Company Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Financial Statements Summary

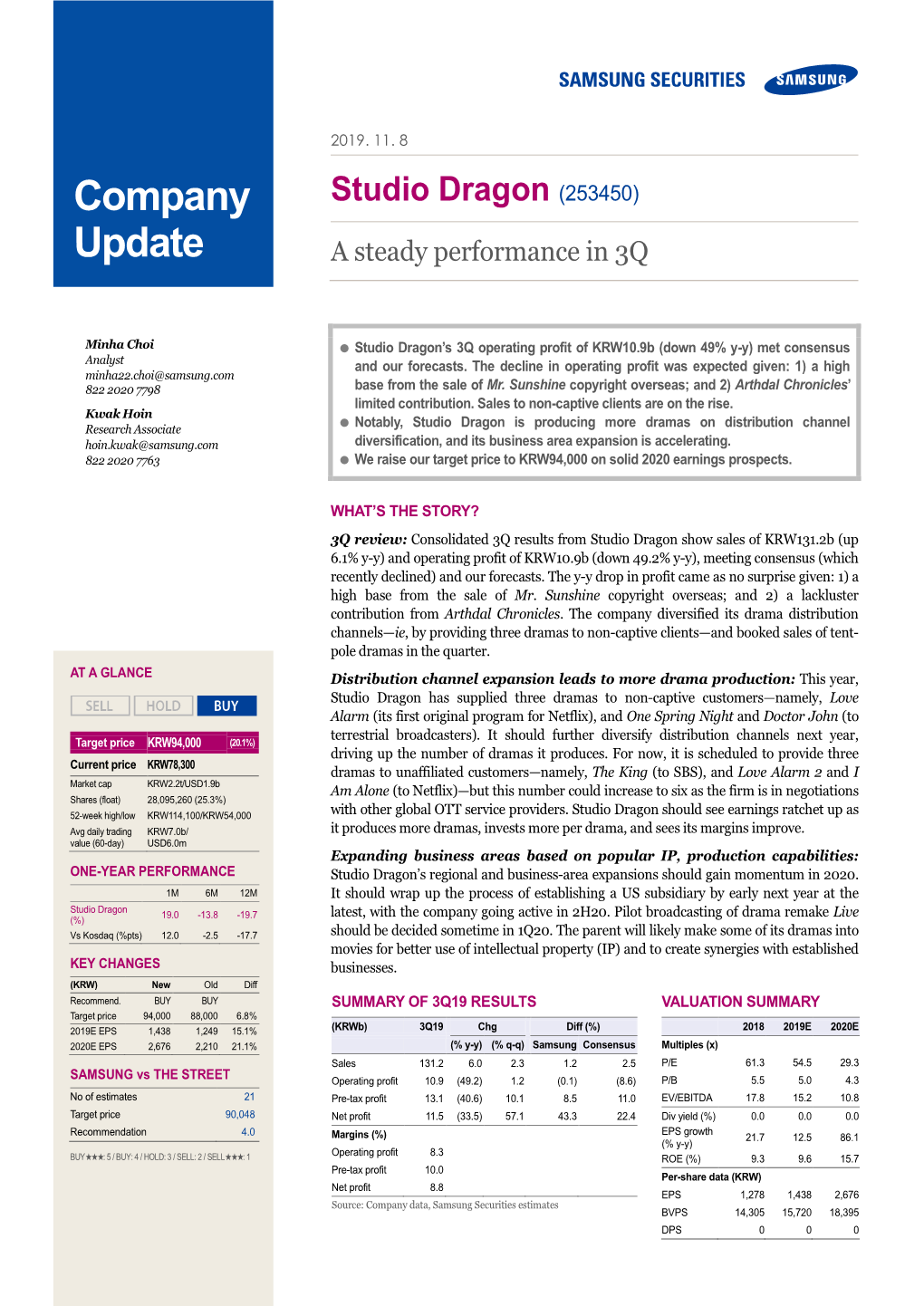

3Q 2019 Earnings Release Studio Dragon November 7, 2019 Disclaimer This financial information in this document are consolidated earnings results based on K-IFRS. This document is provided for the convenience of investors only, before the external audit on our 3Q 2019 financial results is completed. The audit outcomes may cause some parts of this document to change. In addition, this document contains “forward-looking statements” – that is, statements related to future, not past, events. In this context, “forward-looking statements” often address our expected future business and financial performance, and often contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks” or “will”. Our actual results to be materially different from those expressed in this document due to uncertainties. 3Q 2019 Earnings Release TABLE OF CONTENTS 1 3Q 2019 Highlights 2 3Q 2019 Operating Performance º Programing º Distribution º Cost 3 Growth Strategies Appendix We Create New Culture 1 3Q 2019 Highlights <Arthdal Chronicles> <Hotel Del Luna> <Miss Lee> <Watcher> <Mr. Temporary> <The Running Mates> <Love Alarm> (1) Programming Distribution Production Revenue Revenue Revenue Trend W131.2bn w60.8bn w60.0bn 13titles (YoY +6.0%) (YoY +24.4%) (YoY -5.4%) (YoY +5 titles) Note (1) Each quarter includes all titles in progress - 4 - We Create New Culture 12 3Q 2019 Operating Performance Summary 3Q19 Revenue (+6.0% YoY) – Hit a record high, driven by diversified business, premium IP, and expanded lineups OP (-49.2% YoY) – Maintained stable fundamentals amid last year’s high-base <Mr. Sunshine> and BEP of <Arthdal Chronices> 4Q19 Aim to reinforce influence via titles incl. -

Studio Dragon (253450) Update Fundamental S to Improve in 2020

2019. 10. 31 Company Studio Dragon (253450) Update Fundamental s to improve in 2020 ● The business environment in Korea and overseas is moving favorably for the Minha Choi media industry—eg , OTT platforms are launching around the world, a number of Analyst Korean players are engaging in M&A activity, and terrestrial broadcasters are [email protected] investing more heavily in tent-pole content. These developments should lead to 822 2020 7798 more demand for quality content, which bodes well for content producers in 2020. Kwak Hoin ● Studio Dragon should enjoy greater earnings stability by producing multi-season Research Associate original content for OTT services. It may produce content for both Netflix and new [email protected] global players. Terrestrial broadcasters are also eager to secure quality content. 822 2020 7763 ● Capitalizing on its popular intellectual property and production prowess, the firm has been expanding into new business areas and should see solid top- and bottom-line growth next year. We raise our 12-month target price to KRW88,000. WHAT’S THE STORY? Poised to benefit from sea change in media market: The business environment has been changing quickly at home and abroad. Several global giants are preparing to launch OTT platforms from November, and, in response, Korean OTT service providers are teaming up to boost their competitiveness. Struggling from low viewership ratings, the country’s three terrestrial broadcasters have altered programming lineups and in AT A GLANCE September launched OTT platform Wavve in partnership with SK Telecom—the latter a move that may lead to greater investment in tent-pole dramas. -

The Story of Astronomy

www.astrosociety.org/uitc No. 42 - Spring 1998 © 1998, Astronomical Society of the Pacific, 390 Ashton Avenue, San Francisco, CA 94112. The Story of Astronomy Mindy Kalchman University of Toronto Lorne Brown Storyteller It was dark. The night sky hung clear over the tiny city in the valley; the stars awesome in their brilliance. A small group of men stood on the top of the hill, looking across the city and the valley to another hill on the other side, some fifteen kilometers away. There, a similar group had assembled, their lights flickering in the distance. "We're ready," said the leader of the first group, a bearded man with intense eyes. "Check your lantern." What was happening? Was this a covert military operation? A band of thieves and robbers plotting plunder? Actually, it was a scientific experiment. The leader was the great Galileo himself, who would later be denounced for claiming that the Earth revolves around the Sun. The experiment was simplicity itself: a lantern would be uncovered on one hill. Fifteen kilometers away, a second lantern would be uncovered, shining back to the first. Light would have thus traveled thirty kilometers, twice across the valley where the Italian city of Florence nestled. By timing how long it took the light to travel this distance, Galileo could calculate the speed of light. He was going to catch the ghost of the universe! Oral traditions have since time immemorial satisfied generations of children and adults with stories of wonder, fantasy, truth, and mystery. Stories are irreplaceable stimulants for the imagination and an often endless source of entertainment. -

Bay Colt; Ghostzapper

Hip No. Consigned by De Meric Sales, Agent 1 Bay Filly Harlan . Storm Cat Harlan’s Holiday . {Country Romance {Christmas in Aiken . Affirmed Bay Filly . {Dowager February 5, 2013 Tiznow . Cee’s Tizzy {Favoritism . {Cee’s Song (2009) {Chaste . Cozzene {Purity By HARLAN’S HOLIDAY (1999), [G1] $3,632,664. Sire of 9 crops, 56 black type wnrs, $45,751,850, 3 champions, including Shanghai Bobby ($1,857,- 000, Breeders’ Cup Juv. [G1], etc.) and Into Mischief [G1] ($597,080), Majesticperfection [G1], Pretty Girl [G1] (to 3, 2014), Willcox Inn [G2] ($1,015,543), Mendip [G2] ($895,961), Summer Applause ($814,906). 1st dam FAVORITISM, by Tiznow. Unraced. This is her first foal. 2nd dam Chaste, by Cozzene. 4 wins at 4 and 5, $193,952, 3rd Ballston Spa Bree- ders’ Cup H. [G3]. Sister to Call an Audible. Dam of-- Golubushka. Winner at 3, 9,500 euro in France. Total: $12,751. 3rd dam PURITY, by Fappiano. Winner at 3 and 4, $35,335. Dam of 8 winners, incl.-- Chaste. Black type-placed winner, see above. Call an Audible. 3 wins at 3 and 4, $147,453, 3rd Molly Pitcher Breeders’ Cup H. [G2] (MTH, $33,000). Producer. Mexicali Rose. Winner at 2, $24,240. Dam of 6 winners, including-- Baileys Beach. 8 wins, 2 to 5, $177,515, 3rd Maryland Juvenile Cham- pionship S.-R (LRL, $5,500). 4th dam DAME MYSTERIEUSE, by Bold Forbes. 10 wins in 19 starts at 2 and 3, $346,245, Black-Eyed Susan S.-G2, Bonnie Miss S., Holly S., Treetop S., Forward Gal S., Old Hat S., Mademoiselle S., 2nd Acorn S.-G1, Spec- tacular Bid S., 3rd Ashland S.-G2. -

Wormwood Review

OH WORMIE, YOU'VE TURNED SEVENTEEN... The Wormwood ReviewVolume 5,Number 1IssueSeventeenEditor: MarvinMalone ArtEditor: A.SypherGuest editor,this issue:Allen DeLoachNew YorkRepresentative: HaroldBriggs1965, Wormwood ReviewPress The poets and poems in this anthology are repre sentative of the diverse activity reverberating at the Cafe Le Metro on New York's Lower East Side. Being a center of poetry, rather than a school, Le Metro nur tures the most vital facet of the creative arts: the right and the opportunity to present the created without any form of censorship or pre-judgment. Le Metro not only has the importance of having completely open and permissive readings, but presents, one night a week, a feature reader. Each of the feature readers has either previously obtained recognition in the field of writing, or has shown definite, noticeable growth in that di rection. Since the first of these readings in February of 1963, a random choice of writers that have made an appearance is Gilbert Sorrentino, Joel Oppenheimer, Diane diPrima, Gregory Corso, Denise Levertov, John Weiners, Lawrence Ferlinghetti, LeRoi Jones, Brion Gyson, William Burroughs, etc. The list could continue, and then be added to a similar list of prominent poets who frequently participate in the weekly open readings. However, it is not the elite who profit through the Cafe Le Metro movement. It is the neophytes, shaping their thoughts and molding their voices, who profit mainly through the - availability of associations with poets, such as alien Ginsberg, who always manage to give the extra minutes asked of them. Let it suffice to say that Le Metro offers to any person on any level what he comes for honestly,pri marily because its patrons have made it that way and because its patrons, would like to keep it that way. -

Nchor Newspapers

Rhode Island College Digital Commons @ RIC The Anchor Newspapers 12-9-1954 The Anchor (1954, Volume 27 Issue 04) Rhode Island College of Education Follow this and additional works at: https://digitalcommons.ric.edu/the_anchor Recommended Citation Rhode Island College of Education, "The Anchor (1954, Volume 27 Issue 04)" (1954). The Anchor. 185. https://digitalcommons.ric.edu/the_anchor/185 This Book is brought to you for free and open access by the Newspapers at Digital Commons @ RIC. It has been accepted for inclusion in The Anchor by an authorized administrator of Digital Commons @ RIC. For more information, please contact [email protected]. NCHOR Vol. XXVII, No.~,.;;:==;._.--- RHODE ISLAND COLLEGE OF EDUCATION December 9, 1954 1 PROFESSORSFLASH THERE IS A NEED CHANGE! by Louise Hass an TAKE LEAVE Word has been received from Rhode Island College of Education has made vast progress during During the next semester we the editors of Who's Who Among STUNT NIGHT the hundred years of its existence. The College was once a mere idea Students in American Universities in the minds of educators. During a forty year period these men and shall be missing some of the fam- will be held women struggled to make a dream a reality. A Normal Department iliar faces of our faculty. Prof. and Colleges that eight students Frank E. Greene and Dr. Helen January 14, 1955 was established at Brown University in 1850. Funds were appropriated have been accepted to represent appro E. Scott intend to spend the semes for a Normal School in Providence in 1854. In 1857 when the the College of Education in the Henry Barnard Auditorium ter in study. -

Cultural Production in Transnational Culture: an Analysis of Cultural Creators in the Korean Wave

International Journal of Communication 15(2021), 1810–1835 1932–8036/20210005 Cultural Production in Transnational Culture: An Analysis of Cultural Creators in the Korean Wave DAL YONG JIN1 Simon Fraser University, Canada By employing cultural production approaches in conjunction with the global cultural economy, this article attempts to determine the primary characteristics of the rapid growth of local cultural industries and the global penetration of Korean cultural content. It documents major creators and their products that are received in many countries to identify who they are and what the major cultural products are. It also investigates power relations between cultural creators and the surrounding sociocultural and political milieu, discussing how cultural creators develop local popular culture toward the global cultural markets. I found that cultural creators emphasize the importance of cultural identity to appeal to global audiences as well as local audiences instead of emphasizing solely hybridization. Keywords: cultural production, Hallyu, cultural creators, transnational culture Since the early 2010s, the Korean Wave (Hallyu in Korean) has become globally popular, and media scholars (Han, 2017; T. J. Yoon & Kang, 2017) have paid attention to the recent growth of Hallyu in many parts of the world. Although the influence of Western culture has continued in the Korean cultural market as well as elsewhere, local cultural industries have expanded the exportation of their popular culture to several regions in both the Global South and the Global North. Social media have especially played a major role in disseminating Korean culture (Huang, 2017; Jin & Yoon, 2016), and Korean popular culture is arguably reaching almost every corner of the world. -

Semester to Wrap up on Musical Note

Volume 83 Number 12 Northwestern College, Orange City, IA December 10, 2010 Hays granted Exhibit brings competition, appreciation BY KATE WALLIN NW Student Art Exhibit, which event.” experience. We’re trying too hard to prestigious CONTRIBUTING WRITER opened this week in Dordt’s The joint exhibit is a tradition be meaningful and artsy sometimes. As finals week approaches, Campus Center Art Gallery. The 12 years in the making. Every year, Not to imply that art shouldn’t be acceptance the end of the semester brings exhibit, open daily from 8 a.m. to 10 over 50 pieces of student art are serious, but sometimes we have the always-expectant stress and p.m., offers a wide range of pieces submitted for consideration by a to step back a bit and make fun BY KATI HENG overwhelming schedules. Hours from all mediums and boasts a panel of student jurors. A team of of ourselves or we’ll get too self- OPINION EDITOR in the library, sleepless nights and unique atmosphere crafted by three NW jurors reviewed Dordt’s absorbed; therefore, octopus.” Senior Greta Hays has been excessive amounts of caffeinated students for students. submissions, while a group from Drawing pieces from different selected for a prestigious arts courage are reason enough to make Professor Rein Vanderhill said, Dordt selected NW’s contributions mediums, the show includes management internship at the us consider getting away, if only for “The students are totally on their to the show. paintings, drawings, mixed Kennedy Center in Washington, a short while. own when they make the selections “The pieces I entered were the media, printmaking, photography, D.C. -

Four New Korean Dramas Coming to Viu in April

Four new Korean dramas coming to Viu in April Viu-ers can enjoy simulcast, first-on-Viu and exclusive Korean drama series in April including Great Real Estate, Taxi Driver, Dark Hole and Summer Guys PCCW (SEHK:0008) – HONG KONG/SINGAPORE, March 23, 2021 – Viu, PCCW’s leading pan-regional OTT video streaming service, presents its exciting Korean content lineup for April, featuring four drama series for Viu-ers to enjoy. New titles include Great Real Estate, Taxi Driver, Dark Hole and Summer Guys. First-on-Viu, supernatural drama Great Real Estate will premiere in April. The series follows Hong Ji Ah, the owner of a real estate agency who has a special ability. Not only does she have beauty and brains but she can also see spirits and exorcise them. Hence, her agency focuses on acquiring troubled properties to flip a profit from them. She meets Oh In Bum, a quick-witted con-artist who does not believe in the existence of ghosts, but uses them to scam others out of their wealth. Jang Na Ra, known for An Empress’ Dignity and V.I.P., plays Hong Ji Ah. The series, directed by PD Park Jin Suk (School 2017), also stars lead singer of K-pop boy band CN Blue, Jung Yong Hwa. Also first-on-Viu, Taxi Driver will premiere in April and tells the story of Kim Do Ki, a Navy Officer whose life changes when his mother is murdered by a serial killer. Although he may seem like your typical taxi driver, Kim Do Ki works for the Rainbow Taxi Company, which helps provide revenge for victims whom the justice system has failed. -

Lois Lee Harlan Seyfer, Historian Plattsmouth Main Street Association

BETWEEN THE PAGES Plattsmouth Public Library, 401 Ave A, Plattsmouth, NE 68048 Phone 402-296-4154 Fax 402-296-4712 Volume 20 Issue 1 January 2020 Happy New Year! Photos from Holiday Party! Page 2 Between the Pages January 2020 Library Supervisor Job Opening The City of Plattsmouth is accepting applications for a full-time Library Supervisor at the Plattsmouth Public Library. Must be comfortable with computers and people; bending and lifting required. Must have a mini- mum of 2 years of college or 1-2 years of related experience and/or training; library training preferred. 40 hrs/wk with benefits. Applications are available at City Hall, 136 N. 5th St., Plattsmouth, NE 68048, or online at https://www.plattsmouth.org/index.php/homepage/job-opportunities. Return applications and signed job description to City Hall. If after hours, place it in the utility payment drop box. Position open until filled. Sub- ject to veterans preference. EOE. Schedule Laser Cutter Training The library has a laser cutter capable of etching on wood, glass, ceramic tiles, cork, metals, and many other materials. It can be used by anyone who has completed the one-hour training session. Call the library, 402-296-4154, ext. 24, to schedule train- ing or to reserve time to work on your projects. You don’t need to have a library card or even live in Plattsmouth to use it. It can be used for personal or business purposes, so think about how you might benefit from the opportunity! Charge Your Device While You Browse! Now you can charge your phone, tablet, iPad, Kindle, or other device while you’re browsing or working on the computer in the Plasmouth Public Library. -

Studio Dragon (253450 KQ) Changes to Market Environment to Be Favorable

Studio Dragon (253450 KQ) Changes to market environment to be favorable Media 3Q19 preview: Operating profit of W10.9bn For 3Q19, we forecast Studio Dragon to deliver consolidated revenue of W131.9bn (+6.6% YoY) and operating profit of W10.9bn (-49.6%). Both of these figures are largely Company Report in line with the market consensus over the past month. While profit likely declined YoY October 8, 2019 due to a high base effect (programming/content sales of Mr. Sunshine), licensing revenue likely remained strong on the back of the firm’s robust production capabilities. 1) Studio Dragon will recognize revenue from Love Alarm, the firm’s first Netflix (NFLX US/CP: US$274.46) original drama (production costs of around W1bn per episode; eight (Maintain) Buy episodes in total; margins of around 10%). 2) Designated Survivor: 60 Days and Arthdal Chronicles were licensed to Netflix. 3) Hotel Del Luna was sold across various regions and platforms, but some of the revenue may be recognized in the next quarter due to Target Price (12M, W) 87,000 holdbacks in certain territories. Share Price (10/07/19, W) 65,800 Quarterly OP remains around W10bn For 4Q, we expect Studio Dragon to post operating profit of W10.7bn. Melting Me Expected Return 32% Softly and Emergency Love Landing are anticipated to draw high viewer ratings in the quarter, and the firm’s second Netflix original series, I Holo You, may be released at year-end. For the time being, the firm’s quarterly profit will likely stay at around W10bn, due to: 1) stagnant licensing fee growth (Netflix) despite rising production OP (19F, Wbn) 43 costs; 2) the high costs of producing original series (around W1bn per episode); and 3) Consensus OP (19F, Wbn) 48 slowing programming revenue growth (tvN). -

Kenna Record, 08-22-1913 Dan C

University of New Mexico UNM Digital Repository Kenna Record, 1910-1921 New Mexico Historical Newspapers 8-22-1913 Kenna Record, 08-22-1913 Dan C. Savage Follow this and additional works at: https://digitalrepository.unm.edu/kenna_news Recommended Citation Savage, Dan C.. "Kenna Record, 08-22-1913." (1913). https://digitalrepository.unm.edu/kenna_news/179 This Newspaper is brought to you for free and open access by the New Mexico Historical Newspapers at UNM Digital Repository. It has been accepted for inclusion in Kenna Record, 1910-1921 by an authorized administrator of UNM Digital Repository. For more information, please contact [email protected]. E NNA RECORD. VOL. 7. KENNA, CHAVES COUNTY, NEW MEXICO, FRIDAY, AUGUST 22, 1913. NO. 27. "I'm sorry I don't know what to black striped flannels and the stripes GOOD DESSERT FOR SUMMER AT THE WHITE FARM say !". stammered Jack Fenway con- ran around and around in the most WITH FOREIGN FLAVOR tritely. "I was looking at the moun- heart-breakin- g manner; and Jack Fen- tain peak yonder and thought I had a way's head was shaved and he looked Pies That Make a Fitting Ending to clear road ahead but that's no 'ex- very much like a convict the Dinner Served During the ORIENTAL. DI8HE3 WORTH ADD- Hot Days. Story of the Troubles of Two cuse." as he faced the obdurate cousin of the "No, it isn't. Tou see this is an un- girl he loved. ING TO THE MENU. Girl Farmers, Their.Pigs usual hog we were raising It for the "See what you have done, Ger- Fruit Pie Mix half a tablespoonful county, fatr; we have toiled all sum- trude," his reproachful glance seemed of arrowroot with a little cold water and Lovers.