Workpoint Entertainment PCL

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

C NTENT 2018 L

28 May-10 june C NTENT 2018 www.contentasia.tv l www.contentasiasummit.com Discovery takes StarHub carriage row to Singapore viewers 11 channels in danger as renewal talks deadlock, new StarHub head Peter K could arrive on 9 July to a smouldering TV mess Discovery took its carriage renewal negotiations public this morning in an aggressive campaign designed to whip up public support for its channels in Sin- gapore – and (clearly) to pressure local platform StarHub into softening its current stand against the renewal of an 11-chan- nel bundle. As of today, seven Discovery channels are scheduled to go dark on 30 June, with the newly acquired four-channel Scripps bouquet headed into the abyss at the end of August. Discovery says it has already been for- mally notified by StarHub that its channels are not being renewed. In a response this morning, StarHub didn’t mention any formal notice, saying only that “we are in renewal negotia- tions... and we are doing everything pos- sible to arrive at a deal which would allow Discovery and StarHub to continue our partnership while offering our customers the same content at a reasonable price”. StarHub isn’t coming into this public fight with no firepower, saying it is acquiring fresh content to replace Discovery “in the event that negotiations prove unsuc- cessful”. Several new channels are in the works “to ensure our customers will continue to enjoy access to a good range of educa- tion and lifestyle channels,” StarHub says. Read on: page 2 C NTENTASIA 28 May-10 june 2018 Page 2. -

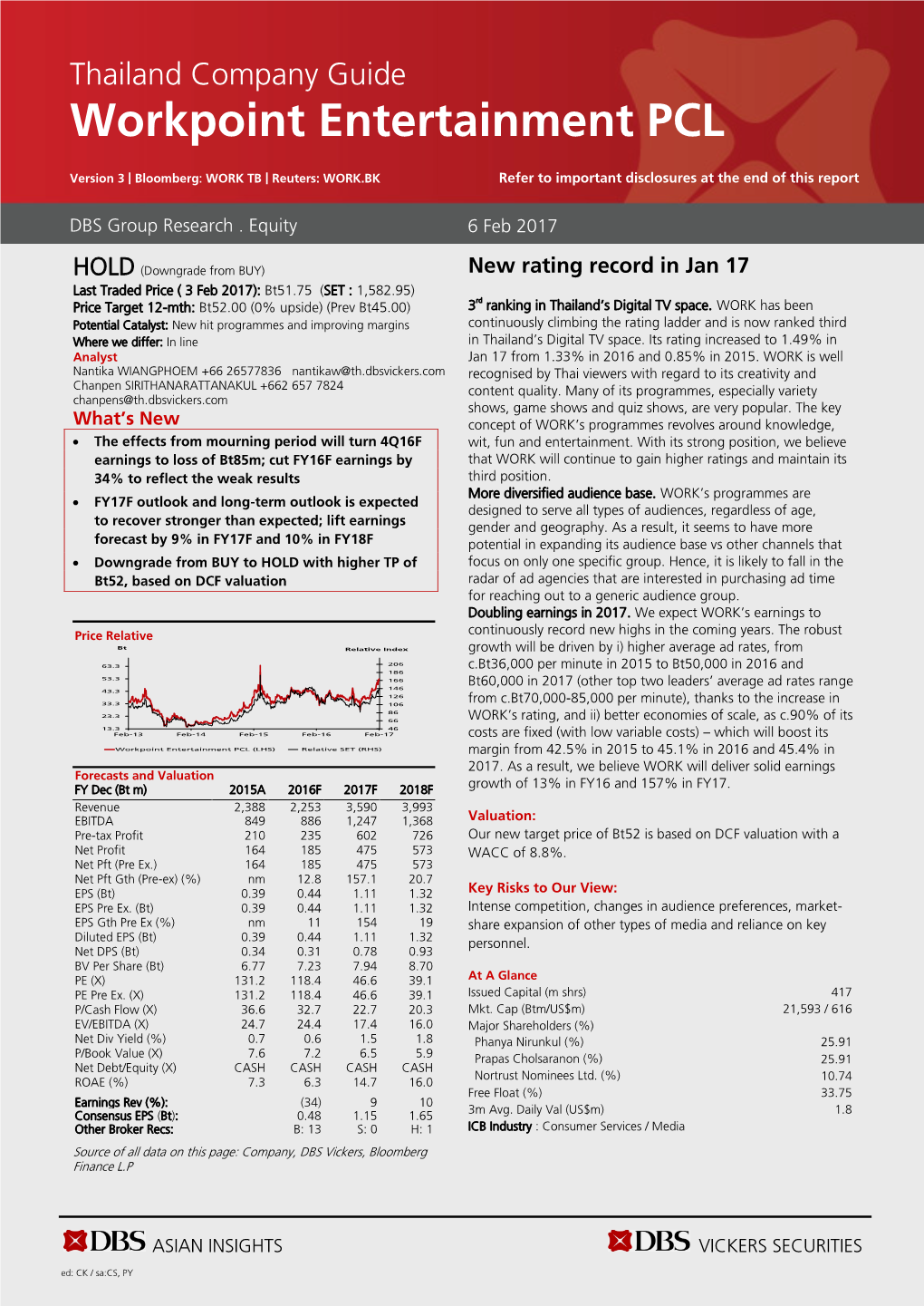

Workpoint Entertainment Target Price: THB60.00 Price: THB53.00 the Best Variety TV Channel in Thailand Market Cap: Usd631m Bloomberg Ticker: WORK TB

Company Update Thailand 9 February 2017 Communications | Media Buy (Maintained) Workpoint Entertainment Target Price: THB60.00 Price: THB53.00 The Best Variety TV Channel In Thailand Market Cap: USD631m Bloomberg Ticker: WORK TB We continue to rate Workpoint as our Top Buy in the media sector with a Share Data new DCF-based THB60.00 TP (from THB46.00, 13% upside) on its: Avg Daily Turnover (THB/USD) 58.6m/1.65m 1. Well-known new style creativity and innovative TV content; 52-wk Price low/high (THB) 28.5 - 53.3 2. Impressive increase in its TV rating to 1.48 in Jan-17, which is already above its full year target of 1.4; Free Float (%) 34 3. Raising assumptions for TV rating to 1.55 and ad rates to Shares outstanding (m) 417 THB67,000/min (+20% YoY); Estimated Return 13% 4. Successful penetration of social media viewers; 5. Exponential future earnings growth. Shareholders (%) Prapas Cholsaranon 25.9 Workpoint Entertainment’s (Workpoint) TV rating hit an all-time high at Phanya Nirankul 25.9 1.48 during January, exceeding its full year target of 1.4, thanks to the overwhelming popularity of its several new programmes particularly The Mask Mindo Asia Investments Limited 10.7 Singer Thailand (Figure 4). The rating of The Mask Singer Thailand now stands Share Performance (%) at 8.38, higher than that of any prime-time drama series – the country’s mainstream programmes – aired currently. The Mask Singer Thailand Season YTD 1m 3m 6m 12m 1 generated THB100,000/minute(min) of ad rates. -

Workpoint Entertainment

COMPANY UPDATE Thailand Workpoint Entertainment (WORK.BK/WORK TB)* Neutral‧Maintained ประมาณการ 3Q61: กาไรจะเพํ มขิ่ นึ้ QoQ แต่ลดลง YoY Price as of 8 Nov 2018 32.25 Event 12M target price (Bt/shr) 34.25 ประมาณการผลประกอบการงวด 3Q61 Unchanged/Revised up(down)(%) (31.5) lmpact Upside/downside (%) 6.2 อตราการขายเวลาโฆษณาและอั ตราคั ่าโฆษณาทลดลงจะฉดใหี่ ุ ้กาไรในํ 3Q61 ลดลง 66% YoY Key messages เราคาดวากาไรส่ ํ ุทธิของ WORK ใน 3Q61 จะอยทู่ ี่ 127 ลานบาท้ (+10% QoQ, -66% YoY) โดยกาไรทํ ี่ เราคาดกาไรสํ ุทธิของ WORK ในงวด 3Q61 ที่ 127 ลานบาท้ เพ่ิมข้ึน QoQ จะมาจากรายไดท้ ี่เพ่ิมข้ึน 11% QoQ ตามการขายเวลาโฆษณาของ Workpoint TV ที่คาดวา่ (+10% QoQ, -66% YoY) โดยกาไรทํ ี่เพ่ิมข้ึน QoQ จะมาจาก จะเพ่ิมข้ึนจาก 53% ใน 2Q61 เป็น 60% ในขณะที่คาดวาส่ ดสวนั ่ คาใช่ จายในการขายและบร้ ่ ิหาร/ รายไดท้ ี่เพ่ิมข้ึน 11% QoQ ของชองเว่ ิร์คพอยท ์ ทีวี ตามเรตติ้ง ยอดขายจะลดลงจาก 24.7% ใน 2Q61 เป็น 21.4% แตเม่ ื่อเทียบ YoY กาไรในํ 3Q61 จะถูกกดดนจากั ที่เพ่ิมข้ึน แตเม่ ื่อเทียบ YoY กาไรในํ 3Q61 จะถูกกดดนจากั รายไดท้ ี่ลดลง 16% YoY เพราะคาดมีอตราการขายเวลาั รายไดท้ ี่ลดลง 16% YoY เพราะคาดอตราการขายเวลาโฆษณาลดลงจากั 71% ใน 3Q60 และ อตราคาั ่ โฆษณา และอตราคาโฆษณาลดลงั ่ เราไดปร้ ับลดประมาณการ โฆษณาลดลง 9% YoY จาก 82,000 บาท/นาที ใน 3Q60 กาไรปํ ี 2561-62 ลง เนื่องจากกาไรของํ WORK ในงวด 9M61 อยทู่ ี่ 410 ลานบาท้ ที่คาด จะคิดเป็นสดสวนเพั ่ ียง 49% ของ เรายงเปั ็นห่วงว่า WORK จะรักษาเรตติงไว้ ้ได้หรือไม่หลงหยดออกอากาศรายการกั ุ ฬาี ประมาณการกาไรปํ ีน้ีท้งปั ีของเราเทาน่ ้นั ซ่ึงภายหลงการปรั ับ เราคาดวาอ่ ตราการขายเวลาโฆษณาทั ี่เพ่ิมข้ึน QoQ ใน 3Q61 ตามเรตติ้ง (24 ชม.) ของชองเว่ -

Workpoint Entertainment PCL

Thailand Company Guide Workpoint Entertainment PCL Version 5 | Bloomberg: WORK TB | Reuters: WORK.BK Refer to important disclosures at the end of this report DBS Group Research . Equity 26 Apr 2017 BUY (Upgrade from HOLD) The show must go on Last Traded Price ( 25 Apr 2017): Bt53.50 (SET : 1,562.27) Upgrade from HOLD to BUY with a higher TP of Bt62. WORK Price Target 12-mth: Bt62.00 (16% upside) (Prev Bt52.00) has been continuously climbing the rating ladder and is now Potential Catalyst: New hit programmes and improving margin ranked third in Thailand’s digital TV space. Its rating increased to Where we differ: Below consensus due to more conservative costs 1.55% in March 2017, from 1.33% in 2016 and 0.85% in Analyst 2015. WORK is well recognised by Thai viewers for its creativity Nantika WIANGPHOEM +66 26577836 [email protected] and content quality. Many of its programmes, especially variety shows, game shows and quiz shows, are very popular. The key What’s New concept of WORK’s programmes revolves around knowledge, 3Q17E core earnings expected to rise to Bt83m wit, fun and entertainment. With its strong position, we believe (+190% y-o-y); fully recover from 4Q16 loss that WORK will continue to gain higher ratings and maintain its third position. Regarding the newest information received from New hit programmes have enhanced overall the company, we have reflected the better-than-expected ratings and ad rates; revised earnings forecast to outlook in terms of the average ad rates in our forecast. -

Biography Cyril Takayama Born and Raised in Los Angeles, California and Now Based in Tokyo, Japan, Cyril Epitomizes the 21St Century Entertainer

Biography Cyril Takayama Born and raised in Los Angeles, California and now based in Tokyo, Japan, Cyril epitomizes the 21st century entertainer. Fascinated with magic from his youth, he became one of the early pioneers of street magic and known for his ability to be an effective story teller. Television Appeared in over 16 prime time TV specials in Japan an in two TV series in over 26 countries 2009: Starred in a 3-part English language TV special titled “Cyril, Simply Magic,” in partnership with Sony Pictures Entertainment Networks Asia’s AXN channel 2011: Filmed 16th Japanese prime time TV special with Fuji TV 2012: Starred and served as executive producer of a new TV series, in partnership with Charis Entertainment, Sony-owned AXN Asian and AXN Mystery Japan Launched “Cyril’s Family Vacation” 2014: Premiered “Magiculous Rio,” which was filed entirely in Rio der Janeiro, Brazil. Street Magic Traveled extensively sharing his magic and visiting various places from Brazil to India, to China and Indonesia, to Italy and Australia, among many other places Live Tour 2007: 35-city tour throughout Japan 2015: Cyril World Tour 2015 The Secret Tokyo Cyril Magic Up Close & Personal World Tour in Macau The Secret 2015 World Tour in Osaka 2016: Cyril Magic Up Close & Personal Live in Hong Kong Cyril Magic Up Close & Personal Live in Bangkok Recognition - 2007: Recognized by his peers in the magic community at the 39th Annual Academy of Magical Arts Awards, AKA the “Academy Awards of Magic. He was voted “Magician of the Year” (same category as David Copperfield and Seigfried & Roy). -

ANNUAL REPORT 2017 Financial Highlights Financial Highlights (Unit: Thousand Baht) 2014 2015 2016 2017

ANNUAL REPORT 2017 Financial Highlights Financial Highlights (Unit: Thousand Baht) 2014 2015 2016 2017 Revenues Revenue from television programs 1,843,211 2,124,549 2,416,210 3,478,354 Revenue from animation and computer graphic 14,122 5,050 268 535 Revenue from movies 20,625 20,117 - - Revenue from concerts and plays - 167,923 118,145 184,330 Revenue from event marketing 169,533 108,063 116,357 138,010 Revenue from management fee 150 60 Revenue from sale of goods and rendering of other services 5,307 8,000 15,925 51,213 Other income 57,138 20,376 26,420 24,998 Share of gain of investments in joint ventures 52,009 14,430 2,139 -12,840 Total revenues 2,161,943 2,468,507 2,695,614 3,864,661 Total costs 1,433,824 1,375,861 1,504,750 1,741,278 Selling and Administrative expenses 661,153 763,681 823,039 859,618 Net Profit -16,021 150,341 198,631 904,089 Financial Position Current Assets 1,288,336 1,760,674 1,725,621 2,676,586 Total assets 4,985,067 5,588,357 5,422,405 6,447,772 Liabilities 3,306,141 2,801,687 2,435,899 2,004,348 Equity 1,678,926 2,786,670 2,986,506 4,443,424 2 (Unit: Thousand Baht) 2014 2015 2016 2017 Financial Ratio Current Ratio (Times) 1.4 1.6 1.8 2.2 Debt to Equity Ratio (Times) 2.0 1.0 0.8 0.5 Gross Profit (%) 30.2 43.5 43.6 54.8 Net Profit (%) -0.7 6.1 7.4 23.5 Return on Assets (%) -0.4 2.8 3.7 14.0 Return on Equity (%) -1.0 6.8 6.7 20.3 Earnings per Share -0.0 0.4 0.5 2.1 Dividend per Share 0.44 0.34 0.27 1.388 * Dividend Payout Ratio to Net Income (%) 73% 81% 81% 77%* * Notes The Board of Directors the meeting No.1/2018 on February 26,2018. -

Dimensional ETF Trust Form N-CSRS Filed 2021-07-09

SECURITIES AND EXCHANGE COMMISSION FORM N-CSRS Certified semi-annual shareholder report of registered management investment companies filed on Form N-CSR Filing Date: 2021-07-09 | Period of Report: 2021-04-30 SEC Accession No. 0001193125-21-211771 (HTML Version on secdatabase.com) FILER Dimensional ETF Trust Mailing Address Business Address 6300 BEE CAVE ROAD 6300 BEE CAVE ROAD CIK:1816125| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1031 BUILDING ONE BUILDING ONE Type: N-CSRS | Act: 40 | File No.: 811-23580 | Film No.: 211082792 AUSTIN TX 78746 AUSTIN TX 78746 512-306-7400 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-CSR CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES Investment Company Act file number 811-23580 DIMENSIONAL ETF TRUST (Exact name of registrant as specified in charter) 6300 Bee Cave Road, Building One, Austin, TX 78746 (Address of principal executive offices) (Zip code) Catherine L. Newell, Esquire, President and General Counsel Dimensional ETF Trust, 6300 Bee Cave Road, Building One, Austin, TX 78746 (Name and address of agent for service) Registrants telephone number, including area code: 512-306-7400 Date of fiscal year end: October 31 Date of reporting period: April 30, 2021 Explanatory Note: Pursuant to an Agreement and Plan of Reorganization, on June 11, 2021, each of the Tax-Managed U.S. Equity Portfolio, Tax-Managed U.S. Small Cap Portfolio, Tax-Managed U.S. Targeted Value Portfolio and T.A. U.S. -

C NTENTASIA Data • Buyers •

programming • schedules • C NTENTASIA data • buyers • www.contentasia.tv Issue 125: 1 August-4 September 2011 Summer Break! Asia media unites behind CSR push ContentAsia is taking its regular Summer break in Climate change campaign kicks off at ATF 2011 August. The next issue will be The Asia-Pacific Media Alliance A keynote address will be fol- published on 5 September. for Social Awareness kicks off its lowed by a panel discussion on Wishing you all a very happy media leaders forum series on 7 “the role and responsibility of downtherabbithole Summer! December in Singapore with a media companies in affecting high-level discussion on climate positive social action and be- change and the media in the haviour change on the critical What’s really going on what’sinside region. issues relating to climate change The inaugural Media Leaders facing the region today”. out there... AsiaContentWatch Forum on Climate Change takes Participants will include broad- Oli gives away Ricky’s $$ Bangkok Broadcasting & TV centre stage as the opening cast, publishing, online and ad- on Singapore streets (Channel 7), Thailand session of this year’s regional vertising companies. ContentAsia’s in-depth look at content market, the Asia Televi- Organisers say the aim is to Here’s something to remem- what goes where on channel sion Forum (ATF). show how socially responsible ber: if a taxi driver asks you schedules in Asia The session is co-organised by content and campaigns can what the biggest organ of the page 12 Reed Exhibitions, ContentAsia lead to partnerships that provide human body is, say “skin”. -

Download Catalogue

ENTERTAINMENT ID LUCKY NUMBER Entertainment Lab 4 COMEDY COMBAT Yellow Film & TV 5 CRACK THEM UP Studio Kvartal 95 6 BLACK SHEEP Workpoint Entertainment 7 U:SUPPORTERS Uncle Ned 8 QUEUE UP Sera Film Services 9 BEAT THE CHAMPIONS TV Asahi 10 ULTIMATE BRAIN Nippon TV 11 THE ENTREPRENEURS Sagafilm 12 MY WAY KBS 13 POP SPORT Idea Asia Media/La Competencia 14 SPELLFIE BIC Formats 15 HIDE & SEEK TV Tokyo 16 MY 5000 FRIENDS Veranda Film 17 Headquarters +46 8 55 60 93 80 Gamla Brogatan 26 111 20 Stockholm Sweden 3 3 Everyone has a lucky number - but is that lucky number found in their ID? This action-packed game show aims to find out! ID Lucky Number is a hit new game show where contestants compete in a set of stun- GENRE Game show ning games on a gigantic LED floor using the number on their ID card. It can be their LENGTH social security, driver’s license or even their passport. 60 min Six players are randomly chosen from the studio audience. They go through different TIME SLOT rounds of fun and challenging games with each round ending in players eliminated in 4 Prime time search of the lucky contestant who will play in the Final Round. BROADCASTERS The luck of the players rests on their own ID number. But is it lucky enough to take them Channel 9 MCOT (Thailand) all the way to the Final Round and win the Jackpot? RIGHTS HOLDER Entertainment Lab and MCOT Launched in 2016 in Thailand, ID Lucky Number is a certified hit. -

Workpoint Entertainment (WORK TB) Buy (Maintained) Communications - Media Target Price: THB50.00 Market Cap: Usd339m Price: THB42.00

Company Update, 19 December 2014 Workpoint Entertainment (WORK TB) Buy (Maintained) Communications - Media Target Price: THB50.00 Market Cap: USD339m Price: THB42.00 Macro Risks อันดับสามในแงของเรตติ้งในกลุมผูประกอบการโทรทัศนภาคพื้นดิน Growth Value คาด WORK ฟนตัวอยางมีนัยสําคัญในรอบป 2558 ดวยอานิสงสจากงบโฆษณาที่ Workpoint Entertainment (WORK TB) Price Close Relative to Stock Exchange of Thailand Index (RHS) เพิ่มขึ้น ธุรกิจทีวีดิจิตอลเริ่มทํากําไรและอัตราสวนกําไร/การดําเนินการที่เริ่มฟนตัว เรา 52.0 150 ยังคงแนะนํา “ซื้อ” ที่ราคาเปาหมายเทากับ 50.00 บาท (19.1% upside) โดยอิงจาก 47.0 139 คา WACC 10%, Terminal Growth 2% ซึ่งคาดวากําไรจะเติบโตถึง 315% และ 46% ในรอบป 2558/59 (y-o-y) ตามลําดับ 42.0 127 ♦ เนนกลยุทธไปยังชองดิจิตอลของตัวเองมากยิ่งขึ้น 37.0 116 หลังจากไดรับใบอนุญาตในการดําเนินการชองทีวีดิจิตอลในเดือนเมษายน WORK 32.0 104 ประสบความสําเร็จในแงของการผันตัวเองจากชองโทรทัศนดาวเทียมเขาสูระบบ 27.0 93 ดิจิตอลทีวี (Workpoint Creative TV, WPTV) ซึ่งเปนอันดับสามในแงของ สัดสวนทางการตลาดรองจากชอง 7 และชอง 3 ซึ่งบริษัทวางเปารายไดจากชอง 22.0 81 ทีวีดิจิตอลเพิ่มขึ้นเปน 1.8-1.9 พันลานบาทในรอบป 2558 ซึ่งไดรับการจายจาก 17.0 70 บริษัทโฆษณามูลคา 1 พันลานบาทแลว 8 7 6 ♦ ปอนเพียง 4 รายการใหชอง 3 เทานั้น 5 4 3 กอนที่จะไดรับใบอนุญาตดําเนินการชองของตัวเอง WORK เคยเปนผูผลิตรายการ 2 ชั้นนําใหชองรายการฟรีทีวีทั้ง 4 แหง แตเริ่มตั้งแตป 2558 จะมีการผลิตเพียง 4 1 Vol m รายการใหชอง 3 เทานั้น ดังนั้น เราจึงคาดวารายไดจากธุรกิจผลิตคอนเทนตจะ ลดลงเปน 350-400 ลานบาทในป 2558 จากเดิม 1.32 พันลานบาทในป 2557 Apr-14 Oct-14 Jun-14 Feb-14 Dec-13 Aug-14 และ 1.48 พันลานบาทในป -

Workpoint TV and Thairath TV

Social TV: Communication from Television to Facebook (Workpoint TV and Thairath TV) 2171176218 NIDA E-THESIS 6011831001 dissertation / recv: 21072563 10:54:34 seq: 67 Pornchai Chanvisatlak A Dissertation Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy (Communication Arts and Innovation) The Graduate School of Communication Arts and Management Innovation National Institute of Development Administration 2019 2171176218 NIDA E-THESIS 6011831001 dissertation / recv: 21072563 10:54:34 seq: 67 2171176218 NIDA E-THESIS 6011831001 dissertation / recv: 21072563 10:54:34 seq: 67 Social TV: Communication from Television to Facebook (Workpoint TV and Thairath TV) Pornchai Chanvisatlak The Graduate School of Communication Arts and Management Innovation Major Advisor 2171176218 (Associate Professor Asawin Nedpogaeo, Ph.D.) The Examining Committee Approved This Dissertation Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy (Communication Arts and Innovation). NIDA E-THESIS 6011831001 dissertation / recv: 21072563 10:54:34 seq: 67 Committee Chairperson (Associate Professor Kullatip Satararuji, Ph.D.) Committee (Associate Professor Asawin Nedpogaeo, Phd) Committee (Sikares Sirakan, Ph.D.) Dean (Professor Yubol Benjarongkij, Ph.D.) ______/______/______ v ABST RACT ABSTRACT Title of Dissertation Social TV: Communication from Television to Facebook(Workpoint TV and Thairath TV) Author Pornchai Chanvisatlak Degree Doctor of Philosophy (Communication Arts and Innovation) 2171176218 Year 2019 The study on Social TV: Communication from Television to Facebook (Workpoint NIDA E-THESIS 6011831001 dissertation / recv: 21072563 10:54:34 seq: 67 TV and Thairath TV) is a mixed method research, comprising of content analysis on ThairathTV’s official Facebook page and interviews the operator on their content selection and their transmedia production process in order to publicize their television content on the official Facebook page, as well as the interaction of the users. -

MEDIA KIT 2O19 a Global Media Powerhouse, We Consistently Look to World Screen Is Moving at Light Speed Today

WS_MEDIAKIT_2019_ALT2_MEDIA_KIT 6/8/18 2:37 PM Page 2 PRINTADVERTISING RATES “It is important to have a reliable and substantive publication such as “We are increasingly a business without borders, as the international Advertisers (U.S. DOLLARS/GROSS) 108 Media Dentsu Entertainment Ledafilms Serious Lunch market continues to grow in scope and importance for all areas of 41 Entertainment Deutsche Welle Legendary Television Sesame Workshop World Screen available as a source for information. The magazine’s 4K Media DHX Media LFP Broadcasting Shaftesbury Films FOUR COLOR 1X 4X 8X 12X 9 Story Media Group dick clark productions Intl. Licensing Expo Silver Wolf International entertainment. As this global footprint grows, we look to the journalism A+E Networks DIEN QUAN Media & Entertainment Like It or Love It Productions Sinking Ship Entertainment reporting is always on the cutting edge of the global TV business.” A+E Networks Latin America DIRECTV Latin America Limelight Design Sixteen South Full Page $3,200 $3,000 $2,850 $2,700 AB International Distribution DISCOP Africa Lightning Entertainment Sky Vision and insight from World Screen to put it all in perspective.” ABC Commercial Discovery Enterprises Intl. Lightning International Small World IFT Two Page Spread 6,400 6,000 5,700 5,400 —Jeffrey Bewkes, Chairman and CEO, Time Warner, U.S.A. About Premium Content Discovery Networks Intl. Lionsgate Smilehood Media ABS-CBN Corporation Discovery Networks LatAm Looking Glass International Smithsonian Networks 1/2 Page 2,050 1,900 1,800 1,700 —Leslie