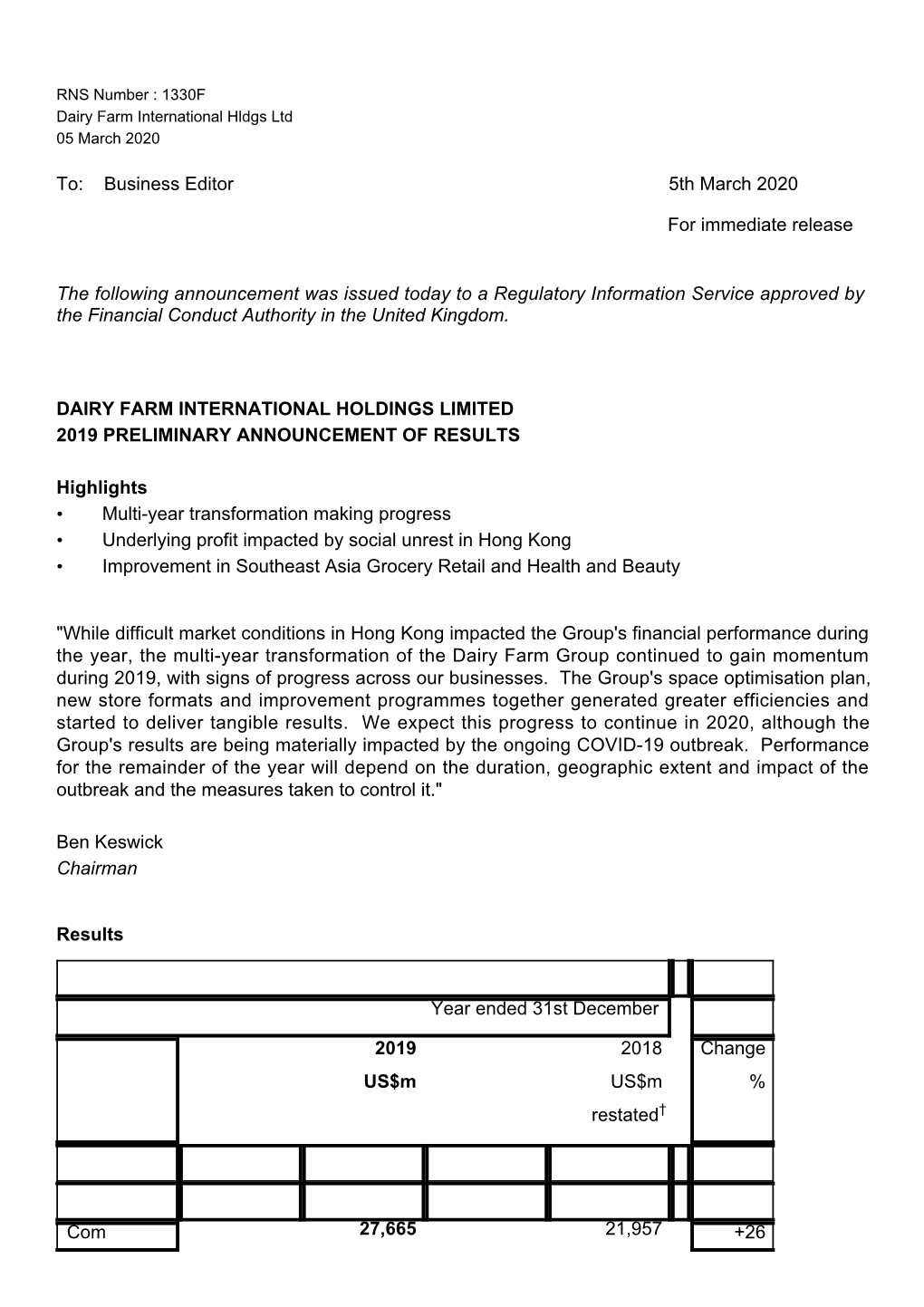

To: Business Editor 5Th March 2020 for Immediate Release The

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pt Hero Supermarket Tbk First Quarter 2019 Results

South Tangerang, 29th April 2019 PT HERO SUPERMARKET TBK FIRST QUARTER 2019 RESULTS Highlights • Net revenue slightly higher at Rp 3,060 billion • Net loss of Rp 4 billion, broadly flat on prior year • Strong sales growth continued in Health and Beauty and IKEA • Food business continued to face challenges but showing improvement Results (Unaudited) First Quarter 2019 2018 Change Rp billion Rp billion % Net Revenue 3,060 3,045 0.5 Gross Profit 872 867 0.6 (Loss) for the year (4) (4) 14.8 Rp Rp % Loss per share (1) (1) - - more - PT Hero Supermarket Tbk Graha Hero I CBD Bintaro Jaya Sektor 7 Blok B7/A7 I Pondok Jaya, Pondok Aren I Tangerang Selatan 15224 - Indonesia Phone: +6221 8378 8388 I www.hero.co.id I Call Centre 0-800-1-998877 Page 2 PRESIDENT DIRECTOR’S STATEMENT Introduction Sales for the period were marginally ahead of the comparable period last year, with Non-Food businesses continuing to perform well, partly offset by softness in the Food business. Financial Performance Total sales in the first quarter increased slightly by 0.5% to Rp 3,060 billion. The Company recorded a net loss of Rp 4 billion, broadly flat against the comparable period in 2018. Food sales were 5% lower at Rp 2,345 billion, impacted by the launch of a store consolidation plan designed to improve space productivity and underlying profitability over time. The Food business recorded an operating loss of Rp 64 billion, before unallocated corporate expenses, compared with Rp 87 billion in the comparable period last year. -

Pipanniversarybrochure.Pdf

www.jardines.com “ Pride in Performance has enabled us to share and celebrate successes across the Group. Anthony Nightingale ” CONTENTS 2 A Decade of Pride in Performance 3 How it Works 5 5 elements to Success 6 Striving 12 Innovating 20 Collaborating 26 Solving 34 Connecting 45 The Entries A DECADE OF PRIDE IN PERFORMANCE HOW IT WORKs A myriad of achievements have contributed to Jardine Matheson’s success since its From inception, the chief executive officers of each business gave their support and founding in 1832. The content of this booklet, however, considers the Group’s more recent encouragement to the new award programme, getting PIP off to an excellent start. history, and a formalized approach that was launched in 2002 to identify and reward outstanding performances across the Group. In the first three years of PIP, entrants sought recognition as the Grand Prize Winner or one of two runners up. From 2005, five categories were introduced so as to recognize specific Through the Pride in Performance (‘PIP’) annual award programme, Jardines recognizes areas of achievement, from which the Grand Prize Winner is then chosen. individual business units within the Group that embody its core values and translate them into sustained commercial success. In addition to recognition, PIP is designed to share Of the categories, some remained consistent, such as Customer Focus, Marketing those operating company success stories with the larger Group. Excellence and Successful New Venture, while others evolved. Business Turnaround became Business Outperformance as the Group’s operations progressed, and Productivity Using the Group’s core values as criteria for submission – The Right People, Energy, Enhancement evolved into Innovation and Creativity. -

Annual Report 2019 Our Goal: “ to Give Our Customers Across Asia a Store They TRUST, Delivering QUALITY, SERVICE and VALUE.”

Annual Report 2019 Our Goal: “ To give our customers across Asia a store they TRUST, delivering QUALITY, SERVICE and VALUE.” Dairy Farm International Holdings Limited is incorporated in Bermuda and has a standard listing on the London Stock Exchange, with secondary listings in Bermuda and Singapore. The Group’s businesses are managed from Hong Kong by Dairy Farm Management Services Limited through its regional offices. Dairy Farm is a member of the Jardine Matheson Group. A member of the Jardine Matheson Group Annual Report 2019 1 Contents 2 Corporate Information 36 Financial Review 3 Dairy Farm At-a-Glance 39 Directors’ Profiles 4 Highlights 41 Our Leadership 6 Chairman’s Statement 44 Financial Statements 10 Group Chief Executive’s Review 116 Independent Auditors’ Report 14 Sustainable Transformation at Dairy Farm 124 Five Year Summary 18 Business Review 125 Responsibility Statement 18 Food 126 Corporate Governance 22 Health and Beauty 133 Principal Risks and Uncertainties 26 Home Furnishings 135 Shareholder Information 30 Restaurants 136 Retail Outlets Summary 34 Other Associates 137 Management and Offices 2 Dairy Farm International Holdings Limited Corporate Information Directors Dairy Farm Management Services Limited Ben Keswick Chairman and Managing Director Ian McLeod Directors Group Chief Executive Ben Keswick Clem Constantine Chairman (joined the Board on 11th November 2019) Ian McLeod Neil Galloway Group Chief Executive (stepped down on 31st March 2019) Clem Constantine Mark Greenberg Chief Financial Officer (joined the board on 19th November 2019) George J. Ho Neil Galloway Adam Keswick Group Finance & IKEA Director (stepped down on 31st March 2019) Simon Keswick (stepped down on 1st January 2020) Choo Peng Chee Chief Executive Officer – North Asia Michael Kok & Group Convenience (stepped down on 8th May 2019) Sam Kim Dr Delman Lee Chief Executive Officer – Health & Beauty and Chief Marketing & Business Development Officer Anthony Nightingale Martin Lindström Y.K. -

Dairy Farm International Holdings Limited

Annual ReportAnnual 2017 Dairy Farm International Holdings Limited Annual Report 2017 Our Goal : “To give our customers across Asia a store they TRUST, delivering QUALITY, SERVICE and VALUE” Dairy Farm International Holdings Limited is incorporated in Bermuda and has a standard listing on the London Stock Exchange, with secondary listings in Bermuda and Singapore. The Group’s businesses are managed from Hong Kong by Dairy Farm Management Services Limited through its regional offices. Dairy Farm is a member of the Jardine Matheson Group. A member of the Jardine Matheson Group Contents 2 Corporate Information 3 Dairy Farm At-a-Glance 4 Highlights 6 Chairman’s Statement 8 Group Chief Executive’s Review 12 Feature Stories 16 Business Review 16 Food 22 Health and Beauty 26 Home Furnishings 30 Restaurants 34 Financial Review 37 Directors’ Profiles 39 Our Leadership 42 Financial Statements 100 Independent Auditors’ Report 108 Five Year Summary 109 Responsibility Statement 110 Corporate Governance 117 Principal Risks and Uncertainties 119 Shareholder Information 120 Retail Outlets Summary 121 Management and Offices Annual Report 2017 1 Corporate Information Directors Dairy Farm Management Services Limited Ben Keswick Chairman and Managing Director Ian McLeod Directors Group Chief Executive Ben Keswick Neil Galloway Chairman Mark Greenberg Ian McLeod Group Chief Executive George J. Ho Neil Galloway Adam Keswick Group Finance Director Sir Henry Keswick Choo Peng Chee Regional Director, North Asia (Food) Simon Keswick Gordon Farquhar Michael Kok Group Director, Health and Beauty Dr George C.G. Koo Martin Lindström Group Director, IKEA Anthony Nightingale Michael Wu Y.K. Pang Chairman and Managing Director, Maxim’s Jeremy Parr Mark Greenberg Lord Sassoon, Kt Y.K. -

Press Release Ahold to Divest Its Indonesian Operation to Hero

Press Release Royal Ahold Public Relations Date: April 29, 2003 For more information: +31 75 659 57 20 Ahold to divest its Indonesian operation to Hero Zaandam, The Netherlands, April 29, 2003 – Ahold hereby announces that it has reached agreement for the sale of its Indonesian operation to PT Hero Supermarket Tbk for approximately Euro 12 million, excluding proceeds from the sale of store inventory. This asset purchase agreement is subject to the approval of Hero’s shareholders and is expected to be finalized in the third quarter of 2003. Hero is a prominent food retail group listed on the Jakarta stock exchange with 200 outlets throughout Indonesia. The transaction involves 22 stores plus one under construction, and two distribution centers. The actual transfer of the stores and both distribution centers will take place following the approval of Hero shareholders. Staff at Ahold’s Indonesian headquarters are not included in the transaction, although Ahold is committed to meeting its obligations to these associates. The divestment of Ahold’s activities in Indonesia is part of the company’s strategic plan to restructure its portfolio to focus on high-performing businesses, to concentrate on its mature and most stable markets and to reduce its debt. Ahold first entered the Indonesian market through a technical service agreement with the PSP group in 1996. That agreement ended in 2002 and Ahold Tops Indonesia became a wholly-owned subsidiary. Unaudited net sales in 2002 amounted to approximately Euro 37 million. Ahold employs approximately 1,600 people in Indonesia. Ahold Corporate Communications: +31.75.659.5720 ------------------------------------------------------------------------------------------------------------------------------------------------------------ Certain statements in this press release are “forward-looking statements” within the meaning of U.S. -

Overseas Packaging Study Tour VAMP.006 1996

Overseas packaging study tour VAMP.006 1996 Prepared by: B. Lee ISBN: 1 74036 973 4 Published: June 1996 © 1998 This publication is published by Meat & Livestock Australia Limited ABN 39 081 678 364 (MLA). Where possible, care is taken to ensure the accuracy of information in the publication. Reproduction in whole or in part of this publication is prohibited without the prior written consent of MLA. MEAT & LIVESTOCK AUSTRALIA CONTENTS 1.0 EXECUTIVE SUMMARY ............................................ 1 2.0 BACKGROUND .................................................... 4 3.0 THE INTERNATIONAL STUDY TOUR .............. .................. 6 3.1 Objectives of the International Study Tour ................................. 6 3.2 Study Tour Itinerary and Dates .......................................... 6 3.3 The Study Team ...................................................... 6 4.0 SUMMARY OF SITE VISITS ......................................... 7 4.1 Taiwan ............................................................. 7 4.2 Hong Kong .......................................................... 8 4.3 France .............................................................. 9 4.4 Holland ............................................................ l 0 4.5 United Kingdom ..................................................... 13 4.6 Canada ............................................................ 15 4.7 Summary Comments of Site Visits by Study Group ......................... 17 5.0 KEY FINDINGS FROM THE STUDY TOUR ....... .................... 18 5.1 -

FOR IMMEDIATE RELEASE Dairy Farm and the Food

FOR IMMEDIATE RELEASE Dairy Farm and The Food Bank Singapore launch Better Together - the first food donation drive focused on better nutrition for families in need ● First 10,000 meals to be donated by Dairy Farm to kick start initiative ● Target to drive donations of 10,000 meals every month SINGAPORE, 18 December 2020 - The Dairy Farm Group, who own retail supermarkets Giant and Cold Storage, today announced a partnership with The Food Bank Singapore to launch Better Together, a first-of-its-kind food donation drive focused on providing daily necessities and more nutritious products to families in need. The partnership kicks off with 10 pilot stores* across Cold Storage and Giant, with a view to roll out island-wide over the next few months. Dairy Farm will kick start the initiative with a donation of 10,000 meals to The Food Bank Singapore’s beneficiaries - a target the initiative hopes to achieve with the help of customers every month. Better Together combines the scale and reach of Dairy Farm supermarkets, and The Food Bank Singapore’s extensive network and expertise with food donations which supports 370 organisations, serving over 100,000 families. Better Together was also organised in support of SG Cares Giving Week which took place earlier in the month. CLOSING THE NUTRITIONAL GAP IN FOOD DONATIONS According to The Hunger Report 2019, a study commissioned by The Food Bank Singapore conducted by the Singapore Management University Lien Centre for Social Innovation, 10.4% of Singaporean households experienced food insecurity – defined as when a household does not have access to food for a healthy life - at least once in 12 months. -

The Impacts of Supermarkets and Hypermarkets from the Perspectives of Fresh Fruit and Vegetable (Ffv) Wholesalers and Retailers

Journal of Agribusiness Marketing • Vol.Amin 4 (2011): Mahir 21-37et al. THE IMPACTS OF SUPERMARKETS AND HYPERMARKETS FROM THE PERSPECTIVES OF FRESH FRUIT AND VEGETABLE (FFV) WHOLESALERS AND RETAILERS Amin Mahir Abdullah* Fatimah Mohamad Arshad Ismail Abd Latif ABSTRACT The importance of the retail sector to economic growth has been very significant. The rapid growth of the sector is partly contributed by the emergence of supermarkets and hypermarkets that are mostly foreign- owned. This has raised some concerns by the local conventional retailers including fresh fruit and vegetable (FFV) retailers. The government has reacted to the concerns by introducing new guidelines to developing new hypermarkets in this country. This study investigates the impacts of these two types of retailers on local FFV wholesalers and retailers. Data from personal interviews with FFV retailers and wholesalers were analysed. Results of the analyses showed that supermarkets and hypermarkets did impose competition on conventional wholesalers and retailers. However, they have also brought some changes to FFV retail business, such as promoting quality products, and a better and a systematic marketing approach. Keywords: Fresh fruit, vegetable, supermarkets, hypermarkets, wholesalers, retailers INTRODUCTION Malaysia’s food retail industry has progressed rapidly in parallel to the changes in the developed economy that is, the growth of hypermarkets and retailers as the major retail centres for consumers to buy foods and consumer goods. This development is brought about by the globalisation process, in particular the free flow of capital between countries and enhanced by the Foreign Direct Investment policy of the country. This development, however, poses a challenge to the traditional distribution network. -

Matahari Putra Prima (MPPA IJ)

Indonesia Initiating Coverage 6 July 2021 Consumer Non-cyclical | Retail - Staples Matahari Putra Prima (MPPA IJ) Buy The Rising Phoenix; Initiate BUY Target Price (Return): IDR1,750 (+50%) Price: IDR1,170 Market Cap: USD606m Avg Daily Turnover (IDR/USD) 81,591m/5.66m Initiate coverage with a BUY and IDR1,750 TP, 50% upside. Matahari Putra Analysts Prima’s recent revamping of initiatives should help to transform its business and keep it ahead of competitors. A strong focus on digital initiatives – particularly Indonesia Research Team the collaboration with Indonesia’s largest technology group GoTo – will likely +6221 5093 9888 lead to greater monetisation from the e-groceries trend. Our SOP-based TP is [email protected] derived from 1.7x 2023F P/S (fresh products) and 11.0x 2023F EV/BITDA (non- fresh products). Possible additional investment from GoTo is a likely catalyst to its share price. Michael Setjoadi Internal business transformation on the cards. The company aims to strongly +6221 5093 9844 [email protected] focus on expanding sales of its fresh products. We are positive on this strategy given less intense competition in the segment and this strategy may work well, supported by its strong merchandising programme (ie partnership with Disney), Marco Antonius Indonesian Ulama Council’s (MUI) halal assurance system (HAS) and strong +6221 5093 9849 logistics facilities. The company will also continue its expansion with a new, [email protected] smaller efficient yet modern hypermarket format, yielding better productivity and efficiency. This should help MPPA penetrate into residential areas, as well as Tier II and III cities. -

200 Leading Retailers in Asia

200 Leading Retailers in Asia . Showcasing the very best in retail innovation across Asia from hypermarkets to convenience retail made with Introduction Thank you for downloading this eBook featuring 200 of the most exciting & innovative retailers in Asia. We've spent weeks speaking with our community and researching across the web to bring you this list, and we hope that you nd it useful & interesting. This is by no means a denitive resource, but more an opportunity to spark a discussion. Which retailers would make your top 200? Which countries do you see as the biggest opportunity for retail? Which categories excite you the most? How will this list change as e-commerce continues to grow? We'd love to hear your thoughts. Seamless Asia We were inspired to put this list together ahead of our Seamless Asia conference and exhibition, running on 2nd-4th May 2018 at Suntec Convention Centre here in Singapore. Over the years we've seen so many phenomenal retailers take the stage to present their challenges and their visions for the future of retail. Through this eBook we wanted to honour many of those businesses, as well as showcase some of those who we hope will join us in the future to share their stories. We would love to see you and your team at the show in May, as we come together to celebrate the very best in Asian retail, and look ahead to the seamless future of commerce throughout the region. Best wishes Oliver Arscott & Team Seamless Key Statistics Category Statistics First let's take a look at categories. -

The Comparison Study of Custommer's Satisfaction Between

The International Journal of Social Sciences and Humanities Invention 4(12): 4161-4168 2017 DOI: 10.18535/ijsshi/v4i12.02 ICV 2015: 45.28 ISSN: 2349-2031 © 2017, THEIJSSHI Research Article The Comparison Study of Custommer’s Satisfaction between Carefour and Giant Hypermarket in Cikarang West Java Edy Supriyadi1, Lies Putriana2, Yanti Murni3 Graduate School Pancasila University, Mercu Buana University Abstract: This research purposed to know the customer satisfaction between Giant and Carrefour Hypermarket. The research methodology that the researcher used in this case is Quantitative analysis method. The sample size, the researchers calculate the minimum sample size required to make the research by using sample size for mean formula by slovin. The result gives that this research requires minimum 180 respondents to gain the 95% level of confidence with the 0.5 standard of error and standard deviation 3.42. The statistical analysis used anova to compare the customer’s satisfaction between two Carefour and Giant Hypermarket. The weighted mean used to evaluate what is dominant factor between them. The result were (1)The Carrefour and The Giant hypermarkets don’t have the significant difference in customer satisfaction (2) In product diversification factor that influences the customer satisfaction, Giant has better role (3) The quality of products in Carrefour is better than products in Giant (4) In product quality factor that influences the customer satisfaction, Carrefour has better role (5) The Quality of products in Carrefour is better -

Profil Perusahaan Company Profile

04 Profil Perusahaan Company Profile PT Hero Supermarket Tbk 32 33 Laporan Tahunan 2019 | Annual Report 2019 Ikhtisar Kinerja 2019 Informasi Saham Laporan Manajemen Profil Perusahaan 2019 Performance Overview Stock Information Management Reports Company Profile Identitas Perusahaan Company Identity Nama Perusahaan Company Name Situs Resmi Perusahaan Company Official Sites PT Hero Supermarket Tbk www.hero.co.id www.herosupermarket.co.id www.guardianindonesia.co.id Perubahan Nama Perusahaan Change of Company www.giant.co.id Sebelumnya Perseroan bernama PT Hero Mini www.IKEA.co.id Supermarket, kemudian berganti nama menjadi PT Hero Supermarket per Rapat Umum Facebook Pemegang Saham tanggal 7 Juni 1991. Hero Infoodtainment, Previously named PT Hero Mini Supermarket, Guardian Indonesia, the Company changed its name to PT Hero Giant Indonesia Supermarket as of the General Meeting of IKEA Indonesia Shareholders dated 7 June 1991 Hero Peduli Twitter Alamat Kantor Pusat Head Office Address Herosupermarket Graha Hero, CBD Bintaro Sektor 7 Blok B7/ GuardianID A7 Pondok Jaya, Pondok Aren, Tangerang GiantIndo Selatan, 15224, Indonesia. IKEA_Ind Graha Hero, CBD Bintaro Sektor 7 Blok B7/A7 Pondok Jaya, Pondok Aren, Tangerang Selatan, Instagram 15224, Indonesia Herosupermarket giant_indonesia Alamat Kontak Contact Address guardianindonesia Sekretaris Perusahaan, Graha HERO Lantai 4, IKEA_id CBD Bintaro Sektor 7 Blok B7 / A7, Pondok hero.peduli Aren, Tangerang Selatan, 15224, Indonesia Corporate Secretary, Graha HERO 4th Floor, Tanggal Pendirian Date of