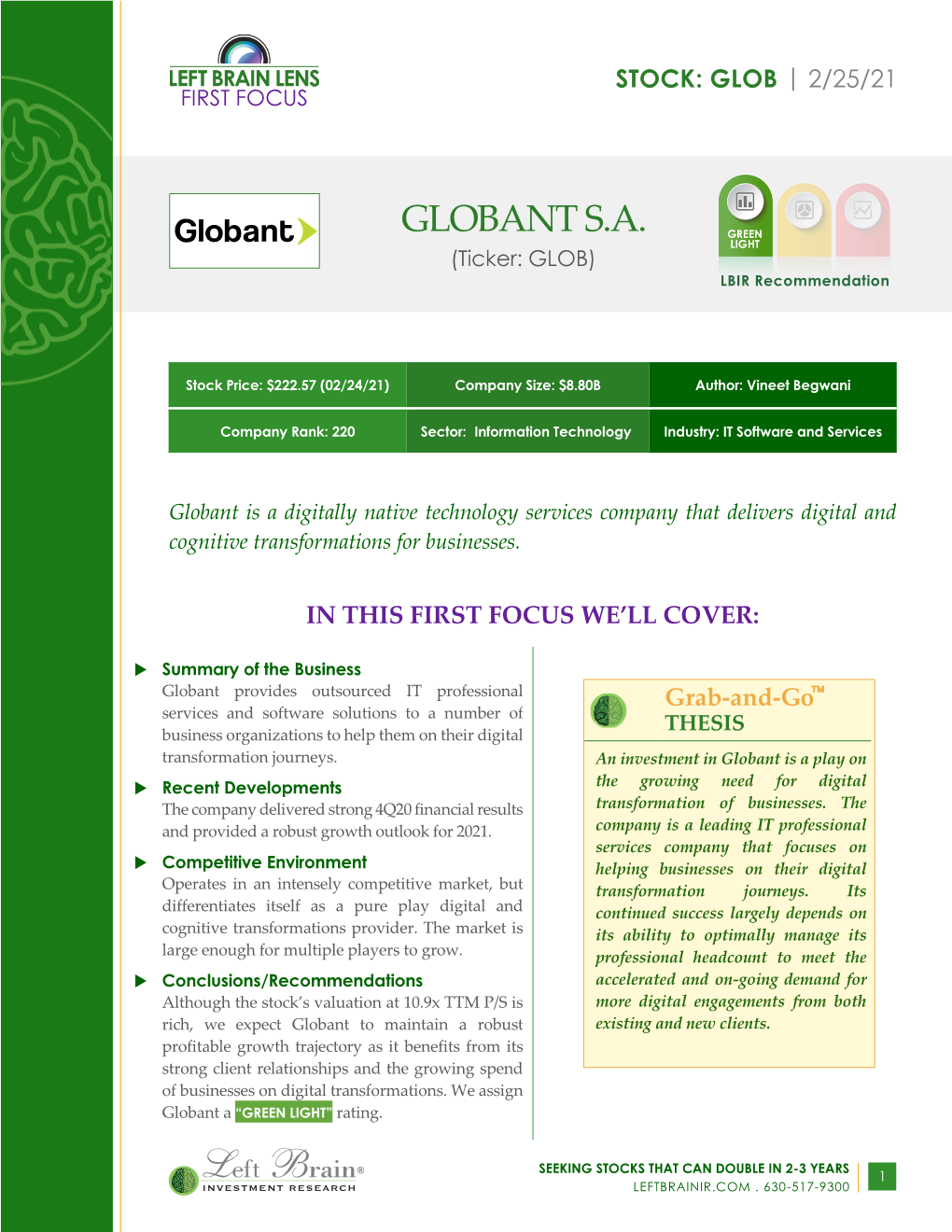

GLOBANT S.A. (Ticker: GLOB) LBIRLBIRLBIR Recommendation Recommendationrecommendation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Department of Electronics and Instrumentation Engineering

Department of Electronics and Instrumentation Engineering The Centre for Training and Placement has conducted Aptitude crash course for first & second year students by SMART. Aptitude crash course was conducted in two phases, first phase in the first semester & second phase in the third semester. Placement orientation program-II (POP II) was conducted for the final year students by SMART and trained them on soft skills, quantitative aptitude skills etc., to prepare them for placement recruitments. Also POP III, a company specific training programme was conducted by SMART to crack Cognizant, Infosys Wipro test pattern. The Centre for Training & Placement conducted Online aptitude assessment tests on every week for all the students through the skill rack portal. Day 1 sharing companies (Cognizant, Infosys, Wipro, ZOHO, Thoughtworks, Zifo, Kaar & Top freshers) & companies like Tech Mahindra, Mphasis, HTC Global Services, Verizon, Info Trellis, Plintron, Mindtree, Tata communications, Wolters Kluwer, Excelencia, Customer Analytics, Billiontags, Spinco, ICICI securities, BNY Mellon, Naukri, Avacend, Bajaj capital, VVDN, K7, HIL, Indusind Bank, ICICI Prudential, VIVO Phones, Huawei, Valued Epistemics, Sosaley, MRF, Hp Inc, Manali petrochemicals, SMART, HCL-Infra, OMICS, BNP Paribas, HCL, Sanmar, VWR, Emerson, Shasun, Amazon, Gislen, Captronic, Kone, Ideas2IT, Artech, SEW-Eurodrive, Krishcoinfolabs, Guptapower, Flextronics, E-Con systems, Samsung, Sitel, HDFC Bank, Bosch, Aithent, Zycus, Eurocon tiles, Aricent & Rjpinfotek through campus recruitment drive held for the academic year 2018-19 with an annual salary package, starting from 2.5 Lakhs to 28 Lakhs for UG & PG students. Placement Details For Past 7 Batches S.No Batch No. of Placements 1 2017-2021 52* 2 2016-2020 75 3 2015-2019 83 4 2014-2018 51 5 2013-2017 140 6 2012-2016 92 7 2011-2015 87 8 2010-2014 83 Batch 2017- 2021 Sl. -

News About You Read Alumni Stories from Your Former Colleagues Audit & Assurance

News about you Read alumni stories from your former colleagues Audit & Assurance ......................................................................................................................................... 1 Consulting ..................................................................................................................................................... 2 Internal Services .......................................................................................................................................... 10 Risk and Financial Advisory ......................................................................................................................... 15 Tax ............................................................................................................................................................... 17 Audit & Assurance Puja Amlani, Audit & Assurance, Core Audit Services, shares that she continued her journey with Deloitte by joining Deloitte Cananda in Toronto. She works as an Assistant Manager in Audit & Assurance in the financial services industry. She is grateful for the opportunities that she gets at work and feels it has been pivotal in what she has become today. Deloitte continues to shape her future and she is eager to see where it takes her next. Jithu Jose Parackal, Audit & Assurance, External Audit Services, shares that after leaving Deloitte he joined the Tax function in another Big 4. He feels that the transition from Deloitte to his current organization was smooth because -

Cloud Managed Services and Hosting Sector Review | Q1 2020

CLOUD MANAGED SERVICES AND HOSTING SECTOR REVIEW | Q1 2020 Technology Cloud Managed Services and Hosting| Q1 2021 TECHNOLOGY, MEDIA & TELECOM PAGE | 0 Cloud Managed Services and Hosting Taxonomy WEB HOSTING MANAGED SERVICES IT OUTSOURCING Refers to a service in which a vendor offers the Refers to the delivery of network, application, system Refers to the use of external service providers to housing of business-to-business or business-to- and e-management services across a network to effectively deliver IT-enabled business process, consumer eCommerce websites via vendor-owned multiple enterprises, using a pay-as-you-go pricing application service and infrastructure solutions shared or dedicated servers and applications for model for business outcomes enterprises at the provider-controlled facilities SELECTED MARKET PARTICIPANTS SELECTED MARKET PARTICIPANTS SELECTED MARKET PARTICIPANTS S E L E C T E D HW CLOUD MANAGED SERVICES AND HOSTING TRANSACTIONS & has made a significant has been acquired by has acquired have been acquired by has been acquired by has been acquired by investment in Provider of a post-warranty Provider of mass hosting Provider of services Provider of web domains, Provider of managed Provider of SME-focused alternative for storage, server services for SMEs, including allowing SMEs to move shared web hosting and technology services with hosting and cloud solutions, and networking hardware web hosting, domains, their IT infrastructure and value-added services with national scale in the US and including domain and maintenance -

Turing Holding Corp. Form S-1 Filed 2021-08-20

SECURITIES AND EXCHANGE COMMISSION FORM S-1 General form of registration statement for all companies including face-amount certificate companies Filing Date: 2021-08-20 SEC Accession No. 0001193125-21-252856 (HTML Version on secdatabase.com) FILER Turing Holding Corp. Mailing Address Business Address 200 EAST RANDOLPH 200 EAST RANDOLPH CIK:1866550| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1231 STREET, 25TH FLOOR STREET, 25TH FLOOR Type: S-1 | Act: 33 | File No.: 333-258985 | Film No.: 211194501 CHICAGO IL 60601 CHICAGO IL 60601 SIC: 7371 Computer programming services 312-373-1000 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Table of Contents As filed with the Securities and Exchange Commission on August 20, 2021. Registration No. 333- UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form S-1 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 Turing Holding Corp.* (Exact name of registrant as specified in its charter) Delaware 7371 82-2668392 (State or other jurisdiction of (Primary Standard Industrial (I.R.S. Employer incorporation or organization) Classification Code Number) Identification Number) 200 East Randolph Street, 25th Floor Chicago, Illinois 60601 (312) 373-1000 (Address, including zip code, and telephone number, including area code, of registrants principal executive offices) Ramona Mateiu General Counsel and Chief Compliance Officer 200 East Randolph Street, 25th Floor Chicago, Illinois 60601 (312) 373-1000 (Name, address, including zip code, and telephone number, including area code, of agent for service) Copies of all communications, including communications sent to agent for service, should be sent to: Joshua N. -

The Forrester Wave

LICENSED FOR INDIVIDUAL USE ONLY The Forrester Wave™: Global API Strategy And Delivery Service Providers, Q2 2019 The Nine Providers That Matter Most And How They Stack Up by Randy Heffner April 22, 2019 Why Read This Report Key Takeaways In our 19-criterion evaluation of global API Infosys, IBM, Accenture, And Capgemini Lead strategy and delivery service providers, we The Pack identified the nine most significant ones — Forrester’s research uncovered a market in Accenture, Capgemini, Cognizant, Deloitte, which Infosys, IBM, Accenture, and Capgemini IBM, Infosys, Tata Consultancy Services (TCS), are Leaders; Wipro, Cognizant, and TCS are Virtusa, and Wipro — and researched, analyzed, Strong Performers; and Virtusa and Deloitte are and scored them. This report shows how each Contenders. provider measures up and helps application BT Vision, API Business Strategy, And API development and delivery (AD&D) professionals Program Setup Are Key Differentiators select the right one for their needs. As APIs become increasingly important enablers of digital transformation and sustainable business agility, consultants and systems integrators must have a clear view into strategic API business value to lead the pack. Vendors that can deliver strong business technology vision, compelling API business strategies, and disciplined and mature API programs position themselves to successfully build a foundation for their clients to thrive in the unpredictable era of digital disruption. This PDF is only licensed for individual use when downloaded from forrester.com -

Evening & Weekend

Evening & Weekend MBA Student Facebook 2018-2019 TABLE OF CONTENTS CLASS OF 2019 ...............................................................................................................3 CLASS OF 2020 ............................................................................................................ 28 CLASS OF 2021 ............................................................................................................ 49 Evening & Weekend MBA Staff Program Office Staff ................................................................................................ 70 Admissions Staff .......................................................................................................71 Lifecycle Staff ............................................................................................................72 First Name Index .........................................................................................................74 EVENING & WEEKEND MBA PROGRAM MBA WEEKEND & EVENING 1 CLASS OF 2019 OF CLASS Suraj Abraham Melanie Akwule Nvidia Corporation GE Digital Senior Hardware Engineer Technical Product Manager, National Institute of Data & Analytics Technology, Karnataka Georgia Tech Electronics and Business Administration Communication 14903 15219 Soumya Aladi Jane Alston HEARST Health - FDB David Grant Medical Center Product Success Manager General Surgeon National Institute of 14623 Technology, Kurukshetra Electrical Engineering 14904 Ganesh Alwarsamy Jon Amadei Cognizant Technology Square, Inc. Solutions -

Top-Consultant.Com's Guide to Consulting Firms

Top-Consultant.com Guide to Consulting Firms Top-Consultant.com 18b Charles Street | Mayfair | London | W1J 5DU | +44 (0) 207 667 6880 Top-Consultant.com 2 Guide to Consulting Firms Table of Contents Things to consider when applying for consulting firms Insights from management consultants Strategy, Boutique & Full-Service firms Three types of firms to consider Additional Resources Annual reports about the consulting industry Appendix A list of firms overlooked by the majority of applicants Publisher: Top-Consultant.com Zambeasy.com Limited Northcliffe House 2 Derry Street London W8 5TT United Kingdom Enquiries: [email protected] +44 (0) 207 667 6880 Registered in England and Wales with company number 3947933 VAT Number GB 243 5711 74 Things to consider when applying to consulting firms Insights from management consultants There are numerous reasons you may be considering a career in consulting. The high-flying lifestyle, the money, the pres- tige, the learning experience… … so this report starts off by identifying the things that actual management consultants are most looking for in their next consulting job. These insights are based on a survey of ~1,500 consultants from the likes of Accenture, McKin- sey and Capgemini, as well as numerous smaller firms. By assessing the things that real consultants are most concerned to secure in their next career move, you can begin to understand the research that you need to be undertaking about future employers and the types of questions you need to be asking your potential employer. Top-Consultant.com 3 Guide to Consulting Firms It is clear that remuneration is the number one Retention factors ranked by consultants concern of actual consultants, especially in a 2007 2007 2005 booming market like today’s. -

HFS Blueprint Report Software Product Engineering Services Excerpt for TCS

Defining future business operations HFS Blueprint Report Software Product Engineering Services Excerpt for TCS August 2018 | Authors: Pareekh Jain, Senior Vice President; Tanmoy Mondal, Senior Research Analyst © 2018 HFS Research Ltd. Excerpt for TCS Proprietary │Page 1 What you’ll read Topic Page Executive summary 6 Research methodology 9 Key market dynamics 15 Market data analysis 18 Service provider grid and profiles 28 Market direction and recommendations 33 About the authors and HFS 40 © 2018 HFS Research Ltd. Excerpt for TCS Proprietary │Page 2 Introduction to the HFS Blueprint Report: Software Product Engineering Services » The HFS Blueprint Report: Software Product Engineering Services applies the HFS Blueprint methodology to the software product engineering services marketplace. This HFS Blueprint Report reviews the software product engineering services market across the value chain for new product development, product sustenance, product testing, product deployment, product support, and product management services. » This report includes profiles and assessments of 25 service providers of software product engineering services. » Unlike other quadrants and matrices, the HFS Blueprint identifies relevant differentials between service providers across a number of facets in two main categories: innovation and execution. » For this report, HFS has increased the attention paid to innovation criteria in particular, and adopted the new 2018 Blueprint Grid layout to assess service providers. This grid now recognizes up-and-coming service providers (High Potentials) that score higher on innovation criteria than on execution criteria as the providers build these practices. This is in addition to the existing rankings for highest overall performance (Winner’s Circle) and strong combined innovation and execution performance (High Performers). -

Market Overview: Agile Development Service Providers

For: Application Market Overview: Agile Development Development & Delivery Service Providers Professionals by Wolfgang Benkel and Diego Lo Giudice, December 8, 2014 KEY TAKEAWAYS Agile Is A Major Trend In Software Development And Maintenance The need for more agility in the business technology world requires resources that increase speed, achieve greater business alignment, and result in faster time-to-market. This is driving increased use of Agile for software development and maintenance. Vendors Prepare Their Capabilities To Support Clients The need for speed is forcing vendors to increase investments to build and improve their Agile capabilities and meet their customers’ needs and expectations. This is the result of recognizing that companies’ Agile-trained resource bases are insufficient to fulfill business requirements. The Vendor Landscape Is Large, So Clients Have To Ask The Right Questions The vendor landscape includes many different types of vendors, from global application service providers to small boutique vendors and freelancers with Agile skills. Navigating the landscape is not easy, but the right vendor and a proactive client can lead to trusted relationships with high business benefits for both client and vendor. Forrester Research, Inc., 60 Acorn Park Drive, Cambridge, MA 02140 USA Tel: +1 617.613.6000 | Fax: +1 617.613.5000 | www.forrester.com FOR APPLICATION DEVELOPMENT & DELIVERY PROFESSIONALS DECEMBER 8, 2014 Market Overview: Agile Development Service Providers The Agile Capabilities Of Leading Outsourcing Services Companies Have Caught Up With Client Expectations by Wolfgang Benkel and Diego Lo Giudice with Chris Andrews and Michelle Mai WHY READ THIS REPOrt As business technology moves higher on the radar screen of CIOs, the need to leverage Agile application development techniques is rising. -

Technology Monthly – February 2021

TECHNOLOGY MONTHLY FEBRUARY 2021 Our technology & tech-enabled services practice advises leading private and publicly traded technology companies including many of the world’s most respected IT consulting, managed services, technical staffing and enterprise software providers. ITS Offshore ITS Managed Services IT Staffing Transaction Processing Info Services VAR HEADLINE TRANSACTIONS TARGET ACQUIROR ACQUISITION SYNOPSIS • McKinsey & Company, a US based management consulting firm, acquired Candid Partners, a US based provider of cloud consulting services • The acquisition scales McKinsey's technical cloud capabilities, which will enable it to generate better client outcomes with regards to cloud adoption • Pamlico Capital, a US based middle market private equity firm, made a growth investment in Protera Technologies, a US based provider of application management and migration services focused on the SAP platform • Pamlico's backing provides the capital needed to expand Protera's market reach and service offering • CoreBTS (backed by Tailwind Capital), a US based IT solutions and managed services provider, acquired Skyline Technologies, a US based provider of Microsoft cloud, data analytics and application development consulting services • The acquisition broadens Core BTS' ability to drive cloud transformation through customized data analytics and application IT Services development • IBM (NYSE: IBM), a global integrated solutions and services company, acquired 7Summits, a US based Salesforce digital solutions consulting firm backed by -

History Career Path

History Career Path Mr. Seth M. McHenry has used his degree in History from Bucknell University to become a financial advisor at Merrill Lynch and Company, Incorporated. He says networking and graduate school weren’t very important for his career, however a business background and people skills are imperative. During a typical day, Mr. McHenry spends his time talking to people, watching the markets, and reviewing portfolios. He says he maintains a very irregular schedule. While Mr. McHenry finds the governmental oversight frustrating, he enjoys the independence of the job. Mr. McHenry recommends his field to anybody who enjoys independence and is a self-starter who has good people skills. If given the chance to do it all over again, he says he would do it differently, as he feels he jumped onto the corporate bandwagon too early. Class Major Job Title Employer Business City Business State 2018 History Lacrosse Player Denver Outlaws Denver CO 2018 History Lacrosse Player Boston Cannons Boston MA 2018 History Teacher Uncommon Schools Roxbury MA 2018 History Teacher, Social Studies Prince George's County Upper Marlboro MD Public Schools 2018 History | Political Science Real Estate Program Cushman & Wakefield New York NY Associate 2018 History | Political Science | Full Committee Clerk United States House of Washington DC Spanish Representatives 2018 History | Psychology | Sales Associate ISN Dallas TX Spanish 2018 History | Religion Intern Haywood Street Asheville NC Methodist Ministry 2018 Economics | History Associate Guidepoint New York NY 2018 Economics | History Management Trainee United Way Healthcare 2018 Economics | History Analyst Sandler O'Neill New York NY 2018 Economics | History | Sales Oracle America, Inc. -

Asliceylanonerthesisapp

APPENDIX A LIST OF NAICS CODES and APS TNCs INCLUDED IN THE RESEARCH 351 Table A1. List of NAICS Codes and APS TNCs NAICS Description Company Names LOGISTICS Transportation and 48-49 Warehousing 482111 Line-Haul Railroads Siemens AG Vivendi Cia Vale do Rio Doce (VALE) Hoyer GmbH Internationale Fachspedition Deep Sea Freight 483111 Transportation DSV A/S FedEx Corp. Marubeni America Corporation Sumitmo Corporation of America DHL (Danzas Group) Kawasaki Kisen Kaisha Ltd. Stolt-Nielsen Transportation Group Inc. Hanjin Shipping Company Ltd. Maersk Line UK Limited Hyundai America Shipping Agency(N.C.), Inc. Coastal and Great Lakes 483113 Freight Transportation Bollore Investissement CMA CGM Groupe APL Company Private Ltd. Hapag-Lloyd AG Yangming Marine Transport Corp Teekay Corporation Seecor Marine LLC Cia Sudamericana de Vapores S.A. General Freight 484110 Trucking, Local Kuehne and Nagel International AG SCHENKER AG Varenso Oy General Freight Trucking, Long-Distance, 484121 Truckload United Parcel Service Inc. (UPS) Suntory Ltd. Nippon Express Company Ltd. Group4 Securicor PLC Brink's Hellmann Worldwide Logistics GmbH and Company KG ABX Logistics 352 Seagate Panalpina Welttransport Deutschland GmbH Ryder Integrated Logistics Cargolux Airlines International S.A. United Arab Shipping Company USF Logistics Services Inc. Mammoet Holding B.V. Dimerco Express Corp. GeoLogistics GmbH EGL Eagle Global Logistics L.P. Menlo Worldwide Logistics Pipeline Transportation 486110 of Crude Oil Koch Industries Inc. Pipeline Transportation 486210 of Natural Gas Mirant Corp. 488320 Marine Cargo Handling Cargill Inc. Mitsui OSK Lines Ltd. Yamato Holdings Company Ltd. Serco Group PLC Pacific International Lines (Private) Ltd. Freight Transportation 488510 Arrangement Mediterranean Shipping Company S.A.