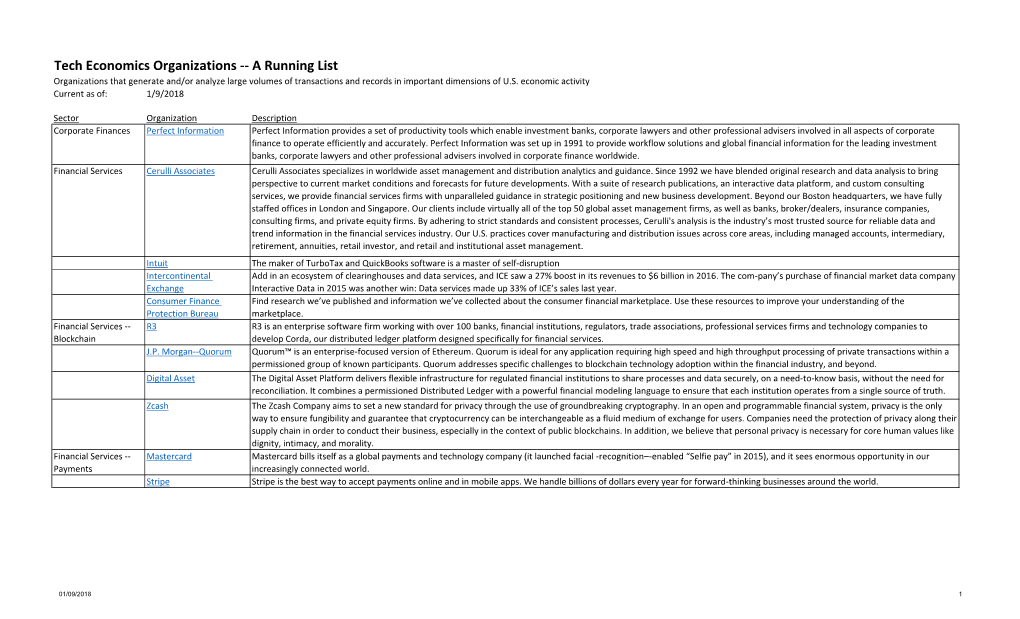

Tech Economics Organizations -- a Running List Organizations That Generate And/Or Analyze Large Volumes of Transactions and Records in Important Dimensions of U.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Diploma Thesis

UNIVERSITY OF THESSALY SCHOOL OF ENGINEERING DEPARTMENT OF ELECTRICAL AND COMPUTER ENGINEERING Software Product Management: From inception to delivery with innovation frameworks Diploma Thesis Panagiotis Nikitakis Supervisor: Aspasia Daskalopoulou Volos 2020 UNIVERSITY OF THESSALY SCHOOL OF ENGINEERING DEPARTMENT OF ELECTRICAL AND COMPUTER ENGINEERING Software Product Management: From inception to delivery with innovation frameworks Diploma Thesis Panagiotis Nikitakis Supervisor: Aspasia Daskalopoulou Volos 2020 iii ΠΑΝΕΠΙΣΤΗΜΙΟ ΘΕΣΣΑΛΙΑΣ ΠΟΛΥΤΕΧΝΙΚΗ ΣΧΟΛΗ ΤΜΗΜΑ ΗΛΕΚΤΡΟΛΟΓΩΝ ΜΗΧΑΝΙΚΩΝ ΚΑΙ ΜΗΧΑΝΙΚΩΝ ΥΠΟΛΟΓΙΣΤΩΝ Διαχείριση προϊόντων λογισμικού: Από την ιδέα εώς την παράδοση σε πλαίσια καινοτομίας Διπλωματική Εργασία Παναγιώτης Νικητάκης Επιβλέπουσα: Ασπασία Δασκαλοπούλου Βόλος 2020 v Approved by the Examination Committee: Supervisor Aspasia Daskalopoulou Assistant Professor, Department of Electrical and Computer En- gineering, University of Thessaly Member Dimitrios Katsaros Associate Professor, Department of Electrical and Computer En- gineering, University of Thessaly Member Michael Vassilakopoulos Associate Professor, Department of Electrical and Computer En- gineering, University of Thessaly Date of approval: 13-10-2020 vii DISCLAIMER ON ACADEMIC ETHICS AND INTELLECTUAL PROPERTY RIGHTS «Being fully aware of the implications of copyright laws, I expressly state that this diploma thesis, as well as the electronic files and source codes developed or modified in the course of this thesis, are solely the product of my personal work and do not infringe any rights of intellectual property, personality and personal data of third parties, do not contain work / contributions of third parties for which the permission of the authors / beneficiaries is re- quired and are not a product of partial or complete plagiarism, while the sources used are limited to the bibliographic references only and meet the rules of scientific citing. -

Download/Sentibank.Html

Artificial Intelligence Review (2021) 54:4873–4965 https://doi.org/10.1007/s10462-021-10030-2(0123456789().,-volV)(0123456789().,-volV) Over a decade of social opinion mining: a systematic review Keith Cortis1 • Brian Davis1 Published online: 25 June 2021 Ó The Author(s) 2021 Abstract Social media popularity and importance is on the increase due to people using it for various types of social interaction across multiple channels. This systematic review focuses on the evolving research area of Social Opinion Mining, tasked with the identification of multiple opinion dimensions, such as subjectivity, sentiment polarity, emotion, affect, sarcasm and irony, from user-generated content represented across multiple social media platforms and in various media formats, like text, image, video and audio. Through Social Opinion Mining, natural language can be understood in terms of the different opinion dimensions, as expressed by humans. This contributes towards the evolution of Artificial Intelligence which in turn helps the advancement of several real-world use cases, such as customer service and decision making. A thorough systematic review was carried out on Social Opinion Mining research which totals 485 published studies and spans a period of twelve years between 2007 and 2018. The in-depth analysis focuses on the social media platforms, techniques, social datasets, language, modality, tools and technologies, and other aspects derived. Social Opinion Mining can be utilised in many application areas, ranging from marketing, advertising and sales for product/service management, and in multiple domains and industries, such as politics, technology, finance, healthcare, sports and government. The latest developments in Social Opinion Mining beyond 2018 are also presented together with future research directions, with the aim of leaving a wider academic and societal impact in several real-world applications. -

Quantifying the Evolution of Success with Network and Data Science Tools

Quantifying the Evolution of Success with Network and Data Science Tools Mil´anJanosov Department of Network and Data Science Central European University Principal supervisor: Prof. Federico Battiston External supervisor: Prof. Roberta Sinatra Associate supervisor: Prof. Gerardo Iniguez˜ A Dissertation Submitted in fulfillment of the requirements for the Degree of Doctor of Philosophy in Network Science CEU eTD Collection 2020 Milan´ Janosov: Quantifying the Evolution of Success with Network and Data Science CEU eTD Collection Tools, c 2020 All rights reserved. I Milan´ Janosov certify that I am the author of the work Quantifying the Evo- lution of Success with Network and Data Science Tools. I certify that this is solely my original work, other than where I have clearly indicated, in this declaration and in the thesis, the contributions of others. The thesis contains no materials accepted for any other degree in any other institution. The copyright of this work rests with its author. Quotation from it is permitted, provided that full acknowledgment is made. This work may not be reproduced without my prior written consent. Statement of inclusion of joint work I confirm that Chapter 3 is based on a paper, titled ”Success and luck in creative careers”, accepted for publication by the time of my thesis defense in EPJ Data Science, which was written in collaboration with Federico Battiston and Roberta Sinatra. On the one hand, the idea of using her previously published impact decomposition method to quantify the effect was conceived by Roberta Sinatra, where I relied on the methods developed by her. On the other hand, I proposed the idea of relating the temporal network properties to the evolution. -

Development of an Authoring Tool Application for Project CHIC

FACULDADE DE ENGENHARIA DA UNIVERSIDADE DO PORTO Development of an authoring tool application for project CHIC Rui Emanuel Cabral de Almeida Quaresma Mestrado Integrado em Engenharia Informática e Computação Supervisor: Pedro Cardoso Co-Supervisor: António Coelho July 28, 2020 Development of an authoring tool application for project CHIC Rui Emanuel Cabral de Almeida Quaresma Mestrado Integrado em Engenharia Informática e Computação July 28, 2020 Abstract Given that, nowadays, tourism is one of the leading industries worldwide, tourism organizations must innovate when creating new experiences to attract more tourists. One way to make these experiences more ludic and engaging is to apply technology and location-based services (LBS), which will spark interest in tourists and make them interact more with the touristic sites. To create such experiences, we developed this dissertation as part of the project CHIC (Co- operative Holistic View on Internet and Content) that aims to study and develop a digital system based on location to provide its users with ludic experiences focused on the exploration of touris- tic points of interest. This system is composed of a tourists’ application (that will guide the user through these experiences) and an authoring tool application (where these experiences will be cre- ated and edited). The experiences consist of paths that link points of interest for the user to visit. The authoring tool displays a map to allow the user to create points of interest and build multiple touristic experience paths. Once the experience is created, it is stored at the server, and once it is published, it becomes available to be fetched by the tourists’ application. -

Transit Zones, Locales, and Locations: How Digital Annotations Affect Communication in Public Places

Media and Communication (ISSN: 2183–2439) 2021, Volume 9, Issue 3, Pages 39–49 https://doi.org/10.17645/mac.v9i3.3934 Article Transit Zones, Locales, and Locations: How Digital Annotations Affect Communication in Public Places Eric Lettkemann * and Ingo Schulz‐Schaeffer Institute of Sociology, Technische Universität Berlin, Germany; E‐Mails: [email protected] (E.L.), schulz‐schaeffer@tu‐berlin.de (I.S.‐S.) * Corresponding author Submitted: 15 December 2020 | Accepted: 16 April 2021 | Published: 23 July 2021 Abstract The article presents an analytical concept, the Constitution of Accessibility through Meaning of Public Places (CAMPP) model. The CAMPP model distinguishes different manifestations of public places according to how they facilitate and restrict communication between urbanites. It describes public places along two analytical dimensions: their degree of per‐ ceived accessibility and the elaboration of knowledge necessary to participate in place‐related activities. Three patterns of communicative interaction result from these dimensions: civil inattention, small talk, and sociability. We employ the CAMPP model as an analytical tool to investigate how digital annotations affect communicative patterns and perceptions of accessibility of public places. Based on empirical observations and interviews with users of smartphone apps that pro‐ vide digital annotations, such as Foursquare City Guide, we observe that digital annotations tend to reflect and reinforce existing patterns of communication and rarely evoke changes in the perceived accessibility of public places. Keywords annotation; civil inattention; Foursquare; locative media; perceived accessibility; public places; small talk; sociability; social worlds; Tabelog Issue This article is part of the issue “Spaces, Places, and Geographies of Public Spheres” edited by Annie Waldherr (University of Vienna, Austria), Ulrike Klinger (European University Viadrina, Germany) and Barbara Pfetsch (Freie Universität Berlin, Germany / Weizenbaum‐Institute for the Networked Society, Germany). -

Casual Dining Restaurant Loyalty Index

Casual Dining Restaurant Loyalty Index 2018 State of the Casual Dining Industry Casual dining is in a transitional period. The challenges that have tested retailers like Kmart and Macy’s, such as over-retailing and change in customer spending habits—are now affecting the dining industry, contributing to sales and closures throughout the past two years. Consumers also have more alternatives to dining out than ever before. Innovative technology has inspired a proliferation of food delivery services like Blue Apron, and on-demand delivery like GrubHub or UberEATS. Synchronously, up-and-coming fast casual chains like Shake Shack are on the rise, many of which are known for their cult following and dedication to more sustainable food sources. One of the above nuances alone can change the market entirely—together, they present an multifaceted challenge. By analyzing foot traffic patterns from a nationally representative group of U.S. consumers who make up our always-on foot traffic panel, Foursquare is uniquely equipped to help casual dining chains succeed by understanding dining trends and shifts in consumption. Furthermore, because Foursquare has a deep understanding of where people go in the real world, we can measure loyalty based on customer behavior rather than perceptions, providing an accurate measure for business health and true loyalty. In 2017, we debuted our first-ever Quick Service Restaurant (QSR) Loyalty Index, ranking the top QSRs in the U.S. and their customers’ loyalty. Now, we’re excited to introduce our first annual Casual Dining Restaurants (CDR) Loyalty Index using the same methodology. In this report, you’ll find.. -

Foams of Togetherness in the Digital Age: Sloterdijk, Software Sorting and Foursquare

Geogr. Helv., 75, 259–269, 2020 https://doi.org/10.5194/gh-75-259-2020 © Author(s) 2020. This work is distributed under the Creative Commons Attribution 4.0 License. supported by Foams of togetherness in the digital age: Sloterdijk, software sorting and Foursquare Sarah Widmer and Francisco Klauser Institute of Geography, University of Neuchâtel, Neuchâtel, 2000, Switzerland Correspondence: Sarah Widmer ([email protected]) Received: 13 February 2020 – Revised: 1 June 2020 – Accepted: 10 July 2020 – Published: 4 September 2020 Abstract. The article brings together Peter Sloterdijk’s theory of spheres and literatures on the socio-spatial implications of the functioning of software. By examining the growing personalization of search results for recreational places on spatial media like Foursquare, we make the case for Sloterdijk’s conceptualization of “foam” offering an interesting contribution to the analysis and critique of contemporary algorithmic life, in particular with regard to the liquidity and fragility of the forms of togetherness in “co-isolation” created by such applications. In emphasizing the impermanence and ambiguities of these fleeting mediations, the article also points to the politics of these algorithmic foams, whose logics of categorization and socio-spatial sorting become increasingly difficult to understand, politically address or challenge. 1 Introduction on Google Maps Explore in 2018, calculating “how likely you are to enjoy a place based on your own preferences” Most social networking applications now also incorporate (Blog Google, 2018); by the introduction of “recommenda- spatial aspects (Wilken and Goggin, 2015). Examples range tions tailored to you . with the help of machine learning” from the georeferencing of posts on Twitter or Facebook to on Yelp (Blog Yelp, 2018); or by the long-established per- location-based social networks (Swarm, Snap Map) or dat- sonalization of place recommendations on Foursquare, these ing apps (Tinder). -

Smart City Initiatives from ITAC Brainstorming 11/28/18 Executive

Smart City initiatives from ITAC brainstorming 11/28/18 Executive Summary It is no news that the pace of technological change is accelerating across all areas creating both social adoption challenges and opportunities for new and improved individual and community benefits. The Smart City concept is a trend that looks at how communities integrate information and communication technology (ICT) and various physical devices connected to the network (the Internet of Things or IoT) to optimize the efficiency of city operations and services and engage with citizens. The Innovation and Technology Advisory Committee of Foster City has been recently looking into how Foster City can adopt and prioritize Smart City initiatives to accelerate progress towards achieving the Strategic Goals set by the Foster City Council for the city. This report describes the work that has been performed by the ITAC team, the analysis and approached that was followed and recommendations to the Foster City Council for next steps in the Smart City Initiative. The ITAC team, working with IT staff from the city, looked at what technology projects other cities and communities worldwide have been launching in support of their strategic priorities. Using the Strategic Goal framework set by the FC City Council, the team brainstormed on opportunities specific to Foster City that had an impact on one or more strategic goals, turning these opportunities into potential projects and initiatives. Each of these projects was then measured in terms of three key factors: Benefits to the community, Time to Implementation and Investment Cost. These measurements are rough estimates that would require more detailed analysis but they provided a framework for comparing and prioritizing the projects. -

Foursquare's Data Deep Dive to Reclaim 'Wasted' Ad Dollars

TM C M Y OMNICOMMERCECM TRACKER MY CY CMY K powered by AUGUST 2016 A MONTHLY RECAP OF THE DEVELOPMENTS WITHIN THE OMNICHANNEL ECOSYSTEM Foursquare’s Data Deep Dive To Reclaim ‘Wasted’ Ad Dollars Walmart launches Walmart Pay app in more than 4,600 stores nationwide 71 percent of consumers use either print, digital media or loyalty cards to save money Study finds 31 percent of online buyers have used in-store pickup Nearly 5% of total U.S. transactions in Starbucks locations are made using company’s Mobile Order & Pay service Acknowledgment Acknowledgment Sponsorship for the PYMNTS Omnicommerce Tracker was provided by Vantiv. Vantiv has no editorial influence over the Tracker’s content. In addition, the methodology for Tracker supplier rankings was developed exclusively by the PYMNTS.com research and analytics team. The methodology, scoring and rankings are done exclusively by this team and without input or influence from the sponsoring organization. © 2016 PYMNTS.com all rights reserved 2 Omnicommerce TrackerTM What’s Inside While a UPS study shows avid online shoppers in the U.S. make the majority of their purchases via the web, a separate study reveals in-store buying remains one of the top ways U.K. and U.S. consumers get what they need. Understanding the need to provide quality customer service in several different ways, many merchants are striving toward improving their overall omnicommerce approach to business. From launching new mobile apps to opening warehouses, large retailers recently took significant steps forward in the omnichannel space to try to meet the high expectations of today’s consumers. -

Competitive Analysis - Hihat

Competitive Analysis - Hihat Introduction: Finding restaurants and other dining locations is market that is dominated with products that help the population find and review these places. A majority of people are looking for tasty food and memorable experiences when finding that next spot to eat. The possibilities seem limitless, unless you are someone who has food allergies and/or have specific dietary requirements. (As I write this is just so happens to Food Allergy Awareness Week). Over 15 million Americans have food allergies, with 1 out of every 3 kids 1 have a food allergy . Anyone can be allergic to any food, but allergies from food are from: Milk/Dairy, Eggs, Peanuts, Tree nuts, Soy, Wheat, Fish, and Shellfish. These are extremely common foods that are used in day to day life. This can make it difficult to go out and find locations that are accommodating to those who have food allergies, and most importantly are aware of the dangers of cross-contamination. Summary: The goal is to design a mobile app that helps those who have food allergies find restaurants, cafes, and other eating locations that will cater or accommodate to their specific diets and needs. Users will be able to find locations that they can confidently go and eat at these locations with the validation from community reviews, being able to see the menu, and viewing other specific details about restaurants on one platform. Not only will this application focus on restaurants that accomodate for food allergies, but other dietary preferences such as vegan, vegetarian, paleo, etc. Primary Audience The goal of this application is to give people who have food allergies a platform to search for places that can give them the best experience. -

IN the UNITED STATES DISTRICT COURT for the DISTRICT of DELAWARE HYPER SEARCH LLC, Plaintiff, Civil Action

Case 1:18-cv-01274-UNA Document 1 Filed 08/20/18 Page 1 of 22 PageID #: 1 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE HYPER SEARCH LLC, Plaintiff, Civil Action No. _______________ vs. PATENT CASE JURY TRIAL DEMANDED FOURSQUARE LABS, INC., Defendant. ORIGINAL COMPLAINT FOR PATENT INFRINGEMENT AGAINST FOURSQUARE LABS, INC. Plaintiff Hyper Search, LLC (“Hyper Search” or “Plaintiff”), by and through its attorneys, hereby alleges for its Complaint against Defendant Foursquare Labs, Inc. (“Foursquare” or “Defendant”) on personal knowledge as to its own activities and on information and belief as to all other matters, as follows: NATURE OF THE ACTION 1. This is an action for patent infringement arising under the Patent Laws of the United States, 35 U.S.C. § 1 et seq. THE PARTIES 2. Plaintiff Hyper Search LLC is a Texas limited liability company with its principal place of business at 5068 W. Plano Parkway, Suite 300, Plano, Texas 75093. 3. Defendant Foursquare Labs, Inc. is a Delaware corporation with a place of business at 568 Broadway, 10th Floor, New York, New York 10012, and can be served through its registered agent, Business Filings Incorporated, 108 West 13th Street, Wilmington, Delaware 19801. -1- Case 1:18-cv-01274-UNA Document 1 Filed 08/20/18 Page 2 of 22 PageID #: 2 JURISDICTION AND VENUE 4. Foursquare is subject to this Court’s specific and general personal jurisdiction, pursuant to due process and the Delaware Long-Arm Statute, due at least to its substantial business in this forum, including at least a portion of the infringements alleged herein. -

Navigations Intelligentes ? Vivre Les Nouveaux Médias Spatiaux Personnalisés

Navigations intelligentes ? Vivre les nouveaux médias spatiaux personnalisés Thèse de doctorat en sciences humaines et sociales Sarah Widmer Institut de géographie – Université de Neuchâtel – Suisse Photographie de Greg Wass, New York 2015, (CC BY-NC-SA 2.0). Université de Neuchâtel Faculté des lettres et sciences humaines – Institut de géographie Navigations intelligentes ? Vivre les nouveaux médias spatiaux personnalisés Thèse de doctorat en sciences humaines et sociales Présentée et soutenue publiquement le 26 février 2019 Par Sarah Widmer Directeur de thèse : Prof. Francisco R. Klauser Rapporteurs : Prof. Anders Albrechtslund, Prof. Louise Amoore, Prof. Vincent Duclos Résumé Mots clés : données, algorithmes, médias spatiaux, personnalisation, fragmentation urbaine, usages, théories de la médiation Repérer son emplacement sur une carte, choisir un itinéraire pour rejoindre le point X, trouver un restaurant proche : aujourd’hui, la résolution de ces problèmes navigationnels passe souvent par l’utilisation de médias numériques. Grâce à eux, plus besoin de chercher où vous êtes, ni de mémoriser le plan des transports publics : vous êtes directement géolocalisé sur une carte et des algorithmes calculent un parcours vers le lieu que vous cherchez. Ces nouveaux médias spatiaux automatisent bon nombre des tâches que nous réalisions par nous-mêmes et présentent souvent un fonctionnement « intelligent », adaptant leurs informations aux données qu’ils captent sur notre contexte (localisation, heure, jour de la semaine, intensité du trafic, etc.).