ASX ANNOUNCEMENT – Xx December 2008

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

8. Proceeding BALE BANJAR and ITS

PROCEEDING BOOK INTERNATIONAL SEMINAR ON TOLERANCE AND PLURALISM IN SOUTHEAST ASIA THE FACULTY OF RELIGIOUS AND CULTURAL SCIENCE UNIVERSITAS HINDU INDONEISA 2 OCTOBER 2018 ISBN: 978-602-52255-7-4 UNHI 2018 All Right Reserved. No part of this publication can be reproduced or transmitted in any form or by any means, electronic or mechanical, including fotocopying, recording or any information storage or retrieval system, without prior permission of UNHI Denpasar. i International Seminar on TOLERANCE AND PLURALISM IN SOUTHEAST ASIA organized by: The Faculty of Religious and Cultural Science Universitas Hindu Indonesia (Unhi) Denpasar venue: held on October 2nd, 2018 Indraprastha Hall, Universitas Hindu Indonesia supported by Yayasan Pendidikan Widya Kerthi (YPWK) The Historian Society of Indonesia (MSI) Universitas Warmadewa (Unwar) Denpasar The Government of Bali Province ISBN: 978-602-52255-7-4 Editors I Putu Sarjana, I Putu Sastra Wibawa Peer Reviewers: I Ketut Ardhana, Restu Gunawan, I Gusti Ngurah Aryana, I Wayan Subratha UNHI PRESS UNIVERSITAS HINDU INDONESIA 2018 ii International Seminar on TOLERANCE AND PLURALISM IN SOUTHEAST ASIA Editors I Putu Sarjana, I Putu Sastra Wibawa Peer Reviewers: I Ketut Ardhana, Restu Gunawan, I Gusti Ngurah Aryana, I Wayan Subratha Organizing Committee: I Putu Sarjana (chief person) , Ida Bagus Sadu Gunawan (secretary) Sulandjari (treasurer) Keynote speaker: Dr. Restu Gunawan (Head of The Historian Society of Indonesia) Plenary: Manohar Puri, Darlene Machell de Leon Espena, Jajat Burhanudin Cover design and layout: Made Adi Widyatmika Satya Prasavita Publisher UNHI PRESS Universitas Hindu Indonesia Jl. Sangalangit, Tembau, Penatih, Denpasar, Bali, Indonesia Phone: +62 361 464800, mail: [email protected] UNHI 2018 All Right Reserved. -

Al-Hind the Making of the Indo-Islamic World

AL-HIND THE MAKING OF THE INDO-ISLAMIC WORLD VOLUME III This page intentionally left blank AL-HIND THE MAKING OF THE INDO-ISLAMIC WORLD BY ANDRÉ WINK Professor of History University of Wisconsin, Madison VOLUME III INDO-ISLAMIC SOCIETY 14th-15th CENTURIES BRILL LEIDEN • BOSTON 2004 This book is printed on acid-free paper. Library of Congress Cataloging-in-Publication Data Wink, André. Al-Hind, the making of the Indo-Islamic world / by André Wink. — p. cm. Includes bibliographical references and index. Contents: v. 3. Indo-Islamic Society, 14th-15th Centuries ISBN 9004095098 (set). — ISBN 9004135618 (v.3) 1. India—History—1000-1765. 2. Indian Ocean Region—History. 3. Muslims—India—Civilization. I. Title. DS452.W56. 1997 954.02—dc20 91-22179 CIP ISBN 90 04 13561 8 ISBN (set) 90 04 09509 8 © Copyright 2004 by Koninklijke Brill, Leiden, The Netherlands All rights reserved. No part of this publication may be reproduced, translated, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission from the publisher. Authorization to photocopy items for internal or personal use is granted by Brill provided that the appropriate fees are paid directly to The Copyright Clearance Center, 222 Rosewood Drive, Suite 910 Danvers MA 01923, USA. Fees are subject to change. PRINTED IN THE NETHERLANDS CONTENTS Maps ............................................................................................ VII Abbreviations ............................................................................. -

The Violations of Cooperative Principle As the Creativity of Humour in Banjar Madihin Art

Advances in Social Science, Education and Humanities Research (ASSEHR), volume 247 International Conference on Science and Education and Technology 2018 (ISET 2018) The Violations of Cooperative Principle as The Creativity of Humour in Banjar Madihin Art Siti Faridah1, Rustono2, Agus Nuryatin3, Hari Bakti Mardikantoro4 1,2,3,4Graduate School,Univesitas Negeri Semarang, Indonesia 1Corresponding email : [email protected] Abstract Madihin art is one of the oral literatures in Banjarmasin, Indonesia. It is performed alongside humour that can be used as a way of communication. The purpose of this study was to find out the violations of the cooperative principle in Banjar madihin art by identifying the violations of conversational maxims. It employed descriptive qualitative method. Meanwhile, the research data consisted of ten videos of Banjar madihin art performances chosen randomly either the date or location of performances and downloaded from Youtube from February 2017 until December 2017. The data collection of those videos was done by the methods of recording, relating and note-taking. Further, the collected data were analysed using normative method. The results showed that the violations of cooperative principle, namely 6 violations of the maxim of quantity or 17%, 8 maxim of quality violations or 23%, 11 violations of the maxim of relevance or 31% and 10 violations of the maxim of manner or 29%. It showed that the highest rank of the maxim violation was the maxim of relevance violations. Moreover, there were found irrelevant, unclear, disorderly and ambiguous speeches in accordance with the matter discussed. They are intended a means of creativity of humour. Keywords: maxims of cooperative principle, madihin art, humour creativity. -

Role of Local Institution in Early Marriage Issue: a Case Study in Some Provinces in Indonesia

International Journal of Governmental Studies and Humanities (IJGH) http://ejournal.ipdn.ac.id/index.php/ijgsh ROLE OF LOCAL INSTITUTION IN EARLY MARRIAGE ISSUE: A CASE STUDY IN SOME PROVINCES IN INDONESIA Tubagus Adi Satria1, Rezariansyah Abdullah2, Fajar Ajie Setiawan3, Fitriana Putri Hapsari4 Anggota Komite Pemantau Resiko (Dewan Pengawas BPJS Kesehatan) Kampus Universitas Moetopo Beragama Department of International Relation (Universitas Wanita Internasional) Department of International Relation (Universitas Lintas Internasional Indonesia) *Correspondence: [email protected] ARTICLE INFO ABSTRACT Article History: The impact of early marriage is closely related to the economic received condition of the family and affects the poverty of women who revised experience it. This study aims to comprehensively examine the extent accepted to which local socio-economic condition affects early marriage and the extent of policy-makers’ role in preventing it. In addition, this study also aims to obtain inaccurate overview of current policies and policy Keywords: recommendations related to government’s effort in controlling Child marriage; early marriage; marriage age in Indonesia. Data were obtained using cross-sectional institutional role; policy method in four provinces with high marriage rates based on Riskesdas coordination. 2010 data (South Kalimantan, Bangka Belitung, Central Sulawesi and West Java). The research is qualitative using explorative approach. Based on the research result, the root of early marriage problem in four provinces is related to several dimensions such as: modernization, education, economic and socio-cultural pressure. Another result of the analysis is that the role of customary and religious institutions are very strategic as a tool of social control in controlling early marriage. In addition, it was concluded that weak inter-sectoral coordination and government policy planning in early marriage control are among the issues to be addressed. -

The Tariqa Khalwatiyya in South Celebes

The tariqa Khalwatiyya in South Celebes Martin van Bruinessen, "The tariqa Khalwatiyya in South Celebes", in: Harry A. Poeze en Pim Schoorl (eds), Excursies in Celebes. Een bundel bijdragen bij het afscheid van J. Noorduyn... Leiden: KITLV Uitgeverij,1991, pp. 251-269. The tariqa Khalwatiyya in South Celebes A striking aspect of Islam in South Celebes is the remarkable prominence of the tariqa (mystical order) Khalwatiyya among the Bugis and Makassarese. There are, in fact, two separate branches of this order, co-existing in many districts of South Celebes and known as Khalwatiyya-Yusuf and Khalwatiyya-Samman. The latter especially is present wherever there are large Bugis and Makasarese communities in the archipelago, such as Riau, Malaysia, East Borneo, Ambon, and West Irian, but the centre of gravity is South Celebes. Membership in both branches appears limited to these two ethnic groups and perhaps a few Mandarese. According to statistics compiled by the Department of Religious Affairs, the Khalwatiyya-Yusuf in 1973 had around 25,000 followers in the province and the Khalwatiyya-Samman 117,435. Of the latter, some 70,000 were registered in the district of Maros alone, where this branch had been established by the charismatic teacher Haji Palopo in the late nineteenth century.[1] It is not clear how these statistics were compiled, and a certain scepticism may be called for, but it is obvious that the tariqa Khalwatiyya in South Celebes is by no means a marginal phenomenon. The followers of these branches taken together represent five percent of the province's population over the age of 15; those in Maros make up two-thirds of that district's adult inhabitants! Even if we file:///P|/Igitur%20Archief/acquisitie/actie%20websites/bruinessen/bruinessen_91_tariqakhalwatiyya.htm (1 van 30)9-3-2007 9:03:27 The tariqa Khalwatiyya in South Celebes allow for a wide margin of error, these are higher proportions than any other tariqa elsewhere in the archipelago can boast. -

Direktori Action Plan

BUKU Editor: 2 Dr. Guspika, MBA., dkk. DIREKTORI ACTION PLAN STAFF ENHANCEMENT - AFIRMASI - MAGANG DALAM NEGERI MAGANG DALAM NEGERI - ENHANCEMENT - AFIRMASI STAFF PROFESSIONAL HUMAN RESOURCE DEVELOPMENT IV Pusat Pembinaan, Pendidikan, dan Pelatihan Perencana Badan Perencanaan Pembangunan Nasional Buku 2 DIREKTORI ACTION PLAN Staff Enhancement - Afirmasi - Magang Dalam Negeri Editor: Dr. Guspika, MBA., dkk. Pusat Pembinaan, Pendidikan, dan Pelatihan Perencana Badan Perencanaan Pembangunan Nasional DIREKTORI ACTION PLAN STAFF ENHANCEMENT AFIRMASI MAGANG DALAM NEGERI: PROFESSIONAL HUMAN RESOURCE DEVELOPMENT IV JILID 2 ©2020 oleh Pusbindiklatren Bappenas Jangan menggandakan dan/atau menggandakan semua dan/atau bagian dari buku ini tanpa izin dari Pencipta atau Pemegang Hak Cipta. Penanggung Jawab : Kapusbindiklatren Editor : Dr. Guspika, MBA, Wignyo Adiyoso, S.Sos., MA, Ph.D., Ali Muharram, S.IP., M.SE, MA., Rita Miranda, S.Sos., M.PA., Wiky Witarni, S.Sos., M.A., Epik Finilih Kontributor : Fahmi Riadi, Desain Eksterior & Interior : Den Binikna & Rafika Nabila Cetakan pertama, September 2020 ISBN Jilid Lengkap: 978-623-92028-2-8 ISBN Jilid 2: 97862392028-4-2 Diterbitkan oleh Pusat Pembinaan, Pendidikan, dan Pelatihan Perencana Badan Perencanaan Pembangunan Nasional (Bappenas) Republik Indonesia Jalan Proklamasi Nomor 70, Jakarta Pusat 10320 Sanksi Pelanggaran Pasal 72 Undang-undang Nomor 19 Tahun 2002 Tentang Hak Cipta Barang siapa dengan sengaja melanggar dan tanpa hak melakukan perbuatan sebagaimana dimaksud dalam Pasal 2 Ayat (1) atau Pasal 49 Ayat (1) dan Ayat (2) dipidana dengan pidana penjara masing-masing paling singkat 1 (satu) bulan dan/atau denda paling sedikit Rp 1.000.000,00 (satu juta rupiah), atau denda pidana paling lama 7 (tujuh) tahun dan/atau denda paling banyak Rp 5.000.000,00 (lima miliar rupiah). -

PROCEEDING BOOK in Association with St

25 April – 02 May 2020 One Week International FDP (Faculty Development Program) Webinar Self, Society, and Personal Development Jointly organized by UNIVERSITAS HINDU INDONESIA GAP – INDIA PROCEEDING BOOK In association with St. Andrew’s Education Foundation, ISBN: 978-623-7963-02-8 Mumbai, Nalanda Nrityaka MahaVidhyalaya, Mumbai, Samarpan Arts and College Gandhinagar, Shree RP arts, KB Commerce and Smt. BCJ Science College, Khambhat Supported by MSI Indonesia, IFSSO, LIPI UNHI PRESS 2020 One Week International FDP (Faculty Development Program) Webinar on Self, Society, and Personal Development ISBN: 978-623-7963-02-8 25 April to 02 May, 2020 One Week International FDP (Faculty Development Program) Webinar on Self, Society, and Personal Development ISBN: 978-623-7963-02-8 Languages: English and Bahasa Indonesia Editors: Prof. Dr. phil. I Ketut Ardhana, M.A. Prof. Dr. I Made Damriyasa, M.S. Dr. Gurudutta Japee Dr. Preeti Oza Made Adi Widyatmika, S.T., M.Si. Committee Chair I Wayan Wahyudi Secretary I Putu Darmawan Keynote sources: Prof. Dr. I Ketut Ardhana, M.A., Prof. Dr. Yekti Maunati, Dr. I Gusti Ayu Ketut Surtiari, M.A. Reviewer: I Ketut Ardhana, Yekti Maunati, Gurudutta P. Japee, Preeti Oza Joinly organized by Universitas Hindu Indonesia, Denpasar, The Grand Academic Portal, India in association with St. Andrew’s Education Foundation, Mumbai, Nalanda Nrityaka MahaVidhyalaya, Mumbai, Samarpan Arts and College Gandhinagar, Shree RP arts, KB Commerce and Smt. BCJ Science College, Khambhat Supported by MSI Provinsi Bali IFSSO LIPI UNHI PRESS 2020 i One Week International FDP (Faculty Development Program) Webinar on Self, Society, and Personal Development ISBN: 978-623-7963-02-8 Messages from the Rector of Universitas Hindu Indonesia Prof. -

Artisanal and Small-Scale Mining in Asia- Pacific Case Study Series

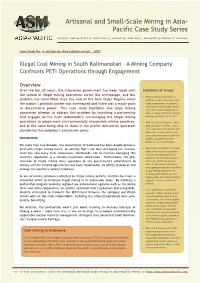

Artisanal and Small-Scale Mining in Asia- Pacific Case Study Series project led by Kuntala Lahiri-Dutt, edited by Joel Katz, designed by Rachel P Lorenzen Case Study No. 4, written by Nina Indriati Lestari , 2007 Illegal Coal Mining in South Kalimanatan - A Mining Company Confronts PETI Operations through Engagement Overview Over the last 25 years, the Indonesian government has been faced with Summary of Issues the spread of illegal mining operations across the archipelago, and this • Prior to the introduction of problem has intensified since the end of the New Order Regime when reforms in 1999, the autocratic the nation’s political system was overhauled and there was a major push style governments of Sukarno and Suharto had a tight control to decentralise power. This case study highlights one large mining over the nations mining opera- companies attempt to address this problem by launching a partnership tions, making it hard for illegal that engages all the main stakeholders, encouraging the illegal mining mining operations to flourish. operations to adopt more environmentally responsible mining practices, • With the fall of Suharto’s New and at the same being able to share in the profits derived by operators Order Regime in 1998, a raft of plundering the company’s concession zones. new laws were introduced, and there was a major push to de- centralise the nation’s political Introduction system, transferring more power to local government. For more than two decades, the Government of Indonesia has been deeply preoccu- pied with illegal mining issues, an activity that’s not only destroying the environ- • During this devolution of power, there were major inconsisten- ment but also many rural Indonesians’ livelihoods, not to mention damaging this cies in government policies country’s reputation as a reliable investment destination. -

I | P a G E the Association for Advancement of Small Business

Perkumpulan Untuk Peningkatan Usaha Kecil i | P a g e The Association for Advancement of Small Business Perkumpulan Untuk Peningkatan Usaha Kecil CONTENTS 1. BACKGROUND ................................................... 1 2. VISION AND MISSION .......................................... 2 3. SERVICES AND METHODOLOGY .......................... 3 4. ORGANIZATION AND MANAGEMENT .................... 7 5. LEGAL ASPECTS AND FINANCIAL REPORTS ........ 9 6. EXPERIENCES ................................................... 10 i | P a g e The Association for Advancement of Small Business Perkumpulan Untuk Peningkatan Usaha Kecil PUPUK (Perkumpulan Untuk Peningkatan Usaha Kecil) THE ASSOCIATION FOR ADVANCEMENT OF SMALL BUSINESS 1. BACKGROUND SMALL ENTERPRISE is the source of living for most of Indonesian people. This sector needs to be developed since it stands as a strategic component of Indonesian economical structure and it contributes significantly to the country. Therefore institutions which continuously support the development of this sector is required. PUPUK (Perkumpulan Untuk Peningkatan Usaha Kecil) or THE ASSOCIATION FOR ADVANCEMENT OF SMALL BUSINESS is an independent and non-political non-profit organization which attempts to channel the aspiration and to stand for small business interests, as well as to develop integrated small business empowerment activities in all economics lines through various integrated efforts. PUPUK was established in 1979 as the result of a cooperation project between KADIN (Indonesia Chambers of Commerce) West Java and a Germany donor agency, Friedrich-Naumann- Stiftung (FNSt), and was legalized by the Department of Justice through SK No. C2-765.HT01.03 year 1988. The consideration of choosing an association as its corporate body is for PUPUK to expand the democratic mechanism within its organization body. Members of this association are individuals from business sector, NGO activists, universities, and others who have concern for small business development. -

Quarterly Report 31January2013

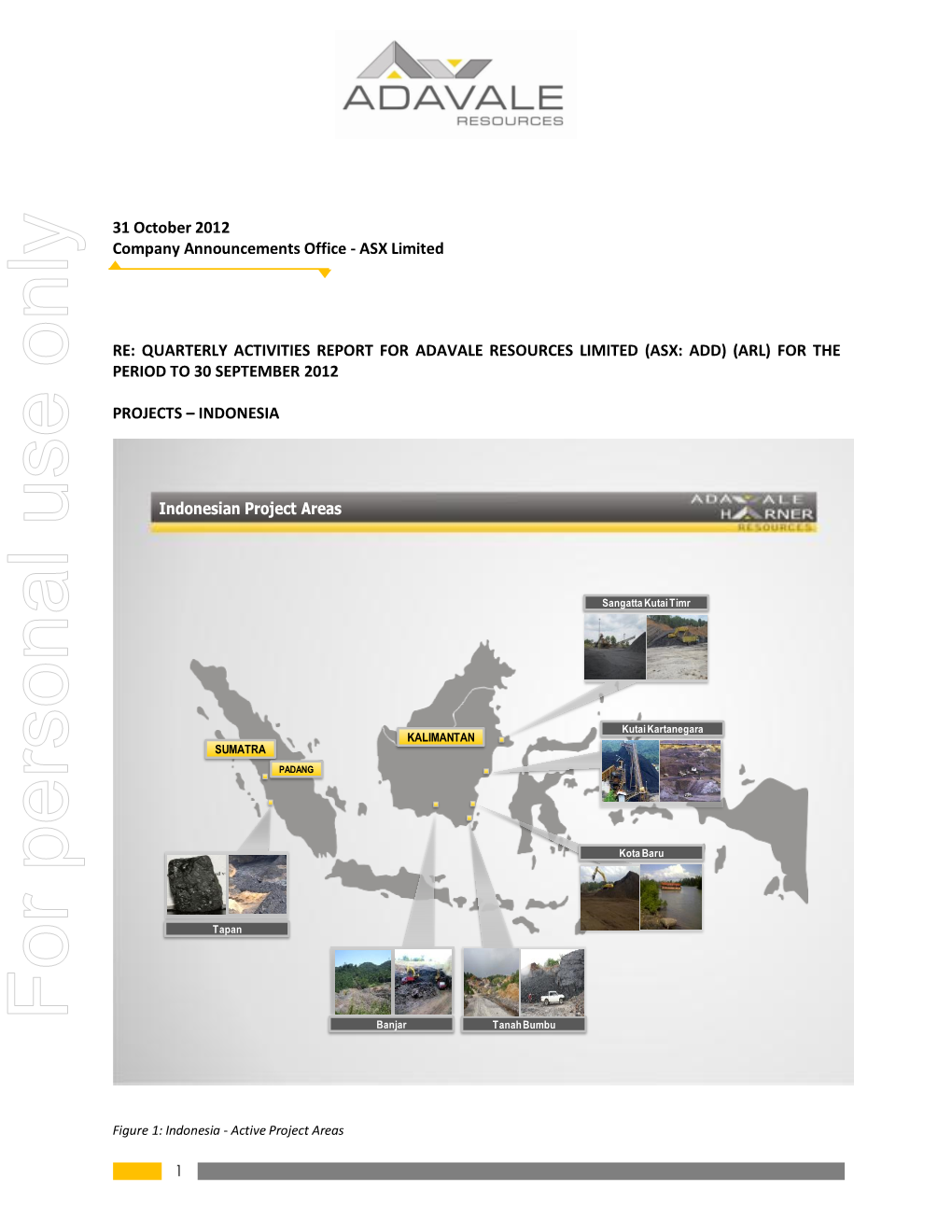

31 January 2013 Company Announcements Office - ASX Limited RE: QUARTERLY ACTIVITIES REPORT FOR ADAVALE RESOURCES LIMITED (ASX: ADD) FOR THE PERIOD TO 31 DECEMBER 2012 HIGHLIGHTS • On December 20th 2012, ADD established a new board and management led by Mr. Haryono Eddyarto as the Executive Chairman. The primary focus is Indonesian coal production. • Tapan: Negotiations continue with an established mining company that has shown strong interest in the project; due diligence process is still in progress. • Lake Surprise: Actively seeking a strategic Joint Venture partner to continue exploring the project. CORPORATE At an EGM on the 20th of December the company finalised a change in directors and management that is intended to herald in a new direction for the company. New management aims to grow from exploration to become an end to end mining company, by actively seeking producing coal assets, together with additional green fields with significant potential matched to end user requirements. Within the management team, an Audit Committee and Investment & Capital Market Committee have been set up to support the company to achieve its goals. During 2013, the company plans to secure off- take agreements and load its first coal from production. 1 Quarter Ended 31 December 2012 PROJECTS– INDONESIA Indonesian Project’s Sangata SUMATRA KALIMANTAN PADANG Kutai Kertanegara Tapan Banjar Figure 1: Indonesia - Active Project Areas 2 Quarter Ended 31 December 2012 SUMATRA PERKASA PRIMA ABADI (PPA) (Wholly owned subsidiary of ARL) TAPAN PROJECT (100% PPA) PADANG JAMBI Prima Perkasa Abadi PAINAN TAPAN Sumatra Figure 2: Current Project Locations - Sumatra PPA holds an IUP production permit on 198Ha and an IUP exploration permit on 2054Ha. -

Keanekaragaman Serangga Polinator Pada Tanaman Nanas (Ananas Comosus (L.) Merr.) Di Desa Bincau

Jurnal Biology Science & Education 2020 MANAP TRIANTO, dkk Keanekaragaman Serangga Polinator Pada Tanaman Nanas (Ananas comosus (L.) Merr.) Di Desa Bincau Manap Trianto1*, Kaini2, Saliyem2, Eko Warsih2, dan Winarsih2 1Laboratorium Entomologi, Departemen Biologi Tropika, Fakultas Biologi, Universitas Gadjah Mada, Yogyakarta, Indonesia 2GCI Science and Technology, Kabupaten Banjar, Kalimantan Selatan, Indonesia *E-mail: [email protected] Abstrak: Serangga polinator adalah hewan yang memindahkan serbuk sari dari antera bunga jantan ke bagian stigma bunga betina. Tujuan dari penelitian ini adalah untuk mengetahui keanekaragaman serangga penyerbuk di perkebunan nanas (Ananas comosus (L.) Merr.) Desa Bincau, Kecamatan Martapura, Kabupaten Banjar, Kalimantan Selatan. Pengambilan sampel dilakukan secara purposive sampling dengan menggunakan perangkap lem kuning (Yellow sticky trap). Pengamatan serangga dilakukan secara visual control. Pengamatan dimulai pukul 07.00-18.00 WITA yang dibagi menjadi 3 periode waktu, yaitu: 07.00-10.00 WITA, 11.00-14.00 WITA dan 15.00-18.00 WITA. Data yang diperoleh dianalisis menggunakan indeks keanekaragaman Shannon-Wiener (H'). Hasil penelitian menunjukkan bahwa total individu serangga penyerbuk di perkebunan nanas adalah 517 individu, yang terdiri dari 4 ordo dan 8 famili. Famili serangga tertinggi didominasi oleh Formicidae, sedangkan terendah adalah famili Syrpidae. Nilai keanekaragaman serangga polinator yaitu H' = 1,760 yang menunjukkan bahwa tingkat keanekaragaman serangga polinator pada perkebunan Nanas (Ananas comosus (L.) Merr.) Di Desa Bincau, Kecamatan Martapura, Kabupaten Banjar, Kalimantan Selatan dalam kategori sedang. Kata Kunci: Keanekaragaman, Serangga Polinator, Tanaman Nanas, Desa Bincau Abstract: Pollinator insects is an animal that moves pollen from the male anther of a flower to the female stigma of a flower. -

The Tuh.Fat Al-Rāghibīn

NOORHAIDI HASAN The Tuhfat al-Rāghibīn The work of Abdul Samad al-Palimbani or of Muhammad Arsyad al-Banjari? The Indonesian archipelago has an abundance of classical literature on Islamic knowledge.1 At the bottom of the pile there is an anonymous Malay treatise written in Jawi script whose authorship has long been debated. It is the Tuhfat al-Rāghibīn fī Bayān Haqīqaṭ Īmān al-Mu’minīn wa Mā Yufsiduhu fī Riddat al- Murtaddīn (The Gift Addressed to Those Desirous of the Exposition of the Essence of the Faith of the Believers and of That Which Corrupts It, with Respect to the Apostasy of the Apostates), hereafter cited as the Tuhfat al- Rāghibīn. This treatise deals with various aspects of Muslim theology. Its colo- phon states that it was composed in 1188 of the Islamic calendar (AD 1774) to comply with the request of ‘one of the people in the highest authority nowa- days, whom I cannot criticize’ (setengah daripada segala orang besar pada masa ini yang tiada boleh akan daku salahi akan dia). Some scholars have argued that this treatise was composed by Abdul Samad al-Palimbani (circa 1704-circa 1790). However, there is reason to believe that the author was actually Muhammad Arsyad al-Banjari (circa 1710-circa 1812). He was a Banjarese Muslim scholar who exerted great influence on Islamic discourse in the archipelago.2 The Dutch scholar P. Voorhoeve was the first to speculate that the Tuhfat al-Rāghibīn was the work of Abdul Samad. Voorhoeve arrived at this conclu- sion based largely on his observations of a photocopy of the manuscript presented to him by V.I.