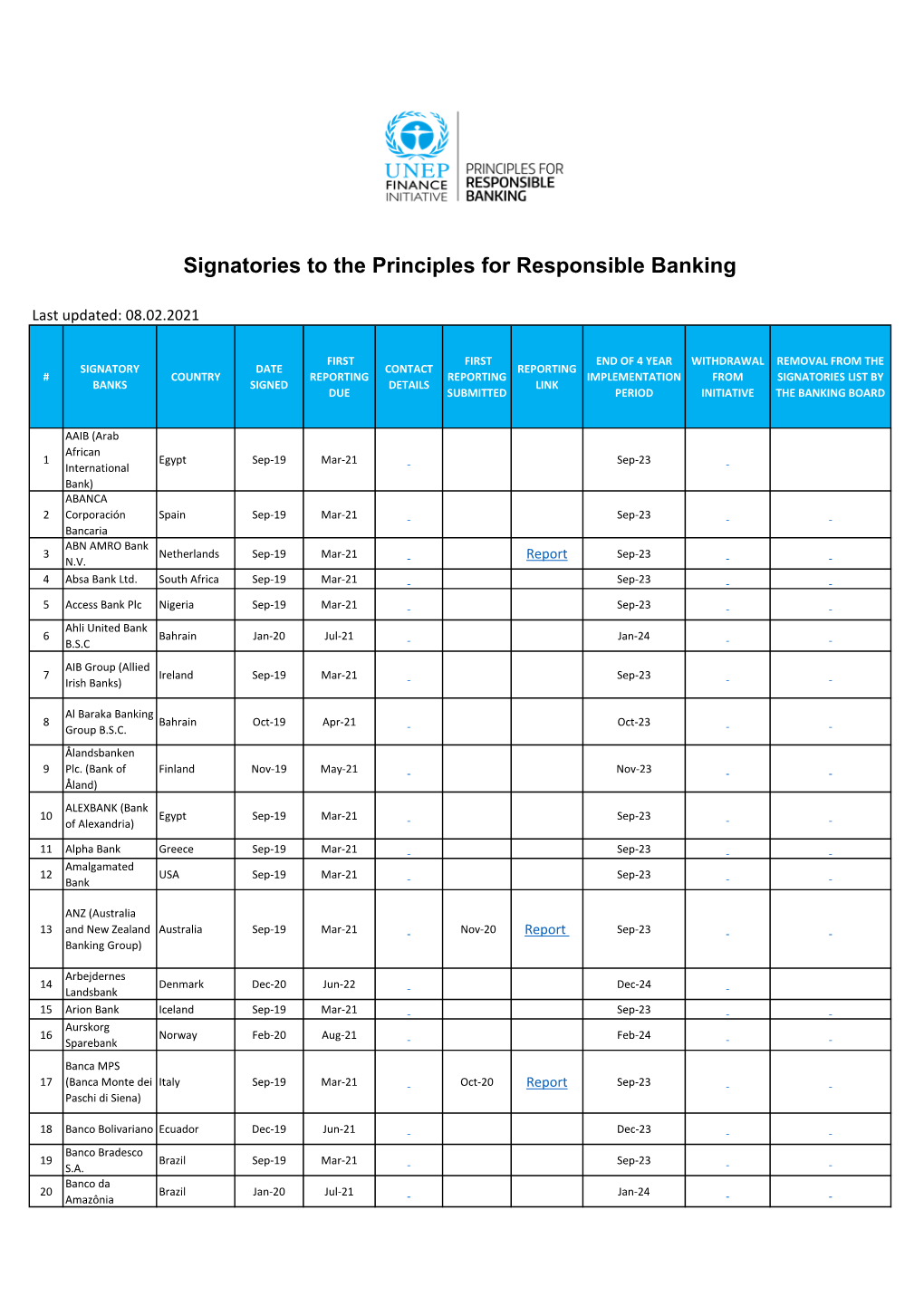

Signatories to the Principles for Responsible Banking

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Técnicas Para La Captación De Nuevos Clientes En La Banca Española: Estudio Comparativo De Costes Y Rentabilidad

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Repositorio Universidad de Zaragoza Técnicas para la captación de nuevos clientes en la Banca Española: Estudio comparativo de costes y rentabilidad. Techniques for attracting new clients in the Spanish Bannking: Comparative study of costs and profitability Autor/ Winter: Ana Valera Bautista. Director/ Director: Aurora Sevillano Rubio. Facultad de Economía y Empresa. 2019 Resumen ejecutivo: El proyecto a desarrollar tiene como objetivo la comprensión del proceso de restructuración de la banca llevado a cabo en los últimos años. Para ello se analizará el problema de rentabilidad que tiene la banca actualmente. Para el estudio, se han analizado aquellas entidades que actualmente poseen el 70% de mercado según el Banco de España. Estudiando de esta forma el ROA, ROE, ROTE y CET1 de cada una de ellas, siendo BBVA y Santander las entidades que más han destacado en el último ejercicio (2018), superando el coste de capital. La rentabilidad que obtienen las entidades con los productos renting y leasing ha sido estudiada de forma comparativa. Estudiando aquellos productos que ofertan de forma similar unas y otras entidades y las condiciones establecidas por cada una de ellas. Se ha estudiado el coste que le supone al cliente optar por esta forma de financiación a plazos y cuotas, y el coste que le supondría si optara por otras vías de financiación. Ya que muchos de los productos ofrecidos le suponen al cliente un coste de más del 100% del valor del bien. Así mismo, se analizará el método de obtener rentabilidad y captar clientes mediante las nominas bancarias, de estas se ha estudiado las condiciones ofertadas y han sido comparadas de manera que aquellas entidades que ofertan regalos en efectivo, materiales o rentabilidades, implican que el cliente se comprometa a unas condiciones conocidas y no conocidas en la firma del contrato. -

20160803 Banco Bancolombia.Xlsx

COD. NOMBRE SUCURSAL- TELÉFONO BANCO DEPARTAMENTO CIUDAD DIRECCIÓN INDICATIVO HORARIO NORMAL HORARIO ADICIONAL HORARIO ATENCION SABADOS SUCURSAL OFICINA OFICINA 5642735 - BANCOLOMBIA 709 ABREGO NORTE DE SANTANDER ABREGO CARRERA 14 N° 7 – 93 97 5642023 8:00 - 11:30 AM - 14:00 - 16:30 PM BANCOLOMBIA 890 ACACIAS META ACACIAS CALLE 14 No 14-20-24 98 6569060 8:00 - 17:00 PM BANCOLOMBIA 297 AGUACHICA CESAR AGUACHICA CALLE 5 N° 17 - 80 95 5651394 8:30 - 18:00 PM BANCOLOMBIA 643 AGUADAS CALDAS AGUADAS CARRRERA 5 N° 6 - 18 96 8514600 8:00 - 12:00 AM - 14:00 - 16:00 PM BANCOLOMBIA 365 AGUAZUL CASANARE AGUAZUL CALLE 10 N° 17 - 06 98 6384247 8:00 - 16:30 PM 16:30 - 18:00 PM 8389569 BANCOLOMBIA 485 AIPE HUILA AIPE CALLE 4 N° 4 - 29 98 8389673 8:00 - 11:30 AM - 14:00 - 16:30 PM BANCOLOMBIA 861 ALBANIA LA GUAJIRA ALBANIA Calle 3 N° 3-38 Albania Guajira 0 8:00 - 11:30 AM - 14:00 - 16:30 PM 847 22 19 – 847 22 20 – BANCOLOMBIA 520 AMAGA ANTIOQUIA AMAGÁ Calle 51 N° 49-43 94 847 22 21 8:00 - 14:00 PM BANCOLOMBIA 443 AMBALEMA TOLIMA AMBALEMA CALLE 8A N° 4 - 23 98 2856163 8:00 - 11:30 AM - 14:00 - 16:00 PM BANCOLOMBIA 384 ANAPOIMA CUNDINAMARCA ANAPOIMA CARRERA 3 N° 3 - 33 91 8993587 8:00 - 15:30 PM BANCOLOMBIA 438 ANDES ANTIOQUIA ANDES CARRERA 50 N° 49A - 52 94 8417262 8:00 - 14:00 PM BANCOLOMBIA 708 ANSERMA CALDAS ANSERMA CARRERA 4 N° 9 - 06 96 8531419 8:00 - 12:00 AM - 14:00 - 16:00 PM BANCOLOMBIA 549 PLAZA DEL RIO ANTIOQUIA APARTADO CALLE 100 CON CARRERA 103 94 8280610 8:00 - 16:00 PM BANCOLOMBIA 645 APARTADO ANTIOQUIA APARTADO CALLE 96 N° 99A - 11 94 8280083 -

List of Supervised Entities (As of 1 September 2020)

List of supervised entities Cut-off date for changes: 1 September 2020 Number of significant entities directly supervised by the ECB: 114 This list displays the significant supervised entities, which are directly supervised by the ECB (part A) and the less significant supervised entities which are indirectly supervised by the ECB (Part B). Based on Article 2(20) of Regulation (EU) No 468/2014 of the European Central Bank of 16 April 2014 establishing the framework for cooperation within the Single Supervisory Mechanism between the European Central Bank and national competent authorities and with national designated authorities (OJ L 141, 14.5.2014, p. 1 - SSM Framework Regulation) a ‘supervised entity’ means any of the following: (a) a credit institution established in a participating Member State; (b) a financial holding company established in a participating Member State; (c) a mixed financial holding company established in a participating Member State, provided that the coordinator of the financial conglomerate is an authority competent for the supervision of credit institutions and is also the coordinator in its function as supervisor of credit institutions (d) a branch established in a participating Member State by a credit institution which is established in a non-participating Member State. The list is compiled on the basis of significance decisions which have been adopted and notified by the ECB to the supervised entity and that have become effective up to the cut-off date. A. List of significant entities directly supervised by the ECB Country of LEI Type Name establishment Grounds for significance MFI code for branches of group entities Belgium Article 6(5)(b) of Regulation (EU) No 1 LSGM84136ACA92XCN876 Credit Institution AXA Bank Belgium SA ; AXA Bank Belgium NV 1024/2013 CVRWQDHDBEPUUVU2FD09 Credit Institution AXA Bank Europe SCF France 2 549300NBLHT5Z7ZV1241 Credit Institution Banque Degroof Petercam SA ; Bank Degroof Petercam NV Significant cross-border assets 54930017BFF0C5RWQ245 Credit Institution Banque Degroof Petercam France S.A. -

What Makes a Good ʽbad Bankʼ? the Irish, Spanish and German Experience

6 ISSN 2443-8022 (online) What Makes a Good ‘Bad Bank’? The Irish, Spanish and German Experience Stephanie Medina Cas, Irena Peresa DISCUSSION PAPER 036 | SEPTEMBER 2016 EUROPEAN ECONOMY Economic and EUROPEAN Financial Affairs ECONOMY European Economy Discussion Papers are written by the staff of the European Commission’s Directorate-General for Economic and Financial Affairs, or by experts working in association with them, to inform discussion on economic policy and to stimulate debate. The views expressed in this document are solely those of the author(s) and do not necessarily represent the official views of the European Commission, the IMF, its Executive Board, or IMF management. Authorised for publication by Carlos Martinez Mongay, Director for Economies of the Member States II. LEGAL NOTICE Neither the European Commission nor any person acting on its behalf may be held responsible for the use which may be made of the information contained in this publication, or for any errors which, despite careful preparation and checking, may appear. This paper exists in English only and can be downloaded from http://ec.europa.eu/economy_finance/publications/. Europe Direct is a service to help you find answers to your questions about the European Union. Freephone number (*): 00 800 6 7 8 9 10 11 (*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you). More information on the European Union is available on http://europa.eu. Luxembourg: Publications Office of the European Union, 2016 KC-BD-16-036-EN-N (online) KC-BD-16-036-EN-C (print) ISBN 978-92-79-54444-6 (online) ISBN 978-92-79-54445-3 (print) doi:10.2765/848761 (online) doi:10.2765/850297 (print) © European Union, 2016 Reproduction is authorised provided the source is acknowledged. -

Evolución De Los Principales Grupos Bancarios Españoles (2009-2021)

Evolución de los principales grupos bancarios españoles (2009-2021) Intervenida por BE (sustitución de administadores) Capital controlado por el FROB Integración SIP Constitución del banco 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Integration processes I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D Santander Santander Banco Popular Banco Popular Banco Pastor BBVA Caixa Sabadell BBVA Caixa Terrasa Unnim Unnim Banc Caixa Manlleu BBVA Caixa Catalunya Caixa Tarragona Catalunya Caixa Catalunya Banc CX Caixa Manresa La Caixa Caixa Girona La Caixa Caixabank Caja Sol Caja Guadalajara Caja Sol Caixabank Caja Navarra Banca Cívica Caja Burgos Banca Cívica Caixabank Caja Canarias Banco de Valencia Banco de Valencia Caja Madrid Bancaja Caixabank Caja de Ávila Caja Segovia BFA-Bankia Caja La Rioja Caixa Laietana Caja Insular de Canarias Bankia Caja Murcia Caixa Penedés Caja Granada Mare Nostrum Banco Mare Nostrum BMN Sa Nostra Banco Sabadell Banco Guipuzcoano Banco Sabadell Banco Sabadell Caja de Ahorros del Mediterráneo CAM Banco CAM Banco Sabadell Banco Gallego (Grupo NCG) Banco Gallego Bankinter Bankinter Unicaja Caja Jaén Unicaja Unicaja Banco Caja Duero Unicaja Banco Caja España Caja España de Inversiones Banco CEISS Cajastur Unicaja CCM CCM Cajastur Banco Caja Cantabria Liberbank Liberbank Caja Extremadura Caja de Ahorros Inmaculada CAI Caja Círculo Católico de Burgos Caja 3 Banco Grupo Caja 3 Caja Badajoz Ibercaja Banco Ibercaja Ibercaja Banco Kutxa Caja Vital BBK BBK Kutxabank Kutxabank CajaSur CajaSur Banco Etcheverría Caixa Galicia Abanca Caixa Nova Novacaixagalicia NCGBanco Evo Banco C.R. -

Estudio Comparativo De Sostenibilidad Entre Las Entidades

ESTUDIO COMPARATIVO DE SOSTENIBILIDAD ENTRE LAS ENTIDADES FINANCIERAS BANCOLOMBIA Y BANCO BRADESCO DE BRASIL Lina Marcela Hernández Ortega Lucia Galvis Quintero Sara Cristina Vahos Pérez Estudiantes Universidad de San Buenaventura –Seccional Medellín Facultad Ciencia Empresariales Programa Administración de Negocios Medellín 2012 2 ESTUDIO COMPARATIVO DE SOSTENIBILIDAD ENTRE LAS ENTIDADES FINANCIERAS BANCOLOMBIA Y BANCO BRADESCO DE BRASIL ESTUDIO COMPARATIVO DE SOSTENIBILIDAD ENTRE LAS ENTIDADES FINANCIERAS BANCOLOMBIA Y BANCO BRADESCO DE BRASIL Lina Marcela Hernández Ortega Lucia Galvis Quintero Sara Cristina Vahos Pérez Estudiantes Germán Escobar Aristizábal Asesor de Trabajo de Grado Trabajo de grado para optar el título de Administrador de Negocios Universidad de San Buenaventura –Seccional Medellín Facultad Ciencia Empresariales Programa Administración de Negocios Medellín 2012 3 ESTUDIO COMPARATIVO DE SOSTENIBILIDAD ENTRE LAS ENTIDADES FINANCIERAS BANCOLOMBIA Y BANCO BRADESCO DE BRASIL TABLA DE CONTENIDO INTRODUCCION ........................................................................................................................................ 7 1. PROBLEMA DE INVESTIGACIÓN .............................................................................................. 9 1.1. Descripción del Problema. ................................................................................................................ 9 1.2 Formulación del Problema ............................................................................................................ -

UBS Investment Research European Banks

ab Global Equity Research Europe Including UK UBS Investment Research European Banks Banks Market Comment Euroviews – that vertiginous feeling The rally increases the probability of equity issuance… Financials have rallied strongly, reflecting recognition that policymakers will do 30 April 2009 what it takes to reflate the global economy and that nationalisation is a very last www.ubs.com/investmentresearch resort. However, this does not mean that dilution risk from equity issuance is no longer a concern, and we believe a number of European banks need new equity – John-Paul Crutchley either for loss absorption capacity or to support market risk within their businesses. Analyst [email protected] …but timing is back in the banks’ control +44-20-7568 5037 Governments (ex UK) have avoided dilutive recapitalisation of banks through the Alastair Ryan creation of “buffer” core Tier 1 – an instrument that satisfies regulators and more Analyst senior creditors – but this capital does not ultimately bear losses. “Buffer” capital is [email protected] useful where a bank is suffering from cyclical capital stress and may buy time – +44 20 7568 3238 giving a bank the opportunity to raise equity on more advantageous terms as the Daniele Brupbacher cycle improves. The alternative is a “zombie” work-out with operating profits Analyst utilised in absorbing losses and rebuilding capital for years to come. [email protected] +41-44-239 1493 Buying recapitalised banks… Nick Davey Through choice, we are taking money off the table following the market rally. Our Analyst preference is for banks with strong business models whose capital strength is close [email protected] to undoubted, such as HSBC, Lloyds and Intesa. -

FINANCIAL SERVICES.Pdf

INTERNATIONAL REFERENCES FINANCIAL SERVICES Algeria Bank of Algeria, Société Générale Algérie, BNP, Salama Bank of Blida Australia Bank of Scotland international Austria “Creditanstalt AG”, National Savings, “Oberbank”, “Raiffeisenkasse” banks France Barclay’s, Banque de France, Credit Lyonnais, Citibank, Credi Mutuel, CIAL of CIC group, Commerzbank Paris Germany Deutsche Bank, Berliner Bank, Commerzbank, Dresdner Bank Hungary National Bank (KFKI) Budapest Hong Kong Hong Kong bank Indonesia BNT Jakarta Italia Banks, Banca popolare di Bescia, Banca commerciale Italiana, Instituto bancario S. Paolo Torno, Banca popolare di Crema Ivory Coast Société Générale de Banque Morocco Banque Centrale Populaire, Commercial Bank of Morocco New Zealand Deutsche Bank Auckland Niger Banque Centrale des Etats d’Afrique de l’Ouest au Niger Norway Oslo Bank of Norway, Bank of Scotland international Philippines Zambales Subic Financial building corporation, Manilla Bangkok bank Portugal Banks Portugal, Pinto & Sotto Mayor, Portugues do Atlantico, Fonsecas & Burnay, Do Fomento, Acores, Uniao de bancos Portugueses, Caixa Geral de depositos, Stock exchange Lisbon Senegal Bank B.C.E.A.O. Dakar Serbia National Bank of Serbia Singapore City Bank South Africa South African Reserve Bank in Durban Spain Caja Rural de Granada, Cajamar, Banco BBVA, Banco Popular, Banca March, Bankinter, Caja Laboral, Unicaja, Caja de Ahorros de Ávila Thailand Bangkok Thai Farmers bank head office, Bangkok bank head office, Bangkok Bank of Ayudhya head office, Chiangmai Central bank of Thailand, Bank of Thailand, BTS Depot United Arab Emirates Abu Dhabi Barclays Bank, National bank of Abu Dhabi United Kingdom Barclays Bank London, Northern Trust London, Bank of England, Lloyds, Blue Crest, HSBC, Schroders. . -

Banco Sabadell Spain

Banco Sabadell Spain Active This profile is actively maintained Send feedback on this profile Created before Nov 2016 Last update: May 10 2021 About Banco Sabadell Banco Sabadell was founded in 1881 by a group of 127 businessmen and traders from Sabadell in Spain, aiming to finance local industries. Nowadays, it is in the top five largest banks in Spain and provides banking and financial products and services in Spain and internationally. Banco Sabadell is comprised of different banks, brands, subsidiaries and part-owned companies. Since 2007, the bank has doubled in size and acquired several other banks. Banco Sabadell adopted the Equator Principles in 2011, and is profiled as part of BankTrack's Tracking the Equator Principles campaign. Website https://www.grupbancsabadell.com/en/ Headquarters Avenida Óscar Esplá 37 03007 Alicante Spain CEO/chair César González-Bueno Mayer CEO Supervisor Banco de España Annual Annual report 2020 reports CSR Report 2020 Ownership listed on Bolsa de Madrid Banco Sabadell's shareholder structure can be accessed here. Subsidiaries TSB Bank – United Kingdom Complaints and grievances Sustainability Voluntary standards Banco Sabadell has committed itself to the following voluntary standards: Carbon Disclosure Project Equator Principles FTSE4Good Supply Chain Labour Standards Criteria Global Reporting Initiative ISO 14001 Principles for Responsible Banking (PRB) Principles for Responsible Investment (PRI) Task Force on Climate-related Financial Disclosures UNEP Finance Initiative United Nations Global Compact -

Analisis De La Responsabilidad Social Corporativa Del Sector Bancario

Facultad de Ciencias Económicas y Empresariales ANÁLISIS DE LA RESPONSABILIDAD SOCIAL CORPORATIVA EN EL SECTOR BANCARIO ESPAÑOL Autor: María Sánchez Barbero Director: Laura Gismera Tierno MADRID | Abril 2020 RESUMEN/ABSTRACT Resumen La Responsabilidad Social Corporativa es una práctica en auge desde finales de los años 90 y su función principal es satisfacer a los grupos de interés –stakeholders- de las empresas que la aplican. La RSC busca cumplir con los intereses internos de las compañías y de la sociedad, mejorando así la imagen corporativa de la empresa. El sector bancario español lleva casi 20 años aplicando esta corriente empresarial hasta el punto que, las distintas entidades bancarias que conforman el sector, desarrollan modelos de RSC prácticamente idénticos. Este trabajo tiene como principal objetivo analizar la Responsabilidad Social Corporativa en el sector bancario español. En primer lugar, se expondrá una aproximación al concepto de Responsabilidad Social Corporativa, así como su evolución, las principales teorías sobre la materia y ciertos aspectos diferenciales y normativos con los que se identifica la RSC. Así mismo, se realizará un análisis de la evolución del sector bancario en los últimos años junto con las oportunidades y amenazas a las que se enfrenta el mismo. Finalmente, se analizará el modelo de RSC de cinco de las entidades bancarias más importantes a nivel nacional: Santander, BBVA, CaixaBank, Bankinter y Banco Sabadell. Palabras clave: Responsabilidad Social Corporativa (RSC), economía, entidades bancarias, stakeholders, interés, sostenibilidad, acción social. Abstract Corporate Social Responsibility has been a growing practice since the late 1990s and its main function is to satisfy the stakeholders of the companies that apply it. -

Disposición 1560 Del BOE Núm. 27 De 2010

BOLETÍN OFICIAL DEL ESTADO Núm. 27 Lunes 1 de febrero de 2010 Sec. III. Pág. 9202 III. OTRAS DISPOSICIONES BANCO DE ESPAÑA 1560 Resolución de 21 de enero de 2010, del Banco de España, por la que se publica la relación de entidades participantes (asociadas y representadas) a 15 de enero de 2010 en el Sistema Nacional de Compensación Electrónica. En cumplimiento de lo dispuesto en el capítulo II, artículo 7, de la Ley 41/1999, de 12 de noviembre, sobre sistemas de pagos y de liquidación de valores, se publica la relación de Entidades participantes (asociadas y representadas) a 15 de enero de 2010 en el Sistema Nacional de Compensación Electrónica. Madrid, 21 de enero de 2010.–El Director General de Operaciones, Mercados y Sistemas de Pago, Javier Alonso Ruiz-Ojeda. RELACIÓN DE ENTIDADES ASOCIADAS DEL S.N.C.E. A 15 DE ENERO DE 2010 NRBE Denominación 0019 Deutsche Bank, S.A.E. 0030 Banco Español de Crédito, S.A. 0042 Banco Guipuzcoano, S.A. 0049 Banco Santander, S.A. 0061 Banca March, S.A. 0065 Barclays Bank, S.A. 0072 Banco Pastor, S.A. 0075 Banco Popular Español, S.A. 0081 Banco de Sabadell, S.A. 0093 Banco de Valencia, S.A. 0128 Bankinter, S.A. 0182 Banco Bilbao Vizcaya Argentaria, S.A. 0198 Banco Cooperativo Español, S.A. 2000 Confederación Española de Cajas de Ahorros. 2013 Caixa d’Estalvis de Catalunya. 2038 Caja de Ahorros y M.P. de Madrid. 2077 C.A. de Valencia, Castellón y Alicante, Bancaja. 2085 C.A.M.P. Zaragoza, Aragón y Rioja (IBERCAJA). -

Arbitraje Con Adrs: Un Estudio De Caso Sectorial Para Empresas De Colombia, México, Brasil Y Chile

Arbitraje con ADRs: un estudio de caso sectorial para empresas de Colombia, México, Brasil y Chile Arbitrage with ADRs: a sectorial case study for companies in Colombia, Mexico, Brazil and Chile Nicolás Acevedo V. * Daniela Fleisman V. ** Angélica Montoya V. *** Andrés Mauricio Mora C. **** Fecha de recepción: Fecha de aprobación: * (FRQRPLVWD 8QLYHUVLGDG ($),7 0DJLVWHU HQ (FRQRPtD ,68 *HUHQWH GH ,QYHVWLJDFLyQ\'HVDUUROORGH3URGXFWRV9DORUHV%DQFRORPELD&RORPELD &RUUHRHOHFWUyQLFRQDYHOH]#\DKRRFRP ** (FRQRPLVWD8QLYHUVLGDG($),7$QDOLVWD3RUWDIROLRV3ULYDGRV%ROVD\5HQWD6$ &RORPELD&RUUHRHOHFWUyQLFRGIOHLVPDQ#EROVD\UHQWDFRP *** (FRQRPLVWD 8QLYHUVLGDG ($),7 (MHFXWLYD &RPHUFLDO 9DORUHV %DQFRORPELD &RORPELD&RUUHRHOHFWUyQLFRDQJHOLPR#9DORUHV%DQFRORPELDFRP **** Administrador de Negocios, Especialista en Finanzas, Magíster en Administración )LQDQFLHUD 0DJtVWHU HQ &LHQFLDV GH OD $GPLQLVWUDFLyQ 8QLYHUVLGDG ($),7 (VSHFLDOLVWDHQ$QiOLVLV%XUViWLO,QVWLWXWRGH(VWXGLRV%XUViWLOHV ,(% -HIHGHO 'HSDUWDPHQWRGH)LQDQ]DV8QLYHUVLGDG($),7&RORPELD &RUUHRHOHFWUyQLFRDPRUDF#HDILWHGXFR ISSN 1657-4206 I Año 15 I No. 33 I julio-diciembre 2011 I pp. 7-23 I Medellín-Colombia 8 Arbitraje con ADRs: un estudio de caso sectorial para empresas de Colombia, México, Brasil y Chile 1,&2/É6$&(9('29 '$1,(/$)/(,60$19 $1*e/,&$02172<$9 $1'5e60$85,&,2025$& Resumen (O SUHVHQWH DUWtFXOR HV OD FRQWLQXDFLyQ GHO DUWtFXOR ´*HQHUDOLGDGHV GH ORV $'5V 8Q estudio de caso sectorial para empresas de Colombia, México, Brasil y Chile” y al igual que este, es un subproducto de la investigación “Arbitraje con