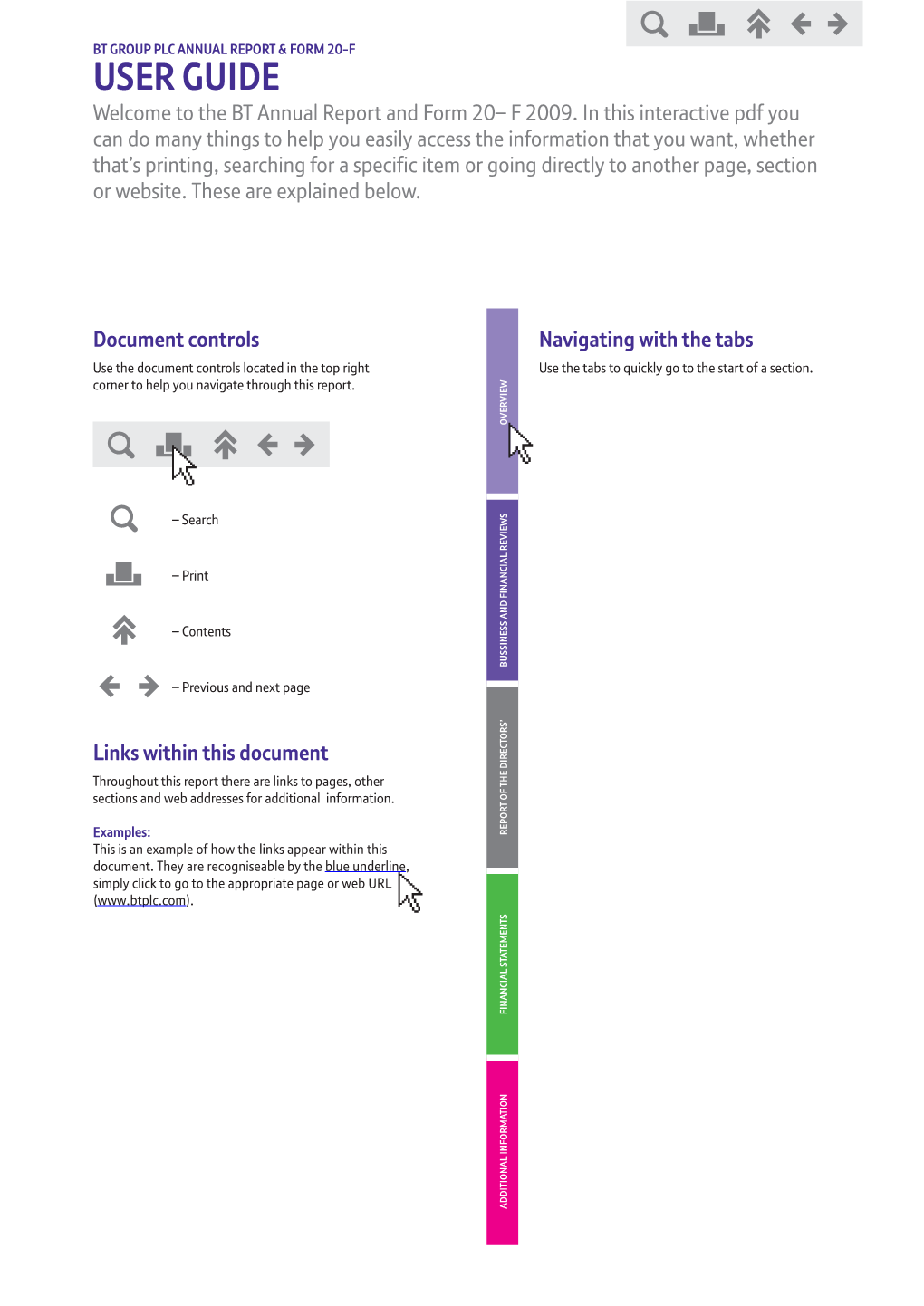

Interactive Annual Report & Form 20-F 2009

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JP4801 Cover ART12.Qxp

Johnston Press plc Annual Report and Accounts 2008 A multi-platform community media company serving local communities by meeting their needs for local news, information and advertising services through 300 newspaper publications and 319 local websites reaching an audience of over 15 million per week. Revenue (£’m) Digital Revenues (£’m) Operating Profit* (£’m) before non-recurring items 5 year comparison 5 year comparison 5 year comparison 600 18 240 19.8 500 15 200 607.5 602.2 15.1 400 531.9 12 160 520.2 519.3 186.8 178.1 180.2 300 9 120 178.2 11.3 200 6 8.3 80 128.4 100 3 6.3 40 0 0 0 04 05 06 07 08 04 05 06 07 08 04 05 06 07 08 Costs* (£’m) Operating Profit Margin*(%) Underlying EPS (p) before non-recurring items before non-recurring items note 14 5 year comparison 5 year comparison 5 year comparison 450 36 30 375 30 25 34.6 34.4 28.44 429.4 27.74 415.4 26.93 403.5 300 24 31.0 20 29.3 25.08 341.1 339.9 225 18 24.1 15 150 12 10 13.41 75 6 5 0 0 0 04 05 06 07 08 04 05 06 07 08 04 05 06 07 08 * see pages 15 and 51 overview governance financial statements 01 Introduction 20 Corporate Social Responsibility 51 Group Income Statement 02 Chairman’s Statement 28 Group Management Board 52 Group Statement of Recognised Income and Expense 05 Chief Executive Officer 29 Divisional Managing Directors 53 Group Reconciliation of Shareholders’ Equity 06 Overview 30 Board of Directors 54 Group Balance Sheet 32 Corporate Governance 55 Group Cash Flow Statement business review 37 Directors’ Remuneration Report 56 Notes to the Consolidated Financial Statements -

Promoting Competition and Investment in Fibre Networks: BT Regulatory Financial Reporting

Promoting competition and investment in fibre networks: BT Regulatory Financial Reporting Reporting requirements covering wholesale fixed telecoms markets 2021-26 CONSULTATION: Publication Date: 6 February 2020 Closing Date for Responses: 1 April 2020 2020 BT Regulatory Financial Reporting Consultation Contents Section 1. Overview 2 2. Introduction 4 3. Regulatory reporting remedies in the Wholesale Fixed Telecoms Market Review 10 4. Published performance schedules 15 5. Preparation and assurance requirements 51 6. Information provided to Ofcom 81 7. Proposed SMP condition, directions and legal tests 92 Annexes A1. Responding to this consultation 104 A2. Ofcom’s consultation principles 107 A3. Consultation coversheet 108 A4. Consultation questions 109 A5. Draft legal instruments 110 1 2020 BT Regulatory Financial Reporting Consultation 1. Overview 1.1 On 8 January 2020, we published the consultation for our Wholesale Fixed Telecoms Market Review (WFTMR)1. This document sets out our proposed regulatory financial reporting requirements on BT in these markets. BT’s regulatory reporting will be subject to these requirements from April 2021 for five years. 1.2 Because the WFTMR covers most wholesale fixed telecoms markets we regulate and will determine our regulatory approach for the next five years, we are taking the opportunity to conduct a more holistic review of BT’s reporting requirements. This will ensure they remain fit for purpose while making the published information more accessible and easier to understand. 1.3 Our proposals cover the preparation and presentation of information published by BT, and information provided privately to Ofcom. What we are proposing We are proposing to impose regulatory financial reporting requirements on BT which require the production of Regulatory Financial Statements (RFS). -

Faster and Cheaper Than BT Unlimited Infinity 1 Based on Wired and Not Wi-Fi Connections

Faster and cheaper than BT Unlimited Infinity 1 Based on wired and not Wi-Fi connections. Sky’s fastest up to 76Mb unlimited Fibre Max is faster and cheaper than BT’s entry level up to 52Mb unlimited Infinity 1. BT’s 76Mb service is more expensive and not faster than Sky Fibre Max. Switch from BT to new Sky Fibre Max £15 a month for 12 months Monthly Sky Line Rental £17.40 applies Below is an illustation of what a BT Unlimited Infinity 1 customer, outside their minimum term, would pay if they switched to Sky Fibre Max BT Sky BT Infinity 1 Unlimited Sky Fibre Max Advertised headline download speed Up to 52Mb Up to 76Mb Usage Cap Unlimited Unlimited Minimum term N/A 12 mths Monthly price for months 1 - 12 £26.00 £15.00 Monthly standard cost of line rental £18.99 £17.40 Activation fee £0.00 £39.00 Router Delivery charge £0.00 £9.95 TOTAL COST OVER 12 MONTHS £539.88 £437.75 Features: BT Smart Hub Sky Hub BT NetProtect on 2 devices & BT parental controls Sky Broadband Shield 100GB BT Cloud Storage Sky WiFi UK Weekend Calls 12 months free McAfee Internet Trial BT Sport from free Selected Fibre areas only. Speeds vary by location. £9.95 router delivery charge. Upfront payment may be required. Subject to status. Faster & Cheaper: Sky Fibre Max offers faster download speeds than BT Unlimited Infinity 1 (see also Ofcom report March 2016). External factors such as internet congestion and home wiring can affect speed. -

Genome Editing with CRISPR/Cas9 in Postnatal Mice Corrects PRKAG2 Cardiac Syndrome

Cell Research (2016) 26:1099-1111. © 2016 IBCB, SIBS, CAS All rights reserved 1001-0602/16 $ 32.00 ORIGINAL ARTICLE www.nature.com/cr Genome editing with CRISPR/Cas9 in postnatal mice corrects PRKAG2 cardiac syndrome Chang Xie1, 2, *, Ya-Ping Zhang3, *, Lu Song2, *, Jie Luo1, Wei Qi2, Jialu Hu3, Danbo Lu3, Zhen Yang3, Jian Zhang2, Jian Xiao1, Bin Zhou4, Jiu-Lin Du5, Naihe Jing2, Yong Liu1, Yan Wang1, Bo-Liang Li2, Bao-Liang Song1, Yan Yan3 1Hubei Key Laboratory of Cell Homeostasis, College of Life Sciences, Wuhan University, Wuhan 430072, China; 2The State Key Laboratory of Molecular Biology, Institute of Biochemistry and Cell Biology, Shanghai Institutes for Biological Sciences, Chinese Academy of Sciences, 320 Yue-Yang Road, Shanghai 200031, China; 3Shanghai Institute of Cardiovascular Diseases, Zhongshan Hospital, Fudan University, Shanghai 200032, China; 4Key Laboratory of Nutrition and Metabolism, Institute for Nutritional Sci- ences, Shanghai Institutes for Biological Sciences, Chinese Academy of Sciences, 320 Yue-Yang Road, Shanghai 200031, China; 5Institute of Neuroscience and State Key Laboratory of Neuroscience, Shanghai Institutes for Biological Sciences, Chinese Acade- my of Sciences, 320 Yue-Yang Road, Shanghai 200031, China PRKAG2 cardiac syndrome is an autosomal dominant inherited disease resulted from mutations in the PRK- AG2 gene that encodes γ2 regulatory subunit of AMP-activated protein kinase. Affected patients usually develop ventricular tachyarrhythmia and experience progressive heart failure that is refractory to medical treatment and requires cardiac transplantation. In this study, we identify a H530R mutation in PRKAG2 from patients with famil- ial Wolff-Parkinson-White syndrome. By generating H530R PRKAG2 transgenic and knock-in mice, we show that both models recapitulate human symptoms including cardiac hypertrophy and glycogen storage, confirming that the H530R mutation is causally related to PRKAG2 cardiac syndrome. -

Vodafone Group Plc (VOD:LN)

Vodafone Group Plc (VOD:LN) Telecommunications/Telecommunication Services Price: 113.80 GBX Report Date: September 24, 2021 Business Description and Key Statistics Vodafone Group is a holding company. Through its subsidiaries, Current YTY % Chg Co. provides mobile and fixed telecommunication services including: access charges, voice and video calls, messaging, Revenue LFY (M) 37,330 -6.4 interconnect fees, fixed and mobile broadband and related services EPS Diluted LFY 0.00 such as providing televisual and music content, connection fees and equipment sales. Co. provides a range of mobile services, Market Value (M) 32,119 enabling customers to call, text and access data in Europe and Africa. Co. also provides mobile, fixed and a suite of converged Shares Outstanding LFY (000) 28,224,194 communication services to support its business customers, who Book Value Per Share 1.68 range from small home offices to large multinational companies, including Internet of Things, cloud and security, and carrier EBITDA Margin % 43.00 services. Net Margin % 0.3 Website: www.vodafone.com Long-Term Debt / Capital % 46.1 ICB Industry: Telecommunications Dividends and Yield TTM 0.04 - 3.50% ICB Subsector: Telecommunication Services Payout Ratio TTM % 100.0 Address: Vodafone House;The Connection Newbury 60-Day Average Volume (000) 72,962 GBR 52-Week High & Low 142.42 - 101.70 Employees: 96,506 Price / 52-Week High & Low 0.80 - 1.12 Price, Moving Averages & Volume 144.5 144.5 Vodafone Group Plc is currently trading at 113.80 which is 3.8% below its 50 day 138.9 138.9 moving average price of 118.35 and 10.3% below its 133.3 133.3 200 day moving average price of 126.88. -

Gigabit-Broadband in the UK: Government Targets and Policy

BRIEFING PAPER Number CBP 8392, 30 April 2021 Gigabit-broadband in the By Georgina Hutton UK: Government targets and policy Contents: 1. Gigabit-capable broadband: what and why? 2. Gigabit-capable broadband in the UK 3. Government targets 4. Government policy: promoting a competitive market 5. Policy reforms to help build gigabit infrastructure Glossary www.parliament.uk/commons-library | intranet.parliament.uk/commons-library | [email protected] | @commonslibrary 2 Gigabit-broadband in the UK: Government targets and policy Contents Summary 3 1. Gigabit-capable broadband: what and why? 5 1.1 Background: superfast broadband 5 1.2 Do we need a digital infrastructure upgrade? 5 1.3 What is gigabit-capable broadband? 7 1.4 Is telecommunications a reserved power? 8 2. Gigabit-capable broadband in the UK 9 International comparisons 11 3. Government targets 12 3.1 May Government target (2018) 12 3.2 Johnson Government 12 4. Government policy: promoting a competitive market 16 4.1 Government policy approach 16 4.2 How much will a nationwide gigabit-capable network cost? 17 4.3 What can a competitive market deliver? 17 4.4 Where are commercial providers building networks? 18 5. Policy reforms to help build gigabit infrastructure 20 5.1 “Barrier Busting Task Force” 20 5.2 Fibre broadband to new builds 22 5.3 Tax relief 24 5.4 Ofcom’s work in promoting gigabit-broadband 25 5.5 Consumer take-up 27 5.6 Retiring the copper network 28 Glossary 31 ` Contributing Authors: Carl Baker, Section 2, Broadband coverage statistics Cover page image copyright: Blue Fiber by Michael Wyszomierski. -

Ascential Secure

Ascential Secure Enhanced Health & Safety Standards at Ascential’s Events in a Post-COVID-19 World 1 About Ascential Secure Ascential Secure is our approach to enhanced health and safety standards at our events following COVID-19. From exhibitors to sponsors, speakers, visitors and journalists, those who come to our events do so to gain the information, insights, connections, data and digital tools that they need, effectively and safely. The standards and practices that make up Ascential Secure are designed to provide confidence that at every Ascential event, we are striving to provide the highest standards of safety, hygiene, cleanliness and quality. Whether they are exhibitors, attendees, visitors, speakers or sponsors, people come to events to connect, learn, know more and do more business, effectively, safely and with confidence. Ascential Secure is based on a set of event industry standards, called AllSecure. The AllSecure industry standards were developed collaboratively by a group including industry associations UFI, AEO and SISO, event organisers Informa, Reed Exhibitions and Clarion, a range of event venues, suppliers and with input from health, government and local authorities. Ascential Secure is the way these industry-wide AllSecure standards are being applied to Ascential live events. You can expect to see that health and safety continues to be a priority, and that a range of measures are in place to ensure everyone involved is able to enjoy a safe, hygienic, productive and high-quality organised event experience. As a starting point, Ascential Secure events will be run according to the guidance of the government or official local authority for that location, and according to any venue-specific regulations. -

Annual Report 2020

In pursuit of progress since Annual report 2020 report Annual Annual report 2020 In pursuit of progress since Annual report 2020 report Annual Annual report 2020 CONTENTS ANNUAL REPORT STRATEGIC REPORT 2 Five-year summary 3 Group overview 4 From the chairman 6 From the chief executive 8 From the editor 9 Business review: the year in detail 13 The Economist Educational Foundation 15 The Economist Group and environmental sustainability 17 Corporate governance: the Wates Principles, our Section 172(1) statement and our guiding principles REPORT AND ACCOUNTS GOVERNANCE 22 Directors 23 Executive team 24 Trustees, board committees 25 Directors’ report 28 Directors’ report on remuneration 31 Financial review CONSOLIDATED FINANCIAL STATEMENTS 35 Independent auditor’s report to the members of The Economist Newspaper Limited 38 Consolidated income statement 39 Consolidated statement of comprehensive income 40 Consolidated balance sheet 41 Consolidated statement of changes in equity 42 Consolidated cashflow statement 44 Notes to the consolidated financial statements COMPANY FINANCIAL STATEMENTS 94 Company balance sheet 95 Company statement of changes in equity 96 Notes to the company financial statements NOTICES 108 Notice of annual general meeting 1 STRATEGIC REPORT Five-year summary 2020 2019 2018 2017 2016 £m £m £m £m £m Income statement—continuing business* Revenue 326 333 329 303 282 Operating profit 31 31 38 43 47 Profit after taxation 21 25 28 39 37 Profit on sale of CQ-Roll Call, Inc - 43 - - - Profit on sale of Economist Complex - - - - -

Annual Report 2012

BRINGING How we have performed KNOWLEDGE FIN ANCIAL HIGHLIGHTS • Record adjusted diluted EPS up 7.7% to 40.7p (2011: 37.8p), ahead of market expectations TO LIFE • Full year dividend increased by 10.1% – second interim dividend of 12.5p giving a total 2012 dividend of 18.5p (2011: 16.8p) Businesses, professionals and • Revenue broadly flat despite Robbins Gioia and European academics worldwide turn to Informa Conference disposals – £1.23bn (2011: £1.28bn) for unparalleled knowledge, up-to- • Adjusted operating profit up 4.0% to £349.7m the minute information and highly (2011: £336.2m); organic growth of 2.8% specialist skills and services. • Record adjusted operating margin of 28.4% (2011: 26.4%) Our ability to deliver high quality • Adjusted profit before tax of £317.4m up 7.3% (2011: £295.9m) knowledge and services through • Statutory profit after tax of £90.7m (2011: £74.3m) multiple channels, in dynamic and rapidly changing environments, • Strong cash generation – operating cash flow up 5.7% to £329.0m (2011: £311.2m) makes our offer unique and • Balance sheet strength maintained – net debt/EBITDA extremely valuable to individuals ratio of 2.1 times (2011: 2.1 times) and organisations. OPEAI R T ONAL HIGHLIGHTS • Proactive portfolio management drives significant Annual Report & Financial Statements for the year ended December 31 2012 improvement in the quality of Group earnings • Total product rationalisation reduced Group revenue by 2% • Investment in new products, geo-cloning and platform development • Acquisition of MMPI and Zephyr -

Welsh Affairs Committee Inquiry Into Digital Inclusion in Wales BT's

Welsh Affairs Committee Inquiry into Digital Inclusion in Wales BT’s response February 2009 Digital Inclusion in Wales - comments from BT Introduction 1. BT Wales welcomes the opportunity to contribute to the Welsh Affairs Select Committee inquiry into Digital Inclusion in Wales. This written submission provides a snapshot of BT’s current activity, as a partner of government and wider civil society, in assisting digital inclusion. 2. BT is the world’s oldest communications company, tracing our history back to the UK’s Electric Telegraph Company established in 1846. However, we have come a long way since then. BT’s story is one of transformation, a story of a company that has grown and prospered. Today we operate in 170 countries and employ over 100,000 people. We have one of the largest IP networks in the world and serve 18 million customers – from consumers and small businesses, to some of the world’s largest global companies. 3. Our products – which include home telephones, BT Vision (our television service), broadband and complex IT networks – help our customers communicate. Thanks to investment from BT, more homes in the UK now have access to broadband than have access to mains water and more than half of UK households are now connected to broadband. 4. As a social corporate citizen BT in Wales sees itself as a positive partner: • supporting its communities - through schemes encouraging digital inclusion; • championing the Welsh language - with an award-winning bilingual policy; • promoting competitiveness - by investing millions in the Welsh economy annually. 5. BT is helping Wales to take its place in the global knowledge economy. -

BT Group Regulatory Affairs, Response Remove All 4

Annex to the BT response to Ofcom’s consultation on promoting competition and investment in fibre networks – Wholesale Fixed Telecoms Market Review 2021-26 29 May 2020 Non - confidential version Branding: only keep logos if the response is on behalf of more than one brand, i.e. BT/Openreach joint response or BT/EE/Plusnet joint response. Comments should be addressed to: Remove the other brands, or if it is purely a BT BT Group Regulatory Affairs, response remove all 4. BT Centre, London, EC1A 7AJ [email protected] BT RESPONSE TO OFCOM’S CONSULTATION ON COMPETITION AND INVESTMENT IN FIBRE NETWORKS 2 Contents CONTENTS .................................................................................................................................................. 2 A1. COMPASS LEXECON: REVIEW OF OFCOM'S APPROACH TO ASSESSING ULTRAFAST MARKET POWER 3 A2. ALTNET ULTRAFAST DEPLOYMENTS AND INVESTMENT FUNDING ...................................................... 4 A3. EXAMPLES OF INCREASING PRICE PRESSURE IN BUSINESS TENDERING MARKETS .............................. 6 A4. MARKET ANALYSIS AND REMEDIES RELATED TO PHYSICAL INFRASTRUCTURE ................................... 7 Our assessment of Ofcom’s market analysis ............................................................................................ 8 Our assessment of Ofcom’s remedies .................................................................................................... 12 A5. RISKS BORNE BY INVESTORS IN BT’S FIBRE INVESTMENT ................................................................ -

Register of Journalists' Interests

REGISTER OF JOURNALISTS’ INTERESTS (As at 14 December 2017) INTRODUCTION Purpose and Form of the Register Pursuant to a Resolution made by the House of Commons on 17 December 1985, holders of photo- identity passes as lobby journalists accredited to the Parliamentary Press Gallery or for parliamentary broadcasting are required to register: ‘Any occupation or employment for which you receive over £760 from the same source in the course of a calendar year, if that occupation or employment is in any way advantaged by the privileged access to Parliament afforded by your pass.’ Administration and Inspection of the Register The Register is compiled and maintained by the Office of the Parliamentary Commissioner for Standards. Anyone whose details are entered on the Register is required to notify that office of any change in their registrable interests within 28 days of such a change arising. An updated edition of the Register is published approximately every 6 weeks when the House is sitting. Changes to the rules governing the Register are determined by the Committee on Standards in the House of Commons, although where such changes are substantial they are put by the Committee to the House for approval before being implemented. Complaints Complaints, whether from Members, the public or anyone else alleging that a journalist is in breach of the rules governing the Register, should in the first instance be sent to the Registrar of Members’ Financial Interests in the Office of the Parliamentary Commissioner for Standards. Where possible the Registrar will seek to resolve the complaint informally. In more serious cases the Parliamentary Commissioner for Standards may undertake a formal investigation and either rectify the matter or refer it to the Committee on Standards.