Malaysia 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Regulating Foreign Labor in Emerging Economies: Between National Objectives and International Commitments

E-ISSN 2281-4612 Academic Journal of Interdisciplinary Studies Vol 10 No 3 May 2021 ISSN 2281-3993 www.richtmann.org . Research Article © 2021 Aries Harianto. This is an open access article licensed under the Creative Commons Attribution-NonCommercial 4.0 International License (https://creativecommons.org/licenses/by-nc/4.0/) Received: 25 September 2020 / Accepted: 9 April 2021 / Published: 10 May 2021 Regulating Foreign Labor in Emerging Economies: Between National Objectives and International Commitments Aries Harianto Universitas Jember, Jalan Kalimantan No. 37, Kampus Tegal Boto, Jember, Jawa Timur 68121, Indonesia DOI: https://doi.org/10.36941/ajis-2021-0092 Abstract The dialectics of the regulation of foreign workers, is a problematic indication as a legal problem in Indonesian legislation. This article aims to describe the urgency of critical studies concerning the regulation of foreign workers by exploring existing legal problems with national commitments to ratify international agreements regarding free trade, with a case study in Indonesia. By using normative and juridical approach with a variety of approaches both the law approach, conceptual approach, case approach and comparative approach, the study found that the regulation there is an inconsistency clause regarding special competencies that must be owned by foreign workers, including the selection and use of terminology in Act No. 13 of 2003 concerning Manpower. Thus, this study offers a constitutional solution due to the regulation of the subordinate foreign workers on international trade commitments which in turn negate the constitutional goals of creating the welfare of domestic workers. The normative consequences that immediately bind Indonesia after integrating itself in the World Trade Organization (WTO) membership are services trade agreements that are contained in the regulations of the General Agreement on Trade in Services (GATS). -

Malaysia's Security Practice in Relation to Conflicts in Southern

LONDON SCHOOL OF ECONOMICS AND POLITICAL SCIENCE Malaysia’s Security Practice in Relation to Conflicts in Southern Thailand, Aceh and the Moro Region: The Ethnic Dimension Jafri Abdul Jalil A thesis submitted for the degree of Doctor of Philosophy in International Relations 2008 UMI Number: U615917 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. Dissertation Publishing UMI U615917 Published by ProQuest LLC 2014. Copyright in the Dissertation held by the Author. Microform Edition © ProQuest LLC. All rights reserved. This work is protected against unauthorized copying under Title 17, United States Code. ProQuest LLC 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106-1346 Libra British U to 'v o> F-o in andEconor- I I ^ C - 5 3 AUTHOR DECLARATION I certify that all material in this thesis which is not my own has been identified and that no material has previously been submitted and approved for the award of a degree by this or any other University. Jafri Abdul Jalil The copyright of this thesis rests with the author. Quotation from it is permitted provided that full acknowledgment is made. This thesis may not be reproduced without prior consent of the author. I warrant that this authorisation does not, to the best of my belief, infringe the rights of any third party. -

EY KL Calling 2020

KL calling: dynamic, digital, diverse Investors guide Foreword The next phase of Kuala Lumpur’s growth is pivoting towards next-gen industries, including Industry 4.0. In recent years, Kuala Lumpur has garnered investments from high-tech multinational corporations in advanced medical technologies, digital e-platforms, Internet of Things, robotics and higher-value Global Business Services. Malaysia’s world-class infrastructure, supportive government policies and agencies Dato’ Abdul Rauf Rashid and future-ready digital talent proficient in EY Asean Assurance Leader English and Asian languages continue to Malaysia Managing Partner attract international businesses to establish Ernst & Young PLT their regional headquarters and centers in Kuala Lumpur. Beyond 2020, I envision that Kuala Lumpur will holistically evolve to become a smart digital city, driven by a balanced community purpose, i.e., to serve its residents’ needs and systemically improve common facilities and amenities for the well-being of Malaysians, business residents, expatriates and international visitors. Malaysia welcomes investors to recognize Kuala Lumpur’s 3 D strengths: dynamic, digital, diverse, and participate in Kuala Lumpur’s next exciting transformation! Selamat datang ke Kuala Lumpur! KL calling: dynamic, digital, diverse | 1 Our strategy is to be as close as “possible to our customers to understand their needs and to Malaysia’s fundamentals remain develop suitable products and “ solutions to fulfil their strong and attractive to investors. requirements. As the region’s most competitive manufacturing Despite the COVID-19 pandemic, powerhouse, Kuala Lumpur we remain in active discussions emerged as a natural favorite. with potential investors. Although some investors are ABB taking a wait-and-see approach, others remain committed to their investments as they hold a long- About 16 months into our term view. -

Table of Contents

TABLE OF CONTENTS PAGE Introduction ANANDA KRISHNAN PROFILE AND BACKGROUND 3 - 8 MAXIS COMMUNICATION COMPANY PROFILE 9 - 12 ASTRO COMPANY PROFILE 13 - 20 STYLE OF LEADERSHIP 21 - 24 LEADERSHIP THEORY ADAPTATION 25 Conclusion 26 References 27 1 (a) Background of the leader: the aim of this section is to know and understand the leader as a person and the bases for his/her success. The data and information should be taken from any published sources such as newspapers, company reports, magazines, journals, books etc. INTRODUCTION ANANDA KRISHNAN Who is Ananda Krishnan? According to a report then by Bernama News Agency, the grandfathers of Tan Sri T. Ananda Krishnan and Tan Sri G. Gnanalingam had been brought to Malaysia from Jaffna by British colonial rulers to work in Malaysia¶s Public Works Department, a common practice then as Jaffna produced some of the most educated people in the whole country. Tan Sri Gnanalingam himself told one of our ministers that he wants to put something back into this country because his grandfather was Sri Lankan," Deputy Director-General of Sri Lanka's Board of Investment (BOI) Santhusht Jayasuriya had told a a group of visiting Malaysian journalists then, 2 according to the Bernama 2003 story. Gnanalingam, executive chairman of Malaysia's Westport, held talks with Prime Minister Ranil Wickremesinghe during a visit to Malaysia in 2003 and the former followed up with a visit to Colombo. In the same year a Memorandum of Understanding was formalized in March this year between 'Westport' and the Sri Lanka Ports Authority (SLPA). Westport is keen to invest in Sri Lanka but no formal process has begun. -

M.V. Solita's Passage Notes

M.V. SOLITA’S PASSAGE NOTES SABAH BORNEO, MALAYSIA Updated August 2014 1 CONTENTS General comments Visas 4 Access to overseas funds 4 Phone and Internet 4 Weather 5 Navigation 5 Geographical Observations 6 Flags 10 Town information Kota Kinabalu 11 Sandakan 22 Tawau 25 Kudat 27 Labuan 31 Sabah Rivers Kinabatangan 34 Klias 37 Tadian 39 Pura Pura 40 Maraup 41 Anchorages 42 2 Sabah is one of the 13 Malaysian states and with Sarawak, lies on the northern side of the island of Borneo, between the Sulu and South China Seas. Sabah and Sarawak cover the northern coast of the island. The lower two‐thirds of Borneo is Kalimantan, which belongs to Indonesia. The area has a fascinating history, and probably because it is on one of the main trade routes through South East Asia, Borneo has had many masters. Sabah and Sarawak were incorporated into the Federation of Malaysia in 1963 and Malaysia is now regarded a safe and orderly Islamic country. Sabah has a diverse ethnic population of just over 3 million people with 32 recognised ethnic groups. The largest of these is the Malays (these include the many different cultural groups that originally existed in their own homeland within Sabah), Chinese and “non‐official immigrants” (mainly Filipino and Indonesian). In recent centuries piracy was common here, but it is now generally considered relatively safe for cruising. However, the nearby islands of Southern Philippines have had some problems with militant fundamentalist Muslim groups – there have been riots and violence on Mindanao and the Tawi Tawi Islands and isolated episodes of kidnapping of people from Sabah in the past 10 years or so. -

Property Market 2013

Property Market 2013 www.wtw.com.my C H Williams Talhar and Wong 30.01, 30th Floor, Menara Multi-Purpose@CapSquare, 8 Jalan Munshi Abdullah, 51000 Kuala Lumpur Tel: 03-2616 8888 Fax: 03-2616 8899 KDN No. PP013/07/2012 (030726) Property Market 2013 www.wtw.com.my C H Williams Talhar and Wong 30.01, 30th Floor, Menara Multi-Purpose@CapSquare, 8 Jalan Munshi Abdullah, 51000 Kuala Lumpur Tel: 03-2616 8888 Fax: 03-2616 8899 KDN No. PP013/07/2012 (030726) CH Williams Talhar & Wong established in 1960, is a leading real estate services company in Malaysia & Brunei (headquartered in Kuala Lumpur) operating with 25 branches and associated offices. HISTORY Colin Harold Williams established C H Williams & Co, Chartered Surveyor, Valuer and Estate Agent in 1960 in Kuala Lumpur. In 1974, the company merged with Talhar & Co, a Johor-base Chartered Surveying and Valuation company under the sole-proprietorship of Mohd Talhar Abdul Rahman. With the inclusion of Wong Choon Kee, in a 3-way equal partnership arrangement, C H Williams Talhar and Wong was founded. PRESENT MANAGEMENT The Group is headed by Chairman, Mohd Talhar Abdul Rahman who guides the group on policy de- velopments and identifies key marketing strategies which have been instrumental in maintaining the strong competitive edge of WTW. The current Managing Directors of the WTW Group operations are: C H Williams Talhar & Wong Sdn Bhd Foo Gee Jen C H Williams Talhar & Wong (Sabah) Sdn Bhd Robin Chung York Bin C H Williams Talhar Wong & Yeo Sdn Bhd (operating in Sarawak) Robert Ting Kang Sung -

Kuala Lumpur

Powered by Powered by Kuala Lumpur Residential Market Update January 2019 The formation of a new government following Malaysia’s recent general election is already having a positive impact Economic indicators on the economy. Nominal quarterly GDP growth for Malaysia, Malaysia-wide unemployment, inflation and the overnight policy rate Consumer sentiment has been improving following the three month tax holiday, with the introduction of the GDP Quarter-on- Malaysia Overnight zero-rating of the Goods and Services Tax (GST), effective 1.7% Quarter Growth 3.25% Policy Rate from 1st June 2018, and the re-introduction of the Sales and Q2 2018 September 2018 Services Tax (SST) on 1st September 2018. This has been reinforced by strong employment and a low inflation rate; in Unemployment Rate Inflation Rate August 2018, unemployment levels stood at 3.4% and the 3.4% August 2018 0.2% August 2018 inflation rate was low at 0.2%. In the second quarter of 2018, the Business Conditions Index Nominal GDP growth Unemployment Rate Inflation Rate 6% (BCI), published by the Malaysian Institute of Economic Research, hit its highest level for the past 13 quarters at 5% 116.3 points. In addition, the continuing development of Kuala 4% Lumpur’s new financial district, Tun Razak Exchange, looks set 3% to further boost Malaysia’s growing financial services sector. 2% Keeping pace with rapid urbanisation is the development 1% progress of transport infrastructure in Greater Kuala Lumpur 0% (GKL). The completed and on-going Light Rail Transit (LRT) and Mass Rapid Transit (MRT) lines are enhancing mobility and -1% connectivity within the region, and helping to transform GKL -2% into a sustainable and liveable metropolis. -

Avara Brochure 12.5Inc Square 32Pages ENG FA Web

www.avara.com.my Developer : BA SHENG SDN BHD (1058822-W) No. 10 (Lot 30), Jalan Seputeh, 58000 Kuala Lumpur. T: +603-7972 3365 Developer’s License No.: __________ • Validity: __________ – __________ • Advertising Permit No.: __________ • Validity: __________ – __________ • Building Plan Approving Authority: Dewan Bandaraya Kuala Lumpur • Building Plan Approval No.: BP S1 OSC 2017 1667 • Expected Date of Completion: 48 months (October 2021) • Land Tenure: Freehold • Land Encumbrances: Charged To RHB Bank Berhad (October 2021) • Type of Property: Serviced Apartment • Total Units: 366 • Selling Price: Type A (46 Units - 667 sq ft) – RM731,250.00 (Min.) RM821,250.00 (Max.) • Type A1 (23 Units - 689 sq ft) – RM757,500.00 (Min.) RM843,750.00 (Max.) • Type B (23 Units - 807 sq ft) – RM868,750.00 (Min.) RM958,750.00 (Max.) • Type C (91 Units - 829 sq ft) – RM890,000.00 (Min.) RM980,000.00 (Max.) • Type D (46 Units - 915 sq ft) RM970,000.00 (Min.) RM1,067,500 (Max.) • Type E (23 Units - 1,087 sq ft) RM1,126,250.00 (Min.) RM1,217,500.00 (Max.) • Type F (23 Units - 926 sq ft) RM981,250.00 (Min.) RM1,071,250.00 (Max.) • Type G (23 Units - 1,076 sq ft) RM1,116,250.00 (Min.) RM1,207,500.00 (Max.) • Type H (22 Units - 850 sq ft) RM910,000.00 (Min.) RM1,000,000.00 (Max.) Type I (46 Units - 1,216 sq ft) RM1,238,750.00 (Min.) RM1,328,750.00 (Max.) • Bumiputra Discount: 5% • Restriction in Interest: N/A. IKLAN INI TELAH DILULUSKAN OLEH JABATAN PERUMAHAN NEGARA. -

Malaysia 2008/2009

Exploring Market Opportunities Malaysia 2008/2009 International Business Malaysia -Market Report 2008/2009 International Business 1 Technocean is a subsea IMR, light construction and engineering contractor providing quality project delivery to clients worldwide. With its main office located in Bergen, Norway, Technocean offers a comprehensive range of integrated subsea intervention services to keep the oil | Gas fields producing at optimum capacity. YOUR SUBSEA www.technocean.no ENTREPRENEUR 2 International business - a unique student project International Business (IB) is an annual non-profit project carried out by a group of twelve students attending the Norwegian University of Science and Technology (NTNU), the Norwegian School of Economics and Business Administration (NHH) and the Norwegian School of Management (BI), in collaboration with Innovation Norway. The main purpose of the project is to explore potential markets for international business ventures and support Norwegian companies considering entering these markets. Since the conception in 1984, IB has visited all continents, each year selecting a new country. In 2008-2009, IB’s focus has been exploring the market opportunities for Norwegian companies in Malaysia. IB Malaysia’s primary goal is to provide information and insights into areas that are important for small and middle-sized Norwegian companies considering establishing in Malaysia. The information and conclusions of the report are based on IB’s field research in Malaysia during January 2009 and extensive research conducted from Norway. The research in Malaysia included meetings with Norwegian and foreign companies established in the country, as well as local companies, institutions and Governmental bodies. During the stay, IB received extensive support from Innovation Norway’s office in Kuala Lumpur, Malaysia. -

The Development and Distribution Pattern of Railway Network for Urban Public Transport Using GIS from 1990 Until 2019 in the Klang Valley and Kuala Lumpur, Malaysia

JOURNAL OF SOCIAL TRANSFORMATION AND REGIONAL DEVELOPMENT VOL. 2 NO. 2 (2020) 1-10 © Universiti Tun Hussein Onn Malaysia Publisher’s Office Journal of Social Transformation JSTARD and Regional Journal homepage: http://publisher.uthm.edu.my/ojs/index.php/jstard Development e-ISSN : 2682-9142 The Development and Distribution Pattern of Railway Network for Urban Public Transport Using GIS from 1990 Until 2019 in The Klang Valley and Kuala Lumpur, Malaysia Mohd Sahrul Syukri Yahya1*, Edie Ezwan Mohd Safian1, Burhaida Burhan1 1Faculty of Technology Management and Business, Universiti Tun Hussein Onn Malaysia, 86400 Parit Raja, Batu Pahat, Johor, MALAYSIA *Corresponding Author DOI: https://doi.org/10.30880/jstard.2020.02.02.001 Received 20 July 2020; Accepted 30 October 2020; Available online 30 December 2020 Abstract: The development and distribution pattern of the railway network has significantly increased in urban public transport with the current situation to move fast towards the fourth industrial revolution (4IR). In Malaysia, the problem issues are related to traffic congestion and many user cars on the roadway in daily lives. One alternative mode of using a rail network is commuter, LRT, Monorail, MRT and ETS. Therefore, the Geographic Information System (GIS) technology is then used to map and produce the railway networks history and developments in urban public transportation (UPT). The goal of this research is to identify the heatmap trends of the Klang Valley railway stations which included Kuala Lumpur as urban public transport sectors. It was based on the OSM image layer from the year 1990 to 2019 and studied the growth of railway networks through a polyline pattern analysis. -

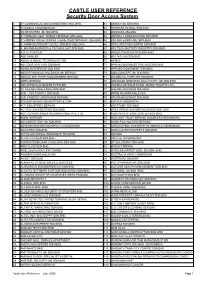

CASTLE USER REFERENCE Security Door Access System

CASTLE USER REFERENCE Security Door Access System 1 2Y COMMUNICATION ENGINEERING SND. BHD. 61 AMWAY (M) SDN.BHD. 2 38 BIDARA CONDOMINIUM 62 ANGKASA GLOBAL SDN.BHD. 3 3D NETWORKS (M) SDN.BHD. 63 ANGSANA ANJUNG 4 A ‘FARMOSA GOLF RESORT BERHAD (MELAKA) 64 ANTARA CONSOLIDATION SDN BHD 5 A ’FAMOSA WATER WORLD THEME PARK SDN.BHD. (MELAKA) 65 ANTARA EKSKLUSIF SDN.BHD. 6 A ’FARMOSA RESORT HOTEL SDN BHD (MELAKA) 66 APAC AUCTION CENTRE SDN BHD 7 A. MAXIMA BUSINESS & TECHNOLOGY SDN BHD 67 APL TECH BATTERY INDUSTRY SDN BHD 8 A.G.V.I.S GROUP 68 APLEX CORPORATION SDN BHD 9 ABB DAIMLER 69 APL-NOL (M) SDN BHD 10 ABDUL & ABDUL TECHNOLOGY S/B 70 APMCE 11 ABI CONSTRUCTION SDN.BHD. 71 APPLIED BUSINESS SYSTEMS SDN BHD. 12 ABIMA ENTERPRISE SDN BHD 72 APPLIED EQUIPMENT (PENANG) 13 ABRAR FINANCIAL HOLDINGS (M) BERHAD 73 AQM CONCEPT (M) SDN.BHD. 14 ABRAR UNIT TRUST MANAGEMENT BERHAD 74 AR DENTAL SUPPLIES SDN.BHD. 15 ABRIC BERHAD 75 ARCADIAN WIRELESS ASIA PACIFIC (M) SDN.BHD. 16 ABS APPLIED BUSINESS SYSTEMS 76 AREMAC INTERNATIONAL MARKETING PTE LTD 17 AC NEILSEN (MALAYSIA) SDN BHD 77 ARENSI HOLDINGS SDN BHD 18 ACE – TEX PLASTIC SND.BHD. 78 ARKIB NEGARA MALAYSIA 19 ACE SYNERGY INSURANCE BERHAD 79 AROSA BUILDINGS SDN BHD 20 ACM NETWORKS ADVERTISING & COM 80 ARTHUR ANDERSON 21 ACP INDUSTRIES BERHAD 81 ARTSTAMP SDN BHD 22 AC-TECH ENGINEERING SDN BHD 82 ASEA BROWN BOVORI HOLDINGS SDN. BHD. 23 ADC TECHNOLOGIES INTERNATIONAL PTE. LTD. 83 ASIA PACIFIC ZONE SYSTEM SDN.BHD. 24 ADEM INTERIOR 84 ASIA UNIT TRUST BERHAD.(KOMPLEKS KEWANGAN) 25 ADVANTEST-ENG (M) SDN BHD 85 ASIAN PAC HOLDING BERHAD 26 ADVERTISING DESIGN IMPACT CHALENGGER 86 ASSOCIATED LOCKSMITH OF AMERICA (SEREMBAN) 27 ADWORKS SDN BHD 87 ASSOCIATED PROPERTY SDN.BHD. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 1ST HALF 2016 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR HIGH END CONDOMINIUM MARKET The residential market continues to remain lacklustre with lower volume and value of transactions recorded. ECONOMIC AND MARKET INDICATORS Limited project completions and new Malaysia’s economy expanded at a launches of high end condominiums / slower pace in 2015 with Gross Domestic residences during the review period. Product (GDP) growing at an annual rate of 5.0% (2014: 6.0%). For 2016, the Government has trimmed the country’s Growing pressure on rentals amid GDP growth forecast to 4 - 4.5% due to strong supply pipeline (existing and the volatility in crude oil prices and other new completions) and a challenging economic challenges. GDP continued rental market while prices in to moderate in the first quarter of 2016, the secondary market generally posting 4.2% growth, its slowest since continue to remain resilient. 3Q2009 (4Q2015: 4.5%), driven by domestic demand. Private consumption expanded by 5.3% while private Developers adopt innovative ‘push investment moderated to 2.2%. marketing’ strategies to boost Headline inflation for April 2016 registered at sales of selected projects and 2.1%. It is expected to be lower at 2% to 3% improve revenue. this year, compared to an earlier projection Aria of 2.5% to 3.5% and will continue to remain stable in 2017. (432 units) and The Residences at The Meanwhile, labour market conditions St. Regis Kuala Lumpur (160 units). continued to weaken with more retrenchment of workers, particularly in By the second half of 2016, the scheduled the manufacturing, mining and services completions of another five projects will sectors.