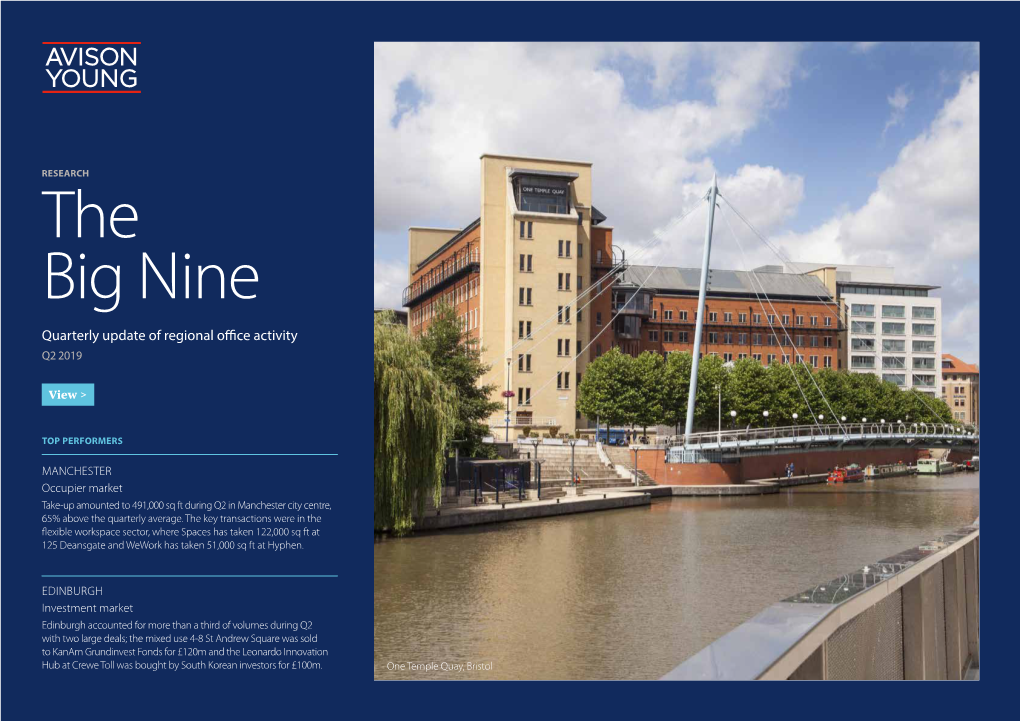

The Big Nine Q2 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Council House, Victoria Square, Birmingham, B1 1BB Listed

Committee Date: 27/06/2013 Application Number: 2013/01613/PA Accepted: 16/04/2013 Application Type: Listed Building Target Date: 11/06/2013 Ward: Ladywood The Council House, Victoria Square, Birmingham, B1 1BB Listed Building Consent for the installation of 4 no. internal recording cameras to Committee Rooms 3 & 4. Applicant: Acivico - Birmingham City Council The Council House, Victoria Square, Birmingham, B1 1BB Agent: Acivico - Development Dept 1 Lancaster Circus, Queensway, Birmingham, B2 2WT Recommendation Refer To The Dclg 1. Proposal 1.1. This application seeks Listed Building Consent for the installation of 4 no. internal recording cameras at The Council House in Victoria Square. 1.2. The cameras would be 0.14m (w) x 0.16m (h) x 0.16m (d) to be installed in each corner of Committee Rooms 3 and 4 used to record meetings. They would be coloured white. 2. Site & Surroundings 2.1. The Birmingham Council House occupies a site between Chamberlain Square, Eden Place, Victoria Square and Chamberlain Square. The present building was designed by Yeoville Thomason and built between 1874 and 1879 on what was once Ann Street. 2.2. The building is three storeys plus basement made of stone with a tile roof. The site forms part of the Colmore Row and Environs Conservation Area designated in October 1971 and extended in March and then July 1985. 2.3. The building provides office accommodation for both employed council officers, Chief Executive and elected council members. There is also a large and ornate banqueting suite complete with minstrels gallery. Committee Rooms 3 & 4 are located on the ground floor fronting onto Victoria Square. -

Travelling to UCE Birmingham Conservatoire

Travelling to UCE Birmingham Conservatoire ROAD From M6 South or North-West Leave the M6 at Junction 6 and follow the A38(M). Follow signs to ‘City centre, Bromsgrove, (A38)’. Do not take any left exit. Go over 1 flyover and through just 1 Queensway tunnel (sign posted ‘Bromsgrove and Queen Elizabeth Hospital’). Leave this tunnel indicating left but stay in the right hand lane of the slip road. UCE Birmingham Conservatoire is located on the Paradise Circus island. Follow directions below for parking and/or loading & unloading. Parking Car parking at the Conservatoire is very limited and we regret we cannot offer parking spaces to visitors. However, there are several NCP car parks located close by, including two located on Cambridge Street. To access these car parks, at the Paradise Circus island, immediately after you pass the exit for the A456 (Broad Street), move into the left lane and take the first left into Cambridge Street. Loading & Unloading To access the Conservatoire’s car park (for loading and unloading only), pass under the bridge and turn right as if to access the Copthorne Hotel, and then right again into the underground road. Follow the road around to the left to gain access to the Conservatoire’s car park, which is at the end of the road. A goods lift is available. From M5 South-West Leave the M5 at Junction 3 and travel towards Birmingham City Centre along the A456 (Hagley Road) for 5 miles to the Five Ways island. This is easily distinguishable as it is surrounded by large office blocks and a Tesco store. -

TPWM News: Project Updates

Artists’ News & Opportunities Bulletin Issue 43: 14 June 2012 Click on the headings below to go straight to your preferred section of the bulletin... o Funding o Opportunities o Commissions o Calls for work o Prizes o Residencies o Traineeships o Jobs o Voluntary Positions o Festivals o Courses/ workshops o Graduate Exhibitions o What’s happening o Ongoing exhibitions TPWM News: Project Updates Artist Development In summer 2012 a professional development programme for artists will be launched by TPWM in collaboration with The Art Gallery Walsall and other partners. It will take place across the West Midlands and will be aimed at artists at varying levels of career development. Details will be available soon on www.tpwestmidlands.org.uk New Art West Midlands 2013: Call for Applications from recent Visual Arts Graduates Application forms available from: http://www.tpwestmidlands.org.uk/new-art-west-midlands-2013/ Deadline: 14 September 2012. Residencies Four organisations in the West Midlands will lead on TPWM new artist residency opportunities: The Library of Birmingham, University of Worcester with Movement Gallery and Worcester City Museum, Eastside Projects and The National Trust at Dudmaston. Two of the four residencies will have an open submission application process. More details will be available soon on www.tpwestmidlands.org.uk Writing Bursary TPWM has awarded a writing bursary to Grand Union (in association with Eastside Projects), in order to offer an opportunity for a new or emerging writer to develop skills in critical writing for publication and encourage writing practice within the West Midlands. The writing bursary will be awarded following an open submission. -

IET Birmingham: Austin Court Map

IET Birmingham: Austin Court Map GRAHAM ST A4400 S A41/M5 M6/M1/M42 U NEWHALL ST M M CAMDEN ST NEW HALL HILL E R H A38 IL L R O A D S UM A457M ER H ILL RD Birmingham Snow Hill CHARLOTTE ST BT Tower Driving Distance SAND PITS 4 mins Walking Distance SAND PITS 15 mins PARADE GREAT CHARLES STREET QUEENSWAY NEWHALL ST A457 LIONEL ST COLMORE ROW ST MARKS CRESCENT Birmingham Cathedral Art Gallery 694m Baskerville Birmingham House Central Library H Council T S Copthorne T House N National Indoor Arena 10 E Hotel C IN 273m T. V 12 New Birmingham Library S C AM 11T BRIIDGE S The Rep (opens Sept 2013) CORPORATION ST Town Hall 6 8 P Centenary A PINFOLD ST NEW ST R 5 9 A 7 Square D I Y SE WA C S Birmingham Symphony Hall/ICC I N HILL ST RC EE U QU HE Moor Street S STEP NSON National Sea Life Centre ST 3 2 Pavillion Driving Distance 342m 4 5 mins Crowne Plaza Shopping Centre Walking Distance Brindleyplace 25 mins BROAD ST H Hyatt Regency 1 Pallasades ST Bullring N IO Birmingham Shopping Centre AT Shopping Centre BRIDGE ST IG New Street AV KING EDWARDS ROAD N Driving Distance A38 4 mins Walking Distance 12 mins HOLIDAY ST E KINGSTON ROW S O L HILL ST C C I V SUFFOLK STREET QUEENSWAY I C A456 BERKLEY ST The Mailbox Malmaison Hotel H SEVERN ST C A GRANVILLE ST MB RID BROAD ST Malt House GE ST M5/M42/M40 Walking Route 1 Leave the station via the ‘Victoria Square’ exit, keeping Boots to your left. -

Office Insight – Birmingham Q3 2020

Office Insight – Birmingham Q3 2020. Office Insight – Birmingham Q3 2020. Not quite bustling Birmingham but getting there… Following a subdued Q2 in which the UK saw a peak in Great British outdoors in the form of a summer ‘staycation’. the number of coronavirus cases and deaths, businesses However, the latter part of the quarter has seen a noticeable went from working in the office to working from home on uptick in activity, with businesses now focusing on their mass overnight. The start of Q3 was typically quiet, with route through the recovery phase of this crisis. many people taking the opportunity to embrace the 1 Colmore Square 103 Colemore Row Signs of Life • Tom Tom traffic data indicated increased levels of road usage in Birmingham, with traffic levels on Monday 14th September seeing just a 26% reduction (compared to a year earlier) against a 63% reduction on Monday 8th June 2020 (compared to a year earlier). • Initial stats from the Eat Out to Help Out scheme also suggested increased activity levels. The parliamentary constituency of Ladywood, which covers most of the city centre, recorded 402,000 claimed meals over the month of August. Many restaurants hailed the success of the scheme and continued it on themselves into September without the Government’s support. • Footfall data recorded by Wireless Social shows increased footfall in Birmingham city centre since the easing of lockdown restrictions. Footfall on 6th June was recorded at 88% below the average seen in February 2020, compared to just a fall of 43% on the 6th September. Office Insight – Birmingham Q3 2020. -

Traffic Movement Variation (TRO)

BIRMINGHAM CITY COUNCIL (BIRMINGHAM CITY COUNCIL (VARIOUS ROADS, CITY CENTRE) (TRAFFIC REGULATION) (MOVEMENT ORDER) 2017) (0826 VARIATION) (No.*) ORDER 202* Birmingham City Council (“the Council”) in exercise of its powers under Sections 1(1), 2(1) to (3) and 4(2), and Part IV of Schedule 9 of the Road Traffic Regulation Act 1984 (“the Act”) and of all other enabling powers and after consulting the Chief Officer of Police in accordance with Part III of Schedule 9 to the Act hereby makes the following Order: 1. The “Birmingham City Council (Various Roads, City Centre) (Traffic Regulation) (Movement) Order 2017” (as amended) shall continue in full force and effect subject to the variation specified in the SCHEDULE to this Order. 2. This Order shall come into operation on the ** th of Month two thousand and year and may be cited as the “Birmingham City Council (Birmingham City Council (Various Roads, City Centre) (Traffic Regulation) (Movement) Order 2017) (0826 Variation) (No. *) Order 202*”. 3. The Birmingham City Council (Paradise Street, Ladywood) (Prohibition of Motor Vehicles) Order 2019 shall be revoked SCHEDULE 1. In Schedule 2 after the reference to “Station Street” the following reference shall be inserted (1) (2) (3) (4) (5) Road or Direction of Location of Road or Exceptions length of road traffic flow “compulsory left length of roads turn” SUFFOLK STREET North at its junction with Paradise Street QUEENSWAY (easternmost westerly Paradise Street carriageway) 2. In Schedule 6 before the reference to “Commercial Street” the following reference shall be inserted (1) (2) (3) Road or length of road Location of “No Entry” Exceptions CENTENARY SQUARE (exit lanes excluding at its junction with Lyon Queensway Tramway) 3. -

BIRMINGHAM CITY CENTRE PUBLIC REALM 2022 Concept Design

BIRMINGHAM CITY CENTRE PUBLIC REALM 2022 Concept design drawings Rev 03. October 2019 1 Notice This document and its contents have been prepared and are intended solely for Birmingham City Council’s information and use in relation to the Options Appraisal of the Enterprise Zone - City Centre Connectivity project. Atkins Transportation assumes no responsibility to any other party in respect of or arising out of or in connection with this document and/or its contents. Document history Job number: Revision Purpose description Originated Reviewed Authorised Date 00 First Issue RH & GC GW EZ 12/06/19 01 Changes to surface material RH&GC GW EZ 17/06/19 02 Materials palette added RH&GC GW EZ 21/06/19 03 Updated as per clients comments AM&GC GW EZ 11/10/19 Client signoff Client Birmingham City Council Project City Centre Connectivity and Public Realm Document title Enterprise Zone Options Report Job no. 5188466 Copy no. 00 Document reference 5188466 - 003 2 Contents KEY PLAN 4 Street Designs 01. VICTORIA SQUARE 5 02. COLMORE ROW/WATERLOO STREET 6 03. CHAMBERLAIN SQUARE, EDEN PLACE 7 04A & 04B. NEW STREET, ETHEL STREET, LOWER TEMPLE STREET 8 05. BENNETT’S HILL 11 06. TEMPLE ROW, TEMPLE ROW WEST 12 07. HIGH STREET 13 08. UNION STREET, UNION PASSAGE, WARWICK PASSAGE 14 09. CANNON STREET & NEEDLESS ALLEY 14 10. TEMPLE STREET 15 11. MATERIALS PALETTE 16 12. TECHNICAL INFORMATION 24 3 KEY PLAN TEMPLE ROWWEST STPHILIP’S CA - THEDRAL BENNET’S HILL EDEN PLACE TEMPLE ROW CHAMBERLAIN COLMORE ROW SQUARE BENNET’S HILL UNION WATERLOO STREET FORGE NEEDLESS ALLEY STREET STREET WARWICK VICTORIA SQUARE PASSAGE TEMPLE STREET CANNON STREET NEW STREET UNION PASSAGE NEW STREET HIGH STREET BIRMINGHAM NEW STREET STATION THE BULL RING 4 Eden Place 01 . -

July 2017 - July May

Artefacts JULY 2017 JULY - MAY The Bullring at Sunrise © Verity E. Milligan Photography MEMBER OF THE ASSOCIATION MAy - JULY 2017 ARTEFACTS 1 OF FRIENDS OF MUSEUMS Friends of Birmingham Museums Magazine 2 ARTEFACTS MAY - JULY 2017 CONTENTs Associate Feature: A bReath of fresh: air CONTACTS David Foster Chair Email: [email protected] Lynda Perrin Membership Email: [email protected] Tel: 0121 348 8330 PAGE 26 Melissa hughes Administrator and Artefacts Editor Email: [email protected] CHAIR´S REPORT 04 Tel: 0121 348 8330 Barbara Preece FRIENDS´ EVENTS 06 Events Coordinator Email: [email protected] [email protected] news from the volunteers 13 Tel: 0121 348 8332 Mary Whetnall NEWS FROM THE office 14 Finance and Events Administration Email: [email protected] Tel: 0121 348 8333 director´s report 15 Margaret Boniface feature: Archivist 16 Document copying and a famous engineer Email: [email protected] exhibition preview: 18 Friends´ Office thresholds ˜ an exhibition by mat collishaw Birmingham Museum & Art Gallery, Chamberlain Square, Birmingham. B3 3DH friends´ crossword 19 Tel: 0121 348 8330 Events: 0121 348 8332 Website: www.fbmt.org.uk birmingham museums ˜ what´s on 20 Reg. Charity No. 528895 FEATURE: 25 the smethwick engine Designed and Produced by Associate Feature: PW Media & Publishing Ltd 26 fresh: Contemporary Art Fair Graphic Design Paul Blyth in the area 28 Printed By exhibition focus: Stephens & George 34 the verity milligan photography exhibition Advertising Sales focus on local cultural organisations: Diane Stinton 36 Email: [email protected] erasmus darwin museum Tel: 01905 727903 friends´ diary 38 MAy - JULY 2017 ARTEFACTS 3 CHAIR’S REPORT history, art & science BY david Foster By the time you are reading this, the second of the shows which partners Birmingham Museums Trust with the Arts Council Collection will have opened. -

Chamberlain Square

CHAMBERLAIN SQUARE SMALL SUITES BIG OPPORTUNITY TAKE CENTRE STAGE FROM 6,000 SQ FT THE OPPORTUNITY THE OPPORTUNITY THE OPPORTUNITY SMALL SUITES A superb opportunity for a high profile office suite is ready and waiting for you. Two Chamberlain Square has two unique spaces all set to occupy right now. The fifth floor suite offers superb views across the city, overlooking the grand setting of Chamberlain Square itself. The upper mezzanine space will be adjacent to new public realm at Ratcliffe Square, with an exceptional perspective on the Grade I listed Town Hall. Providing the opportunity for a prime location in one of the city’s finest addresses, these small suites offer a big opportunity for the right business. 04 05 THE OPPORTUNITY THE OPPORTUNITY THE OPPORTUNITY 6,345 sq ft Fifth Floor WHAT’S CHAMBERLAIN SQUARE 13m AVAILABLE SUITE 12m AVAILABLE 45m LET TO KNIGHTS PLC Seventh 6,264 sq ft Upper Ground Mezzanine Sixth Fifth Restaurant Retail Space Restaurant Retail Space Restaurant Retail Space Fourth Third CHAMBERLAIN SQUARE Second Restaurant Retail Space First Upper Ground 26m CHAMBERLAIN SQUARE AVAILABLE SUITE 18m 14m 35m 06 07 THE OPPORTUNITY THE OPPORTUNITY THE OPPORTUNITY o 360 Fifth Floor Suite 08 09 THE OPPORTUNITY THE OPPORTUNITY THE OPPORTUNITY Two Chamberlain Square provides the very best contemporary office space, overlooking one of the UK’s finest collections of Victorian listed buildings. View from Fifth Floor 10 11 THE OPPORTUNITY THE OPPORTUNITY THE OPPORTUNITY HIGH SPEC ◆ Impressive fully manned reception ◆ Fully accessible -

Written Guide

Walk The jewel in the town Discover the facets of Birmingham’s Jewellery Quarter © Martin Haslett Time: 90 mins Distance: 2 ½ miles Landscape: urban During the Industrial Revolution, Birmingham Location: became the West Midlands’ centre for metal- Jewellery Quarter, Birmingham, West Midlands working. Besides heavy metal goods like cast iron, the town also became famous for fine Start and finish: jewellery. St Paul’s Square, Birmingham B3 1QU Grid reference: This walk charts the changing fortunes of SP 06496 87485 Birmingham’s Jewellery Quarter. Originally little-known, even to locals, the Quarter is now Be prepared: a major tourist attraction. There are steps to and from a canal towpath. Take care at the water’s edge and when crossing We’ll see how the area developed and busy roads. survived, and how recent success threatens the Quarter’s future Keep an eye out for: Cast iron letter boxes and street signs - yet more Most of all this is a chance to walk around reminders of Birmingham’s metal-working heritage a traditional manufacturing district, where skilled workers still ply their trade. Thank you! This walk was created by Martin Haslett, a retired town planner and Fellow of The Royal Geographical Society (with IBG) Every landscape has a story to tell – find out more at www.discoveringbritain.org Route and stopping points 01 St Paul’s Square 11 Birmingham Mint 02 St Paul’s Church, St Paul’s Square 12 Chamberlain Clock 03 Birmingham and Fazeley Canal 13 BCU School of Jewellery 04 Ormiston Academies Trust 14 Warstone Lane 05 Birmingham Assay Office 15 The Big Peg 06 Pickering and Mayell building 16 J W Evans Silver Factory 07 58-59 Caroline Street 17 Thomas Fattorini Ltd 08 W H Hazeler workshop, Hylton Street 18 The Argent Centre 09 Museum of the Jewellery Quarter 19 RBSA Gallery 10 Jewellery Quarter railway station 20 St Paul’s Square Every landscape has a story to tell – Find out more at www.discoveringbritain.org 01 St Paul’s Square Birmingham had been a small manufacturing centre for many centuries, but the Industrial Revolution led to great expansion. -

3 Brindleyplace, Birmingham, B1 2JB

Where we live: 3 Brindleyplace, Birmingham, B1 2JB t 0121 517 0258 e [email protected] w www.prescientbusiness.com PRESCIENT How to find us We are based within the prestigious 3 Brindleyplace development, at the rear of Broad Street in Birmingham. º By Rail There are three train stations situated nearby and just a short walk away from our offices. New Street Station – is a 10-15 minute walk through Chamberlain Square and the International Convention Centre (ICC). Snow Hill Station – is a 15 minute walk via Edmund Street or Livery Street. Five Ways Station is just a 13 minute walk down Broad Street. By Car Birmingham is easily reached via the M5, M6, M40 and M42. Follow signs to Birmingham City Centre and the ICC. From the South-West (M5), leave the motorway at Junction 3, follow the A456 towards the city centre. From the South (M40), South-East (M6) East (M69), or North-East (M42) follow the M6 to Junction 6, then the A38 towards the City Centre. From the North-West (M6) or West (M54) follow the M6 either to Junction 7 then the A34 towards Birmingham City Centre. With many infrastructure changes happening within the city, we recommend checking the Birmingham Connected bulletin and Birmingham Metro Alliance to find the latest updates on road closures and diversions. Parking Brindleyplace is easily accessed by car via Sheepcote Street and has an on-site car park. The car park is managed by Q-Park and is well-lit, safe and extremely convenient for those travelling into Birmingham city centre. -

Birmingham's Shakespeare Memorial Library

EVERyTHInG TOEVEryBODy Birmingham’s Shakespeare Memorial Library Plan of the 1865 Library showing the location of the first Shakespeare Memorial Room which was destroyed in the 1879 fire Contents Foreword by Adrian Lester ............................... 5 After the Fire – The Shakespeare Memorial Room ....... 14-15 Introduction by Tom Epps ................................ 6 The 20th Century ..................................................................... 16 The ‘Our Shakespeare Club’ .............................. 8 The 21st Century ...................................................................... 17 Birmingham in the Early 19th Century .......... 9 The Shakespeare Memorial Library Collection ............. 18-29 George Dawson and the Civic Gospel ....... 10-11 Postscript by Professor Ewan Fernie ............................... 30-31 The Birmingham Free Library ........................ 12 Timeline .................................................................................... 33 The 1879 Fire .................................................... 13 Further Reading & Acknowledgements ............................... 34 EvERything tO EveryBODy Architectural woodwork in the Shakespeare Memorial Room 4 Birmingham’s Shakespeare Memorial Library Foreword Adrian Lester Patron of the Heritage Lottery-Funded ‘Everything to Everybody’ Project ‘The time has come to give everything to everybody’ George Dawson, founder of the Birmingham Shakespeare Memorial Library I was born and bred in so often underestimated as a Birmingham. I started