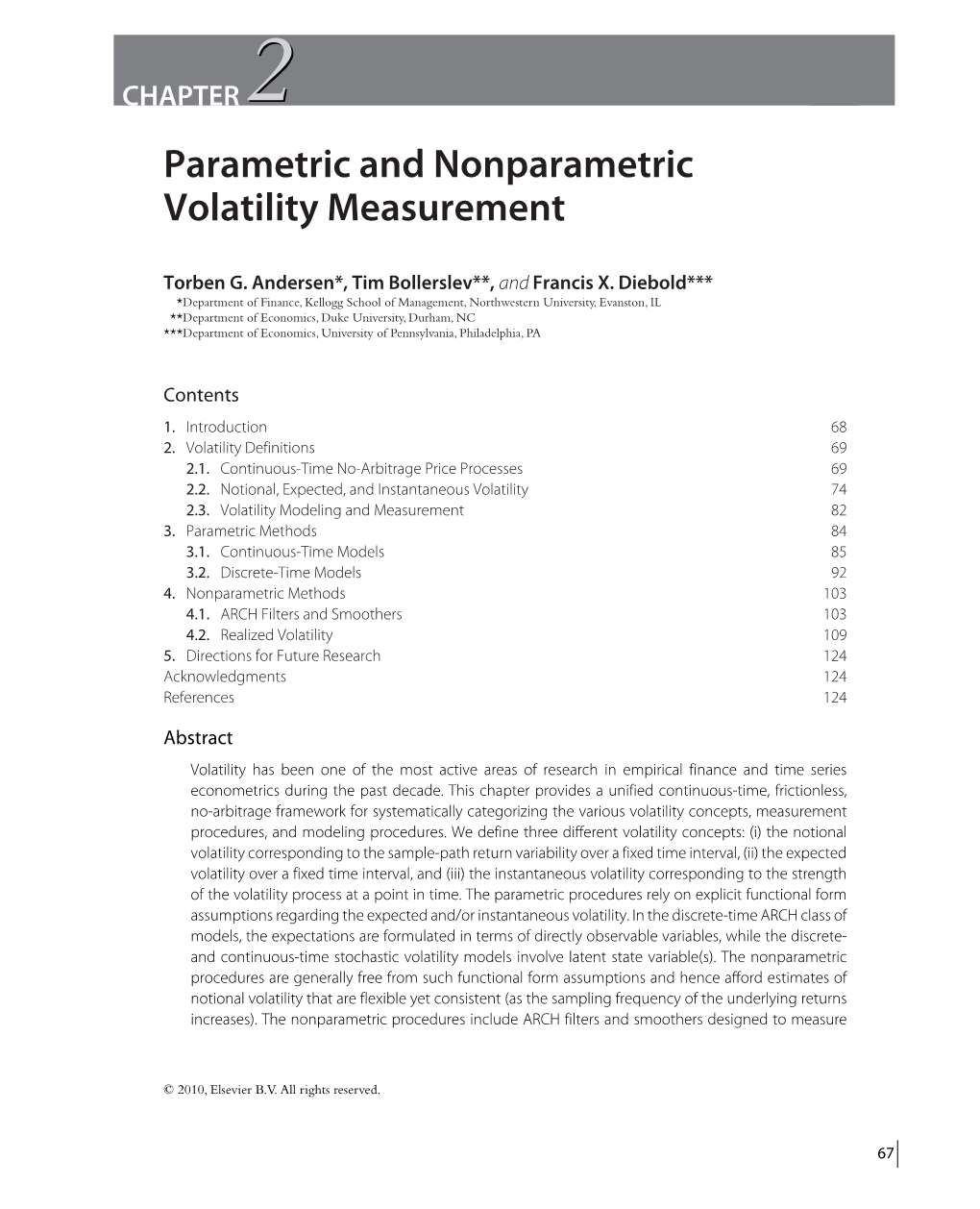

CHAPTER2 Parametric and Nonparametric Volatility Measurement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Poisson Representations of Branching Markov and Measure-Valued

The Annals of Probability 2011, Vol. 39, No. 3, 939–984 DOI: 10.1214/10-AOP574 c Institute of Mathematical Statistics, 2011 POISSON REPRESENTATIONS OF BRANCHING MARKOV AND MEASURE-VALUED BRANCHING PROCESSES By Thomas G. Kurtz1 and Eliane R. Rodrigues2 University of Wisconsin, Madison and UNAM Representations of branching Markov processes and their measure- valued limits in terms of countable systems of particles are con- structed for models with spatially varying birth and death rates. Each particle has a location and a “level,” but unlike earlier con- structions, the levels change with time. In fact, death of a particle occurs only when the level of the particle crosses a specified level r, or for the limiting models, hits infinity. For branching Markov pro- cesses, at each time t, conditioned on the state of the process, the levels are independent and uniformly distributed on [0,r]. For the limiting measure-valued process, at each time t, the joint distribu- tion of locations and levels is conditionally Poisson distributed with mean measure K(t) × Λ, where Λ denotes Lebesgue measure, and K is the desired measure-valued process. The representation simplifies or gives alternative proofs for a vari- ety of calculations and results including conditioning on extinction or nonextinction, Harris’s convergence theorem for supercritical branch- ing processes, and diffusion approximations for processes in random environments. 1. Introduction. Measure-valued processes arise naturally as infinite sys- tem limits of empirical measures of finite particle systems. A number of ap- proaches have been developed which preserve distinct particles in the limit and which give a representation of the measure-valued process as a transfor- mation of the limiting infinite particle system. -

Poisson Processes Stochastic Processes

Poisson Processes Stochastic Processes UC3M Feb. 2012 Exponential random variables A random variable T has exponential distribution with rate λ > 0 if its probability density function can been written as −λt f (t) = λe 1(0;+1)(t) We summarize the above by T ∼ exp(λ): The cumulative distribution function of a exponential random variable is −λt F (t) = P(T ≤ t) = 1 − e 1(0;+1)(t) And the tail, expectation and variance are P(T > t) = e−λt ; E[T ] = λ−1; and Var(T ) = E[T ] = λ−2 The exponential random variable has the lack of memory property P(T > t + sjT > t) = P(T > s) Exponencial races In what follows, T1;:::; Tn are independent r.v., with Ti ∼ exp(λi ). P1: min(T1;:::; Tn) ∼ exp(λ1 + ··· + λn) . P2 λ1 P(T1 < T2) = λ1 + λ2 P3: λi P(Ti = min(T1;:::; Tn)) = λ1 + ··· + λn P4: If λi = λ and Sn = T1 + ··· + Tn ∼ Γ(n; λ). That is, Sn has probability density function (λs)n−1 f (s) = λe−λs 1 (s) Sn (n − 1)! (0;+1) The Poisson Process as a renewal process Let T1; T2;::: be a sequence of i.i.d. nonnegative r.v. (interarrival times). Define the arrival times Sn = T1 + ··· + Tn if n ≥ 1 and S0 = 0: The process N(t) = maxfn : Sn ≤ tg; is called Renewal Process. If the common distribution of the times is the exponential distribution with rate λ then process is called Poisson Process of with rate λ. Lemma. N(t) ∼ Poisson(λt) and N(t + s) − N(s); t ≥ 0; is a Poisson process independent of N(s); t ≥ 0 The Poisson Process as a L´evy Process A stochastic process fX (t); t ≥ 0g is a L´evyProcess if it verifies the following properties: 1. -

POISSON PROCESSES 1.1. the Rutherford-Chadwick-Ellis

POISSON PROCESSES 1. THE LAW OF SMALL NUMBERS 1.1. The Rutherford-Chadwick-Ellis Experiment. About 90 years ago Ernest Rutherford and his collaborators at the Cavendish Laboratory in Cambridge conducted a series of pathbreaking experiments on radioactive decay. In one of these, a radioactive substance was observed in N = 2608 time intervals of 7.5 seconds each, and the number of decay particles reaching a counter during each period was recorded. The table below shows the number Nk of these time periods in which exactly k decays were observed for k = 0,1,2,...,9. Also shown is N pk where k pk = (3.87) exp 3.87 =k! {− g The parameter value 3.87 was chosen because it is the mean number of decays/period for Rutherford’s data. k Nk N pk k Nk N pk 0 57 54.4 6 273 253.8 1 203 210.5 7 139 140.3 2 383 407.4 8 45 67.9 3 525 525.5 9 27 29.2 4 532 508.4 10 16 17.1 5 408 393.5 ≥ This is typical of what happens in many situations where counts of occurences of some sort are recorded: the Poisson distribution often provides an accurate – sometimes remarkably ac- curate – fit. Why? 1.2. Poisson Approximation to the Binomial Distribution. The ubiquity of the Poisson distri- bution in nature stems in large part from its connection to the Binomial and Hypergeometric distributions. The Binomial-(N ,p) distribution is the distribution of the number of successes in N independent Bernoulli trials, each with success probability p. -

Introduction to Lévy Processes

Introduction to L´evyprocesses Graduate lecture 22 January 2004 Matthias Winkel Departmental lecturer (Institute of Actuaries and Aon lecturer in Statistics) 1. Random walks and continuous-time limits 2. Examples 3. Classification and construction of L´evy processes 4. Examples 5. Poisson point processes and simulation 1 1. Random walks and continuous-time limits 4 Definition 1 Let Yk, k ≥ 1, be i.i.d. Then n X 0 Sn = Yk, n ∈ N, k=1 is called a random walk. -4 0 8 16 Random walks have stationary and independent increments Yk = Sk − Sk−1, k ≥ 1. Stationarity means the Yk have identical distribution. Definition 2 A right-continuous process Xt, t ∈ R+, with stationary independent increments is called L´evy process. 2 Page 1 What are Sn, n ≥ 0, and Xt, t ≥ 0? Stochastic processes; mathematical objects, well-defined, with many nice properties that can be studied. If you don’t like this, think of a model for a stock price evolving with time. There are also many other applications. If you worry about negative values, think of log’s of prices. What does Definition 2 mean? Increments , = 1 , are independent and Xtk − Xtk−1 k , . , n , = 1 for all 0 = . Xtk − Xtk−1 ∼ Xtk−tk−1 k , . , n t0 < . < tn Right-continuity refers to the sample paths (realisations). 3 Can we obtain L´evyprocesses from random walks? What happens e.g. if we let the time unit tend to zero, i.e. take a more and more remote look at our random walk? If we focus at a fixed time, 1 say, and speed up the process so as to make n steps per time unit, we know what happens, the answer is given by the Central Limit Theorem: 2 Theorem 1 (Lindeberg-L´evy) If σ = V ar(Y1) < ∞, then Sn − (Sn) √E → Z ∼ N(0, σ2) in distribution, as n → ∞. -

Spatio-Temporal Cluster Detection and Local Moran Statistics of Point Processes

Old Dominion University ODU Digital Commons Mathematics & Statistics Theses & Dissertations Mathematics & Statistics Spring 2019 Spatio-Temporal Cluster Detection and Local Moran Statistics of Point Processes Jennifer L. Matthews Old Dominion University Follow this and additional works at: https://digitalcommons.odu.edu/mathstat_etds Part of the Applied Statistics Commons, and the Biostatistics Commons Recommended Citation Matthews, Jennifer L.. "Spatio-Temporal Cluster Detection and Local Moran Statistics of Point Processes" (2019). Doctor of Philosophy (PhD), Dissertation, Mathematics & Statistics, Old Dominion University, DOI: 10.25777/3mps-rk62 https://digitalcommons.odu.edu/mathstat_etds/46 This Dissertation is brought to you for free and open access by the Mathematics & Statistics at ODU Digital Commons. It has been accepted for inclusion in Mathematics & Statistics Theses & Dissertations by an authorized administrator of ODU Digital Commons. For more information, please contact [email protected]. ABSTRACT Approved for public release; distribution is unlimited SPATIO-TEMPORAL CLUSTER DETECTION AND LOCAL MORAN STATISTICS OF POINT PROCESSES Jennifer L. Matthews Commander, United States Navy Old Dominion University, 2019 Director: Dr. Norou Diawara Moran's index is a statistic that measures spatial dependence, quantifying the degree of dispersion or clustering of point processes and events in some location/area. Recognizing that a single Moran's index may not give a sufficient summary of the spatial autocorrelation measure, a local -

Laplace Transform Identities for the Volume of Stopping Sets Based on Poisson Point Processes

Laplace transform identities for the volume of stopping sets based on Poisson point processes Nicolas Privault Division of Mathematical Sciences School of Physical and Mathematical Sciences Nanyang Technological University 21 Nanyang Link Singapore 637371 November 9, 2015 Abstract We derive Laplace transform identities for the volume content of random stopping sets based on Poisson point processes. Our results are based on antic- ipating Girsanov identities for Poisson point processes under a cyclic vanishing condition for a finite difference gradient. This approach does not require classi- cal assumptions based on set-indexed martingales and the (partial) ordering of index sets. The examples treated focus on stopping sets in finite volume, and include the random missed volume of Poisson convex hulls. Key words: Poisson point processes; stopping sets; gamma-type distributions; Gir- sanov identities; anticipating stochastic calculus. Mathematics Subject Classification (2010): 60D05; 60G40; 60G57; 60G48; 60H07. 1 Introduction Gamma-type results for the area of random domains constructed from a finite number of \typical" Poisson distributed points, and more generally known as complementary theorems, have been obtained in [7], cf. e.g. Theorem 10.4.8 in [14]. 1 Stopping sets are random sets that carry over the notion of stopping time to set- indexed processes, cf. Definition 2.27 in [8], based on stochastic calculus for set- indexed martingales, cf. e.g. [6]. Gamma-type results for the probability law of the volume content of random sets have been obtained in the framework of stopping sets in [15], via Laplace transforms, using the martingale property of set-indexed stochas- tic exponentials, see [16] for the strong Markov property for point processes, cf. -

Lecture 26 : Poisson Point Processes

Lecture 26 : Poisson Point Processes STAT205 Lecturer: Jim Pitman Scribe: Ben Hough <[email protected]> In this lecture, we consider a measure space (S; S; µ), where µ is a σ-finite measure (i.e. S may be written as a disjoint union of sets of finite µ-measure). 26.1 The Poisson Point Process Definition 26.1 A Poisson Point Process (P.P.P.) with intensity µ is a collection of random variables N(A; !), A 2 S, ! 2 Ω defined on a probability space (Ω; F; P) such that: 1. N(·; !) is a counting measure on (S; S) for each ! 2 Ω. 2. N(A; ·) is Poisson with mean µ(A): − P e µ(A)(µ(A))k (N(A) = k) = k! all A 2 S. 3. If A1, A2, ... are disjoint sets then N(A1; ·), N(A2; ·), ... are independent random variables. Theorem 26.2 P.P.P.'s exist. Proof Sketch: It's not enough to quote Kolmogorov's Extension Theorem. The only convincing argument is to give an explicit constuction from sequences of independent random variables. We begin by considering the case µ(S) < 1. P µ(A) 1. Take X1, X2, ... to be i.i.d. random variables so that (Xi 2 A) = µ(S) . 2. Take N(S) to be a Poisson random variable with mean µ(S), independent of the Xi's. Assume all random varibles are defined on the same probability space (Ω; F; P). N(S) 3. Define N(A) = i=1 1(Xi2A), for all A 2 S. P 1 Now verify that this N(A; !) is a P.P.P. -

Lévy Processes (Math 7880, Spring 2011)

Topics in Probability: Lévy Processes Math 7880-1; Spring 2011 Davar Khoshnevisan 155 South 1400 East JWB 233, Department of Mathematics, Uni- versity of Utah, Salt Lake City UT 84112–0090 E-mail address: [email protected] URL: http://www.math.utah.edu/˜davar Contents Lecture 1. Introduction . 1 What is a Lévy process? . 1 Infinite divisibility . 2 The Lévy–Khintchine formula . 3 On equation (1) . 4 Problems for Lecture 1 . 7 Lecture 2. Some Examples . 9 Uniform motion . 9 Poisson processes on the real line . 9 Nonstandard Brownian motion with drift . 10 Isotropic stable laws . 10 The asymmetric Cauchy distribution on the line . 12 The Gamma distribution on the half line . 12 Adding independent Lévy processes . 13 Problems for Lecture 2 . 13 Lecture 3. Continuous-Parameter Martingales . 15 Filtrations . 15 Martingales . 16 Modifications . 18 Problems for Lecture 3 . 19 Lecture 4. Poisson Random Measures . 21 iii iv Contents A construction of Poisson random measures . 21 The Poisson process on the line . 24 Problems for Lecture 4 . 24 Lecture 5. Poisson Point Processes . 25 A construction of Poisson point processes . 25 Compound Poisson processes . 26 Problems for Lecture 5 . 28 Lecture 6. Lévy Processes . 29 The Lévy–Itô construction . 29 Problems for Lecture 6 . 32 Lecture 7. Structure Theory . 33 The Lévy–Itô decomposition . 33 The Gaussian Part . 34 The Compound Poisson Part . 35 A strong law of large numbers . 38 Symmetry and isotropy . 39 Problems for Lecture 7 . 40 Lecture 8. Subordinators . 43 Laplace exponents . 44 Stable subordinators . 45 Subordination . 50 Problems for Lecture 8 . 51 Lecture 9. -

A Course in Interacting Particle Systems

A Course in Interacting Particle Systems J.M. Swart January 14, 2020 arXiv:1703.10007v2 [math.PR] 13 Jan 2020 2 Contents 1 Introduction 7 1.1 General set-up . .7 1.2 The voter model . .9 1.3 The contact process . 11 1.4 Ising and Potts models . 14 1.5 Phase transitions . 17 1.6 Variations on the voter model . 20 1.7 Further models . 22 2 Continuous-time Markov chains 27 2.1 Poisson point sets . 27 2.2 Transition probabilities and generators . 30 2.3 Poisson construction of Markov processes . 31 2.4 Examples of Poisson representations . 33 3 The mean-field limit 35 3.1 Processes on the complete graph . 35 3.2 The mean-field limit of the Ising model . 36 3.3 Analysis of the mean-field model . 38 3.4 Functions of Markov processes . 42 3.5 The mean-field contact process . 47 3.6 The mean-field voter model . 49 3.7 Exercises . 51 4 Construction and ergodicity 53 4.1 Introduction . 53 4.2 Feller processes . 54 4.3 Poisson construction . 63 4.4 Generator construction . 72 4.5 Ergodicity . 79 4.6 Application to the Ising model . 81 4.7 Further results . 85 5 Monotonicity 89 5.1 The stochastic order . 89 5.2 The upper and lower invariant laws . 94 5.3 The contact process . 97 5.4 Other examples . 100 3 4 CONTENTS 5.5 Exercises . 101 6 Duality 105 6.1 Introduction . 105 6.2 Additive systems duality . 106 6.3 Cancellative systems duality . 113 6.4 Other dualities . -

A Point Process Model for the Dynamics of Limit Order Books

A point process model for the dynamics of limit order books Ekaterina Vinkovskaya Submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the Graduate School of Arts and Sciences COLUMBIA UNIVERSITY 2014 c 2014 Ekaterina Vinkovskaya All Rights Reserved ABSTRACT A point process model for the dynamics of limit order books Ekaterina Vinkovskaya This thesis focuses on the statistical modeling of the dynamics of limit or- der books in electronic equity markets. The statistical properties of events affecting a limit order book -market orders, limit orders and cancellations- re- veal strong evidence of clustering in time, cross-correlation across event types and dependence of the order flow on the bid-ask spread. Further investiga- tion reveals the presence of a self-exciting property - that a large number of events in a given time period tends to imply a higher probability of observing a large number of events in the following time period. We show that these properties may be adequately represented by a multi-dimensional self-exciting point process with multiple regimes that reflect changes in the bid-ask spread. We propose a tractable parametrization of the model and perform a Maxi- mum Likelihood Estimation of the model using high-frequency data from the Trades and Quotes database for US stocks. We show that the model may be used to obtain predictions of order flow and that its predictive performance beats the Poisson model as well as Moving Average and Auto Regressive time series models. Contents List of Figures iv List of Tablesx Acknowledgments xii Chapter 1 Introduction1 1.1 Background............................1 1.2 Limit order books and order types...............4 1.3 Point process models of high-frequency data......... -

PERCOLATION: DISCRETE and CONTINUUM MODELS a Thesis Submitted to Kent State University in Partial Fulfillment of the Requirement

PERCOLATION: DISCRETE AND CONTINUUM MODELS A thesis submitted to Kent State University in partial ful¯llment of the requirements for the degree of Master of Science by Wei Bai August 2014 Thesis written by Wei Bai B.S., University Science Malaysia, 2011 M.S., Kent State University, 2014 Approved by Dr. Artem Zvavitch, Advisor Dr. Andrew Tonge, Chair, Department of Mathetics Science Dr. James L.Blank, Dean, College of Arts and Sciences ii TABLE OF CONTENTS LIST OF FIGURES . v Acknowledgements . vi Abstract . vii 1 Introduction . 1 2 Basic Mathematical De¯nitions . 3 2.1 Basic Terminology . 3 2.2 Trees . 4 2.3 Lattices . 5 2.4 Bond Percolation and Site Percolation . 6 3 Discrete Percolation . 7 3.1 Percolation on Binary Trees . 7 3.2 Percolation on k-ary Trees . 10 3.3 Percolation on Square Lattice . 12 3.4 Percolation on d-dimensional Lattices . 15 4 Continuum Percolation . 17 4.1 The Boolean-Poisson Model of Euclidean Balls with ¯xed Radii . 18 4.2 Generalization to Random Radii . 24 iii 4.3 Generalization to Convex Body . 26 BIBLIOGRAPHY . 28 iv LIST OF FIGURES 1 Fluid motion of ground water is one kind of percolation phenomenon. 2 2 Two generations of labeled binary tree . 5 3 Square Integer Lattice Z2 .......................... 6 4 Bond Percolation . 6 5 Site Percolation . 6 6 Fixed points for fp(x)............................. 9 7 The percolation function of binary tree . 10 8 Dual lattice (From [16]) . 13 9 The full line is a path of the Z2 and the dotted line is corresponding path in the dual lattice. -

MCMC Simulation of Markov Point Processes

MCMC simulation of Markov point processes Jenny Andersson 28 februari 2005 1 Introduction Spatial point process are often hard to simulate directly with the exception of the Poisson process. One example of a wide class of spatial point processes is the class of Markov point processes. These are mainly used to model repulsion between points but attraction is also possible. Limitations of the use of Markov point processes is that they can not model to strong regularity or clustering. The Markov point processes, or Gibbs processes, were first used in statistical physics and later in spatial statistics. In general they have a density with respect to the Poisson process. One problem is that the density is only specified up to a normalisation constant which is usually very difficult to compute. We will consider using MCMC to simulate such processes and in particular a Metropolis–Hastings algorithm. In Section 2 spatial point processes in general will be discussed and in particular the Markov point processes. Some properties of uncountable state space Markov chains are shortly stated in Section 3. In Section 4 we will give the Metropolis–Hastings algorithm and some of its properties. Virtually all the material in this paper can be found in [1] with exception of the example at the end of Section 4. A few additions on Markov point processes are taken from [2]. 2 Markov point processes In this section we will define and give examples of Markov point processes. To make the notation clear, a brief description of spatial point processes, in particular the Poisson point process, will proceed the definition of Markov point processes.