Directors' Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

State Street Australian Equities Index Trust

1 July 2017 to 30 June 2018 State Street Australian Equities Index Trust Proxy Voting Record Vote Summary Report Reporting Period: 07/01/2017 to 06/30/2018 Location(s): All Locations Institution Account(s): State Street Australian Equities Index Trust BGP Holdings Plc Meeting Date: 07/03/2017 Country: Malta Primary Security ID: Record Date: 05/25/2017 Meeting Type: Special Ticker: N/A Shares Voted: 7,171,006 Vote Proposal Voting Vote Against Number Proposal Text Proponent Mgmt Rec Policy Rec Instruction Mgmt 1 Approve Reduction of Share Premium Account Mgmt For For For No 2 Approve Distribution of EUR 5 Million to Mgmt For Against Against Yes Directors 3 Approve Distribution of EUR 1.5 Million to Mgmt For Against Against Yes Directors ALS Limited Meeting Date: 07/20/2017 Country: Australia Primary Security ID: Q0266A116 Record Date: 07/18/2017 Meeting Type: Annual Ticker: ALQ Shares Voted: 244,044 Vote Proposal Voting Vote Against Number Proposal Text Proponent Mgmt Rec Policy Rec Instruction Mgmt 1 Elect Grant Murdoch as Director Mgmt For For For No 2 Elect John Mulcahy as Director Mgmt For For For No 3 Approve the Remuneration Report Mgmt For For For No 4 Approve the Grant of Performance Rights to Mgmt For Against Against Yes Raj Naran, Managing Director and CEO of the Company AusNet Services Meeting Date: 07/20/2017 Country: Australia Primary Security ID: Q0708Q109 Record Date: 07/18/2017 Meeting Type: Annual Ticker: AST Shares Voted: 852,633 Vote Proposal Voting Vote Against Number Proposal Text Proponent Mgmt Rec Policy Rec Instruction -

Directors' Report

DIRECTORS' REPORT The Directors present their report together with the consolidated financial report of Insurance Australia Group Limited and its subsidiaries for the financial year ended 30 June 2019 and the Auditor's Report. The following terminology is used throughout the financial report: Company or Parent – Insurance Australia Group Limited; and IAG or Group – the consolidated entity consists of Insurance Australia Group Limited and its subsidiaries. DIRECTORS OF INSURANCE AUSTRALIA GROUP LIMITED The names and details of the Company's Directors in office at any time during or since the end of the financial year are set out below. Directors were in office for the entire period unless otherwise stated. CHAIRMAN ELIZABETH B BRYAN AM BA (Econ), MA (Econ) – Chairman and Independent Non-Executive Director INSURANCE INDUSTRY EXPERIENCE Elizabeth Bryan was appointed a Director of IAG on 5 December 2014, and became Chairman on 31 March 2016. She is the Chairman of the Nomination Committee, and attends all Board committee meetings in an ex-officio capacity. Elizabeth is also the Chairman of Insurance Manufacturers of Australia Pty Limited. OTHER BUSINESS AND MARKET EXPERIENCE Elizabeth brings extensive leadership, strategic and financial expertise to the position of Chairman. She has over 30 years of experience in the financial services industry, government policy and administration, and on the boards of companies and statutory organisations. In addition to her role as Chairman of IAG, Elizabeth is also currently Chairman of Virgin Australia Group. Previous roles include Chairmanship of Caltex Australia Limited and UniSuper Limited. Directorships of other listed companies held in the past three years: IAG Finance (New Zealand) Limited (a part of the Group), since 2016; Virgin Australia Group, since 2015; and Westpac Banking Corporation (2006-2016). -

5 September 2017 Manager, Company Announcements

5 September 2017 Manager, Company Announcements Office ASX Limited Level 4, Exchange Centre 20 Bridge Street Sydney NSW 2000 Dear Sir/Madam Insurance Australia Group Limited (IAG) Notice of Annual General Meeting 2017 Please find attached IAG’s 2017 Notice of Annual General Meeting and Voting Form. Mailing of the above documents to shareholders commenced today. Copies of these documents will be available on IAG’s website at www.iag.com.au/shareholder-centre/annual-meetings. Yours sincerely Chris Bertuch Group General Counsel and Company Secretary Level 26, 388 George Street, Sydney NSW 2000 Insurance Australia Group Limited ABN 60 090 739 923 MEETING. INSURANCE AUSTRALIA GROUP LIMITED NOTICE OF MEETING 2017 ABN 60 090 739 923 LETTER FROM THE CHAIRMAN Dear Shareholder I am pleased to invite you to attend the 2017 Annual General Meeting (AGM or meeting) of Insurance Australia Group Limited (IAG or the Company). The AGM will be held at the Wesley Conference Centre, 220 Pitt Street, The AGM will be webcast live and may be viewed at Sydney on Friday, 20 October 2017, commencing at 10.00am. A map with www.iag.com.au/shareholder-centre/annual-meetings. directions to the venue appears on the inside back cover of this booklet. An archive of the webcast will be available on the site shortly after the AGM concludes. The following pages contain details on the items of business for the meeting, as well as explanatory notes and voting procedures. A shareholder who is entitled to vote at the AGM may also submit written questions for the Company or the Company’s external auditor in advance At this year’s AGM you will have the opportunity to vote on: of the AGM. -

Macquarie Group 2011 Annual Report

MACQUARIE GROUP 2011 ANNUAL REPORT 1 MACQUARIE GROUP LIMITED ACN 122 169 279 This 2011 Macquarie Group Annual 2011 Annual General Meeting The Holey Dollar Report complies with reporting Macquarie Group’s 2011 Annual In 1813 Governor Lachlan Macquarie overcame requirements and contains statutory General Meeting will be held at an acute currency shortage by purchasing Spanish financial statements. It contains 10:30am on Thursday 28 July silver dollars (then worth five shillings), punching reports from the Chairman and 2011 at the Hilton Hotel (Grand the centres out and creating two new coins – the Managing Director on Macquarie’s Ballroom), 488 George Street, ‘Holey Dollar’ (valued at five shillings) and the ‘Dump’ business and operational highlights, Sydney NSW. (valued at one shilling and three pence). Macquarie’s Corporate Governance Details of the business of the This single move not only doubled the number of Statement, the Directors’ Report meeting will be contained in the coins in circulation but increased their worth by including the Remuneration Report Notice of Annual General Meeting, 25 per cent and prevented the coins leaving the and full financial statements. to be sent to shareholders colony. Governor Macquarie’s creation of the Holey The 2011 Shareholder Review separately. Dollar was an inspired solution to a difficult problem contains a report from the and for this reason it was chosen as the symbol for Chairman and Managing Director Macquarie Group. on Macquarie’s business and operational highlights. It is not a concise report prepared under section 314 (2) of the Corporations Act. Macquarie Group has not prepared a concise report for the 2011 financial year. -

Annual Report 2016–17 03

Annual Report 2016–17 03 About Us Contents General Sir John Monash Foundation Our mission is to invest in ensured that Jewish boys such as Monash were Ground Floor, Bennelong House, 9 Queens Street outstanding Australians from welcomed and invited to embrace their faith 03. About Us Melbourne VIC 3000 Australia all fields of endeavour who through the learning of Hebrew. Telephone: +61 3 9620 2428 demonstrate remarkable qualities Counterfactual speculation is fraught. 04. Message from the Chairman Email: [email protected] of leadership and have the ability Nonetheless, it’s worth considering how 05. The Year in Review Web: www.johnmonash.com to deliver outcomes and inspire different Australian and world history could others for the benefit of Australia. have been, had an outsider in so many ways 06. 147 John Monash Scholars – a scholarship boy from Jerilderie, born to johnmonashfoundation The General Sir John Monash German parents and of a minority faith – not 07. 2017 Scholarship Selection @MonashScholars benefited from the enlightened educational Foundation was established in leadership of a good man, who ensured that general-sir-john-monash-foundation 08. 2017 John Monash Scholars 2001 with an initial contribution Monash could access the opportunities which https://www.youtube.com/c/ from the Australian Federal allowed him to realise his immense talents 09. Where Are They Now GeneralSirJohnMonashFoundationMelbourne Government together with further and abilities leading the Australian Corps 12. Impact ABN 78 099 065 184 contributions from corporate in 1918. and private supporters and 15. Events and Activities One hundred years on, the task of Australians donors. Its purpose is to raise is to sustain the memory of those in that 18. -

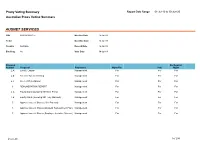

Australian Voting Summary Year Ending 30 June 2019

Proxy Voting Summary Report Date Range: 01-Jul-19 to 30-Jun-20 Australian Proxy Voting Summary AUSNET SERVICES ISIN AU000000AST5 Meeting Date 18-Jul-19 Ticker Deadline Date 12-Jul-19 Country Australia Record Date 16-Jul-19 Blocking No Vote Date 04-Jul-19 Proposal For/Against Number Proposal Proponent Mgmt Rec Vote Mgmt 2.A Elect Li Lequan Management For For For 2.B Re-elect Tan Chee Meng Management For For For 2.C Re-elect Peter Mason Management For For For 3 REMUNERATION REPORT Management For For For 4.A Equity Grant (Outgoing MD Nino Ficca) Management For For For 4.B Equity Grant (Incoming MD Tony Narvaez) Management For For For 5 Approve Issue of Shares (10% Pro-rata) Management For For For 6 Approve Issue of Shares (Dividend Reinvestment Plan) Management For For For 7 Approve Issue of Shares (Employee Incentive Scheme) Management For For For 23-Jul-20 1 of 299 Proxy Voting Summary Report Date Range: 01-Jul-19 to 30-Jun-20 Australian Proxy Voting Summary MACQUARIE GROUP LTD ISIN AU000000MQG1 Meeting Date 25-Jul-19 Ticker Deadline Date 19-Jul-19 Country Australia Record Date 23-Jul-19 Blocking No Vote Date 08-Jul-19 Proposal For/Against Number Proposal Proponent Mgmt Rec Vote Mgmt 2.A Re-elect Michael J. Hawker Management For For For 2.B Re-elect Michael J. Coleman Management For For For 2.C Elect Philip M. Coffey Management For For For 2.D Elect Jillian R. Broadbent Management For For For 3 REMUNERATION REPORT Management For For For 4 Equity Grant (MD/CEO Shemara Wikramanayake) Management For For For 5 Approve Increase in NEDs' Fee -

Extracts from the Macquarie Group Limited 2011 Annual Report PDF 2

MACQUARIE GROUP 2011 ANNUAL REPORT MACQUARIE GROUP LIMITED ACN 122 169 279 Corporate Governance Statement Macquarie’s approach to Corporate Governance Macquarie monitors regulatory and corporate Macquarie’s approach to corporate governance governance developments that impact on Macquarie’s aims to achieve superior and sustainable financial businesses, adopting corporate governance practices performance and long-term prosperity, while meeting it considers are in the best interests of Macquarie and stakeholders’ expectations of sound corporate its shareholders, consistent with Macquarie’s governance. responsibilities to other stakeholders including clients, investors and staff. Macquarie considers that until Macquarie’s corporate governance framework has 17 March 2011, its governance practices were been developed to support Macquarie’s client focused consistent with all but one of the ASX Corporate business operations, while providing clear guidance on Governance Council’s Corporate Governance how authority is exercised within Macquarie, including Principles and Recommendations (ASX Board oversight of key controls. The Macquarie Board, Recommendations), as set out below under the with the assistance of the Board Committees, description of the role of the Chairman. Macquarie determines the most appropriate corporate governance considers that since 17 March 2011, its governance practices. practices have been consistent with all the ASX Members of the Board and staff are responsible for Recommendations. A summary of the ASX upholding the goals -

REGISTRATION DOCUMENT MACQUARIE BANK LIMITLIMITEDEDEDED (ABN 46 008 583 542) (Incorporated with Limited Liability in the Commonwealth of Australia)

REGISTRATION DOCUMENT MACQUARIE BANK LIMITLIMITEDEDEDED (ABN 46 008 583 542) (Incorporated with limited liability in the Commonwealth of Australia) Registration Document of Macquarie Bank Limited dated 28 June 2010 pursuant to Section 12(1) sentence 3 of the German Securities Prospectus Act ( Wertpapierprospektgesetz ) CONTENTS Page IMPORTANT NOTICE.............................................................................................................3 BRIEF DESCRIPTION OF MACQUARIE BANK........................................................................5 FINANCIAL INFORMATION ....................................................................................................6 RISK FACTORS RELATING TO MACQUARIE BANK...............................................................7 INFORMATION ABOUT MACQUARIE BANK ........................................................................13 GENERAL INFORMATION....................................................................................................22 ANNEX I ....................................................................................................................... F-2009 ANNEX II ...................................................................................................................... F-2010 SIGNATURE PAGE ............................................................................................................ S-1 2 IMPORTANT NOTICE This Registration Document has not been, nor will be, lodged with the Australian Securities anandd Investments Commission -

PMI Offering Circular

OOOFFERINGOFFERING CIRCULAR Macquarie PMI LLC (a limited liability company formed in the State of Delaware ) UUU.U...SSSS....$$$$400,000,000400,000,000 Preferred Membership Interests guaranteed on a limited, subordinated and discretionary basis by Macquarie Group Limited (incorporated with limited liability in Australia ) (ABN 94 122 169 279) The U.S.$400,000,000 Preferred Membership Interests (the PMIsPMIs) will be unsecured and subordinated limited liability company interests of Macquarie PMI LLC (the IssuerIssuer). The PMIs will be Exchanged into fully paid preference shares (the Preference SharesShares) in the capital of Macquarie Group Limited (the GuarantorGuarantor) on the date that falls 25 years after the date on which the PMIs are issued (expected to be 2 December 2010, the Issue DateDate) or earlier in the circumstances as described in the terms and conditions of the PMIs (the PMI TermsTerms) and may be Redeemed by the Issuer prior to any Exchange in certain limited circumstances (see “ Terms and Conditions of the PMIs - clause 4 (“Redemption”) and clause 5 (“Exchange”) ”). The PMIs are not Redeemable or Exchangeable at the option of the holders of the PMIs (PMIPMI HolderHolderssss). The PMIs are non-cumulative and confer a right to distributions (each a DistributionDistribution) for the period commencing on (and including) the Issue Date at the rate of 8.375% per annum (see “ Terms and Conditions of the PMIs - clause 3 (“Distributions”) ”). Subject to the provisions of the PMI Terms relating to the deferral or non-payment thereof (including a discretion being exercised not to make the payment), Distributions will be payable on each PMI semi-annually in arrear on each six calendar month anniversary of the Issue Date commencing on the date falling six calendar months after the Issue Date and until (but excluding) the Redemption Date or Exchange Date for that PMI (see “ Terms and Conditions of the PMIs - clause 3 (“Distributions”) ”). -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 300 seats held by women by end 2021. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BRINGING TOGETHER INFLUENTIAL INDIVIDUALS AND FIRMS TO ADVOCATE FOR CHANGE ENSURES WE ACHIEVE MAXIMUM IMPACT. CHAIRS, NON-EXECUTIVE DIRECTORS, INVESTORS, INVESTMENT BANKERS AND HEAD HUNTERS ARE ALL PART OF THE BOARD APPOINTMENT PROCESS AND CAN ADOPT “A RIGOROUS APPROACH THAT FACILITATES THE INCREASED REPRESENTATION OF WOMEN ON BOARDS. Nicola Wakefield Evans, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30 per cent women on ASX 200 boards by the end of 2018. In March 2019 the Australian chapter announced a new objective for 30 per cent women on ASX 300 boards by the end of 2021. The 30% Club will continue to focus on the boards of ASX 200 companies that have not reached the 30 per cent target. -

ACSI Voting Report

Australian Council of Superannuation Investors Board Composition and Non-executive Director Pay in ASX200 Companies ACSI Annual Survey of S&P/ASX200 Board Composition and Non-executive Director Remuneration November 2016 About ACSI The Australian Council of Superannuation Investors (ACSI) is a collaboration of Australian superannuation funds and international asset owners, bound together by their common interests as long-term investors in the capital markets. The focus of ACSI’s research, policy and representation is environmental, social and governance (ESG) investment risks and opportunities. ACSI has 29 Australian superannuation fund members, who collectively manage over $450 billion in assets on behalf of over eight million Australian superannuation fund members and retirees. ACSI’s six international members are among the largest and most respected asset owners globally in terms of their approach to corporate governance. The Australian Council of Superannuation Investors Ground Floor 215 Spring Street Melbourne, 3000 Website: www.acsi.org.au This research report was compiled with the assistance of, and from data compiled by, Ownership Matters. About Ownership Matters Ownership Matters is an Australian governance advisory firm. Its principals have collective experience of over 30 years in advising institutional investors on governance issues at ASX listed companies. Ownership Matters Pty Ltd Level 5 167 Queen Street Melbourne, 3000 Website: www.ownershipmatters.com.au Foreword It is more than a decade and a half now since ACSI began its annual study of who controlled Australia’s largest companies, and how they remunerated themselves. Back then, the boards of the ASX100 were, as we noted and lamented, truly ‘male, pale and stale’.