Indigo-Paints-IPO-Note-Axis-Capital

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Reconciliation of Share Capital for Quarter Ended June

a! INDIGO Be surprised! Date: July 12, 2021 TO), To BSE Limited National Stock Exchange of India Limited Corporate Relationship Department Exchange Plaza, Plot No. C-1, Block G, 25" Floor, Phiroze Jeejeebhoy Towers, Bandra Kurla Complex, Bandra (East) Dalal Street, Mumbai- 400001 Mumbai -400051 Scrip Code: 543258 NSE Symbol: INDIGOPNTS Sub: Submission of Reconciliation of Share Capital Audit Report under Regulation 76 of SEBI (Depositories and Participants) Regulations, 2018 for the quarter ended June 30, 2021. Dear Sir/Madam, Please find enclosed herewith Reconciliation of Share Capital Audit Report for the quarter ended June 30, 2021 as per Regulation 76 of The Securities and Exchange Board of India (Depositories and Participants) Regulations, 2018 for Indigo Paints Limited. Kindly acknowledge and take the same on record. Thanking You For Indigo Paints Limited Company Secretary & Comp e Officer Enel: As above Registered Office: INDIGO Paints Limited (Formerly INDIGO Paints Pvt Ltd), Indigo Tower, Street- 5, Pallod Farm - 2, Baner Road, Pune 411045, Maharashtra T: +91 20 6681 4300, Email: [email protected], Website: www.indigopaints.com, CIN: U24114PN2000PLCO14669 F7WNAWAUIUS N\A Lb f. BAPAT GAIKWAD AND ASSOCIATES COMPANY SECRETARIES To, The Board of Directors, Indigo Paints Limited Indigo Tower, Street-5, Pallod Farm-2, Baner Road Pune- 411045 CERTIFICATE We have examined the relevant books, documents, register of members, beneficiary details produced before us by the depositories and other records/documents maintained by Link Intime India Private Limited, having its registered office situated at C-101, 1st Floor, 247 Park, Lat Bahadur Shastri Marg, Vikhroli (West) Mumbai- 400083, Registrar and Share transfer agent of Indigo Paints Limited (‘The Company’), in respect of Reconciliation of Share Capital Audit as per Regulation 76 of the Securities and Exchange Board of India (Depositories and Participants) Regulations, 2018. -

Vat 7Anaaatauannnanry Ss

ay winiac Be surprised! Date: 14 May, 2021 To, To BSE Limited National Stock Exchange of India Limited Corporate Relationship Department Exchange Plaza, Plot No. C-1, Block G, 25" Floor, Phiroze Jeejeebhoy Towers, Bandra Kurla Complex, Bandra (East) Dalal Street, Mumbai- 400001 Mumbai -400051 Scrip Code: 543258 NSE Symbol: INDIGOPNTS Dear Sir, Sub: Press Release- Unaudited Financial Results of the Company along with the Limited Review Report thereon for the quarter and nine month ended on 3lst December, 2020. Pursuant to regulation 30 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘Listing Regulations’), we have attached herewith a copy of the Press Release that is being issued by the Company today, in connection with the above captioned subject. Please take the above information on record. Thanking you. Yours faithfully, For Indigo Paints Limit Company Secretary & Compliance Officer Encl — As above Registered Office: INDIGO Paints L i m i t e d (Formerly INDIGO P a i n t s P v t L t d ) , Indigo T o w e r , Street - 5 , Pallod F a r m- 2 , B a n e r R o a d , Pune 4 1 1 0 4 5 , Maharashtra T . + 9 1 20 6681 4 3 0 0 , Email: [email protected], Website: www.indigopaints.com, VAT 7ANAAATAUANNNANRY CIN: U24114PN2000PLCO SS 14669 Olyee a Press Release Financial Results for the quarter and nine month ended 31° December 2020. Highlights of the Results: a. Net Revenue from Operations for the quarter ended December 31, 2020 was Rs 209.64 crores as against Rs. -

Indigo Paints Ltd

Stock Idea Sector: Consumer Goods August 23, 2021 Indigo Paints Ltd Paint your portfolio bright Powered by Sharekhan’s 3R Research Philosophy Indigo Paints Ltd Paint your portfolio bright Stock Idea Stock Powered by the Sharekhan 3R Research Philosophy Consumer Goods Sharekhan code: INDIGOPNTS Initiating Coverage 3R MATRIX + = - Summary We initiate coverage on Indigo Paints Ltd (IPL) with a Buy and assign a target price of Rs. 3,305. Right Sector (RS) ü Differentiated business model, excellent return profile and strong structural growth outlook will keep valuation at a premium of 60x/44x its FY2023/24E earnings versus peers. Right Quality (RQ) ü With a differentiated product portfolio and bottom-up approach, IPL is emerging as one of India’s fastest growing paints companies. Revenues and PAT clocked a CAGR of 22% and 71% over FY2018-21. Right Valuation (RV) ü Gross margins are highest among peers at ~48% led by IPL’s locational advantage and healthy mix of revenues from differentiated products. + Positive = Neutral - Negative Better working capital management has kept net working capital cycle low at 13-14 days. Operating cash flows (OCF) improved from Rs. 42.8 crore to Rs. 101.4 crore over FY2019-21. Reco/View Indigo Paints Limited (IPL) is an emerging player, which has created a niche for itself in the highly competitive paints industry by launching differentiated products, creating brand equity through one prominent brand ‘Indigo’ and follow bottoms-up approach to expand its distribution in the Reco: Buy domestic market. It has market share of 2% but has strong potential to improve it in the coming years. -

Indigo Paints Limited

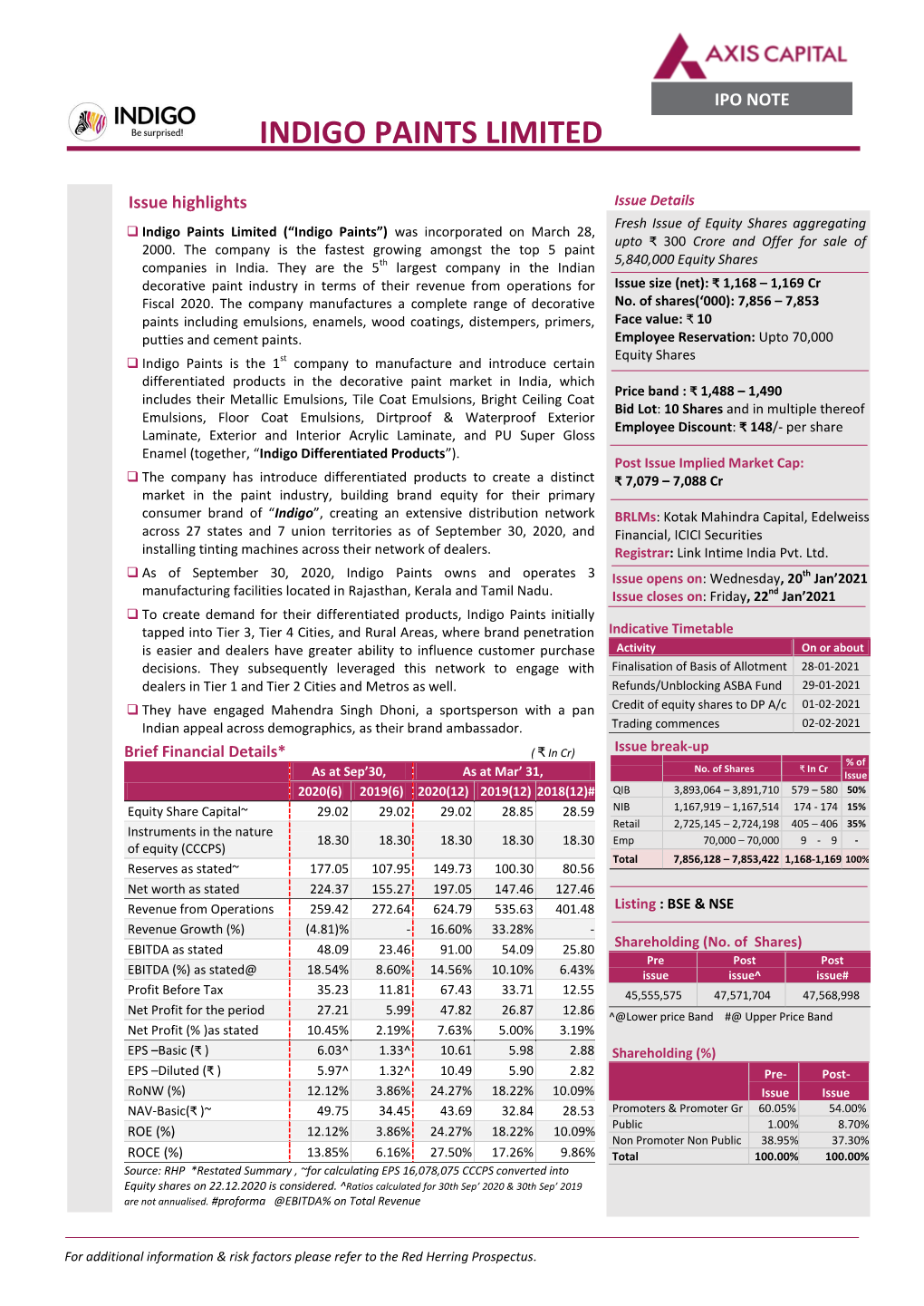

January 18, 2021 IPO Note - SUBSCRIBE INDIGO PAINTS LIMITED Company Background Issue Details Incorporated in 2000, Indigo Paints Ltd (‘Indigo’) has rapidly scaled up its operations to become Fresh Issue of Equity Shares aggregating upto ₹ 300 Crore the fifth largest company in the Indian decorative paint industry in terms of revenues as on and Offer For Sale of 5,840,000 Equity Shares FY20. Indigo has created an extensive distribution network across 27 states and seven union territories. The company manufactures its products across three manufacturing facilities located Issue Highlights in Jodhpur (Rajasthan), Kochi (Kerala) and Pudukkottai (Tamil Nadu) with an aggregate estimated Net Issue Size: ₹ 1,168 – 1,169 Cr No. of Shares ('000): 7,856 – 7,853 installed production capacity of 101,903 kilo litres per annum (“KLPA”) for liquid paints and Face Value (₹): 10 93,118 metric tonnes per annum (“MTPA”) for putties and powder paints. The company has Employee Reservation: Upto 70,000 Equity Shares expanded its manufacturing capabilities to manufacture a complete range of decorative paints Price Band : ₹ 1,488 – 1,490 including emulsions, enamels, wood coatings, distempers, primers, putties and cement paints. Bid Lot: 10 Shares and in multiple thereof Indigo is the first company to manufacture and introduce certain differentiated products in Employee Discount: ₹ 148 /- per share the decorative paint market in India, which includes Metallic Emulsions, Tile Coat Emulsions, Issue Opens On: Wednesday, 20th Jan’2021 Bright Ceiling Coat Emulsions, Floor Coat Emulsions, Dirtproof & Waterproof Exterior Laminates, Issue Closes On: Friday, 22nd Jan’2021 Post Issue Implied Exterior and Interior Acrylic Laminates, and PU Super Gloss Enamel (together, “Indigo ₹ 7,079 – 7,088 Cr Market Cap Differentiated Products”). -

Watt Anac Iana Iz

aay INDIGO Be surprised! Date: 14 May, 2021 To, To BSE Limited National Stock Exchange of India Limited Corporate Relationship Department Exchange Plaza, Plot No. C-1, Block G, 25" Floor, Phiroze Jeejeebhoy Towers, Bandra Kurla Complex, Bandra (East) Dalal Street, Mumbai- 400001 Mumbai -400051 Scrip Code: 543258 NSE Symbol: INDIGOPNTS Dear Sir, Sub: Press Release- Audited Financial Results of the Company along with the Auditor’s Report thereon for the quarter and year ended on 31st March, 2021 Pursuant to regulation 30 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘Listing Regulations’), we have attached herewith a copy of the Press Release that is being issued by the Company today, in connection with the above captioned subject. Please take the above information on record. Thanking you. Yours faithfully, For Indigo Paints Limited (formerly known as Indigo Bai e Sujoy Sudipta Bose Company Secretary & pliance Officer Encl — As above Registered Office: INDIGO Paints Limited (Formerly INDIGO Paints Pvt Ltd), Indigo Tower, Street- 5, Pallod Farm - 2, Baner Road, Pune 411045, Maharashtra WATTT: +91 20 6681ANAC 4300, sineEmail: acacia com, Website:IANA www.indigopaints.com, CIN: U241 14PN2000PLCO14669 IZ ay ae Be surprised! Press Release Financial Results for the quarter and year ended 31't March 2021. Highlights of the Quarterly Results: a. Net Revenue from Operations for the quarter ended March 31, 2021 was Rs 254.27 crores as against Rs. 180.54 crores in the corresponding quarter of the last year representing an increase of 40.8% over the corresponding period of the year before. -

Members' Directory 2017 (Eastern Region)

MEMBERS’ DIRECTORY 2017 (EASTERN REGION) ASSOCIATE MEMBERS Mr. Krishnendu Dey Mr. Sukhendu Hazra Partner CEO Alfa Chemicals Chem-Maco 16, Dum Dum Road 408, Jessore Road Kolkata - 700 074 Bus Stop: Barat Colony West Bengal Kolkata - 700 055 Tel: 033-25495156, 25298121 / 22 West Bengal Fax: 033-25795970 Tel: 033-25221544 / 6199 Mobile: 98312 12723, 98363 81816 Fax: 033-25222153 Email: [email protected]; [email protected] Mobile: 98300 52076, 94331 42299 Email: [email protected]; Mr. Arvind Bubna / Mr. Avinash Bubna [email protected] Chief Executive / Chief Executi ve Arvind Industrials Mr. L.C. Porwal 113, Park Street Ganga Rasayanie Pvt. Ltd. Poddar Point 50-B, Harish Mukherjee Road Block - B, 7th Floor Kolkata - 700 025 Kolkata - 700 016 West Bengal West Bengal Tel: 033-24552080/5884/3203/5814 Tel: 033-40071516 / 17 / 19 Fax: 033-24553203 Fax: 033-40675003 Mobile: 93397 47908 Mobile: 98300 81228 (Arvind Bubna) Email: [email protected] Email: [email protected]; [email protected] Mr. A Mitra Waldies Compound Limited Mr. Nirmal Kumar Bhura A-3/6, Gillanders House Director 8, Netaji Subhas Road Aurum Pharmachem Pvt Ltd Kolkata - 700 001 11, B B Ganguly Street West Bengal 2nd Floor Tel: 033 22302331, 22304182 Kolkata - 700 012 Fax: 033 22304185, 22314912 West Bengal Mobile: 99036 44108 Tel: 033-39851153 Email: [email protected]; [email protected] Fax: 033-40660241 Mobile: 98310 25709 Mr. K Maity Email: [email protected]; GTZ (India) Pvt Ltd [email protected] 9, Brabourne Road, 5th Floor Kolkata - 700 001 West Bengal Tel: 033-22429900 / 01 / 5415 Fax: 033-22107634 Mobile: 98311 05701 Email: [email protected] Mr. -

Credit Rating View

No. CARE/PRO/RL/2020-21/1723 Mr. Hemant Jalan Managing Director Indigo Paints Limited Indigo Tower, Street-5, Pallod Farms II, Baner Road, Pune, Maharashtra - 411045 March 30, 2021 Confidential Dear Sir, Withdrawal of rating assigned to the Bank Facilities of Indigo Paints Limited At the request of the company vide email dated March 13, 2021 along with ‘No Objection Certificate’ dated March 13, 2021 from HDFC Bank, we hereby withdraw the outstanding rating of 'CARE BBB+; Stable/CARE A3+' assigned to the bank facilities of your company with immediate effect. 2. As per our normal procedure, we will be announcing the withdrawal of the rating through a Press Release, a copy of which is enclosed. Meanwhile, please ensure that ratings are not used hereafter, for any purpose whatsoever. 3. In case of any future rating requirements, we will be happy to offer our services. If you need any clarification, you are welcome to approach us in this regard. Thanking you, Yours faithfully, Rahul Gaikwad Amita Yadav Deputy Manager Manager [email protected] [email protected] Page 1 of 6 CARE Ratings Limited CORPORATE OFFICE: 4th Floor, Godrej Coliseum, Somaiya Hospital 9th Floor, Pride Kumar Senate, Plot No. 970 Road, Off Eastern Express Highway, Sion (E), Mumbai - 400 022. Bhamurda, Senapati Bapat Road Tel.: +91-22- 67543456 Fax: +91-22- 022 6754 3457 Shivaji Nagar, Pune - 411 016. Email: [email protected] www.careratings.com Tel: +91-20-4000 9000 CIN-L67190MH1993PLC071691 Encl.: As above Disclaimer CARE’s ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or hold any security. -

Indigo Paints Limited

Page 1 Indigo Paints Limited IPO NOTE 19th January 2021 th India Equity Institutional Research II IPO Note II 19 January 2021 Page 2 Indigo Paints Ltd Issue Opens On Issue Closes On Price Band (INR) Issue Size (INR Cr.) Rating Jan 20, 2021 Jan 22, 2021 1,488-1,490 1,168.0 – 1,169 SUBSCRIBE Indigo Paints Limited was incorporated on March 28, 2000. It is one of the fastest-growing paint companies in India and in terms of revenue, it is the 5th largest company in the decorative paint industry. The company is engaged in manufacturing different types of decorative paints like enamels, emulsions, wood coatings, primers, distempers, putties, and cement paints. It is the first company that started manufacturing certain differentiated products like Metallic Emulsions, Bright Ceiling Coat Emulsions, Tile Coat Emulsions, Dirtproof & Waterproof Exterior Laminate, Floor Coat Emulsions, Exterior and Interior Acrylic Laminate, and PU Super Gloss Enamel. The sales from these differentiated products grew at 28.6% YoY in FY20. It has a strong market network with dealers in Tier 1/2, and Metros as well. It has 3 manufacturing facilities situated in Jodhpur (Rajasthan), Kochi (Kerala), and Pudukkottai (Tamil Nadu). It is further looking to expand its manufacturing capacities at Pudukkottai to manufacture water-based paints. OFFER STRUCTURE Particulars IPO Details Indicative Timetable 7,856,128 – Offer Closing Date Jan 22, 2021 No. of shares under IPO (#) 7,853,422 Finalization of Basis of Allotment with Stock Exchange On or about 27th Jan 2021 7,856,128 -

Press Release Indigo Paints Limited

Press Release Indigo Paints Limited April 06, 2021 Ratings Amount Facilities Ratings1 Rating Action (Rs. crore) Reaffirmed at CARE BBB+; Stable / CARE A3+ Long Term / Short Term Bank - - (Triple B Plus; Outlook: Stable / A Three Plus) and Facilities Withdrawn Reaffirmed at CARE BBB+; Stable Long Term Bank Facilities - - (Triple B Plus; Outlook: Stable) and Withdrawn Total Facilities - Details of instruments/facilities in Annexure-1 Detailed Rationale & Key Rating Drivers CARE has reviewed and reaffirmed the rating assigned to the bank facilities of Indigo Paints Limited (IPL) at CARE BBB+; Stable/CARE A3+ [Triple B Plus; Outlook: Stable/A Three Plus] and has simultaneously withdrawn it, with immediate effect. The reaffirmation of the ratings continues to derive strength from its experienced and qualified promoters and improving track record with dealership network setup across major states. The reaffirmation also takes into account the volume driven growth in scale of operations, healthy profitability, comfortable capital structure and debt coverage indicator during FY20 (refers to a period from April 1 to March 31). Furthermore, CARE takes note of the successful IPO and listing of the company during January 2021. The rating strengths however continue to be constrained by the moderate scale of operations and profitability as compared to established players and intense competition from them which limits the operational flexibility and pricing power of the company. The rating withdrawal is at the request of IPL and ‘No Objection Certificate’ received from the banker that has extended the facilities rated by CARE. Detailed description of the key rating drivers At the time of last rating on February 06, 2020 the following were the rating strengths and weaknesses (updated for the information available) Key Rating Strengths Long established track record and experienced promoters The company has a long track record of more than a decade in the paint industry. -

Nippon India Asset Allocator FOF Allocator Asset India Nippon Nippon Indiaassetallocatorfof Large Cap

Be Where the Growth is Small & Mid Cap Large Cap Gold Debt Visual is for illustration purpose only. Nippon India Asset Allocator FOF (An open ended fund of funds scheme investing in equity oriented schemes, debt oriented schemes and gold ETF of Nippon India Mutual Fund) Performance of various Asset Classes and Sub Asset Classes keep changing over time. Even the best of minds cannot always predict which asset class will do well. But we have a solution for you! Nippon India Asset Allocator FoF invests across Equity oriented schemes, Debt oriented schemes and Gold ETF of Nippon India Mutual Fund with the help of an in-house proprietary model. This model decides allocation across Large Cap, Mid Cap, Small Cap, Short Term Debt, Long Term Debt and Gold ETF. This dynamic framework uses a robust set of Macro, Micro & Market Indicators with an aim to deliver superior risk adjusted returns. This ensures that you are always invested in the asset classes where the growth is most likely to be! NFO Opens On:18th January'21 | NFO Closes On:1st February'21 For more information, contact your mutual fund distributor or visit: mf.nipponindiaim.com Investors will be bearing the recurring expenses of the scheme in addition to the expenses of underlying schemes. Nippon India Asset Allocator FoF (An open ended fund of funds scheme investing in equity oriented schemes, debt oriented schemes and gold ETF of Nippon India Mutual Fund) Nippon India Asset Allocator FoF is suitable for investors who are seeking*: • Long term capital growth • An open ended fund of funds scheme investing in equity oriented schemes, debt oriented schemes and Gold ETF of Nippon India Mutual Fund Investors understand that their principal *Investors should consult their financial advisors if in doubt about whether the product is suitable for them. -

Vap Tanawatlanaary 44 2

aFat l y INDIGO D a t e : May 14, 2 0 2 1 Be surprised! To, To BSE Limited National Stock Exchange of I n d i a Limited Corporate Relationship Department Exchange Plaza, Plot N o . C - 1 , Block G, 25" Floor, Phiroze Jeejeebhoy Towers, Bandra Kurla Complex, Bandra (East) D a l a l Street, Mumbai- 400001 Mumbai - 400051 Scrip C o d e : 543258 NSE SYMBOL: INDIGOPNTS Dear Sir/Madam, Sub: Unaudited Financial Results for t h e Quarter and Nine Month ended December 31, 2020. Dear Sir, Pursuant t o Regulation 33 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2 0 1 5 , p l e a s e f i n d attached the following: 1. Unaudited Financial Results f o r the Quarter and Nine Month e n d e d December 3 1 , 2020; 2 . Limited Review report issued b y the Statutory Auditor f o r t h e Quarter and Nine Month ended December 3 1 , 2020. 3. The Press Release on the financial results for t h e Quarter a n d Nine Month ended December 3 1 , 2020. Kindly take the same on record. Thanking you. Registered Office: INDIGO Pairits Limited (Formerly INDIGO Paints Pvt L t d ) , I n d i g o T o w e r , Street - 5 , Pallod Farm - 2, Baner Road, Pune 41 1045, Maharashtra T : + 9 1 20 6 6 8 1 4300, Email: [email protected], Website: www.indigopaints.com, CIN: U24114PN2000PLCO 14669 VAP TANAWATLANAARY 44 2 Indigo Paints Limited (formerly known as "Indigo Paints Private Limited") Registered Office: Indigo Tower, Street-5, Pallod Farm-2, Baner Road, Pune, Maharashtra- 411045 Corporate Identity Number: U24114PN2000PLC014669 Statement of unaudited -

Paint Sector 1 September 2020

Institutional Equities Paint Sector 1 September 2020 The sector which keeps on giving growth Vishal Punmiya In recent times, growth in India’s paint sector has been an outlier in the overall domestic Research Analyst consumer space. The industry has been witnessing a gradual shift in terms of consumer [email protected] preferences from the traditional whitewash to better quality paints. Besides, it is also witnessing +91-22-6273 8064 healthy competitive environment, where players are applying different strategies to tap the growing demand in the market for a larger regional share. Additionally, rise in disposable income of the average middle class, urbanization, growing rural market, shortening of repainting cycle, upgradation, increase in sale of premium-end products and launch of many innovative products are the major drivers that are pushing the growth of the organized paint industry. Within the Indian decorative paint segment, Asian Paints (APNT) and Berger Paints (BRGR) are the two largest players with more than 80% of their overall revenues coming from the segment and within the industrial paints segment, Kansai Nerolac (KNPL) is the leader (segment contributes ~45% to its revenue). Since in the current environment there is a preference for businesses that are relatively more resilient, sector multiples at current levels in near term will look expensive. We initiate coverage on APNT (Accumulate rating) and BRGR (Sell rating), as we believe that Indian decorative paints will continue to witness higher demand within this space, majorly led by steady shift from unorganized to organized players with bigger players gaining further share. Leaders continue to maintain share even as new players have entered in an oligopolistic market: Organized domestic decorative paints industry is a comfortable oligopoly with a few big players (Asian Paints, Berger, Kansai Nerolac and Akzo Nobel), constituting bulk of the segment, with strong entry barriers such as distribution network and brand equity.