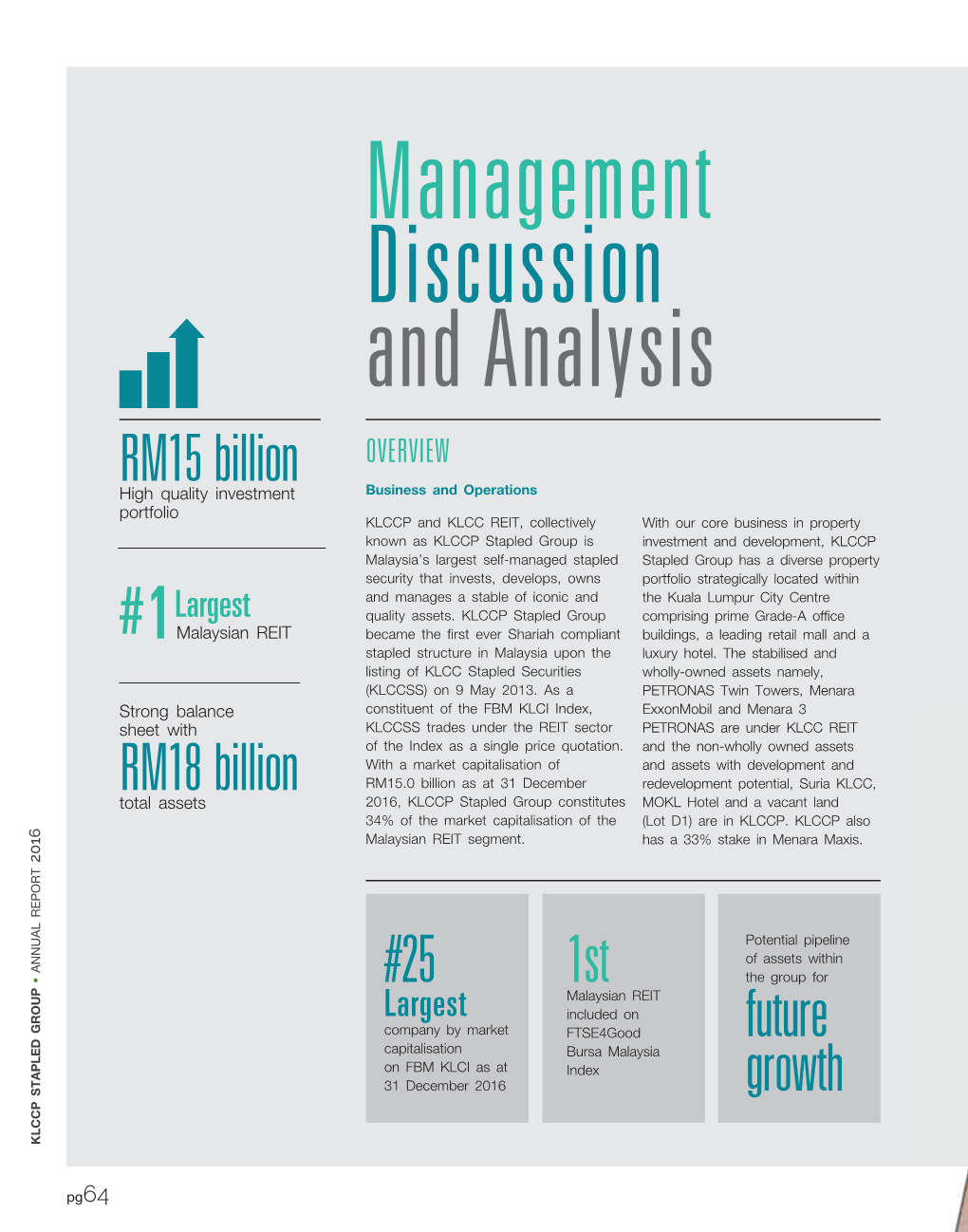

RM15 Billion RM18 Billion #25 1St Future Growth

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 1ST HALF 2016 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR HIGH END CONDOMINIUM MARKET The residential market continues to remain lacklustre with lower volume and value of transactions recorded. ECONOMIC AND MARKET INDICATORS Limited project completions and new Malaysia’s economy expanded at a launches of high end condominiums / slower pace in 2015 with Gross Domestic residences during the review period. Product (GDP) growing at an annual rate of 5.0% (2014: 6.0%). For 2016, the Government has trimmed the country’s Growing pressure on rentals amid GDP growth forecast to 4 - 4.5% due to strong supply pipeline (existing and the volatility in crude oil prices and other new completions) and a challenging economic challenges. GDP continued rental market while prices in to moderate in the first quarter of 2016, the secondary market generally posting 4.2% growth, its slowest since continue to remain resilient. 3Q2009 (4Q2015: 4.5%), driven by domestic demand. Private consumption expanded by 5.3% while private Developers adopt innovative ‘push investment moderated to 2.2%. marketing’ strategies to boost Headline inflation for April 2016 registered at sales of selected projects and 2.1%. It is expected to be lower at 2% to 3% improve revenue. this year, compared to an earlier projection Aria of 2.5% to 3.5% and will continue to remain stable in 2017. (432 units) and The Residences at The Meanwhile, labour market conditions St. Regis Kuala Lumpur (160 units). continued to weaken with more retrenchment of workers, particularly in By the second half of 2016, the scheduled the manufacturing, mining and services completions of another five projects will sectors. -

The Financial Year 2012 Was, Without Doubt, Another Challenging Period for Tenaga Nasional Berhad (Tnb)

KEEPING THE LIGHTS ON YOU SEE Tenaga Nasional Berhad www.tnb.com.my No. 129, Jalan Bangsar, 59200 Kuala Lumpur Tel: 603 2180 4582 Fax: 603 2180 4589 Email: [email protected] Annual Report Annual 2012 Tenaga Nasional Berhad Tenaga 200866-W annual report 2012 WE SEE... OUR COMMITMENT TO THE NATION >OH[ `V\ ZLL PZ Q\Z[ VUL ZTHSS WPLJL VM [OL IPN WPJ[\YL 6\Y YVSL PZ [V WYV]PKL TPSSPVUZ VM 4HSH`ZPHUZ ^P[O HMMVYKHISL YLSPHISL LMMPJPLU[ HUK \UPU[LYY\W[LK HJJLZZ [V LSLJ[YPJP[` -YVT WV^LYPUN [OL UH[PVU»Z HKTPUPZ[YH[P]L JHWP[HS [V SPNO[PUN \W OV\ZLOVSKZ HUK LTWV^LYPUN HSS ZLJ[VYZ VM [OL LJVUVT` ^L OH]L OLSWLK YHPZL [OL X\HSP[` VM SPML PU [OL JV\U[Y` HUK ZW\Y [OL UH[PVU»Z WYVNYLZZ V]LY [OL `LHYZ 4VYL [OHU Q\Z[ SPNO[PUN \W OVTLZ HUK Z[YLL[Z ;5) PZ JVTTP[[LK [V LUZ\YPUN [OH[ L]LY` 4HSH`ZPHU PZ HISL [V LUQV` [OL ILULMP[Z VM LSLJ[YPJP[` LHJO HUK L]LY` KH` VM [OL `LHY I` RLLWPUN [OL SPNO[Z VU KEEPING THE LIGHTS ON INSIDEwhat’s TO BE AMONG THE LEADING VISION CORPORATIONS IN ENERGY AND RELATED BUSINESSES 4 Notice of the 22nd Annual General Meeting 7 Appendix I 9 Statement Accompanying Notice GLOBALLY of the 22nd Annual General Meeting 10 Financial Calendar 11 Investor Relations 14 Share Performance WE ARE 15 Facts at a Glance 16 Chairman’s Letter to Shareholders COMMITTED TO 22 President/CEO’s Review 33 Key Highlights 34 Key Financial Highlights EXCELLENCE 35 Five-Year Group Financial Summary MISSION IN OUR 36 Five-Year Group Growth Summary PRODUCTS AND SERVICES KEEPING THE LIGHTS ON Corporate Framework Operations Review 40 About Us 135 Core Businesses 42 Corporate Information 136 Generation 1 44 Group Corporate Structure 142 Transmission 5 46 Organisational Structure 146 Distribution 47 Awards & Recognition 153 Non-Core Businesses 51 Key Past Awards 154 New Business & Major Projects 54 Media Highlights 160 Group Finance 56 Calendar of Events 163 Planning 62 Milestones Over 60 Years 168 Corporate Affairs & Services 175 Procurement Performance Review Other Services 179 Sabah Electricity Sdn. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 2ND HALF 2016 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR HIGH END CONDOMINIUM MARKET Despite the subdued market, there were noticeably more ECONOMIC INDICATORS launches and previews in the TABLE 1 second half of 2016. Malaysia’s Gross Domestic Product Completion of High End (GDP) grew 4.3% in 3Q2016 from 4.0% Condominiums / Residences in in 2Q2016, underpinned by private 2H2016 The secondary market, however, expenditure and private consumption. continues to see lower volume Exports, however, fell 1.3% in 3Q2016 of transactions due to the weak compared to a 1.0% growth in 2Q2016. economy and stringent bank KL Trillion lending guidelines. Amid growing uncertainties in the Jalan Tun Razak external environment, a weak domestic KL City market and continued volatility in the 368 Units The rental market in locations Ringgit, the central bank has maintained with high supply pipeline and a the country’s growth forecast for 2016 at weak leasing market undergoes 4.0% - 4.5% (2015: 5.0%). correction as owners and Le Nouvel investors compete for the same Headline inflation moderated to 1.3% in Jalan Ampang 3Q2016 (2Q2016: 1.9%). pool of tenants. KL City 195 Units Unemployment rate continues to hold steady at 3.5% since July 2016 (2015: The review period continues to 3.1%) despite weak labour market see more developers introducing conditions. Setia Sky creative marketing strategies and Residences - innovative financing packages Bank Negara Malaysia (BNM) lowered the Divina Tower as they look to meet their sales Overnight Policy Rate (OPR) by 25 basis Jalan Raja Muda KL City target and clear unsold stock. -

Kuala Lumpur Guide

Book online or call us at +60 (3) 2302 7555 www.asiawebdirect.com KUALA LUMPUR GUIDE YOUR FREE KUALA LUMPUR GUIDE FROM THE ASIA TRAVEL SPECIALISTS The capital of an Islamic nation that has enthusiastically embraced the 21st century, Kuala Lumpur strives to emulate and compete with some of Asia's celebrated mega-buck cities. Home to over 1.4 million inhabitants, KL plays host to the world's tallest twin buildings (Petronas Twin Towers), colonial edifices such as Dataran Merdeka, and plenty of inner-city greenery. Although you'll frequently hear the adhan (call to prayer) coming from mosques, it's easy to forget KL's Islamic roots once you hit the city's nitty-gritty sights. It is these spots - thriving hawker centres, pre-war shop-houses and a colourful jumble of street markets - that define KL and draw in countless visitors every year. From Petaling Street's faux-label laden avenue and Little India's colourful, culture- rich wares to the breathtaking view from the Twin Towers' Skybridge and a variety of temples, KL has something for everyone. WEATHER SIM CARDS AND CURRENCY The city's average temperatures range DIALING PREFIXES Ringgit Malaysia (MYR). US$1 = approximately between 29°C - 35°C during the day and 26°C Malaysia's three main cell phone service MYR 3.20 - 29°C at night, though it may get colder after providers are Celcom, Digi and Maxis. You periods of heavy rainfall. As it is shielded by can obtain prepaid SIM cards almost mountainous terrains, KL is relatively cooler anywhere - especially inside large-scale TIME ZONE than most places in Malaysia while being one shopping malls. -

Malaysia 2018 ASIA PACIFIC REAL ESTATE MARKET OUTLOOK | MALAYSIA

CBRE | WTW RESEARCH 2018 ASIA PACIFIC REAL ESTATE MARKET OUTLOOK Malaysia 2018 ASIA PACIFIC REAL ESTATE MARKET OUTLOOK | MALAYSIA FORMATION A B OU T W T W CBRE | WTW entered into an agreement in May 2016 to Colin Harold Williams established C H Williams & Co in form a joint venture to provide a deep, broad service offering Kuala Lumpur in 1960. C H Williams & Company merged for the clients of both firms. This combines Malaysia’s in 1974 with Talhar & Company founded by Mohd Talhar largest real estate services provider, WTW’s local expertise Abdul Rahman and the inclusion of Wong Choon Kee to and in-depth relationships in Malaysia with CBRE’s global form C H Williams Talhar & Wong (WTW). reach and broad array of market leading services. In 1975, C H Williams Talhar Wong & Yeo (WTWY) was The union of CBRE and WTW is particularly significant established in Sarawak. C H Williams Talhar & Wong because of our shared history. In the1970s, CBRE acquired (Sabah) (WTWS) was established in 1977. businesses from WTW in Singapore and Hong Kong, which remain an integral part of CBRE’s Asian operations. The current management is headed by Group Chairman, Mohd Talhar Abdul Rahman. The wider WTW Group comprises a number of subsidiaries and associated offices located in East Malaysia including: The current Managing Directors of the WTW Group operations are: • C H Williams Talhar Wong & Yeo Sdn Bhd (1975) • CBRE | WTW: Mr. Foo Gee Jen • C H Williams Talhar & Wong (Sabah) Sdn Bhd (1977) • C H Williams Talhar & Wong (Sabah) Sdn Bhd: Mr. -

No. Name Address City Postcod State Country Off. No. Email 1 JING

No. Name Address City Postcod State Country Off. No. Email [email protected] JING SHENG BG-16, JALAN MESTIKA / 1 CONSTRUCTION & CHERAS 56100 SELANGOR MALAYSIA 342957713 17, TAMAN MESTIKA [email protected] ENGINEERING SDN BHD om 2H OFFSHORE SUITE 16-3, 16TH FLOOR, KUALA WIL PER 2 50450 MALAYSIA 60321627500 [email protected] ENGINEERING SDN BHD WISMA UOA II, 21 JALAN LUMPUR K.LUMPUR LEVEL 8, BLOCK F, OASIS 3 3M MALAYSIA SDN BHD PETALING JAYA 47301 SELANGOR MALAYSIA 03-78842888 SQUARE, NO. 2, JALAN LOT 15 & 19, PERSIARAN NEG. 4 3M SEREMBA SEREMBAN 70450 MALAYSIA 66778111 TANJUNG 2, SENAWANG SEMBILAN PLO 317, JALAN PERAK, PASIR 072521288 / schw@5e- 5 5E RESOURCES SDN BHD 81700 JOHOR MALAYSIA KAWASAN GUDANG 072521388 resources.com 17-6, THE BOULEVARD KUALA WIL PER 6 8 EDUCATION SDN BHD 59200 MALAYSIA 03-22018089 OFFICE, MID VALLEY LUMPUR K.LUMPUR A & D DESIGN NETWORK F-10-3, BAY AVENUE PULAU 7 BAYAN LEPAS 11900 MALAYSIA 46447718 [email protected] SDN BHD LORONG BAYAN INDAH 1 PINANG NO 23-A, TINGKAT 1, 8 A & K TAX CONSULTANTS JALAN PEMBANGUNAN JOHOR BAHRU 81200 JOHOR MALAYSIA 72385635 OFF JALAN TAMPOI 9 A + PGRP 36B, SAGO STREET SINGAPORE 50927 SINGAPORE SINGAPORE 656325866 [email protected] A A DESIGN 390-A, JALAN PASIR 10 IPOH 31650 PERAK MALAYSIA 6052537518 COMMUNICATION SDN PUTEH, A H T (NORLAN UNITED) & BLOK B UNIT 4-8 IMPIAN KUALA WIL PER 11 50460 MALAYSIA 322722171 CARRIAGE SDN BHD KOTA, JALAN KAMPUNG LUMPUR K.LUMPUR A JALIL & CO SDN BHD ( IPOH ) NO. 14B, LALUAN IPOH 31350 PERAK MALAYSIA 05-3132072 MEDAH RAPAT, 12 A JALIL & CO SDN BHD GUNUNG RAPAT, NO. -

Here He Worked As a Research Fellow, Senior Research Fellow and Lecturer

2015 Third IAPR Asian Conference on Pattern Recognition ACPR 2015 3 - 6 November 2015 · Kuala Lumpur, Malaysia Welcome Message from the Chair On behalf of the ACPR2015 organizing committee, we are delighted to welcome you to Kuala Lumpur, Malaysia for the Third Asian Conference on Pattern Recognition (ACPR2015). The ACPR was initiated to promote the scientific exchanges and collaborations of pattern recognition researchers in the Asia-Pacific Region, and it also welcomes participation from the other regions of the world. The third ACPR follows the previous editions, ACPR2011 in Beijing, China, and ACPR2013 in Naha, Okinawa, Japan. For the ACPR2015, we invite you to take advantage of the technical program and meanwhile experience the culture of the Southeast Asian city Kuala Lumpur. The technical program is no doubt the most important part of the conference ACPR2015. By the submission deadline of July 17, 2015, the program committee received 422 full submissions from 33 countries. The program chairs invited 107 program committee members and 128 additional reviewers to review the submitted papers. Each paper received at least two reviews, and most papers each received three reviews. Based on reviews, the program committee accepted 36 papers for oral presentations and 134 papers for poster presentations. The technical program includes nine oral sessions, three poster sessions, and four invited keynote speeches. The keynote speeches are given by four internationally renowned researchers active in pattern recognition and computer vision. They are: Tieniu Tan (China) with speech title “Large-Scale Visual Computing: Challenges and Opportunities”, Ching Y. Suen (Canada) with speech title “Methods of Achieving Perfect Recognition Scores”, Maja Pantic (UK) with speech title “Automatic Analysis of Facial Expressions”, and Yoshua Bengio (Canada) with speech title “Deep Learning”. -

Property Market Review | 2020–2021 3

2021 2020 / MARKET REVIEW MARKET PROPERTY 2020 / 2021 CONTENTS Foreword | 2 Property Market Snapshot | 4 Northern Region | 7 Central Region | 33 Southern Region | 57 East Coast Region | 75 East Malaysia Region | 95 The Year Ahead | 110 Glossary | 113 This publication is prepared by Rahim & Co Research for information only. It highlights only selected projects as examples in order to provide a general overview of property market trends. Whilst reasonable care has been exercised in preparing this document, it is subject to change without notice. Interested parties should not rely on the statements or representations made in this document but must satisfy themselves through their own investigation or otherwise as to the accuracy. This publication may not be reproduced in any form or in any manner, in part or as a whole, without writen permission from the publisher, Rahim & Co Research. The publisher accepts no responsibility or liability as to its accuracy or to any party for reliance on the contents of this publication. 2 FOREWORD by Tan Sri Dato’ (Dr) Abdul Rahim Abdul Rahman Executive Chairman, Rahim & Co Group of Companies 2020 came through as the year to be remembered but not in the way anyone had expected or wished for. Malaysia saw its first Covid-19 case on 25th January 2020 with the entrance of 3 tourists via Johor from Singapore and by 17th March 2020, the number of cases had reached above 600 and the Movement Control Order (MCO) was implemented the very next day. For two months, Malaysia saw close to zero market activities with only essential goods and services allowed as all residents of the country were ordered to stay home. -

Kuala Lumpur, Malaysia

Kuala Lumpur, Malaysia Southeast Asia’s rising star An investor’s guide With strong foundations in place for stable and sustainable economic growth in Malaysia, the time is ripe for multinational companies (MNCs) to capitalise on Greater Kuala Lumpur’s potential as a gateway to Asia. Kuala Lumpur International Airport (KLIA) photograph courtesy of Malaysia Airports Holdings Berhad 2 Kuala Lumpur – an Asian gem Over the past decade, Asia has demonstrated not just growing influence in the global economy, but increasingly has emerged as an alternative engine of growth, surging ahead of the West. The region has earned admiration, and even envy, for its resilience throughout the 2008/09 global economic downturn. It has strengthened its prowess, now backed by economic powerhouses China, India and Southeast Asia. Asia’s attractiveness to foreign investors can be attributed to a number of reasons: as a whole, the region is rich in natural resources, is home to a large population Tan Theng Hooi offering attractive consumer market potential, and offers capabilities in diverse Country Managing Partner economic activities which includes high-value service industries such as banking, Deloitte Malaysia telecommunications, oil and gas, healthcare, education and tourism. As the world began to turn its attention to this bright spot amid the gloom, the question arises: where in Asia should investors be regionally headquartered? While China in the past decade has been the destination of choice for multinational companies looking to establish themselves in Asia, the flood of investors into the country has pushed up costs thus making it a less attractive destination than before. -

2018 >> Group Highlights 2018

Stay Together. Stay Integrated Report 2018 >> GROUP HIGHLIGHTS 2018 Earnings Per Share 14.8 sen Shareholders Fund Dividend Per Share RM14.14 8.55 sen billion Ongoing Projects 45 Effective Land Banks 9,516 acres Revenue Strong GDV in the Pipeline Unbilled Sales Total Sales RM3.59 RM149.70 RM12.32 Achieved billion billion billion RM5.12 Profit Before Tax Profit Attributable to Owners Total Strong, Dynamic & billion RM991.0 of the Company Diversified Employees million RM671.0 2,300 million People* * Approximate 1 STAY TOGETHER. STAY SETIA >> Inside this Report Our growth trajectory is anchored in sound fundamentals. Our diligence, integrity and Content persistent focus on sound business practices provide a solid foundation for our continued delivery of value in the long term. Introduction 6 Our Approach to Reporting With decades of experience setting the bar in 8 About This Integrated Report Malaysia’s property market, we know beyond a doubt that it is only together that we can thrive. Our Business Our success is a truly befitting reflection of our 10 Who We Are belief that together, we can weather all challenges 12 Our Presence and achieve even greater heights. 14 Corporate Structure 17 Corporate Information As we continue to expand, we are also now 18 Corporate Calendar celebrating the deeper meaning that our name 25 Accolades stands for. We remain loyal to our stakeholders and steadfast in our commitment to quality and Our Leadership growth – striving to ensure a better life for all. 26 Chairman’s Message 30 Board of Directors Therefore, in staying true to our nature and our 40 Key Management Profile name, we will continue to “STAY TOGETHER. -

Asb Visitor's Guide

ASB VISITOR’S GUIDE Table of Contents 1) Map & Directions ....................................................................................................3 2) Airport Transportation .............................................................................................4 3) Getting Around KL ..................................................................................................6 4) Things To Do in KL………………………………………………………………………..…..7 5) Visa Information..……………………………………………………………………………..9 6) Accommodation.…………………………………………….………................................10 7) Administrative Guide.............................................................................................. 13 8) Other Important information................................................................................... 17 9) Dress Code ........................................................................................................... 17 10) Weather .............................................................................................................. 17 11) Internet Connection ............................................................................................. 17 12) Medical Care ...................................................................................................... 17 13) Restaurants.......................................................................................................... 17 2 Map & Directions Asia School of Business Lanai Kijang Sasana Kijang 2, Jalan Berjasa 2, Jalan Dato Onn 50480 Kuala Lumpur, -

Infrastructure

8 December 2016 Sabah: “Land below the wind” Sector Update We made a working visit to Sabah’s capital Kota Kinabalu (KK) recently. Key findings: infrastructure development is accelerating, tourist arrivals are seeing sustained growth, oil and gas investments Infrastructure/ continue despite weak prices, and new large-scale integrated property development projects should transform Greater KK in the Property long run. Our top construction/property stock picks for exposure to Sabah’s rapid development are Gabungan AQRS (GAQRS) and WCT. Other non-rated beneficiaries could be Suria Capital and SBC Corp. Overweight (maintain)/ Overweight (maintain) Infrastructure development to improve connectivity One of the key focuses for the development of Sabah under the 11th Malaysia Plan 2016-2020 (11MP) is improving connectivity via infrastructure development. Planned projects include the RM12.8bn Pan Borneo Highway (Sabah section) (PBH) and the new RM311m KK Bus Absolute Performance (%) Rapid Transit (BRT). For the long-term development of the Sabah Development Corridor (SDC), there are plans to build a new KK Airport, 1M 3M 12M GAQRS (2.2) (12.0) 4.1 Light Rail Transit (LRT) system in KK, upgrade Lahad Datu Airport, and WCT Hldgs (2.2) 9.9 20.4 build new railway lines to connect the north and east coasts of Sabah. Suria Cap (2.9) (0.5) (21.3) SBC Corp (5.7) (11.2) 12.1 Pan Borneo Highway – a boon for construction Borneo Highway PDP Sdn Bhd, a Warisan Tarang-UEM Group-MMC Corp joint venture (60:20:20 shareholding), was appointed as the project Relative Performance (%) AQRS WCT Suria SBC Corp delivery partner (PDP) for the PBH Sabah project in April 2016.