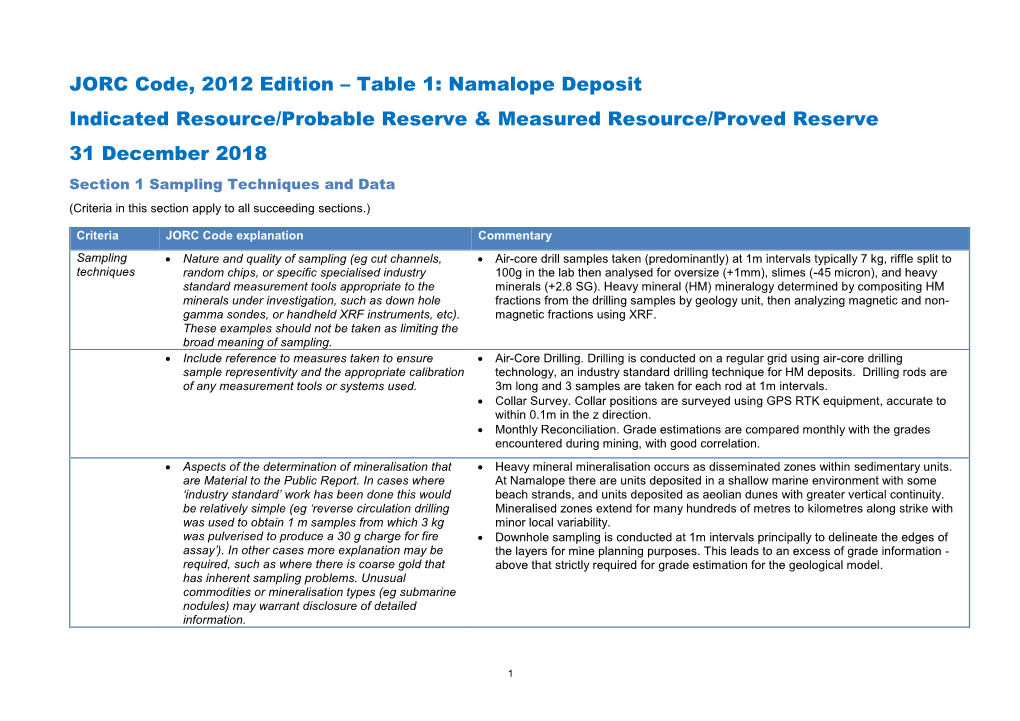

JORC Code, 2012 Edition – Table 1: Namalope Deposit Indicated

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kenmare Resources Plc Moma Titanium Minerals Mine

Kenmare Resources plc Moma Titanium Minerals Mine 2013 Half Yearly Results Trading Update Disclaimer This Confidential Presentation (the “Presentation”) has been prepared and issued by Kenmare Resources plc (the “Company” or “Kenmare”). While this Presentation has been prepared in good faith, the Company and its respective officers, employees, agents and representatives expressly disclaim any and all liability for the contents of, or omissions from, this Presentation, and for any other written or oral communication transmitted or made available to the recipient or any of its officers, employees, agents or representatives. No representations or warranties are or will be expressed or are to be implied on the part of the Company, or any of its respective officers, employees, agents or representatives in or from this Presentation or any other written or oral communication from the Company, or any of its respective officers, employees, agents or representatives concerning the Company or any other factors relevant to any transaction involving the Company or as to the accuracy, completeness or fairness of this Presentation, the information or opinions on which it is based, or any other written or oral information made available in connection with the Company. This Presentation does not constitute or form part of, and should not be construed as, an offer, invitation or inducement to purchase or subscribe for any securities of the Company nor shall it or any part of it form the basis of, or be relied upon in connection with, any contract or investment decision relating to such securities, nor does it constitute a recommendation regarding the securities of the Company. -

2020-08-19 KMR H1 2020 Results and Interim Dividend Announcement

Kenmare Resources plc, 4th Floor, Styne House, Hatch Street Upper, Dublin 2, D02 DY27, Ireland T: +353 1 671 0411 E: [email protected] W: www.kenmareresources.com Kenmare Resources plc (“Kenmare” or “the Company” or “the Group”) 19 August 2020 Half-yearly results for the six months to 30 June 2020 and interim dividend Kenmare Resources plc (LSE:KMR, ISE:KMR), one of the leading global producers of titanium minerals and zircon, which operates the Moma Titanium Minerals Mine (the "Mine" or "Moma") in northern Mozambique, today announces its half year results for the six month period ended 30 June 2020 (“H1 2020”) and declares its interim dividend. The Company also provides updated full year (“FY”) 2020 guidance. Statement from Michael Carvill, Managing Director: “Our performance during the first half of 2020 demonstrated Kenmare’s resilience and agility, effectively managing many challenges posed by the COVID-19 pandemic to continue to produce and ship our products safely. Although production was weaker in H1 2020 than in the corresponding period last year, our business remained profitable and I am pleased to announce an interim dividend of USc2.31 per share. This represents 20% of profit after tax, in line with our dividend policy. Market conditions for titanium feedstocks continued to strengthen in H1 2020, driving a 28% increase in received ilmenite prices, to US$217 per tonne, compared to last year. We have agreements for the majority of our H2 2020 ilmenite production, although market conditions are expected to become more subdued in the second half of the year. We continue to actively manage COVID-19-related disruption to the relocation of Wet Concentrator Plant B. -

Download the Report

ANNUAL REPORT 2000 IRISH TAKEOVER PANEL Report for the year ended June 30, 2000 IRISH TAKEOVER PANEL Report for the year ended June 30, 2000 This third annual report of the Irish Takeover Panel is made to Mary Harney, T.D., Minister for Enterprise, Trade and Employment as required by section 19 of the Irish Takeover Panel Act, 1997 Irish Takeover Panel (Registration No. 265647), 8 Upper Mount Street, Dublin 2 Telephone: (01) 6789020 Facsimile: (01) 6789289 Contents Page Members of the Panel, Directors and Director General 3 Introduction 5 Chairperson’s Statement 7 Director General’s Report 9 Directors’ Report 13 Statement of Directors’ Responsibilities 15 Auditors’ Report 16 Financial Statements 18 Appendix 1 Administrative Appendix 24 Appendix 2 Takeovers supervised by Irish Takeover 31 Panel, July 1, 1999 to June 30, 2000 Appendix 3 List of Relevant Companies as 32 at June 30, 2000 Euro denominated memoranda Financial Statements 33 2 Members of the Panel Irish Association of Investment Managers Irish Clearing House Limited Nominated by the Irish Bankers Federation Irish Stock Exchange Limited Law Society of Ireland Brian Walsh Nominated by the Consultative Committee of Accountancy Bodies Ireland Directors of the Panel Chairperson Daniel O’Keeffe, S.C. } } Appointed by the Governor of the Central } Bank of Ireland Deputy Chairperson William M. McCann, FCA } Leonard Abrahamson Appointed by the Irish Stock Exchange (Alternate: Brendan O’Connor) Ann Fitzgerald Appointed by the Irish Association of Investment Managers Daniel J. Kitchen Appointed by the Consultative Committee of Accountancy Bodies Ireland Brian J. O’Connor Appointed by the Law Society of Ireland (Alternate: Laurence Shields) Roisin Brennan Appointed by the Irish Bankers Federation (Alternate: John Butler) Director General (and Secretary of the Panel) Miceal Ryan 3 4 Introduction The Irish Takeover Panel (“the Panel”) is the statutory body responsible for monitoring and supervising takeovers and other relevant transactions in Ireland. -

Financial Reporting Decisions MISSION

2020 Financial Reporting Supervision Unit Financial Reporting Decisions MISSION To contribute to Ireland having a strong regulatory environment in which to do business by supervising and promoting high quality financial reporting, auditing and effective regulation of the accounting profession in the public interest DISCLAIMER Whilst every effort has been made to ensure the accuracy of the information contained in this document, IAASA accepts no responsibility or liability howsoever arising from any errors, inaccuracies, or omissions occurring. IAASA reserves the right to take action, or refrain from taking action, which may or may not be in accordance with this document IAASA: Financial Reporting Decisions 2 Contents Page 1. Background & introduction .................................................................................................... 4 2. Bank of Ireland Group plc ...................................................................................................... 5 3. Crown Global Secondaries IV plc .......................................................................................... 8 4. Irish Residential Properties REIT plc................................................................................... 10 5. Kerry Group plc ................................................................................................................... 13 6. Kenmare Resources plc ...................................................................................................... 16 7. Smurfit Kappa Group plc .................................................................................................... -

Kenmare Resources CASE STUDY

Kenmare Resources CASE STUDY About SNAPSHOT Metals and Mining Kenmare Resources is an Irish incorporated mining company with its head office INDUSTRY located in Dublin. The company is a member of the FTSE All-Share Index and has a premium listing on the London Stock Exchange and a secondary listing on the Irish 1500 Stock Exchange. EMPLOYEES & CONTRACTORS The principal activity of the company is the operation of the Moma Titanium Minerals Mine, which is located on the north east coast of Mozambique. The Moma Mine Mozambique contains deposits of heavy minerals which include the titanium minerals ilmenite and PROJECT LOCATION rutile, as well as the zirconium silicate mineral, zircon. 2014 CUSTOMER SINCE Q&A PRODUCTS & SERVICES We spoke to Jose Sinanhal, System Administrator at Kenmare Resources, about their need for a workforce management solution to improve their compliance, reduce their INX InControl risk and increase their productivity. Training What were you using to previously manage your workforce in these areas? Data migration We were previously using another EHS solution which had a number of limitations and gaps in functionality such as action management and root case analysis. RELEVANT SOLUTIONS Safety What was sought in a new system? Risk We sought a new user-friendly system were all data and reporting would be maintained, managed and readily available when required. Compliance What have been some notable changes since implementing the system? Since implementing INX, the most notable positive changes have included: • Ease of and range of reporting • Redefining the ‘assign user’ security access, • Aligning the monthly stats with Kenmare Report systems • Focus on relevant and important incidents and events with the ability to better manage and report. -

Introduction of a Central Counterparty at Irish Stock Exchange Information for Production Start

eurex circular 2 41/05 Date: Frankfurt, November 30, 2005 Recipients: All Eurex members, CCP members and vendors Authorized by: Daniel Gisler Introduction of a Central Counterparty at Irish Stock Exchange Information for Production Start Related Eurex Circulars: 057/05, 230/05 Contact: Customer Support, tel. +49-69-211-1 17 00 E-mail: [email protected] Content may be most important for: Attachment: Ü Front Office / Trading Updated List of CCP-eligible Securities for ISE Ü Middle + Back Office Ü Auditing / Security Coordination With this circular we complement information on the introduction of a Central Counterparty for the Irish stock market scheduled for next Monday, December 5, 2005. The Central Counterparty (CCP) for securities traded in the Xetra order book at Irish Stock Exchange (ISE) originated from a common initiative of Irish Stock Exchange, Euroclear/CRESTCo Limited and Deutsche Börse AG. Eurex Clearing AG, which already renders CCP services for other markets, acts as CCP. The product range for production start on December 5, 2005 comprises Irish stocks and Exchange Traded Funds (ETFs) traded in the Xetra order book at Irish Stock Exchange. Please find attached to this circular an updated list of securities which will be CCP-eligible for ISE effective December 5, 2005. Should you have any questions or require further information, please feel free to contact the Customer Support Team at tel. +49-69-211-1 17 00. Eurex Clearing AG Customer Support Chairman of the Executive Board: Aktiengesellschaft mit Sitz D-60485 Frankfurt/Main Tel. +49-69-211-1 17 00 Supervisory Board: Rudolf Ferscha (CEO), in Frankfurt/Main www.eurexchange.com Fax +49-69-211-1 17 01 Dr. -

ZIRCONIUM and HAFNIUM by James B

ZIRCONIUM AND HAFNIUM By James B. Hedrick Domestic survey data and tables were prepared by Mahbood Mahdavi, statistical assistant, and the world production table was prepared by Linder Roberts, international data coordinator. In 2004, there was a shortfall in the supply of zirconium Production minerals. Prices increased for standard and premium grades of zircon concentrates. The cause of the shortage was the result Data for zirconium and hafnium manufactured materials of several factors including increased demand, the closure of are developed by the U.S. Geological Survey (USGS) from a several zircon-producing mines, reduced zircon grades at a few voluntary survey of domestic operations. Twenty-four of the 48 mines, and the transfer of mining equipment from mined-out operations surveyed responded. Data for nonrespondents were sites to new mining locations. estimated on the basis of prior-year levels. The principal economic source of zirconium is the zirconium Data for zircon concentrates are developed by a second silicate mineral zircon. A relatively small quantity of the voluntary survey of domestic mining operations. Of the zirconium is derived from the mineral baddeleyite, a natural two domestic zircon producers, which have four mining and form of zirconium oxide or zirconia (ZrO2). In 2004, zircon, the processing operations, 00% responded. Data on domestic principal ore material, was mined at many locations worldwide, production and consumption of zircon concentrates were principally Australia, South Africa, and the United States. withheld to avoid disclosing company proprietary data. Baddeleyite was produced from a single source at Kovdor, Domestic production of milled zircon decreased by 0.8%, Russia. -

2020 Results Presentation 24 March 2021 Disclaimer

RESPONSIBLY MEETING GLOBAL DEMAND FOR QUALITY-OF-LIFE MINERALS 2020 Results Presentation 24 March 2021 Disclaimer This Presentation (the “Presentation”) has been This Presentation does not constitute or form part statements in this Presentation relating to future prepared and issued by Kenmare Resources plc of, and should not be construed as, an offer, financials, results, plans and expectations (the “Company” or “Kenmare”). While this invitation or inducement to purchase or subscribe regarding the Company’s business, growth and Presentation has been prepared in good faith, the for any securities of the Company nor shall it or profitability, as well as the general economic Company and its respective officers, employees, any part of it form the basis of, or be relied upon in conditions to which the Company is exposed, are agents and representatives expressly disclaim any connection with, any contract or investment forward looking by nature and may be affected by and all liability for the contents of, or omissions decision relating to such securities, nor does it a variety of factors. The Company is under no from, this Presentation, and for any other written constitute a recommendation regarding the obligation to update or keep current the or oral communication transmitted or made securities of the Company. information contained in this Presentation, to available to the recipient or any of its officers, correct any inaccuracies which may become This Presentation is as of the date hereof. This employees, agents or representatives. apparent, or to publicly announce the result of Presentation includes certain statements, any revision to the statements made herein and No representations or warranties are or will be estimates and projections provided by the any opinions expressed in the Presentation or in expressed or are to be implied on the part of the Company with respect to the anticipated future any related materials are subject to change Company, or any of its respective officers, performance of the Company or the industry in without notice. -

CSI BHR Report

IRISH BUSINESS & HUMAN RIGHTS: Benchmarking compliance with the UN Guiding Principles Centre for Social Innovation, Trinity Business School Benn Finlay Hogan ML Rhodes Susan P. Murphy Mary Lawlor 8 November 2019 Benchmarking Compliance with the UN Guiding Principles Table of Contents 1. Introduction......................................................................................................................... 1 2. Background........................................................................................................................ 3 3. Benchmarking Process....................................................................................................... 5 3.1 What are we benchmarking against?........................................................................... 5 3.2 Choosing the Corporate Human Rights Benchmark methodology.............................. 5 3.3 Benchmarking indicators in the CHRB methodology................................................... 7 3.4 Selecting a sample of Irish companies........................................................................ 9 3.5 Data collection........................................................................................................... 12 3.6 Quality assurance...................................................................................................... 13 3.7 Constraints and limitations......................................................................................... 13 4. Findings........................................................................................................................... -

Project Summary Information: Moma Titanium (Mozambique)

PROJECT SUMMARY INFORMATION: MOMA TITANIUM (MOZAMBIQUE) 1. Private sector Operation 2. The Project The purpose of the project is the mining, concentration and separation of mineral sands containing ilmenite - main product - rutile and zircon - by-products -, used primarily in the paint industry, as titanium oxide pigments. The project is located in Mozambique, on the coast of the Northern Province of Nampula at Moma, some 160km South of Nampula city. The production and shipping of some 660 000 t/year of ilmenite, zircon and rutile is of a world scale in terms of the titanium industry. 3. Financing Proposal Promoters Principal sponsor: Kenmare Resources Plc (Kenmare). Minority equity investor: Industrial Development Corporation of South Africa (IDC), yet to be confirmed. Borrowers: Kenmare Moma Mining Limited (KMML) and Kenmare Moma Processing Limited (KMPL). Amount: Up to EUR 15m senior debt. Up to EUR 40m subordinated debt. Term: 13 years for the senior loan. 15 years for the subordinated loan. Terms, conditions and Senior loan: Fixed or floating rate at EIB’s standard unsubsidised rate + a interest rates: margin, in line with other co-financiers.. Subordinated loan: terms in line with other co-financiers. They include a remuneration package composed of different items. Security: The security package includes a variety of collaterals. Government Opinion: Full support. Commission Opinion: Not required under the terms of the Cotonou Agreement. Financing Plan Equity (25%) from Kenmare and the equity market. In addition, the equity holders had to raise a further USD 30m1. Subordinated debt (16%) from EIB and others. Senior debt (59%) from EIB and others. -

Listing Particulars-April 2002

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take, you are recommended to immediately consult your stockbroker, bank manager, solicitor, accountant or other independent financial adviser (being in the case of Shareholders in Ireland, an organisation or firm authorised or exempted pursuant to the Investment Intermediaries Act, 1995 of Ireland or the Stock Exchange Act, 1995 of Ireland and, in the case of Shareholders in the United Kingdom, an independent adviser authorised pursuant to the Financial Services & Markets Act 2000 of the United Kingdom (“FSMA”)). If you have sold or otherwise transferred all of your Ordinary Shares in Kenmare Resources plc (“Kenmare” or “the Company”), please send this document and the accompanying Form of Proxy and Application Form, as soon as possible, to the purchaser or transferee or to the stockbroker, bank or other agent through whom the sale or transfer was effected for delivery to the purchaser or transferee. However, such documents should not be forwarded or transmitted in or into the United States, Canada, Australia or Japan. If you have sold or transferred part of your holding in Kenmare, you are referred to the instructions regarding split applications set out in the accompanying Application Form. A copy of this document, having attached hereto the consents referred to in paragraph 22 of Part 5 hereof and copies of the material contracts referred to in paragraph 16 of Part 5 hereof, which comprises Listing Particulars and a Prospectus relating to the Company in accordance with the European Communities (Transferable Securities and Stock Exchange Regulations) 1992 of Ireland (“the 1992 Regulations”) have been delivered for registration to the Registrar of Companies in Ireland in compliance with section 47 of the Companies Act, 1963 of Ireland and as required by the 1992 Regulations. -

Kenmare Resources Plc

Kenmare Resources plc Annual General Meeting | 28 May 2014 Michael Carvill – Managing Director Disclaimer This Presentation (the “Presentation”) has been prepared and issued by Kenmare Resources plc (the “Company” or “Kenmare”). While this Presentation has been prepared in good faith, the Company and its respective officers, employees, agents and representatives expressly disclaim any and all liability for the contents of, or omissions from, this Presentation, and for any other written or oral communication transmitted or made available to the recipient or any of its officers, employees, agents or representatives. No representations or warranties are or will be expressed or are to be implied on the part of the Company, or any of its respective officers, employees, agents or representatives in or from this Presentation or any other written or oral communication from the Company, or any of its respective officers, employees, agents or representatives concerning the Company or any other factors relevant to any transaction involving the Company or as to the accuracy, completeness or fairness of this Presentation, the information or opinions on which it is based, or any other written or oral information made available in connection with the Company. This Presentation does not constitute or form part of, and should not be construed as, an offer, invitation or inducement to purchase or subscribe for any securities of the Company nor shall it or any part of it form the basis of, or be relied upon in connection with, any contract or investment decision relating to such securities, nor does it constitute a recommendation regarding the securities of the Company.