7Th Annual Antitrust Summit 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Conversion Report (PDF, 958

This document is an English translation of the original German language document. The translation is exclusively for convenience purposes. Only the original German language document is authorative and binding. Fresenius SE Change of the Legal Form into a Partnership Limited by Shares Conversion Report of the Management Board Convenience Translation Important Notice: This conversion report is neither an offer to sell voting ordinary bearer shares or non-voting preference bearer shares, nor an invitation to make the Company an offer to buy voting ordinary bearer shares or non-voting preference bearer shares. Such an offer requires special publication as the case may be, and, in so far as required by national law, a separate prospectus. This conversion report is not an offer to sell securities in the United States of America (USA). Securities may be sold or offered for purchase in the USA only with prior registration or without prior registration only on the basis of an exception provided. This conversion report is neither an offer to sell voting ordinary limited partner shares nor an invitation to make the Company an offer to buy voting ordinary limited partner shares. Such an offer requires special publication as the case may be, and, in so far as required by national law, a separate prospectus. This conversion report is not an offer to sell securities in the USA. Securities may be sold or offered for purchase in the USA only with prior registration or without prior registration only on the basis of an exception provided. This document does not constitute an offer document or an offer of transferable securities to the public in the United Kingdom to which section 85 of the Financial Services and Markets Act 2000 of the United Kingdom (“FSMA”) applies and should not be considered as a recommen- dation that any person should subscribe for or purchase any securities as part of the Transaction. -

Assortment Planning

3DEXPERIENCE for CPG & RETAIL September 2013 1 Our Legacy 2 Our new strategy ‘Social Industry Experiences’ Why Experiences? Consumers buy Experiences An Experience is Bigger Than a Product 3 CPG & RETAIL Segments 4 TOP 5 Cosmetics: Top Markets & Leaders Top 10 Countries of A balanced global market representative of most CPG segments Leaders (HQ) RUSSIA UK France Germany UNITED STATES Spain Italy CHINA JAPAN BRASIL Leaders : L’Oréal, P&G, Unilever, Estée Lauder, Shiseido, Avon, Kao, Beiersdorf, Johnson & Johnson, Chanel 5 Consumer Packaged Goods - Challenges 6 Consumer Packaged Goods : Innovation (Forbes 2013 ranking) 1 Salesforce.com 26 Fanuc 51 Smith & Nephew 76 Roper Industries 2 Alexion Pharmaceuticals 27 Diageo 52 Mondelēz International 77 ASML Holding 3 VMware 28 Hershey 53 Infosys 78 Assa Abloy 4 Regeneron Pharmaceuticals 29 Danone 54 Kellogg 79 Apple 5 ARM Holdings 30 Procter & Gamble 55 Ultrapar Participacoes 80 Air Products & Chemicals 6 Baidu 31 Dassault Systemes 56 Intuit 81 Tenaris 7 Amazon.com 32 Colgate-Palmolive 57 Technip 82 Precision Castparts 8 Intuitive Surgical 33 Ecolab 58 PepsiCo 83 Rockwell Automation 9 Rakuten 34 Monsanto 59 Schlumberger 84 Nintendo 10 Natura Cosmeticos 35 Reckitt Benckiser Group 60 Fresenius Medical Care 85 Cameron International 11 Henan Shuanghui 36 Keyence 61 SMC Corp 86 Secom 12 Coloplast 37 Kone 62 Valeant Pharmaceuticals Intl 87 Schindler Holding 13 Cerner 38 Yahoo Japan 63 Unilever NV 88 Campbell Soup 14 Unicharm 39 BRF-Brasil Foods 64 China Oilfield Services 89 Kubota 15 Estee Lauder Cos -

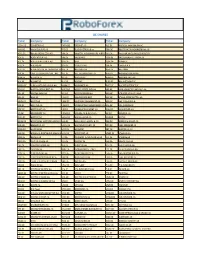

R Trader Instruments Cfds and Stocks

DE SHARES Ticker Company Ticker Company Ticker Company 1COV.DE COVESTRO AG FNTN.DE FREENET AG P1Z.DE PATRIZIA IMMOBILIEN AG AAD.DE AMADEUS FIRE AG FPE.DE FUCHS PETROLUB vz PBB.DE DEUTSCHE PFANDBRIEFBANK AG ACX1.DE BET-AT-HOME.COM AG FRA.DE FRAPORT AG FRANKFURT AIRPORTPFV.DE PFEIFFER VACUUM TECHNOLOGY ADJ.DE ADO PROPERTIES FRE.DE FRESENIUS PSM.DE PROSIEBENSAT.1 MEDIA SE ADL.DE ADLER REAL ESTATE AG G1A.DE GEA PUM.DE PUMA SE ADS.DE ADIDAS AG G24.DE SCOUT24 AG QIA.DE QIAGEN N.V. ADV.DE ADVA OPTICAL NETWORKING SE GBF.DE BILFINGER SE RAA.DE RATIONAL AFX.DE CARL ZEISS MEDITEC AG - BR GFT.DE GFT TECHNOLOGIES SE RHK.DE RHOEN-KLINIKUM AG AIXA.DE AIXTRON SE GIL.DE DMG MORI RHM.DE RHEINMETALL AG ALV.DE ALLIANZ SE GLJ.DE GRENKE RIB1.DE RIB SOFTWARE SE AM3D.DE SLM SOLUTIONS GROUP AG GMM.DE GRAMMER AG RKET.DE ROCKET INTERNET SE AOX.DE ALSTRIA OFFICE REIT-AG GWI1.DE GERRY WEBER INTL AG S92.DE SMA SOLAR TECHNOLOGY AG ARL.DE AAREAL BANK AG GXI.DE GERRESHEIMER AG SAX.DE STROEER SE & CO KGAA BAS.DE BASF SE HAB.DE HAMBORNER REIT SAZ.DE STADA ARZNEIMITTEL AG BAYN.DE BAYER AG HBM.DE HORNBACH BAUMARKT AG SFQ.DE SAF HOLLAND S.A. BC8.DE BECHTLE AG HDD.DE HEIDELBERGER DRUCKMASCHINENSGL.DE SGL CARBON SE BDT.DE BERTRANDT AG HEI.DE HEIDELBERGCEMENT AG SHA.DE SCHAEFFLER AG BEI.DE BEIERSDORF AG HEN3.DE HENKEL AG & CO KGAA SIE.DE SIEMENS AG BIO4.DE BIOTEST AG HLAG.DE HAPAG-LLOYD AG SIX2.DE SIXT SE BMW.DE BAYERISCHE MOTOREN WERKE AGHLE.DE HELLA KGAA HUECK & CO SKB.DE KOENIG & BAUER AG BNR.DE BRENNTAG AG HNR1.DE HANNOVER RUECK SE SPR.DE AXEL SPRINGER SE BOSS.DE HUGO BOSS -

Managing Political Risk in Global Business: Beiersdorf 1914-1990

Managing Political Risk in Global Business: Beiersdorf 1914-1990 Geoffrey Jones Christina Lubinski Working Paper 12-003 July 22, 2011 Copyright © 2011 by Geoffrey Jones and Christina Lubinski Working papers are in draft form. This working paper is distributed for purposes of comment and discussion only. It may not be reproduced without permission of the copyright holder. Copies of working papers are available from the author. Managing Political Risk in Global Business: Beiersdorf 1914-1990 Geoffrey Jones Christina Lubinski 1 Abstract This working paper examines corporate strategies of political risk management during the twentieth century. It focuses especially on Beiersdorf, a German-based pharmaceutical and skin care company. During World War 1 the expropriation of its brands and trademarks revealed its vulnerability to political risk. Following the advent of the Nazi regime in 1933, the largely Jewish owned and managed company, faced a uniquely challenging combination of home and host country political risk. The paper reviews the firm's responses to these adverse circumstances, challenging the prevailing literature which interprets so-called "cloaking" activities as one element of businesses’ cooperation with the Nazis. The paper departs from previous literature in assessing the outcomes of the company’s strategies after 1945. It examines the challenges and costs faced by the company in recovering the ownership of its brands. While the management of distance became much easier over the course of the twentieth century because of communications -

Research Aktuell Vom 05.05.2020

5. Mai 2020 Marktdaten im Überblick ...................................................................................................................... 2 Unternehmenskommentare .................................................................................................................. 3 Airbus ............................................................................................................................................... 3 Altria Group ....................................................................................................................................... 5 Beiersdorf ......................................................................................................................................... 7 Microsoft ......................................................................................................................................... 13 MTU Aero Engines ............................................................................................................................ 15 Roche Holding (Genussschein) ......................................................................................................... 21 Safran ............................................................................................................................................. 23 Rechtliche Hinweise ........................................................................................................................... 25 DAILY Marktdaten im Überblick 04.05.2020 01.05.2020 Änderung Deutschland DAX -

European Accounting and Management Review

EAMR EUROPEAN ACCOUNTING AND MANAGEMENT REVIEW VOLUME 5, ISSUE 1, ARTICLE 2, 21-46, NOVEMBER 2018 Value Creation and Women on Boards Bettina C.K. Binder Hochschule Pforzheim Received September 8, 2018; accepted October 26, 2018. ABSTRACT Value creation is a major claim of most companies. Mahajan (2017) argues that “value and value creation are natural to and basic in human behaviour and endeavour”, nevertheless women are often marginalized and impeded in their advancement towards leadership positions, where they could shape and influence the process of value creation. The present article looks at the companies of EURO STOXX 50 index in the year 2015 and offers an overview of women representation on the boards of these 50 companies. The paper tries to establish whether the success of these companies can be related to the percentage of female members in supervisory positions. The findings reveal the existence of a weak correlation between Earning before Taxes (EBT) and the proportion of women on the boards of the EURO STOXX 50 companies. KEYWORDS Value creation, women on supervisory boards, key performance indicators, gender quota, earnings before taxes. Bettina C.K. Binder 1. Introduction Value creation is a major claim of most companies and when leafing through the annual reports of companies one encounters expressions such as “value to our shareholders”, “we provide value for our customers”, “we create value for our employees, shareholders, business partners, neighbours and the public”, etc. While it seems to be clear for whom value is created, the concept of “value” itself is subjected to various interpretations and is regarded in the literature as ambiguous (Lepak, Smith and Taylor, 2007; Marinova, Larimo and Nummela, 2017). -

Market Data from Deutsche Börse

Market Data + Services Market data from Deutsche Börse Real-time. Reliable. Relevant. Deutsche Börse is a global German company Providing access to international capital markets Market data from Deutsche Börse 3 Deutsche Börse Group A global market operator Deutsche Börse Group, whose history dates back to 1585, is today one of the largest exchange organisations world-wide. The Group is headquartered in Germany and has more than 4,000 employees working to provide investors, financial institutions and companies access to global capital markets. Deutsche Börse Group’s integrated business model covers the entire process chain from securities and derivatives trading, clearing, settlement and custody, through to market data and the development and operation of electronic trading systems. Deutsche Börse Group owns the derivatives trading venue Eurex Exchange, as well as the settlement and custody business Clearstream. The Group’s market data business, operated by Market Data + Services, is trusted by more than 2,500 institutions and 160,000 subscribers. Deutsche Börse Group’s business areas Deutsche Börse Group Eurex Xetra Clearstream Market Data + Exchange Services Cash Settlement, market trading financing services Derivatives Information, indices, market trading tools, market solutions Simplified illustration Trademarks AlphaFlash ®, CEF ®, DAX ®, Eurex ® and Xetra ® are registered trademarks of Deutsche Börse AG. STOXX ® and EURO STOXX 50 ® are registered trademarks of STOXX Limited. Information is the basis for successful decision making -

DWS Equity Funds Semiannual Reports 2010/2011

DWS Investment GmbH DWS Equity Funds Semiannual Reports 2010/2011 ■ DWS Deutschland ■ DWS Investa ■ DWS Aktien Strategie Deutschland ■ DWS European Opportunities ■ DWS Intervest ■ DWS Akkumula : The DWS/DB Group is the largest German mutual fund company according to assets under management. Source: BVI. As of: March 31, 2011. 4/2011 DWS Deutschland DWS Investa DWS Aktien Strategie Deutschland DWS European Opportunities DWS Intervest DWS Akkumula Contents Semiannual reports 2010/2011 for the period from October 1, 2010, through March 31, 2011 (in accordance with article 44 (2) of the German Investment Act (InvG)) TOP 50 Europa 00 General information 2 Semiannual reports 2010 DWS Deutschland 4 DWS Investa 10 2011 DWS Aktien Strategie Deutschland 16 DWS European Opportunities 22 DWS Intervest 28 DWS Akkumula 36 1 General information Performance ing benchmarks – if available – are also b) any taxes that may arise in connec- The investment return, or performance, presented in the report. All financial tion with administrative and custodial of a mutual fund investment is meas - data in this publication is as of costs; ured by the change in value of the March 31, 2011. c) the costs of asserting and enforcing fund’s units. The net asset values per the legal claims of the investment unit (= redemption prices) with the addi- Sales prospectuses fund. tion of intervening distributions, which The sole binding basis for a purchase are, for example, reinvested free of are the current versions of the simpli- The details of the fee structure are set charge within the scope of investment fied and the detailed sales prospec - forth in the current detailed sales accounts at DWS, are used as the basis tuses, which are available from DWS, prospectus. -

Fresenius Achieves 2020 Targets and Expects Healthy Business Development in 2021 Despite Ongoing COVID-19 Impact

Markus Georgi Investor News Senior Vice President Investor Relations & Sustainability Fresenius SE & Co. KGaA Else-Kröner-Straße 1 61352 Bad Homburg Germany T +49 6172 608-2485 F +49 6172 608-2488 [email protected] www.fresenius.com February 23, 2021 Fresenius achieves 2020 targets and expects healthy business development in 2021 despite ongoing COVID-19 impact • Preliminary guidance for 2021 confirmed • Strategic roadmap for accelerated growth through 2023 and beyond • Group-wide initiatives to improve efficiency and profitability in preparation • Medium-term growth targets confirmed th • 28 consecutive dividend increase proposed If no timeframe is specified, information refers to Q4/2020 2020 and 2019 according to IFRS 16 Growth Q4/20 Growth in constant currency Sales €9.3 billion 0% 5% EBIT1 €1,251 million -3% 2% Net income1,2 €494 million -2% 2% Growth FY/20 Growth in constant currency Sales €36.3 billion 2% 5% EBIT1 €4,612 million -2% 0% Net income1,2 €1,796 million -4% -3% 1 Before special items 2 Net income attributable to shareholders of Fresenius SE & Co. KGaA For a detailed overview of special items please see the reconciliation tables on pages 20-22. Page 1/30 Fresenius SE & Co. KGaA, Investor Relations & Sustainability, 61346 Bad Homburg Stephan Sturm, CEO of Fresenius, said:” The pandemic year 2020 showed emphatically the importance of forward-thinking, effective and efficient healthcare. Fresenius is making a vital contribution here, in many different areas of medicine. This year, the pandemic will again present us with a number of challenges, making it even more important that we increase efficiency in order to improve our cost base. -

Annual General Meeting 2021 Beiersdorf AG, Hamburg April 1, 2021 Speech

_____________________________________________________________________________________ Annual General Meeting 2021 Beiersdorf AG, Hamburg April 1, 2021 Speech Stefan De Loecker Chairman of the Executive Board – The spoken word applies – _____________________________________________________________________________________ Dear shareholders, Good morning, ladies and gentlemen, and a warm welcome to our 2021 Annual General Meeting. For the second time, our shareholders’ meeting is taking place in an all-virtual format. When we got together for our first online meeting a year ago, we were in the middle of the first lockdown. The COVID- 19 pandemic continues to mean restrictions around the world. Looking back, 2020 asked a lot of us all. And for Beiersdorf, too, it was a challenging year. But it was not a lost year for us. On the contrary: We announced one year ago that we were not only determined to keep impressing consumers with our products, but would also do everything we could to enable Beiersdorf to emerge from the crisis in a stronger position than before. Despite the headwind, that is exactly what we have done. We have even stepped up investment in our future. The coronavirus has clearly demonstrated to us that many changes in our business are happening much faster than we originally anticipated. We have capitalized on this momentum, achieving significant progress in all our strategic focus areas in 2020: First: We responded swiftly to the crisis, demonstrating great agility and shouldering responsibility. Second: We have created additional innovations, very successfully introduced new products in all markets and gained market share in many countries as a result. Third: We significantly increased investment in e-commerce and digital dialogue with customers – boosting our online business in the Consumer Business Segment by 50%. -

Einladung Zur Ordentlichen Hauptversammlung ISIN: DE0005785604// WKN: 578 560 ISIN: DE0005785620 // WKN: 578 562 ISIN: DE0005785638 // WKN: 578 563

Einladung zur ordentlichen Hauptversammlung ISIN: DE0005785604// WKN: 578 560 ISIN: DE0005785620 // WKN: 578 562 ISIN: DE0005785638 // WKN: 578 563 Wir laden hiermit unsere Aktionäre zu der am Mittwoch, dem 28. Mai 2003, um 10 Uhr im Marriott Hotel Frankfurt, Hamburger Allee 2 - 10, 60486 Frankfurt am Main, stattfindenden ordentlichen Hauptversammlung ein. Tagesordnung 1. Vorlage des festgestellten Jahresabschlusses der Fresenius AG und des Konzern- Abschlusses für das Geschäftsjahr 2002. Vorlage der Lageberichte für den Fresenius- Konzern und die Fresenius AG für 2002. Vorlage des Berichts des Aufsichtsrats. 2. Beschlussfassung über die Verwendung des Bilanzgewinns. Vorstand und Aufsichtsrat schlagen vor, den im Jahresabschluss für das Geschäftsjahr 2002 ausgewiesenen Bilanzgewinn von Euro 47.807.637,93 wie folgt zu verwenden: Zahlung einer Dividende von Euro 1,14 je Stammaktie auf Stück 20.484.842 dividendenberechtigte Stammaktien Euro 23.352.719,88 Zahlung einer Dividende von Euro 1,17 je Vorzugsaktie auf Stück 20.484.842 dividendenberechtigte Vorzugsaktien Euro 23.967.265,14 Die Dividende ist am 29. Mai 2003 zahlbar. Vortrag auf neue Rechnung Euro 487.652,91 Euro 47.807.637,93 1 3. Beschlussfassung über die Entlastung des Vorstands für das Geschäftsjahr 2002. Vorstand und Aufsichtsrat schlagen vor, Entlastung zu erteilen. 4. Beschlussfassung über die Entlastung des Aufsichtsrats für das Geschäftsjahr 2002. Vorstand und Aufsichtsrat schlagen vor, Entlastung zu erteilen. 5. Wahlen zum Aufsichtsrat. Die Amtszeit der bisherigen Aufsichtsratsmitglieder endet mit Ablauf der Haupt- versammlung vom 28. Mai 2003. Der Aufsichtsrat setzt sich gemäß §§ 96 Absatz 1 und 101 Absatz 1 Aktiengesetz und § 7 Absatz 1 Nummer 1 Mitbestimmungsgesetz aus sechs von der Hauptversammlung und sechs von den Arbeitnehmern zu wählenden Mitgliedern zusammen. -

HDI Global SE Geschäftsbericht 2019 Konzernstruktur Group Structure

400-GB205 HDI Global SE HDI-Platz 1 30659 Hannover Telefon +49 511 645-0 Telefax +49 511 645-4545 www.hdi.global www.talanx.com HDI Global SE Geschäftsbericht 2019 Konzernstruktur Group structure Talanx AG HDI GlobalGlobal SE SE auf auf einen einen Blick Blick Geschäftsbereich Geschäftsbereich Privat- Geschäftsbereich Privat- Geschäftsbereich Konzernfunktionen Industrieversicherung und Firmenversicherung und Firmenversicherung Rückversicherung Corporate Operations Industrial Lines Division Deutschland International Reinsurance Division 2019 2018 Retail Germany Division Retail International Lebens- Division Schaden- Personen- Beitragseinnahme (brutto) Mio. EUR 4.449 4.616 Schaden/ Unfallver- versicherung Rück- Rück- Beitragsentwicklung (brutto) % -3,6 4,9 sicherung Life Insurance versicherung versicherung Property/ Life/ Verdiente Beitragseinnahme f.e.R. Mio. EUR 2.110 2.223 Property/ Casualty Casualty Health Aufwendungen für Versicherungsfälle f.e.R. Mio. EUR 1.694 1.999 Insurance Reinsurance Reinsurance 1) Schadenquote f.e.R. % 80,3 89,9 Ampega Asset Aufwendungen für den Versicherungsbetrieb f.e.R. Mio. EUR 518 528 HDI Global SE HDI Deutschland AG HDI International AG Hannover Rück SE Management GmbH 2) Kostenquote f.e.R. % 24,6 23,7 Versicherungstechnisches Ergebnis vor Schwankungsrückstellungen f.e.R. Mio. EUR -103 -302 HDI HDI Seguros S.A. 3) HDI Global Specialty SE E+S Rück versicherung AG Ampega Investment GmbH Kombinierte Schaden-/Kostenquote f.e.R. % 104,9 113,7 Versicherung AG (Argentina) Kapitalanlagen Mio. EUR 7.653 7.121 HDI Versicherung AG HDI Seguros S.A. Hannover ReTakaful B.S.C. (c) Lifestyle Protection AG Ampega Real Estate GmbH Kapitalerträge Mio. EUR 263 358 (Austria) (Brazil) (Bahrain) 4) Ergebnis des allgemeinen Geschäfts Mio.