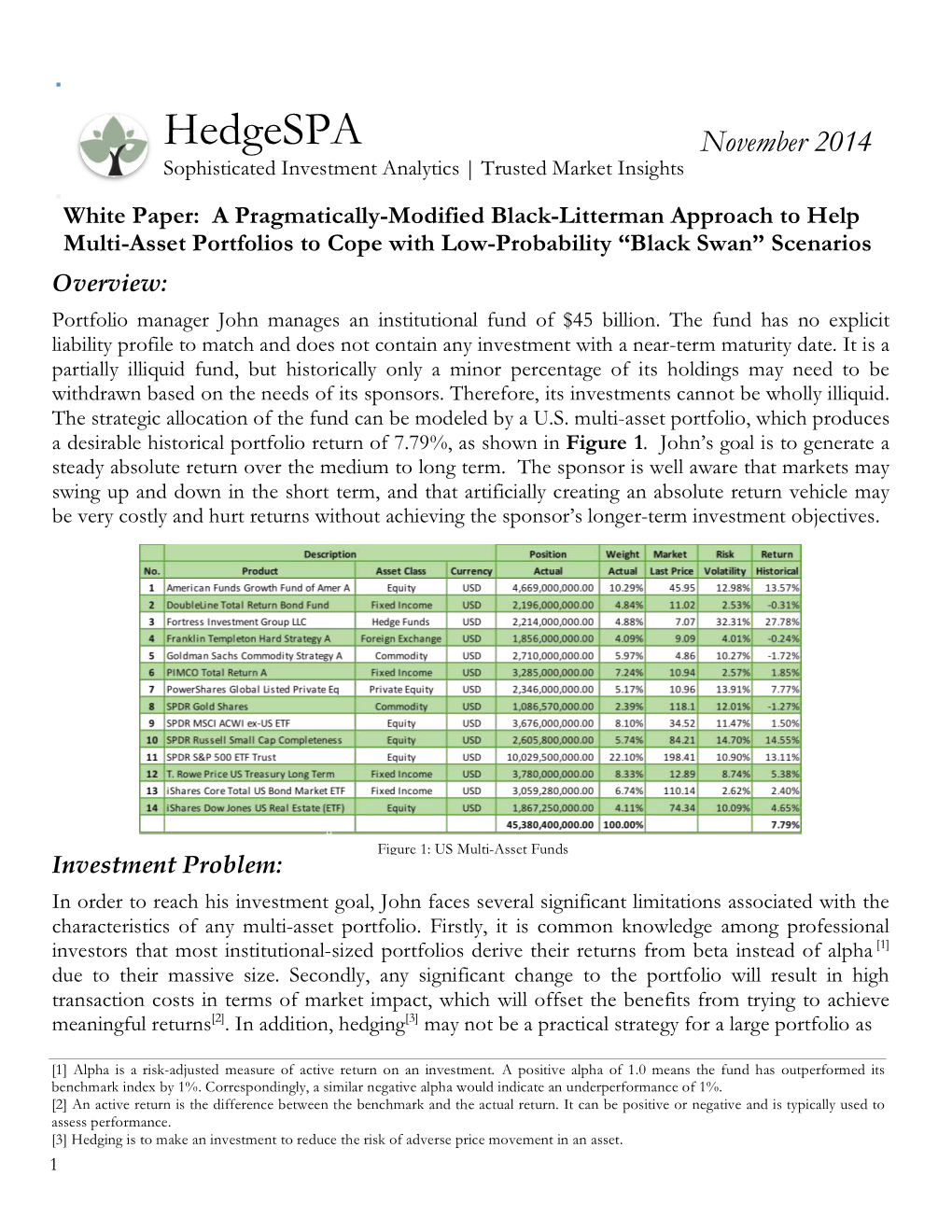

Investment Problem: in Order to Reach His Investment Goal, John Faces Several Significant Limitations Associated with the Characteristics of Any Multi-Asset Portfolio

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vulture Hedge Funds Attack California

JUNE 2019 HEDGE PAPERS No. 67 VULTURE HEDGE FUNDS ATTACK CALIFORNIA "Quick profits for Wall Street" versus safe, sustainable, affordable energy PG&E was plunged into bankruptcy after decades of irresponsible corporate practices led to massive wildfires and billions in new liabilities. Some of the most notorious hedge fund vultures are using their role as investors to make sure PG&E’s bankruptcy leads to big profits for their firms—at the expense of ratepayers, public safety and the environment. CONTENTS 4 | Vulture Hedge Funds Attack 10 | Meet the Billionaires and Vultures Preying on PG&E – Andrew Feldstein – Joshua S Friedman – Paul Singer – Dan Loeb – Jay Wintrob – Seth Klarman – Richard Barrera 17 | How Californias Will Get Hurt – Impact on Public Safety – Impact on Ratepayers – box: Lessons from Puerto Rico 20 | Sustainability / Climate 22 | Protect Californias —And All Americans—From Predatory Hedge Funds 24 | Hedge Funds Should Be Illegal – table: Hedge Funds That Own One Million or More Shares of PG&E 28 | About Hedge Clippers 29 | Press + General Inquiry Contacts MEET HEDGE FUNDS PUTTING THEIR 1 BILLIONS TO WORK IN HARMFUL WAYS Over three dozen hedge funds are attacking California’s biggest utility. SEVEN BILLIONAIRES AND VULTURES are leading the charge. They're treating control of PG&E as up for grabs while climate crisis wildfires rage and customers pay through the nose. The Answer: Outlaw hedge funds. Andrew Feldstein CEO, BlueMountain Capital 2 3 4 Paul Singer Dan Loeb Jay Wintrob Elliott Management Third PointCapital Oaktree -

Vulture Funds and the Fresh Start Accounting Value of Firms Emerging from Bankruptcy

Vulture Funds and the Fresh Start Accounting Value of Firms Emerging from Bankruptcy Miles Gietzmann University of Bocconi, Italy Helena Isidro ISCTE-IUL Instituto Universitário de Lisboa, Portugal Ivana Raonic Cass Business School, City, University of London, UK Abstract: We study how distress-oriented hedge funds (vulture funds) play an important role in the fresh start valuation of firms emerging from Chapter 11 reorganization.. We find that loan-to-own vultures acquire debt positions of the distressed firm that grant dominant power in the bankruptcy negotiations, and they then use the discretion allowed by fresh start accounting to introduce valuation bias in their favor. We show that the strategic influence over fresh start values can create opportunities to increase vulture investors’ returns at the expense of other claim holders. Keywords: distress, bankruptcy, valuation, hedge fund, reporting discretion. JEL: G14, G23, G33, M41 1 1. INTRODUCTION Active hedge funds have an important role in the resolution of Chapter 11 bankruptcies. They can influence the reorganization negotiations and shift control rights in their favor (Hotchkiss and Mooradian, 1997; Kahan and Rock, 2009; Jiang et al., 2012; Lim, 2015; Ivashina et al., 2016). However, how distress-oriented hedge funds achieve that influence is unclear. While finance research underlines the positive effects of hedge fund involvement (e.g., quick recovery from bankruptcy, greater debt reduction, and more efficient contracting, Lim, 2015), legal studies argue that distressed-oriented -

Financing for Development in the Era of COVID-19 and Beyond Menu of Options for the Considerations of Ministers of Finance Part II

Financing for Development in the Era of COVID-19 and Beyond Menu of Options for the Considerations of Ministers of Finance Part II SEPTEMBER 2020 Table of Contents EXTERNAL FINANCE, REMITTANCES, JOBS AND INCLUSIVE GROWTH .............1 Discussion Group I: Executive Summary ...............................................................2 Discussion Group I: Menu of Options .....................................................................8 RECOVERING BETTER FOR SUSTAINABILITY ....................................................32 Discussion Group II: Executive Summary ............................................................33 Discussion Group II: Menu of Options ..................................................................39 GLOBAL LIQUIDITY AND FINANCIAL STABILITY ................................................51 Discussion Group III: Executive Summary ...........................................................52 Discussion Group III: Menu of Options .................................................................55 DEBT VULNERABILITY .......................................................................................80 Discussion Group IV: Executive Summary ...........................................................81 Discussion Group IV: Policy Options ....................................................................83 PRIVATE SECTOR CREDITORS ENGAGEMENT ...................................................97 Discussion Group V: Executive Summary ............................................................98 Discussion -

Drop-It-6-VULTURES-FINAL

DRWinter 2013 OP iT! Stop the debt vultures Design by www.foundation-gd.co.uk. Printed on 100% recycled paper. Cover photo: Alex Sigal/Flickr, Richard Towell/Flickr, RevAngel Designs THE VULTURE THREAT They’re the financial speculators chasing obscene profits from debt crises around the world. Again and again – from Argentina to Zambia, Liberia to Greece, Congo to the Co-op Bank – vulture funds have shown how our financial system allows money to be made from the most distressing situations, while governments sit back and declare ‘that’s just the way things are’. In recent years there’s been a fightback. A handful of countries have bravely fought the vultures through the courts. Our campaigning has brought a landmark UK law protecting 40 impoverished countries from the most outrageous vulture tactics in British courts. And this protection has been extended to shady UK tax havens not covered by the original law. But for most countries, the vulture threat still remains – and this year it has deepened. In a New York court case dubbed the ‘debt trial of the century’, they’ve won a victory that threatens to send one country back in time to a massive debt default, and put all others, rich and poor, on warning that future debt crises will be almost impossible to resolve. It’s time governments stopped accepting vulture funds as a fact of life. It’s time to clip their wings once and for all. SCAVENGING FROM POVERTY the poorest in society, and inequality deepening as a result. But the first thing In Buenos Aires, the capital of Argentina, many countries have encountered as they there is a Museum of Foreign Debt. -

Private Equity and Zambia Olufunmilayo B

Northwestern Journal of International Law & Business Volume 29 Issue 3 Summer Summer 2009 Vultures, Hyenas, and African Debt: Private Equity and Zambia Olufunmilayo B. Arewa Northwestern University School of Law Follow this and additional works at: http://scholarlycommons.law.northwestern.edu/njilb Part of the Tax Law Commons Recommended Citation Olufunmilayo B. Arewa, Vultures, Hyenas, and African Debt: Private Equity and Zambia, 29 Nw. J. Int'l L. & Bus. 643 (2009) This Article is brought to you for free and open access by Northwestern University School of Law Scholarly Commons. It has been accepted for inclusion in Northwestern Journal of International Law & Business by an authorized administrator of Northwestern University School of Law Scholarly Commons. Vultures, Hyenas, and African Debt: Private Equity and Zambia Olufunmilayo B. Arewa* TABLE OF CONTENTS I. The Globalization of Private Equity ...................................................... 643 A. Donegal v. Zambia: Vulture Funds in Africa ................................. 643 B. Private Equity in International Perspective .................................... 647 II. Governance and Scavenging: Vultures and Hyenas in Africa .............. 651 A. African Institutional Frameworks: Sovereigns, Performance, and T yranny ............................................................................ 651 B. The Slave Trade, the Colonial State, and African Institutions ....... 655 C. African Sovereigns and Commerce: Business History, Models, and Current Conditions .......................................................... -

From Puerto Rico to the Dublin Docklands;

FROM PUERTO RICO TO THE DUBLIN DOCKLANDS; Vulture funds and debt in Ireland and the Global South Debt and Development Coalition Ireland (DDCI) is a membership organisation working for global financial justice. This report was commissioned by DDCI and written by Dr. Michael Byrne. Please send any comments or enquiries to [email protected] Contents 1. Introduction 2 2. Vulture funds: speculating on debt and crisis 3 3. Vulture funds and sovereign debt in the global south 4 4. The vultures come to Europe 6 4.1) The European financial crisis: an investment opportunity for vulture funds 6 4.2) Ireland’s great property give away 8 4.3) Understanding the risks posed by vulture funds in Ireland 9 4.4) The role of the Irish government in attracting vulture funds 10 5. Vulture funds, distressed debt and global financialization 12 6. Clipping the vulture’s wings: recommendations 14 6.1) Vulture funds in the global south: recommendations 14 6.2) Vulture funds in Ireland: recommendations 15 6.3) Financial crisis and distressed debt 16 Annex 1. Case Studies 17 Annex 2. Further Reading 20 G3092 Vulture Funds Report FINAL.indd 1 1/12/16 12:55 PM 1. Introduction Vulture funds have become familiar to those Despite the problems and risks associated with this kind of concerned with debt justice over recent decades. investment the Irish government has whole-heartedly embraced Because of their speculative strategies and negative vulture funds. Indeed the latter’s aggressive entry into the impacts on sovereign debt restructuring, they have Irish market could not have occurred without two major public come to symbolize the highly unequal and unjust nature financial institutions: the Irish Banking Resolution Corporation of sovereign debt. -

An Analysis of Argentina's 2001 Default

CIGI PAPERS NO. 110 — OCTOBER 2016 AN ANALYSIS OF ARGENTINA’S 2001 DEFAULT RESOLUTION MARTIN GUZMAN AN ANALYSIS OF ARGENTINA’S 2001 DEFAULT RESOLUTION Martin Guzman Copyright © 2016 by the Centre for International Governance Innovation The opinions expressed in this publication are those of the author and do not necessarily refect the views of the Centre for International Governance Innovation or its Board of Directors. This work is licensed under a Creative Commons Attribution — Non-commercial — No Derivatives License. To view this license, visit (www.creativecommons.org/ licenses/by-nc-nd/3.0/). For re-use or distribution, please include this copyright notice. Centre for International Governance Innovation, CIGI and the CIGI globe are registered trademarks. 67 Erb Street West Waterloo, Ontario N2L 6C2 Canada tel +1 519 885 2444 fax +1 519 885 5450 www.cigionline.org TABLE OF CONTENTS iv About the Global Economy Program iv About the Author 1 Acronyms 1 Executive Summary 1 Introduction 3 The Path to the 2001 Default Crisis 4 Macroeconomic Performance in the Post-default Era 4 The First Two Rounds of Restructuring: 2005 and 2010 11 The Legal Disputes 15 Implications for Sovereign Lending Markets 17 Conclusions 19 Appendix 21 Works Cited 24 About CIGI 24 CIGI Masthead CIGI PAPERS NO. 110 — OCTOBER 2016 ABOUT THE GLOBAL ECONOMY ABOUT THE AUTHOR PROGRAM Addressing limitations in the ways nations tackle shared economic challenges, the Global Economy Program at CIGI strives to inform and guide policy debates through world-leading research and -

Sovereign Defaults in Court Henrik Enderlein

Working Paper Series Julian Schumacher, Christoph Trebesch, Sovereign defaults in court Henrik Enderlein No 2135 / February 2018 Disclaimer: This paper should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the authors and do not necessarily reflect those of the ECB. Abstract For centuries, defaulting governments were immune from legal action by foreign creditors. This paper shows that this is no longer the case. Building a dataset covering four decades, we find that creditor lawsuits have become an increasingly common feature of sovereign debt markets. The legal developments have strengthened the hands of creditors and raised the cost of default for debtors. We show that legal disputes in the US and the UK disrupt government access to international capital markets, as foreign courts can impose a financial embargo on sovereigns. The findings are consistent with theoretical models with creditor sanctions and suggest that sovereign debt is becoming more enforceable. We discuss how the threat of litigation affects debt management, government willingness to pay, and the resolution of debt crises. Keywords: Sovereign default, enforcement, government financing, debt restructuring regime JEL codes: F34, G15, H63, K22 ECB Working Paper Series No 2135 / February 2018 1 Non-technical summary This paper provides novel empirical evidence that creditor lawsuits have become a significant cost of sovereign default. Based on a newly collected dataset, we show that creditor lawsuits against defaulting governments have proliferated, with far-reaching consequences for government willingness to pay and for government access to international capital markets. This finding stands in contrast to the common view that sovereigns are largely immune from legal action by foreign creditors. -

Why Is the Exempt Market Flourishing?

CANADIAN JANUARY 2012 VOL 2 • ISSUE 1 exempt marketWatch canadianemwatch.com The winds of change Why Is the Exempt Market Flourishing? REVIEW OF ACCREDITED INVESTOR AND MINIMUM AMOUNT PROSPECTUS EXEMPTIONS 2011 in Review: Flow Through Shares Exempt Market News & Announcements In step with market needs At KPMG, we understand the asset management industry. Our integrated teams of Audit, Tax, and Advisory professionals help to provide our clients with an in-depth understanding of the markets in which they operate. Through our varied perspectives, we help our clients navigate the potential challenges and take advantage of new opportunities throughout the fund lifecycle—from value creation to realization. We provide leading professional services within the domestic and offshore alternative investments space, including hedge funds, venture capital funds, private equity funds, commodity pools, and infrastructure funds, and to the advisers who sponsor these investment vehicles. kpmg.ca © 2011 KPMG LLP, a Canadian limited liability partnership and a member fi rm of the KPMG network of independent member fi rms affi liated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. emCANADIAN Watch EXEMPT MARKET PRODUCTS The Exempt Markets are not new. But their continuing growth and success makes them a significant element in contemporary portfolio construction. Canadian-based Exempt Market securities are in the midst of rapid expansion, a trend that shows no signs of slowing. EM providers have a story to tell... investors need to get the whole story. We help Canada’s Exempt Market investors and managers tell the whole story with informed commentary and analysis from the leading professionals themselves. -

Editor's Note

Editor’s Note SUPERFICIALLY viewed, the global economy appears there are higher returns to be had elsewhere. to be in great shape. Last year, global gross domestic When such a reversal takes place, the impact on product (GDP) growth was at its strongest since 2011, the economy of the host developing country can be at 3.8%. Despite some headwinds, most pundits expect devastating. The collapse of prices, the fall in the value it to register a respectable growth rate this year. Even of the national currency and the crippling of economic those who concede that US President Donald Trump’s activity because of the climate of uncertainty will trade war is bound to have a dampening effect on growth debilitate the country’s economy. And in a globalised as a result of the climate of uncertainty it engenders are world, where developing-country economies are already still hopeful that it will still be a good year, even if not integrated into the global system, the impact cannot be quite as good as the last. confined to a single country. The turmoil in financial However, such a sanguine view appears to ignore markets will send shockwaves throughout the global some of the underlying fragilities that render the global economy and may well plunge the world into a financial economy more vulnerable than may seem apparent. Many crisis. developing countries are deeply in debt and the situation Developing countries experienced a foretaste of is reminiscent of the 1980s, which have gone down in this sort of shock impact recently. Western investors and history as ‘the lost decade’. -

How Distressed Debt Investors Decrease Debtor Leverage and the Efficacy of Business Reorganization

THOMAS GALLEYSFINAL 2/16/2011 12:05 PM TIPPING THE SCALES IN CHAPTER 11: HOW DISTRESSED DEBT INVESTORS DECREASE DEBTOR LEVERAGE AND THE EFFICACY OF BUSINESS REORGANIZATION INTRODUCTION Congress drafted chapter 11 of the Bankruptcy Code to provide a forum where creditors and business debtors enter the reorganization process with the common interest of maximizing returns to all creditors through the debtor’s rehabilitation,1 while preserving the going-concern value2 of the debtor.3 Contravening this purpose, chapter 11 also allows nontraditional creditors4 to buy claims5 at a steep discount once a business files for bankruptcy and to demand full payment of these claims.6 These nontraditional creditors are known as distressed debt investors7 or vulture funds.8 For the purposes of this Comment, “DDI” will be used to describe all parties that invest in distressed 1 Chaim J. Fortgang & Thomas Moers Mayer, Trading Claims and Taking Control of Corporations in Chapter 11, 12 CARDOZO L. REV. 1, 12–13 (1990) [hereinafter Fortgang & Mayer, Trading Claims]. 2 “Going concern value” is defined as the positive difference between the debtor’s liquidation value and value of the business in continued operation. See H.R. REP. NO. 95-595, at 223 (1977) (“[G]oing-concern value . is usually higher than the liquidation value of the business, because assets in operation can usually earn more than assets sold for scrap.”). 3 Id. at 220 (“The purpose of a business reorganization case, unlike a liquidation case, is to restructure a business’s finances so that it may continue to operate, provide its employees with jobs, pay its creditors . -

Distressed Mergers and Acquisitions

Wachtell, Lipton, Rosen & Katz DISTRESSED MERGERS AND ACQUISITIONS 2013 Summary of Contents Introduction ..............................................................................................................1 I. Out-of-Court Workouts of Troubled Companies ...............................................3 A. Initial Responses to Distress ........................................................................4 B. Out-of-Court Transactions ...........................................................................9 II. Prepackaged and Pre-Negotiated Bankruptcy Plans ........................................40 A. Prepackaged Plans .....................................................................................41 B. Pre-Negotiated Plans ..................................................................................46 C. Pre-Negotiated Section 363 Sales ..............................................................48 III. Acquisitions Through Bankruptcy ...................................................................48 A. Acquisitions Through a Section 363 Auction ............................................48 B. Acquisitions Through the Conventional Plan Process .............................101 IV. Acquisition and Trading in Claims of Distressed Companies .......................150 A. What Claims Should an Investor Seeking Control Buy? .........................150 B. What Rights Does the Claim Purchaser Obtain? .....................................154 C. Acquisition of Claims Confers Standing to Be Heard in a Chapter 11 Case