One-Pager: 2020 Fermentation SOTIR

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Analysis for Cultured Proteins in Low- and Lower-Middle Income Countries

Market Analysis for October 2019 Cultured Proteins in Low- and Lower-Middle Income Countries Acknowledgments This report was developed as part of a series of interrelated assessments regarding alternative proteins. The development of this report was led by PATH in collaboration with Duke University, the International Food Policy Research Institute, and The Nature Conservancy through the Bridge Collaborative. PATH gratefully acknowledges the input and feedback of the many technical experts who reviewed and contributed to this report. We would like to thank the stakeholders who participated in interviews for their time and insights. We would also like to thank Isha Datar, Cyril Engmann, Bruce Friedrich, Dipika Matthias, and Bonnie McClafferty for reviewing this report. Finally, we would like to thank Shawn Kavon for graphic design and Teri Gilleland Scott and Rica Asuncion-Reed for proofreading. The development of this report was made possible with funding from The Rockefeller Foundation. Authors: Tara Herrick, Sarah Gannon, Katharine Kreis, Stephanie Zobrist, Megan Parker, Claudia Harner-Jay, Josh Goldstein, Sara Mason, Lydia Olander, Nicostrato Perez, Claudia Ringler, and Drew Shindell. Mailing Address PO Box 900922 Seattle, WA 98109 USA Street Address 2201 Westlake Avenue Suite 200 Seattle, WA 98121 USA www.path.org Suggested citation: PATH. Market Analysis for Cultured Proteins in Low- and Lower-Middle Income Countries. Seattle: PATH; 2019. © 2019, PATH. All rights reserved. PATH contact: Katharine Kreis Director, Strategic Initiatives -

Death-Free Dairy? the Ethics of Clean Milk

J Agric Environ Ethics https://doi.org/10.1007/s10806-018-9723-x ARTICLES Death-Free Dairy? The Ethics of Clean Milk Josh Milburn1 Accepted: 10 January 2018 Ó The Author(s) 2018. This article is an open access publication Abstract The possibility of ‘‘clean milk’’—dairy produced without the need for cows—has been championed by several charities, companies, and individuals. One can ask how those critical of the contemporary dairy industry, including especially vegans and others sympathetic to animal rights, should respond to this prospect. In this paper, I explore three kinds of challenges that such people may have to clean milk: first, that producing clean milk fails to respect animals; second, that humans should not consume dairy products; and third, that the creation of clean milk would affirm human superiority over cows. None of these challenges, I argue, gives us reason to reject clean milk. I thus conclude that the prospect is one that animal activists should both welcome and embrace. Keywords Milk Á Food technology Á Biotechnology Á Animal rights Á Animal ethics Á Veganism Introduction A number of businesses, charities, and individuals are working to develop ‘‘clean milk’’—dairy products created by biotechnological means, without the need for cows. In this paper, I complement scientific work on this possibility by offering the first normative examination of clean dairy. After explaining why this question warrants consideration, I consider three kinds of objections that vegans and animal activists may have to clean milk. First, I explore questions about the use of animals in the production of clean milk, arguing that its production does not involve the violation of & Josh Milburn [email protected] http://josh-milburn.com 1 Department of Politics, University of York, Heslington, York YO10 5DD, UK 123 J. -

( 12 ) United States Patent

US009924728B2 (12 ) United States Patent (10 ) Patent No. : US 9 , 924 , 728 B2 Pandya et al . (45 ) Date of Patent: Mar. 27, 2018 ( 54 ) FOOD COMPOSITIONS COMPRISING ONE FOREIGN PATENT DOCUMENTS OR BOTH OF RECOMBINANT BETA -LACTOGLOBULIN PROTEIN AND WOWO 2013 / 009182 1 /2013 RECOMBINANT ALPHA - LACTALBUMIN PROTEIN OTHER PUBLICATIONS Arora et al. , “ Variations in the fat unsaponifiable matter and ( 71 ) Applicant: Perfect Day , Inc. , Berkeley , CA (US ) cholesterol contents of goat milk , ” Ind . J . Daily Sci. , Sep . 29 : 191, 1976 . (72 ) Inventors : Ryan Pandya , South San Francisco , Beare -Rogers et al. , “ Lexicon of lipid nutration ( IUPAC Technical CA (US ) ; Perumal Gandhi, Santa Report ) ,” Pure and Applied Chemistry 73 ( 4 ) :685 - 744 , 2001 . Clara , CA (US ) ; Shaowen Ji, Ann Brignon et al . , “ Preparation and amino acid sequences of human Arbor, MI ( US) ; Derek Beauchamp , kappa -casein ,” FEBS Lett. 188 ( 1 ) :48 -54 , 1985 . Dexter , MI (US ) ; Louis Hom , San Singh et al. , “ Post - translational Modification of Caseins, ” In Milk Proteins from Expression to Food , Chapter 5 , Second Edition , Carlos, CA (US ) 141 - 162 , 2014 . Choi and Jimenez - Flores , “ Expression and purification of ( 73 ) Assignee : Perfect Day, Inc ., Berkeley , CA (US ) glycosylated bovine beta -casein (L70S / P71S ) in Pichia pastoris , ” J . Agric . Food Chem . 49 ( 4 ): 1761 - 1766 , 2001 . ( * ) Notice : Subject to any disclaimer , the term of this Deshpande et al . , “ Protein Glycosylation Pathways in Filamentus patent is extended or adjusted under 35 Fungi, ” Glycobiology 18 ( 8 ) :626 -637 , 2008 . U . S . C . 154 ( b ) by 0 days . Farrell Jr. , et al. , “ Casein Micelle Structure : What Can Be Learned from Milk Synthesis and Structural Biology ? ” Curr. -

GRAS Notice GRN 863 Agency Response Letter

U.S. FOOD & DRUG ADMINISTRATION CENTER FOR FOOD SAFETY &. APPLIED NuntmON . Mr. Melvin S. Drozen Keller and Heckman LLP 1001 G Street, NW, Suite 500W Washington, DC 20005 Re: GRAS Notice No. GRN 000863 Dear Mr. Drozen: The Food and Drug Administration (FDA, we) completed our evaluation of GRN 000863. We received the notice that you submitted on behalf of Perfect Day, Inc. on May 20, 2019 and filed it on June 28, 2019. Perfect Day submitted amendments to the notice on July 3, August 14, September 10, and December 30, 2019, and January 28, 2020. These amendments provide additional information about the identity, manufacturing specifications, and intended use. The subject of the notice is -lactoglobulin produced by Trichoderma reesei ( - lactoglobulin) for use as a source of protein in food at levels up to 35%. Perfect Day states that -lactoglobulin is not intended for use in infant formula or in products subject to regulation by the United States Department of Agriculture. The notice informs us of Perfect Day’s view that this use of -lactoglobulin is GRAS through scientific procedures. Our use of the term, “ -lactoglobulin,” in this letter is not our recommendation of that term as an appropriate common or usual name for declaring the substance in accordance with FDA’s labeling requirements. Under 21 CFR 101.4, each ingredient must be declared by its common or usual name. In addition, 21 CFR 102.5 outlines general principles to use when establishing common or usual names for nonstandardized foods. Issues associated with labeling and the common or usual name of a food ingredient are under the purview of the Office of Nutrition and Food Labeling (ONFL) in the Center for Food Safety and Applied Nutrition. -

July 10, 2020

d's Dairy orl In W du e st h r t y g W n i e e v Since 1876 k r e l y S OutShred Your Competition PRECISE, RAPID CHEESE REPORTER SHREDS urschel.com Vol. 145, No. 4 • Friday, July 10, 2020 • Madison, Wisconsin CME Block Cheddar Cheese Price Lawmakers Want USTR, USDA To Sets Another New Record: $2.9150 Pursue Phase Two USDA Cuts 2020 Milk Production Forecast By Meanwhile, in its monthly Deal With Japan To supply-demand estimates released Boost Dairy Access 1.0 Billion Pounds; Most Price Forecasts Hiked today, the US Department of Agricuture (USDA) reduced its Washington—Some 50 House Chicago—The CME cash (spot) to $2.7375 per pound on Wednes- milk production forecast for 2020 members from both parties this market price for 40-pound Ched- day on the sale of four carloads of while raising most of its dairy prod- week asked two Trump adminis- dar blocks reached a new record blocks at that price. uct and milk price forecasts for tration officials to work swiftly on high today of $2.9150 per pound. Then on Thursday, the block both 2020 and 2021. a comprehensive Phase Two trade That broke the previous record price jumped 9.25 cents to a then- USDA’s milk production fore- agreement with Japan. high for the Cheddar block price record $2.8300 per pound, on the cast for 2020 is lowered by 1.0 The letter to US Trade Rep- of $2.8300 per pound, which was sale of one carload at that price. -

WO 2018/039632 Al 01 March 2018 (01.03.2018) W !P O PCT

(12) INTERNATIONAL APPLICATION PUBLISHED UNDER THE PATENT COOPERATION TREATY (PCT) (19) World Intellectual Property Organization International Bureau (10) International Publication Number (43) International Publication Date WO 2018/039632 Al 01 March 2018 (01.03.2018) W !P O PCT (51) International Patent Classification: (74) Agent: CONKLIN, David R.; 36 S. State Street, Suite A23C 9/15 (2006.01) A23J 3/08 (2006.01) 1900, Salt Lake City, Utah 841 11 (US). A23C 20/00 (2006.01) A23J 3/14 (2006.01) (81) Designated States (unless otherwise indicated, for every A23C 21/08 (2006.01) kind of national protection available): AE, AG, AL, AM, (21) International Application Number: AO, AT, AU, AZ, BA, BB, BG, BH, BN, BR, BW, BY, BZ, PCT/US20 17/048730 CA, CH, CL, CN, CO, CR, CU, CZ, DE, DJ, DK, DM, DO, DZ, EC, EE, EG, ES, FI, GB, GD, GE, GH, GM, GT, HN, (22) International Filing Date: HR, HU, ID, IL, IN, IR, IS, JO, JP, KE, KG, KH, KN, KP, 25 August 2017 (25.08.2017) KR, KW, KZ, LA, LC, LK, LR, LS, LU, LY, MA, MD, ME, (25) Filing Language: English MG, MK, MN, MW, MX, MY, MZ, NA, NG, NI, NO, NZ, OM, PA, PE, PG, PH, PL, PT, QA, RO, RS, RU, RW, SA, (26) Publication Language: English SC, SD, SE, SG, SK, SL, SM, ST, SV, SY,TH, TJ, TM, TN, (30) Priority Data: TR, TT, TZ, UA, UG, US, UZ, VC, VN, ZA, ZM, ZW. 25 August 2016 (25.08.2016) US 62/379,647 (84) Designated States (unless otherwise indicated, for every (71) Applicant: PERFECT DAY, INC. -

April 17, 2020

d's Dairy orl In W du e st h r t y g W n i e e v Since 1876 k r e l y S PRECISE, RAPID SHREDS with Urschel CHEESE REPORTER urschel.com Vol. 144, No.44 • Friday, April 17, 2020 • Madison, Wisconsin Feeding America, Ag Groups Push Class III Volume On California Order USDA To Boost Aid To Food Banks Reached New Low, Urgent Need For Food Assistance Expected To being told there is an oversupply Class IV Volume Hit of their product,” the letter said. New High In March Keep Rising; Other Dairy Aid Measures Sought “The unfortunate consequences include public panic about an Folsom, CA—The volume of milk Washington—Dairy and farm million who were food insecure adequate food supply and plunging pooled in Class III on the Califor- organizations, Feeding America prior to the pandemic,” the letter prices for farm produce.” nia federal milk marketing order and numerous lawmakers are urg- continued. USDA has the opportunity to hit a new low in March while the ing US Secretary of Agriculture “We ask USDA to look at how help address both of these unfor- volume of milk pooled in Class Sonny Perdue to help food banks to strengthen existing partner- tunate consequences through IV reached a new high, accord- meet growing demand for food ships with additional investment a voucher program that would ing to the statistical uniform price assistance due to the coronavirus as you identify how to provide deepen the relationships between announcement released Tuesday by pandemic. support to US producers impacted farmers and food banks, allowing the market administrator’s office. -

Pandya Position Paper F

Toward a Diversified Protein Future** Ryan Pandya, Chief Executive Officer, Perfect Day, Berkeley, California Summary: Global demand for high-quality, animal-sourced protein is expected to rise substantially in the coming decades as population grows and household incomes rise. Simultaneously, climate experts are calling for a rapid transition away from animal-derived foods in an effort to curb greenhouse gas emissions from animal agriculture. There is a global need for innovative solutions to produce quality protein without contributing to the negative environmental impacts associated with industrial animal agriculture. Current realities: Currently, the world’s highest-quality proteins come from animal products and have been shown to provide important defense against malnutrition and stunting, especially in the developing world. Among animal-sourced proteins, dairy is the most bioavailable in the human diet. Global demand for dairy protein is projected to increase 60% by 2050 as global incomes rise and the population grows to over 9 billion. Unfortunately, many people cannot afford to buy food that contains dairy protein, are unable to consume it because of milk protein allergies or lactose intolerance, or choose to restrict their consumption of dairy products. Additionally, dairy’s reliance on animal agriculture poses a serious challenge to sustainability by burdening land and water resources already in high demand. In light of these realities, many consumers are choosing dairy alternatives derived from plants. However, these products are of a much lower nutritional quality than animal proteins, as indicated by the Protein Digestibility Corrected Amino Acid Score and the Digestible Indispensable Amino Acid Score. In addition, plant-based products do not have the same taste, texture, and functional properties of dairy products. -

Dairy Without Compromise

Dairy without compromise. Who’s hungry? INGREDIENTS: Filtered water, tapioca starch, palm fruit oil, expeller pressed non-GMO canola oil and/or expeller pressed non-GMO safflower oil, coconut oil, pea protein isolate, nat- ural vegan flavours, vegetable glycerine, sea salt, yeast ex- tract, xanthan gum, lactic acid (vegan, for flavour), annatto (for colour), carrageenan, titanium dioxide, vegan enzyme. Introducing the animal-free future of dairy. Perfect Day is a food company developing a way to make all your favorite dairy products — without animals. It’sIt’s notnot magic.magic. ButBut itit isis magical.magical. It’sIt’s notnot magic.magic. Instead of having cows do all the work, we ButBut makeitit isis our milkmagical.magical. with a process similar to craft brewing. Using yeast and well-established fermentation techniques, we make the very We makeInstead our ofsame having milk milk withcows proteins do a allprocess (casein the work, and similar we whey) tothat craft makebrewing. our cowsmilk with make. a process similar to craft brewing. Using yeast and well-established fermentationThen techniques, we combine we our make pure the milk very proteins with PLANT FATS & Usingsame yeast milk anda proteins special fermentation, mix(casein of plant- and whey) based we makethat fats, the SUGARS very samecows make. milklactose-free proteins sugars, that and cows the same make. vitamins and micronutrients found in milk, along with MILK Then we combinepowerhouses our pure such milk as omega-3proteins with fatty acids. PROTEINS PLANT FATS & Thena wespecial add mix ofplant-based plant- based fats, sugars, fats, SUGARS and micronutrientslactose-freeThe sugars, result? to andA totallymake the same new a kind vitaminstotally of dairy new milk and micronutrientsthat delivers found the insame milk, great along taste with as cow’s kind of dairy milk! MILK powerhousesmilk, such with assuperior omega-3 nutrition fatty acids.and none of the PROTEINS nonsense. -

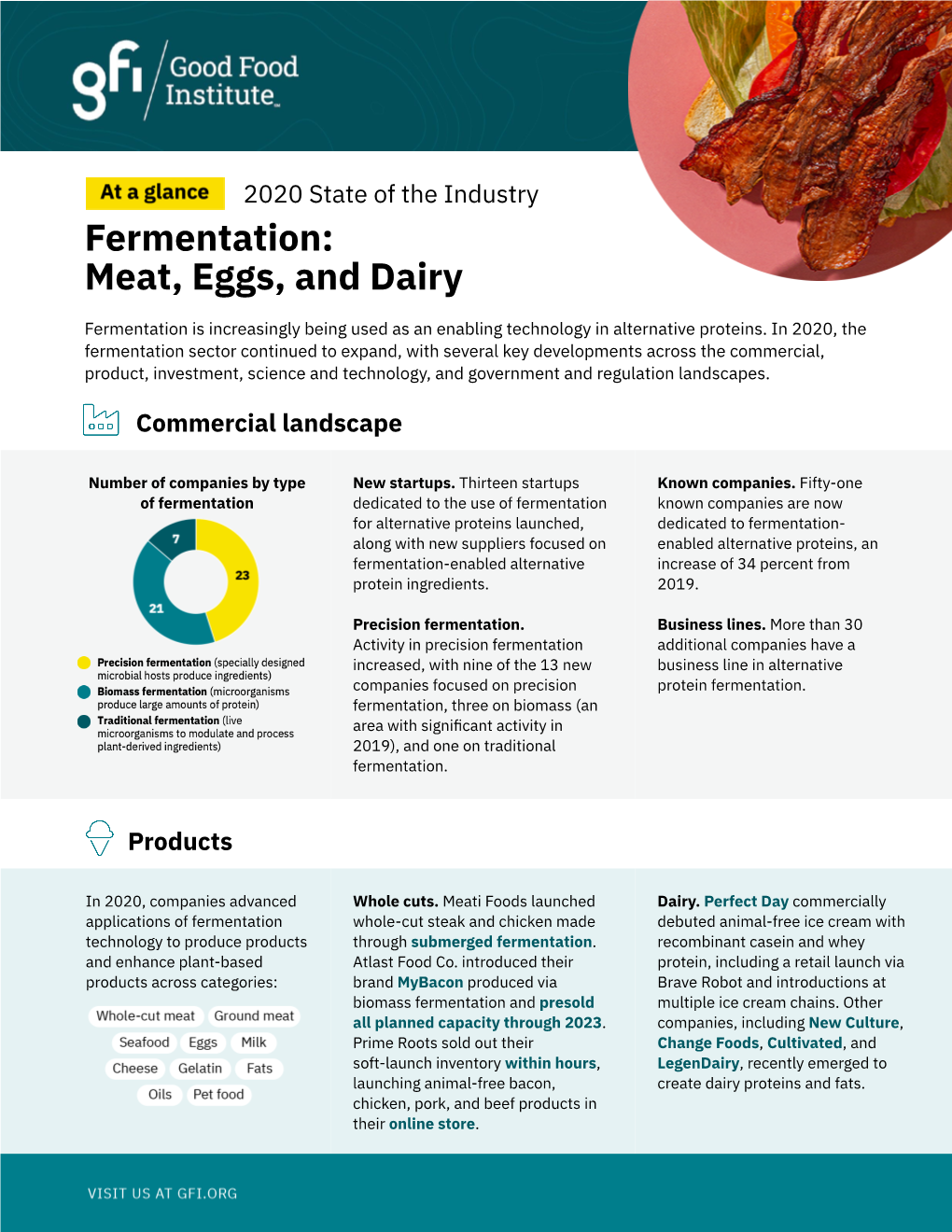

2020 State of the Industry Report: Fermentation

Table of Contents — Executive summary 6 Fermentation-enabled proteins year at-a-glance 6 Section 1: Introduction 8 The definition and role of fermentation in the context of alternative proteins 9 Section 2: Commercial landscape 12 Overview 12 A note on Covid-19 12 Figure 1: A conceptual landscape of fermentation-derived and fermentation-enabled products 13 Figure 2: Mind map of fermentation in the alternative protein industry 14 Table 1: Types of companies included in report scope 14 Fermentation for alternative protein end products 15 Figure 3: Number of companies by type of fermentation 15 Table 2: Companies focused on fermentation for animal-free meat, eggs, and dairy (ordered by year founded) 16 Figure 4: Number of fermentation-enabled alternative protein companies (2013–2020) 20 Fermentation initiatives for animal-free meat, eggs, and dairy 21 Figure 5: Companies with fermentation initiatives for animal-free meat, eggs, and dairy 21 Figure 6. Geographic distribution of fermentation-enabled alternative protein companies, by headquarters 22 Section 3: Products 24 Consumer product categories: Fermentation allows for a huge diversity of products 24 Ground meat 24 Whole-cut meats 25 Eggs and egg replacements 25 Dairy 25 Box 1: Fermentation-enabled milk proteins come to market 25 Gelatin 26 Seafood 27 Fats and oils 27 Pet food 27 The role of incumbents in enzyme solutions and scaling 28 Emerging B2B companies as suppliers and service providers for the alternative protein industry 29 State of the Industry Report | Fermentation 2 Section 4: -

Not Just Fake Meat but Fake Ice Cream

Not Just Fake Meat but Fake Ice Cream Analysis by Dr. Joseph Mercola Fact Checked STORY AT-A-GLANCE - The new Planetary Health Diet is designed to be applied to the global population and entails cutting meat and dairy intake by up to 90% Along with fake meat products, fake dairy foods are on the horizon, including imitation ice cream made with lab-produced milk proteins A company called Perfect Day is using genetically engineered (GE) Trichoderma reesei fungus to produce animal-free versions of the dairy proteins casein and whey The healthiest dairy products come from grass fed cows that are integrated into their surrounding environment, but Perfect Day’s fake milk proteins can only be produced in a system that’s “isolated from the outside world” Grass fed, regenerative farming is the true environmental and sustainability winner, but it’s being overshadowed by the New Normal, intent on forcing you to eat fake food Swapping traditional, whole foods grown by small farmers for mass-produced fake foods grown in a laboratory is part and parcel of the Great Reset. The EAT Forum, co- founded by the Wellcome Trust, developed a Planetary Health Diet that’s designed to be applied to the global population and entails cutting meat and dairy intake by up to 90%, replacing it largely with foods made in laboratories, along with cereals and oil.1 Sadly, this is not what your body needs to thrive, but it’s being pushed as a healthy, green and sustainable alternative to animal foods. The fake meat industry is already well- established. -

Comparative GHG Emissions Report for Perfect Day Prepared by WSP 09Feb2021 Non-Confidential.Docx

ISO-CONFORMANT REPORT COMPARATIVE GHG EMISSIONS ASSESSMENT OF PERFECT DAY WHEY PROTEIN PRODUCTION TO DAIRY PROTEIN PERFECT DAY, INC. VERSION 1 WSP 851 SW 6TH STREET SUITE 1600 PORTLAND, OR 97214 USA PHONE: +1 503 478 2820 WSP FEBRUARY 09, 2021 Table of Contents EXECUTIVE SUMMARY ......................................................5 ASSESSMENT SUMMARY..................................................7 1 GOAL OF THE STUDY..............................................8 1.1 Reasons for Carrying out the Study.........................................8 1.2 Intended Applications................................................................8 1.3 Target Audience .........................................................................8 1.4 Type of Critical Review ..............................................................8 2 SCOPE OF THE STUDY ...........................................9 2.1 Function ......................................................................................9 2.2 Functional Unit ...........................................................................9 2.3 System Boundary .......................................................................9 2.4 Allocation ..................................................................................11 2.5 Sensitivity Analysis..................................................................11 3 LIFE CYCLE INVENTORY ANALYSIS ....................12 3.1 Data Collection Procedures ....................................................12 3.2 Calculation Procedures ...........................................................17