecting to a Stronger Future for Credit Unions Born in 1935 out of the emerging credit union In 2012, we improved our financial strength, enhanced products movement, during the depths of the Great Depression, and services, and invested in CUNA Mutual Group endeavored to fulfill the vision the markets we serve and the communities in which we operate. of credit union pioneers. Driven by the belief that These results are a direct reflection of our insurance was as fundamental to the movement original mission. as savings and lending, CUNA Mutual Group would Jeff Post President & CEO become the leading provider of credit life insurance in the United States in just two years. Today, CUNA Mutual Group is a Fortune 1000 company, with assets of more than $17 billion. Our products have expanded to include Life Insurance, Annuities, Retirement Income and Investments. Our achievements are directly attributable to a single principle: an enduring commitment to the success of credit unions, their members and our policyholders. Total Revenue Total Revenue Operating Revenue by Product 2012 Results: Delivering on Our Commitment Total(in billions) Revenue Operating Revenue by Product (in billions) Operating Revenue by Product (in billions) 3.1 3.0 3.1 to Policyholders 3.0 3.1 2.8 3.0 2.7 2.8 2.6 2.7 2.8 The external challenges in 2012 remained formidable with 2.6 2.7 a sluggish national economy and the continuing struggle at 2.6 the federal level to address the fiscal issues. Severe weather events also presented difficult obstacles to overcome, from the drought in the Midwest’s Corn Belt to Superstorm Sandy that battered the East Coast. -

An Experimental Investigation of Extended Warranties

Volume 64 Issue 2 Article 4 7-1-2019 Protecting Consumers Through Mandatory Disclosures: An Experimental Investigation of Extended Warranties Breagin K. Riley Follow this and additional works at: https://digitalcommons.law.villanova.edu/vlr Part of the Consumer Protection Law Commons Recommended Citation Breagin K. Riley, Protecting Consumers Through Mandatory Disclosures: An Experimental Investigation of Extended Warranties, 64 Vill. L. Rev. 285 (2019). Available at: https://digitalcommons.law.villanova.edu/vlr/vol64/iss2/4 This Article is brought to you for free and open access by Villanova University Charles Widger School of Law Digital Repository. It has been accepted for inclusion in Villanova Law Review by an authorized editor of Villanova University Charles Widger School of Law Digital Repository. Riley: Protecting Consumers Through Mandatory Disclosures: An Experiment 2019] PROTECTING CONSUMERS THROUGH MANDATORY DISCLOSURES: AN EXPERIMENTAL INVESTIGATION OF EXTENDED WARRANTIES BREAGIN K. RILEY* AND AHMED E. TAHA** IMAGINE that you go to a consumer electronics store and buy a large- Iscreen television for $1,499. At the checkout counter, the cashier asks if you also wish to purchase an extended warranty for $249, which will pro- vide you three additional years of coverage beyond the manufacturer’s one-year warranty. Would you buy the extended warranty? What would drive your decision? If you are like most consumers, you would make this decision with little idea of the probability that the television will break down during the extended warranty’s coverage period and the cost of repairing it. But how would your decision and motivations change if the cashier told you there is only a 3% chance of the television needing repair during the first four years you own it and that the average cost of repairing the television is $300? These questions are the focus of this Article. -

786-1 Credit for Reinsurance Model Regulation

NAIC Model Laws, Regulations, Guidelines and Other Resources—Summer 2019 CREDIT FOR REINSURANCE MODEL REGULATION Table of Contents Section 1. Authority Section 2. Purpose Section 3. Severability Section 4. Credit for Reinsurance—Reinsurer Licensed in this State Section 5. Credit for Reinsurance—Accredited Reinsurers Section 6. Credit for Reinsurance—Reinsurer Domiciled in Another State Section 7. Credit for Reinsurance—Reinsurers Maintaining Trust Funds Section 8. Credit for Reinsurance––Certified Reinsurers Section 9. Credit for Reinsurance—Reciprocal Jurisdictions Section 10. Credit for Reinsurance Required by Law Section 11. Asset or Reduction from Liability for Reinsurance Ceded to Unauthorized Assuming Insurer Not Meeting the Requirements of Sections 4 Through 10 Section 12. Trust Agreements Qualified Under Section 11 Section 13. Letters of Credit Qualified Under Section 11 Section 14. Other Security Section 15. Reinsurance Contract Section 16. Contracts Affected Form AR-1 Certificate of Assuming Insurer Form CR-1 Certificate of Certified Reinsurer Form RJ-1 Certificate of Reinsurer Domiciled in Reciprocal Jurisdiction Form CR-F Form CR-S Section 1. Authority This regulation is promulgated pursuant to the authority granted by Sections [insert applicable section number] and [insert applicable section number] of the Insurance Code. Section 2. Purpose The purpose of this regulation is to set forth rules and procedural requirements that the commissioner deems necessary to carry out the provisions of the [cite state law equivalent to the Credit for Reinsurance Model Law (#785)] (the Act). The actions and information required by this regulation are declared to be necessary and appropriate in the public interest and for the protection of the ceding insurers in this state. -

Deposit Insurance

Information about your DEPOSIT INSURANCE American Share Insurance insures each and every account of an individual member up to $250,000 without any limitation as to the number of accounts held. Your Insured Funds* Member’s Accounts Amount Covered Savings/Regular Share $ 250,000 Checking/Share Draft $ 250,000 Money Market $ 250,000 CD/Share Certificate #1 $ 250,000 CD/Share Certificate #2 $ 250,000 IRA $ 250,000 TOTAL INSURED $ 1,500,000 *Example only AmericanShare.com 5656 Frantz Road | Dublin, OH 43017 800.521.6342 American Share Insurance is a member-owned non- federal deposit insurer. This institution is not federally insured, or insured by any state government. MEMBERS’ ACCOUNTS ARE NOT INSURED OR GUARANTEED BY ANY GOVERNMENT OR GOVERNMENT-SPONSORED AGENCY. Form 100 © 01/16 We are pleased to inform you American Share is selective as to whom that your deposit accounts it insures, and to qualify for its deposit in this credit union are insurance the credit union must comply with American Share’s rigid underwriting insured up to $250,000 per standards. Also, American Share’s insurance account by American Share policy requires that every quarter the credit Insurance. American Share is union submit financial statements in order to a credit union-owned private continue coverage. Individual policies are not organization whose only provided to members, and there is no direct business is to provide deposit cost to you for this coverage. It is important to note that deposit insurance is payable only insurance to credit unions. upon the failure and liquidation of the credit union. -

July 2020 Report

AU/NZ REPORT PREPARED FOR COLORADO TOURISM OFFICE JULY 2020 cases are at 7,519 and there have been EXECUTIVE SUMMARY 247 deaths in total. The vast majority of active cases reside in the state of Victoria, where in the past 24 hours there have July marked the first month of FY21 – a been over 700 new cases reported as the year in which we expect a rollercoaster locked-down state continues to battle a journey to a return of international second wave. travel. While border opening dates remain unknown, predictions continue to span The New Zealand (NZ) Department of from September/October for trans-Tasman Health reported total and probable cases travel and late 2020 through to Q2 2021 are 1,569 with 479,000 tests conducted. for long-haul travel including the USA. As The current active cases are 24 and total Australia regained confidence in booking deaths are 22. travel domestically in June and early July, the soaring COVID-19 cases in the state of In July, the focus for both AU and NZ Victoria caused somewhat of a realization has largely been the return to economic that we are far from clear of the virus stability, albeit with Victoria now as state borders tightened once again, an exception. In NZ, all coronavirus creating a new wave of cancellations. restrictions have been lifted except for international travel as daily life returns to Despite the uncertain environment, we a degree of normality. With the exception have kicked off the new year attending of Victoria, intrastate travel continued to several insightful webinars across the increase as confidence in regional travel trade and media landscapes, networked returned. -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

Spheria Opportunities Fund ARSN 144 032 431 APIR WHT0025AU

Spheria Opportunities Fund ARSN 144 032 431 APIR WHT0025AU Performance as at 30th November 2020 Top 5 Holdings Inception Company Name % Portfolio 1m 6m 1yr 3yr p.a. p.a.# Als Ltd 4.7 Orora Limited 4.4 Fund ^ 13.3% 23.5% 2.7% 8.1% 10.3% Crown Resorts Ltd 4.0 Benchmark* 8.3% 19.6% 8.9% 8.2% 10.4% Incitec Pivot 3.8 Fletcher Building 3.8 Value added 5.1% 3.9% -6.2% -0.1% -0.1% Top 5 20.8 ^ Spheria Opportunities Fund. Returns of the Fund are net of applicable fees, costs and taxes. Source: Spheria Asset Management * Benchmark is the S&P/ASX Mid-Small Accumulation Index. # Inception date of the current investment strategy is 11th July 2016. The Fund was established in June 2010. Past performance is not a reliable indicator of future performance. Market Cap Bands Commentary Spheria Opportunities Fund returned 13.3% (after fees) in November, $0-$500m 17.5% outperforming it’s benchmark by 5.1%. Markets $500-$1000m 8.4% Early during the month Pfizer made the pivotal announcement that its Covid 19 vaccine had successfully passed trials and was swiftly followed up by $1000-5000m 45.3% further successful vaccine trials from other pharma companies. This provided markets with a well needed shot in the arm – so to speak. The $5000m- 21.6% backdrop of a genuine prospect for the world to emerge out the Covid 19 shadow, extremely loose monetary regimes and abundant liquidity were like gasoline being poured on steadily burning bonfire. -

Single Sector Funds Portfolio Holdings

! Mercer Funds Single Sector Funds Portfolio Holdings December 2020 welcome to brighter Mercer Australian Shares Fund Asset Name 4D MEDICAL LTD ECLIPX GROUP LIMITED OOH MEDIA LIMITED A2 MILK COMPANY ELDERS LTD OPTHEA LIMITED ABACUS PROPERTY GROUP ELECTRO OPTIC SYSTEMS HOLDINGS LTD ORICA LTD ACCENT GROUP LTD ELMO SOFTWARE LIMITED ORIGIN ENERGY LTD ADBRI LTD EMECO HOLDINGS LTD OROCOBRE LTD ADORE BEAUTY GROUP LTD EML PAYMENTS LTD ORORA LTD AFTERPAY LTD ESTIA HEALTH LIMITED OZ MINERALS LTD AGL ENERGY LTD EVENT HOSPITALITY AND ENTERTAINMENT PACT GROUP HOLDINGS LTD ALKANE RESOURCES LTD EVOLUTION MINING LTD PARADIGM BIOPHARMACEUTICALS LTD ALS LIMITED FISHER & PAYKEL HEALTHCARE CORP LTD PENDAL GROUP LTD ALTIUM LTD FLETCHER BUILDING LTD PERENTI GLOBAL LTD ALUMINA LTD FLIGHT CENTRE TRAVEL GROUP LTD PERPETUAL LTD AMA GROUP LTD FORTESCUE METALS GROUP LTD PERSEUS MINING LTD AMCOR PLC FREEDOM FOODS GROUP LIMITED PHOSLOCK ENVIRONMENTAL TECHNOLOGIES AMP LTD G8 EDUCATION LTD PILBARA MINERALS LTD AMPOL LTD GALAXY RESOURCES LTD PINNACLE INVESTMENT MANAGEMENT GRP LTD ANSELL LTD GDI PROPERTY GROUP PLATINUM INVESTMENT MANAGEMENT LTD APA GROUP GENWORTH MORTGAGE INSRNC AUSTRALIA LTD POINTSBET HOLDINGS LTD APPEN LIMITED GOLD ROAD RESOURCES LTD POLYNOVO LIMITED ARB CORPORATION GOODMAN GROUP PTY LTD PREMIER INVESTMENTS LTD ARDENT LEISURE GROUP GPT GROUP PRO MEDICUS LTD ARENA REIT GRAINCORP LTD QANTAS AIRWAYS LTD ARISTOCRAT LEISURE LTD GROWTHPOINT PROPERTIES AUSTRALIA LTD QBE INSURANCE GROUP LTD ASALEO CARE LIMITED GUD HOLDINGS LTD QUBE HOLDINGS LIMITED ASX LTD -

Aon Non Executive Director Survey Participating Organisations (Pdf, 181.66Kb)

Proprietary and Confidential Constituent Organisations . Abacus Property Group . Bendigo and Adelaide Bank Limited . Accent Group Limited . BHP Group Limited . Adelaide Brighton Ltd. Bingo Industries Ltd. Afterpay Touch Group Limited . Blackmores Limited . AGL Energy Limited . Blue Sky Alternative Investments Ltd. Alacer Gold Corp. Bluescope Steel Limited . ALS Ltd. Boral Limited . Altium Limited . Brambles Limited . Altura Mining Ltd. Bravura Solutions Limited . Alumina Ltd. Breville Group Limited . AMA Group Ltd. Brickworks Ltd. amaysim Australia Ltd. Bubs Australia Ltd. Amcor Plc . BWX Ltd. AMP Ltd. Caltex Australia Ltd. Ansell Limited . Cardno Limited . APA Group . Carnarvon Petroleum Limited . APN Industria REIT . Carsales.Com Limited . Appen Ltd. Cedar Woods Properties Limited . ARB Corp. Ltd. Centuria Capital Group . Ardent Leisure Group Ltd. Challenger Limited . Arena REIT . Champion Iron Ltd. Aristocrat Leisure Limited . Charter Hall Group . Arq Group Ltd. Charter Hall Long WALE REIT . Asaleo Care Ltd. Charter Hall Retail REIT . ASX Limited . Chorus Ltd. Atlas Arteria . CIMIC Group Ltd. AUB Group Limited . Class Ltd. (Australia) . Auckland International Airport Ltd. Clean Teq Holdings Limited . Audinate Group Ltd. Cleanaway Waste Management Ltd. Aurelia Metals Limited . Clinuvel Pharmaceuticals Limited . Aurizon Holdings Ltd. Coca-Cola Amatil Ltd. AusNet Services Ltd. Cochlear Limited . Austal Limited . Codan Limited . Australia & New Zealand Banking Group . Coles Group Ltd. Ltd. Collins Foods Limited . Australian Agricultural Co. Ltd. Commonwealth Bank of Australia . Australian Pharmaceutical Industries Ltd. Computershare Limited . Australian Scholarships Group . Cooper Energy Limited . Automotive Holdings Group Ltd. Coopers Brewery Ltd . Avanti Finance Limited . Corporate Travel Management Limited . Aventus Group . Costa Group Holdings Ltd. Aveo Group . Credit Corp. Group Ltd. Avita Medical Ltd. Cromwell Property Group . Baby Bunting Group Ltd.