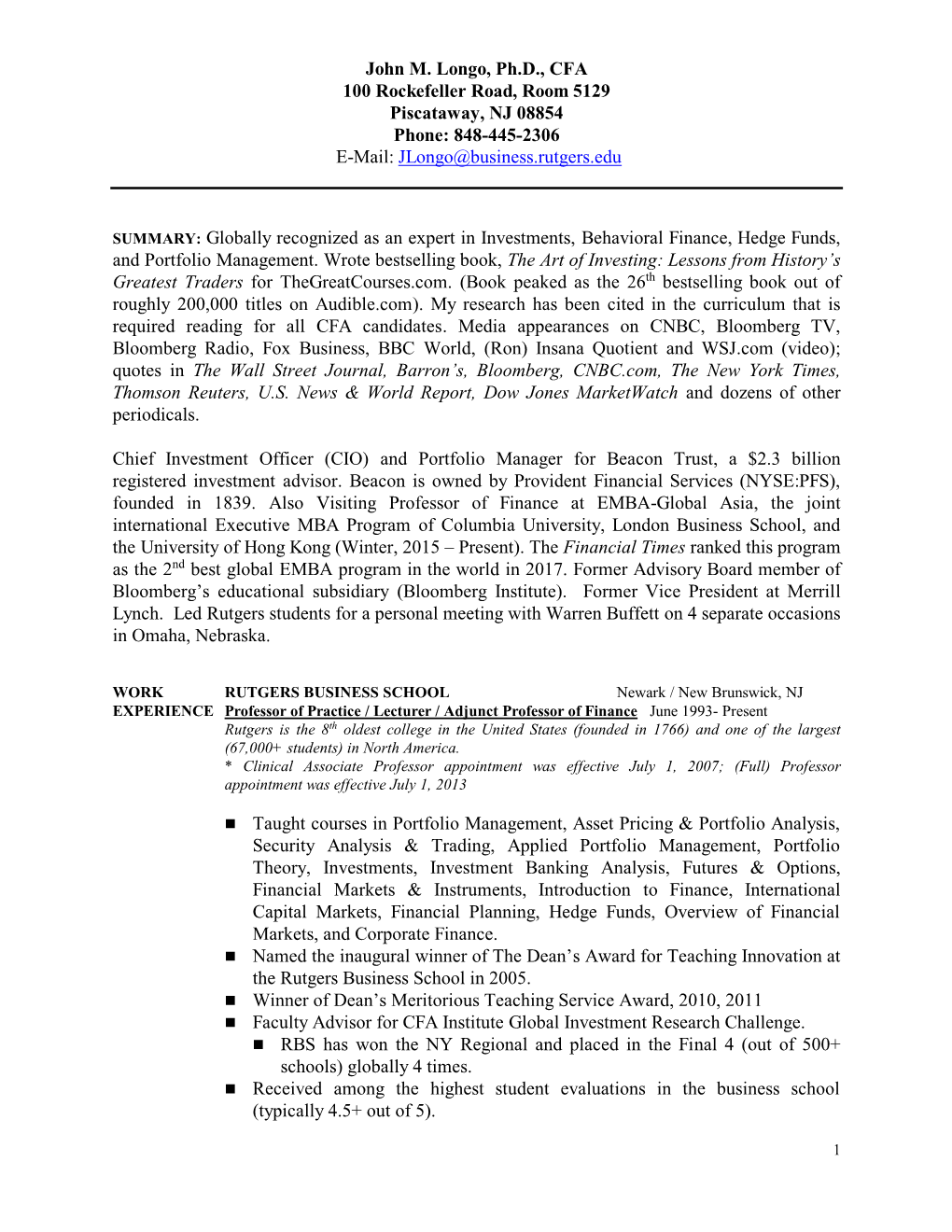

Cv-John-Longo.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Radio and Television Correspondents' Galleries

RADIO AND TELEVISION CORRESPONDENTS’ GALLERIES* SENATE RADIO AND TELEVISION GALLERY The Capitol, Room S–325, 224–6421 Director.—Michael Mastrian Deputy Director.—Jane Ruyle Senior Media Coordinator.—Michael Lawrence Media Coordinator.—Sara Robertson HOUSE RADIO AND TELEVISION GALLERY The Capitol, Room H–321, 225–5214 Director.—Tina Tate Deputy Director.—Olga Ramirez Kornacki Assistant for Administrative Operations.—Gail Davis Assistant for Technical Operations.—Andy Elias Assistants: Gerald Rupert, Kimberly Oates EXECUTIVE COMMITTEE OF THE RADIO AND TELEVISION CORRESPONDENTS’ GALLERIES Joe Johns, NBC News, Chair Jerry Bodlander, Associated Press Radio Bob Fuss, CBS News Edward O’Keefe, ABC News Dave McConnell, WTOP Radio Richard Tillery, The Washington Bureau David Wellna, NPR News RULES GOVERNING RADIO AND TELEVISION CORRESPONDENTS’ GALLERIES 1. Persons desiring admission to the Radio and Television Galleries of Congress shall make application to the Speaker, as required by Rule 34 of the House of Representatives, as amended, and to the Committee on Rules and Administration of the Senate, as required by Rule 33, as amended, for the regulation of Senate wing of the Capitol. Applicants shall state in writing the names of all radio stations, television stations, systems, or news-gathering organizations by which they are employed and what other occupation or employment they may have, if any. Applicants shall further declare that they are not engaged in the prosecution of claims or the promotion of legislation pending before Congress, the Departments, or the independent agencies, and that they will not become so employed without resigning from the galleries. They shall further declare that they are not employed in any legislative or executive department or independent agency of the Government, or by any foreign government or representative thereof; that they are not engaged in any lobbying activities; that they *Information is based on data furnished and edited by each respective gallery. -

For Immediate Release Ceg Media Contacts Bnef Media

FOR IMMEDIATE RELEASE June 21, 2010 CEG MEDIA CONTACTS Ken Locklin Lewis Milford Clean Energy Group Clean Energy Group C 703-476-1561 P 802-223-2554 [email protected] C 802-238-4023 [email protected] BNEF MEDIA CONTACT Jill Goodkind Bloomberg LP +1 212 617 3669 [email protected] SHEPHERDING CLEAN ENERGY PROJECTS THROUGH THE “VALLEY OF DEATH” Washington, June 21, 2010—A new report issued by Clean Energy Group (CEG) and Bloomberg New Energy Finance (BNEF) undertakes a much-needed evaluation of current gaps in clean energy financing, offering recommendations to address the so-called commercialization “Valley of Death” financing shortfall that occurs before a clean energy technology can achieve commercial viability. The findings, based on analysis of interviews with more than five dozen industry thought-leaders and underlined with quantitative research from Bloomberg New Energy Finance’s Intelligence database, are contained in the white paper “Crossing the Valley of Death: Solutions to the next generation clean energy project financing gap.” Clean Energy Group, with the support of The Annenberg Foundation, commissioned Bloomberg New Energy Finance to join in the study, which examines the shortage of capital for clean energy technologies that require extensive and expensive field-testing before being deployed. Clean Energy Group and Bloomberg New Energy Finance conducted over 60 open-ended interviews with technologists, entrepreneurs, project developers, venture capitalists, institutional investors, bankers and policymakers from 10 countries across the globe to provide solutions on how to address the “Valley of Death” phenomenon. Ken Locklin, Clean Energy Group’s director of finance and investment, said, “This study presents some exciting new approaches to overcome this Valley of Death financing challenge that we should explore further. -

Stations Monitored

Stations Monitored 10/01/2019 Format Call Letters Market Station Name Adult Contemporary WHBC-FM AKRON, OH MIX 94.1 Adult Contemporary WKDD-FM AKRON, OH 98.1 WKDD Adult Contemporary WRVE-FM ALBANY-SCHENECTADY-TROY, NY 99.5 THE RIVER Adult Contemporary WYJB-FM ALBANY-SCHENECTADY-TROY, NY B95.5 Adult Contemporary KDRF-FM ALBUQUERQUE, NM 103.3 eD FM Adult Contemporary KMGA-FM ALBUQUERQUE, NM 99.5 MAGIC FM Adult Contemporary KPEK-FM ALBUQUERQUE, NM 100.3 THE PEAK Adult Contemporary WLEV-FM ALLENTOWN-BETHLEHEM, PA 100.7 WLEV Adult Contemporary KMVN-FM ANCHORAGE, AK MOViN 105.7 Adult Contemporary KMXS-FM ANCHORAGE, AK MIX 103.1 Adult Contemporary WOXL-FS ASHEVILLE, NC MIX 96.5 Adult Contemporary WSB-FM ATLANTA, GA B98.5 Adult Contemporary WSTR-FM ATLANTA, GA STAR 94.1 Adult Contemporary WFPG-FM ATLANTIC CITY-CAPE MAY, NJ LITE ROCK 96.9 Adult Contemporary WSJO-FM ATLANTIC CITY-CAPE MAY, NJ SOJO 104.9 Adult Contemporary KAMX-FM AUSTIN, TX MIX 94.7 Adult Contemporary KBPA-FM AUSTIN, TX 103.5 BOB FM Adult Contemporary KKMJ-FM AUSTIN, TX MAJIC 95.5 Adult Contemporary WLIF-FM BALTIMORE, MD TODAY'S 101.9 Adult Contemporary WQSR-FM BALTIMORE, MD 102.7 JACK FM Adult Contemporary WWMX-FM BALTIMORE, MD MIX 106.5 Adult Contemporary KRVE-FM BATON ROUGE, LA 96.1 THE RIVER Adult Contemporary WMJY-FS BILOXI-GULFPORT-PASCAGOULA, MS MAGIC 93.7 Adult Contemporary WMJJ-FM BIRMINGHAM, AL MAGIC 96 Adult Contemporary KCIX-FM BOISE, ID MIX 106 Adult Contemporary KXLT-FM BOISE, ID LITE 107.9 Adult Contemporary WMJX-FM BOSTON, MA MAGIC 106.7 Adult Contemporary WWBX-FM -

Bloomberg L.P

Bloomberg L.P. 731 Lexington Ave Tel +1 212 318 2000 New York, NY 10022 bloomberg.com 15 July 2016 Ms. Sandra O'Connor Chair Alternative Reference Rates Committee Federal Reserve Bank of New York 33 Liberty Street, New York, NY 10045 [email protected] Via email Dear Ms. O'Connor: Bloomberg, L.P. ("BLP") appreciates the opportunity to provide input on the Alternative Reference Rates Committee's ("ARRC") consultation request regarding its Interim Report and Consultation ("Report").1 BLP commends your work as Chair of the ARRC and the work of the ARRC as a whole. BLP, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Professional service, which provides real time financial information to more than 325,000 subscribers globally. BLP is focused on giving our customers the financial tools they need to navigate the markets and develop and execute their financial and business strategies. BLP has a strong interest in having a benchmark that is well-governed, highly resistant to manipulation, and properly calibrated to lending risks. BLP offers the following responses to the consultation: 1) The ARRC has narrowed its focus to two potential alternative rates, the Overnight Bank Funding Rate ("OBFR") and an overnight Treasury general collateral repo rate. Do you have a preference between these two rates? If so, why? The OBFR has advantages in that it is based on a robust pool of market transactions, including both overnight fed funds and Eurodollar transactions. -

To Check out the Siriusxm TOUR Subscription Packages

TOUR 360L PACKAGE DETAILS ALL MOSTLY PACKAGES ACCESS SELECT MUSIC See Details below. $2199/Month $1699/Month $1099/Month Our widest variety of entertainment, Your favorites, with your choice of Listen to a sampling of music, customizable to you. where to enjoy them. news and talk channels. Includes ad-free music, plus Includes ad-free music, plus Includes a selection of sports, news, talk, comedy sports, news, talk, comedy ad-free music, plus news and more and more and talk Satellite Channels 5 Xtra Channels: 5 Xtra Channels: 60s/70s, 70s/80s/90s, 60s/70s, 70s/80s/90s, Hits 1 Top Hits, 80s on 8 Top 100, Hits 1 Top Hits, 80s on 8 Top 100, Classic Rock Mix Classic Rock Mix Over 300 channels, including Over 300 channels, including 100+ Xtra channels of ad-free 100+ Xtra channels of ad-free music made for any mood, music made for any mood, Streaming Channels* occasion or activity occasion or activity Thousands of hours Thousands of hours of On Demand shows, of On Demand shows, performances and interviews performances and interviews Personalized Stations Create your own ad-free music stations based on the artists Powered by Pandora* you love Exclusive Artist- The Beatles, Garth Brooks, The Beatles, Garth Brooks, Pearl Jam, Bruce Springsteen, Pearl Jam, Bruce Springsteen, Dedicated Channels Grateful Dead and more Grateful Dead and more Howard Stern 2 Dedicated Channels CONTENT Netfl ix Is A Joke Radio, Netfl ix Is A Joke Radio, 24/7 Comedy Kevin Hart’s Laugh Out Loud Kevin Hart’s Laugh Out Loud Radio and more Radio and more FOX News Channel, -

BLOOMBERG RADIO EXPANDS in BOSTON Now Available on 106.1FM, WRCA 1330 AM and 92.9/WBOS-FM HD2

, Contact: Augusta Mellon, Bloomberg Media 212-617-5152 [email protected] Heidi Raphael, Beasley Media Group 239-659-7332 [email protected] BLOOMBERG RADIO EXPANDS IN BOSTON Now Available on 106.1FM, WRCA 1330 AM and 92.9/WBOS-FM HD2 July 3rd, 2017 (Boston, MA) — Bloomberg Radio, the world's only global 24-hour business and radio station, in conjunction with Beasley Media Group, Inc., a subsidiary of Beasley Broadcast Group, Inc. (NASDAQ: BBGI), announced that starting tomorrow July 4th at 12:00pm ET, Bloomberg Radio can now be heard on Beasley Media Group's 106.1FM, WRCA 1330 AM and 92.9/W- BOS-FM HD2. Bloomberg Radio will continue to broadcast on WXKS 1200AM/94.5FM-HD2 for the next few months. "We have been eager to expand our presence in the Boston area to deliver the best of Bloomberg Radio to this important market of those who manage money, move markets and shape the future of global business and the innovations of tomorrow," said Al Mayers, Global Head of Bloomberg Radio and Television. “We’re excited to partner with a global news and business leader of Bloomberg’s magnitude,” said Beasley Media Boston Vice President and Market Manager Mary Menna. “This unique programming underscores the company’s commitment to providing our listeners with the very best content and compliments our five existing music brands in Boston.” Listeners will also be able to tune in to Bloomberg's broadcast of the 2017 Boston Pops Fireworks Spectacular, tomorrow at 8:00pm ET. Bloomberg is the exclusive media partner of this year's concert. -

Stations Monitored

Stations Monitored Call Letters Market Station Name Format WAPS-FM AKRON, OH 91.3 THE SUMMIT Triple A WHBC-FM AKRON, OH MIX 94.1 Adult Contemporary WKDD-FM AKRON, OH 98.1 WKDD Adult Contemporary WRQK-FM AKRON, OH ROCK 106.9 Mainstream Rock WONE-FM AKRON, OH 97.5 WONE THE HOME OF ROCK & ROLL Classic Rock WQMX-FM AKRON, OH FM 94.9 WQMX Country WDJQ-FM AKRON, OH Q 92 Top Forty WRVE-FM ALBANY-SCHENECTADY-TROY, NY 99.5 THE RIVER Adult Contemporary WYJB-FM ALBANY-SCHENECTADY-TROY, NY B95.5 Adult Contemporary WPYX-FM ALBANY-SCHENECTADY-TROY, NY PYX 106 Classic Rock WGNA-FM ALBANY-SCHENECTADY-TROY, NY COUNTRY 107.7 FM WGNA Country WKLI-FM ALBANY-SCHENECTADY-TROY, NY 100.9 THE CAT Country WEQX-FM ALBANY-SCHENECTADY-TROY, NY 102.7 FM EQX Alternative WAJZ-FM ALBANY-SCHENECTADY-TROY, NY JAMZ 96.3 Top Forty WFLY-FM ALBANY-SCHENECTADY-TROY, NY FLY 92.3 Top Forty WKKF-FM ALBANY-SCHENECTADY-TROY, NY KISS 102.3 Top Forty KDRF-FM ALBUQUERQUE, NM 103.3 eD FM Adult Contemporary KMGA-FM ALBUQUERQUE, NM 99.5 MAGIC FM Adult Contemporary KPEK-FM ALBUQUERQUE, NM 100.3 THE PEAK Adult Contemporary KZRR-FM ALBUQUERQUE, NM KZRR 94 ROCK Mainstream Rock KUNM-FM ALBUQUERQUE, NM COMMUNITY RADIO 89.9 College Radio KIOT-FM ALBUQUERQUE, NM COYOTE 102.5 Classic Rock KBQI-FM ALBUQUERQUE, NM BIG I 107.9 Country KRST-FM ALBUQUERQUE, NM 92.3 NASH FM Country KTEG-FM ALBUQUERQUE, NM 104.1 THE EDGE Alternative KOAZ-AM ALBUQUERQUE, NM THE OASIS Smooth Jazz KLVO-FM ALBUQUERQUE, NM 97.7 LA INVASORA Latin KDLW-FM ALBUQUERQUE, NM ZETA 106.3 Latin KKSS-FM ALBUQUERQUE, NM KISS 97.3 FM -

Bloomberg News & Multimedia

BLOOMBERG NEWS & MULTIMEDIA The AV menu is the gateway to the BLOOMBERG PROFESSIONAL® service multi-media library. Demonstrating the strength and diversity of Bloomberg’s media products, AV provides around-the-clock access to pre-recorded and live broadcasts, reports, interviews, news and teleconferences, events and training sessions. From streaming video to archived audio and video coverage for on-demand viewing. Access the multi-media main menu on Bloomberg by typing: AV Follow each command with the key to activate the function: READ Most Popular News NRR Companies and Topics in the News LIVE ‘Live’ audio/video broadcasts NI LIVE Archived global ‘LIVE’ events TNI AV TOP TOP multimedia stories MNI AV The Most Read multimedia stories NI WIN Bloomberg Exclusives! VID Bloomberg T.V AIR Listen to Bloomberg Radio T US <Equity> CNAV Use CNAV on any ticker symbol for company AV CAD <Crncy> CNAV 7/9/2005 Use CNAV & a date for historical AV coverage VID Display Bloomberg TV live. A sophisticated 24-hour business and financial news channel, ® Bloomberg Television delivers tools for power players and serious investors via 10 networks in seven languages, reaching more than 200 million homes around the world. No television or satellite dish required. AIR Listen to a live feed of BLOOMBERG WBBR 1130 Each audio visual presentation is displayed in its own window and runs separately from the traditional 2 or 4 Bloomberg panel set-up. This ensures the traditional panels remain accessible for all other Bloomberg functionality & analytics. NEW Alerts Create an audio alert for economic releases 1) ECO 2) Left mouse click on the announcement/statistic that interests you. -

Radio and Television Correspondents' Galleries

RADIO AND TELEVISION CORRESPONDENTS’ GALLERIES* SENATE RADIO AND TELEVISION GALLERY The Capitol, Room S–325, 224–6421 Director.—Michael Mastrian Deputy Director.—Jane Ruyle Senior Media Relations Coordinators: Michael Lawrence, Erin Yeatman Media Relations Coordinators: Chris Bois, Arlen Salazar HOUSE RADIO AND TELEVISION GALLERY The Capitol, Room H–321, 225–5214 Director.—Olga Ramirez Kornacki Deputy Director.—Andy Elias Assistant for Administrative Operations Manager.—Gail Davis Media Logistics Coordinators: Helen DeBarge, Anthony Kellaher, Kimberly Oates EXECUTIVE COMMITTEE OF THE RADIO AND TELEVISION CORRESPONDENTS’ GALLERIES Linda Scott, The Newshour with Jim Lehrer, Chair Peter Slen, C–SPAN, Vice Chair Linda Kenyon, SRN News, Treasurer Jeffrey Ballou, Aljazeera Jill Jackson, CBS News Dave McConnell, WTOP Radio Chad Pergram, Fox News RULES GOVERNING RADIO AND TELEVISION CORRESPONDENTS’ GALLERIES 1. Persons desiring admission to the Radio and Television Galleries of Congress shall make application to the Speaker, as required by Rule 34 of the House of Representatives, as amended, and to the Committee on Rules and Administration of the Senate, as required by Rule 33, as amended, for the regulation of the Senate wing of the Capitol. Applicants shall state in writing the names of all radio stations, television stations, systems, or news- gathering organizations by which they are employed and what other occupation or employment they may have, if any. Applicants shall further declare that they are not engaged in the prosecution of claims or the promotion of legislation pending before Congress, the Departments, or the independent agencies, and that they will not become so employed without resigning from the galleries. They shall further declare that they are not employed in any legislative or executive department or independent agency of the Government, or by any foreign govern- *Information is based on data furnished and edited by each respective gallery. -

Alternatives to XM/Sirius Services

EXHIBIT B SIRIUS-XM JOINT OPPOSITION MB Docket No. 07-57 July 24, 2007 SIRIUS POST-MERGER CHANNEL LINEUP Summary of Sirius Post-Merger Channel Line Up Proposal OFFERING # CHANNELS MONTHLY PRICE: MONTHLY PRICE: CURRENT POST-MERGER Sirius Everything** Approx. 130 $12.95 $12.95 Pick Your Own 50 (Optional: Add a Channel Starting at A La Carte I* @ $.25 Each; Add Super $12.95 Premium Packages @ $6.00 $6.99 or $5.00 Each) Pick Your Own 100 A La Carte II* $25.90*** $14.99 (Including some best of XM) Sirius Everything & Approx. 140 $25.90*** $16.99 Select XM** Family Friendly & Select XM Approx. 130 $25.90*** $14.99 Family Friendly Approx. 120 $12.95 $11.95 Mostly Music Commercial Free Music (59) Family and Kids (4) Approx. 65 $12.95 $9.99 Religion (3) Emergency (2) News, Sports & Talk Sports Channels (8) Talk and Entertainment (10) Family and Kids (4) Approx. 50 $12.95 $9.99 Religion (3) News (13) Traffic and Weather (11) Emergency (2) All content is subject to change from time to time due to contractual relationships with third-party providers and for other reasons. *Available only for subscribers using next generation receivers who select channels via the Internet. **Consumers may block adult-themed content. Consumers who elect to block adult-themed content will be provided a monthly credit. ***Currently requires two subscriptions. Sirius Everything $12.95 COMMERCIAL Heart and Soul SPORTS Playboy TRAFFIC AND FREE MUSIC (59) Soul Town CHANNELS (7) Out Q WEATHER (11) Starlite New Country Sports Action Sirius Stars New York Sirius Love Prime Country ESPN Radio Fox News Phila/Boston Movin’ Easy Roadhouse ESPNews Foxxhole Los Angeles SIRIUS Gold Outlaw Country ESPN Desportes Blue Collar Comedy Chicago/St. -

SIRIUS Canada to Broadcast 100 Channels of Satellite Radio

SIRIUS Canada to Broadcast 100 Channels of Satellite Radio * 60 Channels of Commercial-Free Rock, Pop and Classical Music * 40 Channels of News, Sports and Entertainment * 30 Games of Play-by-Play NHL Action per Week * 10 Channels of Canadian Content NEW YORK, Nov 03, 2005 /PRNewswire-FirstCall via COMTEX News Network/ -- SIRIUS Satellite Radio (Nasdaq: SIRI) today announced that its Canadian affiliate, SIRIUS Canada, will offer 100 channels of programming when it begins broadcasting next month. With a full 100 channels of the best music, news, sports, and entertainment available, SIRIUS Canada will provide the most comprehensive satellite radio service in the country. SIRIUS Canada will also be the only satellite radio provider to include 10 Canadian music and information stations in both English and French for all Canadians, including a multilingual service. (Logo: http://www.newscom.com/cgi-bin/prnh/19991118/NYTH125 ) "We are launching SIRIUS Canada with 100 channels of music, entertainment, sports and information -- the true A-List," said Mark Redmond, President and CEO, SIRIUS Canada. "With 60 channels of commercial-free music, incredible sports coverage from the NFL, NHL and the NBA, great entertainment programming from Maxim to Martha Stewart and up-to-the-minute news from CBC/Radio-Canada and the BBC, SIRIUS Canada will have it all." "Canadians will be able to experience SIRIUS Canada's programming in time for the holidays. As the fastest growing satellite radio provider in North America, SIRIUS will have the greatest depth and variety of any satellite radio company in Canada," he added. SIRIUS Canada's premium satellite radio service will be available soon at Future Shop, Best Buy, London Drugs, The Source by Circuit City, Canadian Tire and many other leading retailers throughout Canada. -

Woodstock, VA (United States) FM & AM Radio Travel DX

Woodstock, VA (United States) FM & AM Radio Travel DX Log Updated 12/29/2019 Click here to view corresponding RDS/HD Radio screenshots from this log. http://fmradiodx.wordpress.com/ Freq Calls City of License State Country Date Time Prop Miles ERP HD RDS Audio Information 88.1 W201BA Front Royal VA USA 5/24/2008 12:16 AM Tr 88.3 WOTC Edinburg VA USA 3/27/2005 1:54 AM Tr 11 1,000 88.5 WAMU Washington DC USA 5/24/2008 12:20 AM Tr 75 50,000 HD "88.5 WAMU" - public radio 88.5 WCUG Lumpkin GA USA 12/25/2015 8:21 PM Es 598 23,000 RDS "WCUG" - ccm, car radio, mention of Cougar sports 88.9 WVEP Martinsburg WV USA 3/27/2005 1:56 AM Tr 18 3,600 RDS "West Virginia Public Radio" - public radio 89.1 WGMS Hagerstown MD USA 5/25/2015 12:00 AM Tr 77 900 classical 89.3 WVTU Charlottesville VA USA 6/8/2014 4:35 PM Tr 57 195 "WVTF" - classical 89.3 WPFW Washington DC USA 5/25/2015 12:02 AM Tr 76 50,000 legal ID 89.5 WAUA Petersburg WV USA 5/24/2008 12:19 AM Tr 46 10,000 "West Virginia Public Radio" - public radio 89.9 WPER Culpeper VA USA 3/27/2005 1:57 AM Tr 42 41,000 RDS* "89.9 WPER" - ccm 90.1 WCSP-FM Washington DC USA 5/24/2008 12:21 AM Tr 75 36,000 "C-Span Radio 90" - politics 90.1 WPVA Waynesboro VA USA 6/8/2014 4:37 PM Tr 62 2,500 ccm 90.3 WXDM Culpeper VA USA 5/24/2015 11:10 PM Tr 37 14,000 RDS religious 90.5 WJYJ Fredericksburg VA USA 5/24/2008 12:21 AM Tr 89 26,000 "Virginia's Positive Hits 89-9, 90-5 PER" - ccm 90.7 WMRA Harrisonburg VA USA 3/27/2005 1:57 AM Tr 36 21,500 RDS public radio 90.9 WVPM Morgantown WV USA 3/27/2005 1:58 AM Tr 36 5,000