Disclosure 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Operation of Savings-Bank Life Insurance in Massachusetts and New York

UNITED STATES DEPARTMENT OF LABOR Frances Perkins, Secretary BUREAU OF LABOR STATISTICS Isador Lubin, Commissioner (on leave) A . F. Hinrichs, Acting Commissioner + Operation of Savings-Bank Life Insurance in Massachusetts and New York Revision of Bulletin No. 615: The Massachusetts System of Savings-Bank Life Insurance, by Edward Berman ♦ Bulletin 7s[o. 688 UNITED STATES GOVERNMENT PRINTING OFFICE WASHINGTON : 1941 For sale by the Superintendent of Documents, Washington, D. C. Price 20 cents Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis UNITED STATES DEPARTMENT OF LABOR F rances P er k ins, S e c r e t a r y + BUREAU OF LABOR STATISTICS I s a d o r L tjbin, Commissioner (o n lea v e) A. F. H in r ic h s , Acting Commissioner Donald Davenport, Chief, Employ Aryness Joy, Chief, Prices and Cost of ment and Occupational Outlook Living Branch Branch N. Arnold Tolies, Chief, Working Con Henry J. Fitzgerald, Chief, Business ditions and Industrial Relations Management Branch Branch Hugh S. Hanna, Chief, Editorial and Research Sidney W. Wilcox, Chief Statistician CHIEFS OF DIVISIONS Herman B. Byer, Construction and Charles F. Sharkey, Labor Law In Public Employment formation J. M. Cutts, Wholesale Prices Boris Stern, Labor Information Ser W. Duane Evans, Productivity and vice Technological Developments Stella Stewart, Retail Prices Swen Kjaer, Industrial Accidents John J. Mahanev, Machine Tabula Lewis E. Talbert, Employment Sta tion tistics Robert J. Myers, Wage and Hour Emmett H. Welch, Occupational Out Statistics look Florence Peterson, Industrial Rela tions Faith M. Williams, Cost of Living i i Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. -

A Regulatory Review of Formal and Informal Funeral Insurance Markets in South Africa a Market Review and Regulatory Proposal

A regulatory review of formal and informal funeral insurance markets in South Africa A market review and regulatory proposal prepared for Finmark Trust April 2005 26/04/2005: VERSION 4.5 Author: Hennie Bester Doubell Chamberlain Ryan Short Richard Walker Genesis Analytics (Pty) Ltd 2nd Floor, No 3 Melrose Square, Melrose Arch, Johannesburg South Africa, 2196. Post to: Suite 3, Private Bag X1, Melrose Arch, Johannesburg, South Africa, 2076. Tel: +27 11 214 4080, Fax: +27 11 214 4099 www.genesis-analytics.com FOREWORD The need to provide for funerals is one of the key drivers of financial behaviour for many South Africans and has led to a relatively sophisticated and widely accessed informal financial sector. It is estimated that over 6 million people currently belong to burial societies where an estimated R6 billion is invested every year- in addition to the wide usage of stokvels (or savings clubs). These informal groups play an extremely important role in mitigating the risks of poor households and, interestingly, are often complemented or supported by formal providers - as can be seen in the Financial Diaries project1. However it was evident from the scoping study FinMark Trust completed on making insurance markets work for the poor2, that the existing legislative and regulatory environment was especially inhibitive to the potential graduation of the so-called „informal mutual assistance (common bond) organisations‟ ability to become insurers in their own right. At the same time, however, there is a heated debate about the extent of abuse in both the informal and formal funeral insurance market. In light of the above, the following report sheds light on the operations of this key market (from formal to informal), assesses the extent of the abuse and current regulatory environment and proposes some amendments to the current regulatory regime. -

Lloyd's Minimum Standards

LLOYD’S MINIMUM STANDARDS MS1.1 – UNDERWRITING STRATEGY & PLANNING October 2017 1 MS1.1 – UNDERWRITING STRATEGY & PLANNING UNDERWRITING MANAGEMENT PRINCIPLES, MINIMUM STANDARDS AND REQUIREMENTS These are statements of business conduct required by Lloyd’s. The Principles and Minimum Standards are established under relevant Lloyd’s Byelaws relating to business conduct. All managing agents are required to meet the Principles and Minimum Standards. The Requirements represent the minimum level of performance required of any organisation within the Lloyd’s market to meet the Minimum Standards. Within this document the standards and supporting requirements (the “must dos” to meet the standard) are set out in the blue box at the beginning of each section. The remainder of each section consists of guidance which explains the standards and requirements in more detail and gives examples of approaches that managing agents may adopt to meet them. UNDERWRITING MANAGEMENT GUIDANCE This guidance provides a more detailed explanation of the general level of performance expected. They are a starting point against which each managing agent can compare its current practices to assist in understanding relative levels of performance. This guidance is intended to provide reassurance to managing agents as to approaches which would certainly meet the Principles and Minimum Standards and comply with the Requirements. However, it is appreciated that there are other options which could deliver performance at or above the minimum level and it is fully acceptable for managing agents to adopt alternative procedures as long as they can demonstrate the Requirements to meet the Principles and Minimum Standards. DEFINITIONS AFR: actuarial function report Benchmark Premium: The price for each risk at which the managing agent is expected to deliver their required results, in line with the approved Syndicate Business Plan. -

Employment Practices Liability Insurance Program EPLI

B5848_EPLI 2/14/06 2:49 PM Page 1 For more information about EPLI … Why your firm needs Employment For instant information on the EPLI program offered through Marsh Affinity Group Services, simply visit Practices Liability Insurance www.proliablity.com/EPLI Think your firm won’t be sued by an employee for wrongful termination … You’ll be able to self-rate, apply for coverage EPLI EPLI and submit your premium payment. Or call discrimination … defamation … failure to make partner … negligent supervision … us at 1-888-601-6667. sexual harassment … or other inappropriate employment conduct? Underwritten by Lloyd’s of London Employment (underwriting syndicates 2623 and Six out of ten employers have faced 623 – Beazley Furlonge Ltd. Rated “A” by Practices employee lawsuits within the past A.M. Best) five years. Beazley / Furlonge – Lloyd’s of London These facts show Beazley Furlonge Ltd. is a large syndicate of Liability it can happen and Lloyd’s of London and a recognized world 67% of all employment cases that leader in Specialty Insurance Services. Beazley how much it will go to litigation result in a judgment for is rated “A” by A.M. Best. For more Insurance cost your firm: the plaintiff. information, see www.beazley.com. Statistics show an Edgewater Holdings Ltd. (Edgewater), a Managing General Agency and consulting Program employer is more likely The average amount paid for out-of-court firm, is a leader in the development and to have an employment settlement is $40,000. delivery of EPLI policies. claim than a property or general liability claim.* Offered by Marsh Affinity Defense of the average EPLI case, through Group Services *Society for Human trial, costs more than $45,000. -

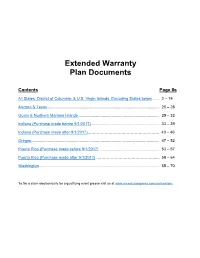

Extended Warranty Coverage

Extended Warranty Plan Documents Contents Page #s All States, District of Columbia, & U.S. Virgin Islands, Excluding States below ...... 2 – 19 Arizona & Texas ..................................................................................................... 20 – 28 Guam & Northern Mariana Islands ......................................................................... 29 – 32 Indiana (Purchase made before 9/1/2017) ............................................................. 33 – 39 Indiana (Purchase made after 9/1/2017)………………………………………………. 40 – 46 Oregon.................................................................................................................... 47 – 52 Puerto Rico (Purchase made before 9/1/2017) ...................................................... 53 – 57 Puerto Rico (Purchase made after 9/1/2017) ……………………………………….... 58 – 64 Washington ............................................................................................................. 65 – 70 To file a claim electronically for a qualifying event please visit us at www.americanexpress.com/onlineclaim. All States, District of Columbia, & U.S. Virgin Islands, Except States below Back to top EXTENDED WARRANTY DESCRIPTION OF COVERAGE Underwritten by AMEX Assurance Company Administrative Office, 20022 N. 31st Ave. MC: 08-01-20 Phoenix AZ 85027 For purchases charged to Your Account, Extended Warranty will extend the terms of the original manufacturer's warranty on warranties of five (5) years or less that are eligible in the United States of America, -

Fidelity Bond and Errors and Omissions Insurance

SELLER/SERVICER RISK SELF-ASSESSMENT FIDELITY BOND AND ERRORS AND OMISSIONS INSURANCE SELLER/SERVICER RISK SELF-ASSESSMENT IN THIS DOCUMENT Fidelity Bond and Errors and • Self-Assessment Checklist • Common Findings and Omissions Insurance Documentation A seller/servicer must have a blanket fidelity bond and an errors and omissions insurance RESOURCES policy in effect at all times in an amount sufficient to meet Fannie Mae’s minimum coverage requirements, maximum deductible requirements, and provision requirements. • Selling Guide A3-5-01, Fidelity Bond and Errors Omissions A fidelity bond is a form of insurance protection that covers policyholders for losses that Coverage they incur as a result of fraudulent acts by specified individuals. Errors and omissions insurance is a type of professional liability insurance that protects companies, their workers, and other professionals against claims of inadequate work or negligent actions. ONE SELLER/SERVICER’S STORY It’s time to renew our professional liability insurance policy. Managing insurance is one of those routine tasks that could use a little more attention – we’ve also found that our documentation is not centralized, creating additional burden on staff to locate the policy and coverage requirements. We know it’s critical to document, monitor, and evaluate our Fidelity Bond and Errors and Omissions coverage, but where do we begin? SELLER/SERVICER RISK SELF-ASSESSMENT FIDELITY BOND AND ERRORS AND OMISSIONS INSURANCE Self-Assessment Checklist REQUIRED FIDELITY BOND COVERAGE The fidelity bond coverage must be equal to a percentage of the greater of the seller/servicer’s annual total unpaid principal balance (UPB) of single-family and multifamily annual mortgage loan originations; or the highest monthly total UPB of single-family and multifamily servicing of mortgage loans that the seller/servicer owns, including mortgage loans owned by the seller/servicer and serviced by others (details below). -

Investigations Unveil Extent of Fraud

ESSENTIAL READING FOR TRAVEL INSURANCE INDUSTRY PROFESSIONALS WWW.ITIJ.CO.UK NOVEMBER 2011 • ISSUE 130 Investigations unveil extent of fraud Kenyan conundrum The summer holiday season has come to an end in the northern hemisphere, and with it has come more dire warnings from travel insurance Travel insurers basing their coverage decisions on companies that fraud is on the up – both from travel advice from government agencies have hit clinics treating travellers, and from travellers the headlines in the UK recently. Mandy Aitchison themselves. Sarah Watson reports on the problem looks into the issue In a recent editorial piece in Insurance Insight, The UK’s Foreign and Commonwealth Offi ce (FCO) Mike Keating of AXA Insurance explained that has advised against ‘all but essential travel to coastal the company noticed ‘a worrying trend over the areas within 150 km of the Kenya-Somalia border’. It summer’, stating that AXA’s claims department further explained: “We advise against all but essential received some excessively high medical bills as part travel to coastal areas within 150 km of the Somali of claims for treatment in Spain, Turkey, Bulgaria, border, following two attacks by armed gangs in small Egypt and sub-Saharan Africa. He added: “There boats against beach resorts in the Lamu area on 11 is evidence of overcharging, overdiagnosis and September and 1 October 2011. This advice will be over-treatment of minor problems and collusion kept under review. Both attacks were on beach-front between clinics and holidaymakers. Travellers need properties, with two Westerners kidnapped and one to be warned of the risks involved in using overseas murdered. -

Social Insurance Law PART 1

Social Insurance Law PART 1: THE CONSOLIDATED ACT ON SOCIAL INSURANCE CHAPTER I THE REGULATION OF SOCIAL INSURANCE, SCOPE OF APPLICATION AND DEFINITIONS Article 1 This Law shall be cited as "The Social Insurance Law" and shall include the following branches of Insurance :- 1. Insurance against old age, disability and death; 2. Insurance against employment injuries; 3. Insurance against temporary disability by reason of sickness or maternity; 4. Insurance against unemployment; 5. Insurance for the self-employed and those engaged in liberal professions; 6. Insurance for employers; 7. Family Allowances; 8. Other branches of insurance which fall within the scope of social security. Each of the first two branches shall be introduced in accordance with the following provisions and the protection guaranteed by this Law shall be extended in future stages by introducing the other branches of social insurance by Order of the Council of Ministers. Article 2 The provisions of this Law shall be applied compulsorily to all workers without discrimination as to sex, nationality, or age, who work by virtue of an employment contract for the benefit of one or more employers, or for the benefit of an enterprise in the private, co-operative, or para-statal sectors and, unless otherwise provided for, those engaged in public organisations or bodies, and also those employees and workers in respect of whom Law No. 13 of 1975 does not apply, and irrespective of the duration, nature or form of the contract, or the amount or kind of wages paid or whether the service is performed in accordance with the contract within the country or for the benefit of the employer outside the country or whether the assignment to work abroad is for a limited or an unlimited period. -

An Experimental Investigation of Extended Warranties

Volume 64 Issue 2 Article 4 7-1-2019 Protecting Consumers Through Mandatory Disclosures: An Experimental Investigation of Extended Warranties Breagin K. Riley Follow this and additional works at: https://digitalcommons.law.villanova.edu/vlr Part of the Consumer Protection Law Commons Recommended Citation Breagin K. Riley, Protecting Consumers Through Mandatory Disclosures: An Experimental Investigation of Extended Warranties, 64 Vill. L. Rev. 285 (2019). Available at: https://digitalcommons.law.villanova.edu/vlr/vol64/iss2/4 This Article is brought to you for free and open access by Villanova University Charles Widger School of Law Digital Repository. It has been accepted for inclusion in Villanova Law Review by an authorized editor of Villanova University Charles Widger School of Law Digital Repository. Riley: Protecting Consumers Through Mandatory Disclosures: An Experiment 2019] PROTECTING CONSUMERS THROUGH MANDATORY DISCLOSURES: AN EXPERIMENTAL INVESTIGATION OF EXTENDED WARRANTIES BREAGIN K. RILEY* AND AHMED E. TAHA** IMAGINE that you go to a consumer electronics store and buy a large- Iscreen television for $1,499. At the checkout counter, the cashier asks if you also wish to purchase an extended warranty for $249, which will pro- vide you three additional years of coverage beyond the manufacturer’s one-year warranty. Would you buy the extended warranty? What would drive your decision? If you are like most consumers, you would make this decision with little idea of the probability that the television will break down during the extended warranty’s coverage period and the cost of repairing it. But how would your decision and motivations change if the cashier told you there is only a 3% chance of the television needing repair during the first four years you own it and that the average cost of repairing the television is $300? These questions are the focus of this Article. -

Consumers Guide to Auto Insurance

CONSUMERS GUIDE TO AUTO INSURANCE PRESENTED TO YOU BY THE DEPARTMENT OF BUSINESS REGULATION INSURANCE DIVISION 1511 PONTIAC AVENUE, BLDG 69-2 CRANSTON, RI 02920 TELEPHONE 401-462-9520 www.dbr.ri.gov Elizabeth Kelleher Dwyer Superintendent of Insurance TABLE OF CONTENTS Introduction………………………………………………………………1 Underwriting and Rating………………………………………………...1 What is meant by underwriting and how is it accomplished…………..1 How are rates and premium charges determined in Rhode Island……1 What factors are considered in ratemaking……………………………. 2 What discounts are used in determining final premium cost…………..3 Rhode Island Automobile Insurance Plan…………………..…………..4 Regulation of Rates……………………………………………………….4 The Tort System…………………………………………………………..4 Liability Coverages………………………………………………………..5 Coverages Other Than Liability…………………………………………5 Physical Damage to the Automobile……………………………………..6 Other Optional Coverages………………………………………………..6 The No-Fault System……………….……………………………………..7 Smart Shopping……………………………………………………………7 Shop for True Comparison………………………………………………..8 Consumer Protection Available...…………………………………………8 What to Do if You are in an Automobile Accident………………………9 Your State Insurance Department………………………………….........9 Auto Insurance Buyer’s Worksheet…………………………………….10 Introduction Auto insurance is an expensive purchase for most Americans, and is especially expensive for Rhode Islanders. Yet consumers rarely comparison-shop for auto insurance as they might for other products and services. Auto insurance companies vary substantially both in price and service to policyholders, so it pays to shop around and compare different insurance companies. This guide to buying auto insurance was developed to help you become a more knowledgeable policyholder and to get the combination of price and service best suited to your needs. It provides information on how to shop for coverage and how insurance premiums are determined. You will also find an Auto Insurance Buyer’s Worksheet in the guide to help you compare premium prices among insurers. -

ERISA Faqs for Welfare Benefit Plans

ERISA FAQs for Welfare Benefit Plans What Is ERISA? ERISA (the Employee Retirement Income Security Act of 1974) is a Federal law which deals with employee benefit plans, both Qualified Retirement Plans (e.g., pension and profit sharing plans) and Welfare Benefit Plans (e.g., group insurance and other fringe benefit plans). The goals of ERISA are to provide uniformity and protections to employees. ERISA imposes certain reporting (to the DOL) and disclosure (to Plan Participants) requirements on employers. ERISA compliance is enforced primarily by the Department of Labor (DOL). However, employee benefit plans may also be regulated by other government agencies, such as the Internal Revenue Service (IRS) and a state’s Department of Insurance. Failure to comply with ERISA can result in enforcement actions, penalties, and/or employee lawsuits. Which Employers Are Subject to ERISA? ERISA applies to virtually all private-sector corporations, partnerships, and proprietorships, including non-profit corporations—regardless of their size or number of employees. Churches and governmental employers are exempted from ERISA’s Welfare Benefit Plan provisions. Which Benefits are ERISA Plans? ERISA generally applies to the following Plans, whether they are fully insured or self-insured: Health, Medical, Surgical, Hospital, or HMO Plans Health Reimbursement Accounts (HRAs) Health/Medical Flexible Spending Accounts (FSAs) Dental Plans Vision Plans Prescription Drug Plans Sickness, Accident, and Disability Insurance Plans Group Life and AD&D Insurance Employee Assistance Plans (EAPs) (if providing counseling, not just referrals) Executive Medical Reimbursement Plans Wellness Plans (if medical care is offered) Long Term Care Insurance Plans Severance Pay Plans Business Travel Accident Plans Copyright © 2011 by ERISA Pros, LLC. -

The Burial of the Urban Poor in Italy in the Late Republic and Early Empire

Death, disposal and the destitute: The burial of the urban poor in Italy in the late Republic and early Empire Emma-Jayne Graham Thesis submitted for the degree of Doctor of Philosophy Department of Archaeology University of Sheffield December 2004 IMAGING SERVICES NORTH Boston Spa, Wetherby West Yorkshire, LS23 7BQ www.bl.uk The following have been excluded from this digital copy at the request of the university: Fig 12 on page 24 Fig 16 on page 61 Fig 24 on page 162 Fig 25 on page 163 Fig 26 on page 164 Fig 28 on page 168 Fig 30on page 170 Fig 31 on page 173 Abstract Recent studies of Roman funerary practices have demonstrated that these activities were a vital component of urban social and religious processes. These investigations have, however, largely privileged the importance of these activities to the upper levels of society. Attempts to examine the responses of the lower classes to death, and its consequent demands for disposal and commemoration, have focused on the activities of freedmen and slaves anxious to establish or maintain their social position. The free poor, living on the edge of subsistence, are often disregarded and believed to have been unceremoniously discarded within anonymous mass graves (puticuli) such as those discovered at Rome by Lanciani in the late nineteenth century. This thesis re-examines the archaeological and historical evidence for the funerary practices of the urban poor in Italy within their appropriate social, legal and religious context. The thesis attempts to demonstrate that the desire for commemoration and the need to provide legitimate burial were strong at all social levels and linked to several factors common to all social strata.