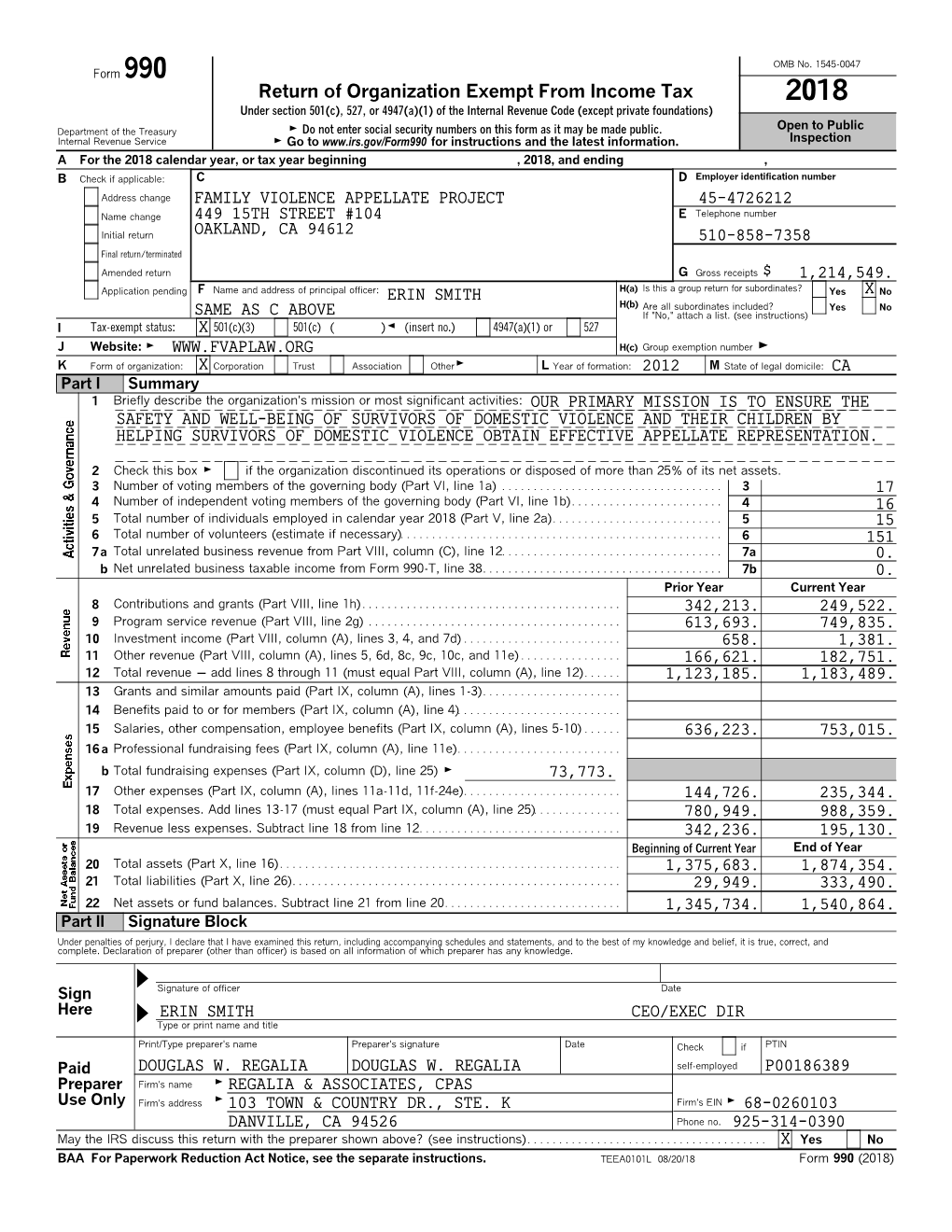

2018 Tax Returns

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Overview a Quarterly Publication of the San Francisco Office Market by the Axiant Group 1St Quarter 2020

Market Overview A quarterly publication of the San Francisco office market by The Axiant Group 1st Quarter 2020 multiple buildings in Oakland, three of which they owned. COVID-19 will undoubtedly change Kaiser sited construction costs and delays as the major the future of real estate. The 1st quarter factors in the decision, not COVID-19. Many felt the project lost significant momentum when its Kaiser’s Chairman and numbers do not reflect the shelter-in- CEO, Bernard Tyson, the chief activist and mentor for the place order as it went into effect just prior project, died in November at age 60. to the end of the quarter. Overall rents The sale of the Uptown Station remain stable, vacancy rates increased. (former Capwell’s/ Sears) project fell Vacancy Rate Increases, Rent Stable apart when the First quarter vacancy rates increased from an adjusted buyer, Blackstone 5.5% in the 4th quarter to 6.5% in the 1st quarter. Gross Group, walked away leasing activity decreased from 1,886,983 square feet in the from a $20 million 4th quarter to 1,037,496 square feet in the 1st quarter. Net deposit upon fears UPTOWN STATION, OAKLAND absorption was significantly lower and negative at -603,723 that the real estate square feet, compared to 4th quarter. With positive absorption of and finance markets would become shaky in the wake of 743,407 square feet. This represents a swing of over 1,300,000 the COVID-19 pandemic. The sale would have come in at square feet. over $1,000 per foot, $300 per foot higher than any other Average asking comparable real estate transactions in the Oakland market. -

Before the Public Utilities Commission of the State of California

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA Order Instituting Rulemaking to Implement Electric Utility Wildfire Mitigation Plans R.18-10-007 Pursuant to Senate Bill 901 (2018). (Filed October 25, 2018) CERTIFICATE OF SERVICE I hereby certify that, pursuant to the Commission’s Rules of Practice and Procedure, I have this day served a true copy RESPONSE OF LIBERTY UTILITIES (CALPECO ELECTRIC) LLC (U 933 E) TO ADMINISTRATIVE LAW JUDGE’S RULING SEEKING ADDITIONAL INFORMATION ON WILDFIRE MITIGATION PLANS AND NOTICE REGARDING THE LOCATION OF DOCUMENTS REFERENCED IN ITS WILDFIRE MITIGATION PLAN on all parties identified. Service was effected by one or more means indicated below: ☒ Transmitting the copies via e-mail to all parties who have provided an e-mail address. ☒ Placing the copies in sealed envelopes and causing such envelopes to be delivered by U.S. mail to the offices of the Assigned ALJ(s) or other addressee(s) on the service list without an e-mail address. ALJ Peter V. Allen ALJ Sarah R. Thomas CPUC CPUC 505 Van Ness Avenue, Room 5017 505 Van Ness Avenue, Room 5033 San Francisco, CA 94102-3214 San Francisco, CA 94102-3214 Executed February 26, 2019, at Downey, California. /s/ AnnMarie Lett AnnMarie Lett LIBERTY UTILITIES (California) 9750 Washburn Road Downey, CA 90241 CPUC - Service Lists - R1810007 Page 1 of 15 CPUC Home CALIFORNIA PUBLIC UTILITIES COMMISSION Service Lists PROCEEDING: R1810007 - CPUC - OIR TO IMPLEM FILER: CPUC LIST NAME: LIST LAST CHANGED: FEBRUARY 26, 2019 Download the Comma-delimited File About Comma-delimited Files Back to Service Lists Index Parties PETE SMITH ALI AMIRALI CITIZENS TRANSMISSION LLC STARTRANS IO, LLC 88 BLACK FALCON AVENUE, SUITE 342 591 W. -

2011 Annual Report

2011 COMPREHENSIVE ANNUAL Fl NANCIAL REPORT For the Fiscal Year Ended June 30, 2011 The Public Employees' Retirement Fund is a discretely presented component unit of the state of Indiana. PERF is a trust and an independent body, corporate and politic. The fund is not a department or agency of the state of Indiana, but is an independent instrumentality exercising essential governmental functions. (Indiana (ode Sections S-10.3-2- 1(b) and S-10.2-2-1). 2011 COMPREHENSIVE ANNUAL FINANCIAL REPORT For the Fiscal Year Ended June 30, 2011 The Public Employees' Retirement Fund is a disaetely presented component unit of the state of Indiana. Public Employees' Retirement Fund J1977 Police Officers' and Firefighters' Pension and Disability Fund I Judges' Retirement System State Excise Police, Gaming Agent, Gaming Control Officer, and Conservation Enforcement Officers' Retirement Plan Prosecuting Attorneys' Retirement Fund Jlegislators' Retirement System: Defined Contribution Plan and Defined Benefit Plan State Employees' Death Benefit Fund 1 Public Safety Officers' Special Death Benefit Fund 1 Pension Relief Fund Prepared By Public Employees ' Retirement Fund I One North Capitol, Suite 001Jindianapolis, IN 46204 Toll-free: (888) 526-1687 I ww1v.inprs.in.gov I [email protected] PUBLIC EMPLOYEES' RETIREMENT FUND 2011 COMPREHENSIVE ANNUAL FINANCIAL REPORT For the Fiscal Year Ended June 30, 2011 TABLE OF CONTENTS INTRODUCTORY SECTION Other Supplementary Information 06 letter of Transmittal 80 Administrative Expenses 12 Government Finance Officers -

Certificate of Service

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIAFILED 07/07/20 Order Instituting Investigation on the 04:01 PM Commission’s Own Motion into the Maintenance, Operations and Practices of Pacific Gas and Electric Company (U39E) with Respect to its Electric Facilities; and Investigation 19-06-015 Order to Show Cause Why the Commission Should not Impose Penalties and/or Other Remedies for the Role PG&E’s Electrical Facilities had in Igniting Fires in its Service Territory in 2017. CERTIFICATE OF SERVICE I, Thomas R. Del Monte, certify under penalty of perjury under the laws of the State of California that on Tuesday, July 07, 2020, I served a copy of the following on all parties on the attached list 19-06-015: • INTERVENOR COMPENSATION CLAIM OF THOMAS R. DEL MONTE Executed this Tuesday, July 07, 2020, at Walnut Creek, California. /s/ Thomas R. Del Monte 1555 Botelho Drive, #172 Walnut Creek, CA 94956 [email protected] 858-412-0738 Certificate of Service 1 1 / 4 CPUC - Service Lists - I1906015 https://ia.cpuc.ca.gov/servicelists/I1906015_86896.htm WENDY AL-MUKDAD HAYLEY GOODSON CALIF PUBLIC UTILITIES COMMISSION STAFF ATTORNEY SAFETY POLICY DIVISION THE UTILITY REFORM NETWORK AREA 4-A 785 MARKET ST., STE. 1400 505 VAN NESS AVENUE SAN FRANCISCO, CA 94103 SAN FRANCISCO, CA 94102-3214 ASHLEY VINSON CRAWFORD GEORGE D.(CHIP) CANNON, JR. AKIN GUMP STRAUSS HAUER & FELD LLP AKIN GUMP STRAUSS HAUER & FELD LLP 580 CALIFORNIA ST, SUITE 1500 580 CALIFORNIA STREET, STE. 1500 SAN FRANCISCO, CA 94104 SAN FRANCISCO, CA 94104 FOR: AD HOC COMMITTEE OF SENIOR FOR: AD HOC COMMITTEE OF SENIOR UNSECURED NOTEHOLDERS OF PACIFIC GAS UNSECURED NOTEHOLDERS OF PACIFIC GAS AND ELECTRIC COMPANY AND ELECTRIC COMPANY ALYSSA T. -

505 Montgomery Street, Suite 1000/1100, San Francisco, California, USA

505 Montgomery Street, Suite 1000/1100, San Francisco, California, USA View this office online at: https://www.newofficeamerica.com/details/serviced-offices-505-montgomery- street-suite-1000-1100-san-francisco-califo Fabulous facilities are available at this innovative business center located within a stunning 24 story building. Many first class facilities and services are available including cutting edge Internet access and professional, friendly reception services. In a great location well served by public transport links. Transport links Nearest railway station: San Francisco Shopping Center Nearest road: Nearest airport: Key features 24 hour access 24-hour security Access to multiple centres nation-wide Administrative support AV equipment Caterer services available Comfortable lounge Conference rooms Flexible contracts Furnished workspaces High speed internet Hot desking IT support available Kitchen facilities Meeting rooms On-site management support Open plan workstations Raised floors Reception staff Recycling facilities Telephone answering service Unbranded offices Virtual office available Voicemail Wireless networking Points of interest within 1000 metres Hilton San Francisco Financial District (hotel) - 165m from business centre Portsmouth Square (park) - 234m from business centre Saint Mary's Square (park) - 286m from business centre Maritime Plaza (common) - 362m from business centre Willie "Woo Woo" Wong Park (park) - 366m from business centre Notre Dame Des Victoires Church (place of worship) - 482m from business centre City Lights Bookstore -

3700 SF for Lease Prime San Francisco Restaurant

± 3,700 SF 424 Clay Street For Lease Prime San Francisco restaurant opportunity in highly trafficked Financial District Jones Lang LaSalle Brokerage, Inc. Real Estate License #: 01856260 Financial District • Highly trafficked area • Strong hotel and office driven demand: 2,500 hotel rooms and 15,534,764 SF of office space • Highly visible storefront CLUB QUARTERS HOTEL TRANSAMERICA PYRAMID • Existing liquor license • Kitchen equipment in place • Attached to a 346 room hotel • Strong partners: Blackstone owned and Club Quarters operated since 2003 • Robust neighborhood: Jackson Square, North Beach, Ferry Building • Co-tenancy: Popular restaurants such as Cotogna and Kokkari, famed galleries, and OMNI HOTEL EMBARCADERO CENTER emerging retailers such as Shinola Area Profile 0.5 miles 0.75 miles 1 mile Daytime Population 192,479 265,367 322,305 LE MERIDIEN HOTEL ONE MARITIME PLAZA DUNNE'S BROADWAY Offices NOTTINGHAM OSGOOD PL. DAVIS ST. DAVIS FRONT ST. BATTERY ST. BATTERY SANSOME ST. THE EMBARCADERO 1 444 Washington Street (415,805 SF) MONTGOMERY ST. MONTGOMERY PACIFIC AVE. 2 One Maritime Plaza (526,464 SF) ACSON 3 600 Montgomery Street (501,456 SF) SQUARE 4 655 Montgomery Street (445,500 SF) 5 1 Embarcadero Center (907,560 SF) JACKSON ST. COLUMBUS ST. 6 2 Embarcadero Center (708,300 SF) 424 Clay Street 7 3 Embarcadero Center (767,340 SF) 8 4 Embarcadero Center (973,575 SF) HOTALING PL. HOTALING 1 CUSTOM HOUSE PL. CUSTOM 9 50 California Street (703,000 SF) WASHINGTON ST. 10 100 California Street (273,988 SF) 4 2 11 505 Montgomery Street (348,000 SF) MARK TWAIN ST. MERCHANT ST. -

3700 SF for Lease Prime San Francisco Restaurant

± 3,700 SF 424 Clay Street For Lease Prime San Francisco restaurant opportunity in highly trafficked Financial District Jones Lang LaSalle Brokerage, Inc. Real Estate License #: 01856260 Financial District • Highly trafficked area • Strong hotel and office driven demand: 2,500 hotel rooms and 15,534,764 SF of office space • Highly visible storefront CLUB QUARTERS HOTEL TRANSAMERICA PYRAMID • Existing liquor license • Kitchen equipment in place • Attached to a 346 room hotel • Strong partners: Blackstone owned and Club Quarters operated since 2003 • Robust neighborhood: Jackson Square, North Beach, Ferry Building • Co-tenancy: Popular restaurants such as Cotogna and Kokkari, famed galleries, and OMNI HOTEL EMBARCADERO CENTER emerging retailers such as Shinola Area Profile 0.5 miles 0.75 miles 1 mile Daytime Population 192,479 265,367 322,305 LE MERIDIEN HOTEL ONE MARITIME PLAZA DUNNE'S BROADWAY Offices NOTTINGHAM OSGOOD PL. DAVIS ST. DAVIS FRONT ST. BATTERY ST. BATTERY SANSOME ST. THE EMBARCADERO 1 444 Washington Street (415,805 SF) MONTGOMERY ST. MONTGOMERY PACIFIC AVE. 2 One Maritime Plaza (526,464 SF) ACSON 3 600 Montgomery Street (501,456 SF) SQUARE 4 655 Montgomery Street (445,500 SF) 5 1 Embarcadero Center (907,560 SF) JACKSON ST. COLUMBUS ST. 6 2 Embarcadero Center (708,300 SF) 424 Clay Street 7 3 Embarcadero Center (767,340 SF) 8 4 Embarcadero Center (973,575 SF) HOTALING PL. HOTALING 1 CUSTOM HOUSE PL. CUSTOM 9 50 California Street (703,000 SF) WASHINGTON ST. 10 100 California Street (273,988 SF) 4 2 11 505 Montgomery Street (348,000 SF) MARK TWAIN ST. MERCHANT ST. -

Before the Public Utilities Commission of the State Of

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA FILED 04/26/21 04:59 PM Order Instituting Rulemaking to Review, Revise and Consider Alternatives to the Rulemaking 17-06-026 Power Charge Indifference Adjustment. CERTIFICATE OF SERVICE I hereby certify that I have on this date served a copy of the PUBLIC ADVOCATES OFFICE COMMENTS ON THE PROPOSED PHASE 2 DECISION ON POWER CHARGE INDIFFERENCE ADJUSTMENT CAP AND PORTFOLIO OPTIMIZATION to all known parties by either United States mail or electronic mail, to each party named on the official service list attached in R.17-06-026. An electronic copy was sent to the assigned Administrative Law Judge. Executed on April 26, 2021 at San Francisco, California. /s/ RACHEL GALLEGOS Rachel Gallegos 380195577 1 / 25 CALIFORNIA PUBLIC UTILITIES COMMISSION Service List PROCEEDING: R1706026 - CPUC - OIR TO REVIEW FILER: CPUC LIST NAME: LIST LAST CHANGED: APRIL 26, 2021 Parties BARBARA BOSWELL BETH VAUGHAN SAN JACINTO POWER OPERATIONS DIRECTOR EMAIL ONLY CALIFORNIA COMMUNITY CHOICE ASSOCIATION EMAIL ONLY, CA 00000 EMAIL ONLY FOR: SAN JACINTO POWER EMAIL ONLY, CA 00000 FOR: CALIFORNIA COMMUNITY CHOICE ASSOCIATION EVELYN KAHL KATHERINE HERNANDEZ GENERAL COUNSEL, CALCCA CITY OF PICO RIVERA CALIFORNIA COMMUNITY CHOICE ASSOCIATION EMAIL ONLY EMAIL ONLY EMAIL ONLY, CA 00000 EMAIL ONLY, CA 00000 FOR: PICO RIVERA COMMUNITY CHOICE FOR: ENERGY PRODUCERS AND USERS AGGREGATION COALITION KRISTY MORRIS MATT SKOLNIK CITY OF HERMOSA BEACH LOS ANGELES COUNTY EMAIL ONLY EMAIL ONLY EMAIL ONLY, CA 00000 EMAIL -

Calcca and DACC Comments on Draft Resolution E-5131

March 30, 2021 CPUC Energy Division Attn: Tariff Unit and Edward Randolph, Director 505 Van Ness Avenue San Francisco, CA 94102 By email: [email protected] Re: California Community Choice Association and Direct Access Customer Coalition Comments on Draft Resolution E-5131, Concerning Joint IOU Advice Letters in response to Decision 20-03-019 (PCIA Bill Presentation) Dear Tariff Unit and Mr. Randolph: Pursuant to General Order 96-B, and the Comment Letter dated March 10, 2021, California Community Choice Association1 (CalCCA) and the Direct Access Customer Coalition2 (DACC) (Joint Parties) submit these comments on draft resolution E-5131 (Draft Resolution). The Draft Resolution approves with modifications Pacific Gas and Electric Company’s Advice Letter 4302-G/5932-E, Southern California Edison Company’s Advice Letter 4280-E, and San Diego Gas & Electric Company’s Advice Letter 3600-E (Advice Letters). 1. Summary of CalCCA Position Joint Parties support implementing the proposed changes in the Advice Letters, as modified in the Draft Resolution, as soon as possible. Joint Parties disagree with Finding 5 that “Further changes to bundled customer bills are 1 California Community Choice Association was formed in 2016 as a trade organization to facilitate joint participation in certain regulatory and legislative matters in which members share common interests. CalCCA’s voting membership includes community choice aggregators (CCAs) serving load and others in the process of implementing new service, including: Apple Valley Choice Energy, -

April 25, 2008 Comments on the ALJ Ruling on Cost

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA Order Instituting Rulemaking Regarding Policies and Protocols for Demand Response, Load Impact Estimates, Cost-Effectiveness Rulemaking 07-01-041 Methodologies, Megawatt Goals and (January 25, 2007) Alignment with California Independent System Operator Market Design Protocols COMMENTS OF THE CALIFORNIA INDEPENDENT SYSTEM OPERATOR ON THE ALJ RULING REGARDING THE COST EFFECTIVENESS FRAMEWORK The California Independent System Operator Corporation (“CAISO”) submits its comments regarding the ALJ’s Ruling re Comments on the Cost Effectiveness Framework, dated April 4, 2008, (“Ruling”) and Attachment A to the Ruling, “Draft Demand Response Cost Effectiveness Protocols” (“Staff Protocols”). Introduction As the Ruling states, the methodology set forth in the Staff Protocols is based largely upon the Cost Effectiveness Framework (aka Consensus Parties Framework) that the Joint Parties submitted in this proceeding in November 2007. (Ruling at pp. 1-2.) The Ruling further notes that party comments should address “the completeness, accuracy, and feasibility of the staff proposal.” (Ruling at p. 2.). The CAISO’s comments herein are intended either (1) to raise points for further refinement of the protocol’s interim methodologies or (2) to raise points that the CAISO believes should be included within the document, so that they are “teed up” for consideration when the - 1 - R.07-01-041 CAISO COMMENTS ON DRAFT DR CE PROTOCOLS protocols are revised with reformulated criteria intended to replace the interim methodologies1. Overall, the CAISO considers the Staff Protocols to be a sound basis for interim review of DR programs that will be presented to the Commission in 2009 for the procurement cycle period of 2009 to 2011. -

Premier Montgomery Address

LEASE > CLASS A OFFICE SPACE Premier Montgomery Address 505 MONTGOMERY STREET, SAN FRANCISCO EED L GOLD Availabilities CERTIFIED Suite Square Feet Available 600 3,742 Now Leased. 625 2,984 Now Leased. 1200 6,148 Now Good set back and outlook. 7 private offices, conference room, kitchen, server room and copy room. 1250 4,936 Now 8 private offices, conference room, kitchen and copy room. Can combine Suites 1200 & 1250 for a total 11,084 SF Building Highlights > High profile tenant roster - Latham & Watkins; Method Products, Horsley Bridge, and Davis Wright Tremaine > Great views and abundant natural light > Column free floor plans > Heart of Financial District > Close proximity to public transportation > Walking distance to well known restaurants such as Palio d’Asti, Bob’s Steakhouse, Wayfare Tavern > Free secured bike storage with bike repair station > LEED Gold Certified 5 5 MON T GOMER Y H O M E AVAILABILITIES LOC A TIO N San Francisco Office This document has been prepared by Colliers International for advertising and general information only. Colliers International makes no guarantees, representations or warranties 50 California Street, Floor 19 Information contained herein has been obtained from the owners or from other sources deemed reliable. We have no reason to doubt its accuracy San Francisco, California 94111 of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interestedbut regret we cannot party guarantee it.should All properties subjectundertake to change or withdrawal without notice. Phone: 415.788.3100 their own inquiries as to the accuracy of the information. -

Áêåìáí= ______COUNTY of SAN MATEO, No

Case: 18-15499, 06/18/2018, ID: 10913233, DktEntry: 52, Page 1 of 229 Nos. 18-15499, 18-15502, 18-15503 IN THE råáíÉÇ=pí~íÉë=`çìêí=çÑ=^ééÉ~äë=Ñçê=íÜÉ=káåíÜ=`áêÅìáí= _______________________________________________ COUNTY OF SAN MATEO, No. 18-15499 Plaintiff-Appellee, No. 17-cv-4929-VC v. N.D. Cal., San Francisco CHEVRON CORPORATION, et al., Hon. Vince Chhabria presiding Defendants-Appellants. CITY OF IMPERIAL BEACH, No. 18-15502 Plaintiff-Appellee, No. 17-cv-4934-VC v. N.D. Cal., San Francisco CHEVRON CORPORATION, et al., Hon. Vince Chhabria presiding Defendants-Appellants. COUNTY OF MARIN, No. 18-15503 Plaintiff-Appellee, No. 17-cv-4935-VC v. N.D. Cal., San Francisco CHEVRON CORPORATION, et al., Hon. Vince Chhabria presiding Defendants-Appellants. ________________________________________________________________________________________________________ OPPOSITION TO MOTION FOR PARTIAL DISMISSAL ________________________________________________________________________________________________________ Joshua S. Lipshutz Theodore J. Boutrous, Jr. GIBSON, DUNN & CRUTCHER LLP William E. Thomson 555 Mission Street, Suite 3000 GIBSON, DUNN & CRUTCHER LLP San Francisco, CA 94105-0921 333 South Grand Avenue (415) 393-8200 Los Angeles, California 90071-3197 (213) 229-7000 [email protected] Counsel for Defendants-Appellants Chevron Corporation and Chevron U.S.A. Inc. [Additional counsel listed on signature page] Case: 18-15499, 06/18/2018, ID: 10913233, DktEntry: 52, Page 2 of 229 CORPORATE DISCLOSURE STATEMENT Pursuant to Rule 26.1 of the Federal Rules of Appellate Procedure, Defendants submit the following statement: Anadarko Petroleum Corporation is a publicly traded corporation that has no corporate parent. No corporation owns 10% or more of Anadarko’s stock. Apache Corp. does not have a parent corporation, and there is no publicly- held corporation that owns 10% or more of Apache Corp’s stock.