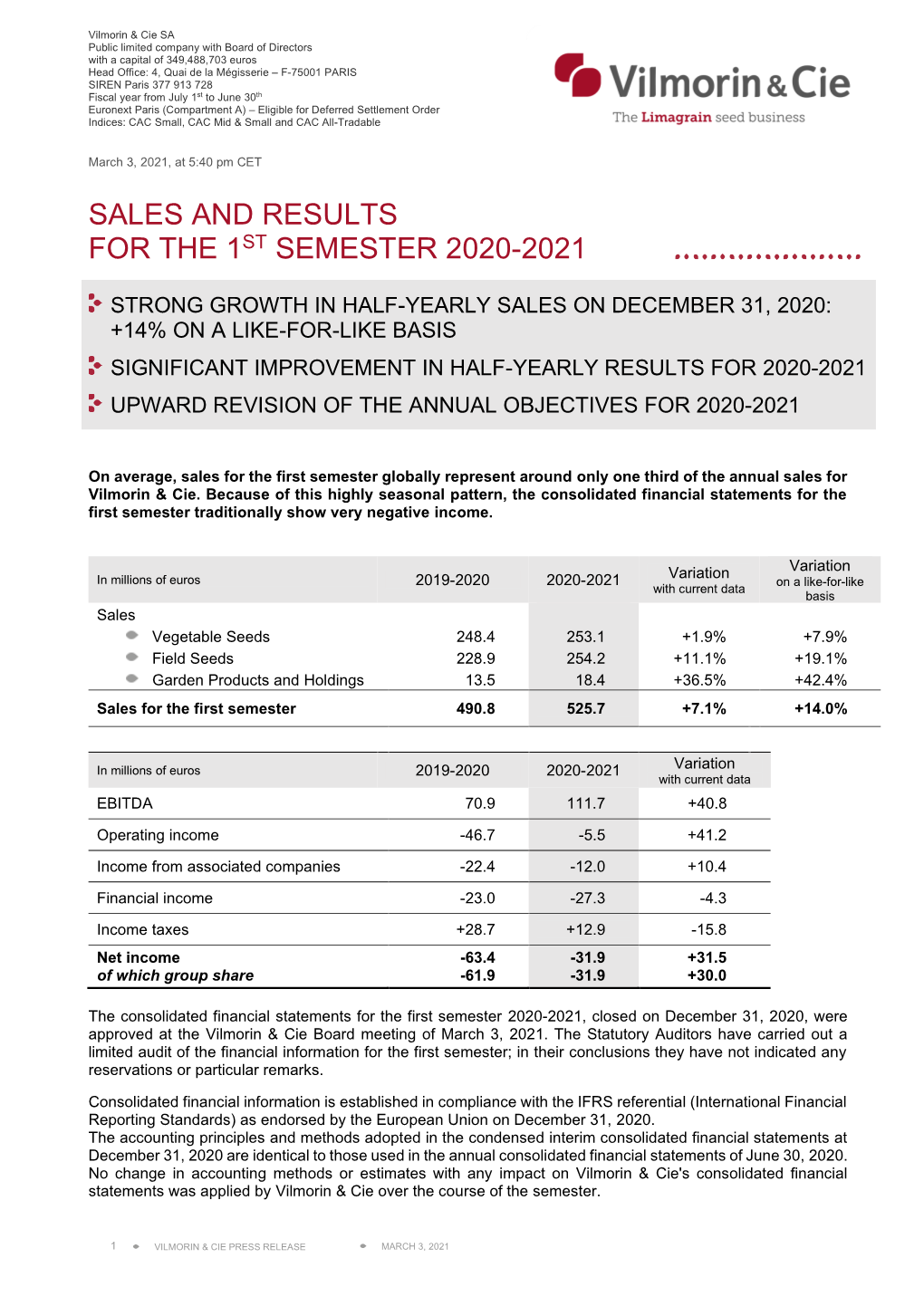

Sales and Results for the 1St Semester 2020-2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Century Botanical Networks1

Easterby-Smith, Reputation in a box April 2014 Reputation in a box. Objects, communication and trust in late eighteenth- 1 century botanical networks Sarah Easterby-Smith, University of St Andrews [email protected] Author final version. This article was published in History of Science 53(2) (June 2015), pp. 180-208. Please cite from the published version: DOI: http://hos.sagepub.com/content/53/2/180 Some time in 1782 or 1783, Philippe-Victoire Lévêque de Vilmorin (1715-1804), a French nurseryman and botanist, sent a box of kitchen-garden seeds to America. The tinplate box, with a tightly fitting lid to keep out the noxious sea air as well as insects, heat, and water, was despatched to one of Vilmorin’s correspondents, a Philadelphian plant hunter called William Young (or Yong) (1742-1785).2 This parcel of seeds is 1 I wish to express my thanks to Maxine Berg, Jorge Flores, Katherine Foxhall, Oliver Fulton, Colin Jones, Neil Safier, Penny Summerfield, Koji Yamamoto and the editor and anonymous reviewers of History of Science – who all kindly read and gave helpful feedback on earlier versions of this paper. Research was supported by a Max Weber Fellowship at the European University Institute, and a Dibner Fellowship in the History of Science at the Huntington Library. 2 For more on Philippe-Victoire Lévêque de Vilmorin, see: Augustin-François de Silvestre, “Notice Bibliographique sur P.-V.-L. de Vilmorin,” Séance publique de la Société d’Agriculture (Paris: Société d’Agriculture, 26 Brumaire an XIV [17 November 1805]); Gustav Heuzé, Les Vilmorin (1746-1899) (Paris: Libraire Agricole de la Maison Rustique, 1899). -

Euronext® Direct Listing Prospectus of the 107,127,984 Existing Shares

EURONEXT® DIRECT LISTING PROSPECTUS OF THE 107,127,984 EXISTING SHARES This Prospectus was approved by the Commission de Surveillance du Secteur Financier du Luxembourg / (Luxembourg Financial Sector Supervisory Commission) on July 17th, 2020, as the competent authority under Regulation (EU) 2017/1129. This Prospectus has been prepared by the issuer and engages the responsibility of its signatories. The Commission de Surveillance du Secteur Financier du Luxembourg / (Luxembourg Financial Sector Supervisory Commission) only approves this Prospectus as complying with the standards for completeness, comprehensibility and consistency imposed by Regulation (EU) 2017/1129. This approval should not be considered as a favorable opinion on the issuer which is the subject of this Prospectus, in accordance with the provisions of Article 6 (4) of Luxembourg Law relating to the preparation of prospectuses for securities. July 17th 2020 Advisor of the Company It should be noted that the Commission de Surveillance du Secteur Financier du Luxembourg / (Luxembourg Financial Sector Supervisory Commission) approved on July 17th, 2020 the Prospectus in French and that this document in English is a free translation provided by the Company for courtesy purposes only, so that in case of discrepancies between the original French version and this English translation, it is the original French version that shall always prevail. PERSON RESPONSIBLE Copies of this Prospectus This obligation to supplement the FOR THIS PROSPECTUS ON BEHALF are available free of charge: Prospectus with a supplement OF SOLUTIONS 30: - at the registered office to the Prospectus in the event of of the Company; significant new facts or errors or Mr. Gianbeppi FORTIS, Chairman - on the Company’s website substantial inaccuracies no longer of the Group Management Board, (www.solutions30.com) ; applies as soon as the Prospectus is the person responsible for this - as well as on the website is no longer valid. -

Vilmorin Increases Its Stake in Hazera Genetics’ Capital and Successfully Concludes a Strategic Partnership with the Indian Biotechnology Company Avesthagen

19th July 2006 Public limited company with Board of Directors with a capital of 204 225 819,25 euros. Head Office: 4, Quai de la Mégisserie – 75001 PARIS R.C.S. Paris 377 913 728 Accounts from 1st July to 30th June VILMORIN INCREASES ITS STAKE IN HAZERA GENETICS’ CAPITAL AND SUCCESSFULLY CONCLUDES A STRATEGIC PARTNERSHIP WITH THE INDIAN BIOTECHNOLOGY COMPANY AVESTHAGEN. VILMORIN STRENGTHENS ITS POSITION IN THE VEGETABLE SEED MARKET … Vilmorin has recently finalized, with the holding company Megadlei Zeraim Ltd., acquisition of the stake that this company held in Hazera Genetics (Israel). Vilmorin has consequently increased its own stake from 54.8% to 90%. Vilmorin thus confirms its long-term commitment to support Hazera’s development strategy, which will above all be based on strengthening collaboration with the other professional vegetable seed companies at Vilmorin and on a broader opening-up towards external partners. In financial terms, this operation, which is entirely self-financed, values Hazera at a sum slightly below its market capitalization. It should increase the earning per share for Vilmorin from the 2006-2007 fiscal year. Listed on the Tel Aviv stock market, Hazera had a turnover of more than 50 million euros in 2005 with net profits of 6.1 million euros. The world leader in tomato seeds, Hazera also holds an important place in the pepper, melon and watermelon markets and is present in Europe, notably in the areas surrounding the Mediterranean and on the American market. 1/2 … AND CONCLUDES A FUNDAMENTAL STEP IN ITS DEVELOPMENT IN ASIA In consultation with its leading shareholder Limagrain, Vilmorin announces the successful negotiation of a strategic alliance with the Indian biotechnology company Avestha Gengraine Technologies Pvt. -

Andrew Finch Acting Assistant Attorney General U.S. Department of Justice Antitrust Division 950 Pennsylvania Avenue, N.W.� Washington, D.C

THE ANTICOMPETITIVE IMPACT OF THE PROPOSED BAYER-MONSANTO MERGER ON VEGETABLE SEED MARKETS Andrew Finch Acting Assistant Attorney General U.S. Department of Justice Antitrust Division 950 Pennsylvania Avenue, N.W. Washington, D.C. 20530 August 2, 2017 Re: The Proposed Bayer-Monsanto Merger and Vegetable Seeds BY POST AND ELECTRONIC MAIL: [email protected] Dear Acting Assistant Attorney General Finch: The 24 undersigned advocacy organizations representing farmers, consumers and rural communities respectfully urge the U.S. Department of Justice to block the proposed merger between Bayer AG (Bayer) and the Monsanto Company (Monsanto). The proposed $66 billion Bayer-Monsanto deal would create the world’s biggest agrochemical and seed company — eclipsing the Dow Chemical-DuPont and Syngenta-ChemChina deals completed over the past two years.1 The completion of the three seed mega-mergers would make these top three seed and agribusiness firms three times larger than the rest of the top 10 global competitors combined.2 This deal has drawn most attention for the combination of agrochemicals and patented genetically modified (GM) commodity crop seeds, but the two companies are both significant players in vegetable seeds as well. Monsanto and Bayer are the first and fourth largest vegetable seed producers in the world, respectively.3 The vegetable seed industry is already highly consolidated. The proposed merger would strengthen the market power of the largest firm, disadvantage rival seed companies and increase the prices farmers pay for vegetable seeds while reducing their planting options — resulting in higher prices and reduced choices that are passed onto consumers at the supermarket. -

The Impact of the French Securities Transaction Tax on Market Liquidity and Volatility ◊◊◊

The Impact of the French Securities Transaction Tax on Market Liquidity and Volatility ◊◊◊ ∗ Gunther CAPELLE-BLANCARD ∗∗ ϒ Olena HAVRYLCHYK ϒϒ First draft: April 2013 Current draft: December 2013 Abstract : In this paper, we assess the impact of the securities transaction tax (STT) introduced in France in 2012 on market liquidity and volatility. To identify causality, we rely on the unique design of this tax that is imposed only on large French firms, all listed on Euronext. This provides two reliable control groups (smaller French firms and foreign firms also listed on Euronext) and allows using difference-in-difference methodology to isolate the impact of the tax from other economic changes occurring simultaneously. We find that the STT has reduced trading volume, but we find no effect on theoretically based measures of liquidity, such as price impact, and no significant effect on volatility. The results are robust if we rely on different control groups (German stocks), analyze dynamic effects or construct a control group by propensity score matching. Keywords : Financial transaction tax, Securities transaction tax, Tobin tax, Volatility, Liquidity, Euronext. JEL Classification : G21, H25. L'impact de la taxation des transactions financières sur la liquidité et la volatilité des actions françaises Résumé : Dans cet article, nous évaluons l’impact de la taxe sur les transactions financières (TTF), introduite en France en 2012, sur la liquidité et la volatilité des actions. Cette taxe se prête particulièrement bien à une étude d’impact dans la mesure où seules les grandes entreprises qui ont leur siège social en France sont taxées, permettant ainsi d’identifier deux groupes de contrôle : les autres entreprises françaises et les entreprises étrangères, toutes cotées sur Euronext. -

Vegetable Cultivar Descriptions for North America List 26 2002 Edited by Todd C

Vegetable Cultivar Descriptions for North America List 26 2002 Edited by Todd C. Wehner Department of Horticultural Science, North Carolina State University, Raleigh, NC 27695-7609 Crop listings: amaranth—vegetable (tampala), asparagus, bean—dry, bean—green, bean—Lima, beet, broccoli, Brussels sprouts, cabbage, cabbage—Chinese, carrot, cauliflower, celery, collard, cucumber, eggplant, endive, endive—Belgian (Witloof chicory), escarole, gourd—benincasa, gourd—cucurbita, gourd—lagenaria, gourd—luffa sponge, gourd—momordica, herbs—parsley, kale, leek, lettuce, melon, mustard, okra, onion, pea—green, pepper, potato, pumpkin, radish, radish—daikon, rhubarb, southernpea (cowpea), spinach, squash, sweetcorn, sweetpotato, tomato, turnip, watermelon This list of the North American vegetable cultivars was developed 15. Barnes, W.C. 1969. New vegetable varieties list XVI. Hort- using the database of cultivars registered with the American Seed Science 4:65–69. Trade Association, as well as published descriptions from scientific 16. Barnes, W.C. 1970. New vegetable varieties list XVII. Hort- journals and seed catalogs. Assistant editors responsible for each crop Science 5:146–149. were instructed to obtain as much information as possible about the 17. Barnes, W.C. 1971. New vegetable varieties list XVIII. Hort- cultivars available to North American growers. The crop species are Science 6:124–127. listed alphabetically, with cultivars listed alphabetically within each of 18. Lower, R.L. 1973. New vegetable varieties list XIX. Hort- those. Science 8:465–470. The information about each cultivar is presented in a standard 19. Lower, R.L. 1975. New vegetable varieties list XX. Hort- format that includes the cultivar name, experimental designation, Science 10:467–470. breeder, vendor, parentage, plant characteristics, disease and other 20. -

Investors Presentation

INVESTORS PRESENTATION NOVEMBER 2020 1 INVESTORS PRESENTATION NOVEMBER 2020 DISCLAIMER Some of the statements contained in this document may be forward- looking statements concerning Vilmorin & Cie SA's financial position, results, businesses, strategy or projects. Vilmorin & Cie SA considers that such statements are based on reasonable assumptions but cannot and does not give any assurance that the Group's future performance will be consistent with those statements. Actual results could differ from those currently anticipated in such statements due to a certain number of inherent risks and uncertainties, most of which are beyond Vilmorin & Cie SA's control, such as those described in the documents filed or to be filed by Vilmorin & Cie SA with the French securities regulator (Autorité des marchés financiers) and made available for downloading from the Company's website: www.vilmorincie.com 2 INVESTORS PRESENTATION NOVEMBER 2020 AGENDA VILMORIN & CIE AT A GLANCE s. 04 VILMORIN & CIE GROWTH STRATEGY s. 11 CSR PROGRAM s. 22 SALES FOR THE 1ST QUARTER 2020-2021 s. 26 OUTLOOK FOR 2020-2021 s. 34 NEWS s. 38 VILMORIN & CIE ON THE STOCK EXCHANGE s. 42 SCHEDULE AND CONTACTS s. 45 GLOSSARY s. 48 APPENDICES s. 51 3 INVESTORS PRESENTATION NOVEMBER 2020 VILMORIN & CIE AT A GLANCE 4 4 INVESTORS PRESENTATION NOVEMBER 2020 VILMORIN & CIE AT A GLANCE VILMORIN & CIE, 4TH LARGEST SEEDS COMPANY IN THE WORLD Fourth largest seeds company in the world with leading positions on its core activities N°1 N°6 worldwide worldwide for vegetable seeds for field seeds -

Sales on March 31, 2019

Vilmorin & Cie SA Public limited company with Board of Directors with a capital of 349 488 703 euros Head Office: 4, Quai de la Mégisserie – F-75001 PARIS SIREN Paris 377 913 728 Fiscal year from July 1st to June 30th Euronext Paris (Compartment A) – Eligible for Deferred Settlement Order Indices: CAC Small, CAC Mid & Small and CAC All-Tradable April 25, 2019, at 7.15 am CET SALES ON MARCH 31, 2019 SIGNIFICANT BUSINESS GROWTH AT THE END OF THE THIRD QUARTER 2018-2019: +3.5% ON A LIKE-FOR-LIKE BASIS CONFIRMATION OF OBJECTIVES FOR 2018-2019 Closing on March 31, sales at the end of the third quarter for fiscal year 2018-2019, corresponding to revenue from ordinary activities, came to 1,002 million euros, up by 1.4% with current data and 3.5% on a like-for-like basis compared with March 31 of the previous fiscal year. Variation Variation In millions of euros 2017-2018 2018-2019 with current data on a like-for-like basis Sales at the end of the third 988.3 1,001.9 +1.4% +3.5% quarter Vegetable Seeds 439.5 437.9 -0.4% +1.9% Field Seeds 512.2 526.4 +2.8% +4.9% Garden Products and Holdings 36.6 37.5 +2.6% +4.2% Consolidated financial information is established in compliance with the IFRS reference (International Financial Reporting Standards), as adopted by the European Union on March 31, 2019. It takes into account the application of IAS 29 with regard to the treatment of hyperinflation in Argentina. -

Annual Report

ANNUAL REPORT 2015-2016 WorldReginfo - a06bd56e-b534-4ea6-bce2-daafb5b9d55e CONTENTS 1 5 PRESENTATION FINANCIAL OF VILMORIN & CIE INFORMATION 1.1. Key figures 2 5.1. Consolidated Financial Statements 128 1.2. History and Evolution of the Company 9 1.3. The seed market 12 1.4. Activities 19 6 1.5. Development model 29 VILMORIN & CIE 1.6. Strategy and perspectives 32 AND ITS SHAREHOLDERS 1.7. Risk factors 45 6.1. Information on the Company 198 6.2. Capital stock and shareholders 201 2 6.3. Vilmorin & Cie’s shares 205 CORPORATE GOVERNANCE 6.4. Relations with shareholders 209 2.1. The Board of Directors 56 2.2. Specialized Committees 68 7 2.3. Management bodies 70 ANNUAL GENERAL MEETING 2.4. Agreements with Corporate Officers OF DECEMBER 9, 2016 and interests of the Management Bodies 72 2.5. Summary table of the recommendations 7.1. Meeting agenda 214 of the AFEP-MEDEF Code that are not adopted 77 7.2. Resolutions of an ordinary nature 216 2.6. Chairman’s Report on the functioning 7.3. Resolutions of an extraordinary nature 219 of the Board of Directors and internal control 78 7.4. Resolution of an ordinary nature 224 3 8 MANAGEMENT REPORT FURTHER INFORMATION Report of the Board of Directors to the Joint Annual Meeting (Ordinary and Extraordinary) of December 9 , 2016 84 8.1. Statutory Auditors 226 8.2. Publicly available documents 227 8.3. Incorporation with reference to historical financial information 227 4 8.4. Glossary 228 SOCIAL, ENVIRONMENTAL AND SOCIETAL INFORMATION 4.1. -

“Syngenta Ag” Company Report

MASTERS IN FINANCE “SYNGENTA AG” COMPANY REPORT “SEEDS AND CROP PROTECTION” 2 JANUARY 2018 STUDENT: “TIAGO GOMES ROLIM” [email protected] Title Recommendation: SELL Vs Previous Recommendation Chinese fever on Agro technology Price Target FY18: 77.84 $ • ChemChina takeover offer implied a premium Vs Previous Price Target of 105 CHF per share, overvaluing the stock Price (as of 2-Jan-18) 92.84 $ Bloomberg: SIT:US • Yet, Syngenta operates in a sector that is growing and it will continue to do so due to: 52-week range (€) 78.20$-92.96$ agriculture output growth; better performance Market Cap (€m) 42 974.800 of hybrid and Genetically Modified seeds Outstanding Shares (m) 462.891 compared to conventional ones; and Source: Bloomberg increasing number of crop protection applications for each crop • The growth of agriculture output will be driven by: increasing food consumption per capita; energy demand increase; and population growth • Besides the forecasted growth in sales, Syngenta, also will achieve margins improvements (Gross Profit, EBIT, Net Income and NWC to Sales) • Syngenta will continue to expense 10% of Source: Bloomberg Sales in R&D cementing her position in (Values in € millions) 2015 2016E 2017F patented active substances development that Revenues 13 411 12 790 12 936 give her a competitive advantage EBIT 2 021 1 806 2 011 Net Profit 1 344 1 181 1 405 • Modest market share gains are forecasted in EPS 2,89 2,55 3,04 both sectors in EMEA, LatAm, North America P/E 26,18 30,65 R&D expenses 1 362 1 299 1 314 and APAC, except for Crop Protection in North Investment in NWC 832 106 -770 America, in the period 2018-2022 CAPEX 214 266 369 FCF 798 1 288 1 937 ROE 16% 14,8% 18,9% RONIC -19,2% 14,4% 10,1% Source: Student estimates THIS REPORT WAS PREPARED EXCLUSIVELY FOR ACADEMIC PURPOSES BY [TIAGO GOMES ROLIM], A MASTERS IN FINANCE STUDENT OF THE NOVA SCHOOL OF BUSINESS AND ECONOMICS. -

Annual Report

Report To the Commission on the application of accepted market practices 13 December 2019 | ESMA70-156-1823 Table of Contents 1 Executive Summary ....................................................................................................... 2 2 Background .................................................................................................................... 3 3 Information on the legal situation of AMPs established under MAD (and applied as of July 2016) and AMPs established under MAR .............................................................................. 5 3.1 CNMV ..................................................................................................................... 5 3.2 CONSOB ................................................................................................................ 6 3.3 AMF ........................................................................................................................ 7 4 Application of the established AMPs............................................................................... 7 4.1 AMP established by the CNMV under MAR ............................................................ 8 4.2 AMP established by the CMVM under MAR ............................................................ 8 4.3 AMP established by CONSOB under MAD ............................................................. 8 4.3.1 CONSOB AMP No 1 ........................................................................................ 9 4.3.2 CONSOB AMP No 2 ....................................................................................... -

Annual Report Xtrackers

Xtrackers** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Annual Report and Audited Financial Statements For the year ended 31 December 2020 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers** accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. ** This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Directors’ Report 6 Independent Auditor’s Report 15 Information for Hong Kong Residents 19 Statistics 20 Statement of Net Assets as at 31 December 2020 41 Statement of Operations and Changes in Net Assets for the year ended 31 December 2020 61 Statement of Changes in Shares Issued for the year ended 31 December 2020 82 Statement of Investments as at 31 December 2020 85 Xtrackers MSCI WORLD SWAP UCITS ETF* 85 Xtrackers MSCI EUROPE UCITS ETF 90 Xtrackers MSCI JAPAN UCITS ETF 101 Xtrackers MSCI USA SWAP UCITS ETF* 108 Xtrackers EURO STOXX 50 UCITS ETF 112 Xtrackers DAX UCITS ETF 114 Xtrackers FTSE MIB UCITS ETF 115 Xtrackers SWITZERLAND UCITS ETF 117 Xtrackers FTSE 100 INCOME UCITS ETF 118 Xtrackers FTSE 250 UCITS ETF 121 Xtrackers MSCI UK ESG UCITS ETF(1) 127 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 131 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 135 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 138 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 140 Xtrackers MSCI TAIWAN UCITS ETF 142 Xtrackers